Global Electrocardiograph (ECG) Market Overview

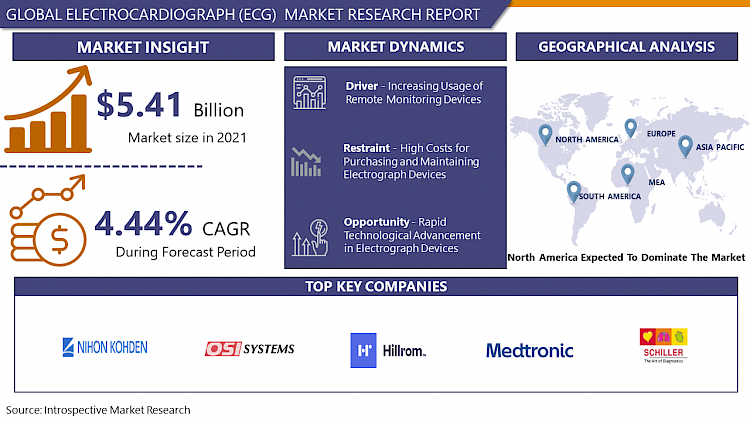

Global Electrocardiograph (ECG) market was valued at USD 5.41 billion in 2021 and is expected to reach USD 7.34 billion by the year 2028, at a CAGR of 4.44%.

An electrocardiogram (ECG) is a test used to inspect the functioning of the heart by measuring the electrical activity of the heart. An ECG measures and registers the electrical activity that goes through the heart. An ECG may be suggested if a patient is feeling arrhythmia, chest pain, or palpitations, and an abnormal ECG result can be a signal of several different heart conditions. The key factors bolstering the market growth include increasing cases of cardiovascular diseases, increasing usage of remote monitoring devices, and rapid technological advancements. Moreover, the geriatric population that is more prone to chronic diseases is expected to increase in the coming years, which may ultimately lead to increased demand for electrocardiographs.

Additionally, key players in the ECG market are focusing on frequent product developments and approvals, which may substantially drive the market growth during the forecast period. For instance, in 2019, the US Food and Drug Administration (FDA) approved Verily's Study Watch, a wearable medical device that conducts electrocardiograms (ECGs), which measure the electrical activity of the heart and can be used to diagnose several heart conditions. The FDA acknowledged a 510(k) clearance to the watch, segmented it as a Class II medical device for its on-demand ECG feature, which records, stores, transfers, and displays single-channel ECG rhythms. The constant improvement and up-gradation of exiting marketed ECG devices are also anticipated to improve the accuracies by reducing the incidence of false alarms. Furthermore, with a rise in the approval of devices worldwide, the adoption rate is expected to increase over the forecast period.

Market Dynamics And Factors

Drivers

Increasing Usage Of Remote Monitoring Devices

The demand for remote monitoring devices has increased over the past few years, which can be attributed to the increased geriatric population and growing burden of chronic diseases worldwide. Remote ECG monitoring systems are gradually becoming conventional medical devices for heart monitoring. In recent years, remote ECG monitoring systems have been adopted to monitor arrhythmia, tachycardia, and bradycardia heart conditions, and the quality of the conduction and reception of the ECG signals during the process has advanced. As per a 2021 article, 'Home Monitoring of Cardiac Devices in the Era of COVID-19', remote patient monitoring (RPM) technology remained underutilized secondary to a lack of data transparency and systems issues until the COVID-19 outbreak leads to a new era of telehealth and virtual solutions out of requirements. The advancements in integrated circuits and wireless communications have led to the design and fabrication of low-cost, powerful, and intelligent physiological data acquisition devices. There is a trend of replacing Holter monitors with inexpensive wearable or smartphone-based ECG monitors such as preferable event monitors that remain active for a month. Thus, the increasing usage of remote monitoring devices is one of the major driving factors for the studied market.

Rapid Technological Advancements

There have been constant technological developments in the field of electrocardiographs (ECG). As technology improves, it seems likely that a substantial proportion of chronic diseases will be tackled by this approach, which makes it an attractive option for both physicians and patients. ECG devices upgrade the patients' quality of life by allowing them to move around freely while undergoing continuous heart monitoring and reduce healthcare costs associated with prolonged hospitalization, treatment, and monitoring. Market players are adopting various growth strategies and are also focusing on the launch of advanced wireless devices in the market. For instance, in June 2020, the FDA expanded guidance on remote monitoring devices for COVID-19, which may address the emergency of the coronavirus (COVID-19) pandemic by allowing modifications that may increase access to important patient physiological data without the need for in-clinic visits, as well as facilitating outpatient management. Thus, the advent of technology may propel the growth of the electrocardiograph (ECG) market during the forecast period.

