Copper Sulfate Pentahydrate Market Synopsis

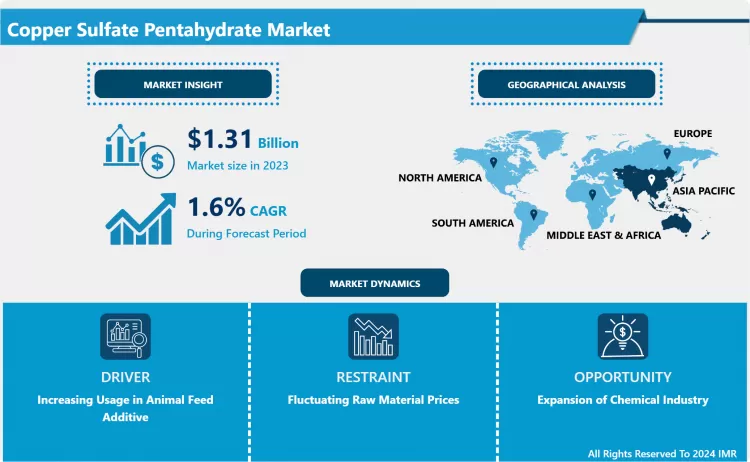

Copper Sulfate Pentahydrate Market Size Was Valued at USD 1.31 Billion in 2023, and is Projected to Reach USD 1.51 Billion by 2032, Growing at a CAGR of 1.60% From 2024-2032.

Copper sulfate pentahydrate is a light blue crystalline solid that is a derivative of copper sulfate that comprises CuSO4·5H2O. People know that it is used as a fungicide and herbicide in farms, for electroplating industries and as a mordant in the process of bleaching of fabrics in addition to being applied in numerous practical experiments in the field of chemistry. Thanks to its particular color and its application in many industries it is very popular nowadays.

- This can be considered as one of the main research areas: the market of Copper Sulfate Pentahydrate has been undergoing relatively fast growth for the last few years and it may be associated with its application in various industries. Copper Sulfate Pentahydrate is easy to dissolve in water and thus is used agricultural to manage funguses and plants to enhance crop yields and their quality. Agriculture productivity demand throughout the nation and globally coupled with knowledge of efficient farming practices increases the demand for this compound.

- In mining, Copper Sulfate Pentahydrate acts as a flotation collector through which minerals within ores are recovered. This chemical has been favored by the advancement of the mining industry especially in the developing world due to the fact that the mining firms need to increase their recovery rates. Besides that, the chemical industry has potentialised the consumption of Copper Sulfate Pentahydrate as a reagent in production of chemical.

- On a regional basis, Asia-Pacific seems to dominate the market mainly due to the boost in agricultural practices and also due to the boost in mining industries in the country including China and Indian. Asia Pacific and Europe are also prospective markets due to emerging concerns for green process of production along with biomonitoring policies set for chemical content. However, there has been some areas that the market explained to need a solution, for example; the raw materials for production of copper compound products may have different prices and the copper compounds themselves may beMORE harming the environment. At the same time, as for the outlook for Copper Sulfate Pentahydrate market, it is expected that the main further development stimulated by the subjects such as agriculture and mining industry and the future development of these sections.

Copper Sulfate Pentahydrate Market Trend Analysis

Copper sulfate pentahydrate market is witnessing significant growth

- Market of this active ingredient such as Copper Sulfate Pentahydrate is experiencing immense growth, especially because it is widely used in agriculture. It has been found used widely for fungicides, herbicides, and algaecides at a very central role in increasing crop yield and quality. With the constantly changing global agriculture industry, especially with the shift towards the use of organic agriculture, Crop Protection is becoming a vital necessity. Farmers are looking for a safe and efficient way to control these pests and diseases and since copper sulfate pentahydrayde has been proved to be effective more so that it is environmentally friendly as a chemical govenremental than the synthetic ones.

- And, the use of copper sulfate pentahydrate in the aquaculture market is not only ensuring a long-term market status. In fish farming it assists in reducing the growth of algae therefore creating health environment for the fish to produce and thrive. As the trends of consumption of aquaculture products continues to be propelled by consumers’ awareness of the sustainable practices which involves the use of copper sulfate pentahydrate, the growth of its market is projected. Further, due to raising awareness of environmental factors for farmers and aquaculture operators, there is a trend toward sustainable solutions. This progression toward sustainability coupled with the dual utility of this compound in agricultural and fish farming applications presents strong opportunities for its enhanced demand in the next year’s further.

