Corundum Market Synopsis

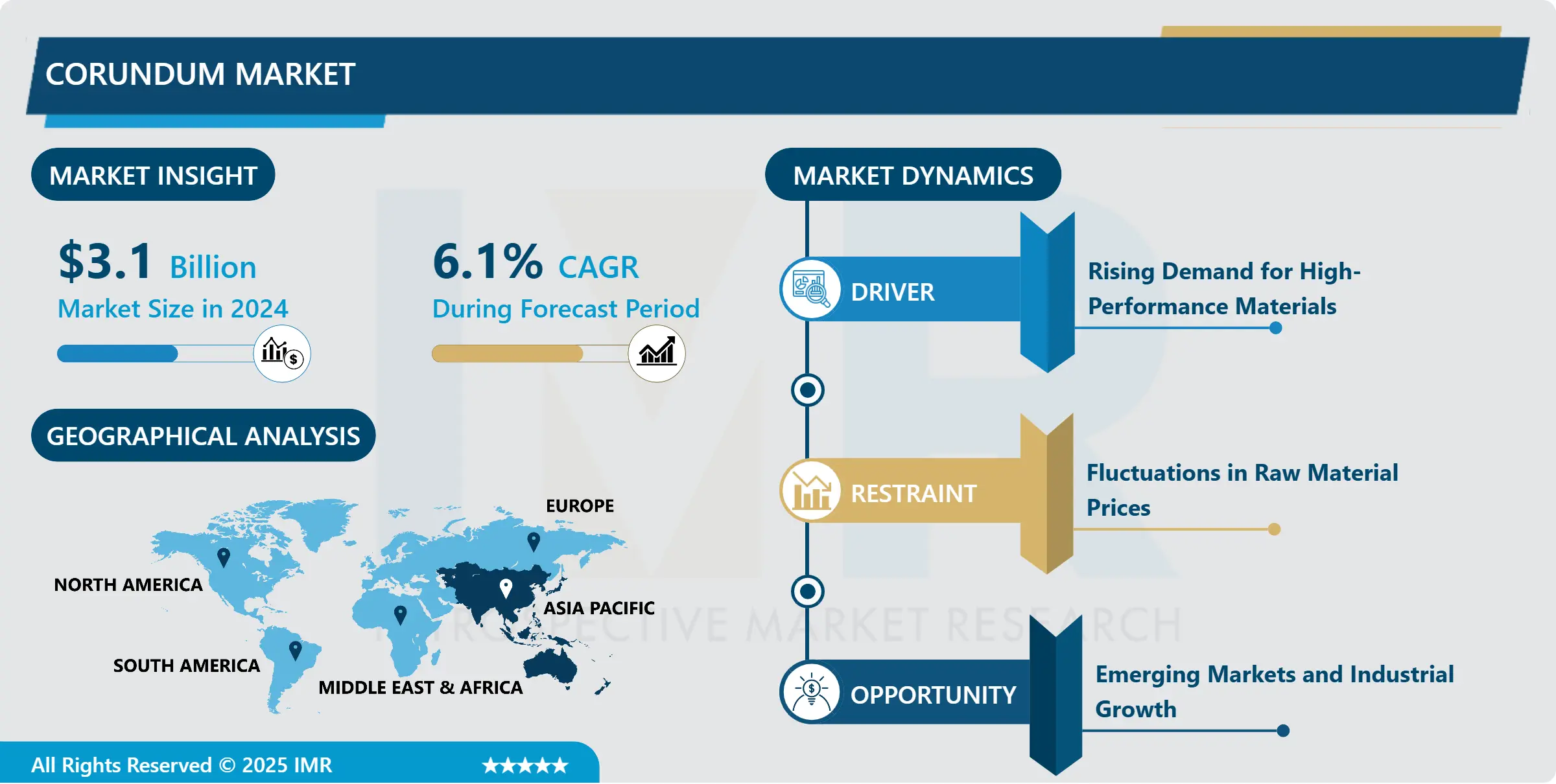

Corundum Market Size is Valued at USD 3.1 Billion in 2024, and is Projected to Reach USD 5.67 Billion by 2035, Growing at a CAGR of 6.1% From 2025-2035.

The Corundum Market brings together the manufacturing, sale and use of corundum, a mineral formed from aluminum oxide (Al?O?). Corundum is also a gemstone, famous for its hardness, and is employed in production of abrasives, ceramics and electronics. It has both the natural and artificial types and the applications are typically all over the automobile, the medical industry and many more.

