Electric Vehicle Motor Market Synopsis

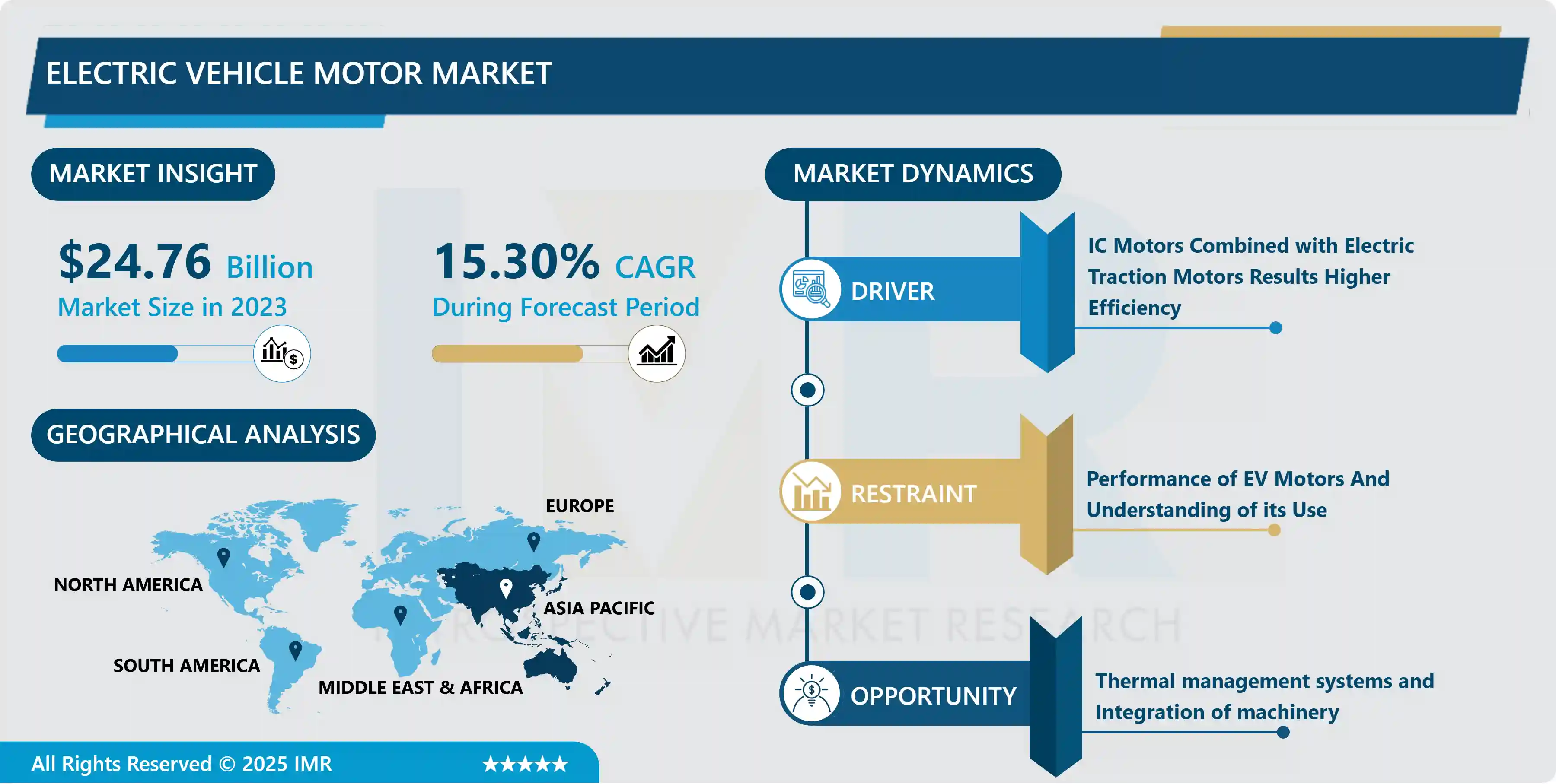

Electric Vehicle Motor Market Size Was Valued at USD 24.76 Billion in 2023 and is Projected to Reach USD 89.17 Billion by 2032, Growing at a CAGR of 15.3% From 2024-2032.