Restraints:

Some emerging countries have cost-effective factors, doctors are exacted to use traditional ECG devices instead of the latest high-end devices. Thus, high costs for purchasing and maintaining, and poor technical skills are hampering the growth of the market in emerging regions. In developed economies, the new sales are almost equal to the replacement rate because of already well-established infrastructure.

Moreover, need awareness among people regarding the usage of electrograph for the diagnosis of cardiovascular diseases, lack of skilled personnel for the operation of electrograph devices, and adverse reimbursement policies are other key factors expected to restraint the growth of the global diagnostic electrocardiograph (DECG) market.

Opportunities:

The rising number of chronic diseases worldwide is the major concerning factor, due to which many key players are investing highly in this sector. The rising investments in the healthcare sector are allowing healthcare companies to come up with advanced technologies.

There has been a growth in the incidence of heart diseases that require long-term ECG monitoring, which was earlier possible only in hospitals. However, with the wireless ECG introduction, doctors can monitor and diagnose patient's information remotely for years and more frequently. There are many cost-effective and efficient ECG devices coming up in the market in the recent few years with the involvement of information technology in healthcare facilities, which bolsters the adoption of these devices among consumers.

The future is anticipated to be bright, especially in the developed markets, with the continuous evolvement in the currently trending wireless ECG devices, such as ECG necklace (ALiveCor, HeartCheck Pen, MD 100E, and Dimetek), ECG strips, and mobile phone ECG. Also, an upcoming project involves nanosensors embedded in smart wear/ nanotechnology, which acts as digital polymers and soft electronics biosensors. Therefore, it can be inferred that there is significant scope for improvements in the sensor technologies currently being used, which is expected to drive market growth in the future.

COVID-19 Impact on Electrocardiograph (ECG) Market

The COVID-19 outbreak continues to change the growth of some markets, and the significant impact of the outbreak is varied. In this period, some of the sectors may account for a fall in demand, numerous other markets may continue to remain unscathed and show promising growth opportunities. Moreover, the effects of the disease on public health, there is also the collateral effect of near‐universal interruptions and cancelation of surgical services. This has unprecedented implications on surgical services and patients with surgical conditions.

Further, standard electrocardiography (ECG) is a recommended diagnostic test for all COVID-19 affected patients because virus infection and pneumonia increase the risk of rhythm disturbance and acute coronary syndrome. Moreover, ECGs are also helpful in evaluating the cardiac toxicity of antibiotics prescribed to COVID-19 patients. Further, the February 2020 case report in the Journal of the American Medical Association (JAMA) identified those complications in 16.7% and 7.2% of hospitalized patients, respectively; hence, physicians have found ECG an essential tool to monitor cardiac complications in patients, which may generate demand and have a positive impact on the market growth.

Market Segmentation

Segmentation Insights

Based on Product, the rest ECG systems segment held the major share of USD 1993.26 million of the market in 2020, and it may witness a high CAGR over the forecast period. Rest ECG is most widely used in clinical routines of all kinds; however, testing systems are evolving continuously. There has been a trend over the past decade toward smaller, more compact, mobile ECG monitoring systems, which are likely to drive the demand for wireless resting ECG systems. There are also various recent advances seen in ECG stress testing systems that include better waveform analysis algorithms, improved connectivity with electronic medical records, and wireless lead systems to untether patients from the machines. These advances have helped the growth of the overall market.

Based on Technology, the wireless ECG systems segment is expected to witness the fastest growth, with a high CAGR over the forecast period. Portable ECG systems are used to diagnose an arrhythmia, which provides full disclosure ECG signal, complete data, analysis, comprehensive reporting, and allows for heart monitoring at home. Thus, the aforementioned factors are expected to contribute to the overall segment growth over the forecast period. The demand for wireless ECG systems is increasing due to the growing geriatric population, increasing incidence of cardiovascular diseases, declining cost of wireless technologies, and technological advancements in remote monitoring technologies.

Based on Lead Type, the 12 lead ECG segment held the major share of USD 2980.59 million of the market in 2020, and it may witness a high CAGR over the forecast period. The standard 12-lead electrocardiogram is a representation of the heart's electrical activity recorded from electrodes on the body surface. It is the most widely used tool for the early diagnosis of heart diseases. Different wireless, single-lead real-time electrocardiogram devices are commercially available for efficient screening, monitoring, and on-demand diagnosis. 1-lead ECG recorders are primarily used for basic heart monitoring, checking for various arrhythmias, or simple educational or research purposes.

