Cybersecurity Market Synopsis

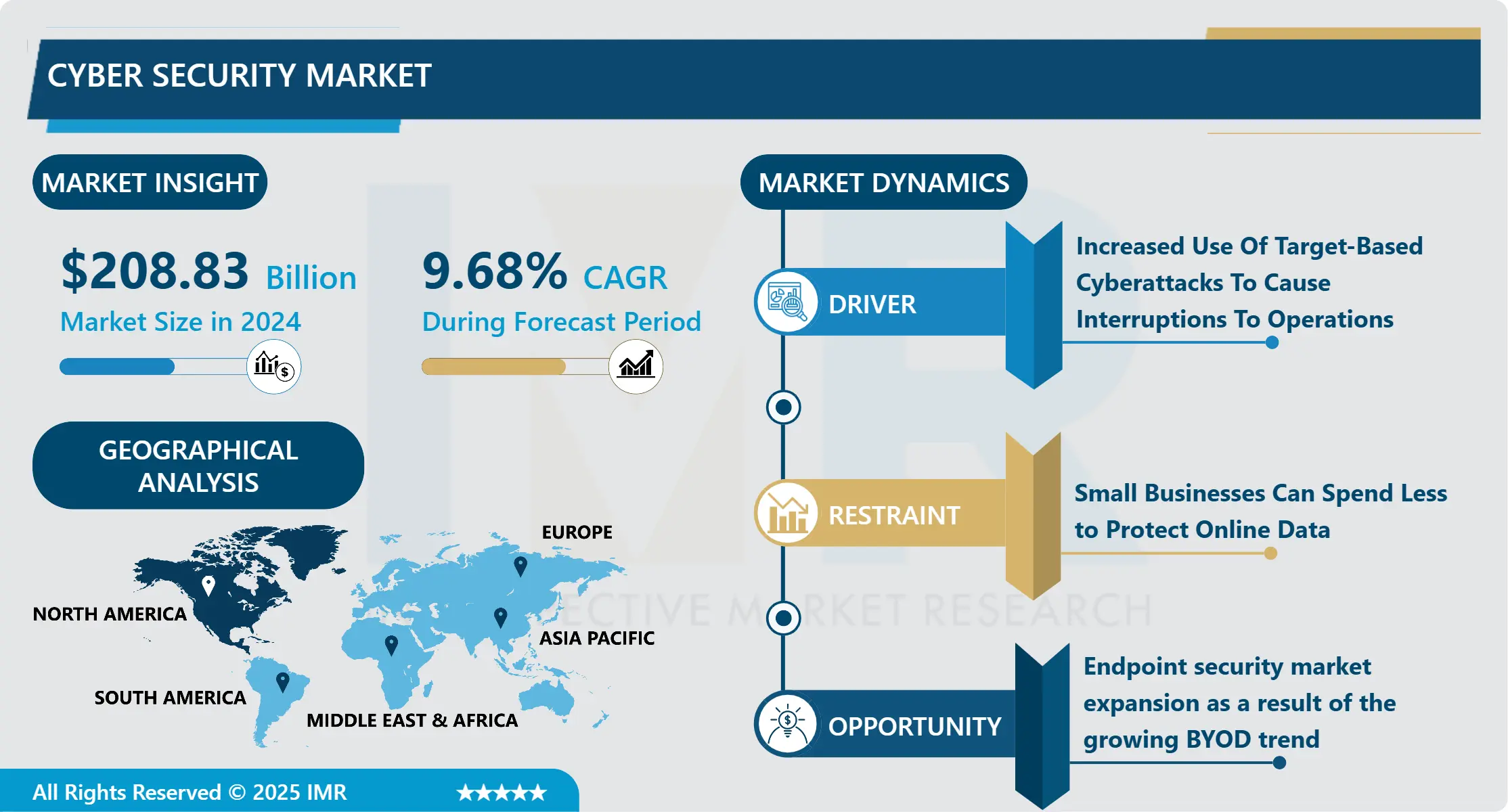

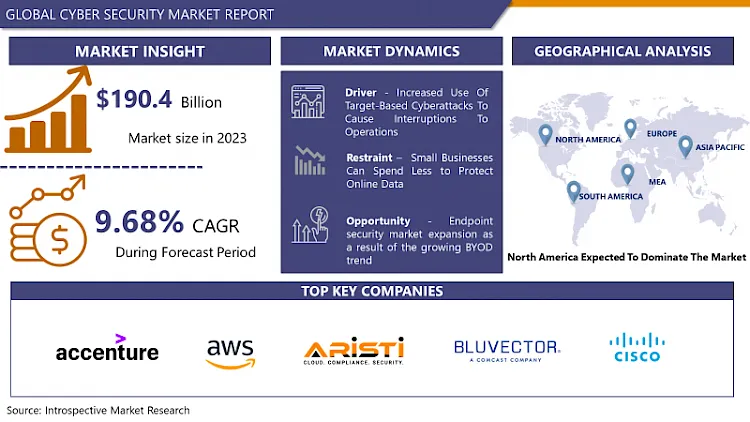

Cyber Security Market Size is Valued at USD 208.83 Billion in 2024 and is Projected to Reach USD 437.33 Billion by 2032, Growing at a CAGR of 9.68% From 2025-2032.

Cybersecurity is the practice of protecting computer systems, networks, and data from digital attacks. These attacks often aim to access, steal, or damage sensitive information or disrupt normal business operations. Cybersecurity measures include the use of technologies, processes, and controls to secure devices, networks, and data from unauthorized access or attacks.

The activity referred to as cyber security aims at preventing cyber crimes done by shelling or attacking computer systems and networks. These attacks often are about getting and/or to destroy important data or by slowing down the working processes. Cybersecurity methods are essentially a mix of technical, procedural, and control components that ensure that your devices, networks, and data are not accessed or attacked by unauthorized people.

The cybersecurity market is just growing at a high rate due to the fact that cyber threats have become an every day story across the industries. As digital technologies become increasingly used and various systems remain interconnected, the ability to preserve sensitive data and secure critical infrastructure from cyber-attacks has been identified as the key to ensure security. In addition, the emerging of cloud computing, the Internet of Things (IoT) and mobile devices has broadened the spectrum suitable for cyber-attacks, contributing to the need for enhancing security against cyber-attacks.

Compliance to the laws and regulations is also a major concern. Governments in different parts of the world are introducing data protection laws and rules which are stringent like, General Data Protection Regulations in Europe and the California Consumer Privacy Acts in the US. Organizations are now spending heavily on cybersecurity solutions as part of the effort to keep hackers out and evade huge penalties in the case that their data is breached.

