Global Data Historian Market Synopsis

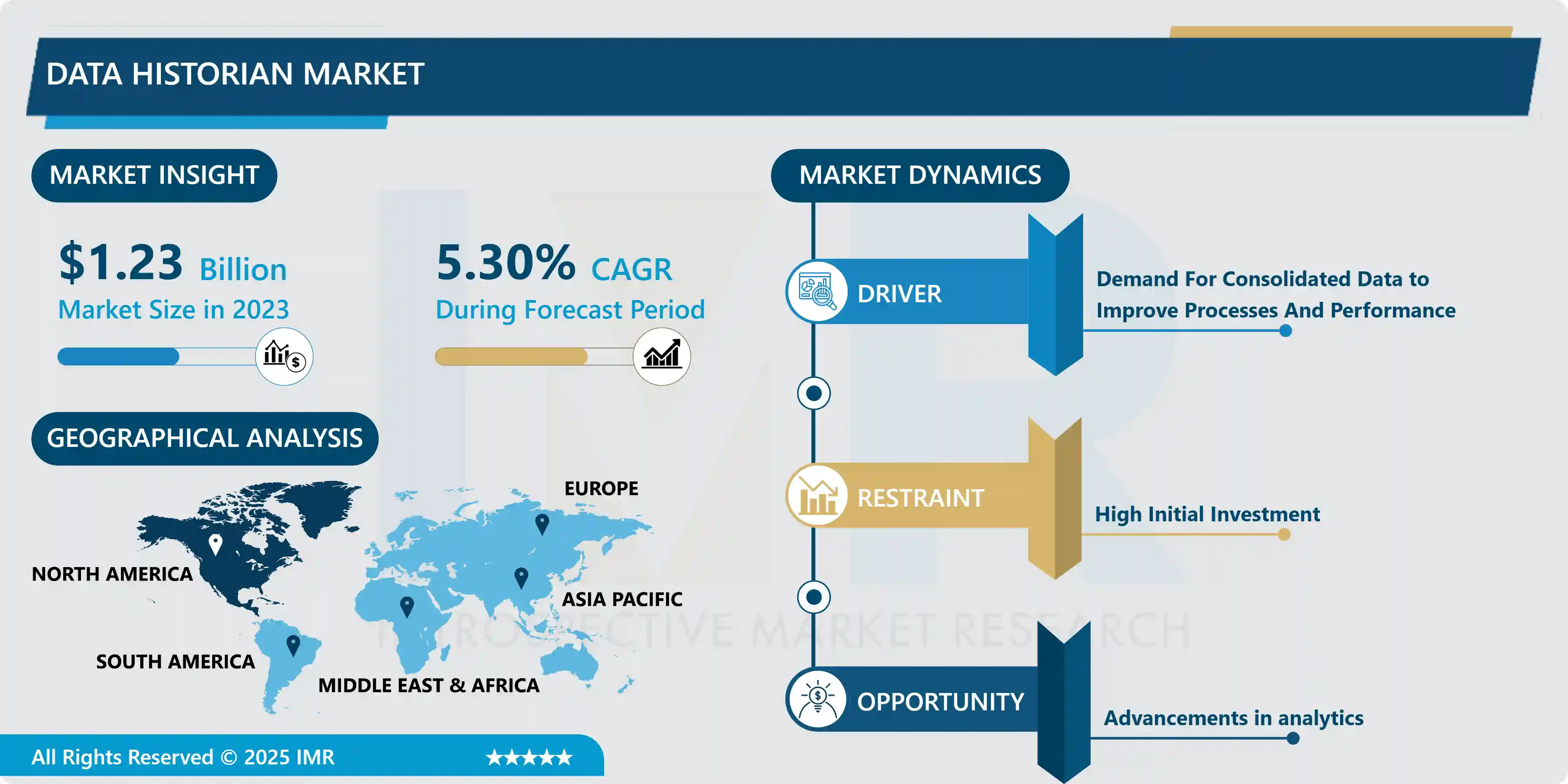

The Data Historian market was worth USD 1.23 Billion in 2023. As such, the forecast is that the market is expected to reach USD 1.96 Billion by 2032 with a CAGR of 5.30% over the period from 2024 to 2032.

