DNS Security Software Market Synopsis

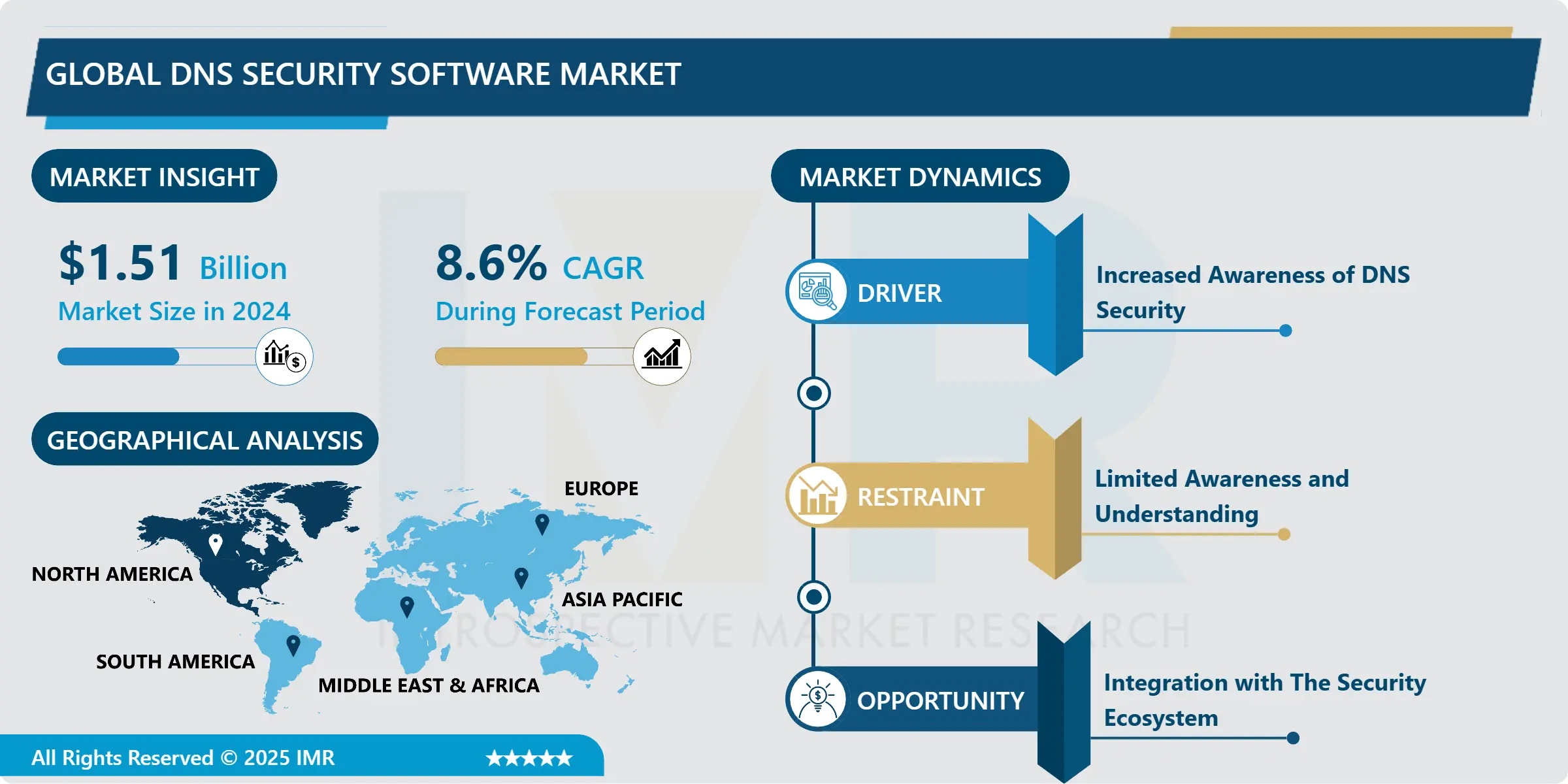

DNS Security Software Market Size Was Valued at USD 1.51 Billion in 2024 and is Projected to Reach USD 2.92 Billion by 2032, Growing at a CAGR of 8.6% From 2025-2032.