Industrial Applications and Growth of the Copper Sulfate Pentahydrate Market

- Copper sulfate pentahydrate is continually benefiting from advances that have been cascaded in various industries most notably the chemical and mining industries. In chemical manufacturing its application in making other copper compounds is eminent, a aspect that makes this product ideal for industries. Of greater importance is its use in the electroplating process since it determines the quality and amount of the metal coatings therefore the market for the product. These application demonstrate the essence of using the copper sulfate pentahydrate in particularly to the industries that require high level of accuracy in their processes.

- In addition, mining sector is one of the largest end user markets due to the basic usage of copper sulfate pentahydrate in the flotation process of separating valuable minerals from the ore. A higher spending on mining activities especially in the emergent countries should lead to increased demand for this compound even further in the future. As the demand for methods of enhancing the process and the recovery rates place pressure on mining companies, copper sulfate pentahydrate is expected to experience growth. The market for copper sulfate pentahydrate is therefore set for slow gradual growth that should fit into broad trends towards sustainability and diversification in numerous industries. This trajectory also determines that the compound is essential for contemporary uses across various fields now and for future developments of the disciplines studied in the subject areas.

Copper Sulfate Pentahydrate Market Segment Analysis:

Copper Sulfate Pentahydrate Market Segmented based on By Product Type and By Application

By Product Type, Industrial Grade segment is expected to dominate the market during the forecast period

- Commercial products are common in many industries for product that are meant to be used and serve functional purposes by industries. These products are highly pure, and possess high co-efficient variation that render the optimum operating conditions in demanding conditions. They are used in number of fields like chemical, electroplating or galvanic process industries wherein, the degree of measurement cannot be overemphasized. high quality control on industrial products is applied in manufacturing material that will produce quality that will reach the standard test, regulatory condition and measures. This focus on, quality aspects not only enhances the safety thus the improved effectiveness of the product but also assist in developing the confidence of the manufactures and consumers.

- However, it is worth to understand that one of the main causes why more people purchase industrial grade products is because of the development of various industries like construction and manufacturing business that cannot run without these products. With these sectors evolving generations of products due to evolving technological advancements coupled with growth in production capacities, there is demand for higher performance, reliability and enabling materials than in the past. In addition, this safety and compliance imperative is forcing manufacturers to integrate even higher-sustainability and durability industrial materials appropriate for the contemporary production environments. Consequently, there is a trend of increased grounds for industrial-grade markets because industries demand products where formulation does not only consider the current but also the creative for the future sustainability.

By Application, Aquaculture segment held the largest share in 2023

- One has identified the use of aquaculture as the main emphasis farm of fish and other aquatic animals to feed the world’s ever expanding population. This sector relies heavily on specialites which include feed with better nutritional values and water treatment products that are necessary for the production and comfortable living of the various forms of aqua products. By altering the tendency on consumption of fish which is nutritional changes, raised aquaculture is also incorporating efficient technology which improves its ability to produce fishes.

- Increasing global demand for fish, over fishing, pollution resulting from delegation of resources which previously fed fish, has hugely placed the concept of sustainable aquaculture. They are designed to reduce effects caused by fish farming practices and are capable of giving high yield at once. Proteins and natural feed supplements through new sources in the feed formulation are relatively contributing better feed conversion and fish health. Finally, better innovations in the production management system, then precision farming and the monitor system real-time have pave the way for farmed fish industry to manage resources for the consumption in aquaculture. As it is, the aquaculture industry today suggests a lot of prospect with regard to the producing food and at the same time a sustainable environment.

Copper Sulfate Pentahydrate Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The copper sulfate pentahydrate market in the Asia Pacific has been general on the online growth within the recent past because of the needs in the Agriculture and mining industries. Mineral oil is applied in the prevention of fungal infection to crops hence promoting crop yield in agricultural activities. Copper Sulphate As the need to control crop yield has grown, large manufactures and suppliers of agricultural products have shown more and more interest in copper sulfate in crop protection. Besides, its application in the mining industry, especially in the flotation process, makes it chemical reagents that improve the recovery of mineral making it important factor that will enable it to have a strategic position in the market of the region.

