Content Delivery Network (CDN) Market Synopsis

Content Delivery Network (CDN) Market Size Was Valued at USD 21.9 Billion in 2023, and is Projected to Reach USD 55.12 Billion by 2032, Growing at a CAGR of 10.8 % From 2024-2032.

A Content Delivery Network (CDN) is a distributed network of servers strategically placed in multiple data centers across the globe. Its primary function is to deliver web content, such as images, videos, scripts, and other static or dynamic assets, to users based on their geographic location. CDN's help improve website performance, reduce latency, and enhance the overall user experience by caching content closer to end-users, thereby speeding up content delivery and reducing server load.

- Content Delivery Networks (CDNs) are used in various industries and applications to accelerate website loading times, distribute global content, and facilitate video streaming. They cache static content on servers closer to end-users, reducing latency and improving user experience. CDNs also facilitate software and application delivery by caching frequently accessed files and distributing them across a network of servers. They play a crucial role in e-commerce by accelerating page load times, improving product image performance, and ensuring seamless checkout experiences. CDNs are also utilized in online gaming platforms to deliver game updates, patches, and downloadable content, reducing lag, latency, and downtime.

- CDNs also provide security features like DDoS protection, Web Application Firewall, and SSL encryption to mitigate DDoS attacks. They can accelerate API responses by caching frequently requested API endpoints and reducing latency for API calls, particularly beneficial for mobile applications and web services. With the rise of IoT devices and edge computing, CDNs are increasingly used to deliver content and applications to network edge devices, reducing latency and bandwidth consumption, making IoT applications more responsive and efficient.

- CDNs are data centers that cache content across multiple servers in different locations, reducing latency and improving website loading times. They offer scalability, redundancy, and failover capabilities, ensuring continuous availability of content and minimizing downtime. CDNs are globally reachable, making them crucial for businesses targeting international audiences or regions with limited internet infrastructure. They also offer security features like DDoS protection, web application firewalls, and SSL/TLS encryption to protect against cyber threats.

- CDNs use techniques like caching, compression, and content optimization to minimize bandwidth usage and reduce server load, improving website performance and lowering hosting costs for content providers. As the demand for video streaming and online gaming continues to grow, CDNs play a vital role in delivering such content efficiently and reliably to users worldwide.

Content Delivery Network (CDN) Market Trend Analysis

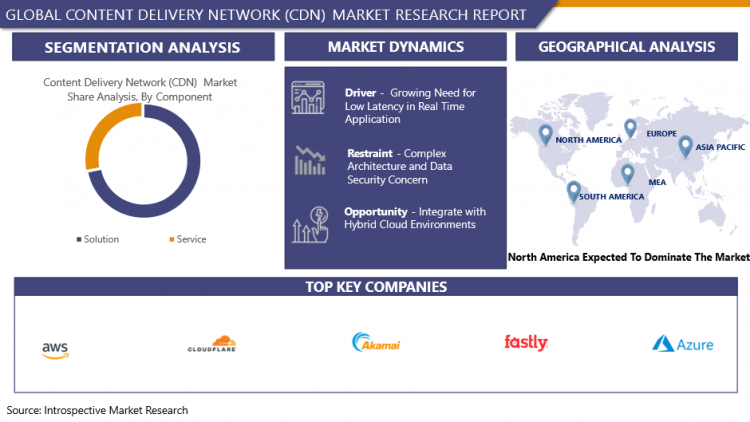

Growing Need for Low Latency in Real Time Application

- The increasing demand for low latency in real-time applications is driving the adoption of Content Delivery Networks (CDNs). Low latency refers to the minimal delay experienced when transmitting data between a client device and a server. In real-time applications like video streaming, online gaming, live event broadcasting, and financial trading, even small delays can significantly degrade the user experience or render the application unusable.

- CDNs are used to enhance user experience, support high-quality streaming, optimize real-time data processing, and provide a competitive advantage in industries like online gaming, e-commerce, and financial services. CDNs can optimize the delivery of dynamic content, application data, and API responses, enabling real-time interactions between users and applications without compromising performance. In industries like online gaming, e-commerce, and financial services, applications that can deliver real-time updates, transactions, or gaming experiences with minimal delay are more likely to attract and retain users compared to slower alternatives.

- By leveraging CDNs to reduce latency, businesses can gain a competitive edge and enhance customer satisfaction. Emerging technologies such as augmented reality, virtual reality, and the Internet of Things further amplify the demand for low latency, as these applications require instant responsiveness to user inputs and sensor data, making low-latency CDN infrastructure essential for their successful deployment and widespread adoption.

Restraint

Complex Architecture and Data Security Concerns

- CDN networks face several challenges in terms of expansion and optimization, including infrastructure availability, regulatory restrictions, network congestion, and cost considerations. Infrastructure limitations can lead to suboptimal content delivery performance, while regulatory restrictions can limit the reach of CDN providers. Network congestion can also affect CDN performance, causing slower content delivery or increased latency.

- Cost considerations can also limit the scalability or expansion of CDN networks, especially for smaller providers or startups competing with larger companies. The architecture of a CDN is complex, involving multiple layers of infrastructure, caching mechanisms, routing algorithms, and optimization techniques. Key aspects contributing to this complexity include managing a large number of edge servers, implementing sophisticated routing algorithms, caching mechanisms, and load balancing.

- Data security concerns arise from CDNs, which store and transmit sensitive user data, and are vulnerable to content tampering, unauthorized duplication, or distribution of copyrighted material. CDNs must implement robust access controls, encryption mechanisms, and digital rights management (DRM) solutions to mitigate these risks.