The term "DNS Security Software" describes a group of instruments and programs intended to protect the Domain Name System from online attacks. To ensure the integrity and dependability of DNS infrastructure, it consists of filtering mechanisms to block malicious websites, firewalls for network-level protection, anomaly detection for spotting unusual traffic patterns, encryption protocols for secure communication, and integration with threat intelligence to counter evolving threats.DNS security software is used to filter and monitor DNS traffic, detect and block dangerous domains, encrypt DNS interactions, and incorporate threat intelligence feeds. These technologies improve network security by blocking access to harmful websites, identifying anomalies, and guaranteeing the integrity of DNS transactions. They do this by enforcing policies, examining traffic patterns, and applying machine learning.

Software for DNS security has many advantages. By offering proactive security against cyber threats, it lowers the possibility of data breaches and illegal access. Organizations may preserve regulatory compliance, secure critical data, and preserve their brand by censoring material and banning bad domains. DNS security software also improves network performance and dependability overall, guaranteeing continuous access to authorized resources and actively thwarting emerging cybersecurity threats.

DNS Security Software Market Trend Analysis:

Increased Awareness of DNS Security

- The rapid growth of the DNS Security Software Market is significantly influenced by the heightened awareness of DNS security risks. With increasing cyber-attacks exploiting vulnerabilities in the Domain Name System, organizations across various industries realize the crucial importance of securing their DNS infrastructure. This awareness is fueled by a surge in cyber threats like DNS cache poisoning, DDoS attacks, and DNS tunneling, which have the potential to result in data breaches, service disruptions, and unauthorized access. The growing understanding of the potential consequences associated with DNS-related vulnerabilities is compelling businesses to invest in advanced DNS security solutions to strengthen their cybersecurity defenses.

- Additionally, the evolving regulatory landscape and compliance requirements are amplifying the significance of DNS security. Organizations are now mandated to adhere to data protection regulations that require robust measures to safeguard sensitive information. This, combined with the rising frequency of cybersecurity incidents, has prompted decision-makers to prioritize DNS security as an integral component of their cybersecurity strategy. Consequently, there is a surge in demand for DNS security software offering comprehensive threat detection, real-time analytics, and adaptive defense mechanisms to counter emerging cyber threats, contributing significantly to the market's expansion.

- The proactive stance taken by businesses, driven by increased awareness of the critical role DNS security plays in overall cybersecurity, is reshaping the landscape and propelling the DNS Security Software Market forward as organizations seek advanced solutions to mitigate potential risks and secure their digital assets.

Integration with The Security Ecosystem

- The burgeoning growth of the DNS Security Software Market presents a significant opportunity through integration with the broader security ecosystem. As organizations grapple with increasingly sophisticated cyber threats, the necessity for a cohesive and interoperable security infrastructure becomes paramount. DNS security solutions that seamlessly incorporate other cybersecurity tools, such as SIEM (Security Information and Event Management) platforms, firewalls, and endpoint protection systems, provide a holistic defense strategy. This integration facilitates a unified approach to threat detection, incident response, and overall security management, streamlining operations and bolstering the efficiency of security teams.

- The integration of DNS security software with the security ecosystem allows for the utilization of collective intelligence and visibility provided by various security tools. This collaborative approach enables more comprehensive threat analysis, empowering organizations to detect and respond to advanced attacks that may involve multiple attack vectors. Additionally, integrated solutions support the sharing of actionable threat intelligence across different components of the security infrastructure, contributing to a proactive and adaptive defense posture.

- Furthermore, the alignment of DNS security solutions with the broader cybersecurity ecosystem resonates with the industry trend toward zero-trust security models. This approach emphasizes continuous verification and least privilege access, creating a security paradigm where trust is never assumed, and every transaction undergoes scrutiny. Its seamless integration with other security layers enhances the overall security fabric, presenting a compelling opportunity for growth within the DNS Security Software Market.

DNS Security Software Market Segment Analysis:

DNS Security Software Market Segmented on the basis of Deployment, Enterprise Size, and Industry.

