Decorative Coatings Market Synopsis

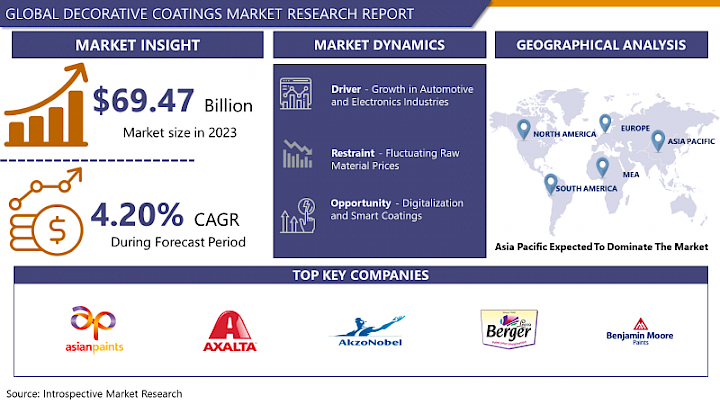

Decorative Coatings Market Size Was Valued at USD 69.47 Billion in 2023 and is Projected to Reach USD 100.60 Billion by 2032, Growing at a CAGR of 4.20% From 2024-2032.

Decorative coatings refer to specialized finishes or coatings applied to surfaces primarily for aesthetic purposes. These coatings enhance the appearance of various substrates, including walls, floors, furniture, and more. They come in diverse forms such as paints, stains, varnishes, and specialty coatings like metallic or textured finishes.

- The applications of decorative coatings are vast and varied. In interior design, they're used to create visually appealing spaces by adding color, texture, and patterns to walls or furniture. In architecture, these coatings protect surfaces while enhancing their visual appeal. Moreover, in industries like automotive and electronics, decorative coatings are applied to enhance product appearance and durability.

- Current trends in the decorative coatings market involve eco-friendly formulations, driven by a growing awareness of sustainability. Low-VOC (volatile organic compound) and water-based coatings are gaining popularity due to their reduced environmental impact. Additionally, there's a rising demand for innovative finishes like metallic and pearlescent coatings, allowing for unique visual effects. Technological advancements have led to coatings with improved durability, scratch resistance, and self-cleaning properties, catering to evolving consumer preferences for long-lasting and low-maintenance solutions.

Decorative Coatings Market Trend Analysis

Growth in Automotive and Electronics Industries

- In the automotive sector, coatings play a crucial role in enhancing aesthetics and providing protection to vehicle surfaces. The rising demand for customized and visually appealing cars has led to increased adoption of specialty coatings that offer unique finishes, textures, and colours. Moreover, these coatings provide functional benefits like scratch resistance and weather durability, meeting consumer expectations for both style and longevity.

- Similarly, in the electronics industry, decorative coatings are applied to various devices and components to improve their appearance and durability. With the increasing demand for consumer electronics, such as smartphones, tablets, and wearables, there's a growing need for coatings that offer not only visual appeal but also protective features like scratch resistance and water repellence.

- As both industries evolve and emphasize product differentiation and aesthetics, the demand for advanced decorative coatings continues to rise. Manufacturers are developing specialized coatings tailored to meet the stringent requirements of automotive and electronics applications, fostering innovation in the market. The symbiotic relationship between these industries and the decorative coatings sector fuels ongoing advancements and drives the market's expansion.

Digitalization and Smart Coatings

- Smart coatings, leveraging technological advancements, offer functionalities beyond traditional coatings, introducing innovations that respond dynamically to environmental stimuli or user interactions. These coatings can possess self-cleaning properties, adapt to changes in temperature or light, or even provide antimicrobial surfaces, catering to diverse industry needs.

- Digitalization contributes to this opportunity by enabling the development of coatings with enhanced functionalities through the incorporation of sensors, nanotechnology, or responsive materials. For instance, coatings embedded with sensors can detect environmental changes and trigger adaptive responses, improving efficiency and performance in various applications.

- These smart coatings find applications in multiple sectors, including architecture, automotive, electronics, and healthcare. In architecture, self-adjusting coatings can contribute to energy efficiency by adapting to temperature changes. In the automotive industry, coatings that respond to external factors like moisture or sunlight enhance durability and aesthetics. Moreover, in healthcare settings, antimicrobial coatings promote hygiene and inhibit the spread of pathogens.

