Dried Apricots Market Synopsis

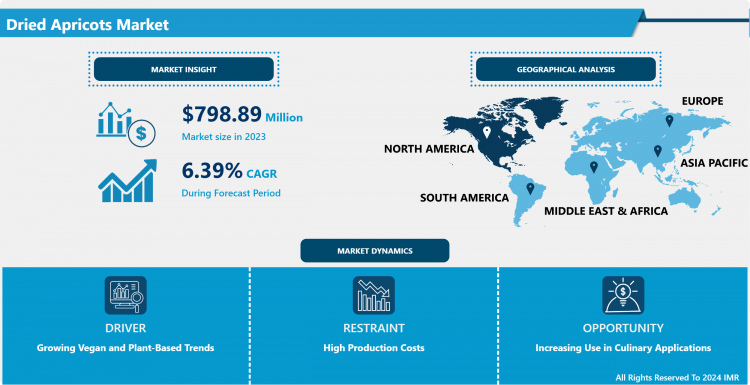

Dried Apricots Market Size Was Valued at USD 798.89 Million in 2023, and is Projected to Reach USD 1395.06 Million by 2032, Growing at a CAGR of 6.39% From 2024-2032

Apricots on which the water content has been removed by drying and which are nutrient dense foods. It enhances the natural sweetness and flavor as well as focusing nutrient content during drying process. They are normally taken as a snack or incorporated into baked goods or used on cereals and salads. Fruits such as dried apricots contain high fiber, vitamins as well as minerals, thus making them appropriate treasures to store in a kitchen.

- The market for dried apricots for consumption has been on the rise in the global market and this is possible due to the shift in consumer mentality towards healthy snack and the value addition of dried fruits. Dehydrated apricots which have components such as fiber, vitamin A, and antioxidants are therefore finding their way into the market among health-welfare clientele. The food processing sector experiencing growth in its demand for dried apricots used in bakery materials, cereal products and confectionery products is another factor that will fuel the market. The continuously expanding interest for plant-based and natural products also makes the market even more attractive. In developed countries including those in North America and Europe where there is an increasing focus on improved and healthier living standards the market is growing due to the disposable incomes available to individuals in the Asia-Pacific region.

- Because of the high production of apricots particularly in the Turkey, Asia-Pacific region is expected to experience high growth in production. This can be attributed to increase in exports of the product to markets in Europe and in Middle Eastern countries. Nevertheless, key issues that affect the market include arbitrary raw material price and irregular supply chain issues. As for social factors, concern for sustainable manufacture and materials, the focus on organic products is forcing manufacturers to use ecological approaches to processing their goods. Nonetheless, the market is expected to remain on course for growth, through increased distribution networks such as e-business and the increasing market for better quality and flavoured dried apricots.

Dried Apricots Market Trend Analysis

A Shift Towards Health Consciousness and Organic Offerings

- The dried apricot market segment is under a dramatic change due to the shifting of consumers toward higher awareness and demand for healthy and additive-free products. Due to people’s increased focus on a healthier way of living, quality parameters, especially vitamins A and C, dietary fibres and antioxidants are an asset of dried apricots. This is compounded by the increasing number of people adopting plant base diets and therefore dried apricots provide a healthy snack on the go snack. Also, a remarkable trend is the so called clean label trend which suggests the consumer choice in favor of products with minimal degrees of processing and the complete absence of additives and other similar innovations. This clear labeling of food leads to consumers’ trust thus they are more likely to purchase food.

- Also, a change in consumption towards health and wellness products is further enhanced by an inclination towards organic products within the dried apricots market. With increasing awareness of consumers towards the health and ecological benefits of chemical free or organic food production method the credit for the constant increase in sales of organic dried apricots goes to. To this effect, retailers are investing in more organics as they bring variety to the consumer’s options. The increase of e-commerce as one of the leading distribution channels also enables customers to create a wider Basket of dried apricot products, including organic, conventional, and flavored. The market continues to grow with the development of packaging techniques and diversification of products including considering dried apricot as an added ingredient in health bars, cereals and trail mixes due to the ever changing preferences of the health conscious consumers.

