E-Prescribing Market Synopsis:

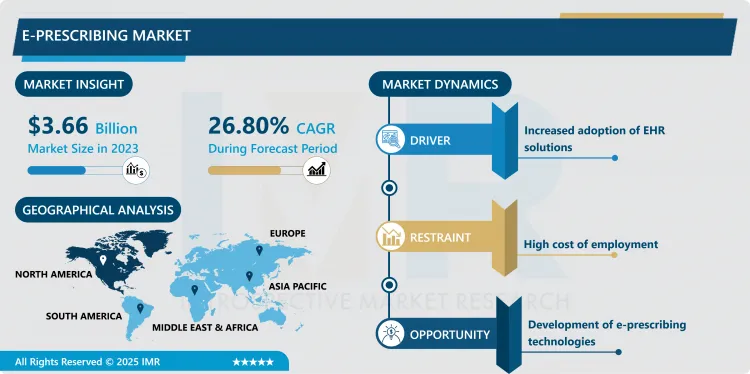

E-Prescribing Market Size Was Valued at USD 3.66 Billion in 2023, and is Projected to Reach USD 31.05 Billion by 2032, Growing at a CAGR of 26.80% From 2024-2032.

E-prescribing, also referred to as electronic prescribing, is a technological structure that allows doctors and other prescribers to electronically write prescriptions that are sent to a participating pharmacy instead of handwritten orders, facsimile, or voice, transmittals. E-prescribing or electronic prescribing is a type of application that implemented commonly through web or cloud that enables the provider to prescribe electronically. It is a computer-generated and computer-delivered process of producing and transmitting correct prescription orders to a hospital-based or any independent pharmacy. Electronic prescription software is capable of renewing prescription and analyzing a patient’s medication history and prescribing appropriate medicaments and software compatibility with the EMR.

The e-prescribing market has grown significantly over the years because of technological advancement and the advancement of the adoption of Electronic Health Record/ Electronic Medical Record, the need to lower on avoidable incidences of medication error, and an overall move towards efficient Health Information Technology systems. E-prescribing refers to a practice whereby prescriptions are transmitted through an electronic system to the pharmacist with a view of enhancing the tradition of handling prescriptions electronically. Increased incidence of chronic ailments together with the increasing aging population has played a major role in the growth of this market. Such demographic factors have plunged the consumption of healthcare services hence raising the importance of efficient prescription systems. Further, it has been seen that ministries of health and government driven strategies and rules all over the world especially the Health Information Technology for Economic and Clinical Health (HITECH) Act within the United States of America and similar policies within European nations have greatly contributed to the contemporary use of e-prescribing systems.

The market’s growth is also attributed to the development of heath IT infrastructure such as the integration of e-prescribing solutions with EHRs and CDSs. This integration does not only benefits the patients but the heath care providers since it increases effectiveness of patient care delivery. In addition, to the COVID-19 outbreak, increased the importance of telehealth services and safe and convenient necessity for e-prescribing than paper prescriptions. Nonetheless, the market has its pitfalls like the industry’s anxiety about data security, and the enormous cost of adopting e-prescribing solutions. Nonetheless, existing challenges of high implementation cost, complexity, and lack of standardisation, coupled with continued technological advancements and increasing appreciation of e-prescribing are expected to reduce the impact of these barriers to preserve the future market growth.

E-Prescribing Market Trend Analysis:

Widespread Adoption of E-Prescribing Systems and Enhanced Data Integration

- Another dynamic in the e-prescribing market is where e-prescribing systems is gradually making its way into healthcare facilities. Prescription ordering systems enable the healthcare providers to electronically communicate the prescriptions to the pharmacies eliminating the use of prescription writing and passing. The use of such a digital approach means that the amount of prescription work done is greatly reduced by eliminating the time spent completing paperwork, entering data into a computer, or handwriting prescriptions. The above errors find their way eliminated by e-prescribing and in the same process, patient safety and efficiency in the operation of the health sector, particularly the readiness of the pharmacy becomes a reality.

