Cyclohexene Market Synopsis

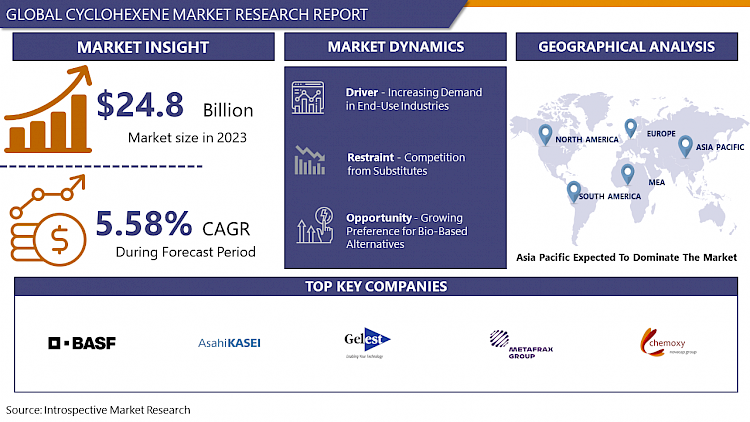

Cyclohexene Market Size Was Valued at USD 24.8 Billion in 2023 and is Projected to Reach USD 40.43 Billion by 2032, Growing at a CAGR of 5.58% from 2024-2032.

Cyclohexene is a colorless liquid hydrocarbon with the chemical formula C6H10. It is a cyclic alkene derived from cyclohexane through the removal of a hydrogen atom. Cyclohexene is primarily used in the production of adipic acid, a key precursor in nylon manufacturing. It also serves as a solvent in various industries and as a chemical intermediate in the synthesis of organic compounds

The cyclohexene market refers to the global trade and consumption patterns of cyclohexene, a crucial chemical compound primarily utilized in the production of adipic acid, is a key component in the manufacture of nylon. As a colorless liquid hydrocarbon, cyclohexene is derived from cyclohexane through the removal of a hydrogen atom, making it an essential intermediate in various chemical processes.

- The market dynamics of cyclohexene are influenced by factors such as the demand for nylon and its derivatives, which are extensively used in industries like automotive, textiles, and packaging. The cyclohexene market is affected by trends in chemical manufacturing and solvent applications across different sectors.

- The market is spread across regions with significant industrial bases, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. Each region contributes to the global consumption and production of cyclohexene, with varying demand patterns driven by economic growth, industrialization, and regulatory policies.

- The cyclohexene market is crucial for its role as a chemical intermediate and solvent, production of essential materials like nylon, and its responsiveness to market changes.

Cyclohexene Market Trend Analysis

Increasing Demand in End-Use Industries

- The Cyclohexene market witnessed a surge driven by increasing demand in end-use industries, marking a pivotal growth factor in recent years. Industries such as automotive, pharmaceuticals, and agrochemicals have prominently contributed to the demand. Cyclohexene is widely used in the automotive industry for producing nylon, used in gears, bearings, and bushings. It also serves as a solvent in coatings and paints. In the pharmaceutical industry, it is a key intermediate in the synthesis of antihistamines and analgesics due to its versatility and efficacy in chemical reactions.

- Furthermore, the agrochemical industry relies on Cyclohexene for the production of pesticides and herbicides, where it acts as a crucial precursor in the synthesis of active ingredients.

- The increasing demand from these end-use industries has propelled the Cyclohexene market forward, fostering innovation and driving market players to expand their production capacities to meet the growing needs of various sectors. This trend is expected to continue, further solidifying Cyclohexene's position as a vital component in numerous industrial applications.

Growing Preference for Bio-Based Alternatives

- The growing preference for bio-based alternatives presents a significant opportunity for the Cyclohexene market. As environmental concerns continue to escalate and regulations become stricter, industries are increasingly shifting towards sustainable and renewable resources. Cyclohexene, a key chemical intermediate derived from petroleum, is facing scrutiny due to its association with fossil fuels and environmental degradation.

- Bio-based alternatives offer a compelling solution to these challenges. Produced from renewable feedstocks such as biomass, bio-based Cyclohexene reduces reliance on finite fossil resources and decreases carbon emissions. Additionally, bio-based production processes often require less energy and generate fewer harmful by-products, further enhancing their appeal.

- Consumer demand for eco-friendly products is driving industries to adopt bio-based Cyclohexene in various applications, including the production of plastics, resins, and solvents. Moreover, government incentives and regulations promoting the use of renewable chemicals further stimulate market growth.

- Companies investing in research and development to enhance the efficiency and scalability of bio-based Cyclohexene production stand to gain a competitive edge in the market. Collaborations across the value chain, from feedstock suppliers to end-users, can accelerate innovation and market adoption.

Cyclohexene Market Segment Analysis:

Cyclohexene Market Segmented on the basis of Application, and End-User.

By Application, Adipic Acid segment is expected to dominate the market during the forecast period

- Adipic Acid, a key derivative of Cyclohexene, utilization in the production of nylon 6,6, which is extensively used in manufacturing textiles, automotive components, carpets, and other consumer goods. Its versatility extends to the production of polyurethane resins, coatings, and plasticizers, further fueling its demand.

