Global Energy Bar Market Overview

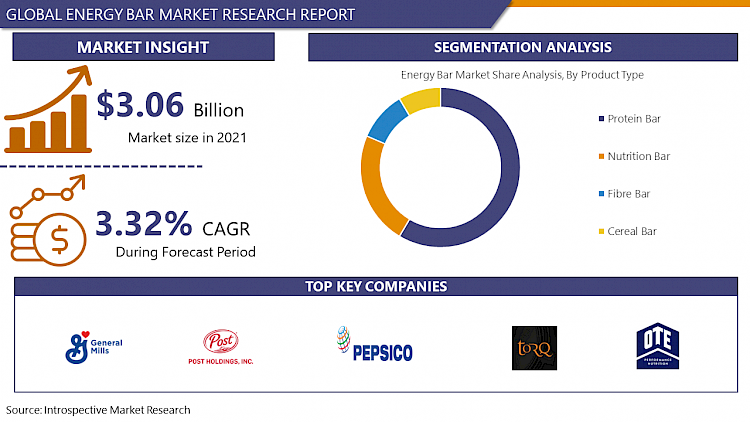

The Global Energy Bar market was valued at USD 3.06 billion in 2021 and is expected to reach USD 3.85 billion by the year 2028, at a CAGR of 3.32%.

Consumer demand for suitable and healthy ready-to-eat snack options has by far been the primary assign for the sales of energy bars worldwide. Additionally, owing to its small packaging and high energy content, it is an ideal solution for adults who need instant results. It also holds proteins and other nutrients, and micronutrients required daily, therefore, packing a balanced diet in a small quantity. Consumers are highly aware of their food content, quantity, and the number of times they eat. This has led them to focus more on their diet content, eat smaller portions, and increase the frequency of their meals. To fulfil these requirements, energy bars are suitable options for them.

Further, the growing demand for energy bars for various consumers' needs has led to various product innovations and increased utilization of healthy ingredients. Labelling these bars with various characteristics, such as gluten-free, vegan, low fat, low calories, no added sugars, and sweeteners, is hastening the market growth. Energy bars were unheard of among people who were not sports enthusiasts, but these days, they can be found at any supermarket or retail store. They are a good option for sports freaks as they are handy and give instant energy upon consumption. These are also considered meal replacements in many instances owing to factors, such as convenience, lack of options, and reducing calorie intake.

Market Dynamics And Factor

Drivers

Increasing Demand For Convenient And Healthy On-The-Go Snacking

Owing to fast-paced lifestyles and the need for instant energy among adults, there has been a growing demand for healthy and convenient food that can be consumed instantly without any preparation. Energy bars, which are covered into little quantities carrying large amounts of instant energy and all the daily essential nutrients and micronutrients, have been extensively adopted, thus, hastening the market growth. Also, the growing trend of on-the-go snacking is becoming extremely popular among children owing to their need for regular meals while adults prefer them due to active hectic lifestyles. Other factors, such as growing disposable incomes, ease of carrying, and increasing health concerns, are also augmenting the market growth.

An Increasing Number Of Health And Fitness Centres

Sports nutrition products have highly gained popularity, primarily among athletes and individuals involved in numerous physical activities. The rising significance of continuing healthy and in shape, and increasing participation in sports, health clubs, sports clubs, and gyms are some of the key drivers contributing to the growth of the global energy bars market. Energy bars have also found high levels of popularity in the sports nutrition market as sports activities involve lots of energy breakdown, and energy bars are a convenient and efficient option for the supply of instant energy to athletes. Hence, the demand for these products is gaining traction among athletes. In the past few years, health clubs and fitness centres have witnessed consistent growth, due to increases in health concerns and lifestyle changes. The rise in health consciousness and the need for proper nutritional content in food have also fostered the demand for sports nutrition products.

Restraints

High Pricing Of Energy Bars

The energy bars are prepared with quality ingredients packed with instant energy-providing food materials. The high cost of the raw material, processing equipment, packaging, and high-profit margins have resulted in the higher retail price of the bars. As per industry sources, the cost of raw material is somewhere around 25% while profit hovers at 40-50% of the retail cost. Additionally, the premium packaging of these products, first in the wrapper and then in a box again, increases the overall price of the product.

