Global Corporate Wellness Market Overview

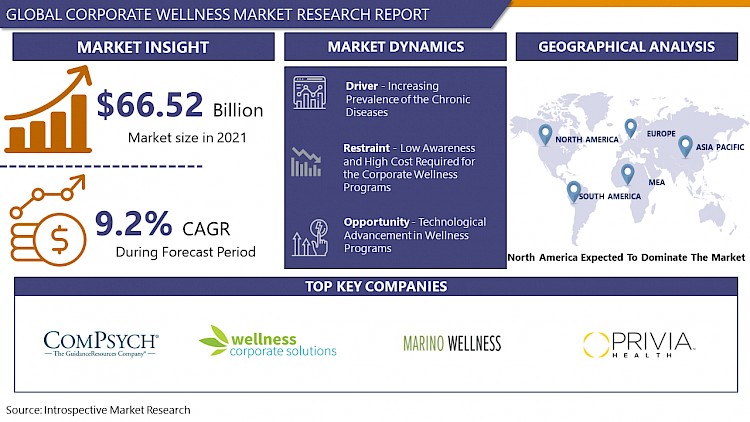

The global Corporate Wellness Market size was valued at USD 66.52 billion in 2021 and is projected to reach USD 123.18 billion by 2028, growing at a CAGR of 9.2% from 2022 to 2028.

Corporate wellness is a new concept, in which programs are created to offer a healthier lifestyle for the employee in the workplace. Corporate wellness programs develop productivity, minimize absenteeism, rise positive morale, and by designing an organizational culture of health to employee wellbeing it supports a holistic approach. The history of corporate wellness stated that in the 1800s the practice of employee wellness was generally simple. Pullman company designed an athletic association for their workers in 1870. In the present days, several companies provide a number of corporate wellness programs like a free or reduced gym membership, free massages at work, on-site fitness centers, yoga classes, educational opportunities, rooms for rest, vaccination clinics, health risk assessments, provide healthy food at work, and wellness outings to enhance job satisfaction in employees. Many employees spend too much time in the workplace and because of the hectic environment of the organization, they battle physical, mental, emotional, and financial problems. Hence, to improve employee health, the demand for corporate wellness programs in the number of organizations is increasing that supporting the market growth.

Market Dynamics And Factors For Corporate Wellness Market

Drivers:

Increasing Prevalence of the Chronic Diseases

In the past few decays, the growing number of chronic diseases is the key factor that supports the growth of the market of corporate wellness. A number of people do not have sufficient time to take care of their physical as well as mental health after work due to a hectic lifestyle which leads to them facing some serious health problems. For instance, according to Statista, the number of diabetes patients in the world in 2021 was 537 million. WHO stated that 17.9 million people cause death each due to cardiovascular diseases. These are preventable diseases corporate wellness can support employees in creating healthy habits. Moreover, Medwise is a diabetes solution company, that created ‘Health and Wellness Programs’ to encourage healthier lifestyle behaviors in employees. Thus, with the growing prevalence of chronic diseases among the employees, hence a number of companies focusing on creating corporate wellness programs that boost the growth of the market of corporate wellness during the projected timeframe.

Restraints:

Low Awareness and High Cost Required for the Corporate Wellness Programs

Many employees are unaware of their company’s health programs and their benefits are the key factor that restricts the growth of the market. Owing to the unconsciousness, there is little interest in engaging in corporate wellness programs. The cost required for corporate wellness programs is high as well as not affordable for every industry. Most of the companies provided a gym setup that requires maintenance of the equipment on the regular basis and also requires fees to the trainer, the result increases the operational cost of the organization. Thus, less awareness and high costs associated with corporate wellness programs hinder market growth during the forecast periods.

