Electric Vehicle TIC (Testing, Inspection and Certification) Market Synopsis

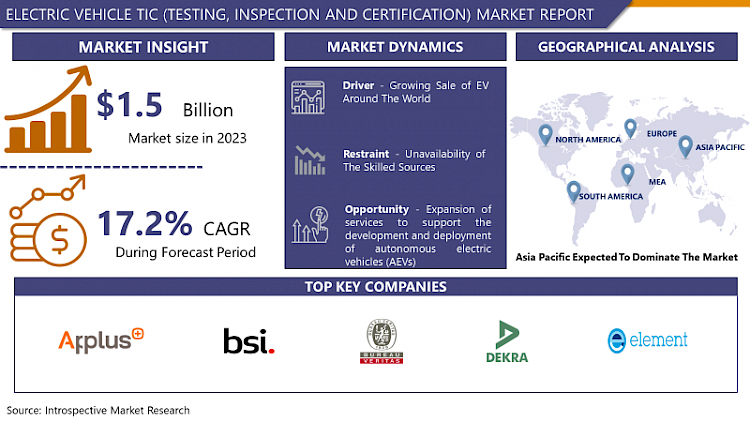

Electric Vehicle TIC (Testing, Inspection and Certification) Market Size Was Valued at USD 1.5 Billion in 2023, and is Projected to Reach USD 6.3 Billion by 2032, Growing at a CAGR of 17.2% From 2024-2032.

- EV Testing, Inspection, and Certification (TIC) solutions that assist in enhancing the quality and production of EVs with specific rules and guidelines in a particular area. The TIC service ensures the safety of users’ equipment and infrastructure and also the safety of the environment. Therefore, the government of various countries concentrated on the enforcement of stringent regulatory norms concerning the testing of electric vehicles. The rising trend of digitalization in the automotive industries; also the production of electric vehicles in developed as well as developing countries that helps to increase the demand for electric vehicles with quality and safety.

- Statista reported that there were 10. 2 million electric vehicles on the road in 2020. Due to big damage or failure of any component of the electric vehicle that leads to the dissatisfaction of the customer and also a loss for the company. In order to avoid this, this company offers the TIC service. Hence, the increased penetration of the electric vehicle and the approval of the periodic technical inspection (PTI) of vehicles by the government offers the growth for the electric vehicle TIC market during the forecast period.

- Other benefits of electric vehicle TIC include enhancing quality and production standards as well as increasing consumers’ acceptance of the vehicles. TIC services can also reduce the risks associated with EV adoption, including battery safety, vehicle function, and compatibility of charging stations with regulatory norms and standards.

- In addition, TIC services offer manufacturers critical information and intelligence that can be used to assess their performance and make improvements to their production and product quality. The electric vehicle industry is a promising sector in which to invest in TIC services due to its expanding demand for these services worldwide.

Electric Vehicle TIC (Testing, Inspection and Certification) Market Trend Analysis

Increasing emphasis on cybersecurity testing and certification for electric vehicles

- Cybersecurity for electric vehicles is an emerging issue as such cars are not only interconnected but also primarily based on software functionalities. This has resulted in many new regulations and policies from regulatory bodies and other industry players focusing on cybersecurity testing and certification to maintain the safety and reliability of electric vehicle systems.

- Cybersecurity audits involve various examinations such as penetration testing, vulnerability scans, and risk assessments to determine the possible risks to vehicle systems and operations, software, communication networks, or data transmission methods. Further, certification programs can be utilized to confirm that the electric vehicle meets cybersecurity standards and best practices throughout its lifecycle, offering consumers, regulatory bodies, and other stakeholders increased confidence that cybersecurity risks are managed throughout the electric vehicle’s value chain.

- This makes EV cybersecurity a top priority as the overall systems in EVs continue to evolve and become more electronically connected and automated. The use of cybersecurity testing and certification methods not only mitigates against cyber risks but also builds consumer confidence in EV technology.

- In addition, since EVs are considered part and parcel of intelligent mobility platforms, security concerns move from focusing on vehicular security to system-wide security of mobility systems. Consequently, the Electric Vehicle TIC market is experiencing increased demand for cybersecurity services and related solutions, especially those designed to meet the specific needs of electric cars, which will continue to foster new investments and initiatives for improving cybersecurity in the automotive industry.

Development and deployment of autonomous electric vehicles (AEVs): An ecosystem services perspective.