Finally, the advent of IoT and the digitization of enterprises nearly results in a barrage of data considered as precious information in need of cybersecurity investment to protect it. As the business operations digitize, cybersecurity becomes the important tool of the business risk management strategy. Thus, advanced security solutions and services are in much demand.

Cyber Security Market Trend Analysis

Securing Tomorrow, Trends Driving the Cybersecurity Market Expansion

- The cybersecurity market is currently developing very rapidly as a result of the growing number of cyber threats, experience with disruptive digital transformation, and stricter legal controls. Through different industries, a large amount of capital is being injected into cybersecurity companies so that adequate measures are provided to the networks, systems, and information of businesses that may be attacked virtually.

- It is one major trend in the setting up security cloud solutions. Organizations switches from traditionalness based on-premises security solutions such as firewalls and antivirus software to cloud-based solutions that have scalability, flexibility and ultimately cost-effectiveness as a result of growing adoption of cloud services.

- Data Privacy and Protection signification is another factor which is worth mentioning. Establishment of such laws like the CCPA and the GDPR now makes the companies to take the conservation of the sensitive and personal data with utmost concern. The demand for the services offering the identity and access management, encryption, and data loss prevention has boosted using the solutions.

Unveiling Lucrative Avenues in the Cybersecurity Sector Amidst Rising Cyber Threats and Digitization Trends

- Owing to the high variety and size of cyber-attacks usage and the advance corporate Internet technologies, possibilities in cyber security become an attractive proposition. Secure cybersecurity measures must be implemented in order to protect sensitive information and guard the key systems as many business sectors are on the way of bettering themselves through digital transformation.

