Digital Currency Market Synopsis

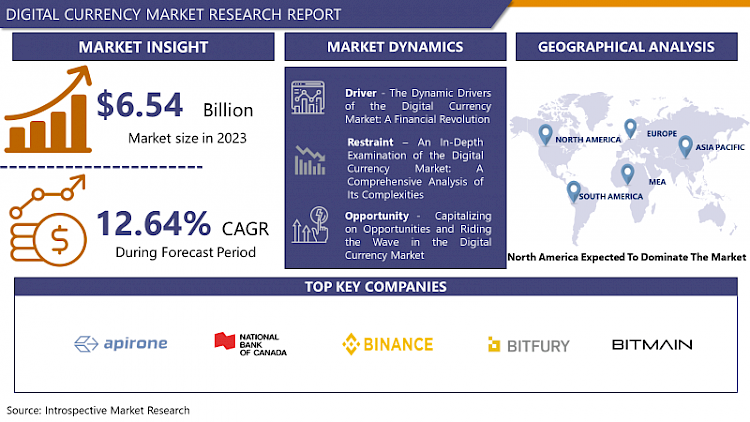

Digital Currency Market Size is Valued at USD 6.54 Billion in 2023, and is Projected to Reach USD 16.95 Billion by 2032, Growing at a CAGR of 12.64% From 2024-2032.

The ecosystem of cryptocurrencies and digital assets, which includes Bitcoin, Ethereum, and thousands of other tokens, is referred to as the digital currency market. It comprises the purchase, sale, and exchange of these digital currencies across a multitude of online marketplaces and exchanges. The decentralized structure of the market facilitates peer-to-peer transactions in lieu of conventional financial intermediaries. Furthermore, it is renowned for its substantial volatility, regulatory complexities, and technological advancements, the majority of digital currencies being supported by blockchain technology.

- The market for digital currency can be attributed to several reasons as major driving forces that have aid in the expansion of this market. Mr. Kabakov identifies one of the main drivers as the constantly growing popularity and legitimization of cryptocurrencies as payment and investment tools. More trading platforms, mid-scale merchants and large corporations enter the list of organizations willing to recognize and adopt digital currencies as their means of payment, and this is the proved evidence in favor of those assets.

- Lastly, the structures of many cryptocurrencies are independent, which avoids conducing to the usage of banks, and this has attracted people with more control of their funds and operations. The other crucial factor is the rising interest in distributed ledger technology the primary foundation of most digital currencies. Blockchain’s capability of focusing on reliable, open, and inconvenient ways of making transactions has gained the attention of various sectors other than the financial market such as supply chain, healthcare and voting systems.

- This has even led to the growth of this new broader blockchain technology for various applications which in most of them demand for cryptocurrencies since they are used to unlock and engage in such applications. In summary, digital currency market occupies a key position in the overall market prospects due to various factors that include greater acceptance, advanced technologies, and calls for better monetary structures.

Digital Currency Market Trend Analysis

Decentralized Finance and NFTs, Transforming the Digital Currency Landscape.

- Here are some of the most significant trends that are currently unfolding in the sphere of digital currency. Another notable trend is that more and more institutional investors and companies, without necessarily understanding the full implications of the technology, are investing in and accepting cryptocurrency payments. Many banking and financial organizations, brokers, and dealers – rather, large-scale and traditional lending and investing companies – offer crypto ones like trading, storage, and products to buy, demonstrating the institutionalization of the market.

- Also, there is increasingly more public demand for firms to accept cryptocurrencies for paying for goods and services as well as a growing number of firms that hold cryptocurrency as part of their portfolio, signifying the increasing acceptance of cryptocurrencies as a valid investment instrument. Another trend would be in decentralized finance and non-fungible tokens or NFTs.

- DeFi solutions, which can be described as a sort of globalization of various financial services without the participation of middlemen, have also been evolving rapidly, with billions of dollars in value being locked into the respective platforms and programs.

- Non-fungible tokens, which are tokens designed to enable the ownership of tangible and intangible items like art pieces, collectibles, and virtual land, has recently become a trending topic and has opened up new niches and possibilities for artists as well as buyers. Such trends signified that the market for digital currency is diversifying and finding its growing up; and thus, the digital currency is diversifying from being only as a speculative market.