- The Adipic Acid's role in the synthesis of various chemicals and polymers amplifies its significance in the market. Industries such as automotive, construction, packaging, and textiles rely heavily on Adipic Acid, thereby consolidating its position as the leading application segment within the Cyclohexene market.

- The growing emphasis on sustainable practices and environmental regulations is driving the demand for Adipic Acid, owing to its potential for bio-based production methods and eco-friendly applications. These factors collectively contribute to the prominence of the Adipic Acid segment, shaping the dynamics of the Cyclohexene market.

By End-User, Paints & Coatings segment held the largest share of xx% in 2022

- The paints and coatings segment exerts significant dominance in the cyclohexene market. Cyclohexene, a key chemical intermediate, finds extensive application in the formulation of various paints and coatings due to its properties such as excellent solvency and compatibility with resins. Within this segment, cyclohexene serves as a crucial component in the production of coatings for automotive, architectural, industrial, and decorative purposes.

- The demand for cyclohexene in paints and coatings is primarily driven by the flourishing construction and automotive industries worldwide. With rapid urbanization, infrastructural developments, and increasing automotive production, the need for high-performance coatings has surged, propelling the growth of the cyclohexene market. Moreover, stringent regulations pertaining to VOC emissions have led to the adoption of eco-friendly coatings, further boosting the utilization of cyclohexene-based formulations.

- Furthermore, ongoing research and development efforts aimed at enhancing the performance and sustainability of coatings are expected to fuel the demand for cyclohexene in the paints and coatings segment, reinforcing its dominance in the market.

Cyclohexene Market Regional Insights:

Asia Pacific is expected to dominate the Market over the Forecast period

- The Asia Pacific area's growing industrial sector, especially in nations like China, India, and Japan, is one of the main factors driving the cyclohexene market in that region. These countries have strong manufacturing capacities and are rapidly industrializing and urbanizing, which is driving up demand for items made from cyclohexene.

- Cyclohexene, a key chemical intermediate used in the production of various products including nylon, plastics, and solvents, is witnessing rising demand primarily due to its versatile applications across industries such as automotive, construction, and packaging.

- The favourable government policies aimed at promoting industrial growth and investments in infrastructure development further contribute to the expansion of the cyclohexene market in the region. The increasing focus on sustainability and environmentally-friendly manufacturing processes is driving the adoption of cyclohexene-based products, as it can be produced from renewable resources and offers lower environmental impact compared to alternatives.

- The Asia Pacific region benefits from a large pool of skilled labour and technological advancements, facilitating innovation and research in the cyclohexene sector. This fosters the development of new applications and enhances production efficiency, thereby bolstering market growth.

- The strategic location of the Asia Pacific region also plays a pivotal role, enabling easy access to raw materials and facilitating trade with other global markets. This, combined with the presence of established chemical manufacturers and a growing network of distribution channels, further the region's position as a dominant force in the cyclohexene market.

Cyclohexene Market Top Key Players:

- The Dow Chemical Company (US)

- CITGO Petroleum Corporation (US)

- Gelest (United States)

- Chevron Phillips Chemical Company (US)

- Chemoxy (United Kingdom)

- Metadynea Austria (Austria)

- CEPSA (Spain)

- Clariant (Switzerland)

- BP Refining & Petrochemicals GmbH (Germany)

- BASF (Germany)

- Reliance Industries Limited (India)

- China Petroleum & Chemical Corporation (China)

- Shenma Group (China)

- Tangshan Zhonghao (China)

- Idemitsu Kosan Co., Ltd (Japan)

- Asahi Kasei Group (Japan), and Other Major Players

Key Industry Developments in the Cyclohexene Market:

- In December 2023, Asahi Kasei Corp. and Asahi Kasei Medical Co., Ltd. unveil the Asahi Kasei (China) Bioprocess Technical Center (CBTC) in Suzhou, Jiangsu, China, on November 23, 2023. The CBTC aims to enhance support for China's pharmaceutical sector by offering practical tests and technical assistance for bioprocess and Microza™ products. This initiative underscores Asahi Kasei's commitment to advancing biotherapeutics manufacturing safety and efficiency in China.

|

Global Cyclohexene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.58 % |

Market Size in 2032: |

USD 40.43 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CYCLOHEXENE MARKET BY APPLICATION (2017-2030)

- CYCLOHEXENE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ADIPIC ACID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CAPROLACTAM

- CYCLOHEXENE MARKET BY END-USER (2017-2030)

- CYCLOHEXENE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAINTS AND COATINGS

- TEXTILE

- CONSTRUCTION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Cyclohexene Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- GELEST (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CHEMOXY (UNITED KINGDOM)

- METADYNEA AUSTRIA (AUSTRIA)

- ASAHI KASEI GROUP (JAPAN)

- SHENMA GROUP (CHINA)

- TANGSHAN ZHONGHAO (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL CYCLOHEXENE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Cyclohexene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.58 % |

Market Size in 2032: |

USD 40.43 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CYCLOHEXENE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CYCLOHEXENE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CYCLOHEXENE MARKET COMPETITIVE RIVALRY

