Diet Fiber Market Synopsis

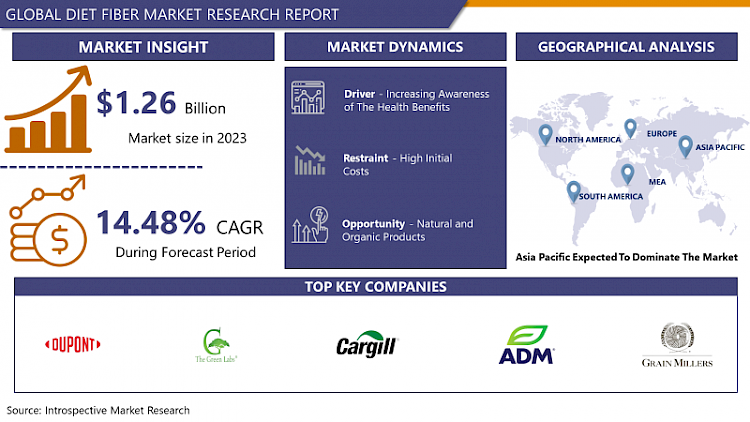

Diet Fiber Market Size Was Valued at USD 1.26 Billion in 2023 and is Projected to Reach USD 4.26 Billion by 2032, Growing at a CAGR of 14.48 % From 2024-2032.

Dietary fiber, also known as roughage or bulk, refers to the indigestible portion of plant foods that aids digestion and promotes overall health. It includes soluble fiber, which dissolves in water and helps regulate blood sugar and cholesterol levels, and insoluble fiber, which adds bulk to stools and facilitates bowel movements. A diet rich in fiber can prevent constipation, promote satiety, and reduce the risk of various chronic diseases like heart disease and diabetes.

There's a growing consumer interest in products that promote digestive health, aid in weight management, and contribute to overall well-being. This trend has spurred a diversification of dietary fiber sources, encompassing fruits, vegetables, grains, and legumes. Furthermore, there's an increasing preference for natural and organic fiber sources, reflecting a broader shift towards clean label and sustainable food choices.

- Ensuring an adequate intake of dietary fiber is associated with numerous health advantages. It supports digestive health by preventing constipation and encouraging regular bowel movements. Moreover, fiber aids in stabilizing blood sugar levels, particularly beneficial for individuals managing diabetes. Additionally, embracing a high-fiber diet is correlated with a decreased risk of heart disease due to its ability to reduce cholesterol levels.

- The market for functional foods and beverages fortified with fiber is expanding, with manufacturers incorporating innovative ingredients to enhance nutritional profiles. Advancements in fiber extraction technologies and formulations are improving the taste and texture of fiber-enriched products.

- Government initiatives aimed at promoting healthy diets and lifestyles further bolster the growing dietary fiber market. As awareness of the pivotal role of fiber in maintaining optimal health continues to grow, the market is primed for sustained expansion in the foreseeable future.

- Regarding global grain production in 2022/23, wheat production worldwide totaled approximately 783.8 million metric tons, while corn emerged as the most significant grain, with a production exceeding 1.15 billion metric tons.

Diet Fiber Market Trend Analysis

Increasing Awareness of The Health Benefits

- The diet fiber market is experiencing robust growth, primarily driven by an increasing awareness of the health benefits associated with fiber consumption. As consumers become more health-conscious, there is a growing recognition of the pivotal role that dietary fiber plays in promoting overall well-being.

- Fiber is known for its positive impact on digestive health, aiding in regular bowel movements and preventing constipation. Moreover, it helps in weight management by promoting a feeling of fullness, reducing overall calorie intake. The awareness of these benefits is prompting individuals to incorporate fiber-rich foods into their diets, leading to a surge in demand for fiber-based products.

- Additionally, scientific studies highlighting the association between high-fiber diets and a reduced risk of chronic diseases such as cardiovascular conditions, diabetes, and certain types of cancer have further fueled the market growth.

Natural and Organic Products creates an Opportunity Line for Diet Fiber Market

- The increasing consumer preference for natural and organic products has created significant opportunities for the diet fiber market. As health and wellness awareness grows, individuals are increasingly seeking dietary options that align with their desire for wholesome, minimally processed ingredients. Natural and organic products in the diet fiber market cater to this demand, offering a clean label and a perceived higher nutritional value.

- Consumers are becoming more conscious of the impact of their food choices on overall well-being, leading to a shift towards plant-based and organic diets. Diet fibers derived from natural sources, such as fruits, vegetables, and whole grains, are gaining popularity due to their perceived health benefits, including improved digestion and weight management.

- Moreover, natural and organic products in the diet fiber market often come with certifications that assure consumers of the absence of synthetic additives, pesticides, and genetically modified organisms (GMOs). This transparency in labeling contributes to building trust among consumers.