- It is the cyber-security managers' knowledge of finding and reacting to advanced threats that determines the growth in the industry. While keeping tabs on cybersecurity risks is becoming ever more problematic as of the rise of technically complex cyber threats, for example, phishing, ransomware, and insider threats, enterprises are still looking for solutions that will be able to anticipate these risks, and mitigate their consequences.

- The advent of cloud-based security systems usher in the possibility of other emergent opportunities too. Since there is an incremental number of companies moving their processes to the cloud, the number of enterprises that need cloud-native security solutions to protect data, workloads, and applications is also on the rise, as the cyberattacks are increasingly becoming a real threat.

- However, along with the compliance needs, enterprises tend to invest in cyber tools that deal with compliance itself, such as those which are associated with the General Data Protection Regulation and the California Consumer Privacy Act.

Cyber Security Market Segment Analysis:

Cyber Security Market is segmented on the basis of Type, Development Type, and Software, End user.

By Type, Solution segment is expected to dominate the market during the forecast period

- In the cybersecurity sector, offerings typically fall into two main categories: ready alternatives and offers.

- As part of sustainable fashion, transparent methods of production such as organic agriculture, fair working conditions, and eco-friendly manufacturing are adopted. Cyber disruption systems comprise of a variety of products that are meant to safeguard practically all the systems, networks, and information against cyber threats. By implementing these technologies as antivirus software, firewalls, intrusion detection systems, and encryption tools, the organization would have a great foundation for its information security. In the other hand, cybersecurity services encompass professional services provided to organizations by cybersecurity professionals through the assessment of security priorities, the development and implantation of security strategies and response and recovery from security events.

- These services can include the provision of the security consultancy, vulnerability detection, incident response, as well as the training provision. These providers extend a hand in the entire process of risk assessment and response to changing cybersecurity threats, as well as help to counter disruptive acts from cyber criminals by strengthening the defensive posture of the organizations.

By Software, IAM segment held the largest share

- In the domain of cybersecurity software, several important categories emerge in terms of providing an adequate level of protection for data assets. The identity and access management solutions are of utmost important in terms of manage and control users’ permission to system and data in order to prevent non- authorized individuals from getting the access.

- Software encryption and tokenization are key element of data safety that ensures the data safety both while at rest and in transiting which is coded and can only be decoded when the correct encryption key or token is applied. Besides, there are numerous computer cybersecurity software tools that are widely used, these include anti-virus programs, firewalls, and intrusion detection systems which are meant to discover, block, or respond to cyber threat. Such software solutions are instrumental in the (overall) cybersecurity plan and they play a crucial role in fighting organizations against various types of cyber threats and risks.

Cyber Security Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Cybersecurity sales in North America is one of the most developed and the red-hot markets. It is comprised of the whole set of cybersecurity products and services, which makes it possible to build up the necessary protection against the various online threats and break-ins. In North America, the demand for cyber security solutions continues to climb as attacks grow in complexity, and businesses experience a constant drive to digitize.

- The market reveals the features of the high level of competition among the multitude of local and international companies offering a diversified variety of products and services. To mention only the top companies involved in the cybersecurity industry in North America we have Palo Alto Networks Inc. , Cisco Systems Inc. , IBM Corporation, and Symantec Corporation.

- One of main force behind the cybersecurity market's growth in North America is due to number of infrastructure. Examples include frequent attacks by hacker and data theft as well as the increasing use of cloud computing and mobile devices by industry players, and the continually rising expenses that companies face in complying with the laws about the protection of the general public’s data.

- In general, the market for cybersecurity in North America is not only rife with great potential but also with a number of hindrances. There are a number of issues which emerge here; namely, the tremendous expenses involved in the cybersecurity implementation, the issue of specialist deficiency and the complexity of cyber security threats.