Three main subsystems make up an electric vehicle, the electric propulsion subsystem, the auxiliary subsystem, and the energy supply subsystem. The electronic controller, power converter, mechanical transmission, and electric motor make up the electronic propulsion subsystem. An electric motor typically has the following components, a rotor, stator, windings, air gap, and commutators/converters. Different configurations of these parts result in different kinds of electric motors being built. Brushless permanent magnet motors are those electric motors that don't need brushes for energy conversion or commutation. Moreover, the form of a motor's back-EMF can be used to classify them. They can have either a trapezoidal or sinusoidal shape. These geometries indicate that they are either brushless DC motors (BLDC) or permanent magnet AC synchronous motors (PMSM). An electric motor needs to be extremely efficient, have a high-power density, and be reasonably priced to be used as the drive for electric vehicles. On the other hand, the motor's specifications vary depending on its intended use. This application can be used for heavy-duty vehicles, normal cars, or homes. Additionally, the vehicle duty cycle, temperature properties, and the cooling technique used all affect how well motors work.

When driving in locations with low vehicle speed, such hills, or when crossing busy roads, the electric motor should have a high torque output. The motor drive's characteristics dictate the vehicle's performance. Without a brush the torque of a DC motor is the largest, but because of variations in its field, its power range is not constant. In the future, it is anticipated that the production and manufacturing of electric vehicles would rise. Since BLDC and induction motors are the lightest and most efficient types of motors, they should be the best choices for electric drives. To attain the required efficiency, rare-earth elements make up most of the permanent magnet used in electric vehicles. The contrast pertaining to a variable reluctance motor the study examines permanent magnet motors, brushless DC motors, and induction motors (IM) for electric drives. They are compared based on their effectiveness, cost, weight, and dependability. It is believed that the rising acceptance of electric cars (EVs) represents a step in the right direction for automotive technology. The engine, which powers these EVs, must be carefully inspected considering this. The motor of an electric car is an essential component of its propulsion system, and it can have a significant impact on the vehicle's performance, dependability, weight, cost, and efficiency. Comprehensive comparison study that assesses and compares the various motor types and topologies now in use, therefore desperately needed. The capabilities of permanent magnet AC motors, permanent magnet DC motors, switching reluctance motors, DC motors, and induction motors all of which can be used to power electric vehicles. In addition to a thorough analysis of existing motors and the possible application of power electronic techniques to EVs, recommendations are made for several innovative brushless DC motor designs. Permanent magnet spoke or insert motors and permanent magnet hybrid motors are the two types of permanent magnet motors.

Electric Vehicle Motor Market Trend Analysis

IC Motors Combined with Electric Traction Motors Results Higher Efficiency

- Driveline topologies for hybrid and completely electric vehicles are becoming more and more popular as electric vehicles achieve widespread adoption. The development of the EV has included studies on common motor drives for EV and HEV, with an emphasis on currently available and forthcoming electric motors. which highlights the automatic components of the EV driveline and discusses the advantages and disadvantages of recent technical advancements. Ever since the Ford T started to be produced in substantial quantities, the automotive industry has been a major influence in research. Electric vehicles (EVs) are currently viewed as the automobile of the future and are gaining industrial traction quickly.

- Three main periods may be distinguished in the history of the EV. IC motors began to acquire traction. Steam cars were expensive to fix, dirty, and dangerous. Electric vehicles offered several technological advantages. The limited range of EVs was less of a hindrance because those long excursions were uncommon and only major cities had completely paved roads. For many years, internal combustion (IC) vehicles were the only option available due to advancements in the technology and the reduction in cost brought about by mass production. It was realised early in the HEV's development that IC motors combined with electric traction motors might result in higher efficiency. The second wave of EVs emerged because of advancements in power electronics.

