Digital Business Card Market Synopsis

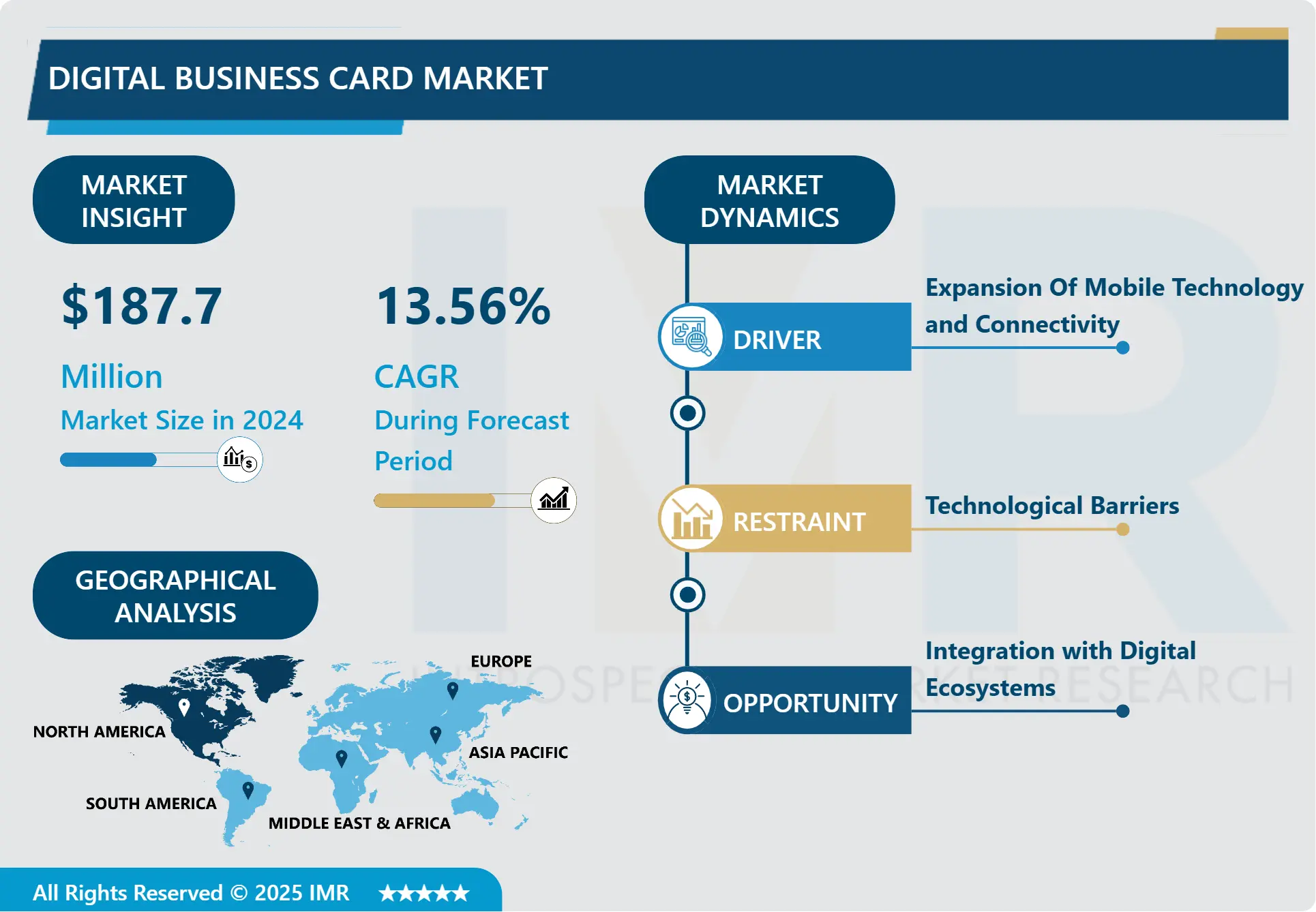

Digital Business Card Market Size Was Valued at USD 187.7 Million in 2024, and is Projected to Reach USD 519.13 Million by 2032, Growing at a CAGR of 13.56% From 2025-2032.

An online business card, called as a digital business card, is an inexpensive method to share contact details over the internet. It can be accessed on different devices like an iPad, iPhone, Android, or computer, allowing anyone to use it. Digital cards can contain a wide range of information like images, videos, logos, and social media links without being limited by size, unlike traditional business cards.

