Crab Market Synopsis

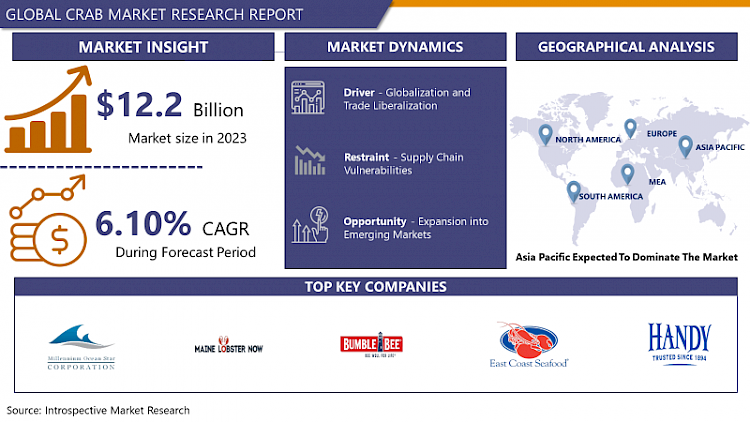

Crab Market Size Was Valued at USD 12.2 Billion in 2023, and is Projected to Reach USD 20.8 Billion by 2032, Growing at a CAGR of 6.10 % From 2024-2032.

A crab market is a specialized market where different types of crab are bought and sold for consumption, often in the seafood industry these markets can vary greatly in size, from smaller local vendors selling fresh crabs to wholesale supermarkets providing restaurants and retailers selling regionally or internationally Common features location, seasonality, local fishing regulations Depending on factors such as these. In some areas, certain types of crab, such as blue crab or Dungeness crab, can be especially valuable for their flavor and texture, leading to higher demand and potentially higher market prices Crab markets serve especially in delivering crabs to fishermen or crab eaters, so fresh and high-quality seafood : In addition to ensuring that food reaches the world’s table, crab markets are an important center of trade and commerce, it provides economic activity develops and supports livelihoods in coastal communities dependent on crab fishing and related industries

- This increased demand has created huge opportunities for suppliers and distributors operating within the market. In response to evolving consumer aspirations, there has been a marked shift towards more sustainable and ethical brands, with consumers placing increased emphasis on traceability and production is clearly in the supply chain

- Furthermore, advances in technology and transportation have enabled market expansion beyond traditional boundaries, enabling greater availability of crab products worldwide

- Despite this positive scenario, the crab market faces many challenges such as environmental problems, regulatory challenges, and fluctuating market prices but prompt manufacturers aimed to overcome challenges this year, with a focus on innovation and strategic partnerships

- Overall, the crab market presents an attractive opportunity for value-added players, characterized by strong demand, changing consumer preferences, and untapped potential to achieve sustainable development

Crab Market Trend Analysis

The Rising Demand for Eco-Friendly Crab Products

- The increasing popularity of sustainably sourced crab products is indicative of a global trend towards more conscientious consumption. Due to greater environmental awareness, individuals are increasingly aware of the impact of their purchasing decisions on the planet Consumers are increasingly concerned about the long-term sustainability of seafood, and consciously focus mainly on crack. Many individuals are now looking for confirmation that their seafood choices are consistent with sustainable fishing practices. As a result, more emphasis is placed on crab recovery from fisheries with strategies designed to reduce bycatch, conserve habitat, and ensure the long-term viability of crab populations

- In response to this trend, many crab fishermen are actively adopting eco-friendly harvesting methods and seeking certification from reputable organizations to ensure the sustainability of their practices are regularly valid These certificates, such as those issued by the Marine Supervisory Council (MSC) or the Aquatic Surveillance Commission (ASC). , serve as tangible evidence of the fishery’s commitment to sustainability Beyond the standards Rigorous scrutiny allows certified crab fisheries to differentiate their products in the marketplace, attract environmentally conscious consumers, enter attractive market segments prioritizing growth Finally, growing demand for sustainably sourced crab products and not only trends but a fundamental shift towards a more ethical and environmentally responsible seafood industry

