Decorative Concrete Market Synopsis

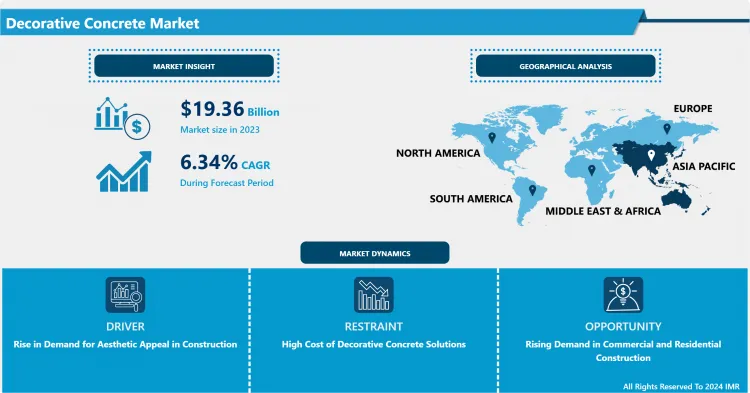

Decorative Concrete Market Size Was Valued at USD 19.36 Billion in 2023, and is Projected to Reach USD 33.66 Billion by 2032, Growing at a CAGR of 6.34 % From 2024-2032.

Decorative concrete refers to a special kind of concrete. Products made of decorative concrete must meet, in addition to the increased requirements for appearance, certain architectural expressiveness, and also certain indicators for strength, durability, and environmental friendliness. In addition, one should strive to reduce the cost of both decorative concrete and products made of such concrete. In recent years, decorative concretes are increasingly used in construction for the architectural expressiveness of buildings and structures. Using the plastic properties of decorative concrete, they are widely used for molding products of relief surfaces, sculptures, facing slabs, making floors, bas-reliefs, paving slabs, i.e. such concrete can be configured in a variety of configurations. Expansion of the range of products from decorative concrete is associated with the implementation of the State Program of the Russian Federation to create an urban comfortable environment.

World practice of construction shows that the field of application of white and colored cements on its basis is as extensive as the usual (gray) and some special types of Portland cement have. White cements are used in the form of facing slabs that perfectly imitate natural stone, plaster, concrete coatings, in the manufacture of floors, steps, sculptures, etc. The lined products have an aesthetic appearance, sufficiently high strength, and durability for longterm operation. Naturally, the production of such cement requires a raw material base, containing a low iron content, and the absence of oxides of manganese, chromium. In other words, the output of white Portland cement is based on the use of pure calcite and kaolin clays, so that the total Fe2O3 content in white cement does not exceed 0.8% (1%)

Decorative Concrete Market Trend Analysis

Rise in Demand for Aesthetic Appeal in Construction

- One of the primary drivers of the decorative concrete market is the growing demand for aesthetically appealing construction projects. As urbanization accelerates globally, both residential and commercial sectors are placing a higher emphasis on visual appeal and unique designs. Decorative concrete, known for its durability and customization, is increasingly sought after in landscaping, driveways, patios, and interior floors, giving architects and homeowners endless possibilities to create distinct and attractive surfaces.

- Consumers’ preference for cost-effective, long-lasting materials has also led to increased adoption of decorative concrete. Unlike traditional materials like stone or tile, decorative concrete offers a blend of beauty and strength at a lower cost, making it an attractive option for many. It is widely used in renovation projects, new builds, and commercial spaces due to its versatility, available in stamped, polished, or stained finishes that mimic expensive materials while remaining budget-friendly.

- Sustainability is another factor driving growth in this market. Decorative concrete's eco-friendly attributes, such as energy efficiency, recyclability, and reduced waste, align with the increasing global shift toward green building practices. These characteristics appeal to environmentally conscious consumers and developers looking to meet regulatory standards while also reducing the environmental footprint of construction projects.