A data historian is a software program that records the data of processes running in a computer system. Organizations use data historians to gather information about the operation of programs to diagnose failures when reliability and uptime are critical.

The data historian market is fueled by the increasing adoption of the Industrial Internet of Things (IIoT) and big data analytics across various industries. Data historians are specialized software solutions designed to collect, store, and analyze time-series data generated by industrial processes and equipment. They provide insights for process optimization, predictive maintenance, regulatory compliance, and overall operational efficiency.

The growing demand for real-time data analytics, the need for asset performance management, and the rise of smart manufacturing initiatives. Industries such as manufacturing, energy and utilities, oil and gas, pharmaceuticals, and automotive are among the major adopters of data historian solutions.

The market is characterized by a diverse range of vendors offering both on-premises and cloud-based data historian solutions. Established players have long been dominant in this space, offering robust and scalable solutions tailored to the needs of industrial customers.

The data historian market is expected to continue its growth trajectory, driven by factors such as the increasing digitization of industrial processes, the proliferation of connected devices, and the growing importance of data-driven insights in optimizing operational performance and ensuring regulatory compliance.

The number of Internet of Things (IoT) devices worldwide was 9.76 billion in 2020. In 2023, there were 15.14 billion consumer devices. IoT devices are used in all types of industry verticals and consumer markets, with the consumer segment accounting for around 60 percent of all IoT-connected devices in 2020.

Global Data Historian Market Trend Analysis

Demand For Consolidated Data to Improve Processes And Performance

- The Data Historian Market is experiencing a surge in demand driven by the need for consolidated data to enhance processes and performance across various industries. Data historians play a critical role in capturing, storing, and analyzing time-series data from industrial processes, machinery, and equipment. These solutions enable organizations to effectively monitor operations, identify trends, troubleshoot issues, and optimize performance.

- Data Historian Market is the growing emphasis on data-driven decision-making. Businesses recognize the importance of leveraging historical data to gain insights into past performance, predict future trends, and make informed decisions. Data historians provide a centralized repository for storing vast amounts of time-stamped data, enabling organizations to conduct thorough analyses and extract valuable insights.

- As organizations strive for operational excellence and seek to optimize their processes, the demand for advanced analytics capabilities within data historian platforms is on the rise. Features such as predictive maintenance, anomaly detection, and machine learning algorithms enable organizations to proactively identify potential issues, optimize resource utilization, and drive continuous improvement initiatives.

Advancements in analytics Create an Opportunity for the Global Data Historian Market

- The integration of advanced analytics techniques within Data Historian platforms. Traditional Data Historians have primarily focused on data storage and retrieval, providing a historical record of process variables. With the advent of machine learning, artificial intelligence, and predictive analytics, Data Historians can now offer much more than mere data archival.

- By leveraging advanced analytics capabilities, Data Historians can provide actionable insights in real-time, enabling businesses to optimize operations, improve efficiency, and reduce downtime. Predictive maintenance, for instance, utilizes historical data to forecast equipment failures before they occur, allowing for proactive maintenance interventions and minimizing costly downtime.

- The integration of AI-driven anomaly detection algorithms within Data Historians enables the early identification of deviations from normal operating conditions. This proactive approach not only enhances operational efficiency but also improves quality control and ensures regulatory compliance.

- Data Historians with Industrial Internet of Things (IIoT) devices and sensors. The proliferation of connected devices across industrial environments generates vast streams of real-time data, which can be seamlessly integrated with Data Historians for comprehensive analysis. This convergence of IIoT and Data Historians enables businesses to gain deeper insights into their operations, identify optimization opportunities, and drive informed decision-making.

Global Data Historian Market Segment Analysis:

Global Data Historian Market is Segment divided into Component, Application, Deployment Mode, Organization Size, and End User.

By Component, the Software/Tools segment is expected to dominate the market during the forecast period.

- Data historians are vital tools for organizations across various sectors, enabling them to collect, store, and analyze vast amounts of time-series data for operational insights and decision-making. Within this market, the Software/Tools segment encompasses a wide array of offerings tailored to meet the diverse needs of businesses, driving its dominance.