TABLE 005. CYCLOHEXENE MARKET THREAT OF NEW ENTRANTS

TABLE 006. CYCLOHEXENE MARKET THREAT OF SUBSTITUTES

TABLE 007. CYCLOHEXENE MARKET BY TYPE

TABLE 008. CONTENT ABOVE 99% MARKET OVERVIEW (2016-2028)

TABLE 009. CONTENT BELOW 99% MARKET OVERVIEW (2016-2028)

TABLE 010. CYCLOHEXENE MARKET BY APPLICATION

TABLE 011. INTERMEDIATES MARKET OVERVIEW (2016-2028)

TABLE 012. SOLVENT MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA CYCLOHEXENE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA CYCLOHEXENE MARKET, BY APPLICATION (2016-2028)

TABLE 015. N CYCLOHEXENE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE CYCLOHEXENE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE CYCLOHEXENE MARKET, BY APPLICATION (2016-2028)

TABLE 018. CYCLOHEXENE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC CYCLOHEXENE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC CYCLOHEXENE MARKET, BY APPLICATION (2016-2028)

TABLE 021. CYCLOHEXENE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA CYCLOHEXENE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA CYCLOHEXENE MARKET, BY APPLICATION (2016-2028)

TABLE 024. CYCLOHEXENE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA CYCLOHEXENE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA CYCLOHEXENE MARKET, BY APPLICATION (2016-2028)

TABLE 027. CYCLOHEXENE MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASAHI KASEI GROUP: SNAPSHOT

TABLE 029. ASAHI KASEI GROUP: BUSINESS PERFORMANCE

TABLE 030. ASAHI KASEI GROUP: PRODUCT PORTFOLIO

TABLE 031. ASAHI KASEI GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. SHENMA GROUP: SNAPSHOT

TABLE 032. SHENMA GROUP: BUSINESS PERFORMANCE

TABLE 033. SHENMA GROUP: PRODUCT PORTFOLIO

TABLE 034. SHENMA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. CHEMOXY: SNAPSHOT

TABLE 035. CHEMOXY: BUSINESS PERFORMANCE

TABLE 036. CHEMOXY: PRODUCT PORTFOLIO

TABLE 037. CHEMOXY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. GELEST: SNAPSHOT

TABLE 038. GELEST: BUSINESS PERFORMANCE

TABLE 039. GELEST: PRODUCT PORTFOLIO

TABLE 040. GELEST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. METADYNEA AUSTRIA: SNAPSHOT

TABLE 041. METADYNEA AUSTRIA: BUSINESS PERFORMANCE

TABLE 042. METADYNEA AUSTRIA: PRODUCT PORTFOLIO

TABLE 043. METADYNEA AUSTRIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. TANGSHAN ZHONGHAO: SNAPSHOT

TABLE 044. TANGSHAN ZHONGHAO: BUSINESS PERFORMANCE

TABLE 045. TANGSHAN ZHONGHAO: PRODUCT PORTFOLIO

TABLE 046. TANGSHAN ZHONGHAO: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CYCLOHEXENE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CYCLOHEXENE MARKET OVERVIEW BY TYPE

FIGURE 012. CONTENT ABOVE 99% MARKET OVERVIEW (2016-2028)

FIGURE 013. CONTENT BELOW 99% MARKET OVERVIEW (2016-2028)

FIGURE 014. CYCLOHEXENE MARKET OVERVIEW BY APPLICATION

FIGURE 015. INTERMEDIATES MARKET OVERVIEW (2016-2028)

FIGURE 016. SOLVENT MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA CYCLOHEXENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE CYCLOHEXENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC CYCLOHEXENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA CYCLOHEXENE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA CYCLOHEXENE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Cyclohexene Market research report is 2023-2032.

The Dow Chemical Company (US), CITGO Petroleum Corporation (US), Gelest (United States), Chevron Phillips Chemical Company (US), Chemoxy (United Kingdom), Metadynea Austria (Austria), CEPSA (Spain), Clariant (Switzerland), BP Refining & Petrochemicals GmbH (Germany), BASF (Germany), Reliance Industries Limited (India), China Petroleum & Chemical Corporation (China), Shenma Group (China), Tangshan Zhonghao (China), Idemitsu Kosan Co., Ltd (Japan), Asahi Kasei Group (Japan).and Other Major Players.

The Cyclohexene Market is segmented into Application, End-User, and region. By Application, the market is categorized into Adipic Acid and Caprolactam. By End-User, the market is categorized into Automotive, Paints and Coatings, Textile, and Construction. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cyclohexene is a colorless liquid hydrocarbon with the chemical formula C6H10. It is a cyclic alkene derived from cyclohexane through the removal of a hydrogen atom. Cyclohexene is primarily used in the production of adipic acid, a key precursor in nylon manufacturing. It also serves as a solvent in various industries and as a chemical intermediate in the synthesis of organic compounds.

Cyclohexene Market Size Was Valued at USD 24.8 Billion in 2023 and is Projected to Reach USD 40.43 Billion by 2032, Growing at a CAGR of 5.58% from 2024-2032.