- It's also important to remember that the automotive sector was the first to research electric vehicle motor control. Funding and enthusiasm in EV research were maintained in part by the oil crisis. Prototypes made during this period served as the foundation for modern electric cars. EVs were less feasible than internal combustion engine cars due to their low energy density and rising battery costs. However, because of the current state of transportation and the increase in pollution, EVs and HEVs are becoming more popular. Legislative support for environmentally friendly transportation is also evident in the subsidies and tax breaks offered for EVs and HEVs.

- Social and economic factors contribute to the allure of electric vehicles. This accomplishment indicates a renewed interest in efficient electric drives. Separate standards for vehicle propulsion apply to on-board and stationary motors. Every kilogramme carried aboard raises the structural strains and results in energy loss for the system via friction. Low energy requirements from high efficiency translate into lighter batteries. Therefore, Permanent Magnet (PM) motors are the most efficient option. It is predicted that a conversion to EVs and HEVs for all industrialised nations would result in higher prices and a shortage of raw materials if PM motors are composed of rare earth elements.

Restraints

Performance of EV Motors And Understanding of its Use

- Elevated temperatures have the potential to cause premature motor failure by weakening magnets, reducing bearing life, and deteriorating wire insulation. Heat dissipation causes the motor's electrical resistance to rise, which reduces driving range and wastes energy. The goal is to provide cutting-edge cooling solutions that are versatile, lightweight, and able to withstand a larger range of operating environments. The term "torque ripple" describes variations in the motor's torque production as it is rotating. This may result in felt in the car's interior and on the steering wheel, making driving less comfortable. noises that passengers may find unpleasant, such as whining or grinding. Now, powerful electric motors are often large and weighty because of The power a motor can produce per unit of weight or volume.

- The high cost of electric vehicle motors can be ascribed to the use of permanent magnets in some motors, which use geopolitically problematic supply chains and rare earth materials like neodymium, which can be costly. Electric motors are complex devices that demand labour-intensive procedures and specialised methods for accurate assembly. At lower speeds than their maximum performance, electric motors are often less efficient. This is especially pertinent to Although useful, the braking process's ability to convert kinetic energy into electrical may be less effective at lower speeds. Significant barriers to EV adoption include their high initial cost, inadequate infrastructure for charging, and range anxiety. These elements are impacted by One of the key reasons EVs are still so expensive is battery pricing. Moreover, deterioration and range restrictions of batteries.

- To overcome these obstacles, technological advancements in batteries are essential. EVs and gasoline-powered vehicles can be more affordably priced thanks to government subsidies and tax advantages. Nevertheless, there are regional differences in these incentives' availability and efficacy. Prospective EV customers are deterred by the absence of widely available and dependable charging facilities, particularly quick chargers for lengthy journeys. Both public and commercial sectors must make investments in developing the infrastructure for charging. The advantages of electric vehicles (EVs), including reduced operating costs, environmental benefits, and breakthroughs in battery technology, are not well known to many consumers. Misconceptions can be addressed with the aid of educational programmes and the promotion of actual driving experiences.

Opportunity

Thermal management systems and Integration of machinery

- Power electronics and machine integration is another emerging technology that is here to stay. Compact powertrain systems are required as space requirements for car comfort increase, making innovative integration approaches even more important. By enclosing the power electronic drive and electric machine into a single compartment, advantages such as density or reduced size, reduction in number of parts, shortened cable runs and busbars, lower electromagnetic interference, and significant cost savings can be realised. PD may be increased by at least 10% and manufacturing and installation costs may be lowered by 30% to 40% with integrated motor and power electronics. But placing the power electronics and electric machine in the same compartment causes problems with the system. It can be difficult to control compound thermal concerns. Electrical boards are more brittle and less adaptable to motion.