Growing Demand for Organic Products and E-Commerce Expansion in the Dried Apricots Market

- As for the trends in the dried apricots market, it is also important to mention their increasing popular among consumers of organic produce. Consumers are increasingly learning of the health and environmental impacts of organic farming and therefore the consumption of organic dried apricots has significantly grown. These changes in customer behavior are helping retailers add more Certified Organic items to their food portfolios to meet the demands of more conscious customers. In addition to their health value, organic dried apricots are still demanded because of the associations related to quality and environmental friendliness of the products with an organic certificate. Hence, the brands are going for organic foods sourcing and getting certifications from appropriate authorities to meet the needs of a smarter consumer.

- Additionally, getting to market, and the increased visibility of e-commerce as a principal means of distribution is altering consumption of dried apricots. Internet-based stores provide ease of access to patrons as they seek various oils, with options for certified organic, normally processed, and flavored products from the comfort of their homes several clicks away. This accessibility is improving customer relations and contributing to market development. Also, packaging advancements and product line extension like the addition of dried apricot in health bar, cereals and trail mixes will also increase the sales opportunities. Not only do these products address evolving customer taste buds, but they are also aligned with the emergence of healthier snacking options something that places dried apricots as a viable and healthy snack in the transformed market place environment.

Dried Apricots Market Segment Analysis:

Dried Apricots Market Segmented based on By Product, By Form, By End-Users, By Distribution Channel.

By Product, Sulphured Dried Apricot segment is expected to dominate the market during the forecast period

- Sulphured dried apricots are treated with sulfur dioxide which ultimately improves the appearance and longevity of the product. The use of this preservative not only retains the bright orange color on the fruit but also arrests formation of brown color which is normal on other naturally dehydrated fruits. This aesthetic quality makes sulphured dried apricots ideal for consumers who give a lot of importance to looks of the foods they wish to purchase. At the same time, the sulfur dioxide treatment itself has antioxidant properties which can reduce oxidation of the product and thus retain levels of vitamins and minerals within the fruit. Therefore, these kinds of dried fruits are particularly popular among the companies which supply goods to the customers who want tasty, aromatic and beautiful products.

- Sulphuring also gives these dried apricots a longer shelf life and this makes them a preferred option by food processors. Due to these properties, they reserve their stability in storage and transportation, which in turn improves cost cutting and profitability for firms that use them in products like raw nut nut bars, trail mixes, and baked produce. Further, the quality and texture of the sulphured dried apricots do not differ in any specific manner, thus making it ideal for the food industries because it will not let them down in some of the applications. These qualities, such as improved appearance, increased shelf life, and retained nutritional advantage, make sulphured dried apricots the ever growing segment in the retail and culinary markets.

By End-Users, Food and Beverage segment held the largest share in 2023

- Consequently, dried apricots enjoy a wide utility in food n beverage industries they are used in everyday products such as granola bars, cereals, and flavoured yogurt. Due to their inherent natural sugars and soft moist texture, they are perfect for health conscious food products, thus satisfying consumer demand. To gratifying obtain satisfactory, in granola bars, dried apricots are able to create taste and aroma and besides, play a position of the nutritional values such as vitamins, minerals and diet fiber. Likewise in cereals they bring out contrast in textures providing bursts of taste to breakfast meals leaving them enriched naturally. Producers of cultured and flavored milk products sweeten yogurts and add the dried fruits to enhance the taste and textures and to produce an appealing and healthful dairy product that is in accord with customers’ perception of balanced and nutritious food.

- New latter dried apricots are widely used not only as a decoration in bakeries, but also valuable and functional ingredients, adding to a vast range of sweets such as muffins, cakes, and bread. Just adding dried apricots to muffins and cakes enhances the taste as well as increases the level of moistness resulting in making products more enjoyable. Some of them are naturally sweeteners, thus eliminating the need for more sugar which is currently trending due to the healthier option for baking. In bakery production, incorporating dried apricots creates an extra dimension in taste and nutrition which works to make the artisan and specialty breads more fascinating. Due to their taste and texture and healthfully Crunchy to eat and their ability to make recipes moist and flavorful Dried apricot is an essential ingredient in commercial bake ware and home baking recipes in line with the consumers new found desire of healthy foods that are delicious to eat.

Dried Apricots Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The dried apricots market in North America is mainly influenced by the increasing tendency in health-conscious and organic foods consumption. More and more consumers in U.S and Canada are focusing on healthy foods and apoptans such as dried apricots containing fiber, vitamins and antioxidants. This has led to the addition of dried apricots to breakfast cereals, bakery products and snacks for daily meals and snacks taken when on the move. The growth of the market is further driven by the increased awareness of consumers towards organic and Non GMO food products being available in numerous online stores and specialty shops stocking expensive brands. Thanks to the tendencies of choosing healthy food products, the regional need for dried apricots is consistently increasing.

