Drill Pipe Market Synopsis

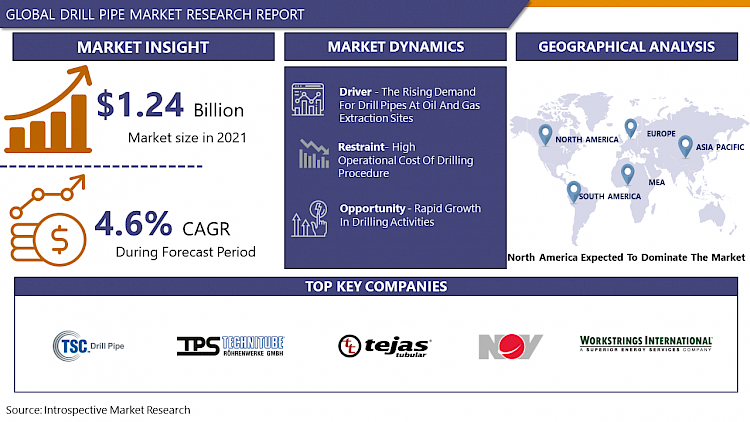

Global Drill Pipe Market was valued at USD 1.24 Billion in 2021 and is expected to reach USD 1.70 Billion by the year 2028, at a CAGR of 4.6%

Drill pipe is a thick-walled and hollow piping used for transmission of drilling fluid through wellbore to the drill bit during rig drilling operation. Drill pipes are seamless steel pipes and are considered as a component of drill string assembly. Drill pipes are also built to handle high external and internal pressures that drilling fluids exert. It is manufactured, inspected, and tested in compliance with the American Petroleum Institute's standard criteria (API). Drill pipes are classified as E grade, X-95, G-105, and S-135 on their API grade.

- A drill pipe is a thick-walled tubular pipe made of metal alloy and other composite materials. It consists of threaded ends called tool joints. Drill pipe is mainly used to connect the interface between the drilling rig and the boreholes. It is also used to move the liquid down towards the drilling point or up using the ring. A variety of drill pipes are available for directional drilling and a gradual transition from heavy-duty drill collars to lightweight options.

- Each double-ended section of the drill pipe is connected to tool connections. Standard drill pipe, heavy drill, and drill collars are different types of drill pipe. Drill pipe is used in a variety of industries including mining, agriculture, oil and gas, and many others. The market is mainly driven by the growth of mining activities and the construction of new oil and gas fields.

The Drill Pipe Market Trend Analysis

The Rising Demand for Drill Pipes at Oil and Gas Extraction Sites

- The rapidly increasing demand for oil and gas in the industrial, transportation, and residential sectors is the main factor driving the growth of the market. In addition, drill pipes play an important role in oil and gas exploration because they withstand enormous stress, heat, and stress during drilling and completion fluids. They also prevent failures that can cause delays and loss of resources.

- In addition, when drilling wells, drill pipes are used to cut rock layers on land and underwater. As global oil exploration moves to complex geographies, the demand for advanced drill pipes increases. Moreover, increased investment in offshore exploration and production activities in both developed and emerging economies is driving market growth.

- Many product innovations such as the introduction of drill pipes that can operate in areas with high pressure, temperature, permafrost, or high concentrations of toxic substances such as hydrogen sulfide (H2S) will further boost the market growth. It also includes making stronger tubes, higher torque joints, and metallurgical properties to increase durability and longevity.

Rapid Growth in Drilling Activities

- Discovery of new hydrocarbon reserves in the countries especially in the South China Sea, Pakistan, Australia, Egypt, and Senegal in the last few years is excepted to provide growth opportunities to industry participants in the upcoming years. The increasing technological advancements and innovations related to drilling operations are likely to provide growth opportunities for the market.

- During the forecast period drill pipe provides many opportunities for market players to invest in research and development of the market. Developing countries such as China, Australia, India, and Indonesia, are leading the Asia-Pacific market with rising rig activities in the region, development of offshore basins, strong economic growth, large consumer base, and significant investment by leading industry players considering potential growth opportunities.

