Double Diaphragm Pumps (DDP) Market Synopsis

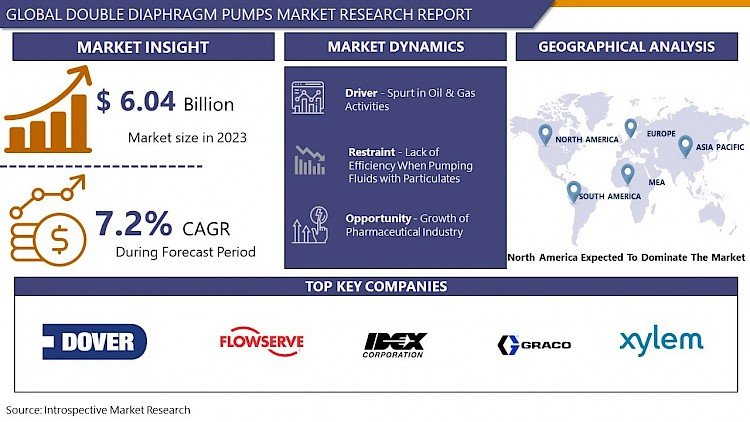

Double Diaphragm Pumps (DDP) Market Size Was Valued at USD 6.04 Billion in 2023 and is Projected to Reach USD 11.29 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

Double diaphragm pumps are characterized by two flexible diaphragms that reciprocate back and forth, creating a temporary chamber, which draws in and then expels fluid through the pump. This design allows the pump to handle a wide range of fluids, from clean, light viscosity to corrosive, abrasive, medium viscosity fluids, and even fluids containing solid particles.

- These pumps are used in various industries due to their adaptability and efficiency. Key industries include chemical processing, water and wastewater management, pharmaceuticals, food and beverage, and oil and gas. They are particularly valued in applications where the fluid being pumped is complex, like high viscosity, or contains fragile solids or abrasive particles.

- The market for double diaphragm pumps is influenced by factors such as the expansion of industrial activities, technological advancements in pump design, and increasing emphasis on wastewater treatment globally. Innovations aimed at enhancing efficiency, reducing maintenance costs, and increasing the lifespan of these pumps are key drivers for market growth.

Double Diaphragm Pumps (DDP) Market Trend Analysis

Spurt in Oil & Gas Activities

- The expansion of activities in the Oil and gas sector, including exploration, drilling, and production, creates a substantial demand for reliable and efficient fluid-handling solutions. Double Diaphragm Pumps are particularly suited for these applications due to their ability to handle a variety of fluids, including those with high viscosity or containing abrasive particles, commonly found in the Oil and gas industry. Their robust design ensures consistent performance in demanding environments, making them ideal for oilfield services, offshore drilling operations, and the transfer of crude oil and natural gas.

- The Oil and gas industry are increasingly subject to stringent environmental and safety regulations, which necessitate the use of equipment that minimizes the risk of spills and leaks. Double Diaphragm Pumps offer a high level of containment and control, which is essential for maintaining environmental compliance and ensuring workplace safety. Additionally, as the industry moves towards more sustainable practices, the efficiency and reliability of DDPs make them a preferred choice, aiding in reducing operational downtime and maintenance costs, thereby supporting sustainable and responsible operations in the Oil and gas sector.

Growth of the Pharmaceutical Industry

- The pharmaceutical industry requires stringent standards for cleanliness, precision, and contamination control in fluid handling. Double diaphragm pumps are particularly suited for these needs due to their design, which allows for gentle handling of sensitive fluids without contamination. The hermetic separation between the fluid and the pump environment ensures sterility, a crucial factor in pharmaceutical processes. As the pharmaceutical industry grows, driven by factors like an aging global population and increased investment in healthcare infrastructure, there is a corresponding increase in the demand for reliable and efficient fluid-handling solutions. DDPs, with their ability to handle a variety of chemically aggressive and sensitive fluids, are well-positioned to meet these expanding requirements.