- Although, there are few issues that can restrain the market growth in the nearest future. What’s more, prices of raw materials are likely to change with things such as crop productivity, climate change and the degree of internationalization of trade. Furthermore, depending on the role dried apricots are viewed as a healthy snacking product, while many Nort American consumers prefer fresh fruit which might restrain the market for dried apricots. Nevertheless, the trend for dried apricots in North America is generally favorable because of the increasing interest in healthy nutrition among the population of the region.

Active Key Players in the Dried Apricots Market

- Kenkko Corporation (Japan)

- ApricotKing (U.S.)

- BATA FOOD (Turkey)

- National Raisin Company (U.S.)

- Anatolia A.S. (Turkey)

- ZIBA FOODS (U.S.)

- Kayisicioglu Apricot (Turkey)

- Traina Home Grown (U.S.)

- Sun-Maid Growers of California (U.S.)

- Red River Foods (U.S.)

- PURCELL MOUNTAIN FARMS (Canada)

- B & R Farms (U.S.)

- Jutai Foods Group Limited (China)

- Retaj Agro Farms (Turkey), Other Active Players

Dried Apricots Market Scope:

|

Global Dried Apricots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 798.89 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.39% |

Market Size in 2032: |

USD 1395.06 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Form |

|

||

|

By End-Users |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dried Apricots Market by Product

4.1 Dried Apricots Market Snapshot and Growth Engine

4.2 Dried Apricots Market Overview

4.3 Sulphured Dried Apricot

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Sulphured Dried Apricot: Geographic Segmentation Analysis

4.4 Natural Dried Apricot & Organic Dried Apricot

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Natural Dried Apricot & Organic Dried Apricot: Geographic Segmentation Analysis

Chapter 5: Dried Apricots Market by Form

5.1 Dried Apricots Market Snapshot and Growth Engine

5.2 Dried Apricots Market Overview

5.3 Powdered

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Powdered: Geographic Segmentation Analysis

5.4 Whole Dried

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Whole Dried: Geographic Segmentation Analysis

5.5 Diced

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Diced: Geographic Segmentation Analysis

Chapter 6: Dried Apricots Market by End-User

6.1 Dried Apricots Market Snapshot and Growth Engine

6.2 Dried Apricots Market Overview

6.3 Business to Business

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Business to Business: Geographic Segmentation Analysis

6.4 Cosmetics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cosmetics: Geographic Segmentation Analysis

6.5 Food & Beverage

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Food & Beverage: Geographic Segmentation Analysis

6.6 Bakery

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Bakery: Geographic Segmentation Analysis

6.7 Confectionary & Business to Customer

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Confectionary & Business to Customer: Geographic Segmentation Analysis

Chapter 7: Dried Apricots Market by Distribution Channel

7.1 Dried Apricots Market Snapshot and Growth Engine

7.2 Dried Apricots Market Overview

7.3 Store-Based Retailing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Store-Based Retailing: Geographic Segmentation Analysis

7.4 Modern Grocery Retailers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Modern Grocery Retailers: Geographic Segmentation Analysis

7.5 Convenience Store

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Convenience Store: Geographic Segmentation Analysis

7.6 Forecourt Retailers

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Forecourt Retailers: Geographic Segmentation Analysis

7.7 Hypermarkets

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Hypermarkets: Geographic Segmentation Analysis

7.8 Supermarkets

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Supermarkets: Geographic Segmentation Analysis

7.9 Traditional Grocery Retailers

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Traditional Grocery Retailers: Geographic Segmentation Analysis

7.10 Food Specialist

7.10.1 Introduction and Market Overview

7.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.10.3 Key Market Trends, Growth Factors and Opportunities

7.10.4 Food Specialist: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Dried Apricots Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 KENKKO CORPORATION (JAPAN)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 APRICOTKING (U.S.)

