Content Intelligence Platform Market Synopsis

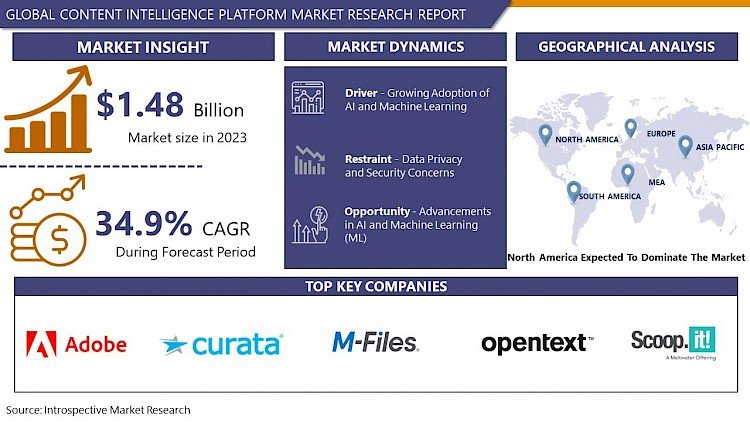

Global Content Intelligence Platform Market size is expected to grow from USD 1.48 Billion in 2023 to USD 21.9 Billion by 2032, at a CAGR of 34.9% during the forecast period (2024-2032).

A Content Intelligence Platform (CIP) is a technology solution that empowers organizations to manage, analyze, and optimize their content across various digital channels. It combines elements of artificial intelligence, machine learning, and data analytics to provide actionable insights into content performance, audience engagement, and overall content strategy. By leveraging CIPs, businesses can make data-driven decisions to enhance their content creation process, improve customer experiences, and drive better results.

-

These platforms typically offer features such as content analytics, content recommendation engines, personalization tools, and workflow automation capabilities. They cater to diverse industries such as marketing, e-commerce, publishing, and media, helping businesses gain a competitive edge by delivering relevant and impactful content to their target audiences. As the digital landscape continues to evolve, Content Intelligence Platforms play a crucial role in helping organizations stay agile, responsive, and efficient in their content management efforts.

- Content intelligence software provides marketers with a comprehensive solution for optimizing their content creation and promotion efforts. It offers metrics, reporting, content analysis, automation, and content management. Big data analysis helps marketers understand the best content, reach, and impact, while content analysis helps identify style and SEO improvements. Automation uses artificial intelligence and algorithms to automate content creation and promotion processes.

Content Intelligence Platform Market Trend Analysis:

Growing Adoption of AI and Machine Learning

- The market for content intelligence platforms (CIPs) is expanding due in large part to the growing use of machine learning (ML) and artificial intelligence (AI). many different sectors are realizing how revolutionary AI and ML can be when it comes to gleaning insightful information from large-scale content databases. By utilizing cutting-edge algorithms and learning processes, CIPs let companies effectively examine, classify, and extract valuable information from their content archives. These platforms are essential tools in today's corporate climate because they automate content processing, enhance decision-making procedures, and reveal insightful patterns.

- Industries are facing an ever-increasing amount of digital material, which is driving up demand for advanced content intelligence platforms. In an era of information overload, this flexibility guarantees that businesses can stay competitive by enabling them to make well-informed decisions based on a thorough understanding of their material. The market for content intelligence platforms is expected to increase significantly as a result of the growing reliance on AI and ML technologies. These platforms give organizations a competitive edge by enabling them to fully use their digital assets and transform unstructured data into insightful strategic plans.

Advancements in AI and Machine Learning (ML)

- Rapid advancements in machine learning (ML) and artificial intelligence (AI) have created significant potential in a variety of businesses. With the further advancement of AI and ML, one's capacity for data analysis, pattern recognition, and decision-making is enhanced. In the context of business, this means there are opportunities for more sophisticated and efficient solutions, such as customized user experiences and predictive analytics. By utilizing AI and ML, organizations may gain a competitive edge by optimizing processes, fostering innovation, and better understanding consumer behaviour.

- Additionally, the incorporation of AI and ML into a variety of industries creates opportunities for the automation and optimization of manual or resource-intensive procedures. Healthcare, banking, manufacturing, and logistics are just a few of the industries that stand to gain from these developments. Artificial intelligence (AI) has the potential to improve healthcare diagnoses, maximize manufacturing efficiency, expedite financial procedures, and improve supply chain logistics. Because AI and ML can learn from data patterns and are flexible, they can be used to continuously develop, which makes them valuable tools for companies trying to be resilient and agile in a market that is changing quickly.