- The evolution of DDP technology, aimed at enhancing efficiency and reducing contamination risks, aligns well with the pharmaceutical industry's move towards more sophisticated production methodologies, such as continuous manufacturing and personalized medicine. Innovations in pump materials, design for easier sterilization, and improved control systems for precise flow regulation are making DDPs increasingly compatible with the high standards of the pharmaceutical industry. Additionally, the ability to customize these pumps for specific applications, such as handling biologically active compounds or high-purity water, adds to their attractiveness.

Double Diaphragm Pumps (DDP) Market Segment Analysis:

Double Diaphragm Pumps (DDP) Market Segmented on the basis of Operation Type, Mechanism Type, and End-User Industry.

By Operation Type, Double Acting Agent segment is expected to dominate the market during the forecast period

- Double Acting Diaphragm Pumps are designed to pump on both the push and pull of the diaphragm, effectively doubling the pump's capacity compared to Single Acting Pumps, which pump only on one side of the diaphragm. This results in a continuous and more consistent flow rate, which is particularly advantageous in industrial applications where a steady and reliable fluid transfer is critical. The increased efficiency and output of Double Acting Pumps make them the preferred choice for high-volume applications.

- Double-acting diaphragm Pumps excel in handling fluids with high viscosity or high solid content. The pumping mechanism allows for a smoother flow of such challenging fluids, reducing the risk of clogging and wear. This capability is crucial in industries like mining, construction, and wastewater treatment, where the fluids involved often contain abrasive particles or are of a thicker consistency.

By Mechanism Type, Air Operated Pumps segment held the largest share of 29.8% in 2022

- Air Operated Double Diaphragm Pumps (AODD) are highly versatile and safe for use in hazardous environments, which is a key reason for their large market share. These pumps use compressed air as their power source, eliminating the risks associated with electrical power sources, particularly in explosive or flammable environments. This feature makes AODD pumps ideal for industries like chemical processing, oil and gas, and paint manufacturing, where safety is a paramount concern. Additionally, AODD pumps can be used in a variety of environments, including those with limited electrical infrastructure, enhancing their appeal across a wide range of industrial applications.

- AODD pumps are known for their simple design and ease of maintenance. Unlike other pump types that may require complex and costly maintenance routines, AODD pumps have fewer moving parts and do not require electricity or intricate mechanical components, reducing the likelihood of mechanical failures. This simplicity translates to lower maintenance costs and increased reliability, factors highly valued in industries where downtime can be extremely costly.

Double Diaphragm Pumps (DDP) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America boasts a mature and sophisticated industrial infrastructure, particularly in sectors like chemicals, pharmaceuticals, and water treatment. These industries have a high demand for reliable and efficient fluid-handling solutions, which is a key driver for the DDP market. Furthermore, stringent environmental and safety regulations in the region necessitate the use of advanced pumping technology that can handle hazardous and delicate fluids safely and efficiently. Double Diaphragm Pumps, known for their ability to meet these requirements, are thus in high demand.

- The region's commitment to technological advancements and increasing investments in water and wastewater treatment infrastructure also play a crucial role. North America is at the forefront of adopting new technologies in pump design, such as improved materials for diaphragms, enhanced efficiency, and automation capabilities. These advancements make DDPs more attractive for various applications, including handling difficult or hazardous fluids.

Double Diaphragm Pumps (DDP) Market Top Key Players:

- Dover Corporation(USA)

- Flowserve(USA)

- Idex Corporation (USA)

- Graco Inc. (USA)

- Xylem Inc. (USA)

- Pump Solutions Group (USA)

- SPX Flow, Inc. (USA)

- DAYTON (USA)

- WHITE KNIGHT (USA)

- EDSON (USA)

- SOTERA (USA)

- VERSA-MATIC (USA)

- SANDPIPER (USA)

- WARREN-RUPP (USA)

- STANDARD PUMP (USA)

- ARO (USA)

- Ingersoll Rand (Ireland)

- Tapflo (Sweden)

- Verder Group (The Netherlands)