- As industries seek innovative solutions that combine aesthetics with functionality, the development of smart coatings through digitalization presents an opportunity for manufacturers to offer advanced, high-value products that meet the evolving demands for sustainability, efficiency, and performance. This convergence of technology and coatings opens doors for transformative advancements and expanded market reach.

Decorative Coatings Market Segment Analysis:

Decorative Coatings Market Segmented based on resin type, technology, and application.

By Resin Type, Acrylic segment is expected to dominate the market during the forecast period

- The acrylic segment is poised to lead the decorative coatings market throughout the forecast period due to several inherent advantages. Acrylic resins offer exceptional durability, weather resistance, and colour retention properties, making them highly suitable for various applications. Their versatility allows for easy formulation of coatings with varying gloss levels, textures, and finishes, catering to diverse consumer preferences.

- Moreover, acrylic-based decorative coatings exhibit excellent adhesion to different substrates, including wood, concrete, metal, and plastics, enhancing their suitability for a wide range of surfaces in both indoor and outdoor environments. Additionally, acrylic coatings often have lower VOC content compared to other resin types, aligning with the increasing demand for environmentally friendly and low-emission products.

- The ease of application, combined with their excellent performance characteristics and environmental considerations, positions acrylic-based decorative coatings as a preferred choice in the market, contributing to their dominance in the forecasted period.

By Application, Residential segment held the largest market share of 58.2% in 2022

- The residential segment emerged as the dominant sector in the decorative coatings market due to a confluence of factors. With a surge in housing construction, remodeling activities, and an increased focus on aesthetics in home décor, the demand for decorative coatings in residential applications skyrocketed.

- Homeowners' emphasis on personalization and creating visually appealing living spaces contributed significantly to the dominance of decorative coatings in the residential segment. These coatings offer a wide array of colors, finishes, and textures, allowing individuals to express their style and preferences. Additionally, the durability and protective properties of these coatings play a pivotal role in preserving and enhancing surfaces within homes, including walls, ceilings, furniture, and fixtures.

- Furthermore, manufacturers have tailored their offerings to meet the specific requirements of residential applications, introducing eco-friendly, low-VOC formulations that align with consumer preferences for sustainable products. The continuous innovation in decorative coatings to cater to the evolving needs of homeowners solidifies the residential sector's leading position in the market.

Decorative Coatings Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is anticipated to lead the decorative coatings market throughout the forecast period, owing to several contributing factors. The region's robust economic growth, rapid urbanization, and substantial infrastructural development initiatives drive the demand for decorative coatings across various sectors. With burgeoning populations and rising disposable incomes, there's a heightened focus on constructing and renovating residential and commercial spaces, propelling the need for aesthetically pleasing coatings.

- Moreover, the increasing awareness regarding the importance of protective coatings to preserve infrastructure against environmental factors further bolsters market growth. Additionally, manufacturers in the region are investing in research and development to introduce innovative, technologically advanced coatings that cater to diverse consumer preferences and environmental regulations.

- Countries like China, India, and Southeast Asian nations witness significant construction activities and a surge in renovation projects, thereby augmenting the demand for decorative coatings. The region's dominance is attributed to its burgeoning construction industry, burgeoning middle-class population, and the continual evolution of innovative coating solutions tailored to meet the demands of various applications.

Decorative Coatings Market Top Key Players:

- Asian Paints (India)

- Axalta (USA)

- Akzonobel (Netherlands)

- Berger Paints (India)

- Benjamin Moore (USA)

- Basf (Germany)

- Cromology (France)

- Covestro (Germany)

- Dowdupont (USA)

- Daw Se (Germany)

- Dunn-Edwards (USA)

- Duluxgroup (Australia)

- Rpm International (USA)

- The Sherwin-Williams Company (USA)

- Ppg Industries (USA)

- Kansai Paints (Japan)

- Arkema (France)

- Masco Corporation (USA)

- Nippon Paint (Japan)

- Noroo Paint & Coatings (South Korea)

- Nuplex Industries (New Zealand)

- Ring International (Austria)

- Tikkurila (Finland) And Other Major Players

Key Industry Developments in the Decorative Coatings Market:

In May 2023, PPG announced a $44 million investment to upgrade five powder coating manufacturing facilities in the U.S. and Latin America. The projects are part of PPG’s strategic efforts to expand its powder coatings offerings and increase global production to meet growing customer demand for sustainably advantaged products.

