Corporate Performance Management Market Synopsis

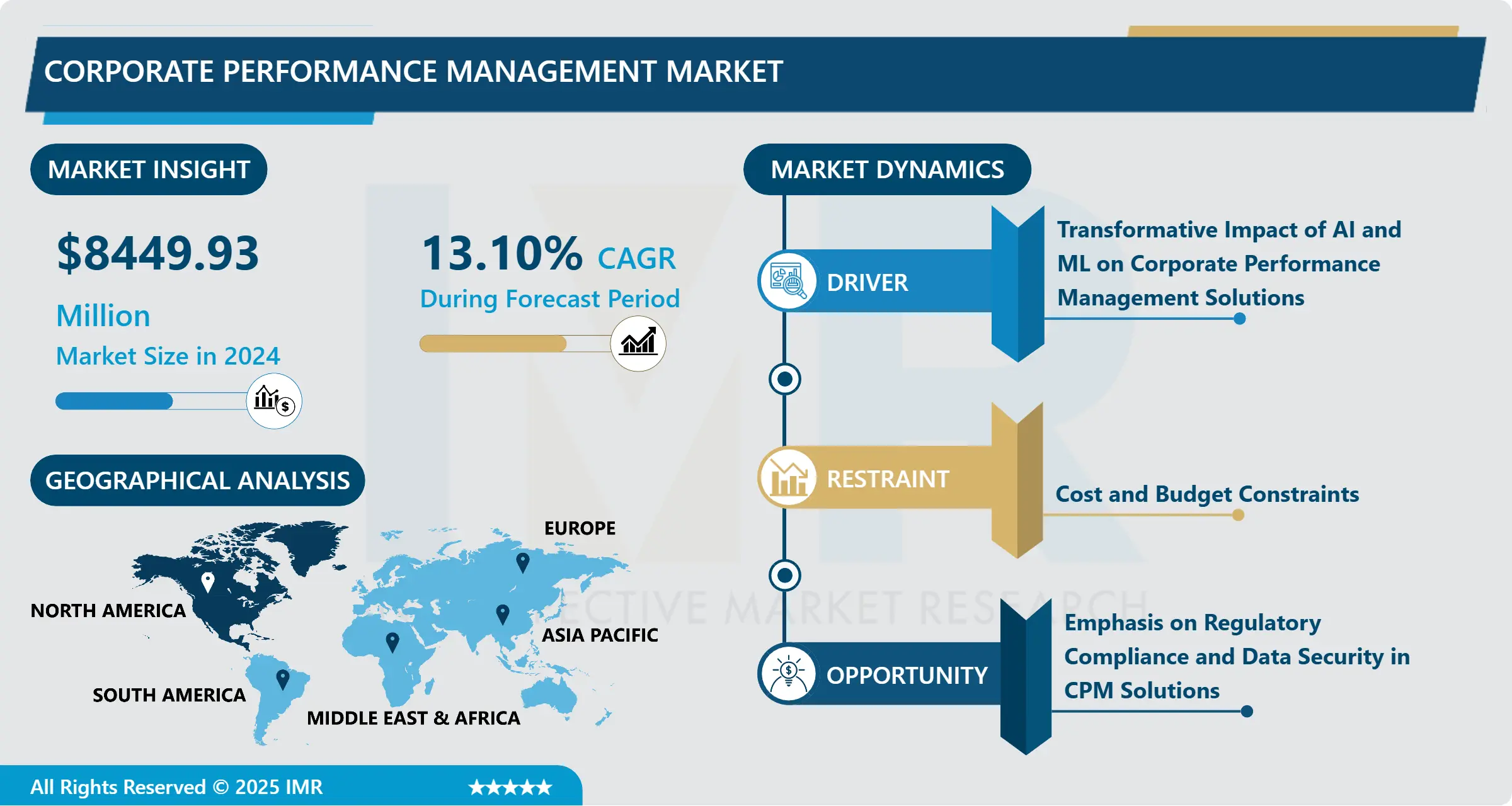

Corporate Performance Management Market Size Was Valued at USD 8449.93 Million in 2024 and is Projected to Reach USD 22623.19 Million by 2032, Growing at a CAGR of 13.10% From 2025-2032.

