Data Center Server Market Synopsis

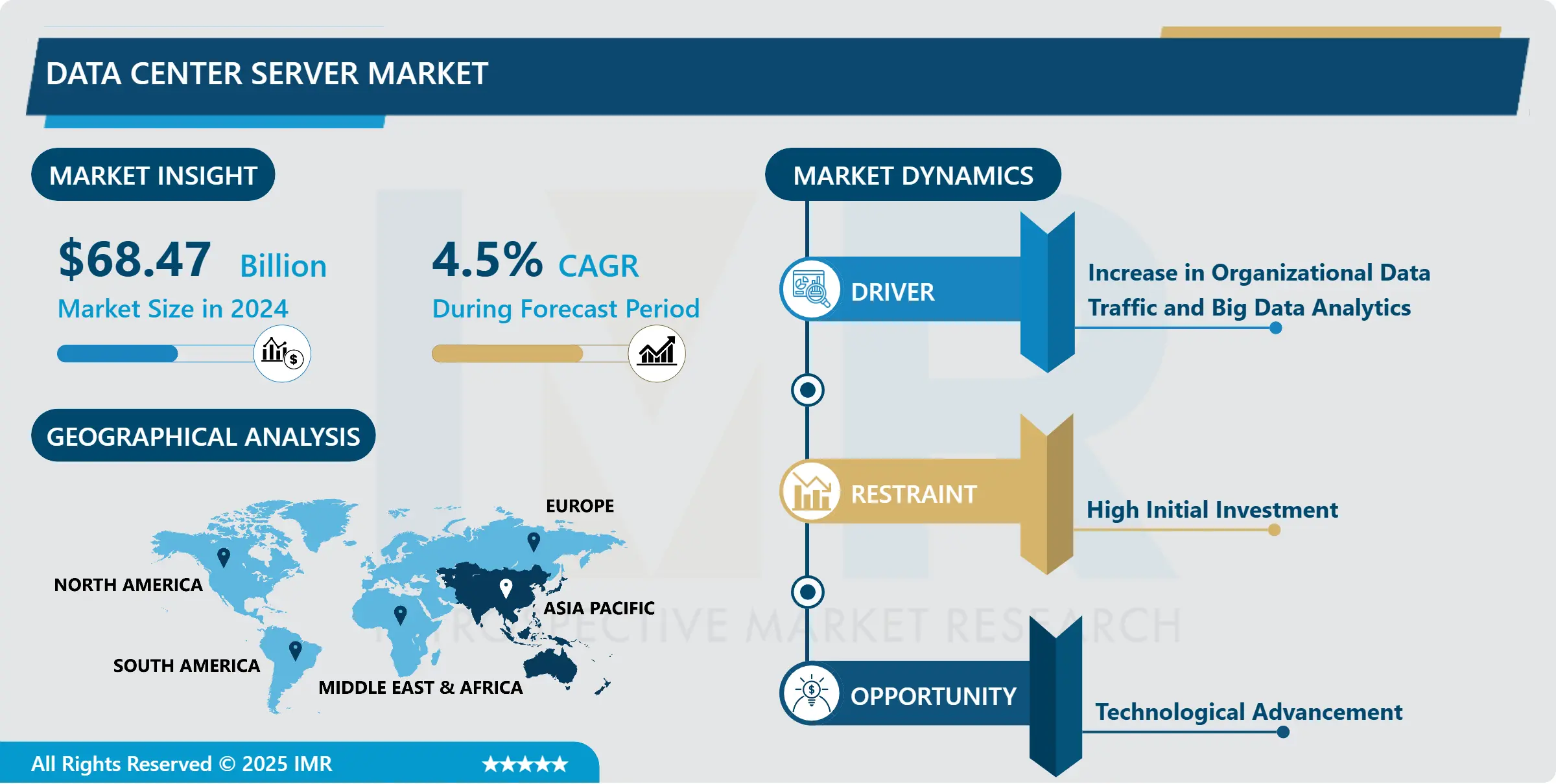

The Data Center Server Market was valued at USD 68.47 Billion in 2024 and is projected to reach USD 97.37 Billion by 2032, growing at a CAGR of 4.5% from 2025 to 2032.