Based on End-Users, the hospital's segment accounted for the largest share in the market. In 2019, the hospitals, clinics, & cardiac care centres segment registered for the highest share of the market. The highest share of this segment can especially be attributed to the rising burden of cardiovascular diseases, which, in demand, is growing the need for quality cardiology care and rising the number of patient visits to physician offices for the diagnosis of CVD, and the availability of reimbursements for Holter & event monitors over developed markets.

Regional Insights

The North American region dominates the market, followed by the Asia Pacific and Europe. In North America, the United States is expected to hold the major share of the market studied. The United States holds the largest share in the Electrocardiograph (ECG) market, which is majorly due to the high adoption of advanced technologies and the increasing trend for home health care monitoring, and the rising incidence of cardiovascular diseases. The electrocardiograph market in Germany is growing due to rising healthcare expenditure, and the increasing prevalence of cardiovascular diseases is fuelling the market growth.

In Europe, advancing technologies, growing economies, and increasing healthcare spending will offer vast growth potential for international market players, which may drive Europe's overall market during the forecast period.

In the Asia Pacific, China, one of the primary factors for the electrocardiograph market's growth is the increasing burden of cardiovascular diseases and well-established healthcare infrastructure. Additionally, rising government initiatives to aware the populous about chronic diseases may help the market to boost in the APAC region.

Key Industry Developments

- In March 2018, Biotelemetry purchased Geneva Healthcare to build up its position in the remote cardiac monitoring devices market.

- In May 2018, GE Healthcare partnered with Preventice Solutions (US) to expand GE's ECG services into home settings, supplying observing for ambulatory ECG patients.

- In March 2018, Philips Healthcare started IntelliSpace Cardiovascular 3.1 upon its cardiovascular product portfolio.

Players Covered in Electrocardiograph (ECG) market are :

- GE Healthcare

- Koninklinje Philips NV

- Nihon Kohden Corporation

- Schiller AG

- OSI Systems Inc. (Spacelabs Healthcare)

- AliveCor

- Mindray Medical International Limited

- Medtronic PLC

- Hill-Rom Holdings Inc. (Welch Allyn) and others major players.

|

Global Electrocardiograph (ECG) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 5.41 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.44% |

Market Size in 2028: |

USD 7.34 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Lead Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Technology

3.3 By Lead Type

3.4 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Electrocardiograph (ECG) Market by Type

4.1 Electrocardiograph (ECG) Market Overview Snapshot and Growth Engine

4.2 Electrocardiograph (ECG) Market Overview

4.3 Rest ECG Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Rest ECG Systems: Grographic Segmentation

4.4 Stress ECG Systems

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Stress ECG Systems: Grographic Segmentation

4.5 Holter ECG Systems

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Holter ECG Systems: Grographic Segmentation

4.6 Event Recorders

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Event Recorders: Grographic Segmentation

4.7 Other Products

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2016-2028F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Other Products: Grographic Segmentation

Chapter 5: Electrocardiograph (ECG) Market by Technology

5.1 Electrocardiograph (ECG) Market Overview Snapshot and Growth Engine

5.2 Electrocardiograph (ECG) Market Overview

5.3 Portable ECG Systems

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Portable ECG Systems: Grographic Segmentation

5.4 Wireless ECG Systems

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Wireless ECG Systems: Grographic Segmentation

Chapter 6: Electrocardiograph (ECG) Market by Lead Type

6.1 Electrocardiograph (ECG) Market Overview Snapshot and Growth Engine

6.2 Electrocardiograph (ECG) Market Overview

6.3 Single-Lead ECG

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Single-Lead ECG: Grographic Segmentation

6.4 3-6 Lead ECG

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 3-6 Lead ECG: Grographic Segmentation

6.5 12 Lead ECG

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 12 Lead ECG: Grographic Segmentation

Chapter 7: Electrocardiograph (ECG) Market by End-User

7.1 Electrocardiograph (ECG) Market Overview Snapshot and Growth Engine

7.2 Electrocardiograph (ECG) Market Overview

7.3 Home-Based Users

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Home-Based Users: Grographic Segmentation

7.4 Hospitals

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Hospitals: Grographic Segmentation