- Software/Tools segment benefits from the increasing adoption of advanced analytics and machine learning techniques within industries. These tools offer sophisticated functionalities for data analysis, visualization, and predictive modeling, empowering businesses to extract actionable insights from historical data stored in data historians. As organizations seek to derive greater value from their data assets, they are increasingly turning to feature-rich software solutions that enhance their analytical capabilities.

- Software vendors are thus innovating to deliver scalable, interoperable platforms that seamlessly integrate with existing infrastructure, further bolstering the dominance of the Software/Tools segment.

By End User, the IT and data centers segment held the largest share of 29.5% in 2023.

- The IT and data centers segment dominates the Data Historian Market by End User. With the exponential growth in data generation and storage requirements within these sectors, the demand for efficient data management solutions like data historians is escalating. Data historians play a pivotal role in these environments by capturing, storing, and analyzing vast amounts of historical data from various sources, enabling informed decision-making, troubleshooting, and performance optimization.

- In IT and data center operations, where uptime, reliability, and efficiency are paramount, data historians provide valuable insights into system performance, resource utilization, and predictive maintenance. Moreover, with the increasing adoption of cloud computing, edge computing, and IoT devices, the need for robust data management solutions offered by data historians becomes even more pronounced, solidifying the dominance of this segment in the market landscape.

Global Data Historian Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is poised to assert dominance in the Data Historian Market, driven by factors such as technological advancements, widespread adoption of Industrial Internet of Things (IIoT) solutions, and the presence of major market players. The region's mature industrial infrastructure and a high concentration of key industries like manufacturing, energy, and healthcare contribute to its leading position.

- Moreover, stringent regulatory requirements regarding data management and the need for real-time analytics further fuel the demand for data historian solutions. Additionally, initiatives aimed at digital transformation across various sectors bolster market growth. With a strong emphasis on innovation and a robust technological ecosystem, North America is anticipated to maintain its prominent position in the global data historian market, offering lucrative opportunities for market players and stakeholders alike.

Global Data Historian Market Top Key Players:

- GE (US)

- ABB (Switzerland)

- Emerson (US)

- Siemens (Germany)

- AVEVA (UK)

- Honeywell (US)

- Rockwell Automation (US)

- OSIsoft (US)

- ICONICS (US)

- IBM (US)

- Yokogawa (Japan)

- PTC (US)

- Inductive Automation (US)

- Canary Labs (US)

- Open Automation Software (US)

- InfluxData (US)

- Progea (Italy)

- Kx Systems (US)

- SORBA (US)

- Savigent Software (US)

- Automsoft (Ireland)

- LiveData Utilities (US)

- Industrial Video & Control (US)

- Aspen Technology (US)

- COPA-DATA (Austria), Other Active players

Key Industry Developments:-

- In March 2024: TDengine announced the release of a new connector to integrate Wonderware Historian (now known as AVEVA Historian) into its industrial data platform. With the addition of this connector, TDengine now offers a zero-code option for replicating Wonderware data to TDengine out-of-the-box, expanding its efforts to assist industrial enterprises in accelerating digital transformation and modernizing their data infrastructure.

- In October 2023: TDengine, the next-generation data historian, announced the release of new connectors to support OPC-UA, OPC-DA, and MQTT protocols. These connectors deliver a zero-code solution to easily ingest Industrial Internet of Things (IIoT) data into the TDengine platform, giving enterprises an accessible and affordable solution for modern data management and analytics.

- In July 2023, TDengine, the popular open-source time-series data platform, announced today that TDengine Cloud is available for purchase in AWS Marketplace, a digital catalog with thousands of software listings from independent software vendors (ISVs) that makes it easy to find, test, buy, and deploy software that runs on Amazon Web Services (AWS).

|

Global Data Historian Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024- 2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.30% |

Market Size in 2032: |

USD 1.96 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Deployment Mode |

|

||

|

By Organization Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Historian Market by Component (2018-2032)

4.1 Data Historian Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software/Tools

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Data Historian Market by Application (2018-2032)

5.1 Data Historian Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Production Tracking

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Environmental Auditing

5.5 Asset Performance Management

5.6 GRC Management

5.7 Predictive Maintenance

5.8 Others (security and quality control management)

Chapter 6: Data Historian Market by Deployment Mode (2018-2032)