The CPM market is composed of software and services that support organizations in planning performance measurement and monitoring. It entails the money supply planning tools, forecast models for finances, reports, and analysis that help organizations relate their strategies with the firms’ targets, effectively allocate capital and enhance on financial decision making systems. CPM solutions consolidate inputs across the organization, and deliver organizational performance information to support strategic planning, and compliance with internal and external rules and regulations. The main driver for the market is the ability of business operations to improve efficiency, flexibility and competitiveness within ever volatile economy.

Corporate performance management, also known as CPM, has been experiencing continual growth due to organizations’ increasing need for better capabilities to make strategic decisions and effective business executions.. Today, CPM solutions that offer powerful support for consolidations, reporting, forecasting and budgeting processes, established as indispensable tools in organizations, operating in the complicated and competitive conditions. These systems have proved doubly beneficial with incorporated analytics and artificial intelligence. This has enabled great accuracy in data analysis and helped organizations gain increased insight on their operations. One of the drivers for the CPM market is the fact that many solutions are shifting to the cloud. result of businesses' growing desire to improve their capacity for strategic decision-making and operational efficiency. CPM solutions, which provide strong capabilities for financial consolidation, reporting, forecasting, and budgeting, have evolved into essential tools for organizations navigating a challenging and competitive environment. CPM solutions, that offer powerful consolidation, reporting, financial forecasting, and budgeting features, have developed into indispensable helping tools for companies operating in a complex and highly competitive context. While these core systems have gained more importance with the growth of analytics and artificial intelligence. This has helped business organizations to make better decisions informed by data and gain better information of their performance.

Also, the requirement from SMEs in the market has increased rapidly over the recent year. That is the reason why Large businesses have always adopted the CPM solutions because by the time they are hard coded and normally entail a great deal of cost to put in traction. In essence, scalability, flexibility and cost advantages are some of the advantages that enterprises stand to gain due to cloud computing when looking to Management of Performance. Moreover, the recent shift to remote work and the emerging interest in digitalization has emphasized the need for cloud-based CPM systems due in part to real-time access of data even in fully distributed teams. Moreover, there is an increasing trend of entrepreneurial new venture contributions that norms and emerges in the market by SMEs.lt of businesses' growing desire to improve their capacity for strategic decision-making and operational efficiency. CPM solutions that include centered capabilities for offering an essential CFO toolkit with consolidation, reporting, forecasting, and budgeting solutions have emerged to become crucial for organizations to manage in a complex and competitive environment. They are most appreciated when they are supplemented with the ability to analyze this diverse data and integrate artificial intelligence and machine learning capabilities into the actual programs and systems used in CPM. This has enabled managers to make better informed decisions for their businesses and gain better analysis of their firm’s performance.

Corporate Performance Management Market Trend Analysis

Corporate Performance Management Market Growth Drivers- Transformative Impact of AI and ML on Corporate Performance Management Solutions

- The Corporate Performance Management (CPM) solutions are now in a revolution era due to increased Advanced Technology such as Artificial intelligence (AI) Machine Learning (ML).. These technologies help businesses to gain better understanding of their financial and organizational performance. With the help of AI and ML algorithms, high amounts of data could be processed at a rate never before seen while the fortunes hiding within data could be seen by these formulas where traditional analytical models could not. With the help of these technologies, CPM systems can to provide more refined and sophisticated forecasts for any given organisation to help it in anticipating changes in the market, consumers, and risks. Strategic planning is one of the areas that get a lot of benefits from such predictive capabilities that help them stay one step ahead of the competition, make sensible decisions and wisely delegate the resources.