- It's challenging to combine them. Considering this, several trade-off studies have been carried out to generate solutions that optimise integration benefits while lowering system errors. outlined four options for integrating a motor and an inverter. The techniques essentially include installing the power electronics on the motor's axis using an axial and radial mounting approach. This allows the power electronic inverter to be seen on the motor's end shield in addition to its casing. Power electronics are installed around the perimeter of the motor stator and at the end of the stator. For example, while the more common method shown in is easy to build, it can only achieve a limited high PD. The IM is installed on the motor housing in this configuration, or on the housing's side in several iterations of the same concept. A combined or separate cooling system may also be used by the motor and drive. In some cases, the cooling system could be independent, which leads to less-than-optimal system volume utilisation. In some cases, the cooling system could be independent, which leads to less-than-optimal system volume utilisation.

- These other designs offer better integration even though the stator curvature makes it impossible for them to simply offer a flat surface on which to attach electrical components. The degree and technique of integration will be determined by the EV's design, including factors like the number of axles and motors. A common example of radial housing application is the Chevy Volt. The Tesla vehicles with two axle motors and rear motor combinations are oriented towards the axial end plate mount to provide a longitudinal configuration as opposed to a vertical one. Given the substantial advantages already mentioned, it is generally expected that ever-closer integration will be pursued. To keep vehicle traction drive systems' specific power and PD from increasing, advanced heat management technologies are required.

Challenges

High cost of Raw Material and Low Performance

- Motors utilised in certain EV vehicles are displayed in the examined EV market. Draw the conclusion that the PMSM, IM, and SRM are the three major types of motors now used in EV propulsion systems. Of these, EV manufacturers now choose PMSMs because of their high torque and high-power density, which are made possible by high-energy-density PMs like samarium cobalt (SmCo) and neodymium ferromagnet (NdFeB). The PMSM is separated into two categories, surface and interior PMSM. Since internal PMSMs have a larger overload capacity for a given size, internal PMSMs are more frequently found in electric vehicles.

- The cost of high-energy-density PM is at least double that of the other raw materials used in electric motors because of its limited yield, non-renewability, and geopolitical implications. For this reason, methods that can lower PM costs without significantly compromising performance are crucial and pressing for the EV sector. Two low-cost alternatives to PM motors are the spoke-type motor and the permanent magnet assisted synchronous reluctance motor (PMasyRM). With its well-established methods and economic benefits, the IM is one of the PM-free motors that has effectively entered the EV market. However, the IM's efficiency performance is worse than that of other motors because of structural limitations, which is detrimental to mileage. It is expected that when alternative motor techniques advance, the financial benefit of mature IM technology will be gradually reduced.

- For instance, there is growing interest in the SRM with the lowest material cost. The material cost of SRM is roughly half that of PMSM (NdFeB) and less than 80% of IM to produce the same output power of 30kW. Nevertheless, few EVs now use SRM due to its drawbacks, which include low torque density, high torque ripple, and high noise. Furthermore, the regenerative braking technique is becoming more and more crucial for electric vehicles (EVs) due to its ability to recover electrical energy for extended distances. Enhancing the. A sample of a market-available electric vehicle (EV), complete with model, motor category, and power. For EV motors, improving motor performance to boost the energy recovered through regenerative braking has emerged as a new problem.

Electric Vehicle Motor Market Segment Analysis:

Electric Vehicle Motor market is segmented on the basis of Electric Vehicle Type, Motors Type, End Users, Powertrain Type.

By Motor Type, Permanent Synchronous Motors Segment Is Expected to Dominate the Market During the Forecast Period

By Motors Type, the market is categorized into Brush Less Motors, DC Brush Motors, Induction Motors, Switched Reluctance Motors, Synchronous Motors, And Permanent Synchronous Motors.In which Permanent Synchronous Motors Segment Is Expected to Dominate the Market During the Forecast Period

- Due to higher efficiency, PMSMs can drive farther between charges. This is an important consideration for customers, particularly as the infrastructure for charging grows, but it might not always be available when travelling great distances. Because PMSMs offer great power density for their size and increased range, EVs will appeal to a larger variety of consumers and allow for lighter motors. Better acceleration and handling result from this, making driving an EV more enjoyable and engaging. Furthermore, cost reductions are anticipated due to economies of scale as PMSM production rises, making EVs more accessible to customers.