- In this explanation, I focused on the point about the growing demand for aesthetic appeal in construction projects. This driver reflects the increased emphasis on visually appealing, unique designs that enhance the overall look of buildings, aligning with modern architectural trends. Decorative concrete’s versatility allows for creative freedom in both residential and commercial projects, making it a preferred choice for consumers seeking custom finishes and long-lasting durability.

Rising Demand in Commercial and Residential Construction

- The decorative concrete market is seeing significant growth due to rising demand in commercial and residential construction. As design trends shift toward more sustainable and aesthetically pleasing materials, decorative concrete offers a versatile solution that can mimic high-end finishes like stone and wood, but at a lower cost. Its durability, customization, and environmental benefits appeal to architects and builders seeking long-lasting yet stylish materials.

- One of the key opportunities in this market lies in the growing urbanization and infrastructure development. Governments and private developers are investing in modernizing cities, with decorative concrete being used in sidewalks, public spaces, and high-traffic areas where both functionality and design are critical. As smart cities evolve, the demand for visually appealing and low-maintenance materials like decorative concrete is expected to rise.

- A prime opportunity exists in innovative surface treatments for decorative concrete, such as stamped, stained, polished, and textured finishes. These techniques allow for high levels of customization, which appeals to both residential and commercial clients looking to distinguish their spaces. This customization also opens doors for collaborations with designers and architects, offering tailored solutions for premium projects.

Decorative Concrete Market Segment Analysis:

Decorative Concrete Market Segmented based on Type, Application, End-User Industry and Region

By Type, Stained Segment Is Expected to Dominate the Market During the Forecast Period

- Stained decorative concrete is leading the decorative concrete market due to its versatility and aesthetic appeal. This concrete type offers a range of colors and finishes, enabling designers and homeowners to achieve custom looks that mimic materials like marble, stone, or even wood. It’s widely used in both residential and commercial projects for flooring, patios, and walkways, making it a go-to choose for those seeking durable and stylish surfaces.

- The process of staining concrete allows for a semi-transparent finish that penetrates the surface, resulting in vibrant hues that resist fading. This long-lasting characteristic, coupled with low maintenance, makes stained concrete a popular option in high-traffic areas. Its ability to integrate seamlessly into indoor and outdoor designs also boosts its demand in various sectors such as retail spaces, restaurants, and public buildings.

- Another reason for the dominance of stained decorative concrete is its cost-effectiveness. Compared to other decorative materials like natural stone or tile, stained concrete offers a more affordable solution without sacrificing visual appeal. Its eco-friendliness, with fewer materials used in production, adds to its growing appeal, especially in projects focused on sustainability.

By End-User Industry, Residential Segment Held the Largest Share In 2023

- The residential sector plays a dominant role in the decorative concrete market, driven by increasing demand for aesthetically appealing, durable, and cost-effective flooring and surfaces. Homeowners are increasingly opting for decorative concrete in driveways, patios, walkways, and interior floors due to its versatility and ability to mimic high-end materials like stone or tile at a fraction of the cost. Its customizable nature allows homeowners to enhance their properties with unique textures, patterns, and colors, boosting curb appeal and interior design.

- The rise in home renovation and remodeling activities, particularly post-pandemic, has accelerated the adoption of decorative concrete in residential settings. This trend is fueled by the growing focus on personalizing living spaces, with homeowners seeking stylish, long-lasting solutions that are low-maintenance. Additionally, decorative concrete is eco-friendly, further appealing to environmentally conscious consumers who are looking to reduce their carbon footprint while improving their homes.

- Moreover, the availability of advanced concrete technologies has enabled the development of innovative decorative options that are not only visually appealing but also highly durable and weather-resistant. As a result, the residential sector continues to outpace other market segments, including commercial and industrial, as homeowners increasingly recognize the value of decorative concrete for enhancing both functionality and aesthetic appeal in their living spaces.

