Display Packaging Market Synopsis

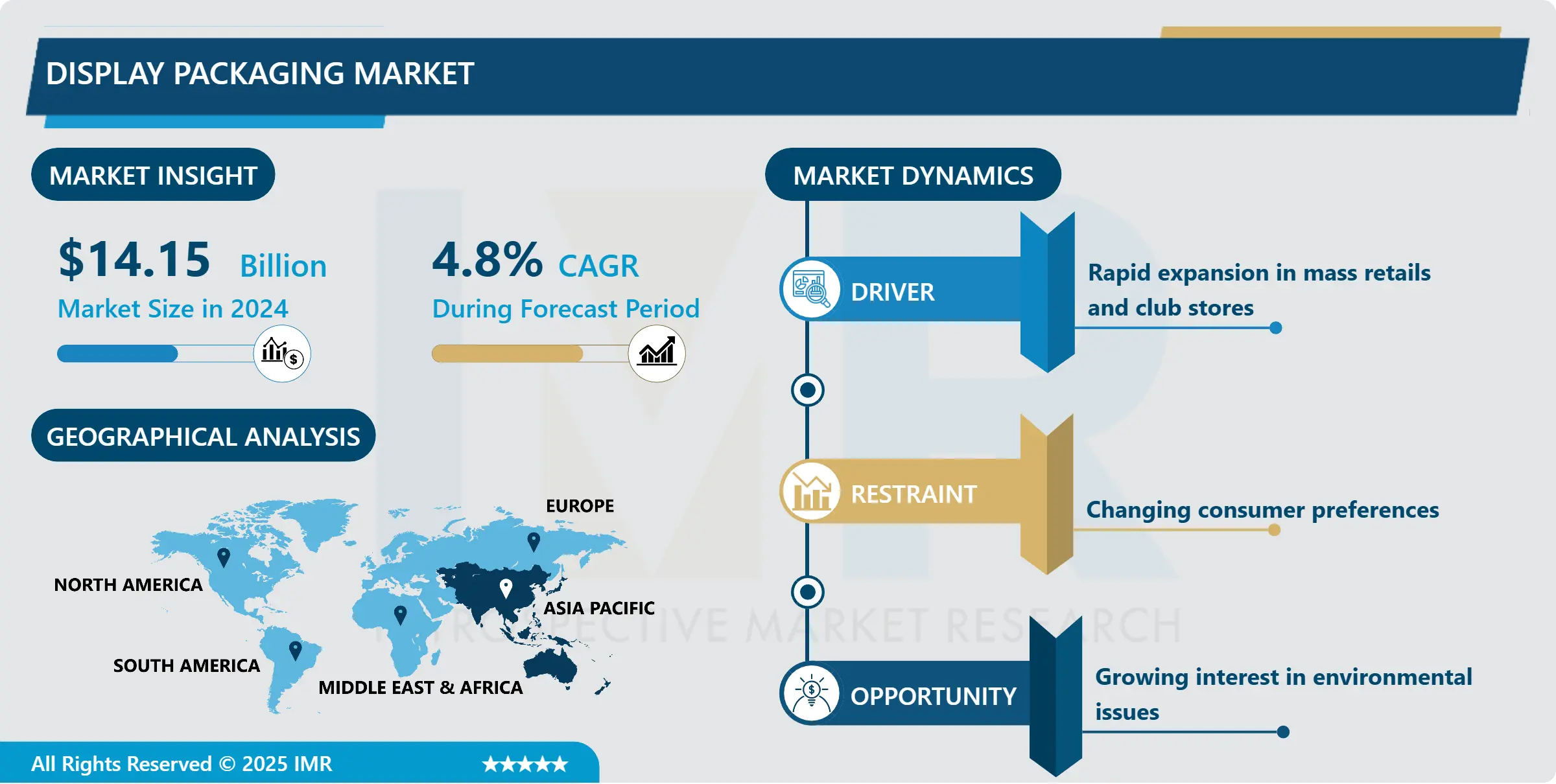

Display Packaging Market Size Was Valued at USD 14.15 Billion in 2024, and is Projected to Reach USD 23.7 Billion by 2035, Growing at a CAGR of 4.8% From 2025-2035.

Display packaging is also referred to as luxury packaging mainly because of the expensive appearance that these kinds of packaging offer. The characteristics and qualitative attributes distinguishing highly Expensive and Complex Types are juxtaposed in display packaging. This also offers the Type secure packing and it is also a more realistic idea from the other various packagings. In addition, it gives a clear visibility needed in its environment and an artistic glance more likely to be noticed in a retail store. All chains such as food and beverages, cosmetics, and medicines industries offer display packaging to organizations where customers are able to browse for long and possibly expend more money. It also helps in Type tracking during shipping, enable less time been spent on display setup as well as protect Types during shipping and storage.