- Grundfos Holding A/S (Denmark)

- LEWA Group (Germany)

- Seepex GmbH (Germany)

- Yamada Corporation (Japan)

- Leak-Proof Pumps LEWA (India)

Key Industry Developments in the Double Diaphragm Pumps (DDP) Market:

- In Aug. 2023, Wilden, part of PSG and Dover announced that it has extended its line of small air-operated double-diaphragm (AODD) pumps with the addition of two new 6 mm (1/4") Bolted Plastic Pump models, the Pro-Flo® SHIFT Series PS25 and Accu-Flo™ Series A25PS. Providing the reliability, energy efficiency, and dependability required in challenging fluid-handling activities, the PS25 and A25PS AODD pumps are ideal for dosing and batching applications.

- In July 2023, Wilden®, a brand of PSG®, a Dover company, and a worldwide leader in specialty pumps, extended its line of small air-operated double-diaphragm (AODD) pumps with the addition of the new 6 mm (1/4") Pro-Flo® SHIFT Series PS25 Bolted Plastic AODD Pump model and 6 mm (1/4") Accu-Flo™ Series A25PS Bolted Plastic Pump zodels.

|

Global Double Diaphragm Pumps (DDP) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 6.04 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 11.29 Bn. |

|

Segments Covered: |

By Operation Type |

|

|

|

By Mechanism Type |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DOUBLE DIAPHRAGM PUMPS (DDP) MARKET BY OPERATION TYPE (2016-2030)

- DOUBLE DIAPHRAGM PUMPS (DDP) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SINGLE ACTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DOUBLE ACTING AGENT

- DOUBLE DIAPHRAGM PUMPS (DDP) MARKET BY MECHANISM TYPE (2016-2030)

- DOUBLE DIAPHRAGM PUMPS (DDP) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AIR OPERATED PUMPS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ELECTRICALLY OPERATED PUMPS

- DOUBLE DIAPHRAGM PUMPS (DDP) MARKET BY END-USER INDUSTRY (2016-2030)

- DOUBLE DIAPHRAGM PUMPS (DDP) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OIL & GAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD & BEVERAGES

- WATER & WASTE WATER

- CHEMICALS & PETROCHEMICALS

- PHARMACEUTICALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- DOUBLE DIAPHRAGM PUMPS (DDP) Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DOVER CORPORATION (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- FLOWSERVE (USA)

- IDEX CORPORATION (USA)

- GRACO INC. (USA)

- XYLEM INC. (USA)

- PUMP SOLUTIONS GROUP (USA)

- SPX FLOW, INC. (USA)

- DAYTON (USA)

- WHITE KNIGHT (USA)

- EDSON (USA)

- SOTERA (USA)

- VERSA-MATIC (USA)

- SANDPIPER (USA)

- WARREN-RUPP (USA)

- STANDARD PUMP (USA)

- ARO (USA)

- INGERSOLL RAND (IRELAND)

- TAPFLO (SWEDEN)

- VERDER GROUP (THE NETHERLANDS)

- GRUNDFOS HOLDING A/S (DENMARK)

- LEWA GROUP (GERMANY)

- SEEPEX GMBH (GERMANY)

- YAMADA CORPORATION (JAPAN)

- LEAK-PROOF PUMPS LEWA (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL DOUBLE DIAPHRAGM PUMPS (DDP) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By OPERATION TYPE

- Historic And Forecasted Market Size By MECHANISM TYPE

- Historic And Forecasted Market Size By END-USER INDUSTRY

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Double Diaphragm Pumps (DDP) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 6.04 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 11.29 Bn. |

|

Segments Covered: |

By Operation Type |

|

|

|

By Mechanism Type |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DOUBLE DIAPHRAGM PUMPS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DOUBLE DIAPHRAGM PUMPS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DOUBLE DIAPHRAGM PUMPS MARKET COMPETITIVE RIVALRY

