Defense Cyber Security Market Synopsis

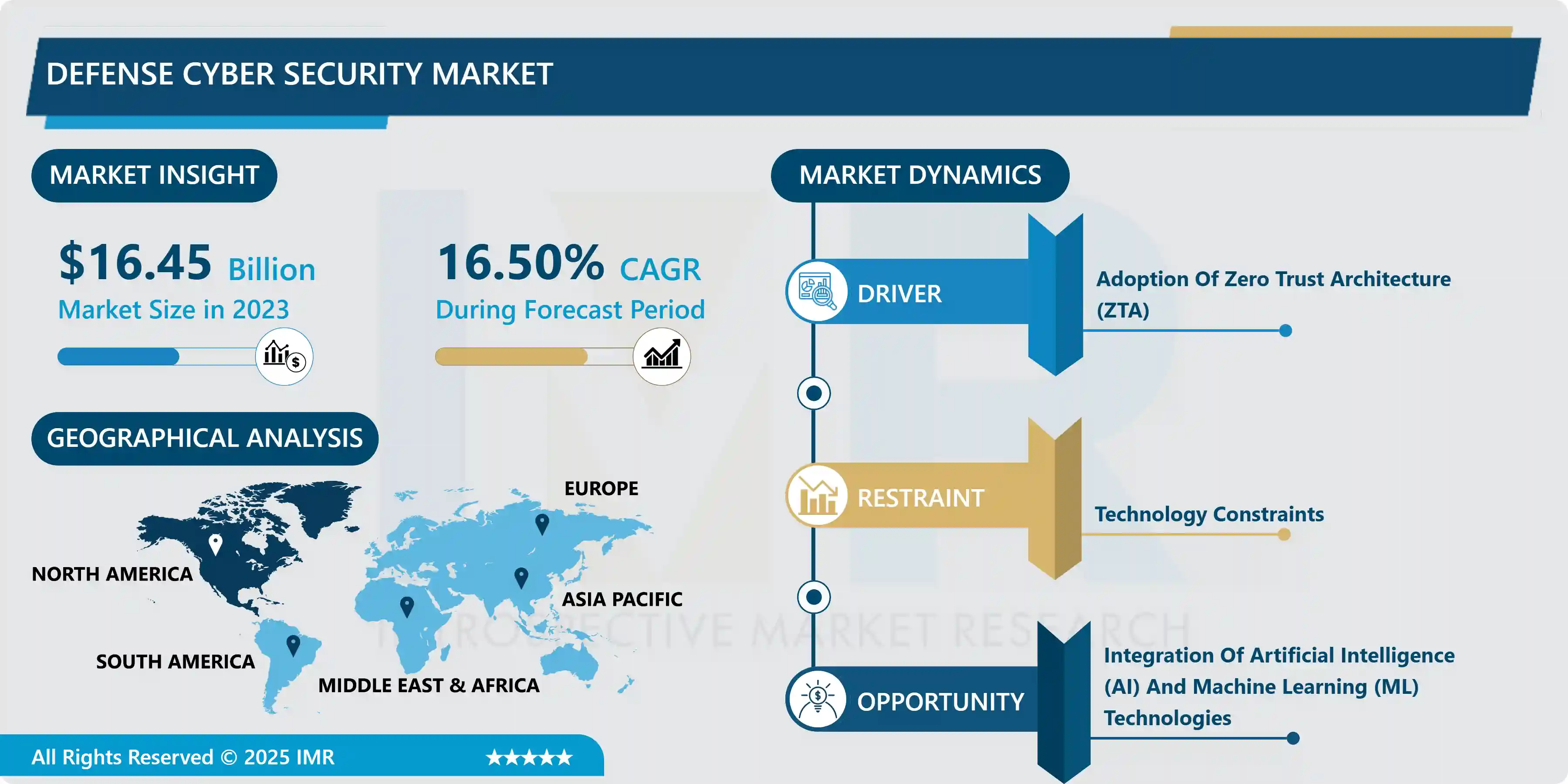

Defense Cyber Security Market Size Was Valued at USD 16.45 Billion in 2023 and is Projected to Reach USD 64.38 Billion by 2032, Growing at a CAGR of 16.5% From 2024-2032.