- Also, the market restrains concerning the local use of chemical material has to the introduction of the new green mix of Copper Sulfate Pentahydrate. They are making manufacturers train and transform their manufacturing product line to live up to today’s requirements of the environment friendly agricultural practices. Thus, there are recent intensified volumes through research and development for the less hazardous effective formulations. This trend not only enabled the firm to meet the legal regulations presented to the manufacturing industries but also enabled it to address the consumers’ demands in the organic agriculture inputs. As a result, the market becomes more challenging, with sustainability issues addressed as a vital major alongside performance efficiency in both the agricultural and industrial domains.

Active Key Players in the Copper Sulfate Pentahydrate Market

- Wego Chemical & Mineral Corporation (U.S.)

- Allan Chemical Corporation (U.S.)

- Noah Chemicals (U.S.)

- Atotech (Germany)

- Laiwu Iron and Steel Group (China)

- Jiangxi Copper (China)

- Jinchuan Group (China)

- UNIVERTICAL (U.S.)

- Highnic Group (South Korea)

- G.G. MANUFACTURERS (India)

- Beneut (South Korea)

- Old Bridge Chemicals (U.S.)

- GREEN MOUNTAIN (U.S.)

- Mitsubishi (Japan)

- Sumitomo (Japan)

- Bakirsulfat (Turkey)

- Blue Line Corporation (U.S.)

- MCM Industrial (U.S.)

- Mani Agro Chem (India), Other Key Players

|

Global Copper Sulfate Pentahydrate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.31 Bn. |

|

Forecast Period 2023-34 CAGR: |

1.60% |

Market Size in 2032: |

USD 1.51 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Copper Sulfate Pentahydrate Market by Product Type (2018-2032)

4.1 Copper Sulfate Pentahydrate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Industrial Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Agricultural Grade

4.5 Feed Grade

Chapter 5: Copper Sulfate Pentahydrate Market by Application (2018-2032)

5.1 Copper Sulfate Pentahydrate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Agriculture and Forestry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fruits and Vegetables

5.5 Cereals and Grains

5.6 Ornamental Plants

5.7 Construction

5.8 Aquaculture

5.9 Chemical Industry

5.10 Electroplating and Galvanic

5.11 Metal and Mine

5.12 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Copper Sulfate Pentahydrate Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 WEGO CHEMICAL & MINERAL CORPORATION (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALLAN CHEMICAL CORPORATION (U.S.)

6.4 NOAH CHEMICALS (U.S.)

6.5 ATOTECH (GERMANY)

6.6 LAIWU IRON AND STEEL GROUP (CHINA)

6.7 JIANGXI COPPER (CHINA)

6.8 JINCHUAN GROUP (CHINA)

6.9 UNIVERTICAL (U.S.)

6.10 HIGHNIC GROUP (SOUTH KOREA)

6.11 G.G. MANUFACTURERS (INDIA)

6.12 BENEUT (SOUTH KOREA)

6.13 OLD BRIDGE CHEMICALS (U.S.)

6.14 GREEN MOUNTAIN (U.S.)

6.15 MITSUBISHI (JAPAN)

6.16 SUMITOMO (JAPAN)

6.17 BAKIRSULFAT (TURKEY)

6.18 BLUE LINE CORPORATION (U.S.)

6.19 MCM INDUSTRIAL (U.S.)

6.20 MANI AGRO CHEM (INDIA)

6.21 OTHER KEY PLAYERS

6.22

Chapter 7: Global Copper Sulfate Pentahydrate Market By Region

7.1 Overview

7.2. North America Copper Sulfate Pentahydrate Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Industrial Grade

7.2.4.2 Agricultural Grade

7.2.4.3 Feed Grade

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Agriculture and Forestry

7.2.5.2 Fruits and Vegetables

7.2.5.3 Cereals and Grains

7.2.5.4 Ornamental Plants

7.2.5.5 Construction

7.2.5.6 Aquaculture

7.2.5.7 Chemical Industry

7.2.5.8 Electroplating and Galvanic

7.2.5.9 Metal and Mine

7.2.5.10 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Copper Sulfate Pentahydrate Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Industrial Grade