Opportunity:

Technological Advancement in Wellness Programs

The use of novel technology in wellness programs offers a lucrative opportunity for market growth. Nowadays, wearable technologies are becoming popular like fitness trackers and Fitbit offering smartwatches that monitor activity levels and enhance productivity in the workplace. Through these devices, employers can track particular information regarding their employees such as heart rate, number of steps taken every day, physical activity levels, sleep quality, number of burned calories, and more information. These devices become effective tools that can assist employees in data collection and analysis, through which they can make the necessary changes in the workplace. However, the number of healthcare apps uses in corporate for employee health like Telemedicine apps. By using this app employees can schedule an appointment with the doctor from their smartphones. Other AI-based tools like conversational chatbots are the most cost-effective and easier solutions for employers to manage risk profiles according to physical, mental, and lifestyle characteristics. Thus, these advanced technologies are anticipated to provide a profitable opportunity for the corporate wellness market in the upcoming years.

Segmentation Analysis Of Corporate Wellness Market

By Service Type, health risk assessment is expected to have the highest market share in the corporate wellness market during the forecast period. The health risk assessment system also referred to as health risk appraisal provides a healthy lifestyle for the employees. It is an instrument that is used to gather health-related information which contains the process of biometric testing to determine the health status, risks, and habits of the individual. Health risk assessment includes four steps which start with planning. The steps consist of hazard identification, dose-response assessment, exposure assessment, and risk characterization. The questions in the risk assessment are related to demographic characteristics, lifestyle behaviors, emotional health, physical health, current and previous health conditions, preventive screenings, and readiness to change behaviors to improve health. This questionnaire is completed online by using tablets, smartphones, and PC. This service is adopted by various organizations in corporate wellness programs and is reinforced for the growth of the market.

By End-Users, the large-scale organization’s segment is expected to have maximum market share in the corporate Wellness market during the forecast period. This is owing to a growing number of large-scale organizations. For instance, according to Statista, in 2021, there are 351,520 large companies present in the world, and 337, 523 were present in 2020. This organization has a high budget so they can increase the investment in the program wellness for employees’ health. The People also moving towards work in such types of large organizations so increasing the number of employees in the large organizations. For company growth, the large organization is more focused on employee health which propels the growth of the corporate wellness market in the forecast period.

By Delivery Modes, the onsite segment is projected to have maximum market growth during the forecast period. This segment provides a personal touch to the employee’s health and under the guidance of the fitness consultants it provides the facility to exercise. Several large organizations provide onsite corporate wellness programs like an on-site gym and on-site fitness center. These on-site wellness programs create a healthy environment in the workplace. Most employees spend a lot of time in the workplace, so on-site programs boost employee engagement rates and enhance employee productivity. 80%-90% of chronic diseases are preventable, the on-site corporate wellness solution is one to help the employee to cure them. Thus, their growing demand anticipated the market growth of the corporate wellness in the projected timeframe.

Source: Statista

Regional Analysis Of Corporate Wellness Market

North America is the dominating region in the corporate wellness market during the forecast period. This is owing to the growing number of new organizations and growing increasing adoption of wellness programs like nutritional balance, weight management, fitness classes, smoking cessation programs, and other programs by organizations in this region. In recent years the prevalence of chronic diseases is rising so companies focused on employees’ health. For instance, according to the Centre for Disease Control and Prevention (CDC), about 37.3 million Americans suffer from diabetes. The peoples in this region are more aware of chronic diseases. Hence, most organizations growing their investments in mental health and stress management programs. The US is the most dominating country in the North American region owing to the adoption of wearable technologies and fitness activities are rises. According to CDC, 6 out of the 10 persons suffering from chronic diseases in the US country also support the growth of the market.

The Asia Pacific is the second dominating region in the market of corporate wellness during the projected timeframe. The number of new businesses is growing in this region. The following figure shows the number of new businesses registered in the top five countries in the APAC region in 2020.

Moreover, with the growing prevalence of chronic diseases including diabetes, migraines, and disease related to CVS, rising concern about the health of the employee. So, a number of organizations adopted different wellness programs for their health. Australia is the dominating country in this region due to a large number of businesses with high investments in wellness programs and growing awareness about health and fitness among corporate employees.