- Moreover, the presence of major key players like Drill Pipe International LLC., Superior Drill Pipe Manufacturing Inc, DP Master Manufacturing Pte Ltd., and others are focused on new product launches, collaborations, partnerships, and acquisition drives the market growth in the upcoming years. For instance, NOV acquired the advanced drilling solutions (ADS) business of AFGlobal, an oil and gas OEM specializing in technology, products, and services. Under this acquisition, NOV’s experience and expertise combined with AFGlobal’s extensive portfolio provided the company with promising breakthrough opportunities in MPD.

Segmentation Analysis of The Drill Pipe Market

Drill Pipe market segments cover the Type, Material, Application, and Grade. By Grade, the American Petroleum Institute (API) Grade, a segment is anticipated to dominate the Market Over the Forecast period.

- API grade drill bit accounted for the largest share of global demand and is expected to continue its dominant position during the forecast period. Standardization of finished products and relatively low prices for their quality are expected to encourage market entry. The use of these products also ensures a reduction in operating costs for E&P and operator companies. API grade products are largely preferred in conventional environments and conventional reservoirs due to easy availability and lower OpEx costs for both E&P and contractor companies.

- Exploration in unusual and harsh environmental conditions, especially oil shale, CBM, and tight reserves, will increase the demand for high-quality drill pipes during the forecast period. API grade drill bit is cheaper than a high-grade drill bit. Superior drill pipes are generally suitable for unusual drilling conditions, such as high temperature, high pressure, corrosive environment, etc. With the growth of deep-water drilling, the premium drill pipe market is expected to grow faster than the API drill pipe market.

Regional Analysis of The Drill Pipe Market

North America is Expected to Dominate the Market Over the Forecast period.

- The North American drill pipe market will witness strong growth, owing to a rise in capital expenditure from independent players across the region. Large investments by major E&P companies in both conventional and unconventional fields have been the major factor responsible for initial market penetration in the region.

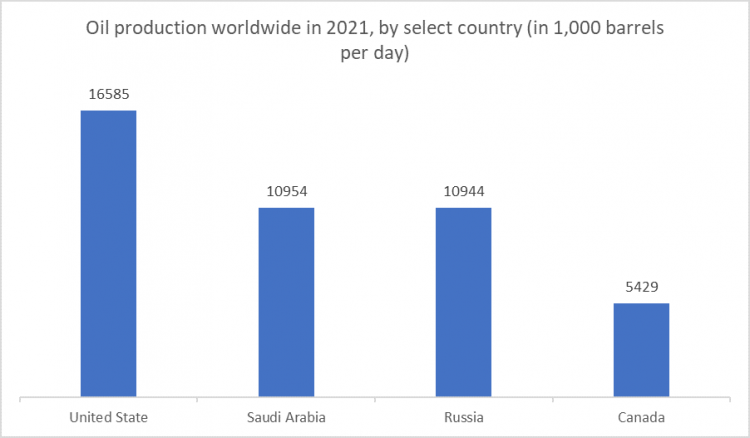

- Due to an increase in demand for oil and gas production activities in these regions, the demand for drill pipes required to pump drilling fluid during these production activities will also most likely increase, thus, leading to market growth in the upcoming years. For instance, according to Statista, The United States is the world's largest crude oil producer. In 2021, it had an output of 16.6 million barrels worth of oil per day. This was nearly 10 million barrels more than ten years prior and largely a result of advances in unconventional tight oil production. Saudi Arabia and Russia ranked second and third, each at around 11 million barrels daily. Oil production includes crude oil, shale oil, oil sands, and natural gas liquids.

- Due to the ongoing shale gas exploration in the region, especially in the United States. The improvement of shale formations has been associated with an increase in employment in the oil and gas industry in the United States and is excepted to boost the market growth during the forecast period. The presence of a large number of oil and gas companies, such as Schlumberger, Baker Hughes, and RK Pipe LLC, increases the market share of the drill pipe market in this region.