Growing demand for digital business cards is attributed to the rise in social media platforms and government push for digitization. Digital business cards provide flexibility by enabling users to effortlessly update details and maintain contact with their connections. They also address issues linked with conventional business cards and lower expenses. Key advantages consist of convenience, sustainability, cost-effectiveness, touchless operation, modifiability, and personalization. The emphasis on mobile experiences, with a focus on Apple IOS and Android Apps, is predicted to continue boosting market expansion.

Anticipated trends involve increased use by businesses, reduced expenses for labour, and high-quality printing. Nevertheless, a limitation of the market is the requirement of an internet connection for sharing or receiving digital business cards and their lesser memorability in comparison to physical cards. Users have the ability to customize and distribute their digital cards in different languages on different platforms including text, QR codes, and social media platforms like Facebook, Twitter, WhatsApp, and LinkedIn.

Digital business cards provide flexibility and adaptability for efficiently sharing contact information in the digital era. Prioritizing Apple IOS and Android Apps to enhance mobile experiences is poised to stimulate market growth even more. Anticipated trends involve increased usage by businesses, affordable workforce expenses, and high-quality printing. Nevertheless, a limitation of the market is the requirement for an internet connection in order to exchange or receive digital business cards and their decreased memorability in comparison to physical cards.

Digital Business Card Market Trend Analysis

Digital Business Card Market Growth Driver- Expansion Of Mobile Technology and Connectivity

- The emergence of digital business cards has been enabled by the utilization of mobile technology and smartphones. This development has changed the manner in which we share contact details. Due to the global adoption of smartphones, many users can now conveniently access digital business card solutions. Smartphones are the most practical gadgets for keeping and exchanging digital business cards, thanks to their portability and user-friendly features. Mobile technology allows for instant retrieval of digital business cards from any place at any moment.

- Digital cards can be stored on mobile devices for convenient sharing, enabling fast interactions through email, messaging applications, or physically tapping phones together. This removes restrictions of physical cards and improves networking chances through quick and easy interactions. QR codes are becoming more and more widely used for sharing information on the internet. QR codes are used for easy sharing on digital business card platforms. Individuals have the ability to create QR codes from their electronic business cards, enabling others to conveniently store contact details by scanning the codes with their mobile devices, removing the necessity for inputting data manually.

- Mobile technology now provides multiple ways to share digital business cards on different platforms and channels. Users have the ability to distribute cards through various channels, such as email, messaging platforms, social media, and specialized networking apps, which improve networking possibilities for professionals. Cloud storage services can seamlessly connect with mobile technology, enabling users to safely store and retrieve business cards across multiple devices. Digital business card platforms provide cloud storage choices, allowing users to conveniently access their digital cards on various devices such as smartphones, tablets, and desktops, thus contributing to the growth of the Digital Business Card Market.

Digital Business Card Market Opportunity- Integration with Digital Ecosystems

- Digital business cards have the ability to automatically update CRM systems, leading to a decrease in manual data entry mistakes. Blending them with CRM systems enhances customer understanding by offering a complete perspective of contacts, interaction history, and engagement data. Digital ecosystem integration enhances the digital business card market by enhancing functionality, user experience, and networking/business process value. Utilizing CRM data enables automated follow-up reminders and personalized communication to increase interaction with new contacts received via digital business cards.

- Digital business cards effortlessly integrate with email marketing tools, streamlining the task of managing contacts and designing customized campaigns for enhanced communication. Users are able to connect their digital business cards to social media profiles, allowing recipients to easily connect on various platforms with a single click. This also includes incorporating social media analytics to provide information on trust and credibility. Connecting with applications such as Slack, Microsoft Teams, or Zoom allows for immediate messaging and video conferencing, simplifying communication. Unified communication centralizes contact details for uniformity and ease of use.

- Digital business cards have the capability to connect with calendars and scheduling tools in order to arrange meetings, and they also have the ability to integrate with task management tools to create reminders and tasks for new contacts to ensure prompt follow-ups. Integration with data analytics tools provides in-depth reports on engagement with digital business cards, aiding in the optimization of networking strategies. Monitoring the generation of leads and conversion rates offers important information for assessing the return on investment. Incorporate cloud storage platforms such as Google Drive, Dropbox, or OneDrive into digital business cards to streamline sharing resources and improve professional engagements by consolidating essential files for convenient accessibility.

Digital Business Card Market Segment Analysis:

Digital Business Card Market is Segmented on the basis of User Type, Platform, Application, Features and Functionality, Solution Type, And Region.