- The fact that some PMSMs still require rare earth elements to power their permanent magnets presents a problem today. These components have supply chain geopolitical issues and can be costly. Research into alternate magnet materials that perform similarly but require fewer rare earth elements will probably be prioritised in the future. As a result, the supply chain will be stable and production costs may go down. Another area of research is investigating motor designs that achieve excellent performance using less or different magnet materials.

- By expanding the ecosystem for R&D and cost-cutting, this diversification will further boost the PMSM industry. PMSMs are expected to be widely adopted across a range of industries as they become more accessible and cheaper. It is a win-win situation for PMSMs and EVs. The performance and efficiency that PMSMs provide are critical to EV success. On the other hand, the expanding EV market will spur PMSM technological innovation and development, increasing EVs' efficiency, power, and affordability. Both technologies' futures will probably be shaped by this symbiotic relationship, which will also be crucial in the shift to a cleaner and more sustainable transportation environment.

- The brushless DC motor offers a straightforward design with minimal noise, cost, and torque ripple. However, it degrades in terms of chapter performance and dependability. The induction motor, which is highly versatile and ranks second overall after the permanent magnet motor, is made possible by its moderate size, high speed efficiency, and power density. The Synchronous Reluctance powertrain is third on the list because of its high implementation costs, size, and control simplicity. Tesla managed to overcome these issues by using pricey and sophisticated power electronics.

- A switched resistor motor excels in dependability and critical areas like cost, efficiency, and speed range but falls short in other areas like noise and size. Finally, the use of PMSM traction is demonstrated by its outstanding size, performance, efficiency, and power density without the need for very sophisticated electronics at least not in the same way as SynRm while maintaining a reasonable cost and speed range. The performance value of PMSM is comparatively high then others motor.

By Electric Vehicle Type, Plug in Electric Vehicle Segment Held the Largest Share In 2023

By Electric Vehicle Type, the market is categorized into Battery Electric Vehicle, Hybrid Electric Vehicle, Plug in Electric Vehicle. In which Plug in Electric Vehicle Segment Held the Largest Share In 2023

- Plug-in electric vehicles (PEVs) have so far emerged as the dominant vehicle type, dislodging conventionally powered vehicles in the transitional phase of the automotive market. Since PEV adoption has been going on for more than ten years, adopters of PEVs are starting to replace the cars they started with. In this study, we examine this behaviour through survey data from 1,446 PEV adopters who were surveyed both a few years and a year and a half after their initial adoption. This enables us to define and comprehend the decisions that users of plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) make when they replace their PEVs.

|

Electric Vehicle Motor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.76 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.3 % |

Market Size in 2032: |

USD 89.17 Bn. |

|

Segments Covered: |

By Electric Vehicle Type |

|

|

|

By Motors Type |

|

||

|

By End Users |

|

||

|

By Powertrain Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Motor Market by

Electric Vehicle Type (2018-2032)

4.1 Electric Vehicle Motor Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Battery Electric Vehicle

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid Electric Vehicle

4.5 Plug in Electric Vehicle

Chapter 5: Electric Vehicle Motor Market by

Motors Type (2018-2032)

5.1 Electric Vehicle Motor Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Brush Less Motors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 DC Brush Motors

5.5 Induction Motors

5.6 Switched Reluctance Motors

5.7 Synchronous Motors

5.8 Permanent Synchronous Motors

Chapter 6: Electric Vehicle Motor Market by End Users (2018-2032)

6.1 Electric Vehicle Motor Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Residential

6.6 Transportation

6.7 Agriculture

Chapter 7: Electric Vehicle Motor Market by Powertrain Type (2018-2032)