In March 2023, Axalta Coating Systems introduced its latest ICONICA collection of Alesta® SD powder coatings, a global line exclusive to the United States market. These coatings, based on a super-durable polyester resin system, combine higher-grade pigments and stabilizers with outstanding exterior durability, extending the life cycle of architectural projects. The collection reflects Axalta's commitment to innovation and sustainability.

|

Global Decorative Coatings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 69.47 Bn |

|

Forecast Period 2024-32 CAGR: |

4.20 % |

Market Size in 2032: |

USD 100.60 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DECORATIVE COATINGS MARKET BY RESIN TYPE (2016-2030)

- DECORATIVE COATINGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACRYLIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POLYURETHANE

- ALKYD

- VINYL

- DECORATIVE COATINGS MARKET BY TECHNOLOGY (2016-2030)

- DECORATIVE COATINGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WOOD COATINGS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EMULSION

- ENAMELS

- PRIMER

- DECORATIVE COATINGS MARKET BY APPLICATION (2016-2030)

- DECORATIVE COATINGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-RESIDENTIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- DECORATIVE COATINGS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ASIAN PAINTS (INDIA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AXALTA (USA)

- AKZONOBEL (NETHERLANDS)

- BERGER PAINTS (INDIA)

- BENJAMIN MOORE (USA)

- BASF (GERMANY)

- CROMOLOGY (FRANCE)

- COVESTRO (GERMANY)

- DOWDUPONT (USA)

- DAW SE (GERMANY)

- DUNN-EDWARDS (USA)

- DULUXGROUP (AUSTRALIA)

- RPM INTERNATIONAL (USA)

- THE SHERWIN-WILLIAMS COMPANY (USA)

- PPG INDUSTRIES (USA)

- KANSAI PAINTS (JAPAN)

- ARKEMA (FRANCE)

- MASCO CORPORATION (USA)

- NIPPON PAINT (JAPAN)

- NOROO PAINT & COATINGS (SOUTH KOREA)

- NUPLEX INDUSTRIES (NEW ZEALAND)

- RING INTERNATIONAL (AUSTRIA)

- TIKKURILA (FINLAND) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL DECORATIVE COATINGS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By RESIN TYPE

- Historic And Forecasted Market Size By TECHNOLOGY

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Decorative Coatings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 69.47 Bn |

|

Forecast Period 2024-32 CAGR: |

4.20 % |

Market Size in 2032: |

USD 100.60 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DECORATIVE COATINGS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DECORATIVE COATINGS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DECORATIVE COATINGS MARKET COMPETITIVE RIVALRY

TABLE 005. DECORATIVE COATINGS MARKET THREAT OF NEW ENTRANTS

TABLE 006. DECORATIVE COATINGS MARKET THREAT OF SUBSTITUTES

TABLE 007. DECORATIVE COATINGS MARKET BY RESIN TYPE

TABLE 008. ACRYLIC MARKET OVERVIEW (2016-2028)

TABLE 009. POLYURETHANE MARKET OVERVIEW (2016-2028)

TABLE 010. ALKYD MARKET OVERVIEW (2016-2028)

TABLE 011. VINYL MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. DECORATIVE COATINGS MARKET BY TECHNOLOGY

TABLE 014. WOOD COATINGS MARKET OVERVIEW (2016-2028)

TABLE 015. EMULSION MARKET OVERVIEW (2016-2028)

TABLE 016. ENAMELS MARKET OVERVIEW (2016-2028)

TABLE 017. PRIMER MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. DECORATIVE COATINGS MARKET BY APPLICATION

TABLE 020. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 021. NON-RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA DECORATIVE COATINGS MARKET, BY RESIN TYPE (2016-2028)

TABLE 023. NORTH AMERICA DECORATIVE COATINGS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 024. NORTH AMERICA DECORATIVE COATINGS MARKET, BY APPLICATION (2016-2028)

TABLE 025. N DECORATIVE COATINGS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE DECORATIVE COATINGS MARKET, BY RESIN TYPE (2016-2028)

TABLE 027. EUROPE DECORATIVE COATINGS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. EUROPE DECORATIVE COATINGS MARKET, BY APPLICATION (2016-2028)

TABLE 029. DECORATIVE COATINGS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC DECORATIVE COATINGS MARKET, BY RESIN TYPE (2016-2028)

TABLE 031. ASIA PACIFIC DECORATIVE COATINGS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 032. ASIA PACIFIC DECORATIVE COATINGS MARKET, BY APPLICATION (2016-2028)