Unlocking Opportunities in the Digital Currency Market

- The market of digital currency has several opportunities that can be ventured in by investors, businesses and even governments. The first potential benefit comes from financial inclusion, which can certainly be considered as a financial product. H, finally, there are social benefits of cryptocurrencies in that they can open up the financial systems to the currently financially excluded and marginalized people, especially in the developing world. This can result in greater economic enfranchisement and improvement as people can engage in the worldwide market.

- The other one is in financial services and technology which in today’s generation has been introduced widely. Most of cryptocurrencies use a technology called blockchain technology to provide safe and more effective records of any transaction. This innovation holds the potential of transforming not only the financial service industry but also numerous other sectors ranging from supply chain, health care, and even election voting technology. It is seen that when more business and government entities started assessing these technologies, there exists enough scope for additional possibilities and new generation business models in the digital currency marketplace.

Digital Currency Market Segment Analysis:

Digital Currency Market is segmented on the basis of type, Technology and application.

By Type, Bitcoin segment is expected to dominate the market during the forecast period

- Based on the above classification, the digital currency market can be broadly divided into the following types of cryptocurrencies. Founded in 2009, Bitcoin is one of the first cryptocurrencies and the most influential and popular in the market. It uses distributed consensus mechanism and it wants to create a decentralized transfer of value that is secure and anonymous in nature. Another popular crypto that appeared shortly after Bitcoin is Ethereum it also started the idea of smart contracts through which application developers can build decentralized applications (dApps) on the Ethereum blockchain.

- Definitions of Altcoins, which can be simply regarded as a coin that is not Bitcoin, are numerous and vary depending on their specific characteristics. Stablecoins, in contrast, are digital assets that are launched with the intent of underpinning their valuation and avoiding extreme volatility by referencing an underlying asset, for instance, a fiat currency or a commodity. Last but not least, Central Bank Digital Currencies are cryptocurrencies that are issued by the central banks with the function to be an electronic means of payment that substitutes cash, which possibly will increase effectiveness and decrease costs in the financial sector.

By Application, Personal segment held the largest share in 2023

- Examples of digital currencies are employed in various sectors such as enterprise, government, and even personal utilities. At the corporate level, organizations are seeking to utilize cryptocurrencies for various purposes including as payment, in supply chains, and in decentralized finance markets (DeFi). Authorities are also researching on the potential of digital currencies, some of which are in the process of consulting on the creation of new Central Bank Digital Currencies (CBDCs) to transform existing monetary systems and increase financial access.

- Also, digital currencies are in widespread use for personnel purposes, such as retail buying, transferring money, including remittances, and as an investment tool. The different applications of the digital currencies demonstrated in this paper are evidence to the fact that the versatile technology has the capability to change the traditional financial systems and empower the individuals and organizations across the globe.

Digital Currency Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- One of the major regions that is credited with a rise in the digital currency market is the North America with US and Canada leading on the usage of such products. The following are some of the factors that make this region to be shaped greatly in this market. First of all, there is a properly developed system of financial industry in the United States, and the technological penetration into people’s lives and business is quite high, therefore, the conditions for the development of digital currencies are favourable.

- The adoption of digital assets by financial regulators, for example, the stand that was taken by the Securities and Exchange Commission (SEC), where it has explained which category of digital assets is permissible for trading, has assisted in bringing in more institutions in the market.

- Secondly, Canada has also been among the leading nations privy to availing this policy, with both the Canadian government and other related authoritative bodies relatively lenient on the cryptocurrency provisions. Sanctioning has stimulated the development of digital currency companies and entrepreneurship in the country.

- In addition, North America has relevant players that could impact or be affected by digital currency such as dominant exchanges, payment service providers and blockchain technology solutions. Major players in the cryptocurrency trading market such as Coinbase, Kraken, and BitPay have kept themselves invested in this region, thereby fostering market expansion.

- Also, high consumer purchasing power and growing population, coupled with the high acceptance of using banking technologies, makes the region to embrace new financial technology such as digital currencies. They are supported by the increasing concern from institutional investors aiming to invest in digital assets through its diversified investment portfolios.