By Deployment, Cloud-based DNS Security Software is expected to dominate the market during the forecast period

- Cloud-based offerings provide organizations with the advantage of centralized management, enabling swift implementation and updates without the need for extensive on-premises infrastructure. This approach aligns seamlessly with the evolving IT landscape, where businesses are increasingly adopting cloud services for enhanced agility and resource optimization.

- Cloud-based DNS Security Software not only ensures effective protection against DNS threats but also caters to the requirements of organizations with distributed networks and remote workforces. Leveraging the power of cloud resources, these solutions provide real-time threat intelligence, global threat detection, and a collaborative defense approach, positioning them as the preferred choice for businesses seeking robust and adaptable DNS security measures.

By Enterprise Size, Large Enterprises segment held the largest share in 2024

- The DNS Security Software market sees the Large Enterprises segment as a significant contributor, holding the predominant share. Large enterprises, with their expansive networks and critical data infrastructure, prioritize robust cybersecurity measures to combat evolving threats. These organizations frequently encounter complex cyber challenges and are proactive in deploying comprehensive DNS security solutions to enhance their defenses. The imperative for scalability, advanced threat detection, and seamless integration with existing security architectures drives substantial investments from large enterprises into DNS security software.

- Moreover, the regulatory compliance requirements imposed on these organizations further underscore the critical role of DNS security. As industry leaders, large enterprises significantly influence the DNS Security Software market by adopting cutting-edge solutions to safeguard their digital assets, setting trends, and shaping the broader cybersecurity landscape.

DNS Security Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is positioned to lead the DNS Security Software market, propelled by its advanced technological infrastructure, heightened awareness of cybersecurity threats, and the presence of numerous key market players. The United States, in particular, plays a significant role in this dominance, with its large and technologically mature enterprises actively seeking robust DNS security solutions. The region's proactive stance on cybersecurity, stringent regulatory frameworks, and the rising frequency of cyber threats contribute to the increasing demand for DNS security software.

- Additionally, the ongoing adoption of cloud services, the surge in remote work trends, and the prioritization of data protection further drive the market's growth in North America. With organizations in the region emphasizing the security of their digital assets, it is anticipated that the DNS Security Software market in North America will continue to uphold its leadership position and foster innovations in the cybersecurity landscape.

Key Players Covered in DNS Security Software Market:

- Cisco(U.S.)

- Comodo(U.S.)

- DNSFilter (U.S.)

- Webroot (U.S.)

- Infoblox (U.S.)

- Akamai (U.S.)

- MXToolBox (U.S.)

- F5 Networks (U.S.)

- Neustar (U.S.)

- Bluecat (Canada)

- CSIS Security Group (Denmark)

- EfficientIP (France)

- TitanHQ (Ireland), and Others Active Players.

Key Industry Developments in the DNS Security Software Market:

- In February 2024, Infoblox Inc., a leader in cloud networking and security services, unveils an industry-first, AI-driven security operations solution, SOC Insights, enhancing its DNS Detection and Response solution, BloxOne® Threat Defense. SOC Insights tackles challenges faced by security teams, such as analyst burnout, alert fatigue, and skills shortages. It accelerates threat prevention by analyzing vast amounts of data to identify critical issues, providing actionable insights, and driving automation for rapid remediation and containment. This empowers security analysts to focus on essential investigations, reducing response times significantly.

- In December 2023, DNSFilter announced the addition of a new Malicious Domain Protection feature to its protective DNS software, building on its machine learning capabilities. This feature bolsters DNSFilter's enterprise-grade defenses providing better visibility and protection against Domain Generation Algorithms used in malware, botnet, and other malicious domains, in addition to other threat vectors. This expands the company's threat detection capabilities and its ability to block large lists of undesirable domains and the security threats they pose.

|

Global DNS Security Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 2.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Enterprise Size |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: DNS Security Software Market by Type (2018-2032)

4.1 DNS Security Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud-based DNS Security Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-premises DNS Security Software

Chapter 5: DNS Security Software Market by Enterprise Size (2018-2032)

5.1 DNS Security Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium-sized Enterprises (SMEs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: DNS Security Software Market by Industry (2018-2032)

6.1 DNS Security Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 IT & Telecom

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BFSI

6.5 Healthcare

6.6 Manufacturing

6.7 Retail

6.8 Government

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 DNS Security Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CISCO SYSTEMS (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GE TRANSPORTATION SYSTEMS (U.S.)