The Data Center Server Market refers to the global industry that encompasses the manufacturing, distribution, and utilization of servers within data centers. Data centers are essential facilities that house computer systems, storage devices, networking equipment, and other hardware components required for the storage, processing, and management of digital data. Servers are the workhorses of these data centers, providing the computational power and storage capacity needed to support various applications and services, including cloud computing, big data analytics, and online services.

In recent years, the Data Center Server Market has witnessed significant growth and evolution due to the increasing demand for digital services and the proliferation of data-driven technologies. This market is characterized by a wide range of server types, including rack servers, blade servers, tower servers, and microservers, each designed to cater to specific data center requirements. Furthermore, the market includes both physical server hardware and virtualized server instances, as virtualization technologies have become integral to optimizing data center resources.

Several key drivers fuel the expansion of the Data Center Server Market. The first is the exponential growth of data generated by businesses, individuals, and IoT devices, necessitating larger and more efficient data centers with powerful servers to handle the workload. Additionally, the migration towards cloud computing solutions has led to increased server deployments by cloud service providers. Moreover, the pursuit of energy efficiency and sustainability has prompted the development of energy-efficient server designs, aligning with global environmental concerns.

Competition in this market is fierce, with major players such as Dell Technologies, Hewlett Packard Enterprise (HPE), IBM, and Cisco Systems dominating the landscape. These companies continually innovate to produce servers that offer improved performance, reliability, and scalability while also addressing concerns about energy consumption and environmental impact.

The Data Center Server Market Trend Analysis

The Data Center Server Market Drivers- Increase in Organisational Data Traffic and Big Data Analytics

- The Data Center Server Market has experienced a significant boost in recent years, primarily attributed to the surge in organizational data traffic and the growing importance of big data analytics. This dynamic shift in the business landscape has compelled companies to rethink their data center strategies, leading to increased investments in server infrastructure.

- One of the primary drivers of the Data Center Server Market is the exponential growth in organizational data traffic. As businesses expand their digital presence and embrace digital transformation, the volume of data generated and processed has soared. This surge is due to factors such as online transactions, social media interactions, IoT devices, and the proliferation of digital content. To effectively manage and process this massive influx of data, companies are compelled to upgrade and expand their data center server infrastructure. Modern servers need to handle not only increased data traffic but also ensure low latency and high availability, thus driving the demand for more powerful and efficient server solutions.

- Big data analytics has emerged as a critical tool for organizations to extract valuable insights and make data-driven decisions. To harness the potential of big data, companies need robust server infrastructure capable of processing and analyzing vast datasets efficiently. Traditional servers often fall short in handling the complex computations required for advanced analytics, prompting businesses to invest in specialized servers optimized for big data workloads. These servers are equipped with high-performance processors, ample memory, and storage capacity, enabling organizations to derive actionable insights from their data quickly.

The Data Center Server Market Opportunity- Technological Advancement

- Technological advancement stands as a pivotal opportunity for the Data Center Server market, catalyzing innovation and shaping the landscape of data center infrastructure.

- Technological advancements in server hardware, including more powerful processors, faster memory, and high-speed networking interfaces, enable data centers to achieve unprecedented levels of performance. This allows organizations to process and analyze data at lightning speeds, accommodating the demands of resource-intensive applications like artificial intelligence, machine learning, and real-time analytics. Enhanced server capabilities translate into improved operational efficiency and greater competitive advantage.

- The growing concern for environmental sustainability and energy conservation has driven significant advancements in energy-efficient server designs. Modern servers are equipped with features like advanced power management, optimized cooling systems, and components designed for lower power consumption. As a result, data centers can reduce their carbon footprint and operational costs while aligning with global efforts to address climate change.

Data Center Server Market Segment Analysis

Data Center Server Market segments cover the Type, Source, and Distribution Channel. By source Rack Servers segment is Anticipated to Dominate the Market Over the Forecast period.

- In the Data Center Server market, rack servers have emerged as a dominant and widely adopted type segment, playing a pivotal role in the architecture of modern data centers. These servers are favored for their versatility, scalability, and efficiency, making them the preferred choice for many organizations as they seek to meet the ever-growing demands of data processing and storage.

- Rack servers are characterized by their compact, standardized design, which allows them to be mounted in industry-standard racks or enclosures. This standardization offers several advantages. It simplifies the deployment process, as these servers can be easily integrated into existing rack infrastructure, minimizing installation time and complexity. Additionally, their modular design facilitates maintenance and upgrades, reducing downtime and operational disruptions.