Opportunities:

Allergy-Free Energy Bars Launch

There's a growing demand for a dedicated line of allergy-free, nut-free snacks and energy bars among the allergy prevalent consumers. To cater to such demands, manufacturers have launched energy bars that are free from all the allergy-causing ingredients. For instance, Spark Nutrition LLC, in 2019, introduced its product line No Nuts! which is nut-free protein + energy bars. It is manufactured in a 100% nut-free facility specializing in non-allergic product manufacturing.

Flavour And Texture Appeal More To Consumers

The taste and texture of the bars are very important for consumers' decisions and buying preferences. As per the result published in Trends impacting nutrition bar market, 74% say good taste is important when choosing a bar. Also, over 60% are concerned about the texture and ingredients used in the bar. Manufacturers are experimenting and launching energy bars with various ingredients to meet the consumer demand for new and tasty products. For this, they use ingredients like soy, amaranth, millets, and other cereals and grains, fruits, chocolates, etc. For instance, in 2020, General Mills launched its Nature Valley Packed Sustained energy bar that contains nut butter, nuts, seeds, and dried fruit and is creamy, crunchy, and chewy in texture. It is also available in peanut butter & cranberry and almond butter & blueberry options.

COVID-19 Impact on Energy Bar Market

Even though the COVID-19 pandemic continues to change the growth of various sectors, the immediate influence of the outbreak is varied. In the period a few sectors will record a fall in demand, several others will continue to remain unharmed and show promising growth opportunities. Additionally, the COVID-19 outbreak has created opportunities for many key players to develop in the markets to offer to the inflated demand for snack products, which in drive benefited the producers of energy bars. The need for innovative snacks is constantly high in emerged economies owing to the associated convenience of storing, quick applications, and easy provision for nutrition and energy requirements.

Market Segmentation

Segmentation Insights

Based on Product Nature, the conventional segment recorded a revenue of USD 2,520.10 million in 2020, and it is expected to register a high CAGR during 2021-2027. However, the organic segment is estimated to register the fastest growth, recording the highest CAGR during 2021-2027. Consumer demand for easy and nutritious on-the-go snack choices has been the primary driver of energy bar sales across the world. Moreover, consumers' evolving lifestyles, which include eating fewer meals, also contribute to a rise in snack consumption, which is expected to drive demand for conventional energy bars. Consumers are increasingly going health-conscious when it comes to bite-in-between meals. Thus, there is a growing awareness of various health effects of artificial additives, such as colour, flavour, sweeteners, and preservatives, which, in turn, has accelerated the demand for an organic energy bar.

Based on Distribution Channel, the supermarkets/hypermarkets segment held the majority market share, amounting to 64.08%, in 2020, and is expected to register a high CAGR during 2021-2027. supermarkets/hypermarkets provide a super-sized shopping experience with suitable displays and assortments of indulgent snacking products. The proximity factor of these channels, especially in bigger cities and metropolitan areas, gives them an added advantage of influencing the snacking habits of consumers. Convenience stores around the world witnessed an increase in the sales of functional snacking options at the expense of indulgent ones, a trend that is set to boost the market sentiments for functional bars from such distribution networks.

Based on Product Type, the protein bar segment is accounted for the largest share in the market owing to the switching consumer preferences towards healthy and protein-based products included protein-based beverages. Increasing the consumption especially in youth and athletic, sportspersons has led to the demand for the protein energy bar in the market during the forecast period.

Regional Insights

By Geography, North America held the largest market share of 72.34% in 2020. It is expected to register a CAGR of 2.32% over the forecast period. North America was followed by the Asia-Pacific region, which accounted for 18% of the market share and was valued at USD 534.25 million in 2020. The growing consumer inclination toward sports and workout activities has raised the demand for nutritional snack bars, as they provide an instant energy boost and satiate hunger after a workout. Thus, increased consumer demand for nutritious products and rising clean label claims on energy bar products have augmented market growth in the North American region.