Covid-19 Impact Analysis On Drill Pipe Market

- Covid-19 affects almost every industry. Due to the pandemic situation, there were significantly reduced production and construction activities owing to the lockdown shutting down the manufacturing sectors, social stratification, and supply chain disruption. During the COVID-19 pandemic, the market was adversely affected as upstream activities were shut down due to lower crude oil prices, which created unfavourable conditions for many upstream players.

- The decreased crude oil prices brought on by the pandemic hindered upstream activities such that they were temporarily postponed or stopped, which had a negative impact on various upstream players. Additionally, the outbreak of the Covid-19 pandemic has affected oil and gas extraction procedures all around the world. This, in turn, hindered the growth of the market.

- Due to the lockdown there was a shutdown of construction sites, a shortage of labor as well a decline in the demand for drill pipes affecting the market growth during the pandemic situation. Moreover, a positive thing comes out during the pandemic situation as the market for drill pipes may benefit in the upcoming years from the continually increasing demand for energy and petroleum products.

Top Key Players Covered in The Drill Pipe Market

- Drill Pipe International LLC. (US)

- Superior Drill Pipe Manufacturing Inc (US)

- DP Master Manufacturing Pte Ltd. (Singapore)

- RK Pipe LLC (US)

- TPS-Technitube Röhrenwerke (Germany)

- Oil Country Tubular Limited (India)

- Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd. (China)

- Hilong Group (China)

- Tejas Tubular Products Inc. (US)

- Tenaris SA (Luxembourg)

- National Oilwell Varco (US)

- Workstrings International (US)

- Vallourec (France)

- Inter Drill Asia Ltd (India), and Other Major Players

Key Industry Developments in the Drill Pipe Market

In April 2021, NOV launched Sour Service Drill Stem Products. MSI is always on the lookout for new products and services that can work in conjunction with its pipe protection products. NOV has recently launched their sour service drill stem product line that when paired with MSI’s product offering, can help oil and gas companies protect their pipe even in the most rugged regions of the world

|

Global Drill Pipe Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.24 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.6% |

Market Size in 2028: |

USD 1.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Grade |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Grade

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Drill Pipe Market by Type

5.1 Drill Pipe Market Overview Snapshot and Growth Engine

5.2 Drill Pipe Market Overview

5.3 Standard Drill Pipe

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Standard Drill Pipe: Geographic Segmentation

5.4 Heavy Weight Drill Pipe

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Heavy Weight Drill Pipe: Geographic Segmentation

5.5 Drill Collar

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Drill Collar: Geographic Segmentation

Chapter 6: Drill Pipe Market by Grade

6.1 Drill Pipe Market Overview Snapshot and Growth Engine

6.2 Drill Pipe Market Overview

6.3 American Petroleum Institute (API) Grade

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 American Petroleum Institute (API) Grade: Geographic Segmentation

6.4 Proprietary Grade

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Proprietary Grade: Geographic Segmentation

Chapter 7: Drill Pipe Market by Application

7.1 Drill Pipe Market Overview Snapshot and Growth Engine

7.2 Drill Pipe Market Overview

7.3 Onshore

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Onshore: Geographic Segmentation

7.4 Offshore

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Offshore: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Drill Pipe Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Drill Pipe Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Drill Pipe Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 DRILL PIPE INTERNATIONAL LLC.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 SUPERIOR DRILL PIPE MANUFACTURING INC

8.4 DP MASTER MANUFACTURING PTE LTD.

8.5 RK PIPE LLC

8.6 TPS-TECHNITUBE ROHRENWERKE

8.7 OIL COUNTRY TUBULAR LIMITED

8.8 JIANGYIN LONG BRIGHT DRILL PIPE MANUFACTURE CO. LTD.

8.9 HILONG GROUP

8.10 TEJAS TUBULAR PRODUCTS INC.

8.11 TENARIS SA

8.12 NATIONAL OILWELL VARCO

8.13 WORKSTRINGS INTERNATIONAL

8.14 VALLOUREC

8.15 INTER DRILL ASIA LTD

8.16 OTHER MAJOR PLAYERS

Chapter 9: Global Drill Pipe Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Standard Drill Pipe