8.4 BATA FOOD (TURKEY)

8.5 NATIONAL RAISIN COMPANY (U.S.)

8.6 ANATOLIA A S (TURKEY)

8.7 ZIBA FOODS (U.S.)

8.8 KAYISICIOGLU APRICOT (TURKEY)

8.9 TRAINA HOME GROWN (U.S.)

8.10 SUN-MAID GROWERS OF CALIFORNIA (U.S.)

8.11 RED RIVER FOODS (U.S.)

8.12 PURCELL MOUNTAIN FARMS (CANADA)

8.13 B & R FARMS (U.S.)

8.14 JUTAI FOODS GROUP LIMITED (CHINA)

8.15 RETAJ AGRO FARMS (TURKEY)

8.16 OTHER ACTIVE PLAYERS

Chapter 9: Global Dried Apricots Market By Region

9.1 Overview

9.2. North America Dried Apricots Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product

9.2.4.1 Sulphured Dried Apricot

9.2.4.2 Natural Dried Apricot & Organic Dried Apricot

9.2.5 Historic and Forecasted Market Size By Form

9.2.5.1 Powdered

9.2.5.2 Whole Dried

9.2.5.3 Diced

9.2.6 Historic and Forecasted Market Size By End-User

9.2.6.1 Business to Business

9.2.6.2 Cosmetics

9.2.6.3 Food & Beverage

9.2.6.4 Bakery

9.2.6.5 Confectionary & Business to Customer

9.2.7 Historic and Forecasted Market Size By Distribution Channel

9.2.7.1 Store-Based Retailing

9.2.7.2 Modern Grocery Retailers

9.2.7.3 Convenience Store

9.2.7.4 Forecourt Retailers

9.2.7.5 Hypermarkets

9.2.7.6 Supermarkets

9.2.7.7 Traditional Grocery Retailers

9.2.7.8 Food Specialist

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Dried Apricots Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product

9.3.4.1 Sulphured Dried Apricot

9.3.4.2 Natural Dried Apricot & Organic Dried Apricot

9.3.5 Historic and Forecasted Market Size By Form

9.3.5.1 Powdered

9.3.5.2 Whole Dried

9.3.5.3 Diced

9.3.6 Historic and Forecasted Market Size By End-User

9.3.6.1 Business to Business

9.3.6.2 Cosmetics

9.3.6.3 Food & Beverage

9.3.6.4 Bakery

9.3.6.5 Confectionary & Business to Customer

9.3.7 Historic and Forecasted Market Size By Distribution Channel

9.3.7.1 Store-Based Retailing

9.3.7.2 Modern Grocery Retailers

9.3.7.3 Convenience Store

9.3.7.4 Forecourt Retailers

9.3.7.5 Hypermarkets

9.3.7.6 Supermarkets

9.3.7.7 Traditional Grocery Retailers

9.3.7.8 Food Specialist

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Bulgaria

9.3.8.2 The Czech Republic

9.3.8.3 Hungary

9.3.8.4 Poland

9.3.8.5 Romania

9.3.8.6 Rest of Eastern Europe

9.4. Western Europe Dried Apricots Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product

9.4.4.1 Sulphured Dried Apricot

9.4.4.2 Natural Dried Apricot & Organic Dried Apricot

9.4.5 Historic and Forecasted Market Size By Form

9.4.5.1 Powdered

9.4.5.2 Whole Dried

9.4.5.3 Diced

9.4.6 Historic and Forecasted Market Size By End-User

9.4.6.1 Business to Business

9.4.6.2 Cosmetics

9.4.6.3 Food & Beverage

9.4.6.4 Bakery

9.4.6.5 Confectionary & Business to Customer

9.4.7 Historic and Forecasted Market Size By Distribution Channel

9.4.7.1 Store-Based Retailing

9.4.7.2 Modern Grocery Retailers

9.4.7.3 Convenience Store

9.4.7.4 Forecourt Retailers

9.4.7.5 Hypermarkets

9.4.7.6 Supermarkets

9.4.7.7 Traditional Grocery Retailers

9.4.7.8 Food Specialist

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 Netherlands

9.4.8.5 Italy

9.4.8.6 Russia

9.4.8.7 Spain

9.4.8.8 Rest of Western Europe

9.5. Asia Pacific Dried Apricots Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product

9.5.4.1 Sulphured Dried Apricot

9.5.4.2 Natural Dried Apricot & Organic Dried Apricot

9.5.5 Historic and Forecasted Market Size By Form

9.5.5.1 Powdered

9.5.5.2 Whole Dried

9.5.5.3 Diced

9.5.6 Historic and Forecasted Market Size By End-User

9.5.6.1 Business to Business

9.5.6.2 Cosmetics

9.5.6.3 Food & Beverage

9.5.6.4 Bakery

9.5.6.5 Confectionary & Business to Customer

9.5.7 Historic and Forecasted Market Size By Distribution Channel

9.5.7.1 Store-Based Retailing

9.5.7.2 Modern Grocery Retailers

9.5.7.3 Convenience Store

9.5.7.4 Forecourt Retailers

9.5.7.5 Hypermarkets

9.5.7.6 Supermarkets

9.5.7.7 Traditional Grocery Retailers

9.5.7.8 Food Specialist

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Dried Apricots Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product