Consumers in European countries have been looking for products that help them maintain their busy lifestyles and provide them with much-needed energy. There has been a growing demand for Energy bars with labels, like less or no sugar, no added flavors, gluten-free, and vegan, which help consumers meet their growing obesity concerns.

Asia Pacific region is expected to significant growth during the forecast period owing to high populations, consumer preferences towards the packaged and energy-based food. Growing demand for protein-based products in youth and athlete candidates has led the market growth for this product and is expected to continue during the forecast period.

Key Industry Developments

- In 2020, KIND Healthy Snacks (KIND) introduced KIND Energy that supplies comfort energy from whole grains. The product line's first ingredient, oats, subscribes to complex carbohydrates, the chosen nutrient for comfort energy.

- In October 2019, Post Holdings purchased its active sports nutrition business BellRing Brands Inc., which includes various brands such as Premier Protein, Dymatize, and PowerBar under its portfolio. The brand is operated on the New York Stock Exchange under the symbol BRBR.

Players Covered in Energy Bar market are :

- Nature Essential Foods Pvt Ltd

- Lotus Bakeries

- General Mills Inc.

- Clif Bar & Company

- ProBar LLC

- Post Holdings Inc.

- BumbleBar Inc.

- PepsiCo Inc.

- Eat Anytime

- TORQ Limited

- OTE Sports Ltd

- Kind LLC

- Science in Sports PLC

- Kellogg Company and others.

|

Global Energy Bar Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 3.06 Bn. |

|

Forecast Period 2022-28 CAGR: |

3.32% |

Market Size in 2028: |

USD 3.85 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Product Nature |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By By Product Type

3.2 By By-Product Nature

3.3 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Energy Bar Market by By Product Type

4.1 Energy Bar Market Overview Snapshot and Growth Engine

4.2 Energy Bar Market Overview

4.3 Protein Bar

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Protein Bar: Grographic Segmentation

4.4 Nutrition Bar

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Nutrition Bar: Grographic Segmentation

4.5 Fibre Bar

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Fibre Bar: Grographic Segmentation

4.6 And Cereal Bar

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 And Cereal Bar: Grographic Segmentation

Chapter 5: Energy Bar Market by By-Product Nature

5.1 Energy Bar Market Overview Snapshot and Growth Engine

5.2 Energy Bar Market Overview

5.3 Organic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Organic: Grographic Segmentation

5.4 Conventional

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Conventional: Grographic Segmentation

Chapter 6: Energy Bar Market by Distribution Channel

6.1 Energy Bar Market Overview Snapshot and Growth Engine

6.2 Energy Bar Market Overview

6.3 Supermarkets/ Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Supermarkets/ Hypermarkets: Grographic Segmentation

6.4 Convenience Stores

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Convenience Stores: Grographic Segmentation

6.5 Specialty Stores

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Specialty Stores: Grographic Segmentation

6.6 Online Stores

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Online Stores: Grographic Segmentation

6.7 Other Distribution Channels

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Other Distribution Channels: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Energy Bar Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Energy Bar Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Energy Bar Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 NATURE ESSENTIAL FOODS PVT LTD

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 LOTUS BAKERIES

7.4 GENERAL MILLS INC.

7.5 CLIF BAR & COMPANY

7.6 PROBAR LLC

7.7 POST HOLDINGS INC.

7.8 BUMBLEBAR INC.

7.9 PEPSICO INC.

7.10 EAT ANYTIME

7.11 TORQ LIMITED

7.12 OTE SPORTS LTD

7.13 KIND LLC

7.14 SCIENCE IN SPORTS PLC

7.15 KELLOGG COMPANY

Chapter 8: Global Energy Bar Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By By Product Type