7.1 Electric Vehicle Motor Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Single Motor

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Dual Motor

7.5 Triple Motor

7.6 Four Motor

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Electric Vehicle Motor Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 TESLA (NORTH AMERICA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 GENERAL MOTORS (NORTH AMERICA)

8.4 FORD MOTOR COMPANY (NORTH AMERICA)

8.5 AMETEK INC. (NORTH AMERICA)

8.6 GENERAL MOTORS (NORTH AMERICA)

8.7 ABB LTD (EUROPE)

8.8 RENAULT (EUROPE)

8.9 VOLKSWAGEN (EUROPE)

8.10 BMW (EUROPE)

8.11 ROBERT BOSCH (EUROPE)

8.12 CONTINENTAL AG(EUROPE)

8.13 MERCEDES-BENZ GROUP (EUROPE)

8.14 HITACHI ASTEMO LTD. (ASIA)

8.15 JOHNSON ELECTRIC (ASIA)

8.16 MG MOTOR INDIA PRIVATE LIMITED (ASIA)

8.17 NIDEC CORPORATION (ASIA)

8.18 TOYOTA MOTOR CORPORATION (ASIA)

8.19 HYUNDAI (ASIA)

8.20 TATA MOTORS (ASIA)

8.21 MAHINDRA & MAHINDRA (ASIA)

8.22 ATHER ENERGY PRIVATE LIMITED (ASIA)

8.23 JBM AUTO LTD (ASIA)

8.24 BYD (ASIA)

8.25 OLECTRA GREENTECH LIMITED (ASIA)

8.26 SAIC MOTORS (ASIA) OTHER ACTIVE KEY PLAYERS

Chapter 9: Global Electric Vehicle Motor Market By Region

9.1 Overview

9.2. North America Electric Vehicle Motor Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by

Electric Vehicle Type

9.2.4.1 Battery Electric Vehicle

9.2.4.2 Hybrid Electric Vehicle

9.2.4.3 Plug in Electric Vehicle

9.2.5 Historic and Forecasted Market Size by

Motors Type

9.2.5.1 Brush Less Motors

9.2.5.2 DC Brush Motors

9.2.5.3 Induction Motors

9.2.5.4 Switched Reluctance Motors

9.2.5.5 Synchronous Motors

9.2.5.6 Permanent Synchronous Motors

9.2.6 Historic and Forecasted Market Size by End Users

9.2.6.1 Industrial

9.2.6.2 Commercial

9.2.6.3 Residential

9.2.6.4 Transportation

9.2.6.5 Agriculture

9.2.7 Historic and Forecasted Market Size by Powertrain Type

9.2.7.1 Single Motor

9.2.7.2 Dual Motor

9.2.7.3 Triple Motor

9.2.7.4 Four Motor

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Electric Vehicle Motor Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by

Electric Vehicle Type

9.3.4.1 Battery Electric Vehicle

9.3.4.2 Hybrid Electric Vehicle

9.3.4.3 Plug in Electric Vehicle

9.3.5 Historic and Forecasted Market Size by

Motors Type

9.3.5.1 Brush Less Motors

9.3.5.2 DC Brush Motors

9.3.5.3 Induction Motors

9.3.5.4 Switched Reluctance Motors

9.3.5.5 Synchronous Motors

9.3.5.6 Permanent Synchronous Motors

9.3.6 Historic and Forecasted Market Size by End Users

9.3.6.1 Industrial

9.3.6.2 Commercial

9.3.6.3 Residential

9.3.6.4 Transportation

9.3.6.5 Agriculture

9.3.7 Historic and Forecasted Market Size by Powertrain Type

9.3.7.1 Single Motor

9.3.7.2 Dual Motor

9.3.7.3 Triple Motor

9.3.7.4 Four Motor

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Electric Vehicle Motor Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by