7.4 IBM (U.S.)

7.5 COGNIZANT (U.S.)

7.6 CUBIC (U.S.)

7.7 NORTHROP GRUMMAN (U.S.)

7.8 DESCARTS SYSTEMS (CANADA)

7.9 SAP (GERMANY)

7.10 SIEMENS (GERMANY)

7.11 AMADEUS (SPAIN)

7.12 IKUSI (SPAIN)

7.13 INDRA SISTEMAS (SPAIN)

7.14 ACCENTURE (IRELAND)

7.15 ALSTOM (FRANCE)

7.16 ATOS (FRANCE)

7.17 CAPGEMINI (FRANCE)

7.18 KAPSCH TRAFFICCOM AG (AUSTRIA)

7.19 TATA CONSULTANCY SERVICES (INDIA)

7.20 MINDFIRE SOLUTIONS (INDIA)

7.21 WIPRO (INDIA)

7.22 NEC CORPORATION (JAPAN)

7.23

Chapter 8: Global DNS Security Software Market By Region

8.1 Overview

8.2. North America DNS Security Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Cloud-based DNS Security Software

8.2.4.2 On-premises DNS Security Software

8.2.5 Historic and Forecasted Market Size by Enterprise Size

8.2.5.1 Small and Medium-sized Enterprises (SMEs)

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size by Industry

8.2.6.1 IT & Telecom

8.2.6.2 BFSI

8.2.6.3 Healthcare

8.2.6.4 Manufacturing

8.2.6.5 Retail

8.2.6.6 Government

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe DNS Security Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Cloud-based DNS Security Software

8.3.4.2 On-premises DNS Security Software

8.3.5 Historic and Forecasted Market Size by Enterprise Size

8.3.5.1 Small and Medium-sized Enterprises (SMEs)

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size by Industry

8.3.6.1 IT & Telecom

8.3.6.2 BFSI

8.3.6.3 Healthcare

8.3.6.4 Manufacturing

8.3.6.5 Retail

8.3.6.6 Government

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe DNS Security Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Cloud-based DNS Security Software

8.4.4.2 On-premises DNS Security Software

8.4.5 Historic and Forecasted Market Size by Enterprise Size

8.4.5.1 Small and Medium-sized Enterprises (SMEs)

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size by Industry

8.4.6.1 IT & Telecom

8.4.6.2 BFSI

8.4.6.3 Healthcare

8.4.6.4 Manufacturing

8.4.6.5 Retail

8.4.6.6 Government

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific DNS Security Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Cloud-based DNS Security Software

8.5.4.2 On-premises DNS Security Software

8.5.5 Historic and Forecasted Market Size by Enterprise Size

8.5.5.1 Small and Medium-sized Enterprises (SMEs)

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size by Industry

8.5.6.1 IT & Telecom

8.5.6.2 BFSI

8.5.6.3 Healthcare

8.5.6.4 Manufacturing

8.5.6.5 Retail

8.5.6.6 Government

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa DNS Security Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Cloud-based DNS Security Software

8.6.4.2 On-premises DNS Security Software

8.6.5 Historic and Forecasted Market Size by Enterprise Size

8.6.5.1 Small and Medium-sized Enterprises (SMEs)

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size by Industry

8.6.6.1 IT & Telecom

8.6.6.2 BFSI

8.6.6.3 Healthcare

8.6.6.4 Manufacturing

8.6.6.5 Retail

8.6.6.6 Government

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America DNS Security Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Cloud-based DNS Security Software

8.7.4.2 On-premises DNS Security Software

8.7.5 Historic and Forecasted Market Size by Enterprise Size

8.7.5.1 Small and Medium-sized Enterprises (SMEs)

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size by Industry

8.7.6.1 IT & Telecom

8.7.6.2 BFSI

8.7.6.3 Healthcare

8.7.6.4 Manufacturing

8.7.6.5 Retail

8.7.6.6 Government

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global DNS Security Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 2.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Enterprise Size |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||