TABLE 005. DOUBLE DIAPHRAGM PUMPS MARKET THREAT OF NEW ENTRANTS

TABLE 006. DOUBLE DIAPHRAGM PUMPS MARKET THREAT OF SUBSTITUTES

TABLE 007. DOUBLE DIAPHRAGM PUMPS MARKET BY OPERATION TYPE

TABLE 008. SINGLE ACTING MARKET OVERVIEW (2016-2028)

TABLE 009. DOUBLE ACTING AGENT MARKET OVERVIEW (2016-2028)

TABLE 010. DOUBLE DIAPHRAGM PUMPS MARKET BY MECHANISM TYPE

TABLE 011. AIR OPERATED PUMPS MARKET OVERVIEW (2016-2028)

TABLE 012. ELECTRICALLY OPERATED PUMPS MARKET OVERVIEW (2016-2028)

TABLE 013. DOUBLE DIAPHRAGM PUMPS MARKET BY END-USER INDUSTRY

TABLE 014. OIL & GAS MARKET OVERVIEW (2016-2028)

TABLE 015. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 016. WATER & WASTE WATER MARKET OVERVIEW (2016-2028)

TABLE 017. CHEMICALS & PETROCHEMICALS MARKET OVERVIEW (2016-2028)

TABLE 018. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET, BY OPERATION TYPE (2016-2028)

TABLE 020. NORTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET, BY MECHANISM TYPE (2016-2028)

TABLE 021. NORTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 022. N DOUBLE DIAPHRAGM PUMPS MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE DOUBLE DIAPHRAGM PUMPS MARKET, BY OPERATION TYPE (2016-2028)

TABLE 024. EUROPE DOUBLE DIAPHRAGM PUMPS MARKET, BY MECHANISM TYPE (2016-2028)

TABLE 025. EUROPE DOUBLE DIAPHRAGM PUMPS MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 026. DOUBLE DIAPHRAGM PUMPS MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC DOUBLE DIAPHRAGM PUMPS MARKET, BY OPERATION TYPE (2016-2028)

TABLE 028. ASIA PACIFIC DOUBLE DIAPHRAGM PUMPS MARKET, BY MECHANISM TYPE (2016-2028)

TABLE 029. ASIA PACIFIC DOUBLE DIAPHRAGM PUMPS MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 030. DOUBLE DIAPHRAGM PUMPS MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA DOUBLE DIAPHRAGM PUMPS MARKET, BY OPERATION TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA DOUBLE DIAPHRAGM PUMPS MARKET, BY MECHANISM TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA DOUBLE DIAPHRAGM PUMPS MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 034. DOUBLE DIAPHRAGM PUMPS MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET, BY OPERATION TYPE (2016-2028)

TABLE 036. SOUTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET, BY MECHANISM TYPE (2016-2028)

TABLE 037. SOUTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 038. DOUBLE DIAPHRAGM PUMPS MARKET, BY COUNTRY (2016-2028)

TABLE 039. PUMP SOLUTIONS GROUP: SNAPSHOT

TABLE 040. PUMP SOLUTIONS GROUP: BUSINESS PERFORMANCE

TABLE 041. PUMP SOLUTIONS GROUP: PRODUCT PORTFOLIO

TABLE 042. PUMP SOLUTIONS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. LEWA GMBH: SNAPSHOT

TABLE 043. LEWA GMBH: BUSINESS PERFORMANCE

TABLE 044. LEWA GMBH: PRODUCT PORTFOLIO

TABLE 045. LEWA GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. FLOWSERVE CORPORATION: SNAPSHOT

TABLE 046. FLOWSERVE CORPORATION: BUSINESS PERFORMANCE

TABLE 047. FLOWSERVE CORPORATION: PRODUCT PORTFOLIO

TABLE 048. FLOWSERVE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. GRUNDFOS HOLDING A/S: SNAPSHOT

TABLE 049. GRUNDFOS HOLDING A/S: BUSINESS PERFORMANCE

TABLE 050. GRUNDFOS HOLDING A/S: PRODUCT PORTFOLIO

TABLE 051. GRUNDFOS HOLDING A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. XYLEM INC.: SNAPSHOT

TABLE 052. XYLEM INC.: BUSINESS PERFORMANCE

TABLE 053. XYLEM INC.: PRODUCT PORTFOLIO

TABLE 054. XYLEM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. TAPFLO AB: SNAPSHOT