Defense Cyber Security is the safeguarding of defense systems, networks, and data from cyber threats and attacks. It includes various methods, technologies, and procedures aimed at protecting confidential data and ensuring the security of defense-related digital assets. Cybersecurity risks are changing, as cybercriminals employ sophisticated strategies such as zero-day exploits and APTs. The number and size of attacks are increasing, requiring strong cybersecurity measures to avoid breaches and reduce damage. Geopolitical tensions drive cyber-attacks sponsored by governments aimed at defense capabilities and critical infrastructure. Countries prioritize cybersecurity to safeguard against cyber warfare and espionage threats due to national security concerns.

The rise of IoT and smart devices within defense systems leads to vulnerabilities that necessitate advanced security precautions. Defense agencies need strong cloud security solutions to adopt cloud computing. AI and machine learning provide improvements in cybersecurity, yet present fresh security issues that require creative solutions. Defense organizations are upgrading their systems with digital technologies, resulting in an increased demand for cyber security to safeguard these resources. Advanced security measures are essential for safeguarding system integrity and protection in defense operations with automated processes. Government and international regulations encourage investment in cybersecurity for defense, prompting organizations to increasingly adopt advanced security solutions in order to meet regular audits and certifications that guarantee conformity to standards. Increased awareness of cyber risks in defense operations is resulting in higher funding for extensive cyber security initiatives. This involves investing in training, threat detection, and incident response to enhance overall security stance.

Defense Cyber Security Market Trend Analysis

Adoption Of Zero Trust Architecture (ZTA)

- Zero Trust improves security by actively verifying user and device identities to minimize the danger from potential insider threats. It further decreases the attack surface by restricting access and overseeing interactions to decrease possible entry points for adversaries. The rise of cloud and hybrid IT setups has emphasized the constraints of old security strategies. Zero Trust provides a remedy by placing emphasis on safeguarding data and applications irrespective of where they are located.

- Likewise, the increasing utilization of remote work and mobile devices necessitates a thorough security plan that encompasses secure access protocols for every user. Trust is not automatically assumed for users, devices, and applications, necessitating verification for each access request. Access is given depending on the least amount of privilege to lessen harm if there is a breach. AI and ML technologies are integrated into Zero Trust Architecture to enhance threat detection. It depends on sophisticated IAM solutions to handle access controls and guarantee that only approved users can access resources.

- Continuous verification and monitoring under Zero Trust are successful in combating sophisticated threats such as APTs by restricting movement within the network. Granular access controls help improve the speed of incident response, increasing overall resistance to security incidents. Implementing Zero Trust is difficult, as it involves making adjustments to both infrastructure and processes. High initial expenses result in eventual cost savings in terms of security and risk mitigation. Thorough planning and implementation are crucial for achieving success.

Opportunity

Integration Of Artificial Intelligence (AI) And Machine Learning (ML) Technologies

- AI and ML algorithms are used in real-time monitoring to analyze data for security threats, allowing for quicker detection of attacks compared to traditional approaches. Machine learning models set standard patterns for regular activities and pinpoint anomalies to recognize sophisticated cyber threats. AI-powered systems automate incident responses by isolating impacted systems, blocking malicious IP addresses, and implementing countermeasures, thereby decreasing response time and potential harm. This minimizes mistakes made by humans and guarantees security actions that are consistent and dependable.

- AI and ML systems enhance security by adjusting to emerging threats through ongoing learning. Security posture is evaluated, vulnerabilities are identified, and defenses are offered by risk assessment tools. This flexibility guarantees success in battling new threats and changing enemies.AI and ML examine historical data and patterns to predict potential dangers, aiding defense in preparedness. Collecting threat intelligence from various sources enables organizations to keep up with changing threats, assisting in proactive defense strategies.