Transforming Distribution and Sales in the Crab Industry

- Technological advances have indeed transformed the cracker industry, vastly increasing distribution and logistics capacity. Improved logistics infrastructure including expedited delivery methods and more efficient cold chain logistics play an important role in ensuring that crab reaches the market with minimal delays and in excellent condition These improvements not only reduced transit time but also helped keep the crackers fresher and better, meeting consumer expectations for high-quality seafood goods Ship the crab quickly and in new conditions reaching the market Suppliers can expand their geographic reach, into new markets to meet the global demand for high-quality seafood

- Furthermore, digital channels and the rise of online marketplaces have changed the way crack products are bought and sold, ushering in a new era of convenience and accessibility These digital channels act as important intermediaries, and affect crab suppliers' interact directly with customers, and simplify the buying process. The use of online platforms allows suppliers to showcase their products to a wider audience, allowing them to reach consumers who may not have access to traditional brick-and-mortar seafood markets Furthermore, digital channels enable better visibility and traceability of the crackers purchased, sustainably, providing quality information and enabling more informed purchasing decisions In other words and collectively, technological advances have not only improved distribution and logistics in the crab industry, but also democratized access to high-quality crab products through digital channels

Crab Market Segment Analysis:

Crab Market is Segmented Based on Type and Form.

By Type, Blue Crab segment is expected to dominate the market during the forecast period

- One of the most popular blue crab products is crabmeat, prized for its delicate flavor and versatility in both simple and complex dishes. Whether used as a salad topping, dipped in a creamy crab sauce, or presented as the main ingredient in a traditional crab cake, blue crab meat gives a sea of sweet, sweet flavors that are sure to satisfy

- Moreover, the culinary appeal of blue crabs goes beyond just their meat. Blue crab shells are often used as sweet and savory preserves, forming the base of comforting soups and biscuits. In addition, blue crab fingers, prized for their tender flesh, are often served simply with butter or juice to enjoy the steamed or boiled juices

- The versatility of blue crab extends to a variety of dishes, from Maryland crab feasts of fried whole crab seasoned with Old Bay spices to Asian-inspired dishes like Singaporean chili crab or Japanese crab sushi rolls Is essentially the taste and flavor profile of blue crab Ensures enduring popularity among seafood enthusiasts and chefs, securing its status as a favorite in the culinary world tough

By Form, the Frozen segment held the largest share in 2023

- Frozen crackers emerged as a dominant force in the market segment in terms of quality, gaining a significant share due to several compelling factors. First, refrigeration technology allows for longer preservation of the freshness and flavor of crab meat, addressing spoilage concerns and ensuring that consumers can enjoy high-quality crab of interest regardless of time or place.

- This method of preservation not only extends the shelf life of the product but also preserves its nutritional value, making frozen crab more convenient and healthy for consumers exploring the sea year-round food options

- Moreover, the softening factor plays an important role in the popularity of frozen crab products. With readily available frozen options at grocery stores and seafood markets, consumers have the option of buying and storing crabs for future use without having to eat them immediately

- Furthermore, frozen crackers can be transported long distances without compromising quality, expanding their market and availability to consumers worldwide Whether used in home cooking or added to restaurant dishes, the versatility and convenience of the frozen crab make it a favorite for seafood enthusiasts in search of quality and convenience

Crab Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The dominance of the Asia-Pacific region in the global crab market can be attributed to several major factors. First, China’s dominant presence as a producer and consumer plays an important role. Not only does China have many coastal areas suitable for crab farming and harvesting but it also has a large population with a strong cultural affinity for seafood including various species of crab This combination provides resources for the country’s consumption both internally and exports, increasing China’s market dominance.