- With the increasing adoption of autonomous and connected vehicles in the automotive industry, the application of liability in AEV will focus more on ensuring the safety and reliability of these vehicles through proper testing and certification processes. TIC companies should consider this gap as an opportunity to expand their business by focusing on AEV testing services such as autonomous driving systems, sensor technologies, vehicle-to-vehicle communication, and cybersecurity. Automotive manufacturers can benefit from TIC providers’ greater attention to testing and certification services to meet stricter regulatory requirements and faster transition to AEVs.

- Further, the increased adoption of AI, ML, big data, and other future technologies is creating opportunities for innovation and value creation within the Electric Vehicle TIC market. TIC companies can use these technologies to improve methods of testing, facilitate procedures for certification, and provide effective analysis of the huge amount of data gathered during processes of testing.

- For example, some AI simulation tools can be used to replicate real-world driving scenarios to test the performance of EV and AV systems and conditions, which can also help in streamlining the testing process. Moreover, ML algorithms can monitor test results and detect possible threats to safety or quality of performance during the tests to correct the situation before going to the field. In summary, Electric Vehicle TIC providers must be proactive with digitalization and technological innovation to adapt to the changing automotive industry in the electrified and autonomous future.

Electric Vehicle TIC (Testing, Inspection and Certification) Market Segment Analysis:

Electric Vehicle TIC (Testing, Inspection and Certification) Market is Segmented on the basis of Service type, Sourcing Type, Application and end-users.

By Service Type, Testing segment is expected to dominate the market during the forecast period

- The Electric Vehicle TIC (Testing, Inspection and Certification) Market is further classified by the service type where testing segment is expected to continue its dominance during the forecast period. This can be due to several factors that contribute to EV dominance. First of all, there are numerous legal constraints and demands for safety that require a full range of testing to demonstrate that electric vehicles can meet certain criteria for quality, dependability, and safety.

- Testing services cover a broad scope of activities, from battery tests to electrical systems, vehicle dynamics, crashworthiness, and emissions testing for compliance. According to analysts, the scope of testing requirements for electric vehicles will continue to grow in line with the technological sophistication of EV powertrains and battery packs, fueling market opportunities for EV-focused testing services.

- Also, innovation and the evolution of electric vehicles are very fast, which requires constant product testing and validation of future trends and product needs. Testing services providers are extremely important to EV manufacturers as they help check new design materials and components for flaws or conduct tests to ascertain the level of improvement of existing products.

- Moreover, the rising focus on sustainability and the environment stimulates the demand for testing services regarding the energy efficiency and emissions of EVs as well as the overall lifecycle assessment of the vehicles. In conclusion, the testing segment is expected to continue to lead in the Electric Vehicle TIC market due to the importance of testing in ensuring the quality, safety and conformity of electric vehicles in an evolving and extremely competitive environment for automotive manufacturers.

On the basis of application, the Safety & Security segment is the largest in 2023.

- The Electric Vehicle TIC market by application shows that the Safety & Security segment leads with the major market share. This comes as a result of the paramount significance of safety and security mechanisms of the EVs for the producers as well as consumers. Due to the high-voltage electrical systems and the sophisticated battery technologies that come with EVs, safety is of utmost concern.

- TIC services in this segment concentrate on testing and certifying different features of EVs to ensure that they comply with strict safety and legal requirements. This includes inspecting battery systems, electrical components, charging equipment, and the vehicle as a whole to identify potential hazards of fire or electrical shock, as well as liability concerns.

- Furthermore, considering that EVs are becoming a part of regular traffic, one of the major issues that have arisen is the focus on vehicle cybersecurity. TIC services are crucial for the analysis of cyber security features in EVs and their cybersecurity of the vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication systems’ effectiveness in preventing cyber threats and data breaches.

- Safety & Security segment in Electric Vehicle TIC market is responsible for testing, inspection, and Certification of EVs to promote safety and security of EVs and provide confidence to the consumer and manufacturer about standardization and regulatory compliances in EV industry. The focused emphasis on this segment further reiterates the criticality of safety and security in the dynamic future of electric mobility.