9.2.2 Heavy Weight Drill Pipe

9.2.3 Drill Collar

9.3 Historic and Forecasted Market Size By Grade

9.3.1 American Petroleum Institute (API) Grade

9.3.2 Proprietary Grade

9.4 Historic and Forecasted Market Size By Application

9.4.1 Onshore

9.4.2 Offshore

Chapter 10: North America Drill Pipe Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Standard Drill Pipe

10.4.2 Heavy Weight Drill Pipe

10.4.3 Drill Collar

10.5 Historic and Forecasted Market Size By Grade

10.5.1 American Petroleum Institute (API) Grade

10.5.2 Proprietary Grade

10.6 Historic and Forecasted Market Size By Application

10.6.1 Onshore

10.6.2 Offshore

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Drill Pipe Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Standard Drill Pipe

11.4.2 Heavy Weight Drill Pipe

11.4.3 Drill Collar

11.5 Historic and Forecasted Market Size By Grade

11.5.1 American Petroleum Institute (API) Grade

11.5.2 Proprietary Grade

11.6 Historic and Forecasted Market Size By Application

11.6.1 Onshore

11.6.2 Offshore

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Drill Pipe Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Standard Drill Pipe

12.4.2 Heavy Weight Drill Pipe

12.4.3 Drill Collar

12.5 Historic and Forecasted Market Size By Grade

12.5.1 American Petroleum Institute (API) Grade

12.5.2 Proprietary Grade

12.6 Historic and Forecasted Market Size By Application

12.6.1 Onshore

12.6.2 Offshore

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Drill Pipe Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Standard Drill Pipe

13.4.2 Heavy Weight Drill Pipe

13.4.3 Drill Collar

13.5 Historic and Forecasted Market Size By Grade

13.5.1 American Petroleum Institute (API) Grade

13.5.2 Proprietary Grade

13.6 Historic and Forecasted Market Size By Application

13.6.1 Onshore

13.6.2 Offshore

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Drill Pipe Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Standard Drill Pipe

14.4.2 Heavy Weight Drill Pipe

14.4.3 Drill Collar

14.5 Historic and Forecasted Market Size By Grade

14.5.1 American Petroleum Institute (API) Grade

14.5.2 Proprietary Grade

14.6 Historic and Forecasted Market Size By Application

14.6.1 Onshore

14.6.2 Offshore

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Drill Pipe Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.24 Bn. |

|

Forecast Period 2022-28 CAGR: |

4.6% |

Market Size in 2028: |

USD 1.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Grade |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DRILL PIPE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DRILL PIPE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DRILL PIPE MARKET COMPETITIVE RIVALRY

TABLE 005. DRILL PIPE MARKET THREAT OF NEW ENTRANTS

TABLE 006. DRILL PIPE MARKET THREAT OF SUBSTITUTES

TABLE 007. DRILL PIPE MARKET BY TYPE

TABLE 008. STANDARD DRILL PIPE MARKET OVERVIEW (2016-2028)

TABLE 009. HEAVY WEIGHT DRILL PIPE MARKET OVERVIEW (2016-2028)

TABLE 010. DRILL COLLAR MARKET OVERVIEW (2016-2028)

TABLE 011. DRILL PIPE MARKET BY GRADE

TABLE 012. AMERICAN PETROLEUM INSTITUTE (API) GRADE MARKET OVERVIEW (2016-2028)

TABLE 013. PROPRIETARY GRADE MARKET OVERVIEW (2016-2028)

TABLE 014. DRILL PIPE MARKET BY APPLICATION

TABLE 015. ONSHORE MARKET OVERVIEW (2016-2028)

TABLE 016. OFFSHORE MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA DRILL PIPE MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA DRILL PIPE MARKET, BY GRADE (2016-2028)

TABLE 019. NORTH AMERICA DRILL PIPE MARKET, BY APPLICATION (2016-2028)

TABLE 020. N DRILL PIPE MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE DRILL PIPE MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE DRILL PIPE MARKET, BY GRADE (2016-2028)