Diet Fiber Market Segment Analysis:

Diet Fiber Market Segmented on the basis of Raw Material, Product and application

By Raw Material, Legumes segment is expected to dominate the market during the forecast period

- Legumes serve as a crucial raw material in the diet fiber market, contributing significantly to the growing demand for dietary fiber. These versatile plant-based foods, including beans, lentils, and peas, are rich sources of soluble and insoluble fiber, essential for maintaining digestive health and overall well-being.

- Dietary fiber derived from legumes offers numerous health benefits. Soluble fiber helps regulate blood sugar levels and lowers cholesterol, while insoluble fiber promotes regular bowel movements and prevents constipation. Additionally, legumes are known for their high protein content, making them an ideal choice for plant-based diets.

- The increasing awareness of the health benefits associated with dietary fiber has driven the demand for legume-based products and ingredients in the food industry. Consumers are seeking fiber-rich alternatives to enhance the nutritional profile of their diets. Food manufacturers are incorporating legumes into a variety of products, such as snacks, cereals, and baked goods, to meet this demand.

By Product, Insoluble Dietary Fiber segment held the largest share of 52.65% in 2022

- The insoluble dietary fiber segment in the diet fiber market has witnessed significant growth and demand due to its numerous health benefits. Insoluble dietary fiber, primarily found in wheat bran, vegetables, and whole grains, contributes to digestive health by promoting regular bowel movements and preventing constipation. As consumers increasingly prioritize wellness and digestive well-being, the market for insoluble dietary fiber has expanded.

- Key players in the diet fiber market have responded to this trend by introducing innovative products that cater to the growing demand for insoluble fiber. These products often come in various forms, such as powders, supplements, and functional foods, providing consumers with convenient options to incorporate insoluble dietary fiber into their daily diets. Additionally, the market has seen collaborations between food manufacturers and health experts to develop products that address specific dietary needs.

- The rise in awareness regarding the role of insoluble dietary fiber in weight management, cardiovascular health, and blood sugar control has further fueled its popularity. With an increasing emphasis on preventive healthcare and holistic well-being, the insoluble dietary fiber segment is poised for continued growth in the diet fiber market, offering consumers effective solutions for maintaining a healthy and balanced lifestyle.

Diet Fiber Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as a dominant force in the fiber market, reflecting a combination of dynamic economic growth, technological advancements, and a burgeoning population. With a rising middle class and increasing disposable incomes, the demand for fiber products, particularly in the textile and apparel industry, is witnessing a significant uptick.

- China, India, and other rapidly industrializing nations in the region are key contributors to this trend, fostering a robust manufacturing sector and driving the need for raw materials such as fiber. The region's emphasis on infrastructure development, including smart cities and high-speed connectivity, further propels the demand for advanced fiber optics.

- Moreover, the Asia Pacific region is witnessing a surge in awareness regarding sustainability and eco-friendly practices. There is a growing preference for natural and sustainable fibers in various industries, aligning with global efforts towards environmental conservation.

- North America is poised to drive significant growth in the fiber market, buoyed by increasing consumer awareness of the health benefits associated with high-fiber diets. The region's robust demand for functional foods and a rising focus on preventive healthcare contribute to this momentum. Additionally, the growing popularity of plant-based diets and a surge in fitness consciousness further fuel the demand for fiber-rich products. As manufacturers respond to these trends by innovating and introducing a diverse range of fiber-enriched options, North America emerges as a key player in shaping the expanding landscape of the global fiber market.

Diet Fiber Market Top Key Players:

- Cargill (United States)

- Ingredion Incorporated (United States)

- Grain Millers Inc. (United States)

- Grain Processing Corporation (United States)

- KFSU Ltd (United States)

- Archer Daniels Midland Company (United States)

- Ingredion Incorporated (United States)

- The Green Labs Llc (United States)

- Puris (United States)

- FARBEST Brands (United States)

- Dupont (United States)

- Batory Foods (United States)

- AGT Food And Ingredients (Canada)

- NEXIRA (France)

- Roquette Freres (France)

- Roquette Freres (France)

- Beneo (Germany)

- Emsland Group (Germany)

- J. Rettenmaier & Sohne GmbH + Co Kg (Germany)

- Tate & Lyle (United Kingdom)

- Lonza (Switzerland)

- Kerry Inc. (Ireland)

Key Industry Developments in the Diet Fiber Market:

- In November 2023, Cargill launched a year-long regenerative agriculture research and practice project with the China Development Research Foundation, aiming to promote green development in Chinese agriculture and support the national carbon neutrality goal, contributing one million yuan to the project. In July 2023, Cargill China and the Rural Economy Research Center of the Ministry of Agriculture and Rural Affairs started a year-long conservation tillage/regenerative agriculture pilot project in Jilin Province, monitoring 100 corn-growing households over an area of no less than 10,000 mu.