8.2.1 Protein Bar

8.2.2 Nutrition Bar

8.2.3 Fibre Bar

8.2.4 And Cereal Bar

8.3 Historic and Forecasted Market Size By By-Product Nature

8.3.1 Organic

8.3.2 Conventional

8.4 Historic and Forecasted Market Size By Distribution Channel

8.4.1 Supermarkets/ Hypermarkets

8.4.2 Convenience Stores

8.4.3 Specialty Stores

8.4.4 Online Stores

8.4.5 Other Distribution Channels

Chapter 9: North America Energy Bar Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By By Product Type

9.4.1 Protein Bar

9.4.2 Nutrition Bar

9.4.3 Fibre Bar

9.4.4 And Cereal Bar

9.5 Historic and Forecasted Market Size By By-Product Nature

9.5.1 Organic

9.5.2 Conventional

9.6 Historic and Forecasted Market Size By Distribution Channel

9.6.1 Supermarkets/ Hypermarkets

9.6.2 Convenience Stores

9.6.3 Specialty Stores

9.6.4 Online Stores

9.6.5 Other Distribution Channels

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Energy Bar Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By By Product Type

10.4.1 Protein Bar

10.4.2 Nutrition Bar

10.4.3 Fibre Bar

10.4.4 And Cereal Bar

10.5 Historic and Forecasted Market Size By By-Product Nature

10.5.1 Organic

10.5.2 Conventional

10.6 Historic and Forecasted Market Size By Distribution Channel

10.6.1 Supermarkets/ Hypermarkets

10.6.2 Convenience Stores

10.6.3 Specialty Stores

10.6.4 Online Stores

10.6.5 Other Distribution Channels

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Energy Bar Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By By Product Type

11.4.1 Protein Bar

11.4.2 Nutrition Bar

11.4.3 Fibre Bar

11.4.4 And Cereal Bar

11.5 Historic and Forecasted Market Size By By-Product Nature

11.5.1 Organic

11.5.2 Conventional

11.6 Historic and Forecasted Market Size By Distribution Channel

11.6.1 Supermarkets/ Hypermarkets

11.6.2 Convenience Stores

11.6.3 Specialty Stores

11.6.4 Online Stores

11.6.5 Other Distribution Channels

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Energy Bar Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By By Product Type

12.4.1 Protein Bar

12.4.2 Nutrition Bar

12.4.3 Fibre Bar

12.4.4 And Cereal Bar

12.5 Historic and Forecasted Market Size By By-Product Nature

12.5.1 Organic

12.5.2 Conventional

12.6 Historic and Forecasted Market Size By Distribution Channel

12.6.1 Supermarkets/ Hypermarkets

12.6.2 Convenience Stores

12.6.3 Specialty Stores

12.6.4 Online Stores

12.6.5 Other Distribution Channels

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Energy Bar Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By By Product Type

13.4.1 Protein Bar

13.4.2 Nutrition Bar

13.4.3 Fibre Bar

13.4.4 And Cereal Bar

13.5 Historic and Forecasted Market Size By By-Product Nature

13.5.1 Organic

13.5.2 Conventional

13.6 Historic and Forecasted Market Size By Distribution Channel

13.6.1 Supermarkets/ Hypermarkets

13.6.2 Convenience Stores

13.6.3 Specialty Stores

13.6.4 Online Stores

13.6.5 Other Distribution Channels

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Energy Bar Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 3.06 Bn. |

|

Forecast Period 2022-28 CAGR: |

3.32% |

Market Size in 2028: |

USD 3.85 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Product Nature |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ENERGY BAR MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ENERGY BAR MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ENERGY BAR MARKET COMPETITIVE RIVALRY

TABLE 005. ENERGY BAR MARKET THREAT OF NEW ENTRANTS

TABLE 006. ENERGY BAR MARKET THREAT OF SUBSTITUTES

TABLE 007. ENERGY BAR MARKET BY BY PRODUCT TYPE

TABLE 008. PROTEIN BAR MARKET OVERVIEW (2016-2028)

TABLE 009. NUTRITION BAR MARKET OVERVIEW (2016-2028)

TABLE 010. FIBRE BAR MARKET OVERVIEW (2016-2028)

TABLE 011. AND CEREAL BAR MARKET OVERVIEW (2016-2028)