- Furthermore, as AI and ML technologies become more accessible, there is a chance to lead the creation of cutting-edge goods and services. Startups and well-established businesses might investigate novel applications and come up with solutions that meet certain market needs. The broad use of AI and ML not only drives scientific progress but also opens up new avenues for competitiveness and economic growth, making it a crucial enabler for possibilities in a range of industries.

Content Intelligence Platform Market Segment Analysis:

Content Intelligence Platform Market is Segmented Based on By Component, Deployment, Organization Size, and Vertical.

By Component, Services Segment Is Expected to Dominate the Market During the Forecast Period.

- In the market for content intelligence platforms (CIPs), service delivery stands out as a key component that ensures the effective use and customization of these cutting-edge products. Enterprises providing all-inclusive CIP services—including implementation, customisation, training, and continuous support a critical role in meeting the changing demands of companies looking to realize the full value of content intelligence.

- Service providers are essential in helping customers integrate systems smoothly, move data, and modify the platform to fit unique organizational needs. In addition to increasing user adoption and facilitating a seamless transition, this service-centric strategy makes sure that organizations get the most out of their content intelligence platforms. The growing demand for CIPs makes the focus on service-oriented offers a crucial differentiator, allowing providers to forge long-lasting relationships with customers and preserve a competitive advantage in the dynamic market environment.

By Organization Size, Large Enterprise Segment Held the Largest Share Of 69.20% In 2022

- This market for content intelligence platforms (CIPs) is poised for tremendous growth, with the big enterprise sector expected to account for a large share of the industry's total size. These businesses, which are renowned for having vast content libraries and complex data ecosystems, can greatly benefit from the enhanced features that CIPs provide. Large businesses need complex solutions for efficient content management and analysis because of the difficulties presented by vast amounts of digital material spread across several departments. By providing strong capabilities for automated content processing, classification, and the extraction of useful intelligence, content intelligence platforms meet these demands.

- Integrated content intelligence platforms are expected to see a spike in demand as more major organizations become aware of the strategic benefits of using content data. Due to CIPs' scalability and adaptability, they are becoming indispensable tools for large enterprises looking to improve content-related processes and gain a competitive edge in the digital age. This trend further solidifies the dominant role of large enterprises in influencing the wider market landscape.

Content Intelligence Platform Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The market for content intelligence platforms is dominated by North America, which is significant. Strong technical infrastructure, broad digital usage, and a rising need for sophisticated content analytics solutions all attest to its supremacy. To improve content processes and obtain useful insights, major North American organizations are actively using Content Intelligence Platforms or CIPs. The presence of important industrial players and a proactive approach to adopting technology improvements further solidify the region's leadership in CIP adoption. The developed corporate environment in North America and its steadfast dedication to making decisions based on data are other important factors influencing the market's growth and direction for content intelligence platforms.

Key Players Covered in Content Intelligence Platform Market:

- OneSpot Inc. (US)

- Vennli Inc. (US)

- Curata Inc. (US)

- Adobe Inc. (US)

- Scoop. it (US)

- ABBYY (US)

- Smartlogic (US)

- Emplifi Inc. (US)

- Optimizely (US)

- Semrush (US)

- Skyword, Inc. (US)

- Ceralytics (US)

- Progress Software Corporation (US)

- OpenText Corporation (Canada)

- Atomic Reach Inc. (Canada)

- M-Files Corporation (Finland)

- Concured (UK)

- Content360 Ltd (UK)

- Idio (UK)

- BuzzSumo (UK), and Other Major Players

Key Industry Development in The Content Intelligence Platform Market:

- In March 2023, ChapsVision, a prominent data processing specialist, announced today the successful acquisition of QWAM Content Intelligence, marking a significant milestone in its strategic growth initiatives. This strategic move aligns with ChapsVision's vision to emerge as a leading force in European natural language processing (NLP) solutions.

- In May 2023, Laserfiche, a SaaS provider in intelligent content management, introduced a certified connector for MuleSoft. This integration streamlines access to Laserfiche’s content service platform, enabling businesses to enhance productivity by seamlessly integrating the solutions. The connector links Laserfiche’s low-code process automation, secure content management, and intelligent content capture features with various line-of-business applications.

|

Global Content Intelligence Platform Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.48 Bn. |

|

Forecast Period 2024-32 CAGR: |

34.9% |

Market Size in 2032: |

USD 21.9 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CONTENT INTELLIGENCE PLATFORM MARKET BY COMPONENT (2017-2032)

- CONTENT INTELLIGENCE PLATFORM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- CONTENT INTELLIGENCE PLATFORM MARKET BY DEPLOYMENT (2017-2032)