Active Key Players in the Digital Currency Market

- Apirone Ou (Estonia)

- Bank of Canada (Canada)

- Binance (Malta)

- Bitfury Group Limited (Netherlands)

- BITMAIN Group (China)

- BitPay Inc. (United States)

- Blockonomics (India)

- Boxcoin (United States)

- Circle Internet Financial Limited (United States)

- Coinbase (United States)

- Coinbase Global (United States)

- CoinGate (Lithuania)

- Coinify ApS (Denmark)

- Coinremitter Pte Ltd. (Singapore)

- CoinZoom (United States)

- Cryptomus (United States)

- Cryptopay Ltd. (United Kingdom)

- European Central Bank (Eurozone)

- iFinex Inc. (British Virgin Islands)

- NOWPayments (Estonia)

- Nvidia Corporation (United States)

- Paymium SAS (France)

- People's Bank of China (China)

- Polkadot (Switzerland)

- ProBit Global Services Limited (South Korea)

- Reserve Bank of India (India)

- Riksbank (Sweden)

- Ripple (United States)

- Upbit Singapore Pte. Ltd. (Singapore)

- Wirex Digital D.o.o (Croatia)

- Xapo Bank Limited Inc. Inc. (United States)

- Others

Key Industry Developments in the Digital Currency Market:

- In May 2024, RBI Governor Shaktikanta Das announced plans to offer the digital currency offline to address concerns about internet dependency, following an event by Bank for International Settlements. India leads in experimenting with central bank-supported digital currency, unlike cautious developed nations. The country's pilot program has seen significant use by customers and merchants, reaching 1 million daily transactions.

- In March 2024, Brazil's central bank, Banco Central do Brasil, plans to launch its central bank digital currency, the Drex, by early 2025. The digital currency aims to reduce operational costs, increase financial inclusion, and enhance the security of wholesale and retail transactions. The Drex will be regulated and its value guaranteed by the central bank, making it suitable for large transactions.

|

Global Digital Currency Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.54 Bn. |

|

Forecast Period 2023-32 CAGR: |

12.64 % |

Market Size in 2032: |

USD 16.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DIGITAL CURRENCY MARKET BY TYPE (2017-2032)

- DIGITAL CURRENCY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BITCOIN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ETHEREUM

- ALTCOINS

- STABLECOINS

- CENTRAL BANK DIGITAL CURRENCIES

- DIGITAL CURRENCY MARKET BY TECHNOLOGY (2017-2032)

- DIGITAL CURRENCY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BLOCKCHAIN BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON BLOCKCHAIN-BASED

- DIGITAL CURRENCY MARKET BY APPLICATION (2017-2032)

- DIGITAL CURRENCY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENTERPRISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT

- PERSONAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Digital Currency Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- APIRONE OU (ESTONIA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BANK OF CANADA (CANADA)

- BINANCE (MALTA)

- BITFURY GROUP LIMITED (NETHERLANDS)

- BITMAIN GROUP (CHINA)

- BITPAY INC. (UNITED STATES)

- BLOCKONOMICS (INDIA)

- BOXCOIN (UNITED STATES)

- CIRCLE INTERNET FINANCIAL LIMITED (UNITED STATES)

- COINBASE (UNITED STATES)

- COINBASE GLOBAL (UNITED STATES)

- COINGATE (LITHUANIA)

- COINIFY APS (DENMARK)

- COINREMITTER PTE LTD. (SINGAPORE)

- COINZOOM (UNITED STATES)

- CRYPTOMUS (UNITED STATES)

- CRYPTOPAY LTD. (UNITED KINGDOM)

- EUROPEAN CENTRAL BANK (EUROZONE)

- IFINEX INC. (BRITISH VIRGIN ISLANDS)

- NOWPAYMENTS (ESTONIA)

- NVIDIA CORPORATION (UNITED STATES)

- PAYMIUM SAS (FRANCE)

- PEOPLE'S BANK OF CHINA (CHINA)

- POLKADOT (SWITZERLAND)

- PROBIT GLOBAL SERVICES LIMITED (SOUTH KOREA)

- RESERVE BANK OF INDIA (INDIA)

- RIKSBANK (SWEDEN)

- RIPPLE (UNITED STATES)

- UPBIT SINGAPORE PTE. LTD. (SINGAPORE)

- WIREX DIGITAL D.O.O (CROATIA)

- XAPO BANK LIMITED INC. INC. (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL DIGITAL CURRENCY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Digital Currency Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.54 Bn. |

|

Forecast Period 2023-32 CAGR: |

12.64 % |

Market Size in 2032: |

USD 16.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DIGITAL CURRENCY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DIGITAL CURRENCY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DIGITAL CURRENCY MARKET COMPETITIVE RIVALRY

TABLE 005. DIGITAL CURRENCY MARKET THREAT OF NEW ENTRANTS

TABLE 006. DIGITAL CURRENCY MARKET THREAT OF SUBSTITUTES

TABLE 007. DIGITAL CURRENCY MARKET BY TYPE

TABLE 008. IT SOLUTION MARKET OVERVIEW (2016-2028)