9.6.4.1 Sulphured Dried Apricot

9.6.4.2 Natural Dried Apricot & Organic Dried Apricot

9.6.5 Historic and Forecasted Market Size By Form

9.6.5.1 Powdered

9.6.5.2 Whole Dried

9.6.5.3 Diced

9.6.6 Historic and Forecasted Market Size By End-User

9.6.6.1 Business to Business

9.6.6.2 Cosmetics

9.6.6.3 Food & Beverage

9.6.6.4 Bakery

9.6.6.5 Confectionary & Business to Customer

9.6.7 Historic and Forecasted Market Size By Distribution Channel

9.6.7.1 Store-Based Retailing

9.6.7.2 Modern Grocery Retailers

9.6.7.3 Convenience Store

9.6.7.4 Forecourt Retailers

9.6.7.5 Hypermarkets

9.6.7.6 Supermarkets

9.6.7.7 Traditional Grocery Retailers

9.6.7.8 Food Specialist

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkey

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Dried Apricots Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product

9.7.4.1 Sulphured Dried Apricot

9.7.4.2 Natural Dried Apricot & Organic Dried Apricot

9.7.5 Historic and Forecasted Market Size By Form

9.7.5.1 Powdered

9.7.5.2 Whole Dried

9.7.5.3 Diced

9.7.6 Historic and Forecasted Market Size By End-User

9.7.6.1 Business to Business

9.7.6.2 Cosmetics

9.7.6.3 Food & Beverage

9.7.6.4 Bakery

9.7.6.5 Confectionary & Business to Customer

9.7.7 Historic and Forecasted Market Size By Distribution Channel

9.7.7.1 Store-Based Retailing

9.7.7.2 Modern Grocery Retailers

9.7.7.3 Convenience Store

9.7.7.4 Forecourt Retailers

9.7.7.5 Hypermarkets

9.7.7.6 Supermarkets

9.7.7.7 Traditional Grocery Retailers

9.7.7.8 Food Specialist

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Dried Apricots Market Scope:

|

Global Dried Apricots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 798.89 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.39% |

Market Size in 2032: |

USD 1395.06 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Form |

|

||

|

By End-Users |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

KENKKO CORPORATION (Japan), ApricotKing (U.S.), BATA FOOD (Turkey), National Raisin Company (U.S.), Anatolia A.S. (Turkey), ZIBA FOODS (U.S.), Kayisicioglu Apricot (Turkey), Traina Home Grown (U.S.), Sun-Maid Growers of California (U.S.), Red River Foods (U.S.), PURCELL MOUNTAIN FARMS (Canada), B & R Farms (U.S.), Jutai Foods Group Limited (China), and Retaj Agro Farms (Turkey) and among others.

The Dried Apricots Market is segmented into By Product, By Form, By End-Users, By Distribution Channel and region.By Product, the market is categorized into Sulphured Dried Apricot, Natural Dried Apricot and Organic Dried Apricot.By Form, the market is categorized into Powdered, Whole Dried and Diced.By End- Users, the market is categorized into Business to Business, Cosmetics, Food and Beverage, Bakery, Confectionary and Business to Customer.By Distribution Channel, the market is categorized into Store Based Retailing, Modern Grocery Retailers, Convenience Store, Forecourt Retailers, Hypermarkets, Supermarkets, Traditional Grocery Retailers, Food Specialist, Independent Small Grocers, Other Grocery Retailers and Online.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Dried apricots are those where all the water content has been withdrawn so that the fruit lasts longer. The drying process augment the natural sugars and flavour and at the same time creates a concentration of nutrients. They can be consumed as a snack, incorporated into baked goods or on breakfast cereal or salads. Dried apricot contains a lot of fibre vitamin and mineral.

Dried Apricots Market Size Was Valued at USD 798.89 Million in 2023, and is Projected to Reach USD 1395.06 Million by 2032, Growing at a CAGR of 6.39% From 2024-2032.