- CONTENT INTELLIGENCE PLATFORM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISE

- HYBRID

- CONTENT INTELLIGENCE PLATFORM MARKET BY ORGANIZATION SIZE (2017-2032)

- CONTENT INTELLIGENCE PLATFORM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISE

- CONTENT INTELLIGENCE PLATFORM MARKET BY VERTICAL (2017-2032)

- CONTENT INTELLIGENCE PLATFORM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT & PUBLIC SECTOR

- HEALTHCARE & LIFE SCIENCES

- IT & TELECOM

- MANUFACTURING

- MEDIA & ENTERTAINMENT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Content Intelligence Platform Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ONESPOT INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- VENNLI INC. (US)

- CURATA INC. (US)

- ADOBE INC. (US)

- SCOOP. IT (US)

- ABBYY (US)

- SMARTLOGIC (US)

- EMPLIFI INC. (US)

- OPTIMIZELY (US)

- SEMRUSH (US)

- SKYWORD, INC. (US)

- CERALYTICS (US)

- PROGRESS SOFTWARE CORPORATION (US)

- OPENTEXT CORPORATION (CANADA)

- ATOMIC REACH INC. (CANADA)

- M-FILES CORPORATION (FINLAND)

- CONCURED (UK)

- CONTENT360 LTD (UK)

- IDIO (UK)

- BUZZSUMO (UK)

- COMPETITIVE LANDSCAPE

- GLOBAL CONTENT INTELLIGENCE PLATFORM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Content Intelligence Platform Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.48 Bn. |

|

Forecast Period 2024-32 CAGR: |

34.9% |

Market Size in 2032: |

USD 21.9 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CONTENT INTELLIGENCE PLATFORM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CONTENT INTELLIGENCE PLATFORM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CONTENT INTELLIGENCE PLATFORM MARKET COMPETITIVE RIVALRY

TABLE 005. CONTENT INTELLIGENCE PLATFORM MARKET THREAT OF NEW ENTRANTS

TABLE 006. CONTENT INTELLIGENCE PLATFORM MARKET THREAT OF SUBSTITUTES

TABLE 007. CONTENT INTELLIGENCE PLATFORM MARKET BY TYPE

TABLE 008. CLOUD BASED MARKET OVERVIEW (2016-2028)

TABLE 009. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 010. MARKET OVERVIEW (2016-2028)

TABLE 011. CONTENT INTELLIGENCE PLATFORM MARKET BY APPLICATION

TABLE 012. BFSI MARKET OVERVIEW (2016-2028)

TABLE 013. GOVERNMENT AND PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

TABLE 014. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 015. IT AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

TABLE 016. MEDIA AND ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 017. RETAIL AND CONSUMER GOODS MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA CONTENT INTELLIGENCE PLATFORM MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA CONTENT INTELLIGENCE PLATFORM MARKET, BY APPLICATION (2016-2028)

TABLE 021. N CONTENT INTELLIGENCE PLATFORM MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE CONTENT INTELLIGENCE PLATFORM MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE CONTENT INTELLIGENCE PLATFORM MARKET, BY APPLICATION (2016-2028)

TABLE 024. CONTENT INTELLIGENCE PLATFORM MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC CONTENT INTELLIGENCE PLATFORM MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC CONTENT INTELLIGENCE PLATFORM MARKET, BY APPLICATION (2016-2028)

TABLE 027. CONTENT INTELLIGENCE PLATFORM MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA CONTENT INTELLIGENCE PLATFORM MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA CONTENT INTELLIGENCE PLATFORM MARKET, BY APPLICATION (2016-2028)

TABLE 030. CONTENT INTELLIGENCE PLATFORM MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA CONTENT INTELLIGENCE PLATFORM MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA CONTENT INTELLIGENCE PLATFORM MARKET, BY APPLICATION (2016-2028)

TABLE 033. CONTENT INTELLIGENCE PLATFORM MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOCIALBAKERS: SNAPSHOT

TABLE 035. SOCIALBAKERS: BUSINESS PERFORMANCE

TABLE 036. SOCIALBAKERS: PRODUCT PORTFOLIO

TABLE 037. SOCIALBAKERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. ONESPOT: SNAPSHOT

TABLE 038. ONESPOT: BUSINESS PERFORMANCE

TABLE 039. ONESPOT: PRODUCT PORTFOLIO

TABLE 040. ONESPOT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. CERALYTICS: SNAPSHOT

TABLE 041. CERALYTICS: BUSINESS PERFORMANCE

TABLE 042. CERALYTICS: PRODUCT PORTFOLIO

TABLE 043. CERALYTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. CURATA: SNAPSHOT