TABLE 009. FINTECH MARKET OVERVIEW (2016-2028)

TABLE 010. BANK MARKET OVERVIEW (2016-2028)

TABLE 011. CONSULTING MARKET OVERVIEW (2016-2028)

TABLE 012. EXCHANGE MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. DIGITAL CURRENCY MARKET BY APPLICATION

TABLE 015. BFSI MARKET OVERVIEW (2016-2028)

TABLE 016. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 017. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 018. IT & TELECOM MARKET OVERVIEW (2016-2028)

TABLE 019. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA DIGITAL CURRENCY MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA DIGITAL CURRENCY MARKET, BY APPLICATION (2016-2028)

TABLE 023. N DIGITAL CURRENCY MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE DIGITAL CURRENCY MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE DIGITAL CURRENCY MARKET, BY APPLICATION (2016-2028)

TABLE 026. DIGITAL CURRENCY MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC DIGITAL CURRENCY MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC DIGITAL CURRENCY MARKET, BY APPLICATION (2016-2028)

TABLE 029. DIGITAL CURRENCY MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA DIGITAL CURRENCY MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA DIGITAL CURRENCY MARKET, BY APPLICATION (2016-2028)

TABLE 032. DIGITAL CURRENCY MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA DIGITAL CURRENCY MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA DIGITAL CURRENCY MARKET, BY APPLICATION (2016-2028)

TABLE 035. DIGITAL CURRENCY MARKET, BY COUNTRY (2016-2028)

TABLE 036. IBM: SNAPSHOT

TABLE 037. IBM: BUSINESS PERFORMANCE

TABLE 038. IBM: PRODUCT PORTFOLIO

TABLE 039. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. ORACLE: SNAPSHOT

TABLE 040. ORACLE: BUSINESS PERFORMANCE

TABLE 041. ORACLE: PRODUCT PORTFOLIO

TABLE 042. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ACCENTURE: SNAPSHOT

TABLE 043. ACCENTURE: BUSINESS PERFORMANCE

TABLE 044. ACCENTURE: PRODUCT PORTFOLIO

TABLE 045. ACCENTURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. RIPPLE: SNAPSHOT

TABLE 046. RIPPLE: BUSINESS PERFORMANCE

TABLE 047. RIPPLE: PRODUCT PORTFOLIO

TABLE 048. RIPPLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. NASDAQ LINQ: SNAPSHOT

TABLE 049. NASDAQ LINQ: BUSINESS PERFORMANCE

TABLE 050. NASDAQ LINQ: PRODUCT PORTFOLIO

TABLE 051. NASDAQ LINQ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. RUBIX BY DELOITTE: SNAPSHOT

TABLE 052. RUBIX BY DELOITTE: BUSINESS PERFORMANCE

TABLE 053. RUBIX BY DELOITTE: PRODUCT PORTFOLIO

TABLE 054. RUBIX BY DELOITTE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. CITI BANK: SNAPSHOT

TABLE 055. CITI BANK: BUSINESS PERFORMANCE

TABLE 056. CITI BANK: PRODUCT PORTFOLIO

TABLE 057. CITI BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. OKLINK: SNAPSHOT

TABLE 058. OKLINK: BUSINESS PERFORMANCE

TABLE 059. OKLINK: PRODUCT PORTFOLIO

TABLE 060. OKLINK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. DISTRIBUTED LEDGER TECHNOLOGIES: SNAPSHOT

TABLE 061. DISTRIBUTED LEDGER TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 062. DISTRIBUTED LEDGER TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 063. DISTRIBUTED LEDGER TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. AWS: SNAPSHOT

TABLE 064. AWS: BUSINESS PERFORMANCE

TABLE 065. AWS: PRODUCT PORTFOLIO

TABLE 066. AWS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. QIHOO 360: SNAPSHOT

TABLE 067. QIHOO 360: BUSINESS PERFORMANCE

TABLE 068. QIHOO 360: PRODUCT PORTFOLIO

TABLE 069. QIHOO 360: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HUAWEI: SNAPSHOT

TABLE 070. HUAWEI: BUSINESS PERFORMANCE

TABLE 071. HUAWEI: PRODUCT PORTFOLIO

TABLE 072. HUAWEI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ELAYAWAY: SNAPSHOT

TABLE 073. ELAYAWAY: BUSINESS PERFORMANCE

TABLE 074. ELAYAWAY: PRODUCT PORTFOLIO

TABLE 075. ELAYAWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SAP: SNAPSHOT