Decorative Concrete Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- North America is currently dominating the decorative concrete market, driven by significant demand from both the residential and commercial construction sectors. The U.S. in particular, with its robust infrastructure development and renovation activities, contributes heavily to market growth. This region benefits from an increased focus on aesthetic appeal, durable flooring solutions, and sustainability in architectural designs.

- The growing trend toward urbanization and modernization of older structures in Canada and Mexico further boosts the market. Decorative concrete is widely used for patios, driveways, and interior flooring due to its durability and low maintenance. These attributes make it highly popular in public spaces and commercial buildings across the region.

- Additionally, technological advancements in concrete formulations and installation techniques have spurred growth in the North American decorative concrete market. Green building initiatives and the increasing use of stamped, stained, and polished concrete also support its dominance in the global market.

Decorative Concrete Market Active Players

- PPG Industries Inc. (US)

- BASF SE (Germany)

- The Sherwin-Williams Company (US)

- RPM International Inc. (US)

- Sika AG (Switzerland)

- Boral Limited (Australia)

- UltraTech Cement Limited (India)

- CEMEX Colombia SA (Mexico)

- DuPont (US)

- HEIDELBERGCEMENT AG (Germany)

- 3M (US)

- Huntsman International LLC. (US)

- Arkema (France)

- Akzo Nobel N.V. (Netherlands)

- CEMEX, S.A.B. de C.V. (Mexico)

- Fosroc International Ltd (UK)

- RPM Belgium Vandex (Belgium)

- Parchem Construction Supplies Pty. Ltd. (Australia)

- Euclid Chemical Company (US)

- Dow Chemical Company (US)

- MAPEI Corporation (Italy)

- Italcementi Group (Italy)

- LafargeHolcim Ltd (Switzerland)

- Bomanite India (India)

- McKnight Custom Concrete, Inc. (US)

- Deco-Crete, LLC (US)

- Seacoast Concrete (US)

- WG Wearne Limited (South Africa)

- Summit Materials (US)

- Vicat (France)

- U.S. Concrete Inc (US)

- Breedon Group plc (UK) and Other Active Players.

Key Industry Developments in the Decorative Concrete Market:

- In May 2023, RPM International Inc. purchased Boral’s decorative concrete assets. This acquisition will enable RPM to broaden its product portfolio and reach in the decorative concrete sector.

|

Decorative Concrete Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 19.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.34% |

Market Size in 2032: |

USD 33.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Decorative Concrete Market by Type (2018-2032)

4.1 Decorative Concrete Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Stamped

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Stained

4.5 Colored

4.6 Polished

4.7 Epoxy

4.8 Concrete

4.9 Overlays

Chapter 5: Decorative Concrete Market by Application (2018-2032)

5.1 Decorative Concrete Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Floors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Walls

5.5 Driveways & sidewalks

5.6 Pool decks

Chapter 6: Decorative Concrete Market by End-Use Industry (2018-2032)

6.1 Decorative Concrete Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Non-residential

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Decorative Concrete Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PPG INDUSTRIES INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE (GERMANY)

7.4 THE SHERWIN-WILLIAMS COMPANY (US)

7.5 RPM INTERNATIONAL INC. (US)

7.6 SIKA AG (SWITZERLAND)

7.7 BORAL LIMITED (AUSTRALIA)

7.8 ULTRATECH CEMENT LIMITED (INDIA)

7.9 CEMEX COLOMBIA SA (MEXICO)

7.10 DUPONT (US)

7.11 HEIDELBERGCEMENT AG (GERMANY)

7.12 3M (US)