Electric Vehicle TIC (Testing, Inspection and Certification) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The evolution of the Electric Vehicle TIC market in the Asia Pacific region in 2023: Key trends and dynamics of market participants. 0% share. This solid foundation can be explained by the importance of this region as one of the leading centers of the production of electric vehicles – the home of some of the world’s largest and most innovative makers of electric vehicles. The existence of innovative manufacturing capabilities and best-in-class production systems enhances Asia Pacific’s competitive advantage in the electric mobility space. Also, generous subsidies and other interventions by government meant to encourage people to embrace eco-friendly ways of traveling have further boosted the uptake of EVs across the region.

- The growth of EV manufacturing and markets in the Asia Pacific region has also fueled a strong growth in demand for TIC services. These services are a crucial component in the process of meeting strict safety and regulatory requirements which are paramount in protecting both manufacturers and consumers. Working with TIC providers that also offer EV testing and certification services in the Asia Pacific region can help EV manufacturers manage safety regulations and standards better and improve the overall quality and reliability of their products. Overall, the electric mobility market is growing at an extremely fast pace, and with Asia Pacific maintaining its leadership in the number of manufactured electric vehicles and TIC services for them as a prerequisite for further development and innovation in the industry.

Active Key Players in the Electric Vehicle TIC (Testing, Inspection and Certification) Market

- Applus Services S.A. (Spain)

- British Standards Institution (BSI) (United Kingdom)

- Bureau Veritas S.A. (France)

- DEKRA SE (DEKRA) (Germany)

- DNV GL Group AS (Norway)

- Element Materials Technology (London, United Kingdom)

- EQS - Engineering,Quality and Safety (Maia, Porto)

- Eurofins Scientific (Luxembourg)

- Intertek Group PLC (Intertek) (United Kingdom)

- Lloyd’s Register Group Limited (London, United Kingdom)

- MISTRAS Group Inc. (United States)

- Nemko (USA)

- NSF International (United States)

- RINA S.p.A (Genoa, Italy)

- SGS Group (Geneva)

- TÜV SÜD Group (Munich, Germany)

- UL LLC (United States)

- Other Key Players

Key Industry Developments in the Electric Vehicle TIC (Testing, Inspection and Certification) Market:

- August 2021, UL, a global safety science leader, and Hyundai Motor Company, a South Korean multinational automotive manufacturer, have agreed to work together to provide the necessary assurances that the Second-Life Battery Energy Storage System will be installed and operated securely and efficiently. This cooperation is expected to support the safe development of crucial zero-emission, renewable energy technologies and the process of safety evaluation and validation.

|

Global Electric Vehicle TIC (Testing, Inspection and Certification) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.2 % |

Market Size in 2032: |

USD 6.3 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Sourcing Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BY SERVICE TYPE (2017-2032)

- ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TESTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSPECTION

- CERTIFICATION

- ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BY SOURCING TYPE (2017-2032)

- ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IN-HOUSE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OUTSOURCED

- ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BY APPLICATION (2017-2032)

- ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SAFETY AND SECURITY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONNECTORS

- COMMUNICATION

- EV CHARGING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle TIC (Testing, Inspection and Certification) Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- APPLUS SERVICES S.A. (SPAIN)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BRITISH STANDARDS INSTITUTION (BSI) (UNITED KINGDOM)

- BUREAU VERITAS S.A. (FRANCE)

- DEKRA SE (DEKRA) (GERMANY)

- DNV GL GROUP AS (NORWAY)

- ELEMENT MATERIALS TECHNOLOGY (LONDON, UNITED KINGDOM)

- EQS - ENGINEERING,QUALITY AND SAFETY (MAIA, PORTO)

- EUROFINS SCIENTIFIC (LUXEMBOURG)

- INTERTEK GROUP PLC (INTERTEK) (UNITED KINGDOM)

- LLOYD’S REGISTER GROUP LIMITED (LONDON, UNITED KINGDOM)

- MISTRAS GROUP INC. (UNITED STATES)

- NEMKO (USA)

- NSF INTERNATIONAL (UNITED STATES)

- RINA S.P.A (GENOA, ITALY)

- SGS GROUP (GENEVA)

- TÜV SÜD GROUP (MUNICH, GERMANY)

- UL LLC (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service Type

- Historic And Forecasted Market Size By Sourcing Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle TIC (Testing, Inspection and Certification) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.2 % |

Market Size in 2032: |

USD 6.3 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Sourcing Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BY SERVICE TYPE

TABLE 008. TESTING MARKET OVERVIEW (2016-2028)

TABLE 009. INSPECTION MARKET OVERVIEW (2016-2028)