By User Type, Business User Segment Is Expected to Dominate the Market During the Forecast Period

- Business professionals frequently participate in networking events and can take advantage of utilizing digital business cards for efficient sharing of contact information. Updating these cards with new information is simple and avoids the necessity of reprinting physical cards. Producing physical business cards for each staff member can be expensive for big companies. Digital business cards help to cut costs and minimize environmental impact by eliminating paper waste. Digital solutions enable effortless expansion and dissemination to all staff members at no extra cost.

- Advanced features such as multimedia, interactive elements, and social media links are offered by digital business cards. Users are able to access analytics to monitor how they are using the service and interacting with it, which helps improve networking strategies for professionals and their businesses. Digital business cards enhance data security by providing more control over personal data and adhering to regulations such as GDPR. Users have the ability to either update or withdraw access to their information, thus maintaining privacy controls.

- Digital business cards have the ability to display a company's branding for a uniform professional appearance among its employees, as well as giving individuals the option to customize their details and highlight their skills and accomplishments for a lasting impression. Global business environment utilizes digital business cards for international networking without physical cards. Easily adaptable to various languages and cultures, enhancing global business interactions. Digital business cards seamlessly integrate with mobile and cloud solutions, offering a modern way to manage professional contacts. They can also incorporate cutting-edge technologies like AR for unique presentations.

By Platform, Android Segment Held the Largest Share In 2024

- Android is used on a variety of devices, including expensive smartphones and more affordable options, making digital business cards more accessible. Affordable Android devices are attractive to a wide range of people worldwide, leading to the popularity of digital business cards among small businesses and individuals who opt out of more expensive choices. The open-source aspect of Android inspires developers to be creative, leading to the development of a variety of digital business card applications that are customized for unique user requirements.

- The flexibility of Android enables extensive customization and easy integration with other business apps, improving user experience and productivity. Android's ability to work on many different kinds of devices allows digital business card apps to be used by people in different industries, supporting diversity. Consistent OS updates and assistance for app developers are provided to maintain the security and dependability of Android apps. The affordable prices of Android devices are increasing the number of users for digital business card apps, leading to wider adoption.

- Android enables developers to design personalized digital business card apps that cater to the needs of users. Users have a wide range of customization options that allow for easy integration with various tools and applications on Android devices. Developers design personalized Android apps for digital business cards, providing users with a wide range of customization features to easily connect with different tools and applications. Android is commonly utilized in developing countries where smartphone usage is increasing, providing chances for the widespread acceptance of digital business cards. The varied language options provided by its multilingual support allow for a range of languages to be used in business card exchanges.

Digital Business Card Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The digital business card market was typically controlled by the United States, with Canada showing the quickest expansion. These cards can easily be shared across borders, making them perfect for international professionals and businesses. Digital cards are easily accessible on mobile devices due to the widespread use of smartphones in the region. Customization choices enable distinct branding opportunities. Developed business environment, the transition to digital processes, the encouragement of electronic transactions, the use of digital identity solutions, and the involvement of technology businesses makes the growth in this market.

- North Americans' increasing awareness of the environment is pouring the popularity of digital cards as a eco-friendly option to paper cards. Prominent companies such as Adobe, HiHello Inc., and Mobilo also aid in the growth of the market in North America. The market in North America is diverse, encompassing businesses in technology, finance, healthcare, and entertainment. Providers of digital business cards have the capability to focus on a range of industries and customer segments, thereby helping to maintain the region's market leadership.

- North America has excellent digital infrastructure, which is helping businesses and professionals across various industries to adopt digital business card solutions. This region offers the perfect environment for digital business card companies to succeed due to funding opportunities, supportive regulations, and a robust entrepreneurial culture that encourages innovation and investment in the industry. North America's culture, which is highly familiar with technology, contributes to the quick adoption of digital business cards, surpassing other regions worldwide in accepting new technological innovations.

- From this graph, data reflects a significant increase in business internet data traffic from 2020 to 2023. This growth is consistent with the broader trend of digitalization in business, including the rise of digital business cards. The increasing data volume underscores the importance of internet connectivity in modern business operations and the move towards more digital solutions.