Active Key Players in the Cyber Security Market

- Accenture (Ireland)

- Amazon Web Services (AWS) (US)

- Aristi Labs (India)

- BluVector (US)

- Cisco(US)

- CyberArk (US)

- DataVisor (US)

- F5 (US)

- Fortinet (US)

- F-Secure (Finland)

- IBM(US)

- Imperva (US)

- Micro Focus (UK)

- Microsoft (US)

- NortonLifeLock (US)

- Oracle (US)

- Palo Alto Networks (US)

- Qualys (US)

- Rapid7 (US)

- RevBits (US)

- SentinelOne (US)

- Trellix (US)

- Trend Micro (Japan)

- WiJungle (India)

- Others Active player

Key Industry Developments in the Cyber Security Market:

- March 2023 "Project Quantum Leap," an innovative project from IBM, aims to advance the field of commercial quantum computing. This large-scale effort represents a major advancement in the field and IBM's dedication to pushing the limits of quantum technology. Furthermore, IBM and NASA have established a strategic alliance centered on joint asteroid detection initiatives.

- June 2022 Forti Recon, a complete Digital Risk Protection Service (DRPS) service from Fortinet, is designed to manage an organization's risk posture and provide actionable advice on how to safeguard data, organizational assets, and brand reputation. It offers an exclusive triple play of outside-in protection: brand protection (BP), adversary-centric intelligence (ACI), and external attack surface management (EASM).

|

Global Cyber Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 208.83 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.68 % |

Market Size in 2032: |

USD 437.33 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Type |

|

||

|

By Software |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cybersecurity Market by Type (2018-2032)

4.1 Cybersecurity Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Cybersecurity Market by Deployment Type (2018-2032)

5.1 Cybersecurity Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-Premise

Chapter 6: Cybersecurity Market by Software (2018-2032)

6.1 Cybersecurity Market Snapshot and Growth Engine

6.2 Market Overview

6.3 IAM

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Encryption and Tokenization

6.5 Other Software

Chapter 7: Cybersecurity Market by End Users (2018-2032)

7.1 Cybersecurity Market Snapshot and Growth Engine

7.2 Market Overview

7.3 BFSI

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 IT and Telecommunications

7.5 Retail

7.6 Healthcare

7.7 Government

7.8 Manufacturing

7.9 Travel and Transportation

7.10 Energy and Utilities

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cybersecurity Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MAKE MUSIC (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MAESTRO MUSIC SOFTWARE (US)

8.4 PRESONUS AUDIO ELECTRONICS (US)

8.5 NOTEWORTHY SOFTWARE (US)

8.6 PASSPORT MUSIC SOFTWARE (US)

8.7 SION SOFTWARE (US)

8.8 PRESONUS AUDIO ELECTRONICS (US)

8.9 AVID PRO TOOLS (US)

8.10 WAVEFORM FREE (US)

8.11 AUDACITY (US)

8.12 ADOBE AUDITION (US)

8.13 GARAGEBAND (US)

8.14 STUDIO ONE (US)

8.15 LOGIC PRO (US)

8.16 REAPER (US)

8.17 MAESTRO MUSIC SOFTWARE (US)

8.18 ACID PRO (CANADA)

8.19 CUBASE (GERMANY)

8.20 LUGERT VERLAG (GERMANY)

8.21 NOTATION SOFTWARE (GERMANY)

8.22 ABLETON LIVE (GERMANY)

8.23 BITWIG STUDIO (GERMANY)

8.24 FL STUDIO (BELGIUM)

8.25 UNIVERSAL MUSIC GROUP (NETHERLANDS)

8.26 BANDLAB (SINGAPORE)

8.27 AND OTHER ACTIVE KEY PLAYERS

Chapter 9: Global Cybersecurity Market By Region

9.1 Overview

9.2. North America Cybersecurity Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Solution

9.2.4.2 Services

9.2.5 Historic and Forecasted Market Size by Deployment Type

9.2.5.1 Cloud

9.2.5.2 On-Premise

9.2.6 Historic and Forecasted Market Size by Software

9.2.6.1 IAM

9.2.6.2 Encryption and Tokenization

9.2.6.3 Other Software

9.2.7 Historic and Forecasted Market Size by End Users

9.2.7.1 BFSI

9.2.7.2 IT and Telecommunications

9.2.7.3 Retail

9.2.7.4 Healthcare

9.2.7.5 Government

9.2.7.6 Manufacturing

9.2.7.7 Travel and Transportation

9.2.7.8 Energy and Utilities

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cybersecurity Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Solution