TABLE 010. CERTIFICATION MARKET OVERVIEW (2016-2028)

TABLE 011. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BY SOURCING TYPE

TABLE 012. IN-HOUSE MARKET OVERVIEW (2016-2028)

TABLE 013. OUTSOURCED MARKET OVERVIEW (2016-2028)

TABLE 014. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET BY APPLICATION

TABLE 015. SAFETY & SECURITY MARKET OVERVIEW (2016-2028)

TABLE 016. CONNECTORS MARKET OVERVIEW (2016-2028)

TABLE 017. COMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 018. EV CHARGING MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SERVICE TYPE (2016-2028)

TABLE 020. NORTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SOURCING TYPE (2016-2028)

TABLE 021. NORTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY APPLICATION (2016-2028)

TABLE 022. N ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SERVICE TYPE (2016-2028)

TABLE 024. EUROPE ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SOURCING TYPE (2016-2028)

TABLE 025. EUROPE ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY APPLICATION (2016-2028)

TABLE 026. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SERVICE TYPE (2016-2028)

TABLE 028. ASIA PACIFIC ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SOURCING TYPE (2016-2028)

TABLE 029. ASIA PACIFIC ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY APPLICATION (2016-2028)

TABLE 030. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SERVICE TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SOURCING TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY APPLICATION (2016-2028)

TABLE 034. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SERVICE TYPE (2016-2028)

TABLE 036. SOUTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY SOURCING TYPE (2016-2028)

TABLE 037. SOUTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY APPLICATION (2016-2028)

TABLE 038. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET, BY COUNTRY (2016-2028)

TABLE 039. DEKRA SE: SNAPSHOT

TABLE 040. DEKRA SE: BUSINESS PERFORMANCE

TABLE 041. DEKRA SE: PRODUCT PORTFOLIO

TABLE 042. DEKRA SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. TÜV SÜD GROUP: SNAPSHOT

TABLE 043. TÜV SÜD GROUP: BUSINESS PERFORMANCE

TABLE 044. TÜV SÜD GROUP: PRODUCT PORTFOLIO

TABLE 045. TÜV SÜD GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. APPLUS SERVICES S.A.: SNAPSHOT

TABLE 046. APPLUS SERVICES S.A.: BUSINESS PERFORMANCE

TABLE 047. APPLUS SERVICES S.A.: PRODUCT PORTFOLIO

TABLE 048. APPLUS SERVICES S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SGS GROUP: SNAPSHOT

TABLE 049. SGS GROUP: BUSINESS PERFORMANCE

TABLE 050. SGS GROUP: PRODUCT PORTFOLIO

TABLE 051. SGS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BUREAU VERITAS S.A.: SNAPSHOT

TABLE 052. BUREAU VERITAS S.A.: BUSINESS PERFORMANCE

TABLE 053. BUREAU VERITAS S.A.: PRODUCT PORTFOLIO

TABLE 054. BUREAU VERITAS S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. INTERTEK GROUP PLC: SNAPSHOT

TABLE 055. INTERTEK GROUP PLC: BUSINESS PERFORMANCE

TABLE 056. INTERTEK GROUP PLC: PRODUCT PORTFOLIO

TABLE 057. INTERTEK GROUP PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. EUROFINS SCIENTIFIC: SNAPSHOT

TABLE 058. EUROFINS SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 059. EUROFINS SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 060. EUROFINS SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ELEMENT MATERIALS TECHNOLOGY: SNAPSHOT

TABLE 061. ELEMENT MATERIALS TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 062. ELEMENT MATERIALS TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 063. ELEMENT MATERIALS TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. LLOYD’S REGISTER GROUP LIMITED: SNAPSHOT

TABLE 064. LLOYD’S REGISTER GROUP LIMITED: BUSINESS PERFORMANCE

TABLE 065. LLOYD’S REGISTER GROUP LIMITED: PRODUCT PORTFOLIO

TABLE 066. LLOYD’S REGISTER GROUP LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. MISTRAS GROUP INC.: SNAPSHOT

TABLE 067. MISTRAS GROUP INC.: BUSINESS PERFORMANCE

TABLE 068. MISTRAS GROUP INC.: PRODUCT PORTFOLIO

TABLE 069. MISTRAS GROUP INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. UL LLC: SNAPSHOT