- In April 2023, Ingredion Incorporated a leading global provider of ingredient solutions to the food and beverage industry announced that it has completed two strategic investments in India to expand into high-value pharmaceutical applications. During the third quarter of 2022, the company acquired Amishi Drugs & Chemicals (AD&C), headquartered in Ahmedabad, India, which manufactures superdisintegrants, lubricants and viscosifiers, complementing its portfolio of starch, mannitol and dextrose product offerings.

|

Global Diet Fiber Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.26 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.48 % |

Market Size in 2032: |

USD 4.26 Bn. |

|

Segments Covered: |

By Raw Material |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DIET FIBER MARKET BY RAW MATERIAL (2016-2030)

- DIET FIBER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRUITS & VEGETABLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CEREALS & GRAINS

- NUTS & SEEDS

- DIET FIBER MARKET BY PRODUCT (2016-2030)

- DIET FIBER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUBLE DIETARY FIBER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSOLUBLE DIETARY FIBER

- DIET FIBER MARKET BY APPLICATION (2016-2030)

- DIET FIBER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOODS & BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICALS

- ANIMAL FEED

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- DIET FIBER Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CARGILL (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- INGREDION INCORPORATED (UNITED STATES)

- GRAIN MILLERS INC. (UNITED STATES)

- GRAIN PROCESSING CORPORATION (UNITED STATES)

- KFSU LTD (UNITED STATES)

- ARCHER DANIELS MIDLAND COMPANY (UNITED STATES)

- INGREDION INCORPORATED (UNITED STATES)

- THE GREEN LABS LLC (UNITED STATES)

- PURIS (UNITED STATES)

- FARBEST BRANDS (UNITED STATES)

- DUPONT (UNITED STATES)

- BATORY FOODS (UNITED STATES)

- AGT FOOD AND INGREDIENTS (CANADA)

- NEXIRA (FRANCE)

- ROQUETTE FRERES (FRANCE)

- ROQUETTE FRERES (FRANCE)

- BENEO (GERMANY)

- EMSLAND GROUP (GERMANY)

- J. RETTENMAIER & SOHNE GMBH + CO KG (GERMANY)

- TATE & LYLE (UNITED KINGDOM)

- COMPETITIVE LANDSCAPE

- GLOBAL DIET FIBER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Raw Material

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Diet Fiber Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.26 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.48 % |

Market Size in 2032: |

USD 4.26 Bn. |

|

Segments Covered: |

By Raw Material |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DIET FIBER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DIET FIBER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DIET FIBER MARKET COMPETITIVE RIVALRY

TABLE 005. DIET FIBER MARKET THREAT OF NEW ENTRANTS

TABLE 006. DIET FIBER MARKET THREAT OF SUBSTITUTES

TABLE 007. DIET FIBER MARKET BY TYPE

TABLE 008. SOLUBLE DIET FIBER MARKET OVERVIEW (2016-2028)

TABLE 009. INSOLUBLE DIET FIBER MARKET OVERVIEW (2016-2028)

TABLE 010. DIET FIBER MARKET BY APPLICATION

TABLE 011. FOOD MARKET OVERVIEW (2016-2028)

TABLE 012. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 013. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA DIET FIBER MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA DIET FIBER MARKET, BY APPLICATION (2016-2028)

TABLE 016. N DIET FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE DIET FIBER MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE DIET FIBER MARKET, BY APPLICATION (2016-2028)

TABLE 019. DIET FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC DIET FIBER MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC DIET FIBER MARKET, BY APPLICATION (2016-2028)

TABLE 022. DIET FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA DIET FIBER MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA DIET FIBER MARKET, BY APPLICATION (2016-2028)

TABLE 025. DIET FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA DIET FIBER MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA DIET FIBER MARKET, BY APPLICATION (2016-2028)

TABLE 028. DIET FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 029. CARGILL: SNAPSHOT

TABLE 030. CARGILL: BUSINESS PERFORMANCE

TABLE 031. CARGILL: PRODUCT PORTFOLIO

TABLE 032. CARGILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. ARCHER DANIELS MIDLAND COMPANY: SNAPSHOT

TABLE 033. ARCHER DANIELS MIDLAND COMPANY: BUSINESS PERFORMANCE

TABLE 034. ARCHER DANIELS MIDLAND COMPANY: PRODUCT PORTFOLIO

TABLE 035. ARCHER DANIELS MIDLAND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. DUPONT: SNAPSHOT

TABLE 036. DUPONT: BUSINESS PERFORMANCE

TABLE 037. DUPONT: PRODUCT PORTFOLIO

TABLE 038. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. TATE & LYLE: SNAPSHOT