7.3.4.2 Agricultural Grade

7.3.4.3 Feed Grade

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Agriculture and Forestry

7.3.5.2 Fruits and Vegetables

7.3.5.3 Cereals and Grains

7.3.5.4 Ornamental Plants

7.3.5.5 Construction

7.3.5.6 Aquaculture

7.3.5.7 Chemical Industry

7.3.5.8 Electroplating and Galvanic

7.3.5.9 Metal and Mine

7.3.5.10 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Copper Sulfate Pentahydrate Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Industrial Grade

7.4.4.2 Agricultural Grade

7.4.4.3 Feed Grade

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Agriculture and Forestry

7.4.5.2 Fruits and Vegetables

7.4.5.3 Cereals and Grains

7.4.5.4 Ornamental Plants

7.4.5.5 Construction

7.4.5.6 Aquaculture

7.4.5.7 Chemical Industry

7.4.5.8 Electroplating and Galvanic

7.4.5.9 Metal and Mine

7.4.5.10 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Copper Sulfate Pentahydrate Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Industrial Grade

7.5.4.2 Agricultural Grade

7.5.4.3 Feed Grade

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Agriculture and Forestry

7.5.5.2 Fruits and Vegetables

7.5.5.3 Cereals and Grains

7.5.5.4 Ornamental Plants

7.5.5.5 Construction

7.5.5.6 Aquaculture

7.5.5.7 Chemical Industry

7.5.5.8 Electroplating and Galvanic

7.5.5.9 Metal and Mine

7.5.5.10 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Copper Sulfate Pentahydrate Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Industrial Grade

7.6.4.2 Agricultural Grade

7.6.4.3 Feed Grade

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Agriculture and Forestry

7.6.5.2 Fruits and Vegetables

7.6.5.3 Cereals and Grains

7.6.5.4 Ornamental Plants

7.6.5.5 Construction

7.6.5.6 Aquaculture

7.6.5.7 Chemical Industry

7.6.5.8 Electroplating and Galvanic

7.6.5.9 Metal and Mine

7.6.5.10 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Copper Sulfate Pentahydrate Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Industrial Grade

7.7.4.2 Agricultural Grade

7.7.4.3 Feed Grade

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Agriculture and Forestry

7.7.5.2 Fruits and Vegetables

7.7.5.3 Cereals and Grains

7.7.5.4 Ornamental Plants

7.7.5.5 Construction

7.7.5.6 Aquaculture

7.7.5.7 Chemical Industry

7.7.5.8 Electroplating and Galvanic

7.7.5.9 Metal and Mine

7.7.5.10 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Copper Sulfate Pentahydrate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.31 Bn. |

|

Forecast Period 2023-34 CAGR: |

1.60% |

Market Size in 2032: |

USD 1.51 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

Wego Chemical & Mineral Corporation (U.S.), Allan Chemical Corporation (U.S.), Noah Chemicals (U.S.), Atotech (Germany), Laiwu Iron and Steel Group (China), Jiangxi Copper (China), Jinchuan Group (China), UNIVERTICAL (U.S.), Highnic Group (South Korea), G.G. MANUFACTURERS (India), Beneut (South Korea), Old Bridge Chemicals (U.S.), GREEN MOUNTAIN (U.S.), Mitsubishi (Japan), Sumitomo (Japan), Bakirsulfat (Turkey), Blue Line Corporation (U.S.), MCM Industrial (U.S.), and Mani Agro Chem (India) and among others.

The Copper Sulfate Pentahydrate Market is segmented into By Product Type, By Application and region. By Product Type, the market is categorized into Industrial Grade, Agricultural Grade, and Feed Grade.By Application, the market is categorized into Agriculture and Forestry, Aquaculture, Chemical Industry, Electroplating and Galvanic, Metal and Mine, and Others.By region, it is analyzed across Asia Pacific (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Copper sulphate pentahydrate, Copper sulphate, blue crystals, Copper sulphate crystals, hydrated copper sulphate, Bluevitriol, blue ocher, blue gem, Turkish stone blue. In agriculture it is used as a fungicide and herbicide; in industry as in electroplating and in dyeing industry as mordant; while in the chemistry laboratory it has got many uses. The compound is quite distinctive in color and very useful in a wide variety of applications.

Copper Sulfate Pentahydrate Market Size Was Valued at USD 1.31 Billion in 2023, and is Projected to Reach USD 1.51 Billion by 2032, Growing at a CAGR of 1.60% From 2024-2032.