Europe has remarkable growth in the market of corporate wellness market in the upcoming period. Europe is a well-developed region, due to the high number of enterprises. For instance, Statista stated that in 2021, there is 22.65 million enterprises were present in this region. Growing prevalence of chronic diseases among the employees in the Europe region due to unhealthy food habits, excessive stress, and disrupted sleep cycle. According to Statista, in 2021, there were 61 million diabetics in the Europe region. In Europe, the adoption rate of new technology for fitness activity is rising that boosting the corporate wellness market in this region.

Covid-19 Impact Analysis On Corporate Wellness Market

COVID-19 began in Wuhan (China) in December 2019 and has since rapidly grown around the globe. In terms of confirmed cases and reported deaths, the US, India, Brazil, Russia, France, the UK, Turkey, Italy, and Spain are among the countries that have been most severely impacted. Because of the lockdowns, travel restrictions, and business closures, COVID-19 has had an impact on the businesses and industries of numerous nations. During the pandemic, growing awareness among the employees of various organizations and the creation of different wellness programs in the workplace had become the first priority in order for to employees feel safe and connected to each other while working at home. Some companies provided different wellness policies for their employees. Because of social distancing, most organizations provide corporate wellness programs virtually like virtual fitness classes, webinars, and mindfulness exercises. Thus, COVID-19 has had a positive impact on the Digital onboarding market.

Top Key Players Covered In Corporate Wellness Market

- ComPsych Corporation (US)

- Wellness Corporate Solutions (US)

- Virgin Pulse (US)

- Provant Health Solutions (US)

- EXOS(US)

- Marino Wellness (US)

- Privia Health (US)

- Vitality Group (Chicago)

- Wellsource Inc. (US)

- Central Corporate Wellness (Singapore)

- Truworth Wellness (US)

- SOL Wellness (US)

- CXA Group (Singapore)

- Optum (US) and other major players.

Key Industry Development In The Corporate Wellness Market

In February 2022, Quantum CorpHealth Pvt Ltd, a health tech company, opened three new offices in Bengaluru, Pune, and Hyderabad to meet the country's rapidly growing need for health and wellness services for corporate employees and their dependents.

In December 2020, MediKeeper announced the launch of the Fully Integrated COVID-19 App with risk assessment, cleared for workflow, and case management.

|

Global Corporate Wellness Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 66.52 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.2% |

Market Size in 2028: |

USD 123.18 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By End-User |

|

||

|

By Delivery Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Service Type

3.2 By End-Users

3.3 By Delivery Model

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Corporate Wellness Market by Service Type

5.1 Corporate Wellness Market Overview Snapshot and Growth Engine

5.2 Corporate Wellness Market Overview

5.3 Health Risk Assessment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Health Risk Assessment: Grographic Segmentation

5.4 Fitness

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fitness: Grographic Segmentation

5.5 Smoking Cessation

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Smoking Cessation: Grographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Grographic Segmentation

Chapter 6: Corporate Wellness Market by End-Users

6.1 Corporate Wellness Market Overview Snapshot and Growth Engine

6.2 Corporate Wellness Market Overview

6.3 Small Scale Organizations

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Small Scale Organizations: Grographic Segmentation

6.4 Medium Scale Organizations

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Medium Scale Organizations: Grographic Segmentation

6.5 Large Scale Organizations

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Large Scale Organizations: Grographic Segmentation

Chapter 7: Corporate Wellness Market by Delivery Model

7.1 Corporate Wellness Market Overview Snapshot and Growth Engine

7.2 Corporate Wellness Market Overview

7.3 Onsite

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Onsite: Grographic Segmentation

7.4 Offsite

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Offsite: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Corporate Wellness Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Corporate Wellness Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Corporate Wellness Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 COMPSYCH CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 WELLNESS CORPORATE SOLUTIONS

8.4 VIRGIN PULSE

8.5 PROVANT HEALTH SOLUTIONS

8.6 EXOS

8.7 MARINO WELLNESS

8.8 PRIVIA HEALTH

8.9 VITALITY GROUP

8.10 WELLSOURCE INC

8.11 CENTRAL CORPORATE WELLNESS

8.12 TRUWORTH WELLNESS

8.13 SOL WELLNESS

8.14 CXA GROUP

8.15 OPTUM

8.16 OTHER MAJOR PLAYERS

Chapter 9: Global Corporate Wellness Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Service Type