TABLE 012. ENERGY BAR MARKET BY BY-PRODUCT NATURE

TABLE 013. ORGANIC MARKET OVERVIEW (2016-2028)

TABLE 014. CONVENTIONAL MARKET OVERVIEW (2016-2028)

TABLE 015. ENERGY BAR MARKET BY DISTRIBUTION CHANNEL

TABLE 016. SUPERMARKETS/ HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 017. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 018. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 019. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 020. OTHER DISTRIBUTION CHANNELS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA ENERGY BAR MARKET, BY BY PRODUCT TYPE (2016-2028)

TABLE 022. NORTH AMERICA ENERGY BAR MARKET, BY BY-PRODUCT NATURE (2016-2028)

TABLE 023. NORTH AMERICA ENERGY BAR MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 024. N ENERGY BAR MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE ENERGY BAR MARKET, BY BY PRODUCT TYPE (2016-2028)

TABLE 026. EUROPE ENERGY BAR MARKET, BY BY-PRODUCT NATURE (2016-2028)

TABLE 027. EUROPE ENERGY BAR MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 028. ENERGY BAR MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC ENERGY BAR MARKET, BY BY PRODUCT TYPE (2016-2028)

TABLE 030. ASIA PACIFIC ENERGY BAR MARKET, BY BY-PRODUCT NATURE (2016-2028)

TABLE 031. ASIA PACIFIC ENERGY BAR MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 032. ENERGY BAR MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ENERGY BAR MARKET, BY BY PRODUCT TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA ENERGY BAR MARKET, BY BY-PRODUCT NATURE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA ENERGY BAR MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 036. ENERGY BAR MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA ENERGY BAR MARKET, BY BY PRODUCT TYPE (2016-2028)

TABLE 038. SOUTH AMERICA ENERGY BAR MARKET, BY BY-PRODUCT NATURE (2016-2028)

TABLE 039. SOUTH AMERICA ENERGY BAR MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 040. ENERGY BAR MARKET, BY COUNTRY (2016-2028)

TABLE 041. NATURE ESSENTIAL FOODS PVT LTD: SNAPSHOT

TABLE 042. NATURE ESSENTIAL FOODS PVT LTD: BUSINESS PERFORMANCE

TABLE 043. NATURE ESSENTIAL FOODS PVT LTD: PRODUCT PORTFOLIO

TABLE 044. NATURE ESSENTIAL FOODS PVT LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. LOTUS BAKERIES: SNAPSHOT

TABLE 045. LOTUS BAKERIES: BUSINESS PERFORMANCE

TABLE 046. LOTUS BAKERIES: PRODUCT PORTFOLIO

TABLE 047. LOTUS BAKERIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. GENERAL MILLS INC.: SNAPSHOT

TABLE 048. GENERAL MILLS INC.: BUSINESS PERFORMANCE

TABLE 049. GENERAL MILLS INC.: PRODUCT PORTFOLIO

TABLE 050. GENERAL MILLS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CLIF BAR & COMPANY: SNAPSHOT

TABLE 051. CLIF BAR & COMPANY: BUSINESS PERFORMANCE

TABLE 052. CLIF BAR & COMPANY: PRODUCT PORTFOLIO

TABLE 053. CLIF BAR & COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. PROBAR LLC: SNAPSHOT

TABLE 054. PROBAR LLC: BUSINESS PERFORMANCE

TABLE 055. PROBAR LLC: PRODUCT PORTFOLIO

TABLE 056. PROBAR LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. POST HOLDINGS INC.: SNAPSHOT

TABLE 057. POST HOLDINGS INC.: BUSINESS PERFORMANCE

TABLE 058. POST HOLDINGS INC.: PRODUCT PORTFOLIO

TABLE 059. POST HOLDINGS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BUMBLEBAR INC.: SNAPSHOT

TABLE 060. BUMBLEBAR INC.: BUSINESS PERFORMANCE

TABLE 061. BUMBLEBAR INC.: PRODUCT PORTFOLIO

TABLE 062. BUMBLEBAR INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. PEPSICO INC.: SNAPSHOT