The restrains for the global Corundum market are mainly; the increasing demand of advanced material for use in several industries. Because many industrial plants such as automobile and aerospace industries require more efficient products, which have higher durability, there is a rising market for abrasives and ceramics containing corundum. In addition, advanced manufacturing technologies have also worked to enhance the performance characteristics of synthetic corundum thereby having increased market prospects.

The other is rising electronics due to electrical non-conduction that Corundum has to offer for appliances. As developing movement toward the electronic smaller sizes, receptors needful for the creation of new articles of small sizes, the need for high-quality substrates and insulating material, produced from corundum, is continually increasing. This trend was further supported by increasing use of corundum in electronics, and in particular manufacture of LEDs and other specialities.

Corundum Market Trend Analysis

Controlled properties and lower environmental impact compared to natural corundum.

- Now there is a clear market demand in the direction of developing synthetic corundum because the corundum material has more controlled characteristics and has a lesser impact on the environment than the natural product. Synthetic corundum is used extensively by the manufacturers of abrasives, and for various industrial uses because of advancements in the methods used to make corundum better. This trend is expected to rise higher due to the growing awareness of different industries to shift to the usage of more ecological products.

- The second of trends can be based on the application of high technologies in the production and application of corundum. However, core-duction has been the scope of enhancing its performance characteristics due to progression in smart manufacturing and automation. In addition, through suffering pre-studies and developments, corundum applications still find uses in other futuristic in advance and fields such as biomedical instruments & hi-end electronics.

Emerging economies where industrialization is on the rise

- The Corundum Market has many opportunities especially when growth in the emerging region because the industry is expanding. Given the fact that the manufacturing industries of the countries in the Asia-Pacific and Latin American region have been gradually developed, the demand for corundum abrasives and ceramics will also likely increase in the future. Signs of this is that companies should also widen their operations to such fields as well as develop new products that are exclusive to these markets.

- Furthermore, in the relationships with the emerging markets there is the noticeable opportunity in the renewable energies, particularly in the solar photovoltaic and the wind power the sectors that could leverage the increased performance of the corundum-based substrates. Finally, with a transition from traditional energy supply to sustainable energy supply, manufacturers can turn to new opportunities for collaboration and correlation to create further applications of corundum products in this emerging area of interest Bereich.

Corundum Market Segment Analysis:

Corundum Market Segmented on the basis of type, application, and end-users.

By Type, Natural Corundum segment is expected to dominate the market during the forecast period

- The Corundum Market is primarily segmented into two types: That is natural corundum and synthetic corundum. This kind of material is mined from the deposits on the earth and is utilized in designing of jewelries and decorative products. They are owned in nature, making them different and hence very much sort after in the market of precious stones. On the other hand while natural corundum is formed naturally under certain geological conditions synthetic corundum is produced by certain industrial processes where the components of the compound can be controlled in their ratio and thus can be used in application like abrasives, ceramics and electronics. This readiness of synthetic corundum for different uses, in terms of quantity and quality that can be offered in large batches, has contributed to the enhanced uptake in high end markets.

By Application, Abrasives segment held the largest share in 2024

- The Corundum Market is categorized into several major areas of application such as abrasives, ceramics, electronics, jewelry, optical as well as others. Cutting materials increase the overall demand because corundum is rigid and appropriate for cutting grinding and polishing of wide array of commodities. In ceramics, corundum is used for its hardness and thermal stability they are used in manufacturing of products like tiles and refractory materials. In electronics, the electronics sector use corundum to provide insulation needed in the substrates used for electronics components. Also, corundum finds use in jewelry industry of natural and synthetic actual gemstones, which are critically beautiful. In addition corundum also has wide uses in optical systems since it is employed in the production of lenses and other optical accessories. The last is known as the “other applications” that applies corundum in a number of specialized areas within sectors such as healthcare and construction.

Corundum Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific is the biggest market for Corundum in the Global level, as it has been currently occupying a big part of market share due to higher industrial development and increasing rate of economic growth. For the corundum, the major consumers are China and India because of the rapid growth of manufacturing industries and constructions. Natural resources coupled with a growing focus on infrastructure investment also make the region the largest market.