9.2.1 Health Risk Assessment

9.2.2 Fitness

9.2.3 Smoking Cessation

9.2.4 Others

9.3 Historic and Forecasted Market Size By End-Users

9.3.1 Small Scale Organizations

9.3.2 Medium Scale Organizations

9.3.3 Large Scale Organizations

9.4 Historic and Forecasted Market Size By Delivery Model

9.4.1 Onsite

9.4.2 Offsite

Chapter 10: North America Corporate Wellness Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Service Type

10.4.1 Health Risk Assessment

10.4.2 Fitness

10.4.3 Smoking Cessation

10.4.4 Others

10.5 Historic and Forecasted Market Size By End-Users

10.5.1 Small Scale Organizations

10.5.2 Medium Scale Organizations

10.5.3 Large Scale Organizations

10.6 Historic and Forecasted Market Size By Delivery Model

10.6.1 Onsite

10.6.2 Offsite

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Corporate Wellness Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Service Type

11.4.1 Health Risk Assessment

11.4.2 Fitness

11.4.3 Smoking Cessation

11.4.4 Others

11.5 Historic and Forecasted Market Size By End-Users

11.5.1 Small Scale Organizations

11.5.2 Medium Scale Organizations

11.5.3 Large Scale Organizations

11.6 Historic and Forecasted Market Size By Delivery Model

11.6.1 Onsite

11.6.2 Offsite

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Corporate Wellness Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Service Type

12.4.1 Health Risk Assessment

12.4.2 Fitness

12.4.3 Smoking Cessation

12.4.4 Others

12.5 Historic and Forecasted Market Size By End-Users

12.5.1 Small Scale Organizations

12.5.2 Medium Scale Organizations

12.5.3 Large Scale Organizations

12.6 Historic and Forecasted Market Size By Delivery Model

12.6.1 Onsite

12.6.2 Offsite

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Corporate Wellness Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Service Type

13.4.1 Health Risk Assessment

13.4.2 Fitness

13.4.3 Smoking Cessation

13.4.4 Others

13.5 Historic and Forecasted Market Size By End-Users

13.5.1 Small Scale Organizations

13.5.2 Medium Scale Organizations

13.5.3 Large Scale Organizations

13.6 Historic and Forecasted Market Size By Delivery Model

13.6.1 Onsite

13.6.2 Offsite

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Corporate Wellness Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Service Type

14.4.1 Health Risk Assessment

14.4.2 Fitness

14.4.3 Smoking Cessation

14.4.4 Others

14.5 Historic and Forecasted Market Size By End-Users

14.5.1 Small Scale Organizations

14.5.2 Medium Scale Organizations

14.5.3 Large Scale Organizations

14.6 Historic and Forecasted Market Size By Delivery Model

14.6.1 Onsite

14.6.2 Offsite

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Corporate Wellness Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 66.52 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.2% |

Market Size in 2028: |

USD 123.18 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By End-User |

|

||

|

By Delivery Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CORPORATE WELLNESS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CORPORATE WELLNESS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CORPORATE WELLNESS MARKET COMPETITIVE RIVALRY

TABLE 005. CORPORATE WELLNESS MARKET THREAT OF NEW ENTRANTS

TABLE 006. CORPORATE WELLNESS MARKET THREAT OF SUBSTITUTES

TABLE 007. CORPORATE WELLNESS MARKET BY SERVICE TYPE

TABLE 008. HEALTH RISK ASSESSMENT MARKET OVERVIEW (2016-2028)

TABLE 009. FITNESS MARKET OVERVIEW (2016-2028)

TABLE 010. SMOKING CESSATION MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. CORPORATE WELLNESS MARKET BY END-USERS

TABLE 013. SMALL SCALE ORGANIZATIONS MARKET OVERVIEW (2016-2028)