- In addition, using AI and ML in CPM solutions, real-time data analysis and increase in the forecast accuracy are also achieved. artificial intelligence (AI) and machine learning (ML). These technologies allow businesses to obtain deeper insights into their financial and operational performance. Large volumes of data can be processed at previously unheard-of speeds by AI and ML algorithms, which can also spot patterns and trends that conventional analytical techniques might overlook. Through the use of these technologies, CPM systems can offer forecasts that are more precise and nuanced, assisting companies in foreseeing changes in the market, consumer behavior, and possible hazards. Strategic planning benefits greatly from this predictive capabilities, which enables businesses to remain ahead of the competition, make data-driven decisions, and allocate resources more wisely.

- Furthermore, real-time data analysis and improved forecasting accuracy are made possible by the incorporation of AI and ML into CPM solutions. Traditionally, many forecasting methods solely rely on such models and historical data that may not always harness the capability of dynamic business environments. On the other hand, while the AI and ML models consolidate data from new sources, they can refine the parameter of precision continually. This lifestyle kind of forecasting is more advantageous to businesses since they can easily adapt to new trends hence changing their strategies often. This agility is further bolstered by real time data processing that provides up to date information on operations and financial posture. As such, businesses are in a position where monitor their key performance measures for signs of deteriorations, identify these at an early enough stage to correct the problem before it becomes a major one. In the fast growing and changing industry, this kind of real time information processing accompanied with better predictive capability puts firms in a perfect position to deliver near perfect performance and stay ahead of the competition.

Corporate Performance Management Market Opportunities- Emphasis on Regulatory Compliance and Data Security in CPM Solutions

- Information security and following of rules and regulations are growing issues in the field of Corporate Performance Management (CPM). There is a lot of pressure on businesses to ensure that their CPM solutions meet certain demands including the GDPR from the European Union and the SOX from America on financial reporting. Various forms of non-compliance penalties include serious financial penalties, legal actions, and damage to company reputation. Consequently, all the companies have assigned the highest value to the CPM systems incorporating the scraps compliance and ensuring its company financial reports to be accurate, transparent, and most importantly legally compliant with the new laws. Besides, it assists business in avoiding fall traps of the regulations in a certain way, it establishes confidence and trust among the stakeholders including the investors, clients and the regulatory authorities.

- Due to such concerns, vendors are including advance technologies to protect such data and enhancing the security features of their CPM solutions. A number of modern encryption techniques are being applied while the data is in motion or when it is archival so that any unauthorized person cannot interfere or tamper with the data. In particular, the Multi-Factor Authentication (MFA) envisages that before a user is allowed into the system, he will have to prove his identity through at least a few other ways. Furthermore, strong access controls enable businesses to precisely set and oversee user permissions, guaranteeing that only individuals with the proper authorization can view particular information and carry out particular tasks. These improved security measures are essential for reducing the possibility of cyberattacks and data breaches, which can have disastrous effects on companies. CPM providers assist businesses satisfy legal obligations by putting regulatory compliance and data security first. They also help businesses create more reliable and robust performance management systems.

Corporate Performance Management Market Segment Analysis:

Corporate Performance Management Market is segmented based on Mode of Deployment, Size of Organization and End-user Industry.

By End-user Industry, Energy and Power segment is expected to dominate the market during the forecast period

- Power plants, transmission lines, distribution networks, and other vital infrastructure are all included in the energy and power sector. Strong and dependable technological solutions are crucial for controlling grid infrastructure, keeping an eye on equipment performance, and guaranteeing operational safety given the scope and complexity of these tasks. The main reason large businesses rule this market is because they have a lot of money to spend on all-inclusive, frequently on-premises solutions that are customized to meet their unique requirements.

- On-premises solutions are preferred in the energy sector because to their increased control over data security and system stability. Large volumes of data about energy production, consumption trends, and infrastructure health are managed by utilities and energy companies; these data sets necessitate real-time monitoring and analysis. These firms may comply with regulatory standards, reduce the risk of cyber threats or data breaches, and maintain control over vital data by implementing on-premises solutions.