TABLE 033. DECORATIVE COATINGS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA DECORATIVE COATINGS MARKET, BY RESIN TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA DECORATIVE COATINGS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA DECORATIVE COATINGS MARKET, BY APPLICATION (2016-2028)

TABLE 037. DECORATIVE COATINGS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA DECORATIVE COATINGS MARKET, BY RESIN TYPE (2016-2028)

TABLE 039. SOUTH AMERICA DECORATIVE COATINGS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. SOUTH AMERICA DECORATIVE COATINGS MARKET, BY APPLICATION (2016-2028)

TABLE 041. DECORATIVE COATINGS MARKET, BY COUNTRY (2016-2028)

TABLE 042. ASIAN PAINTS: SNAPSHOT

TABLE 043. ASIAN PAINTS: BUSINESS PERFORMANCE

TABLE 044. ASIAN PAINTS: PRODUCT PORTFOLIO

TABLE 045. ASIAN PAINTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. AXALTA: SNAPSHOT

TABLE 046. AXALTA: BUSINESS PERFORMANCE

TABLE 047. AXALTA: PRODUCT PORTFOLIO

TABLE 048. AXALTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. AKZONOBEL: SNAPSHOT

TABLE 049. AKZONOBEL: BUSINESS PERFORMANCE

TABLE 050. AKZONOBEL: PRODUCT PORTFOLIO

TABLE 051. AKZONOBEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BERGER PAINTS: SNAPSHOT

TABLE 052. BERGER PAINTS: BUSINESS PERFORMANCE

TABLE 053. BERGER PAINTS: PRODUCT PORTFOLIO

TABLE 054. BERGER PAINTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. BENJAMIN MOORE: SNAPSHOT

TABLE 055. BENJAMIN MOORE: BUSINESS PERFORMANCE

TABLE 056. BENJAMIN MOORE: PRODUCT PORTFOLIO

TABLE 057. BENJAMIN MOORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BASF: SNAPSHOT

TABLE 058. BASF: BUSINESS PERFORMANCE

TABLE 059. BASF: PRODUCT PORTFOLIO

TABLE 060. BASF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CROMOLOGY: SNAPSHOT

TABLE 061. CROMOLOGY: BUSINESS PERFORMANCE

TABLE 062. CROMOLOGY: PRODUCT PORTFOLIO

TABLE 063. CROMOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. COVESTRO: SNAPSHOT

TABLE 064. COVESTRO: BUSINESS PERFORMANCE

TABLE 065. COVESTRO: PRODUCT PORTFOLIO

TABLE 066. COVESTRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. DOWDUPONT: SNAPSHOT

TABLE 067. DOWDUPONT: BUSINESS PERFORMANCE

TABLE 068. DOWDUPONT: PRODUCT PORTFOLIO

TABLE 069. DOWDUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. DAW SE: SNAPSHOT

TABLE 070. DAW SE: BUSINESS PERFORMANCE

TABLE 071. DAW SE: PRODUCT PORTFOLIO

TABLE 072. DAW SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. DUNN-EDWARDS: SNAPSHOT

TABLE 073. DUNN-EDWARDS: BUSINESS PERFORMANCE

TABLE 074. DUNN-EDWARDS: PRODUCT PORTFOLIO

TABLE 075. DUNN-EDWARDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DULUXGROUP: SNAPSHOT

TABLE 076. DULUXGROUP: BUSINESS PERFORMANCE

TABLE 077. DULUXGROUP: PRODUCT PORTFOLIO

TABLE 078. DULUXGROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. RPM INTERNATIONAL: SNAPSHOT

TABLE 079. RPM INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 080. RPM INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 081. RPM INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. THE SHERWIN-WILLIAMS COMPANY: SNAPSHOT

TABLE 082. THE SHERWIN-WILLIAMS COMPANY: BUSINESS PERFORMANCE

TABLE 083. THE SHERWIN-WILLIAMS COMPANY: PRODUCT PORTFOLIO

TABLE 084. THE SHERWIN-WILLIAMS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. PPG INDUSTRIES: SNAPSHOT

TABLE 085. PPG INDUSTRIES: BUSINESS PERFORMANCE

TABLE 086. PPG INDUSTRIES: PRODUCT PORTFOLIO

TABLE 087. PPG INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. KANSAI PAINTS: SNAPSHOT

TABLE 088. KANSAI PAINTS: BUSINESS PERFORMANCE

TABLE 089. KANSAI PAINTS: PRODUCT PORTFOLIO

TABLE 090. KANSAI PAINTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. ARKEMA: SNAPSHOT