Electric Vehicle Type

9.4.4.1 Battery Electric Vehicle

9.4.4.2 Hybrid Electric Vehicle

9.4.4.3 Plug in Electric Vehicle

9.4.5 Historic and Forecasted Market Size by

Motors Type

9.4.5.1 Brush Less Motors

9.4.5.2 DC Brush Motors

9.4.5.3 Induction Motors

9.4.5.4 Switched Reluctance Motors

9.4.5.5 Synchronous Motors

9.4.5.6 Permanent Synchronous Motors

9.4.6 Historic and Forecasted Market Size by End Users

9.4.6.1 Industrial

9.4.6.2 Commercial

9.4.6.3 Residential

9.4.6.4 Transportation

9.4.6.5 Agriculture

9.4.7 Historic and Forecasted Market Size by Powertrain Type

9.4.7.1 Single Motor

9.4.7.2 Dual Motor

9.4.7.3 Triple Motor

9.4.7.4 Four Motor

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Electric Vehicle Motor Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by

Electric Vehicle Type

9.5.4.1 Battery Electric Vehicle

9.5.4.2 Hybrid Electric Vehicle

9.5.4.3 Plug in Electric Vehicle

9.5.5 Historic and Forecasted Market Size by

Motors Type

9.5.5.1 Brush Less Motors

9.5.5.2 DC Brush Motors

9.5.5.3 Induction Motors

9.5.5.4 Switched Reluctance Motors

9.5.5.5 Synchronous Motors

9.5.5.6 Permanent Synchronous Motors

9.5.6 Historic and Forecasted Market Size by End Users

9.5.6.1 Industrial

9.5.6.2 Commercial

9.5.6.3 Residential

9.5.6.4 Transportation

9.5.6.5 Agriculture

9.5.7 Historic and Forecasted Market Size by Powertrain Type

9.5.7.1 Single Motor

9.5.7.2 Dual Motor

9.5.7.3 Triple Motor

9.5.7.4 Four Motor

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Electric Vehicle Motor Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by

Electric Vehicle Type

9.6.4.1 Battery Electric Vehicle

9.6.4.2 Hybrid Electric Vehicle

9.6.4.3 Plug in Electric Vehicle

9.6.5 Historic and Forecasted Market Size by

Motors Type

9.6.5.1 Brush Less Motors

9.6.5.2 DC Brush Motors

9.6.5.3 Induction Motors

9.6.5.4 Switched Reluctance Motors

9.6.5.5 Synchronous Motors

9.6.5.6 Permanent Synchronous Motors

9.6.6 Historic and Forecasted Market Size by End Users

9.6.6.1 Industrial

9.6.6.2 Commercial

9.6.6.3 Residential

9.6.6.4 Transportation

9.6.6.5 Agriculture

9.6.7 Historic and Forecasted Market Size by Powertrain Type

9.6.7.1 Single Motor

9.6.7.2 Dual Motor

9.6.7.3 Triple Motor

9.6.7.4 Four Motor

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Electric Vehicle Motor Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by

Electric Vehicle Type

9.7.4.1 Battery Electric Vehicle

9.7.4.2 Hybrid Electric Vehicle

9.7.4.3 Plug in Electric Vehicle

9.7.5 Historic and Forecasted Market Size by

Motors Type

9.7.5.1 Brush Less Motors

9.7.5.2 DC Brush Motors

9.7.5.3 Induction Motors

9.7.5.4 Switched Reluctance Motors

9.7.5.5 Synchronous Motors

9.7.5.6 Permanent Synchronous Motors

9.7.6 Historic and Forecasted Market Size by End Users

9.7.6.1 Industrial

9.7.6.2 Commercial

9.7.6.3 Residential

9.7.6.4 Transportation

9.7.6.5 Agriculture

9.7.7 Historic and Forecasted Market Size by Powertrain Type

9.7.7.1 Single Motor

9.7.7.2 Dual Motor

9.7.7.3 Triple Motor

9.7.7.4 Four Motor

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Electric Vehicle Motor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.76 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.3 % |

Market Size in 2032: |

USD 89.17 Bn. |

|

Segments Covered: |

By Electric Vehicle Type |

|

|

|

By Motors Type |

|

||

|

By End Users |

|

||

|

By Powertrain Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||