- Furthermore, systems that can manage massive data volumes and smoothly interact with current infrastructure are required due to the size of activities in large organizations within the energy industry. On-premises deployments allow modification to match unique operational procedures and regulatory standards, as well as easier connection with legacy systems. This strategy helps to maintain robust and dependable energy supply networks by supporting continuous improvement projects like asset optimization and predictive maintenance, in addition to increasing operational efficiency. Large businesses so continue to rule the energy and power industries by utilizing on-premises solutions to efficiently handle their intricate operations and guarantee long-term performance and security requirements.

By Mode of Deployment, On-Premises segment held the largest share in 2024

- On-premises are software and systems that are hosted within the walls of an organization instead of being hosted in a cloud platform. In general, business enterprises over a certain scale, particularly those industries where data security is crucial, including Banking, Financial Services and Insurance (BFSI), and healthcare industries have traditionally preferred on-premise adoption. This preference is because organisations want to have ultimate control over the content of views especially concerning sensitive information and the fact that they must meet very high regulatory requirements.

- On the basis of flexibility, the on-premises solutions have been identified to present more security especially in sectors such as BFSI that require higher security and customer information security in operating financial transactions. These organizations work with large and complex data sets that are more easily controlled and secured within the ‘bubble’ of their own organization rather than with multiple loosely connected enterprises. Likewise, in the healthcare sector, data privacy and general compliance with laws such as, HIPAA in America or GDPR in Europe calls for better security measures than what could be offered by on-cloud services.

- Furthermore, customized and scalability characteristic of on-premises solutions can perfectly meet the IT requirements and business peculiarities of large enterprises. This makes it possible for ICE to customize the software and systems, in order to fit into the already existing small, large scale legacy systems and business processes with minimal interferences. Despite the growing popularity of cloud solutions for their flexibility and cost-effectiveness, on-premises deployments remain a cornerstone for industries where data security, compliance, and operational control are critical priorities.

Corporate Performance Management Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- This study has identified a number of significant factors which make North America the leading player in CPM industry. The area benefits from a sound economic environment which has been fostering the application of advanced technologies in various fields. Technological, manufacturing, healthcare and financial sectors large business organizations need CPM solutions to support substantial organizational strategic planning and operational decision making. The leading economy of the region, United States has deployed very big endorsements which include advanced analytics tools and cloud based platforms in the CPM market place.

- Additionally, North American businesses prioritize enhancing financial management and business processes by utilizing data-driven insights from CPM systems. This emphasis comes in due to the fact that in order to remain competitive the organisation has to ensure that it has certain competitive advantages within a given market which is dynamic. The CPM solutions allow companies to connect performance, planning, forecasting, and controlling in concepts that are consistent with the firm’s goals. Even more, regulations and the requirement for the expanded use of OTC are stimulating the uptake of these technologies at an even faster pace.• In other words, a corporate culture that places emphasis on analytical decision-making and technical and economic performance underpins North America’s commanding position in the CPM industry.budgeting, and financial planning into strategies that are coherent and in line with corporate objectives. Regulations and the need for more openness in financial reporting are driving adoption of these technologies even faster.

- Essentially, a corporate culture that prioritizes data-driven decision-making, technical innovation, and economic strength support North America's dominant position in the CPM industry. The necessity for enhanced CPM solutions is also expected to arise in the future because operational flexibility and performance remain crucial for various organizations which will persistently promote further growth of the market in the field.

Active Key Players in the Corporate Performance Management Market

- Oracle Corporation

- SAP SE7.

- IBM Corporation

- Adaptive Insights

- Host Analytics

- Anaplan Inc.

- Tagetik Software S.r.l

- Longview Solutions

- Board International

- SAS Institue Inc.

- Prophix Software Inc.