Digital Business Card Market Active Players

- LinkedIn (United States)

- Adobe Inc. (United States)

- CamCard (China)

- Sansan (Japan)

- Evernote Corporation (United States)

- Zoho Corporation (India)

- Azeus Systems Ltd. (United Kingdom)

- Salesforce (United States)

- Wantedly, Inc. (Japan)

- Haystack (United States)

- Inigo (United Kingdom)

- Cardhop (United States)

- Cardify (United States)

- Covve Visual Network Limited (United Kingdom)

- HiHello (United States)

- InstaDigit LLC (United States)

- L-Card Pro (United States)

- Microsoft Corporation (United States)

- MobiCard Inc. (United States)

- Other Active Player

|

Global Digital Business Card Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 187.7 Mn |

|

Forecast Period 2025-32 CAGR: |

13.56 % |

Market Size in 2032: |

USD 519.13 Mn |

|

Segments Covered: |

By User Type |

|

|

|

By Platform |

|

||

|

By Application |

|

||

|

By Features and Functionality |

|

||

|

By Solution Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

LinkedIn (United States), Adobe Inc. (United States), CamCard (China), Sansan (Japan), Evernote Corporation (United States), Zoho Corporation (India), and Other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digital Business Card Market by User Type (2018-2032)

4.1 Digital Business Card Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Individual User

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Business User

4.5 Enterprise User

Chapter 5: Digital Business Card Market by Platform (2018-2032)

5.1 Digital Business Card Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Android

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 IOS

5.5 Web

Chapter 6: Digital Business Card Market by Application (2018-2032)

6.1 Digital Business Card Market Snapshot and Growth Engine

6.2 Market Overview

6.3 IT and Telecommunication

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Marketing Agencies

6.5 BFSI

6.6 Sales Entrepreneurs

6.7 Events and Travels

6.8 Others {Education and Training

6.9 Finance and Real-Estate

6.10 Health and Beauty

6.11 Consultant}

Chapter 7: Digital Business Card Market by Features and Functionality (2018-2032)

7.1 Digital Business Card Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Basic

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Advanced

Chapter 8: Digital Business Card Market by Solution Type (2018-2032)

8.1 Digital Business Card Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Mobile Apps

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 SaaS

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Digital Business Card Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 LINKEDIN (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ADOBE INC. (UNITED STATES)

9.4 CAMCARD (CHINA)

9.5 SANSAN (JAPAN)

9.6 EVERNOTE CORPORATION (UNITED STATES)

9.7 ZOHO CORPORATION (INDIA)

9.8 AZEUS SYSTEMS LTD. (UNITED KINGDOM)

9.9 SALESFORCE (UNITED STATES)

9.10 WANTEDLY INC. (JAPAN)

9.11 HAYSTACK (UNITED STATES)

9.12 INIGO (UNITED KINGDOM)

9.13 CARDHOP (UNITED STATES)

9.14 CARDIFY (UNITED STATES)

9.15 COVVE VISUAL NETWORK LIMITED (UNITED KINGDOM)

9.16 HIHELLO (UNITED STATES)

9.17 INSTADIGIT LLC (UNITED STATES)

9.18 L-CARD PRO (UNITED STATES)

9.19 MICROSOFT CORPORATION (UNITED STATES)

9.20 MOBICARD INC. (UNITED STATES)

9.21 NFC DIRECT (UNITED STATES)

9.22 OPENCARDS (UNITED STATES)

9.23 OPENSESAME LTD. (UNITED KINGDOM)

9.24 SNAPDAT LLC (UNITED STATES)

9.25 SWIVELCARD (UNITED STATES)

9.26 SYNC.ME (ISRAEL)

9.27 VISTAPRINT (UNITED STATES)

Chapter 10: Global Digital Business Card Market By Region

10.1 Overview

10.2. North America Digital Business Card Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by User Type

10.2.4.1 Individual User

10.2.4.2 Business User

10.2.4.3 Enterprise User

10.2.5 Historic and Forecasted Market Size by Platform

10.2.5.1 Android

10.2.5.2 IOS

10.2.5.3 Web

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 IT and Telecommunication

10.2.6.2 Marketing Agencies

10.2.6.3 BFSI

10.2.6.4 Sales Entrepreneurs

10.2.6.5 Events and Travels

10.2.6.6 Others {Education and Training

10.2.6.7 Finance and Real-Estate

10.2.6.8 Health and Beauty

10.2.6.9 Consultant}

10.2.7 Historic and Forecasted Market Size by Features and Functionality

10.2.7.1 Basic

10.2.7.2 Advanced

10.2.8 Historic and Forecasted Market Size by Solution Type

10.2.8.1 Mobile Apps

10.2.8.2 SaaS

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Digital Business Card Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by User Type

10.3.4.1 Individual User

10.3.4.2 Business User

10.3.4.3 Enterprise User

10.3.5 Historic and Forecasted Market Size by Platform

10.3.5.1 Android

10.3.5.2 IOS

10.3.5.3 Web

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 IT and Telecommunication

10.3.6.2 Marketing Agencies

10.3.6.3 BFSI

10.3.6.4 Sales Entrepreneurs

10.3.6.5 Events and Travels

10.3.6.6 Others {Education and Training

10.3.6.7 Finance and Real-Estate

10.3.6.8 Health and Beauty

10.3.6.9 Consultant}

10.3.7 Historic and Forecasted Market Size by Features and Functionality

10.3.7.1 Basic

10.3.7.2 Advanced

10.3.8 Historic and Forecasted Market Size by Solution Type

10.3.8.1 Mobile Apps

10.3.8.2 SaaS

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Digital Business Card Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by User Type