TABLE 070. UL LLC: BUSINESS PERFORMANCE

TABLE 071. UL LLC: PRODUCT PORTFOLIO

TABLE 072. UL LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. DNV GL GROUP AS: SNAPSHOT

TABLE 073. DNV GL GROUP AS: BUSINESS PERFORMANCE

TABLE 074. DNV GL GROUP AS: PRODUCT PORTFOLIO

TABLE 075. DNV GL GROUP AS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. BRITISH STANDARDS INSTITUTION: SNAPSHOT

TABLE 076. BRITISH STANDARDS INSTITUTION: BUSINESS PERFORMANCE

TABLE 077. BRITISH STANDARDS INSTITUTION: PRODUCT PORTFOLIO

TABLE 078. BRITISH STANDARDS INSTITUTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. RINA S.P.A: SNAPSHOT

TABLE 079. RINA S.P.A: BUSINESS PERFORMANCE

TABLE 080. RINA S.P.A: PRODUCT PORTFOLIO

TABLE 081. RINA S.P.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. NORGES ELEKTRISKE MATERIELLKONTROLL: SNAPSHOT

TABLE 082. NORGES ELEKTRISKE MATERIELLKONTROLL: BUSINESS PERFORMANCE

TABLE 083. NORGES ELEKTRISKE MATERIELLKONTROLL: PRODUCT PORTFOLIO

TABLE 084. NORGES ELEKTRISKE MATERIELLKONTROLL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. NSF INTERNATIONAL: SNAPSHOT

TABLE 085. NSF INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 086. NSF INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 087. NSF INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. EQS -ENGINEERING: SNAPSHOT

TABLE 088. EQS -ENGINEERING: BUSINESS PERFORMANCE

TABLE 089. EQS -ENGINEERING: PRODUCT PORTFOLIO

TABLE 090. EQS -ENGINEERING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. QUALITY AND SAFETY: SNAPSHOT

TABLE 091. QUALITY AND SAFETY: BUSINESS PERFORMANCE

TABLE 092. QUALITY AND SAFETY: PRODUCT PORTFOLIO

TABLE 093. QUALITY AND SAFETY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 094. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 095. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 096. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY SERVICE TYPE

FIGURE 012. TESTING MARKET OVERVIEW (2016-2028)

FIGURE 013. INSPECTION MARKET OVERVIEW (2016-2028)

FIGURE 014. CERTIFICATION MARKET OVERVIEW (2016-2028)

FIGURE 015. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY SOURCING TYPE

FIGURE 016. IN-HOUSE MARKET OVERVIEW (2016-2028)

FIGURE 017. OUTSOURCED MARKET OVERVIEW (2016-2028)

FIGURE 018. ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY APPLICATION

FIGURE 019. SAFETY & SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 020. CONNECTORS MARKET OVERVIEW (2016-2028)

FIGURE 021. COMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 022. EV CHARGING MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA ELECTRIC VEHICLE TIC (TESTING, INSPECTION AND CERTIFICATION) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle TIC (Testing, Inspection and Certification) Market research report is 2024-2032.

DEKRA SE (DEKRA) (Germany), TÜV SÜD Group (Germany), Applus Services S.A. (Applus+) (Spain), SGS Group (Switzerland), Bureau Veritas S.A.(France), and Other major players.

The Electric Vehicle TIC (Testing, Inspection and Certification) Market is segmented into Service Type, Sourcing Type, Application, and region. By Service Type, the market is categorized into Testing, Inspection and Certification. By Sourcing Type, the market is categorized into In-house and Outsourced. By Application, the market is categorized into Safety & Security, Connectors, Communication and EV Charging. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric vehicle Testing, Inspection, and Certification (TIC) services that help to improve standards of quality and manufacturing of electric vehicles with certain regulations and standards in a specific region. The TIC service provides the safety of users' equipment, infrastructure, and also of the environment. Thus, the government of various countries focused on the implementation of stringent regulatory norms regarding the testing of electric vehicles. The growing trend of digitalization in the automotive industries and also increasing production of electric vehicles in developed as well as developing countries that help to rising the demand for electric vehicles with quality and safety.

Electric Vehicle TIC (Testing, Inspection and Certification) Market Size Was Valued at USD 1.5 Billion in 2023, and is Projected to Reach USD 6.3 Billion by 2032, Growing at a CAGR of 17.2% From 2023-2032.