7.5 Other End Users

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Other End Users: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Electrocardiograph (ECG) Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Electrocardiograph (ECG) Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Electrocardiograph (ECG) Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 GE HEALTHCARE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 KONINKLINJE PHILIPS NV

8.4 NIHON KOHDEN CORPORATION

8.5 SCHILLER AG

8.6 OSI SYSTEMS INC. (SPACELABS HEALTHCARE)

8.7 ALIVECOR

8.8 MINDRAY MEDICAL INTERNATIONAL LIMITED

8.9 MEDTRONIC PLC

8.10 HILL-ROM HOLDINGS INC. (WELCH ALLYN)

Chapter 9: Global Electrocardiograph (ECG) Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Rest ECG Systems

9.2.2 Stress ECG Systems

9.2.3 Holter ECG Systems

9.2.4 Event Recorders

9.2.5 Other Products

9.3 Historic and Forecasted Market Size By Technology

9.3.1 Portable ECG Systems

9.3.2 Wireless ECG Systems

9.4 Historic and Forecasted Market Size By Lead Type

9.4.1 Single-Lead ECG

9.4.2 3-6 Lead ECG

9.4.3 12 Lead ECG

9.5 Historic and Forecasted Market Size By End-User

9.5.1 Home-Based Users

9.5.2 Hospitals

9.5.3 Other End Users

Chapter 10: North America Electrocardiograph (ECG) Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Rest ECG Systems

10.4.2 Stress ECG Systems

10.4.3 Holter ECG Systems

10.4.4 Event Recorders

10.4.5 Other Products

10.5 Historic and Forecasted Market Size By Technology

10.5.1 Portable ECG Systems

10.5.2 Wireless ECG Systems

10.6 Historic and Forecasted Market Size By Lead Type

10.6.1 Single-Lead ECG

10.6.2 3-6 Lead ECG

10.6.3 12 Lead ECG

10.7 Historic and Forecasted Market Size By End-User

10.7.1 Home-Based Users

10.7.2 Hospitals

10.7.3 Other End Users

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe Electrocardiograph (ECG) Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Rest ECG Systems

11.4.2 Stress ECG Systems

11.4.3 Holter ECG Systems

11.4.4 Event Recorders

11.4.5 Other Products

11.5 Historic and Forecasted Market Size By Technology

11.5.1 Portable ECG Systems

11.5.2 Wireless ECG Systems

11.6 Historic and Forecasted Market Size By Lead Type

11.6.1 Single-Lead ECG

11.6.2 3-6 Lead ECG

11.6.3 12 Lead ECG

11.7 Historic and Forecasted Market Size By End-User

11.7.1 Home-Based Users

11.7.2 Hospitals

11.7.3 Other End Users

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific Electrocardiograph (ECG) Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Rest ECG Systems

12.4.2 Stress ECG Systems

12.4.3 Holter ECG Systems

12.4.4 Event Recorders

12.4.5 Other Products

12.5 Historic and Forecasted Market Size By Technology

12.5.1 Portable ECG Systems

12.5.2 Wireless ECG Systems

12.6 Historic and Forecasted Market Size By Lead Type

12.6.1 Single-Lead ECG

12.6.2 3-6 Lead ECG

12.6.3 12 Lead ECG

12.7 Historic and Forecasted Market Size By End-User

12.7.1 Home-Based Users

12.7.2 Hospitals

12.7.3 Other End Users

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America Electrocardiograph (ECG) Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Rest ECG Systems

13.4.2 Stress ECG Systems

13.4.3 Holter ECG Systems

13.4.4 Event Recorders

13.4.5 Other Products

13.5 Historic and Forecasted Market Size By Technology

13.5.1 Portable ECG Systems

13.5.2 Wireless ECG Systems

13.6 Historic and Forecasted Market Size By Lead Type

13.6.1 Single-Lead ECG

13.6.2 3-6 Lead ECG

13.6.3 12 Lead ECG

13.7 Historic and Forecasted Market Size By End-User

13.7.1 Home-Based Users

13.7.2 Hospitals

13.7.3 Other End Users

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa Electrocardiograph (ECG) Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Rest ECG Systems

14.4.2 Stress ECG Systems

14.4.3 Holter ECG Systems

14.4.4 Event Recorders

14.4.5 Other Products

14.5 Historic and Forecasted Market Size By Technology

14.5.1 Portable ECG Systems

14.5.2 Wireless ECG Systems

14.6 Historic and Forecasted Market Size By Lead Type

14.6.1 Single-Lead ECG

14.6.2 3-6 Lead ECG

14.6.3 12 Lead ECG

14.7 Historic and Forecasted Market Size By End-User

14.7.1 Home-Based Users

14.7.2 Hospitals

14.7.3 Other End Users

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Electrocardiograph (ECG) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 5.41 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.44% |