TABLE 076. SAP: BUSINESS PERFORMANCE

TABLE 077. SAP: PRODUCT PORTFOLIO

TABLE 078. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. TECENT: SNAPSHOT

TABLE 079. TECENT: BUSINESS PERFORMANCE

TABLE 080. TECENT: PRODUCT PORTFOLIO

TABLE 081. TECENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. JD FINANCIAL: SNAPSHOT

TABLE 082. JD FINANCIAL: BUSINESS PERFORMANCE

TABLE 083. JD FINANCIAL: PRODUCT PORTFOLIO

TABLE 084. JD FINANCIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. HSBC: SNAPSHOT

TABLE 085. HSBC: BUSINESS PERFORMANCE

TABLE 086. HSBC: PRODUCT PORTFOLIO

TABLE 087. HSBC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. BITSPARK: SNAPSHOT

TABLE 088. BITSPARK: BUSINESS PERFORMANCE

TABLE 089. BITSPARK: PRODUCT PORTFOLIO

TABLE 090. BITSPARK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. BAIDU: SNAPSHOT

TABLE 091. BAIDU: BUSINESS PERFORMANCE

TABLE 092. BAIDU: PRODUCT PORTFOLIO

TABLE 093. BAIDU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. ANT FINANCIAL: SNAPSHOT

TABLE 094. ANT FINANCIAL: BUSINESS PERFORMANCE

TABLE 095. ANT FINANCIAL: PRODUCT PORTFOLIO

TABLE 096. ANT FINANCIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 097. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 098. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 099. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DIGITAL CURRENCY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DIGITAL CURRENCY MARKET OVERVIEW BY TYPE

FIGURE 012. IT SOLUTION MARKET OVERVIEW (2016-2028)

FIGURE 013. FINTECH MARKET OVERVIEW (2016-2028)

FIGURE 014. BANK MARKET OVERVIEW (2016-2028)

FIGURE 015. CONSULTING MARKET OVERVIEW (2016-2028)

FIGURE 016. EXCHANGE MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. DIGITAL CURRENCY MARKET OVERVIEW BY APPLICATION

FIGURE 019. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 020. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 021. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 022. IT & TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 023. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA DIGITAL CURRENCY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE DIGITAL CURRENCY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC DIGITAL CURRENCY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA DIGITAL CURRENCY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA DIGITAL CURRENCY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Digital Currency Market research report is 2024-2032.

Apirone Ou (Estonia), Bank of Canada (Canada), Binance (Malta), Bitfury Group Limited (Netherlands), BITMAIN Group (China), BitPay Inc. (United States), Blockonomics (India), Boxcoin (United States), Circle Internet Financial Limited (United States), Coinbase (United States), Coinbase Global (United States), CoinGate (Lithuania), Coinify ApS (Denmark), Coinremitter Pte Ltd. (Singapore), CoinZoom (United States), Cryptomus (United States), Cryptopay Ltd. (United Kingdom), European Central Bank (Eurozone), iFinex Inc. (British Virgin Islands), NOWPayments (Estonia), Nvidia Corporation (United States), Paymium SAS (France), People's Bank of China (China), Polkadot (Switzerland), ProBit Global Services Limited (South Korea), Reserve Bank of India (India), Riksbank (Sweden), Ripple (United States), Upbit Singapore Pte. Ltd. (Singapore), Wirex Digital D.o.o (Croatia), Xapo Bank Limited Inc. Inc. (United States), Others and Other Major Players.

The Digital Currency Market is segmented into by Type (Bitcoin, Ethereum, Altcoins, Stablecoins, Central Bank Digital Currencies), By Technology (Blockchain-Based, Non-Blockchain-Based) By Application (Enterprise, Government, Personal). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The ecosystem of cryptocurrencies and digital assets, which includes Bitcoin, Ethereum, and thousands of other tokens, is referred to as the digital currency market. It comprises the purchase, sale, and exchange of these digital currencies across a multitude of online marketplaces and exchanges. The decentralized structure of the market facilitates peer-to-peer transactions in lieu of conventional financial intermediaries. Furthermore, it is renowned for its substantial volatility, regulatory complexities, and technological advancements, the majority of digital currencies being supported by blockchain technology.

Digital Currency Market Size is Valued at USD 6.54 Billion in 2024, and is Projected to Reach USD 16.95 Billion by 2032, Growing at a CAGR of 12.64% From 2024-2032.