TABLE 014. MEDIUM SCALE ORGANIZATIONS MARKET OVERVIEW (2016-2028)

TABLE 015. LARGE SCALE ORGANIZATIONS MARKET OVERVIEW (2016-2028)

TABLE 016. CORPORATE WELLNESS MARKET BY DELIVERY MODEL

TABLE 017. ONSITE MARKET OVERVIEW (2016-2028)

TABLE 018. OFFSITE MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA CORPORATE WELLNESS MARKET, BY SERVICE TYPE (2016-2028)

TABLE 020. NORTH AMERICA CORPORATE WELLNESS MARKET, BY END-USERS (2016-2028)

TABLE 021. NORTH AMERICA CORPORATE WELLNESS MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 022. N CORPORATE WELLNESS MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE CORPORATE WELLNESS MARKET, BY SERVICE TYPE (2016-2028)

TABLE 024. EUROPE CORPORATE WELLNESS MARKET, BY END-USERS (2016-2028)

TABLE 025. EUROPE CORPORATE WELLNESS MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 026. CORPORATE WELLNESS MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC CORPORATE WELLNESS MARKET, BY SERVICE TYPE (2016-2028)

TABLE 028. ASIA PACIFIC CORPORATE WELLNESS MARKET, BY END-USERS (2016-2028)

TABLE 029. ASIA PACIFIC CORPORATE WELLNESS MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 030. CORPORATE WELLNESS MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA CORPORATE WELLNESS MARKET, BY SERVICE TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA CORPORATE WELLNESS MARKET, BY END-USERS (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA CORPORATE WELLNESS MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 034. CORPORATE WELLNESS MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA CORPORATE WELLNESS MARKET, BY SERVICE TYPE (2016-2028)

TABLE 036. SOUTH AMERICA CORPORATE WELLNESS MARKET, BY END-USERS (2016-2028)

TABLE 037. SOUTH AMERICA CORPORATE WELLNESS MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 038. CORPORATE WELLNESS MARKET, BY COUNTRY (2016-2028)

TABLE 039. COMPSYCH CORPORATION: SNAPSHOT

TABLE 040. COMPSYCH CORPORATION: BUSINESS PERFORMANCE

TABLE 041. COMPSYCH CORPORATION: PRODUCT PORTFOLIO

TABLE 042. COMPSYCH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. WELLNESS CORPORATE SOLUTIONS: SNAPSHOT

TABLE 043. WELLNESS CORPORATE SOLUTIONS: BUSINESS PERFORMANCE

TABLE 044. WELLNESS CORPORATE SOLUTIONS: PRODUCT PORTFOLIO

TABLE 045. WELLNESS CORPORATE SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. VIRGIN PULSE: SNAPSHOT

TABLE 046. VIRGIN PULSE: BUSINESS PERFORMANCE

TABLE 047. VIRGIN PULSE: PRODUCT PORTFOLIO

TABLE 048. VIRGIN PULSE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PROVANT HEALTH SOLUTIONS: SNAPSHOT

TABLE 049. PROVANT HEALTH SOLUTIONS: BUSINESS PERFORMANCE

TABLE 050. PROVANT HEALTH SOLUTIONS: PRODUCT PORTFOLIO

TABLE 051. PROVANT HEALTH SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. EXOS: SNAPSHOT

TABLE 052. EXOS: BUSINESS PERFORMANCE

TABLE 053. EXOS: PRODUCT PORTFOLIO

TABLE 054. EXOS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MARINO WELLNESS: SNAPSHOT

TABLE 055. MARINO WELLNESS: BUSINESS PERFORMANCE

TABLE 056. MARINO WELLNESS: PRODUCT PORTFOLIO

TABLE 057. MARINO WELLNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. PRIVIA HEALTH: SNAPSHOT

TABLE 058. PRIVIA HEALTH: BUSINESS PERFORMANCE

TABLE 059. PRIVIA HEALTH: PRODUCT PORTFOLIO

TABLE 060. PRIVIA HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. VITALITY GROUP: SNAPSHOT