Market Size in 2028: |

USD 7.34 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Lead Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTROCARDIOGRAPH (ECG) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTROCARDIOGRAPH (ECG) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTROCARDIOGRAPH (ECG) MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTROCARDIOGRAPH (ECG) MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTROCARDIOGRAPH (ECG) MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTROCARDIOGRAPH (ECG) MARKET BY TYPE

TABLE 008. REST ECG SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 009. STRESS ECG SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 010. HOLTER ECG SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 011. EVENT RECORDERS MARKET OVERVIEW (2016-2028)

TABLE 012. OTHER PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 013. ELECTROCARDIOGRAPH (ECG) MARKET BY TECHNOLOGY

TABLE 014. PORTABLE ECG SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 015. WIRELESS ECG SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 016. ELECTROCARDIOGRAPH (ECG) MARKET BY LEAD TYPE

TABLE 017. SINGLE-LEAD ECG MARKET OVERVIEW (2016-2028)

TABLE 018. 3-6 LEAD ECG MARKET OVERVIEW (2016-2028)

TABLE 019. 12 LEAD ECG MARKET OVERVIEW (2016-2028)

TABLE 020. ELECTROCARDIOGRAPH (ECG) MARKET BY END-USER

TABLE 021. HOME-BASED USERS MARKET OVERVIEW (2016-2028)

TABLE 022. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 023. OTHER END USERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY TECHNOLOGY (2016-2028)

TABLE 026. NORTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY LEAD TYPE (2016-2028)

TABLE 027. NORTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY END-USER (2016-2028)

TABLE 028. N ELECTROCARDIOGRAPH (ECG) MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE ELECTROCARDIOGRAPH (ECG) MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE ELECTROCARDIOGRAPH (ECG) MARKET, BY TECHNOLOGY (2016-2028)

TABLE 031. EUROPE ELECTROCARDIOGRAPH (ECG) MARKET, BY LEAD TYPE (2016-2028)

TABLE 032. EUROPE ELECTROCARDIOGRAPH (ECG) MARKET, BY END-USER (2016-2028)

TABLE 033. ELECTROCARDIOGRAPH (ECG) MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC ELECTROCARDIOGRAPH (ECG) MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC ELECTROCARDIOGRAPH (ECG) MARKET, BY TECHNOLOGY (2016-2028)

TABLE 036. ASIA PACIFIC ELECTROCARDIOGRAPH (ECG) MARKET, BY LEAD TYPE (2016-2028)

TABLE 037. ASIA PACIFIC ELECTROCARDIOGRAPH (ECG) MARKET, BY END-USER (2016-2028)

TABLE 038. ELECTROCARDIOGRAPH (ECG) MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA ELECTROCARDIOGRAPH (ECG) MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA ELECTROCARDIOGRAPH (ECG) MARKET, BY TECHNOLOGY (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA ELECTROCARDIOGRAPH (ECG) MARKET, BY LEAD TYPE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA ELECTROCARDIOGRAPH (ECG) MARKET, BY END-USER (2016-2028)

TABLE 043. ELECTROCARDIOGRAPH (ECG) MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY TECHNOLOGY (2016-2028)

TABLE 046. SOUTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY LEAD TYPE (2016-2028)

TABLE 047. SOUTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET, BY END-USER (2016-2028)

TABLE 048. ELECTROCARDIOGRAPH (ECG) MARKET, BY COUNTRY (2016-2028)

TABLE 049. GE HEALTHCARE: SNAPSHOT

TABLE 050. GE HEALTHCARE: BUSINESS PERFORMANCE

TABLE 051. GE HEALTHCARE: PRODUCT PORTFOLIO

TABLE 052. GE HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. KONINKLINJE PHILIPS NV: SNAPSHOT

TABLE 053. KONINKLINJE PHILIPS NV: BUSINESS PERFORMANCE

TABLE 054. KONINKLINJE PHILIPS NV: PRODUCT PORTFOLIO

TABLE 055. KONINKLINJE PHILIPS NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. NIHON KOHDEN CORPORATION: SNAPSHOT