- besides, operational with respect to well-established revenue streams, there is growing attention to the interconnectivity of patient data across health systems, which are fueling e-prescribing solutions that must remain interoperable with EHRs. At this level of interoperability, care is experienced since client’s full medical record and current medication history can be seen in real time by other practitioners involved in his/her care. It has also been argued that such integration enhances medication dispensing detail, minimises potential drug indications, and assists in the formulation of superior clinical decisions thus promoting quality care.

Advancements Driven by EHR Adoption and Government Initiatives in the E-Prescribing Market

- The expansion of electronic health records (EHR) is probably one of the biggest factors that has the potential to influence the e-prescribing market space in the future. EHRs have now become imperative for the healthcare providers due to its use in the simple collection and management of patients’ details making the general organization of healthcare solutions better. The interfacing of e-prescribing systems with EHRs provides automated prescription functions making efficient prescription processes and minimizes the occurrence of prescription errors, increases safer patient care and the existing and efficient communication between care professionals, and pharmacy. Services such as e-prescribing are more in demand now since clinics and other health-care facilities are adopting more electronic technologies for their use and e-prescribing being complementary to EHRs make the market for its vendors highly promising.

- Also, the increasing number of government support and policies to implement the healthcare industry, mostly in the U.S, Europe, and some Asiatic countries, are also complementing the demand of the e-prescribing solutions. Currently, most governments are implementing polices that promote the conversion from paper based prescriptions to electronic systems that enhance the health care systems. Apart from encouraging higher levels of performance and precision in prescribing activities, these interventions pave new opportunities for e-prescribing vendors targeting to enhance their standing in the marketplace. With the growth of demand for fully-fledged digital health-care systems, e-prescribing companies have a chance to integrate their next solutions in compliance with these regulations and respond to the tendencies of increasing digitalization of health-care systems.

E-Prescribing Market Segment Analysis:

E-Prescribing Market Segmented on the basis of Product, Component, Type of System, By Usage Mode, Mode of Delivery, Substances, Specialties, End-User, and Region

By Product, Solutions segment is expected to dominate the market during the forecast period

- Products in the medication management market are mainly focused on the software-based solutions for making medication processes more effective and safer. These solutions include for instance electronic prescribing e-prescribing solutions where practitioners are in a position of writing prescriptions that are electronically sent to the pharmacy thereby reducing the chances of medical errors. Furthermore, medication reconciliation software has another function in identifying and correcting medication order discrepancies for the hospitalized patient, especially in setting cross-cover, admitting and discharge cases. These solutions’ implementation has made work more manageable and has helped to improve the working relationship between practitioners and pharmacists in ways that will benefit patients.

- The growing concern for reducing the cases of medication errors is another factor that is contributing for the use of such software solutions in care centers especially in hospital and pharmacies. Since mediations regimens are becoming more complicated there is a likelihood that errors will be made when prescribing or administering the drugs. Solutions for medication management are intended to cover such problems by offering means to help a clinical decision, for example, alerts for drug interactions or allergies. As the culture of patient safety and quality healthcare has been adopted in healthcare systems, health facility’s most purchase sophisticated medication dispensing systems to reduce on wrong prescription and ensure the patient gets right medicine at the right time.

By End-User, Clinics segment expected to held the largest share

- It has emerged that medication management system is becoming more popular in small clinics since it assists the firms to organise the patients’ prescription data in an efficient manner. These systems allow patient medication histories, prescription, and management of prescription refilling and other related activities to be done within integrated interfaces. Reducing the amoung of paperwork required for prescriptioning helps clinics free up staff time and decreases the time required to fill prescriptions for for patients. It also improves patient satisfaction in a way that enables health-care professionals to spend time more directly serving patient consultations.

- Besides enhancing management to increase operational efficiency, the medication management systems provide better patient care in small clinics by enhancing accurate and early medication administration. Such systems offer one or more clinical decision support tools to the clinicians where they are informed when there are drug interactions or an allergy before a prescription is made. This functionality is specifically useful to health care professionals who admin a small clinic, this may mean that they do not have an easy access to a full pharmacy service. In addition, proper medication management leads to improved understanding and compliance with the use of medication by clinic patients as well as enhances positive patient relations between the clinic staff and the patient.