7.13 HUNTSMAN INTERNATIONAL LLC. (US)

7.14 ARKEMA (FRANCE)

7.15 AKZO NOBEL N.V. (NETHERLANDS)

7.16 CEMEX

7.17 S.A.B. DE C.V. (MEXICO)

7.18 FOSROC INTERNATIONAL LTD (UK)

7.19 RPM BELGIUM VANDEX (BELGIUM)

7.20 PARCHEM CONSTRUCTION SUPPLIES PTY. LTD. (AUSTRALIA)

7.21 EUCLID CHEMICAL COMPANY (US)

7.22 DOW CHEMICAL COMPANY (US)

7.23 MAPEI CORPORATION (ITALY)

7.24 ITALCEMENTI GROUP (ITALY)

7.25 LAFARGEHOLCIM LTD (SWITZERLAND)

7.26 BOMANITE INDIA (INDIA)

7.27 MCKNIGHT CUSTOM CONCRETE INC. (US)

7.28 DECO-CRETE

7.29 LLC (US)

7.30 SEACOAST CONCRETE (US)

7.31 WG WEARNE LIMITED (SOUTH AFRICA)

7.32 SUMMIT MATERIALS (US)

7.33 VICAT (FRANCE)

7.34 U.S. CONCRETE INC (US)

7.35 BREEDON GROUP PLC (UK)

Chapter 8: Global Decorative Concrete Market By Region

8.1 Overview

8.2. North America Decorative Concrete Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Stamped

8.2.4.2 Stained

8.2.4.3 Colored

8.2.4.4 Polished

8.2.4.5 Epoxy

8.2.4.6 Concrete

8.2.4.7 Overlays

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Floors

8.2.5.2 Walls

8.2.5.3 Driveways & sidewalks

8.2.5.4 Pool decks

8.2.6 Historic and Forecasted Market Size by End-Use Industry

8.2.6.1 Residential

8.2.6.2 Non-residential

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Decorative Concrete Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Stamped

8.3.4.2 Stained

8.3.4.3 Colored

8.3.4.4 Polished

8.3.4.5 Epoxy

8.3.4.6 Concrete

8.3.4.7 Overlays

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Floors

8.3.5.2 Walls

8.3.5.3 Driveways & sidewalks

8.3.5.4 Pool decks

8.3.6 Historic and Forecasted Market Size by End-Use Industry

8.3.6.1 Residential

8.3.6.2 Non-residential

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Decorative Concrete Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Stamped

8.4.4.2 Stained

8.4.4.3 Colored

8.4.4.4 Polished

8.4.4.5 Epoxy

8.4.4.6 Concrete

8.4.4.7 Overlays

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Floors

8.4.5.2 Walls

8.4.5.3 Driveways & sidewalks

8.4.5.4 Pool decks

8.4.6 Historic and Forecasted Market Size by End-Use Industry

8.4.6.1 Residential

8.4.6.2 Non-residential

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Decorative Concrete Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Stamped

8.5.4.2 Stained

8.5.4.3 Colored

8.5.4.4 Polished

8.5.4.5 Epoxy

8.5.4.6 Concrete

8.5.4.7 Overlays

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Floors

8.5.5.2 Walls

8.5.5.3 Driveways & sidewalks

8.5.5.4 Pool decks

8.5.6 Historic and Forecasted Market Size by End-Use Industry

8.5.6.1 Residential

8.5.6.2 Non-residential

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Decorative Concrete Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Stamped

8.6.4.2 Stained

8.6.4.3 Colored

8.6.4.4 Polished

8.6.4.5 Epoxy

8.6.4.6 Concrete

8.6.4.7 Overlays

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Floors

8.6.5.2 Walls

8.6.5.3 Driveways & sidewalks

8.6.5.4 Pool decks

8.6.6 Historic and Forecasted Market Size by End-Use Industry

8.6.6.1 Residential

8.6.6.2 Non-residential

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Decorative Concrete Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Stamped

8.7.4.2 Stained

8.7.4.3 Colored

8.7.4.4 Polished

8.7.4.5 Epoxy

8.7.4.6 Concrete

8.7.4.7 Overlays

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Floors

8.7.5.2 Walls

8.7.5.3 Driveways & sidewalks

8.7.5.4 Pool decks

8.7.6 Historic and Forecasted Market Size by End-Use Industry

8.7.6.1 Residential

8.7.6.2 Non-residential

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Decorative Concrete Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 19.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.34% |

Market Size in 2032: |

USD 33.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||