6.1 Data Historian Market Snapshot and Growth Engine

6.2 Market Overview

6.3 On-premises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cloud

Chapter 7: Data Historian Market by Organization Size (2018-2032)

7.1 Data Historian Market Snapshot and Growth Engine

7.2 Market Overview

7.3 SMEs

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Large Enterprises

Chapter 8: Data Historian Market by End User (2018-2032)

8.1 Data Historian Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Oil and Gas

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Marine

8.5 Chemicals and Petrochemicals

8.6 Paper and Pulp

8.7 Metal and Mining

8.8 Others (IT and data centers

8.9 transportation

8.10 Power and Utilities

8.11 and pharmaceuticals)

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Data Historian Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 IBM (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MICROSOFT (US)

9.4 SALESFORCE (US)

9.5 BROADCOM (US)

9.6 OKTA (US)

9.7 AKAMAI TECHNOLOGIES (US)

9.8 PING IDENTITY (US)

9.9 FORGEROCK (US)

9.10 HID GLOBAL (US)

9.11 MANAGEENGINE (US)

9.12 ACUANT (US)

9.13 SECUREAUTH (US)

9.14 WSO2 (US)

9.15 AWS (US)

9.16 SIMEIO SOLUTIONS (US)

9.17 AUTH0 (US)

9.18 CYBERARK (US)

9.19 ONELOGIN (US)

9.20 TRUSONA (US)

9.21 FUSIONAUTH (US)

9.22 STRATA IDENTITY (US)

9.23 EVIDENT (US)

9.24 WIDASCONCEPTS (GERMANY)

9.25 IDNOW (GERMANY)

9.26 ONEWELCOME (NETHERLAND)

9.27

Chapter 10: Global Data Historian Market By Region

10.1 Overview

10.2. North America Data Historian Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Component

10.2.4.1 Software/Tools

10.2.4.2 Services

10.2.5 Historic and Forecasted Market Size by Application

10.2.5.1 Production Tracking

10.2.5.2 Environmental Auditing

10.2.5.3 Asset Performance Management

10.2.5.4 GRC Management

10.2.5.5 Predictive Maintenance

10.2.5.6 Others (security and quality control management)

10.2.6 Historic and Forecasted Market Size by Deployment Mode

10.2.6.1 On-premises

10.2.6.2 Cloud

10.2.7 Historic and Forecasted Market Size by Organization Size

10.2.7.1 SMEs

10.2.7.2 Large Enterprises

10.2.8 Historic and Forecasted Market Size by End User

10.2.8.1 Oil and Gas

10.2.8.2 Marine

10.2.8.3 Chemicals and Petrochemicals

10.2.8.4 Paper and Pulp

10.2.8.5 Metal and Mining

10.2.8.6 Others (IT and data centers

10.2.8.7 transportation

10.2.8.8 Power and Utilities

10.2.8.9 and pharmaceuticals)

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Data Historian Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Component

10.3.4.1 Software/Tools

10.3.4.2 Services

10.3.5 Historic and Forecasted Market Size by Application

10.3.5.1 Production Tracking

10.3.5.2 Environmental Auditing

10.3.5.3 Asset Performance Management

10.3.5.4 GRC Management

10.3.5.5 Predictive Maintenance

10.3.5.6 Others (security and quality control management)

10.3.6 Historic and Forecasted Market Size by Deployment Mode

10.3.6.1 On-premises

10.3.6.2 Cloud

10.3.7 Historic and Forecasted Market Size by Organization Size

10.3.7.1 SMEs

10.3.7.2 Large Enterprises

10.3.8 Historic and Forecasted Market Size by End User

10.3.8.1 Oil and Gas

10.3.8.2 Marine

10.3.8.3 Chemicals and Petrochemicals

10.3.8.4 Paper and Pulp

10.3.8.5 Metal and Mining

10.3.8.6 Others (IT and data centers

10.3.8.7 transportation

10.3.8.8 Power and Utilities

10.3.8.9 and pharmaceuticals)

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Data Historian Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Component