- One of the key drivers of rack servers' dominance is their scalability. Organizations can expand their computing capabilities by adding more rack servers to their data center racks, making it a cost-effective solution that can grow with the evolving needs of the business. This scalability is crucial in accommodating the increasing data volumes generated by modern applications, such as cloud computing, big data analytics, and e-commerce platforms.

Data Center Server Market Regional Insights:

Asia-Pacific is dominating the Market Over the Forecast Period.

- The Asia-Pacific region has emerged as a dominant force in the Data Center Server market, reflecting its pivotal role in the global data center landscape. This region encompasses a diverse and dynamic market, driven by rapid technological advancements, burgeoning digital economies, and a growing demand for data processing and storage capabilities.

- One of the primary factors contributing to the dominance of the Asia-Pacific region is its sheer size and population. With countries like China and India at the forefront, the region is home to a substantial portion of the world's population. This demographic scale results in massive data generation, prompting businesses and organizations to invest heavily in data center infrastructure to manage and leverage this data effectively. Moreover, the Asia-Pacific region has witnessed robust economic growth and urbanization, leading to an expansion of industries ranging from e-commerce and cloud services to telecommunications and manufacturing. These industries heavily rely on data centers to support their operations, fueling the demand for servers. Consequently, data center server vendors have targeted the Asia-Pacific market with tailored solutions to meet the diverse needs of these industries.

COVID-19 Impact Analysis on Data Center Server Market

The COVID-19 pandemic had a significant impact on the Data Center Server market. As businesses accelerated their digital transformation efforts to adapt to remote work and increased online activities, the demand for data center servers surged. Data center providers witnessed a heightened need for server capacity to support remote collaboration tools, e-commerce platforms, and healthcare data processing. However, supply chain disruptions and lockdowns temporarily affected server production and deployment. Over time, the pandemic highlighted the critical role of data centers and led to increased investments in server infrastructure to ensure business continuity, thereby reshaping the market's priorities and growth trajectory.

Data Center Server Market Key Player

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- IBM

- FUJITSU

- Cisco Systems Inc.

- Lenovo

- Oracle

- Huawei Technologies Co. Ltd.

- NEC Corporation

- Vertiv Group Corp

- Schneider Electric

- Atos SE

- Inspur

- Super Micro Computer Inc.

- Sify Technologies Limited

- Delta Power Solutions

- Donwil Company

- NETRACK

- Hivelocity Inc.

- Racklive

- Maysteel Other Major Player.

Key Industry Developments in the Data Center Server Market

- In July 2023, Lenovo announced its next wave of data management innovation with new ThinkSystem DG Enterprise Storage Arrays and ThinkSystem DM3010H Enterprise Storage Arrays, designed to make it easier for organizations to enable AI workloads and unlock value from their data.

- In April 2023, IBM unveiled new single frame and rack mount configurations of IBM z16 and IBM LinuxONE 4, expanding their capabilities to a broader range of data center environments.

|

Data Center Server Market |

||||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 68.47 Bn. |

|

|

Forecast Period 2024-32 CAGR: |

4.5 % |

Market Size in 2032: |

USD 97.37 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Data Center Size |

|

|

||

|

By End User |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Center Server Market by Type (2018-2032)

4.1 Data Center Server Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rack Servers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Blade Servers

4.5 Micro Servers

4.6 Tower Servers

Chapter 5: Data Center Server Market by Data Center Size (2018-2032)

5.1 Data Center Server Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium

5.5 Large

Chapter 6: Data Center Server Market by End User (2018-2032)

6.1 Data Center Server Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 IT and Telecom

6.5 Government

6.6 Healthcare

6.7 Energy

6.8 Manufacturing

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Data Center Server Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DELL TECHNOLOGIES (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HEWLETT PACKARD ENTERPRISE (US)