E-Prescribing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- On a regional level, North America especially the United States has recorded outstanding growth of the E-Prescribing through positive government policies including the HITECH Act and MACRA. These policies encourage the use of E-Prescribing system solutions among the health care service providers and have led to adoption of these systems by almost all the hospitals, clinics, Pharmacy and drug stores. A system which replaces the paper-based prescriptions makes the chance of making errors small hence enhance the safety of patients and enhance the efficiency of the prescribers. The increasing concerns for accurate medication administration and the need to improve the general operational efficiency has provided the necessary conditions for implementation of E-Prescribing systems in this area.

- Further, the solid existing healthcare system in the U.S. and the availability of key industry players including Cerner Corporation, Allscripts Healthcare Solutions, and Epic Systems boosted the market progression. These vendors even have sophisticated E-Prescribing software which are compatible with the EHR, this enhances the co-ordination of care and the final results which are obtained. The rarity of chronic diseases results in the need for patient medication regimens to be constantly adjusted, and with the help of E-Prescribing platforms this becomes easier. Ongoing healthcare provider’s strive in attaining effective operational efficiency as well as minimization of risks involved with prescription medication results in North America to lead the E-Prescribing market globally.

Active Key Players in the E-Prescribing Market:

- Epic Systems Corporation (U.S.)

- Cerner Corporation (U.S.)

- Allscripts Healthcare, LLC. (U.S.)

- NXGN Management, LLC. (U.S.)

- athenahealth, Inc. (U.S.)

- RelayHealth, LLC (U.S.)

- Henry Schein, Inc. (U.S.)

- General electric (U.S.)

- CPSI (U.S.)

- DrFirst (U.S.)

- Medical Information Technology, Inc. (U.S.)

- eClinicalWorks (U.S.), and Other Active Players.

|

Global E-Prescribing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.66 Billion |

|

Forecast Period 2024-32 CAGR: |

26.80% |

Market Size in 2032: |

USD 31.05 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By Type of System |

|

||

|

By Usage Mode |

|

||

|

By Mode of Delivery |

|

||

|

By Substances |

|

||

|

By Specialties |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: E-Prescribing Market by Product (2018-2032)

4.1 E-Prescribing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

4.5 Support

4.6 Implementation

4.7 Training

4.8 Network

Chapter 5: E-Prescribing Market by Component (2018-2032)

5.1 E-Prescribing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Software

5.5 Services

Chapter 6: E-Prescribing Market by Type of System (2018-2032)

6.1 E-Prescribing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Stand-alone E-prescribing System

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Integrated E-prescribing System

Chapter 7: E-Prescribing Market by Usage Mode (2018-2032)

7.1 E-Prescribing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Handheld Device

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Computer-Based Devices

Chapter 8: E-Prescribing Market by Mode of Delivery (2018-2032)

8.1 E-Prescribing Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Web and Cloud-Based Solutions

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 On-Premise Solutions

Chapter 9: E-Prescribing Market by Substances (2018-2032)

9.1 E-Prescribing Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Controlled Substances

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Non-Controlled Substances

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 E-Prescribing Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 EPIC SYSTEMS CORPORATION (U.S.)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 CERNER CORPORATION (U.S.)