TABLE 056. NIHON KOHDEN CORPORATION: BUSINESS PERFORMANCE

TABLE 057. NIHON KOHDEN CORPORATION: PRODUCT PORTFOLIO

TABLE 058. NIHON KOHDEN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SCHILLER AG: SNAPSHOT

TABLE 059. SCHILLER AG: BUSINESS PERFORMANCE

TABLE 060. SCHILLER AG: PRODUCT PORTFOLIO

TABLE 061. SCHILLER AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. OSI SYSTEMS INC. (SPACELABS HEALTHCARE): SNAPSHOT

TABLE 062. OSI SYSTEMS INC. (SPACELABS HEALTHCARE): BUSINESS PERFORMANCE

TABLE 063. OSI SYSTEMS INC. (SPACELABS HEALTHCARE): PRODUCT PORTFOLIO

TABLE 064. OSI SYSTEMS INC. (SPACELABS HEALTHCARE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ALIVECOR: SNAPSHOT

TABLE 065. ALIVECOR: BUSINESS PERFORMANCE

TABLE 066. ALIVECOR: PRODUCT PORTFOLIO

TABLE 067. ALIVECOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. MINDRAY MEDICAL INTERNATIONAL LIMITED: SNAPSHOT

TABLE 068. MINDRAY MEDICAL INTERNATIONAL LIMITED: BUSINESS PERFORMANCE

TABLE 069. MINDRAY MEDICAL INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 070. MINDRAY MEDICAL INTERNATIONAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. MEDTRONIC PLC: SNAPSHOT

TABLE 071. MEDTRONIC PLC: BUSINESS PERFORMANCE

TABLE 072. MEDTRONIC PLC: PRODUCT PORTFOLIO

TABLE 073. MEDTRONIC PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. HILL-ROM HOLDINGS INC. (WELCH ALLYN): SNAPSHOT

TABLE 074. HILL-ROM HOLDINGS INC. (WELCH ALLYN): BUSINESS PERFORMANCE

TABLE 075. HILL-ROM HOLDINGS INC. (WELCH ALLYN): PRODUCT PORTFOLIO

TABLE 076. HILL-ROM HOLDINGS INC. (WELCH ALLYN): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY TYPE

FIGURE 012. REST ECG SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 013. STRESS ECG SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 014. HOLTER ECG SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 015. EVENT RECORDERS MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHER PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 017. ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY TECHNOLOGY

FIGURE 018. PORTABLE ECG SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 019. WIRELESS ECG SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 020. ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY LEAD TYPE

FIGURE 021. SINGLE-LEAD ECG MARKET OVERVIEW (2016-2028)

FIGURE 022. 3-6 LEAD ECG MARKET OVERVIEW (2016-2028)

FIGURE 023. 12 LEAD ECG MARKET OVERVIEW (2016-2028)

FIGURE 024. ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY END-USER

FIGURE 025. HOME-BASED USERS MARKET OVERVIEW (2016-2028)

FIGURE 026. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHER END USERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA ELECTROCARDIOGRAPH (ECG) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electrocardiograph (ECG) Market research report is 2022-2028.

GE Healthcare, Koninklinje Philips NV, Nihon Kohden Corporation, Schiller AG, OSI Systems Inc. (Spacelabs Healthcare), AliveCor, Mindray Medical International Limited, Medtronic PLC, Hill-Rom Holdings Inc. (Welch Allyn), and other major players.

The Electrocardiograph (ECG) Market is segmented into Type, Technology, Lead Type, End Users, and region. By Type, the market is categorized into Rest ECG Systems, Stress ECG Systems, Holter ECG Systems, Event Recorders, and Other. By Technology the market is categorized into Portable ECG Systems, and Wireless ECG Systems. By Lead Type, the market is categorized into Single-Lead ECG, 3-6 Lead ECG, and 12 Lead ECG. By End-User the market is categorized into Home-Based Users, Hospitals, Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An electrocardiogram (ECG) is a test used to inspect the functioning of the heart by measuring its electrical activity of the heart. An ECG measures and registers the electrical activity that goes through the heart. An ECG may be suggested if a patient is feeling arrhythmia, chest pain, or palpitations, and an abnormal ECG result can be a signal of several different heart conditions. The key factors bolstering the market growth include increasing cases of cardiovascular diseases, increasing usage of remote monitoring devices, and rapid technological advancements.

Global Electrocardiograph (ECG) market was valued at USD 5.41 billion in 2021 and is expected to reach USD 7.34 billion by the year 2028, at a CAGR of 4.44%.