TABLE 023. EUROPE DRILL PIPE MARKET, BY APPLICATION (2016-2028)

TABLE 024. DRILL PIPE MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC DRILL PIPE MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC DRILL PIPE MARKET, BY GRADE (2016-2028)

TABLE 027. ASIA PACIFIC DRILL PIPE MARKET, BY APPLICATION (2016-2028)

TABLE 028. DRILL PIPE MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA DRILL PIPE MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA DRILL PIPE MARKET, BY GRADE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA DRILL PIPE MARKET, BY APPLICATION (2016-2028)

TABLE 032. DRILL PIPE MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA DRILL PIPE MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA DRILL PIPE MARKET, BY GRADE (2016-2028)

TABLE 035. SOUTH AMERICA DRILL PIPE MARKET, BY APPLICATION (2016-2028)

TABLE 036. DRILL PIPE MARKET, BY COUNTRY (2016-2028)

TABLE 037. DRILL PIPE INTERNATIONAL LLC.: SNAPSHOT

TABLE 038. DRILL PIPE INTERNATIONAL LLC.: BUSINESS PERFORMANCE

TABLE 039. DRILL PIPE INTERNATIONAL LLC.: PRODUCT PORTFOLIO

TABLE 040. DRILL PIPE INTERNATIONAL LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. SUPERIOR DRILL PIPE MANUFACTURING INC: SNAPSHOT

TABLE 041. SUPERIOR DRILL PIPE MANUFACTURING INC: BUSINESS PERFORMANCE

TABLE 042. SUPERIOR DRILL PIPE MANUFACTURING INC: PRODUCT PORTFOLIO

TABLE 043. SUPERIOR DRILL PIPE MANUFACTURING INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. DP MASTER MANUFACTURING PTE LTD.: SNAPSHOT

TABLE 044. DP MASTER MANUFACTURING PTE LTD.: BUSINESS PERFORMANCE

TABLE 045. DP MASTER MANUFACTURING PTE LTD.: PRODUCT PORTFOLIO

TABLE 046. DP MASTER MANUFACTURING PTE LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. RK PIPE LLC: SNAPSHOT

TABLE 047. RK PIPE LLC: BUSINESS PERFORMANCE

TABLE 048. RK PIPE LLC: PRODUCT PORTFOLIO

TABLE 049. RK PIPE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. TPS-TECHNITUBE ROHRENWERKE: SNAPSHOT

TABLE 050. TPS-TECHNITUBE ROHRENWERKE: BUSINESS PERFORMANCE

TABLE 051. TPS-TECHNITUBE ROHRENWERKE: PRODUCT PORTFOLIO

TABLE 052. TPS-TECHNITUBE ROHRENWERKE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. OIL COUNTRY TUBULAR LIMITED: SNAPSHOT

TABLE 053. OIL COUNTRY TUBULAR LIMITED: BUSINESS PERFORMANCE

TABLE 054. OIL COUNTRY TUBULAR LIMITED: PRODUCT PORTFOLIO

TABLE 055. OIL COUNTRY TUBULAR LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. JIANGYIN LONG BRIGHT DRILL PIPE MANUFACTURE CO. LTD.: SNAPSHOT

TABLE 056. JIANGYIN LONG BRIGHT DRILL PIPE MANUFACTURE CO. LTD.: BUSINESS PERFORMANCE

TABLE 057. JIANGYIN LONG BRIGHT DRILL PIPE MANUFACTURE CO. LTD.: PRODUCT PORTFOLIO

TABLE 058. JIANGYIN LONG BRIGHT DRILL PIPE MANUFACTURE CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. HILONG GROUP: SNAPSHOT