9.3.4.2 Services

9.3.5 Historic and Forecasted Market Size by Deployment Type

9.3.5.1 Cloud

9.3.5.2 On-Premise

9.3.6 Historic and Forecasted Market Size by Software

9.3.6.1 IAM

9.3.6.2 Encryption and Tokenization

9.3.6.3 Other Software

9.3.7 Historic and Forecasted Market Size by End Users

9.3.7.1 BFSI

9.3.7.2 IT and Telecommunications

9.3.7.3 Retail

9.3.7.4 Healthcare

9.3.7.5 Government

9.3.7.6 Manufacturing

9.3.7.7 Travel and Transportation

9.3.7.8 Energy and Utilities

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cybersecurity Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Solution

9.4.4.2 Services

9.4.5 Historic and Forecasted Market Size by Deployment Type

9.4.5.1 Cloud

9.4.5.2 On-Premise

9.4.6 Historic and Forecasted Market Size by Software

9.4.6.1 IAM

9.4.6.2 Encryption and Tokenization

9.4.6.3 Other Software

9.4.7 Historic and Forecasted Market Size by End Users

9.4.7.1 BFSI

9.4.7.2 IT and Telecommunications

9.4.7.3 Retail

9.4.7.4 Healthcare

9.4.7.5 Government

9.4.7.6 Manufacturing

9.4.7.7 Travel and Transportation

9.4.7.8 Energy and Utilities

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cybersecurity Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Solution

9.5.4.2 Services

9.5.5 Historic and Forecasted Market Size by Deployment Type

9.5.5.1 Cloud

9.5.5.2 On-Premise

9.5.6 Historic and Forecasted Market Size by Software

9.5.6.1 IAM

9.5.6.2 Encryption and Tokenization

9.5.6.3 Other Software

9.5.7 Historic and Forecasted Market Size by End Users

9.5.7.1 BFSI

9.5.7.2 IT and Telecommunications

9.5.7.3 Retail

9.5.7.4 Healthcare

9.5.7.5 Government

9.5.7.6 Manufacturing

9.5.7.7 Travel and Transportation

9.5.7.8 Energy and Utilities

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cybersecurity Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Solution

9.6.4.2 Services

9.6.5 Historic and Forecasted Market Size by Deployment Type

9.6.5.1 Cloud

9.6.5.2 On-Premise

9.6.6 Historic and Forecasted Market Size by Software

9.6.6.1 IAM

9.6.6.2 Encryption and Tokenization

9.6.6.3 Other Software

9.6.7 Historic and Forecasted Market Size by End Users

9.6.7.1 BFSI

9.6.7.2 IT and Telecommunications

9.6.7.3 Retail

9.6.7.4 Healthcare

9.6.7.5 Government

9.6.7.6 Manufacturing

9.6.7.7 Travel and Transportation

9.6.7.8 Energy and Utilities

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cybersecurity Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Solution

9.7.4.2 Services

9.7.5 Historic and Forecasted Market Size by Deployment Type

9.7.5.1 Cloud

9.7.5.2 On-Premise

9.7.6 Historic and Forecasted Market Size by Software

9.7.6.1 IAM

9.7.6.2 Encryption and Tokenization

9.7.6.3 Other Software

9.7.7 Historic and Forecasted Market Size by End Users

9.7.7.1 BFSI

9.7.7.2 IT and Telecommunications

9.7.7.3 Retail

9.7.7.4 Healthcare

9.7.7.5 Government

9.7.7.6 Manufacturing

9.7.7.7 Travel and Transportation

9.7.7.8 Energy and Utilities

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Cyber Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 208.83 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.68 % |

Market Size in 2032: |

USD 437.33 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Type |

|

||

|

By Software |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||