TABLE 055. TAPFLO AB: BUSINESS PERFORMANCE

TABLE 056. TAPFLO AB: PRODUCT PORTFOLIO

TABLE 057. TAPFLO AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. DOVER CORP: SNAPSHOT

TABLE 058. DOVER CORP: BUSINESS PERFORMANCE

TABLE 059. DOVER CORP: PRODUCT PORTFOLIO

TABLE 060. DOVER CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. VERDER INTERNATIONAL B.V: SNAPSHOT

TABLE 061. VERDER INTERNATIONAL B.V: BUSINESS PERFORMANCE

TABLE 062. VERDER INTERNATIONAL B.V: PRODUCT PORTFOLIO

TABLE 063. VERDER INTERNATIONAL B.V: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SPX FLOW: SNAPSHOT

TABLE 064. SPX FLOW: BUSINESS PERFORMANCE

TABLE 065. SPX FLOW: PRODUCT PORTFOLIO

TABLE 066. SPX FLOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY OPERATION TYPE

FIGURE 012. SINGLE ACTING MARKET OVERVIEW (2016-2028)

FIGURE 013. DOUBLE ACTING AGENT MARKET OVERVIEW (2016-2028)

FIGURE 014. DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY MECHANISM TYPE

FIGURE 015. AIR OPERATED PUMPS MARKET OVERVIEW (2016-2028)

FIGURE 016. ELECTRICALLY OPERATED PUMPS MARKET OVERVIEW (2016-2028)

FIGURE 017. DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY END-USER INDUSTRY

FIGURE 018. OIL & GAS MARKET OVERVIEW (2016-2028)

FIGURE 019. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 020. WATER & WASTE WATER MARKET OVERVIEW (2016-2028)

FIGURE 021. CHEMICALS & PETROCHEMICALS MARKET OVERVIEW (2016-2028)

FIGURE 022. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA DOUBLE DIAPHRAGM PUMPS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Double Diaphragm Pumps (DDP) Market research report is 2024-2032.

Dover Corporation (USA), Flowserve (USA), Idex Corporation (USA), Graco Inc. (USA), Xylem Inc. (USA), Pump Solutions Group (USA), SPX Flow, Inc. (USA), DAYTON (USA), WHITE KNIGHT (USA), EDSON (USA), SOTERA (USA), VERSA-MATIC (USA), SANDPIPER (USA), WARREN-RUPP (USA), STANDARD PUMP (USA), ARO (USA), Ingersoll Rand (Ireland), Tapflo (Sweden), Verder Group (The Netherlands), Grundfos Holding A/S (Denmark), LEWA Group (Germany), Seepex GmbH (Germany), Yamada Corporation (Japan), Leak-Proof Pumps LEWA (India),and Other Major Players.

The Double Diaphragm Pumps (DDP) Market is segmented into Operation Type, Mechanism Type, End-User Industry, and Region. By Operation Type, the market is categorized into Single Acting, and Double Acting Agent. By Mechanism Type the market is categorized into Air Operated Pumps and Electrically Operated Pumps. By End User Industry the market is categorized into Oil & Gas, Food & Beverages, Water & Waste Water, Chemicals & Petrochemicals, and Pharmaceuticals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Double diaphragm pumps are characterized by two flexible diaphragms that reciprocate back and forth, creating a temporary chamber, which draws in and then expels fluid through the pump. This design allows the pump to handle a wide range of fluids, from clean, light viscosity to corrosive, abrasive, medium viscosity fluids, and even fluids containing solid particles.

Double Diaphragm Pumps (DDP) Market Size Was Valued at USD 6.04 Billion in 2023 and is Projected to Reach USD 11.29 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.