10.4 ALLSCRIPTS HEALTHCARE LLC. (U.S.)

10.5 NXGN MANAGEMENT LLC. (U.S.)

10.6 ATHENAHEALTH INC. (U.S.)

10.7 RELAYHEALTH LLC (U.S.)

10.8 HENRY SCHEIN INC. (U.S.)

10.9 GENERAL ELECTRIC (U.S.)

10.10 CPSI (U.S.)

10.11 DRFIRST (U.S.)

10.12 MEDICAL INFORMATION TECHNOLOGY INC. (U.S.)

10.13 ECLINICALWORKS (U.S.)

10.14 OTHER ACTIVE PLAYERS

Chapter 11: Global E-Prescribing Market By Region

11.1 Overview

11.2. North America E-Prescribing Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Product

11.2.4.1 Solutions

11.2.4.2 Services

11.2.4.3 Support

11.2.4.4 Implementation

11.2.4.5 Training

11.2.4.6 Network

11.2.5 Historic and Forecasted Market Size by Component

11.2.5.1 Hardware

11.2.5.2 Software

11.2.5.3 Services

11.2.6 Historic and Forecasted Market Size by Type of System

11.2.6.1 Stand-alone E-prescribing System

11.2.6.2 Integrated E-prescribing System

11.2.7 Historic and Forecasted Market Size by Usage Mode

11.2.7.1 Handheld Device

11.2.7.2 Computer-Based Devices

11.2.8 Historic and Forecasted Market Size by Mode of Delivery

11.2.8.1 Web and Cloud-Based Solutions

11.2.8.2 On-Premise Solutions

11.2.9 Historic and Forecasted Market Size by Substances

11.2.9.1 Controlled Substances

11.2.9.2 Non-Controlled Substances

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe E-Prescribing Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Product

11.3.4.1 Solutions

11.3.4.2 Services

11.3.4.3 Support

11.3.4.4 Implementation

11.3.4.5 Training

11.3.4.6 Network

11.3.5 Historic and Forecasted Market Size by Component

11.3.5.1 Hardware

11.3.5.2 Software

11.3.5.3 Services

11.3.6 Historic and Forecasted Market Size by Type of System

11.3.6.1 Stand-alone E-prescribing System

11.3.6.2 Integrated E-prescribing System

11.3.7 Historic and Forecasted Market Size by Usage Mode

11.3.7.1 Handheld Device

11.3.7.2 Computer-Based Devices

11.3.8 Historic and Forecasted Market Size by Mode of Delivery

11.3.8.1 Web and Cloud-Based Solutions

11.3.8.2 On-Premise Solutions

11.3.9 Historic and Forecasted Market Size by Substances

11.3.9.1 Controlled Substances

11.3.9.2 Non-Controlled Substances

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe E-Prescribing Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Product

11.4.4.1 Solutions

11.4.4.2 Services

11.4.4.3 Support

11.4.4.4 Implementation

11.4.4.5 Training

11.4.4.6 Network

11.4.5 Historic and Forecasted Market Size by Component

11.4.5.1 Hardware

11.4.5.2 Software

11.4.5.3 Services

11.4.6 Historic and Forecasted Market Size by Type of System

11.4.6.1 Stand-alone E-prescribing System

11.4.6.2 Integrated E-prescribing System

11.4.7 Historic and Forecasted Market Size by Usage Mode

11.4.7.1 Handheld Device

11.4.7.2 Computer-Based Devices

11.4.8 Historic and Forecasted Market Size by Mode of Delivery

11.4.8.1 Web and Cloud-Based Solutions

11.4.8.2 On-Premise Solutions

11.4.9 Historic and Forecasted Market Size by Substances

11.4.9.1 Controlled Substances

11.4.9.2 Non-Controlled Substances

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific E-Prescribing Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Product

11.5.4.1 Solutions

11.5.4.2 Services

11.5.4.3 Support

11.5.4.4 Implementation

11.5.4.5 Training

11.5.4.6 Network

11.5.5 Historic and Forecasted Market Size by Component

11.5.5.1 Hardware

11.5.5.2 Software

11.5.5.3 Services

11.5.6 Historic and Forecasted Market Size by Type of System

11.5.6.1 Stand-alone E-prescribing System

11.5.6.2 Integrated E-prescribing System

11.5.7 Historic and Forecasted Market Size by Usage Mode

11.5.7.1 Handheld Device

11.5.7.2 Computer-Based Devices

11.5.8 Historic and Forecasted Market Size by Mode of Delivery

11.5.8.1 Web and Cloud-Based Solutions

11.5.8.2 On-Premise Solutions

11.5.9 Historic and Forecasted Market Size by Substances

11.5.9.1 Controlled Substances

11.5.9.2 Non-Controlled Substances

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa E-Prescribing Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Product