- Machine learning algorithms are successful in identifying unusual patterns associated with fraud, such as unauthorized entry or data stealing. AI-driven automated verification can reduce fraudulent actions and enhance security through monitoring transactions and user behavior. AI aids in defense cyber security decision-making by offering practical insights and suggestions through data analysis and threat intelligence. Assisting in strategic planning, it prioritizes threats and responses by considering impact and urgency.

Defense Cyber Security Market Segment Analysis:

The Defense Cyber Security market is segmented based on Platforms, Type, Solution, End-User, And Region.

By Platform, Software Segment Is Expected to Dominate the Market During the Forecast Period

- Cyber security software provides a diverse set of features like antivirus, intrusion detection systems, firewalls, and encryption tools, playing a crucial role in tackling different aspects of cyber security. Software solutions can be quickly updated to respond to new threats, allowing for easy adaptation. Cyber security software incorporates threat intelligence feeds to detect threats in real time. By utilizing AI and ML, it examines patterns and identifies anomalies more effectively, enhancing recognition of sophisticated threats and decreasing inaccurate results.

- Defense organizations are able to stay ahead of possible attacks by utilizing these advanced capabilities. Software solutions provide affordability with reduced upfront costs and the ability to adjust to various scales of operations. This makes them a desirable choice for defense organizations operating under budget limitations, preventing the need for costly extra hardware purchases. The ability to centrally manage cyber security software enables defense organizations to enhance efficiency by monitoring and controlling security infrastructure through a single interface. Integration features facilitate smooth integration with current systems, such as SIEM.

- Software can be updated regularly to tackle new threats, helping defense organizations remain safeguarded against changing cyber threats. Providers also provide continuous assistance through updates, patches, and technical support for the most up-to-date security features. Defense software solutions offer encryption, data protection, and advanced threat protection including IPS and malware protection to prevent unauthorized access and breaches, providing defense against complex attacks.

By Type, Network Security Segment Held the Largest Share In 2023

- Ensuring the safety of crucial infrastructure is crucial in military operations. Network Security protects communication networks, command systems, and data exchange to ensure national security. Ensuring security by using tools such as firewalls and intrusion prevention systems is of utmost importance to prevent unauthorized access and cyber intrusions and uphold operational integrity. Network Security solutions work in conjunction with threat intelligence platforms to improve the detection of threats. AI and ML algorithms are also used to analyze network traffic patterns and detect anomalies.

- The defense industry is confronted with sophisticated cyber threats such as APTs and zero-day exploits. Network Security solutions can identify, stop, and react efficiently. Techniques such as traffic analysis and behavioral monitoring offer immediate threat detection to respond promptly to security incidents. Network Security solutions provide defense against DoS and DDoS attacks, which are essential for ensuring the availability and reliability of defense networks.

- Network Security solutions offer a centralized way for defense organizations to effectively monitor and manage network traffic with visibility and control. They also allow for the enforcement of policies and control access to safeguard sensitive resources from unauthorized users and devices. Network segmentation restricts the spread of attacks by establishing secure zones and regulating the flow of traffic. Segmentation aids in restricting breaches and upholding essential network services and activities.

Defense Cyber Security Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, spearheaded by the United States, allocates significant funds towards defense, emphasizing investments in cyber security to safeguard national interests. There are a lot of government contracts available in the area, which are helping cyber security companies to expand as defense agencies and military branches focus on innovative solutions. North America is at the forefront of technology innovation and research and development, with many tech companies and research institutions spearheading advancements in cyber security.

- North America has stringent regulations and standards for cybersecurity, such as the U.S. Department of Defense's criteria for contractors in the defense sector. Efforts like CISA are focused on enhancing cybersecurity across federal, state, and local levels. Key companies and emerging businesses in the area are creating innovative AI, ML, and advanced threat detection technologies, influencing the worldwide tech sector. North America is dealing with a significant cybersecurity risk environment that involves regular attacks, including those sponsored by governments and advanced persistent threats (APTs).