10.4.4.1 Individual User

10.4.4.2 Business User

10.4.4.3 Enterprise User

10.4.5 Historic and Forecasted Market Size by Platform

10.4.5.1 Android

10.4.5.2 IOS

10.4.5.3 Web

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 IT and Telecommunication

10.4.6.2 Marketing Agencies

10.4.6.3 BFSI

10.4.6.4 Sales Entrepreneurs

10.4.6.5 Events and Travels

10.4.6.6 Others {Education and Training

10.4.6.7 Finance and Real-Estate

10.4.6.8 Health and Beauty

10.4.6.9 Consultant}

10.4.7 Historic and Forecasted Market Size by Features and Functionality

10.4.7.1 Basic

10.4.7.2 Advanced

10.4.8 Historic and Forecasted Market Size by Solution Type

10.4.8.1 Mobile Apps

10.4.8.2 SaaS

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Digital Business Card Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by User Type

10.5.4.1 Individual User

10.5.4.2 Business User

10.5.4.3 Enterprise User

10.5.5 Historic and Forecasted Market Size by Platform

10.5.5.1 Android

10.5.5.2 IOS

10.5.5.3 Web

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 IT and Telecommunication

10.5.6.2 Marketing Agencies

10.5.6.3 BFSI

10.5.6.4 Sales Entrepreneurs

10.5.6.5 Events and Travels

10.5.6.6 Others {Education and Training

10.5.6.7 Finance and Real-Estate

10.5.6.8 Health and Beauty

10.5.6.9 Consultant}

10.5.7 Historic and Forecasted Market Size by Features and Functionality

10.5.7.1 Basic

10.5.7.2 Advanced

10.5.8 Historic and Forecasted Market Size by Solution Type

10.5.8.1 Mobile Apps

10.5.8.2 SaaS

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Digital Business Card Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by User Type

10.6.4.1 Individual User

10.6.4.2 Business User

10.6.4.3 Enterprise User

10.6.5 Historic and Forecasted Market Size by Platform

10.6.5.1 Android

10.6.5.2 IOS

10.6.5.3 Web

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 IT and Telecommunication

10.6.6.2 Marketing Agencies

10.6.6.3 BFSI

10.6.6.4 Sales Entrepreneurs

10.6.6.5 Events and Travels

10.6.6.6 Others {Education and Training

10.6.6.7 Finance and Real-Estate

10.6.6.8 Health and Beauty

10.6.6.9 Consultant}

10.6.7 Historic and Forecasted Market Size by Features and Functionality

10.6.7.1 Basic

10.6.7.2 Advanced

10.6.8 Historic and Forecasted Market Size by Solution Type

10.6.8.1 Mobile Apps

10.6.8.2 SaaS

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Digital Business Card Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by User Type

10.7.4.1 Individual User

10.7.4.2 Business User

10.7.4.3 Enterprise User

10.7.5 Historic and Forecasted Market Size by Platform

10.7.5.1 Android

10.7.5.2 IOS

10.7.5.3 Web

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 IT and Telecommunication

10.7.6.2 Marketing Agencies

10.7.6.3 BFSI

10.7.6.4 Sales Entrepreneurs

10.7.6.5 Events and Travels

10.7.6.6 Others {Education and Training

10.7.6.7 Finance and Real-Estate

10.7.6.8 Health and Beauty

10.7.6.9 Consultant}

10.7.7 Historic and Forecasted Market Size by Features and Functionality

10.7.7.1 Basic

10.7.7.2 Advanced

10.7.8 Historic and Forecasted Market Size by Solution Type

10.7.8.1 Mobile Apps

10.7.8.2 SaaS

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Digital Business Card Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 187.7 Mn |

|

Forecast Period 2025-32 CAGR: |

13.56 % |

Market Size in 2032: |

USD 519.13 Mn |

|

Segments Covered: |

By User Type |

|

|

|

By Platform |

|

||

|

By Application |

|

||

|

By Features and Functionality |

|

||

|

By Solution Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

LinkedIn (United States), Adobe Inc. (United States), CamCard (China), Sansan (Japan), Evernote Corporation (United States), Zoho Corporation (India), and Other Active Players. |

||