TABLE 063. PEPSICO INC.: BUSINESS PERFORMANCE

TABLE 064. PEPSICO INC.: PRODUCT PORTFOLIO

TABLE 065. PEPSICO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. EAT ANYTIME: SNAPSHOT

TABLE 066. EAT ANYTIME: BUSINESS PERFORMANCE

TABLE 067. EAT ANYTIME: PRODUCT PORTFOLIO

TABLE 068. EAT ANYTIME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. TORQ LIMITED: SNAPSHOT

TABLE 069. TORQ LIMITED: BUSINESS PERFORMANCE

TABLE 070. TORQ LIMITED: PRODUCT PORTFOLIO

TABLE 071. TORQ LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTE SPORTS LTD: SNAPSHOT

TABLE 072. OTE SPORTS LTD: BUSINESS PERFORMANCE

TABLE 073. OTE SPORTS LTD: PRODUCT PORTFOLIO

TABLE 074. OTE SPORTS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. KIND LLC: SNAPSHOT

TABLE 075. KIND LLC: BUSINESS PERFORMANCE

TABLE 076. KIND LLC: PRODUCT PORTFOLIO

TABLE 077. KIND LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. SCIENCE IN SPORTS PLC: SNAPSHOT

TABLE 078. SCIENCE IN SPORTS PLC: BUSINESS PERFORMANCE

TABLE 079. SCIENCE IN SPORTS PLC: PRODUCT PORTFOLIO

TABLE 080. SCIENCE IN SPORTS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. KELLOGG COMPANY: SNAPSHOT

TABLE 081. KELLOGG COMPANY: BUSINESS PERFORMANCE

TABLE 082. KELLOGG COMPANY: PRODUCT PORTFOLIO

TABLE 083. KELLOGG COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ENERGY BAR MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ENERGY BAR MARKET OVERVIEW BY BY PRODUCT TYPE

FIGURE 012. PROTEIN BAR MARKET OVERVIEW (2016-2028)

FIGURE 013. NUTRITION BAR MARKET OVERVIEW (2016-2028)

FIGURE 014. FIBRE BAR MARKET OVERVIEW (2016-2028)

FIGURE 015. AND CEREAL BAR MARKET OVERVIEW (2016-2028)

FIGURE 016. ENERGY BAR MARKET OVERVIEW BY BY-PRODUCT NATURE

FIGURE 017. ORGANIC MARKET OVERVIEW (2016-2028)

FIGURE 018. CONVENTIONAL MARKET OVERVIEW (2016-2028)

FIGURE 019. ENERGY BAR MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 020. SUPERMARKETS/ HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 021. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 022. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 023. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHER DISTRIBUTION CHANNELS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA ENERGY BAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE ENERGY BAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC ENERGY BAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA ENERGY BAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA ENERGY BAR MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Energy Bar Market research report is 2022-2028.

Nature Essential Foods Pvt Ltd, Lotus Bakeries, General Mills Inc., Clif Bar & Company, ProBar LLC, Post Holdings Inc., BumbleBar Inc., PepsiCo Inc., Eat Anytime, TORQ Limited, OTE Sports Ltd, Kind LLC, Science in Sports PLC, Kellogg Company, and other major players.

The Energy Bar Market is segmented into Product Type, Product Nature, Distribution Channels, and region. By Product Type, the market is categorized into Protein Bar, Nutrition Bar, Fibre bars, and Cereal Bar. By Product Nature, the market is categorized into Organic, and Conventional. By Distribution Channel the market is categorized into Supermarkets/ Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Consumer demand for suitable and healthy ready-to-eat snack options has by far been the primary assign for the sales of energy bars worldwide. Additionally, owing to its small packaging and high energy content, it is an ideal solution for adults who need instant results. It also holds proteins and other nutrients, and micronutrients required daily, therefore, packing a balanced diet in a small quantity.

The Global Energy Bar market was valued at USD 3.06 billion in 2021 and is expected to reach USD 3.85 billion by the year 2028, at a CAGR of 3.32%.