TABLE 091. ARKEMA: BUSINESS PERFORMANCE

TABLE 092. ARKEMA: PRODUCT PORTFOLIO

TABLE 093. ARKEMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. MASCO CORPORATION: SNAPSHOT

TABLE 094. MASCO CORPORATION: BUSINESS PERFORMANCE

TABLE 095. MASCO CORPORATION: PRODUCT PORTFOLIO

TABLE 096. MASCO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. NIPPON PAINT: SNAPSHOT

TABLE 097. NIPPON PAINT: BUSINESS PERFORMANCE

TABLE 098. NIPPON PAINT: PRODUCT PORTFOLIO

TABLE 099. NIPPON PAINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. NOROO PAINT & COATINGS: SNAPSHOT

TABLE 100. NOROO PAINT & COATINGS: BUSINESS PERFORMANCE

TABLE 101. NOROO PAINT & COATINGS: PRODUCT PORTFOLIO

TABLE 102. NOROO PAINT & COATINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. NUPLEX INDUSTRIES: SNAPSHOT

TABLE 103. NUPLEX INDUSTRIES: BUSINESS PERFORMANCE

TABLE 104. NUPLEX INDUSTRIES: PRODUCT PORTFOLIO

TABLE 105. NUPLEX INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. RING INTERNATIONAL: SNAPSHOT

TABLE 106. RING INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 107. RING INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 108. RING INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. TIKKURILA: SNAPSHOT

TABLE 109. TIKKURILA: BUSINESS PERFORMANCE

TABLE 110. TIKKURILA: PRODUCT PORTFOLIO

TABLE 111. TIKKURILA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. OTHERS MAJOR PLAYERS: SNAPSHOT

TABLE 112. OTHERS MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 113. OTHERS MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 114. OTHERS MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DECORATIVE COATINGS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DECORATIVE COATINGS MARKET OVERVIEW BY RESIN TYPE

FIGURE 012. ACRYLIC MARKET OVERVIEW (2016-2028)

FIGURE 013. POLYURETHANE MARKET OVERVIEW (2016-2028)

FIGURE 014. ALKYD MARKET OVERVIEW (2016-2028)

FIGURE 015. VINYL MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. DECORATIVE COATINGS MARKET OVERVIEW BY TECHNOLOGY

FIGURE 018. WOOD COATINGS MARKET OVERVIEW (2016-2028)

FIGURE 019. EMULSION MARKET OVERVIEW (2016-2028)

FIGURE 020. ENAMELS MARKET OVERVIEW (2016-2028)

FIGURE 021. PRIMER MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. DECORATIVE COATINGS MARKET OVERVIEW BY APPLICATION

FIGURE 024. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 025. NON-RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA DECORATIVE COATINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE DECORATIVE COATINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC DECORATIVE COATINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA DECORATIVE COATINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA DECORATIVE COATINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Decorative Coatings Market research report is 2024-2032.

Asian Paints (India), Axalta (USA), AkzoNobel (Netherlands), Berger Paints (India), Benjamin Moore (USA), Basf (Germany), Cromology (France), Covestro (Germany), Dowdupont (USA), Daw Se (Germany), Dunn-Edwards (USA), Duluxgroup (Australia), Rpm International (USA), The Sherwin-Williams Company (USA), Ppg Industries (USA), Kansai Paints (Japan), Arkema (France), Masco Corporation (USA), Nippon Paint (Japan), Noroo Paint & Coatings (South Korea), Nuplex Industries (New Zealand), Ring International (Austria), Tikkurila (Finland) and Other Major Players.

Decorative Coatings Market is segmented into Resin Type, Technology, Application, and region. By Resin Type, the market is categorized into Acrylic, Polyurethane, Alkyd, and Vinyl. By Technology, the market is categorized into Wood Coatings, Emulsions, Enamels, and Primers. By Application, the market is categorized into Residential and non-residential. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Decorative coatings refer to specialized finishes or coatings applied to surfaces primarily for aesthetic purposes. These coatings enhance the appearance of various substrates, including walls, floors, furniture, and more. They come in diverse forms such as paints, stains, varnishes, and specialty coatings like metallic or textured finishes.

Decorative Coatings Market Size Was Valued at USD 69.47 Billion in 2023 and is Projected to Reach USD 100.60 Billion by 2032, Growing at a CAGR of 4.20% From 2024-2032.