For instance in retail business they know the value of display packaging where the products are packaged for the purpose of showcasing them. About the packaging, it found that the company favoured using wholesale display packaging. Since the process of purchasing is mostly done at the stores, this kind of packaging is quite relevant to the general public. Customers who arrive at the stores with a list of products they need are most likely to get a new Type merely because it looks good. But that depends with packaging of the Type. Such display packaging is important for retailers to be able to appreciate the importance of bespoke display packaging. It seems to be not only a guard to the Type but also beneficial to marketing. Unlike traditional forms of marketing, Unique display boxes entice more customers than the popular methods of marketing. Aside from conveying the value and functionalities of the Type, its packaging also ensures that displays are perfect; and that gains attained through bulk purchases can be showcased. Choking cameras also affect Type sales and help brands have a large amount of income on the packaging of products.

Display Packaging Market Trend Analysis

Display Packaging Market Growth Drivers- Rapid expansion in mass retails and club stores

- The market’s growth has also witnessed growth in mass retail and club stores and large scale openings of smaller formats which is expected to be the most influencing factor in driving the market towards the global scenario by the end of the forecast period at 2035. The matters of the retail stores that sell display packaging materials indicate that such stores stock a fewer number of products than the conventional retail stores. Also these stores can benefit from the RRPs and their aptitude to hasten the process of stock-shelves and thereby aid in enhancing the aspects of efficient shelf space. The retail-ready packaging market also plays a crucial role of reducing the amount of packaging waste and assists in reducing the operating cost by reducing the employment of labor. This fact show that there is a higher preference to RRPs because this approach aid in enhancing a proper ordering pattern to consumers and also creates an impulse buying event.

Display Packaging Market Opportunities- Growing interest in environmental issues

- In accordance with the customer’s growing concern about the environment, and the time when a company is on its way to be a market leader, it comes down to eco-friendly packaging. This has put the consumers as well as manufacturers more into consideration of the green ways of living, which is a perfect opportunity for the display packaging to look for the market to compete in. Furthermore, growth in e-commerce sector demands packaging that is sustainable and low in cost for_packaging which will create growth prospects for the display packaging market also.

Display Packaging Market Segment Analysis:

Display Packaging Market Segmented based on Type, and End-User.

By Type, Floor Display segment is expected to dominate the market during the forecast period

- In the display packaging market, the packaging type that can be expected to hold the largest share during the forecast period is the Floor Display. Consequently, floor displays have been deemed to have wide prospects with important benefits in the way of getting consumer attention common in most places of sale. This is because clothes bulky nature afford it much space and flexibility in designing the clothing making it easy to place brand logos and seasonal promotions. Such types of signs are very popular in the zones of high customer traffic as near to the checkouts or entrances or along terminal aisles. Due to its flexibility and capability to accommodate a wide quantity of product, floor displays are frequently used in promotional campaigns such as seasonal and new product offers, and for bulk stock products resulting to its continued consumer preference and domination in the market.

By End-User, Food & Beverage segment held the largest share in 2024

- The Display Packaging Market by end user experienced a higher growth rate in 2024 for the Food & Beverage segment. This is so because packaging industry especially in the food and beverages industries which require attractive and quality packaging since it is the first thing that consumers will notice before being enticed to purchase the products. Well-designed display packaging also contributes to the visibility of brands located in various shelves and increases the sales of the products. The demand for such sustainable packaging is continuously driven by technical improvements required to meet various innovative packaging demands for new products, seasonal products, and shifting consumer trends. Furthermore, since the food and beverage segment is highly concerned with the temporal quality of the products, goals of display packaging are perfectly in tune with the segment’s priorities, thus making this segment the leader in terms of display packaging consumption.

Display Packaging Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific led the Display Packaging Market and it will continue to do so in the coming years as well due to the following reasons. Higher economic growth, the constantly developing retail environment, and the growth of consumer purchasing power also lead to the need for more aesthetically pleasing and in many cases, functional packaging solutions. Some of them are China, India and Japan which have recorded a steep rise in the uptake of modern packaging techniques and superior packing materials due to factors like increased use of electronic commerce and other progressive forms of retailing. Furthermore, the rising popularity of SKUs; and branding in these competitive markets also increase the need for well designed and unique display packaging. The availability of numerous manufacturing units and low cost raw material also contributed to the regions strength and helps APAC stay as a key deciding force for the display packaging markets future trends and developments.

Active Key Players in the Display Packaging Market

- Sonoco Products Company,

- Packaging Corporation of America,

- Proactive Packaging & Display, Inc.,

- C&B Display Packaging Inc.,

- Empire Packaging & Displays,

- Rio Grande,

- Deufol SE,

- Production Packaging Innovations

- MBC Products and Services,

- Other Active Players

Key Industry Developments in the Display Packaging Market

- In November 2024, Coregistics, a leading contract packaging company and a portfolio company of Red Arts Capital, announced the acquisition of Belvika Trade & Packaging (Belvika), a premier contract packaging provider to the food and beverage industry. The acquisition made Coregistics the largest pure-play contract packaging company in North America in terms of scale and revenue. Red Arts Capital acquired Coregistics in June 2022, and together, they generated approximately $350 million in revenue, with a North American footprint covering over 3 million square feet.