- North American corporations are at the forefront of creating and putting into action advanced cybersecurity technologies such as zero trust architecture, next-gen firewalls, and advanced threat intelligence solutions. They also have a strong proficiency in incorporating and automating cyber security solutions through technologies such as SOAR. A focus on safeguarding vital infrastructure necessitates the use of high-level cybersecurity tactics in the area.

Defense Cyber Security Market Active Players

- Lockheed Martin (USA)

- Northrop Grumman (USA)

- Raytheon Technologies (USA)

- Boeing (USA)

- General Dynamics (USA)

- BAE Systems (United Kingdom)

- Hewlett Packard Enterprise (USA)

- Cisco Systems (USA)

- IBM (USA)

- SAIC (USA)

- Dell Technologies (USA)

- Palantir Technologies (USA)

- McAfee (USA)

- FireEye (USA)

- Symantec (USA)

- Fortinet (USA)

- Check Point Software Technologies (Israel)

- Trend Micro (Japan)

- CrowdStrike (USA)

- Splunk (USA)

- Norton LifeLock (USA)

- Proofpoint (USA)

- SonicWall (USA)

- Palo Alto Networks (USA)

|

Defense Cyber Security Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 16.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.5 % |

Market Size in 2032: |

USD 64.38 Bn. |

|

Segments Covered: |

By Platforms |

|

|

|

By Type |

|

||

|

By Solution |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Defense Cyber Security Market by Platforms (2018-2032)

4.1 Defense Cyber Security Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

4.6 Integration

Chapter 5: Defense Cyber Security Market by Type (2018-2032)

5.1 Defense Cyber Security Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Network Security

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Endpoint Security

5.5 Application Security

5.6 Cloud Security

5.7 Data Security

Chapter 6: Defense Cyber Security Market by Solution (2018-2032)

6.1 Defense Cyber Security Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Defense solutions

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Threat assessment

6.5 Network fortification

6.6 Training services

Chapter 7: Defense Cyber Security Market by End-User (2018-2032)

7.1 Defense Cyber Security Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Army

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Navy

7.5 Airforce

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Defense Cyber Security Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LOCKHEED MARTIN (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NORTHROP GRUMMAN (USA)

8.4 RAYTHEON TECHNOLOGIES (USA)

8.5 BOEING (USA)

8.6 GENERAL DYNAMICS (USA)

8.7 BAE SYSTEMS (UNITED KINGDOM)

8.8 HEWLETT PACKARD ENTERPRISE (USA)

8.9 CISCO SYSTEMS (USA)

8.10 IBM (USA)

8.11 SAIC (USA)

8.12 DELL TECHNOLOGIES (USA)

8.13 PALANTIR TECHNOLOGIES (USA)

8.14 MCAFEE (USA)

8.15 FIREEYE (USA)

8.16 SYMANTEC (USA)

8.17 FORTINET (USA)

8.18 CHECK POINT SOFTWARE TECHNOLOGIES (ISRAEL)

8.19 TREND MICRO (JAPAN)

8.20 CROWDSTRIKE (USA)

8.21 SPLUNK (USA)

8.22 NORTON LIFELOCK (USA)

8.23 PROOFPOINT (USA)

8.24 SONICWALL (USA)

8.25 PALO ALTO NETWORKS (USA)

8.26 THALES GROUP (FRANCE)

Chapter 9: Global Defense Cyber Security Market By Region

9.1 Overview

9.2. North America Defense Cyber Security Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Platforms

9.2.4.1 Hardware

9.2.4.2 Software

9.2.4.3 Services

9.2.4.4 Integration

9.2.5 Historic and Forecasted Market Size by Type

9.2.5.1 Network Security

9.2.5.2 Endpoint Security

9.2.5.3 Application Security

9.2.5.4 Cloud Security

9.2.5.5 Data Security

9.2.6 Historic and Forecasted Market Size by Solution

9.2.6.1 Defense solutions

9.2.6.2 Threat assessment

9.2.6.3 Network fortification

9.2.6.4 Training services

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Army

9.2.7.2 Navy

9.2.7.3 Airforce

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Defense Cyber Security Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Platforms