- Second, the awareness of Japan’s taste for high-quality seafood, including premium crab species such as king crab and snow crab, further enhances the sector’s dominance Japanese consumers are willing to high prices will be paid for high-quality crab products and the demand for these affordable It varieties is growing not only in the domestic but also in the international markets

- Additionally, regional culinary traditions play an important role in crab demand. From the processing of China’s incredibly hairy crabs to the careful handling of various crabs treasured in Japanese sushi and sashimi, the versatility of the crab creates a demand for Asian dishes at market time all

Active Key Players in the Crab Market

- Bumble Bee Foods, LLC (United States)

- Handy Seafood (United States)

- Blue Star Foods Corp. (United States)

- East Coast Seafood Group (United States)

- Crown Prince, Inc. (United States)

- JM Clayton Seafood Company (United States)

- Supreme Crab and Seafood, Inc. (United States)

- Maine Lobster Now (United States)

- Millennium Ocean Star Corporation (Philippines)

- Phil-Union Frozen Foods, Inc. (Philippines)

- RGE Agridev Corporation (Philippines)

- Siam Canadian Group Limited (Thailand), and Other Key Players.

Key Industry Developments in the Crab Market:

- October 2022: Pescafresh, an Indian seafood supplier supplying mud crabs, opened a new processing and distribution hub in Mumbai.

- January 2022: A new crabbing vessel was launched for the Russian Crab Group at the Onega shipbuilding plant in Petrozadovsk. It is the first of a series that is under construction.

- January 2022: Handy Seafood (North America's oldest seafood processor) partnered with Old Bay seasoning for the launch of seafood products, mainly focusing on crab cakes featuring wild-caught blue swimming crab from fresh crabs.

|

Global Crab Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.10 % |

Market Size in 2032: |

USD 20.8 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Bumble Bee Foods, LLC, Supreme Crab and Seafood, Inc., Maine Lobster Now, Millennium Ocean Star Corporation, Phil-Union Frozen Foods, Inc., and Other Major Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CRAB MARKET BY TYPE (2017-2032)

- CRAB MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BLUE CRAB

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CHINESE MITTEN

- GAZAMI CRAB

- OTHER CRAB TYPES

- CRAB MARKET BY FORM (2017-2032)

- CRAB MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FROZEN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CANNED

- OTHER FORMS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- CRAB Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BUMBLE BEE FOODS, LLC (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HANDY SEAFOOD (UNITED STATES)

- BLUE STAR FOODS CORP. (UNITED STATES)

- EAST COAST SEAFOOD GROUP (UNITED STATES)

- CROWN PRINCE, INC. (UNITED STATES)

- JM CLAYTON SEAFOOD COMPANY (UNITED STATES)

- SUPREME CRAB AND SEAFOOD, INC. (UNITED STATES)

- MAINE LOBSTER NOW (UNITED STATES)

- MILLENNIUM OCEAN STAR CORPORATION (PHILIPPINES)

- PHIL-UNION FROZEN FOODS, INC. (PHILIPPINES)

- RGE AGRIDEV CORPORATION (PHILIPPINES)

- SIAM CANADIAN GROUP LIMITED (THAILAND)

- COMPETITIVE LANDSCAPE

- GLOBAL CRAB MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Crab Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.10 % |

Market Size in 2032: |

USD 20.8 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Bumble Bee Foods, LLC, Supreme Crab and Seafood, Inc., Maine Lobster Now, Millennium Ocean Star Corporation, Phil-Union Frozen Foods, Inc., and Other Major Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CRAB MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CRAB MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CRAB MARKET COMPETITIVE RIVALRY

TABLE 005. CRAB MARKET THREAT OF NEW ENTRANTS

TABLE 006. CRAB MARKET THREAT OF SUBSTITUTES

TABLE 007. CRAB MARKET BY TYPE

TABLE 008. OCEANS CRAB MARKET OVERVIEW (2016-2028)

TABLE 009. FRESH WATER CRAB MARKET OVERVIEW (2016-2028)

TABLE 010. CRAB MARKET BY APPLICATION

TABLE 011. RETAILS MARKET OVERVIEW (2016-2028)

TABLE 012. FOODSERVICES MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA CRAB MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA CRAB MARKET, BY APPLICATION (2016-2028)