11.6.4.1 Solutions

11.6.4.2 Services

11.6.4.3 Support

11.6.4.4 Implementation

11.6.4.5 Training

11.6.4.6 Network

11.6.5 Historic and Forecasted Market Size by Component

11.6.5.1 Hardware

11.6.5.2 Software

11.6.5.3 Services

11.6.6 Historic and Forecasted Market Size by Type of System

11.6.6.1 Stand-alone E-prescribing System

11.6.6.2 Integrated E-prescribing System

11.6.7 Historic and Forecasted Market Size by Usage Mode

11.6.7.1 Handheld Device

11.6.7.2 Computer-Based Devices

11.6.8 Historic and Forecasted Market Size by Mode of Delivery

11.6.8.1 Web and Cloud-Based Solutions

11.6.8.2 On-Premise Solutions

11.6.9 Historic and Forecasted Market Size by Substances

11.6.9.1 Controlled Substances

11.6.9.2 Non-Controlled Substances

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America E-Prescribing Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Product

11.7.4.1 Solutions

11.7.4.2 Services

11.7.4.3 Support

11.7.4.4 Implementation

11.7.4.5 Training

11.7.4.6 Network

11.7.5 Historic and Forecasted Market Size by Component

11.7.5.1 Hardware

11.7.5.2 Software

11.7.5.3 Services

11.7.6 Historic and Forecasted Market Size by Type of System

11.7.6.1 Stand-alone E-prescribing System

11.7.6.2 Integrated E-prescribing System

11.7.7 Historic and Forecasted Market Size by Usage Mode

11.7.7.1 Handheld Device

11.7.7.2 Computer-Based Devices

11.7.8 Historic and Forecasted Market Size by Mode of Delivery

11.7.8.1 Web and Cloud-Based Solutions

11.7.8.2 On-Premise Solutions

11.7.9 Historic and Forecasted Market Size by Substances

11.7.9.1 Controlled Substances

11.7.9.2 Non-Controlled Substances

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global E-Prescribing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.66 Billion |

|

Forecast Period 2024-32 CAGR: |

26.80% |

Market Size in 2032: |

USD 31.05 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By Type of System |

|

||

|

By Usage Mode |

|

||

|

By Mode of Delivery |

|

||

|

By Substances |

|

||

|

By Specialties |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the E-Prescribing Market research report is 2024-2032.

Epic Systems Corporation (U.S.), Cerner Corporation (U.S.), Allscripts Healthcare, LLC. (U.S.), NXGN Management, LLC. (U.S.), athenahealth, Inc. (U.S.), RelayHealth, LLC (U.S.), Henry Schein, Inc. (U.S.), General Electric (U.S.), CPSI (U.S.), DrFirst (U.S.), Medical Information Technology, Inc. (U.S.), eClinicalWorks (U.S.), and Other Active Players.

The E-Prescribing Market is segmented into By Product, By Component, By Type of System, By Usage Mode, By Mode of Delivery, By Substances, By Specialties, By End-User and region. By Product, the market is categorized into Solutions, Services, Support, Implementation, Training and Network. By Component, the market is categorized into Hardware, Software and Services. By Type of System, the market is categorized into Stand-alone E-prescribing System and Integrated E-prescribing System. By Usage Mode, the market is categorized into Handheld Device and Computer-Based Devices. By Mode of Delivery, the market is categorized into Web and Cloud-Based Solutions and On-Premise Solutions. By Substances, the market is categorized into Controlled Substances and Non-Controlled Substances. By Specialties, the market is categorized into Oncology, Sports Medicine, Neurology, Cardiology and Others. By End-User, the market is categorized into Clinics, Physicians, Pharmacies and Hospitals. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

E-prescribing, also known as electronic prescribing, is a technological framework that enables physicians and other medical practitioners to electronically write and send prescriptions to a participating pharmacy rather than using handwritten or faxed notes or calling in prescriptions. E-prescribing, also known as electronic prescribing, is a web or cloud-based solution that allows healthcare providers to generate digital prescriptions. It is a computer-based process for creating and sending accurate prescription orders to a hospital-based or standalone pharmacy. E-prescription software can automatically refill prescriptions, manage medications based on a patient's history, and integrate with an electronic medical record (EMR) system.

E-Prescribing Market Size Was Valued at USD 3.66 Billion in 2023, and is Projected to Reach USD 31.05 Billion by 2032, Growing at a CAGR of 26.80% From 2024-2032.