7.4 NETAPP (US)

7.5 IBM CORPORATION (US)

7.6 PURE STORAGE (US)

7.7 WESTERN DIGITAL CORPORATION (US)

7.8 SEAGATE TECHNOLOGY (US)

7.9 CISCO SYSTEMS INC. (US)

7.10 NUTANIX INC. (US)

7.11 MICRON TECHNOLOGY INC. (US)

7.12 QUANTUM CORPORATION (US)

7.13 COHESITY INC. (US)

7.14 SUPER MICRO COMPUTER INC. (US)

7.15 COMMVAULT SYSTEMS INC. (US)

7.16 SNOWFLAKE INC. (US)

7.17 DATADIRECT NETWORKS (US)

7.18 LENOVO GROUP (CHINA)

7.19 HUAWEI TECHNOLOGIES COLTD. (CHINA)

7.20 HITACHI VANTARA (JAPAN)

7.21 FUJITSU LIMITED (JAPAN)

7.22 NEC CORPORATION (JAPAN)

7.23 TOSHIBA CORPORATION (JAPAN)

7.24 KIOXIA HOLDINGS CORPORATION (JAPAN)

7.25 INFINIDAT (ISRAEL)

7.26 VEEAM SOFTWARE (SWITZERLAND)

7.27

Chapter 8: Global Data Center Server Market By Region

8.1 Overview

8.2. North America Data Center Server Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Rack Servers

8.2.4.2 Blade Servers

8.2.4.3 Micro Servers

8.2.4.4 Tower Servers

8.2.5 Historic and Forecasted Market Size by Data Center Size

8.2.5.1 Small

8.2.5.2 Medium

8.2.5.3 Large

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 BFSI

8.2.6.2 IT and Telecom

8.2.6.3 Government

8.2.6.4 Healthcare

8.2.6.5 Energy

8.2.6.6 Manufacturing

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Data Center Server Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Rack Servers

8.3.4.2 Blade Servers

8.3.4.3 Micro Servers

8.3.4.4 Tower Servers

8.3.5 Historic and Forecasted Market Size by Data Center Size

8.3.5.1 Small

8.3.5.2 Medium

8.3.5.3 Large

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 BFSI

8.3.6.2 IT and Telecom

8.3.6.3 Government

8.3.6.4 Healthcare

8.3.6.5 Energy

8.3.6.6 Manufacturing

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Data Center Server Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Rack Servers

8.4.4.2 Blade Servers

8.4.4.3 Micro Servers

8.4.4.4 Tower Servers

8.4.5 Historic and Forecasted Market Size by Data Center Size

8.4.5.1 Small

8.4.5.2 Medium

8.4.5.3 Large

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 BFSI

8.4.6.2 IT and Telecom

8.4.6.3 Government

8.4.6.4 Healthcare

8.4.6.5 Energy

8.4.6.6 Manufacturing

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Data Center Server Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Rack Servers

8.5.4.2 Blade Servers

8.5.4.3 Micro Servers

8.5.4.4 Tower Servers

8.5.5 Historic and Forecasted Market Size by Data Center Size

8.5.5.1 Small

8.5.5.2 Medium

8.5.5.3 Large

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 BFSI

8.5.6.2 IT and Telecom

8.5.6.3 Government

8.5.6.4 Healthcare

8.5.6.5 Energy

8.5.6.6 Manufacturing

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Data Center Server Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Rack Servers

8.6.4.2 Blade Servers

8.6.4.3 Micro Servers

8.6.4.4 Tower Servers

8.6.5 Historic and Forecasted Market Size by Data Center Size

8.6.5.1 Small

8.6.5.2 Medium

8.6.5.3 Large

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 BFSI

8.6.6.2 IT and Telecom

8.6.6.3 Government

8.6.6.4 Healthcare

8.6.6.5 Energy

8.6.6.6 Manufacturing

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Data Center Server Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Rack Servers

8.7.4.2 Blade Servers

8.7.4.3 Micro Servers

8.7.4.4 Tower Servers

8.7.5 Historic and Forecasted Market Size by Data Center Size

8.7.5.1 Small

8.7.5.2 Medium

8.7.5.3 Large

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 BFSI

8.7.6.2 IT and Telecom

8.7.6.3 Government

8.7.6.4 Healthcare

8.7.6.5 Energy

8.7.6.6 Manufacturing

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Data Center Server Market |

||||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 68.47 Bn. |

|

|

Forecast Period 2024-32 CAGR: |

4.5 % |

Market Size in 2032: |

USD 97.37 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Data Center Size |

|

|

||

|

By End User |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||