10.4.4.1 Software/Tools

10.4.4.2 Services

10.4.5 Historic and Forecasted Market Size by Application

10.4.5.1 Production Tracking

10.4.5.2 Environmental Auditing

10.4.5.3 Asset Performance Management

10.4.5.4 GRC Management

10.4.5.5 Predictive Maintenance

10.4.5.6 Others (security and quality control management)

10.4.6 Historic and Forecasted Market Size by Deployment Mode

10.4.6.1 On-premises

10.4.6.2 Cloud

10.4.7 Historic and Forecasted Market Size by Organization Size

10.4.7.1 SMEs

10.4.7.2 Large Enterprises

10.4.8 Historic and Forecasted Market Size by End User

10.4.8.1 Oil and Gas

10.4.8.2 Marine

10.4.8.3 Chemicals and Petrochemicals

10.4.8.4 Paper and Pulp

10.4.8.5 Metal and Mining

10.4.8.6 Others (IT and data centers

10.4.8.7 transportation

10.4.8.8 Power and Utilities

10.4.8.9 and pharmaceuticals)

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Data Historian Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Component

10.5.4.1 Software/Tools

10.5.4.2 Services

10.5.5 Historic and Forecasted Market Size by Application

10.5.5.1 Production Tracking

10.5.5.2 Environmental Auditing

10.5.5.3 Asset Performance Management

10.5.5.4 GRC Management

10.5.5.5 Predictive Maintenance

10.5.5.6 Others (security and quality control management)

10.5.6 Historic and Forecasted Market Size by Deployment Mode

10.5.6.1 On-premises

10.5.6.2 Cloud

10.5.7 Historic and Forecasted Market Size by Organization Size

10.5.7.1 SMEs

10.5.7.2 Large Enterprises

10.5.8 Historic and Forecasted Market Size by End User

10.5.8.1 Oil and Gas

10.5.8.2 Marine

10.5.8.3 Chemicals and Petrochemicals

10.5.8.4 Paper and Pulp

10.5.8.5 Metal and Mining

10.5.8.6 Others (IT and data centers

10.5.8.7 transportation

10.5.8.8 Power and Utilities

10.5.8.9 and pharmaceuticals)

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Data Historian Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Component

10.6.4.1 Software/Tools

10.6.4.2 Services

10.6.5 Historic and Forecasted Market Size by Application

10.6.5.1 Production Tracking

10.6.5.2 Environmental Auditing

10.6.5.3 Asset Performance Management

10.6.5.4 GRC Management

10.6.5.5 Predictive Maintenance

10.6.5.6 Others (security and quality control management)

10.6.6 Historic and Forecasted Market Size by Deployment Mode

10.6.6.1 On-premises

10.6.6.2 Cloud

10.6.7 Historic and Forecasted Market Size by Organization Size

10.6.7.1 SMEs

10.6.7.2 Large Enterprises

10.6.8 Historic and Forecasted Market Size by End User

10.6.8.1 Oil and Gas

10.6.8.2 Marine

10.6.8.3 Chemicals and Petrochemicals

10.6.8.4 Paper and Pulp

10.6.8.5 Metal and Mining

10.6.8.6 Others (IT and data centers

10.6.8.7 transportation

10.6.8.8 Power and Utilities

10.6.8.9 and pharmaceuticals)

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Data Historian Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Component

10.7.4.1 Software/Tools

10.7.4.2 Services

10.7.5 Historic and Forecasted Market Size by Application

10.7.5.1 Production Tracking

10.7.5.2 Environmental Auditing

10.7.5.3 Asset Performance Management

10.7.5.4 GRC Management

10.7.5.5 Predictive Maintenance

10.7.5.6 Others (security and quality control management)

10.7.6 Historic and Forecasted Market Size by Deployment Mode

10.7.6.1 On-premises

10.7.6.2 Cloud

10.7.7 Historic and Forecasted Market Size by Organization Size

10.7.7.1 SMEs

10.7.7.2 Large Enterprises

10.7.8 Historic and Forecasted Market Size by End User

10.7.8.1 Oil and Gas

10.7.8.2 Marine

10.7.8.3 Chemicals and Petrochemicals

10.7.8.4 Paper and Pulp

10.7.8.5 Metal and Mining

10.7.8.6 Others (IT and data centers

10.7.8.7 transportation

10.7.8.8 Power and Utilities

10.7.8.9 and pharmaceuticals)

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Data Historian Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024- 2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.30% |

Market Size in 2032: |

USD 1.96 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Deployment Mode |

|

||

|

By Organization Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||