TABLE 061. VITALITY GROUP: BUSINESS PERFORMANCE

TABLE 062. VITALITY GROUP: PRODUCT PORTFOLIO

TABLE 063. VITALITY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. WELLSOURCE INC: SNAPSHOT

TABLE 064. WELLSOURCE INC: BUSINESS PERFORMANCE

TABLE 065. WELLSOURCE INC: PRODUCT PORTFOLIO

TABLE 066. WELLSOURCE INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. CENTRAL CORPORATE WELLNESS: SNAPSHOT

TABLE 067. CENTRAL CORPORATE WELLNESS: BUSINESS PERFORMANCE

TABLE 068. CENTRAL CORPORATE WELLNESS: PRODUCT PORTFOLIO

TABLE 069. CENTRAL CORPORATE WELLNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. TRUWORTH WELLNESS: SNAPSHOT

TABLE 070. TRUWORTH WELLNESS: BUSINESS PERFORMANCE

TABLE 071. TRUWORTH WELLNESS: PRODUCT PORTFOLIO

TABLE 072. TRUWORTH WELLNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. SOL WELLNESS: SNAPSHOT

TABLE 073. SOL WELLNESS: BUSINESS PERFORMANCE

TABLE 074. SOL WELLNESS: PRODUCT PORTFOLIO

TABLE 075. SOL WELLNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. CXA GROUP: SNAPSHOT

TABLE 076. CXA GROUP: BUSINESS PERFORMANCE

TABLE 077. CXA GROUP: PRODUCT PORTFOLIO

TABLE 078. CXA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. OPTUM: SNAPSHOT

TABLE 079. OPTUM: BUSINESS PERFORMANCE

TABLE 080. OPTUM: PRODUCT PORTFOLIO

TABLE 081. OPTUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 082. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 083. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 084. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CORPORATE WELLNESS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CORPORATE WELLNESS MARKET OVERVIEW BY SERVICE TYPE

FIGURE 012. HEALTH RISK ASSESSMENT MARKET OVERVIEW (2016-2028)

FIGURE 013. FITNESS MARKET OVERVIEW (2016-2028)

FIGURE 014. SMOKING CESSATION MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. CORPORATE WELLNESS MARKET OVERVIEW BY END-USERS

FIGURE 017. SMALL SCALE ORGANIZATIONS MARKET OVERVIEW (2016-2028)

FIGURE 018. MEDIUM SCALE ORGANIZATIONS MARKET OVERVIEW (2016-2028)

FIGURE 019. LARGE SCALE ORGANIZATIONS MARKET OVERVIEW (2016-2028)

FIGURE 020. CORPORATE WELLNESS MARKET OVERVIEW BY DELIVERY MODEL

FIGURE 021. ONSITE MARKET OVERVIEW (2016-2028)

FIGURE 022. OFFSITE MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA CORPORATE WELLNESS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE CORPORATE WELLNESS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC CORPORATE WELLNESS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA CORPORATE WELLNESS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA CORPORATE WELLNESS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Corporate Wellness Market research report is 2022-2028.

ComPsych Corporation, Wellness Corporate Solutions, Virgin Pulse, Provant Health Solutions, EXOS, Marino Wellness, Privia Health, Vitality Group, Wellsource Inc, Central Corporate Wellness, Truworth Wellness, SOL Wellness, CXA Group, Optum, and other major players.

The Corporate Wellness Market is segmented into service type, end-user, delivery model and region. By Service Type, the market is categorized into Health Risk Assessment, Fitness, Smoking Cessation, and Others. By End-user, the market is categorized into Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations. By Delivery Model, the market is categorized into Onsite, and Offsite. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A corporate wellness program is an employer’s approach to achieving a healthy workplace by incorporating various health activities within the daily work schedule to promote their employees' wellbeing. This basically takes a holistic approach toward the health of employees by creating a supervisory health culture.

Global corporate wellness market was valued at USD 66.52 billion in 2021 and is expected to reach USD 123.18 billion by 2028, at a CAGR of 9.2% over the analysis period.