- In October 2024, Silgan Holdings Inc. announced that it had completed the acquisition of Weener Plastics Holdings B.V. on October 15, 2024. Weener, a prominent producer of dispensing solutions for personal care, food, and healthcare products, operated 19 global facilities, mainly in Europe and the Americas, and employed around 4,000 people. Silgan financed the acquisition through borrowings under its senior secured credit facility, including a €700 million incremental term loan. The acquisition was expected to generate €20 million in operational cost synergies within 18 months.

|

Global Display Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.15 Bn. |

|

Forecast Period 2024-35 CAGR: |

4.8 % |

Market Size in 2035: |

USD 23.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Display Packaging Market by Type (2018-2035)

4.1 Display Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Floor display

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Counter display

4.5 Shelf display

4.6 Brochure display

4.7 Transparent Containers

4.8 Display boxes

4.9 Blisters

4.10 Others

Chapter 5: Display Packaging Market by End-User (2018-2035)

5.1 Display Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food & beverage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Personal care products

5.5 Home care products

5.6 Pharmaceutical

5.7 Publishing

5.8 Electronics

5.9 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Display Packaging Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SONOCO PRODUCTS COMPANY PACKAGING CORPORATION OF AMERICA PROACTIVE PACKAGING & DISPLAY INC. C&B DISPLAY PACKAGING INC. EMPIRE PACKAGING & DISPLAYS RIO GRANDE DEUFOL SE PRODUCTION PACKAGING INNOVATIONS

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 MBC PRODUCTS AND SERVICES OTHER KEY PLAYERS

Chapter 7: Global Display Packaging Market By Region

7.1 Overview

7.2. North America Display Packaging Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Floor display

7.2.4.2 Counter display

7.2.4.3 Shelf display

7.2.4.4 Brochure display

7.2.4.5 Transparent Containers

7.2.4.6 Display boxes

7.2.4.7 Blisters

7.2.4.8 Others

7.2.5 Historic and Forecasted Market Size by End-User

7.2.5.1 Food & beverage

7.2.5.2 Personal care products

7.2.5.3 Home care products

7.2.5.4 Pharmaceutical

7.2.5.5 Publishing

7.2.5.6 Electronics

7.2.5.7 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Display Packaging Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Floor display

7.3.4.2 Counter display

7.3.4.3 Shelf display

7.3.4.4 Brochure display

7.3.4.5 Transparent Containers

7.3.4.6 Display boxes

7.3.4.7 Blisters

7.3.4.8 Others

7.3.5 Historic and Forecasted Market Size by End-User

7.3.5.1 Food & beverage

7.3.5.2 Personal care products

7.3.5.3 Home care products

7.3.5.4 Pharmaceutical

7.3.5.5 Publishing

7.3.5.6 Electronics

7.3.5.7 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Display Packaging Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Floor display

7.4.4.2 Counter display

7.4.4.3 Shelf display

7.4.4.4 Brochure display

7.4.4.5 Transparent Containers

7.4.4.6 Display boxes

7.4.4.7 Blisters

7.4.4.8 Others

7.4.5 Historic and Forecasted Market Size by End-User

7.4.5.1 Food & beverage

7.4.5.2 Personal care products

7.4.5.3 Home care products

7.4.5.4 Pharmaceutical

7.4.5.5 Publishing

7.4.5.6 Electronics

7.4.5.7 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Display Packaging Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Floor display

7.5.4.2 Counter display

7.5.4.3 Shelf display

7.5.4.4 Brochure display

7.5.4.5 Transparent Containers

7.5.4.6 Display boxes

7.5.4.7 Blisters

7.5.4.8 Others

7.5.5 Historic and Forecasted Market Size by End-User

7.5.5.1 Food & beverage

7.5.5.2 Personal care products

7.5.5.3 Home care products

7.5.5.4 Pharmaceutical

7.5.5.5 Publishing

7.5.5.6 Electronics

7.5.5.7 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Display Packaging Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Floor display

7.6.4.2 Counter display

7.6.4.3 Shelf display

7.6.4.4 Brochure display

7.6.4.5 Transparent Containers

7.6.4.6 Display boxes

7.6.4.7 Blisters

7.6.4.8 Others

7.6.5 Historic and Forecasted Market Size by End-User

7.6.5.1 Food & beverage

7.6.5.2 Personal care products

7.6.5.3 Home care products

7.6.5.4 Pharmaceutical

7.6.5.5 Publishing

7.6.5.6 Electronics

7.6.5.7 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Display Packaging Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Floor display

7.7.4.2 Counter display

7.7.4.3 Shelf display

7.7.4.4 Brochure display

7.7.4.5 Transparent Containers

7.7.4.6 Display boxes

7.7.4.7 Blisters

7.7.4.8 Others

7.7.5 Historic and Forecasted Market Size by End-User

7.7.5.1 Food & beverage

7.7.5.2 Personal care products

7.7.5.3 Home care products

7.7.5.4 Pharmaceutical

7.7.5.5 Publishing

7.7.5.6 Electronics

7.7.5.7 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Display Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.15 Bn. |

|

Forecast Period 2024-35 CAGR: |

4.8 % |

Market Size in 2035: |

USD 23.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||