TABLE 059. HILONG GROUP: BUSINESS PERFORMANCE

TABLE 060. HILONG GROUP: PRODUCT PORTFOLIO

TABLE 061. HILONG GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. TEJAS TUBULAR PRODUCTS INC.: SNAPSHOT

TABLE 062. TEJAS TUBULAR PRODUCTS INC.: BUSINESS PERFORMANCE

TABLE 063. TEJAS TUBULAR PRODUCTS INC.: PRODUCT PORTFOLIO

TABLE 064. TEJAS TUBULAR PRODUCTS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. TENARIS SA: SNAPSHOT

TABLE 065. TENARIS SA: BUSINESS PERFORMANCE

TABLE 066. TENARIS SA: PRODUCT PORTFOLIO

TABLE 067. TENARIS SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. NATIONAL OILWELL VARCO: SNAPSHOT

TABLE 068. NATIONAL OILWELL VARCO: BUSINESS PERFORMANCE

TABLE 069. NATIONAL OILWELL VARCO: PRODUCT PORTFOLIO

TABLE 070. NATIONAL OILWELL VARCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. WORKSTRINGS INTERNATIONAL: SNAPSHOT

TABLE 071. WORKSTRINGS INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 072. WORKSTRINGS INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 073. WORKSTRINGS INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. VALLOUREC: SNAPSHOT

TABLE 074. VALLOUREC: BUSINESS PERFORMANCE

TABLE 075. VALLOUREC: PRODUCT PORTFOLIO

TABLE 076. VALLOUREC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. INTER DRILL ASIA LTD: SNAPSHOT

TABLE 077. INTER DRILL ASIA LTD: BUSINESS PERFORMANCE

TABLE 078. INTER DRILL ASIA LTD: PRODUCT PORTFOLIO

TABLE 079. INTER DRILL ASIA LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 080. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 081. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 082. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DRILL PIPE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DRILL PIPE MARKET OVERVIEW BY TYPE

FIGURE 012. STANDARD DRILL PIPE MARKET OVERVIEW (2016-2028)

FIGURE 013. HEAVY WEIGHT DRILL PIPE MARKET OVERVIEW (2016-2028)

FIGURE 014. DRILL COLLAR MARKET OVERVIEW (2016-2028)

FIGURE 015. DRILL PIPE MARKET OVERVIEW BY GRADE

FIGURE 016. AMERICAN PETROLEUM INSTITUTE (API) GRADE MARKET OVERVIEW (2016-2028)

FIGURE 017. PROPRIETARY GRADE MARKET OVERVIEW (2016-2028)

FIGURE 018. DRILL PIPE MARKET OVERVIEW BY APPLICATION

FIGURE 019. ONSHORE MARKET OVERVIEW (2016-2028)

FIGURE 020. OFFSHORE MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA DRILL PIPE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE DRILL PIPE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC DRILL PIPE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA DRILL PIPE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA DRILL PIPE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Drill Pipe Market research report is 2022-2028.

Drill Pipe International LLC. (US), Superior Drill Pipe Manufacturing Inc (US), DP Master Manufacturing Pte Ltd. (Singapore), RK Pipe LLC (US), TPS-Technitube Rohrenwerke (Germany), Oil Country Tubular Limited (India), Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd. (China), Hilong Group (China), Tejas Tubular Products Inc. (US), Tenaris SA (Luxembourg), National Oilwell Varco (US), Workstrings International (US), Vallourec (France), Inter Drill Asia Ltd (India), and Other Major Players

The Drill Pipe Market is segmented into Type, Material, Grade, Application, and region. By Type, the market is categorized into Standard Drill Pipe, Heavy Weight Drill Pipe, and Drill Collar. By, Material, the market is categorized into Alloys, Composites. By Grade, the market is categorized into American Petroleum Institute (API) Grade and Proprietary Grade. By Application, the market is categorized into Onshore and Offshore. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A drill pipe is a thick-walled tubular pipe made of metal alloy and other composite materials. It consists of threaded ends called tool joints. Drill pipe is mainly used to connect the interface between the drilling rig and the boreholes. It is also used to move the liquid down towards the drilling point or up using the ring. A variety of drill pipes are available for directional drilling and a gradual transition from heavy-duty drill collars to lightweight options.

Global Drill Pipe Market was valued at USD 1.24 Billion in 2021 and is expected to reach USD 1.70 Billion by the year 2028, at a CAGR of 4.6%