- Axiom Software

- Other Active Players

|

Global Corporate Performance Management Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8449.93 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.10% |

Market Size in 2032: |

USD 22623.19 Mn. |

|

Segments Covered: |

By Mode of Deployment |

|

|

|

By Size of Organization |

|

||

|

By End-user Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Corporate Performance Management Market by Mode of Deployment (2018-2032)

4.1 Corporate Performance Management Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-Premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud

Chapter 5: Corporate Performance Management Market by Size of Organization (2018-2032)

5.1 Corporate Performance Management Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Corporate Performance Management Market by End-user Industry (2018-2032)

6.1 Corporate Performance Management Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BFSI

6.5 Manufacturing

6.6 Energy and Power

6.7 Other End-user Industries

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Corporate Performance Management Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ORACLE CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SAP SE7.

7.4 IBM CORPORATION

7.5 ADAPTIVE INSIGHTS

7.6 HOST ANALYTICS

7.7 ANAPLAN INC.

7.8 TAGETIK SOFTWARE S.R.L

7.9 LONGVIEW SOLUTIONS

7.10 BOARD INTERNATIONAL

7.11 SAS INSTITUE INCPROPHIX SOFTWARE INC.

7.12 AXIOM SOFTWARE

7.13 OTHER KEY PLAYERS

Chapter 8: Global Corporate Performance Management Market By Region

8.1 Overview

8.2. North America Corporate Performance Management Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Mode of Deployment

8.2.4.1 On-Premises

8.2.4.2 Cloud

8.2.5 Historic and Forecasted Market Size by Size of Organization

8.2.5.1 Small and Medium Enterprises

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size by End-user Industry

8.2.6.1 Retail

8.2.6.2 BFSI

8.2.6.3 Manufacturing

8.2.6.4 Energy and Power

8.2.6.5 Other End-user Industries

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Corporate Performance Management Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Mode of Deployment

8.3.4.1 On-Premises

8.3.4.2 Cloud

8.3.5 Historic and Forecasted Market Size by Size of Organization

8.3.5.1 Small and Medium Enterprises

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size by End-user Industry

8.3.6.1 Retail

8.3.6.2 BFSI

8.3.6.3 Manufacturing

8.3.6.4 Energy and Power

8.3.6.5 Other End-user Industries

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Corporate Performance Management Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Mode of Deployment

8.4.4.1 On-Premises

8.4.4.2 Cloud

8.4.5 Historic and Forecasted Market Size by Size of Organization

8.4.5.1 Small and Medium Enterprises

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size by End-user Industry

8.4.6.1 Retail

8.4.6.2 BFSI

8.4.6.3 Manufacturing

8.4.6.4 Energy and Power

8.4.6.5 Other End-user Industries

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Corporate Performance Management Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Mode of Deployment

8.5.4.1 On-Premises

8.5.4.2 Cloud

8.5.5 Historic and Forecasted Market Size by Size of Organization

8.5.5.1 Small and Medium Enterprises

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size by End-user Industry

8.5.6.1 Retail

8.5.6.2 BFSI

8.5.6.3 Manufacturing

8.5.6.4 Energy and Power

8.5.6.5 Other End-user Industries

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Corporate Performance Management Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Mode of Deployment

8.6.4.1 On-Premises

8.6.4.2 Cloud

8.6.5 Historic and Forecasted Market Size by Size of Organization

8.6.5.1 Small and Medium Enterprises

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size by End-user Industry

8.6.6.1 Retail

8.6.6.2 BFSI

8.6.6.3 Manufacturing

8.6.6.4 Energy and Power

8.6.6.5 Other End-user Industries

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Corporate Performance Management Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Mode of Deployment

8.7.4.1 On-Premises

8.7.4.2 Cloud

8.7.5 Historic and Forecasted Market Size by Size of Organization

8.7.5.1 Small and Medium Enterprises

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size by End-user Industry

8.7.6.1 Retail

8.7.6.2 BFSI

8.7.6.3 Manufacturing

8.7.6.4 Energy and Power

8.7.6.5 Other End-user Industries

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Corporate Performance Management Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8449.93 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.10% |

Market Size in 2032: |

USD 22623.19 Mn. |

|

Segments Covered: |

By Mode of Deployment |

|

|

|

By Size of Organization |

|

||

|

By End-user Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||