TABLE 039. TATE & LYLE: BUSINESS PERFORMANCE

TABLE 040. TATE & LYLE: PRODUCT PORTFOLIO

TABLE 041. TATE & LYLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. LONZA: SNAPSHOT

TABLE 042. LONZA: BUSINESS PERFORMANCE

TABLE 043. LONZA: PRODUCT PORTFOLIO

TABLE 044. LONZA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. NEXIRA: SNAPSHOT

TABLE 045. NEXIRA: BUSINESS PERFORMANCE

TABLE 046. NEXIRA: PRODUCT PORTFOLIO

TABLE 047. NEXIRA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. INGREDION INCORPORATED: SNAPSHOT

TABLE 048. INGREDION INCORPORATED: BUSINESS PERFORMANCE

TABLE 049. INGREDION INCORPORATED: PRODUCT PORTFOLIO

TABLE 050. INGREDION INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ROQUETTE FRERES: SNAPSHOT

TABLE 051. ROQUETTE FRERES: BUSINESS PERFORMANCE

TABLE 052. ROQUETTE FRERES: PRODUCT PORTFOLIO

TABLE 053. ROQUETTE FRERES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. GRAIN PROCESSING CORPORATION: SNAPSHOT

TABLE 054. GRAIN PROCESSING CORPORATION: BUSINESS PERFORMANCE

TABLE 055. GRAIN PROCESSING CORPORATION: PRODUCT PORTFOLIO

TABLE 056. GRAIN PROCESSING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. GRAIN PROCESSING CORPORATION: SNAPSHOT

TABLE 057. GRAIN PROCESSING CORPORATION: BUSINESS PERFORMANCE

TABLE 058. GRAIN PROCESSING CORPORATION: PRODUCT PORTFOLIO

TABLE 059. GRAIN PROCESSING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. KFSU LTD: SNAPSHOT

TABLE 060. KFSU LTD: BUSINESS PERFORMANCE

TABLE 061. KFSU LTD: PRODUCT PORTFOLIO

TABLE 062. KFSU LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. GRAIN MILLERS INC: SNAPSHOT

TABLE 063. GRAIN MILLERS INC: BUSINESS PERFORMANCE

TABLE 064. GRAIN MILLERS INC: PRODUCT PORTFOLIO

TABLE 065. GRAIN MILLERS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 066. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 067. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 068. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DIET FIBER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DIET FIBER MARKET OVERVIEW BY TYPE

FIGURE 012. SOLUBLE DIET FIBER MARKET OVERVIEW (2016-2028)

FIGURE 013. INSOLUBLE DIET FIBER MARKET OVERVIEW (2016-2028)

FIGURE 014. DIET FIBER MARKET OVERVIEW BY APPLICATION

FIGURE 015. FOOD MARKET OVERVIEW (2016-2028)

FIGURE 016. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 017. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA DIET FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE DIET FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC DIET FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA DIET FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA DIET FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Diet Fiber Market research report is 2024-2032.

Cargill (United States), Ingredion Incorporated (United States), Grain Millers Inc. (United States), Grain Processing Corporation (United States), KFSU Ltd (United States), Archer Daniels Midland Company (United States), Ingredion Incorporated (United States), The Green Labs LLC (United States), PURIS (United States), Farbest Brands (United States), DuPont (United States), Batory Foods (United States), AGT Food and Ingredients (Canada), Nexira (France),Roquette Freres (France), Roquette Freres (France), BENEO (Germany), Emsland Group (Germany), J. RETTENMAIER & SOHNE GmbH + Co KG (Germany) ,Tate & Lyle (United Kingdom), Lonza (Switzerland), Kerry Inc. (Ireland) and Other Major Players.

The Diet Fiber Market is segmented into Raw Material, Product, Application, and region. By Raw Material, the market is categorized into Fruits & Vegetables, Cereals & Grains, Legumes, and Nuts & Seeds. By Product, the market is categorized into Soluble Dietary Fiber and Insoluble Dietary Fiber. By Application, the market is categorized into Foods & Beverages, Pharmaceuticals, Animal Feed. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Dietary fiber, often simply referred to as fiber, is a crucial component of plant-based foods that the human body cannot digest or absorb. Instead, it passes through the digestive system largely intact, providing a range of health benefits. There are two main types of dietary fiber: soluble and insoluble. Soluble fiber dissolves in water to form a gel-like substance and is found in foods like oats, fruits, and legumes. It helps lower cholesterol levels, regulate blood sugar, and contributes to a feeling of fullness. Insoluble fiber, found in foods such as whole grains, vegetables, and nuts, adds bulk to the stool, aiding in digestion and preventing constipation.

Diet Fiber Market Size Was Valued at USD 1.26 Billion in 2023 and is Projected to Reach USD 4.26 Billion by 2032, Growing at a CAGR of 14.48 % From 2024-2032.