9.3.4.1 Hardware

9.3.4.2 Software

9.3.4.3 Services

9.3.4.4 Integration

9.3.5 Historic and Forecasted Market Size by Type

9.3.5.1 Network Security

9.3.5.2 Endpoint Security

9.3.5.3 Application Security

9.3.5.4 Cloud Security

9.3.5.5 Data Security

9.3.6 Historic and Forecasted Market Size by Solution

9.3.6.1 Defense solutions

9.3.6.2 Threat assessment

9.3.6.3 Network fortification

9.3.6.4 Training services

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Army

9.3.7.2 Navy

9.3.7.3 Airforce

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Defense Cyber Security Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Platforms

9.4.4.1 Hardware

9.4.4.2 Software

9.4.4.3 Services

9.4.4.4 Integration

9.4.5 Historic and Forecasted Market Size by Type

9.4.5.1 Network Security

9.4.5.2 Endpoint Security

9.4.5.3 Application Security

9.4.5.4 Cloud Security

9.4.5.5 Data Security

9.4.6 Historic and Forecasted Market Size by Solution

9.4.6.1 Defense solutions

9.4.6.2 Threat assessment

9.4.6.3 Network fortification

9.4.6.4 Training services

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Army

9.4.7.2 Navy

9.4.7.3 Airforce

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Defense Cyber Security Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Platforms

9.5.4.1 Hardware

9.5.4.2 Software

9.5.4.3 Services

9.5.4.4 Integration

9.5.5 Historic and Forecasted Market Size by Type

9.5.5.1 Network Security

9.5.5.2 Endpoint Security

9.5.5.3 Application Security

9.5.5.4 Cloud Security

9.5.5.5 Data Security

9.5.6 Historic and Forecasted Market Size by Solution

9.5.6.1 Defense solutions

9.5.6.2 Threat assessment

9.5.6.3 Network fortification

9.5.6.4 Training services

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Army

9.5.7.2 Navy

9.5.7.3 Airforce

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Defense Cyber Security Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Platforms

9.6.4.1 Hardware

9.6.4.2 Software

9.6.4.3 Services

9.6.4.4 Integration

9.6.5 Historic and Forecasted Market Size by Type

9.6.5.1 Network Security

9.6.5.2 Endpoint Security

9.6.5.3 Application Security

9.6.5.4 Cloud Security

9.6.5.5 Data Security

9.6.6 Historic and Forecasted Market Size by Solution

9.6.6.1 Defense solutions

9.6.6.2 Threat assessment

9.6.6.3 Network fortification

9.6.6.4 Training services

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Army

9.6.7.2 Navy

9.6.7.3 Airforce

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Defense Cyber Security Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Platforms

9.7.4.1 Hardware

9.7.4.2 Software

9.7.4.3 Services

9.7.4.4 Integration

9.7.5 Historic and Forecasted Market Size by Type

9.7.5.1 Network Security

9.7.5.2 Endpoint Security

9.7.5.3 Application Security

9.7.5.4 Cloud Security

9.7.5.5 Data Security

9.7.6 Historic and Forecasted Market Size by Solution

9.7.6.1 Defense solutions

9.7.6.2 Threat assessment

9.7.6.3 Network fortification

9.7.6.4 Training services

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Army

9.7.7.2 Navy

9.7.7.3 Airforce

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Defense Cyber Security Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 16.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.5 % |

Market Size in 2032: |

USD 64.38 Bn. |

|

Segments Covered: |

By Platforms |

|

|

|

By Type |

|

||

|

By Solution |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||