TABLE 016. N CRAB MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE CRAB MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE CRAB MARKET, BY APPLICATION (2016-2028)

TABLE 019. CRAB MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC CRAB MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC CRAB MARKET, BY APPLICATION (2016-2028)

TABLE 022. CRAB MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA CRAB MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA CRAB MARKET, BY APPLICATION (2016-2028)

TABLE 025. CRAB MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA CRAB MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA CRAB MARKET, BY APPLICATION (2016-2028)

TABLE 028. CRAB MARKET, BY COUNTRY (2016-2028)

TABLE 029. BUMBLE BEE FOODS: SNAPSHOT

TABLE 030. BUMBLE BEE FOODS: BUSINESS PERFORMANCE

TABLE 031. BUMBLE BEE FOODS: PRODUCT PORTFOLIO

TABLE 032. BUMBLE BEE FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. THAI UNION GROUP: SNAPSHOT

TABLE 033. THAI UNION GROUP: BUSINESS PERFORMANCE

TABLE 034. THAI UNION GROUP: PRODUCT PORTFOLIO

TABLE 035. THAI UNION GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BONAMAR: SNAPSHOT

TABLE 036. BONAMAR: BUSINESS PERFORMANCE

TABLE 037. BONAMAR: PRODUCT PORTFOLIO

TABLE 038. BONAMAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. J.M. CLAYTON SEAFOOD: SNAPSHOT

TABLE 039. J.M. CLAYTON SEAFOOD: BUSINESS PERFORMANCE

TABLE 040. J.M. CLAYTON SEAFOOD: PRODUCT PORTFOLIO

TABLE 041. J.M. CLAYTON SEAFOOD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. MAINE LOBSTER NOW: SNAPSHOT

TABLE 042. MAINE LOBSTER NOW: BUSINESS PERFORMANCE

TABLE 043. MAINE LOBSTER NOW: PRODUCT PORTFOLIO

TABLE 044. MAINE LOBSTER NOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CRAB MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CRAB MARKET OVERVIEW BY TYPE

FIGURE 012. OCEANS CRAB MARKET OVERVIEW (2016-2028)

FIGURE 013. FRESH WATER CRAB MARKET OVERVIEW (2016-2028)

FIGURE 014. CRAB MARKET OVERVIEW BY APPLICATION

FIGURE 015. RETAILS MARKET OVERVIEW (2016-2028)

FIGURE 016. FOODSERVICES MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA CRAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE CRAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC CRAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA CRAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA CRAB MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Crab Market research report is 2024-2032.

Bumble Bee Foods, LLC, Supreme Crab and Seafood, Inc., Maine Lobster Now, Millennium Ocean Star Corporation, Phil-Union Frozen Foods, Inc., and Other Major Players.

The Crab Market is segmented into By Type, By Form, and region. By Type, the market is categorized into Blue Crab, Chinese Mitten, Gazami Crab, and Other Crab Types. By Form, the market is categorized into Frozen, Canned, and Other Forms. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The crab market is a specialized marketplace where various species of crabs are bought and sold for consumption, typically within the seafood industry. These markets can vary widely in scale, ranging from small local vendors selling freshly caught crabs to large wholesale markets catering to restaurants and retailers on a regional or even international level. The availability of different crab species often depends on factors such as geographical location, seasonality, and local fishing regulations. In some regions, certain species of crabs, such as blue crabs or Dungeness crabs, may be particularly prized for their flavor and texture, leading to higher demand and potentially higher prices in the market. The crab market plays a crucial role in facilitating the distribution of crabs from fishermen or crabbers to consumers, ensuring that fresh and quality seafood reaches dining tables around the world. Additionally, the crab market serves as a hub for trade and commerce, fostering economic activity and supporting livelihoods within coastal communities reliant on crab fishing and related industries.

Crab Market Size Was Valued at USD 12.2 Billion in 2023, and is Projected to Reach USD 20.8 Billion by 2032, Growing at a CAGR of 6.10 % From 2024-2032.