TABLE 044. CURATA: BUSINESS PERFORMANCE

TABLE 045. CURATA: PRODUCT PORTFOLIO

TABLE 046. CURATA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. OPENTEXT: SNAPSHOT

TABLE 047. OPENTEXT: BUSINESS PERFORMANCE

TABLE 048. OPENTEXT: PRODUCT PORTFOLIO

TABLE 049. OPENTEXT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SCOOP.IT (LINKFLUENCE): SNAPSHOT

TABLE 050. SCOOP.IT (LINKFLUENCE): BUSINESS PERFORMANCE

TABLE 051. SCOOP.IT (LINKFLUENCE): PRODUCT PORTFOLIO

TABLE 052. SCOOP.IT (LINKFLUENCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. IDIO: SNAPSHOT

TABLE 053. IDIO: BUSINESS PERFORMANCE

TABLE 054. IDIO: PRODUCT PORTFOLIO

TABLE 055. IDIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ATOMIC REACH: SNAPSHOT

TABLE 056. ATOMIC REACH: BUSINESS PERFORMANCE

TABLE 057. ATOMIC REACH: PRODUCT PORTFOLIO

TABLE 058. ATOMIC REACH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. KNOTCH: SNAPSHOT

TABLE 059. KNOTCH: BUSINESS PERFORMANCE

TABLE 060. KNOTCH: PRODUCT PORTFOLIO

TABLE 061. KNOTCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. VENNLI: SNAPSHOT

TABLE 062. VENNLI: BUSINESS PERFORMANCE

TABLE 063. VENNLI: PRODUCT PORTFOLIO

TABLE 064. VENNLI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. CONDUCTOR: SNAPSHOT

TABLE 065. CONDUCTOR: BUSINESS PERFORMANCE

TABLE 066. CONDUCTOR: PRODUCT PORTFOLIO

TABLE 067. CONDUCTOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CONCURED: SNAPSHOT

TABLE 068. CONCURED: BUSINESS PERFORMANCE

TABLE 069. CONCURED: PRODUCT PORTFOLIO

TABLE 070. CONCURED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ABBYY TECHNOLOGY: SNAPSHOT

TABLE 071. ABBYY TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 072. ABBYY TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 073. ABBYY TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. SMARTLOGIC: SNAPSHOT

TABLE 074. SMARTLOGIC: BUSINESS PERFORMANCE

TABLE 075. SMARTLOGIC: PRODUCT PORTFOLIO

TABLE 076. SMARTLOGIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY TYPE

FIGURE 012. CLOUD BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 014. MARKET OVERVIEW (2016-2028)

FIGURE 015. CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY APPLICATION

FIGURE 016. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 017. GOVERNMENT AND PUBLIC SECTOR MARKET OVERVIEW (2016-2028)

FIGURE 018. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 019. IT AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 020. MEDIA AND ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 021. RETAIL AND CONSUMER GOODS MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA CONTENT INTELLIGENCE PLATFORM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2024-2032.

OneSpot Inc. (US),Vennli Inc. (US), Curata Inc. (US), Adobe Inc. (US), Scoop. it (US), ABBYY (US),Smartlogic (US), Emplifi Inc. (US),Optimizely (US), Semrush (US), Skyword, Inc. (US), Ceralytics (US), Progress Software Corporation (US), OpenText Corporation (Canada), Atomic Reach Inc. (Canada), M-Files Corporation (Finland), Concured (UK), Content360 Ltd (UK), Idio (UK), BuzzSumo (UK), and Other Major Players.

The Content Intelligence Platform Market is segmented into Component, Deployment, Organization Size, Vertical, and region. By Component, the market is categorized into Solutions and services. By Deployment, the market is categorized into Cloud, On-Premise, and Hybrid. By Organization Size, the market is categorized into SMEs and Large Enterprise. By Vertical, the market is categorized into BFSI, Government & Public Sector, Healthcare & Life Sciences, IT & Telecom, Manufacturing, Media & Entertainment, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Content Intelligence Platform is an all-encompassing solution utilizing cutting-edge technologies like artificial intelligence and machine learning to analyze, optimize, and oversee digital content. It allows organizations to acquire valuable insights, improve content relevance and quality, and streamline content workflows. Through automating content processes and providing actionable suggestions, these platforms empower businesses to efficiently generate, distribute, and manage content, resulting in enhanced engagement and better outcomes.

Global Content Intelligence Platform Market size is expected to grow from USD 1.48 Billion in 2023 to USD 21.9 Billion by 2032, at a CAGR of 34.9% during the forecast period (2024-2032).