- Also, there is well-developed supply chain in the Asia-Pacific region that provides favorable conditions for corundum manufacturers. The rising consumption of superior quality abrasives and ceramics by different end uses is estimated to augment the region’s market in the future by advancing technologies and emphasis on innovation.

Active Key Players in the Corundum Market

- Almatis (Germany)

- Saint-Gobain (France)

- Norton Abrasives (United States)

- Hindalco Industries Ltd. (India)

- Washington Mills (United States)

- Krebs & Riedel (Germany)

- Abrasive Technologies (United States)

- Danfoss (Denmark)

- RHI Magnesita (Austria)

- Imerys (France), Other Active Players.

|

Global Corundum Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.1 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.1 % |

Market Size in 2035: |

USD 5.67 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Corundum Market by Type (2018-2035)

4.1 Corundum Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Natural Corundum

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Synthetic Corundum

Chapter 5: Corundum Market by Application (2018-2035)

5.1 Corundum Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Abrasives

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ceramics

5.5 Electronics

5.6 Jewelry

5.7 Optical

5.8 Other Applications

Chapter 6: Corundum Market by End User (2018-2035)

6.1 Corundum Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aerospace

6.5 Construction

6.6 Electronics

6.7 Healthcare

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Corundum Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALMATIS (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SAINT-GOBAIN (FRANCE)

7.4 NORTON ABRASIVES (UNITED STATES)

7.5 HINDALCO INDUSTRIES LTD. (INDIA)

7.6 WASHINGTON MILLS (UNITED STATES)

7.7 KREBS & RIEDEL (GERMANY)

7.8 ABRASIVE TECHNOLOGIES (UNITED STATES)

7.9 DANFOSS (DENMARK)

7.10 RHI MAGNESITA (AUSTRIA)

7.11 IMERYS (FRANCE)

7.12

Chapter 8: Global Corundum Market By Region

8.1 Overview

8.2. North America Corundum Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Natural Corundum

8.2.4.2 Synthetic Corundum

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Abrasives

8.2.5.2 Ceramics

8.2.5.3 Electronics

8.2.5.4 Jewelry

8.2.5.5 Optical

8.2.5.6 Other Applications

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Automotive

8.2.6.2 Aerospace

8.2.6.3 Construction

8.2.6.4 Electronics

8.2.6.5 Healthcare

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Corundum Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Natural Corundum

8.3.4.2 Synthetic Corundum

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Abrasives

8.3.5.2 Ceramics

8.3.5.3 Electronics

8.3.5.4 Jewelry

8.3.5.5 Optical

8.3.5.6 Other Applications

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Automotive

8.3.6.2 Aerospace

8.3.6.3 Construction

8.3.6.4 Electronics

8.3.6.5 Healthcare

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Corundum Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Natural Corundum

8.4.4.2 Synthetic Corundum

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Abrasives

8.4.5.2 Ceramics

8.4.5.3 Electronics

8.4.5.4 Jewelry

8.4.5.5 Optical

8.4.5.6 Other Applications

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Automotive

8.4.6.2 Aerospace

8.4.6.3 Construction

8.4.6.4 Electronics

8.4.6.5 Healthcare

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Corundum Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Natural Corundum

8.5.4.2 Synthetic Corundum

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Abrasives

8.5.5.2 Ceramics

8.5.5.3 Electronics

8.5.5.4 Jewelry

8.5.5.5 Optical

8.5.5.6 Other Applications

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Automotive

8.5.6.2 Aerospace

8.5.6.3 Construction

8.5.6.4 Electronics

8.5.6.5 Healthcare

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Corundum Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Natural Corundum

8.6.4.2 Synthetic Corundum

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Abrasives

8.6.5.2 Ceramics

8.6.5.3 Electronics

8.6.5.4 Jewelry

8.6.5.5 Optical

8.6.5.6 Other Applications

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Automotive

8.6.6.2 Aerospace

8.6.6.3 Construction

8.6.6.4 Electronics

8.6.6.5 Healthcare

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Corundum Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Natural Corundum

8.7.4.2 Synthetic Corundum

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Abrasives

8.7.5.2 Ceramics

8.7.5.3 Electronics

8.7.5.4 Jewelry

8.7.5.5 Optical

8.7.5.6 Other Applications

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Automotive

8.7.6.2 Aerospace

8.7.6.3 Construction

8.7.6.4 Electronics

8.7.6.5 Healthcare

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Corundum Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.1 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.1 % |

Market Size in 2035: |

USD 5.67 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||