- DDoS attacks are a significant threat to CDNs, and they must deploy mitigation strategies such as rate limiting, traffic filtering, and anomaly detection to defend against them. Edge server security is also crucial, with strong authentication mechanisms, regular security audits, and patch management processes essential.

Opportunity

Integrate with Hybrid Cloud Environments

- Hybrid cloud environments combine public and private clouds, allowing businesses to enhance application performance and reliability by integrating Content Delivery Networks (CDNs). CDNs cache content closer to end-users, reducing latency and improving user experience. Hybrid cloud environments offer scalability by offloading traffic and distributing it across multiple points of presence, ensuring consistent performance even during peak traffic times.

- CDNs have a global network of servers, extending their reach and delivering content more efficiently. Security features like DDoS protection, web application firewalls, and SSL/TLS encryption can be integrated into hybrid cloud setups. Cost optimization is achieved by leveraging both on-premises infrastructure and cloud resources, reducing bandwidth consumption and minimizing infrastructure investments.

- Edge computing capabilities enable faster processing of dynamic content, real-time data analytics, and personalized experiences. Multi-cloud flexibility is provided by CDNs, allowing businesses to distribute content across different cloud platforms while maintaining consistent performance and reliability.

Challenge

Maintaining High Levels of Reliability and Redundancy to Ensure Uninterrupted Content Delivery

- CDNs operate on a complex network infrastructure spanning multiple locations, requiring constant monitoring, upgrading, and optimization of network components. Redundancy design is crucial to mitigate single points of failure, deploying redundant servers, storage systems, and network connections in each location.

- Load balancing is essential for efficient traffic distribution, requiring continuous optimization and monitoring. Robust failover mechanisms are necessary to redirect traffic away from failed or overloaded servers, often through automated processes. CDNs serve content to users worldwide, presenting challenges related to latency, network congestion, and regulatory compliance.

- Data security measures are essential to protect content and user data from unauthorized access, breaches, or cyberattacks. Disaster recovery plans are necessary to quickly recover from catastrophic events, including natural disasters, cyberattacks, or infrastructure failures, by replicating data across multiple data centers and implementing backup systems.

Content Delivery Network (CDN) Market Segment Analysis:

Content Delivery Network (CDN) Market Segmented on the basis of component, content type, and end-users.

By Component, Solution segment is expected to dominate the market during the forecast period

- The increasing popularity of video streaming and gaming has led to a growing demand for efficient content delivery networks (CDNs). CDNs help deliver high-quality content with reduced latency, ensuring a smooth user experience. As businesses expand globally, they need to deliver content quickly and reliably to users across different locations.

- CDN solutions help manage the growing internet traffic by caching content and delivering it from edge servers closer to end-users. Cybersecurity threats are on the rise, and CDN solutions often include features like DDoS protection, web application firewalls, and SSL/TLS encryption. CDN solutions offer scalability and flexibility, allowing businesses to easily scale their content delivery infrastructure based on demand.

- CDN Solution also help reduce bandwidth costs by offloading traffic from origin servers and optimizing content delivery. Overall, CDN solutions are essential for businesses to ensure efficient and secure online content delivery.

By Content Type, Dynamic segment held the largest share of 49.3% in 2023

- The rise of dynamic content, including streaming media, real-time updates, and personalized content, has led to a surge in the demand for Content Delivery Network (CDN) services to efficiently deliver dynamic content to users worldwide. This demand is driven by the growth of dynamic websites and applications, which rely on server-side processing to generate personalized content for each user.

- CDN providers have invested in improving their infrastructure and technologies to cache and deliver dynamic content, including edge computing capabilities, dynamic caching algorithms, and real-time content optimization tools. Businesses prioritize user experience, and CDN services specializing in dynamic content delivery help optimize website and application performance, reduce latency, and improve overall user experience.

- CDN providers have gained market share by addressing evolving business needs and staying ahead of competitors through strategic partnerships, innovative product offerings, and superior performance.

Content Delivery Network (CDN) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's advanced internet infrastructure, including robust data centers, high-speed connectivity, and advanced telecommunications systems, makes CDN services more effective in the region. The region is home to numerous content providers, including streaming platforms, e-commerce websites, social media platforms, and online gaming companies, who require reliable and high-performance CDN solutions to deliver their content quickly and securely.

- Technological innovation in North America, such as edge computing, security enhancements, and optimization algorithms, strengthens the market dominance of the region. North American businesses were among the earliest adopters of CDN services due to the region's early internet development and high demand for online content delivery.

- The North American CDN market is relatively mature, with well-established players and high competition. This maturity has led to widespread availability of CDN services and a diverse range of solutions tailored to different industries and businesses, solidifying North America's dominance in the market.

Content Delivery Network (CDN) Market Top Key Players:

- Akamai Technologies (US)

- Cloudflare (US)

- Fastly (US)

- Limelight Networks (US)

- Amazon Web Services (US)

- Microsoft Azure (US)

- Google Cloud Platform (US)

- Verizon Digital Media Services (US)

- StackPath (US)

- CenturyLink (US)

- Aryaka Networks (US)

- Comcast Technology Solutions (US)

- Lumen Technologies (US)

- CloudFront (US)

- Imperva (US)

- Level 3 Communications (US)

- Rackspace Technology (US)

- EdgeCast (US)

- Internap (US)

- IBM Cloud (US)

- BitGravity (US)

- Alibaba Cloud (China)

- Tencent Cloud (China)

- CDNetworks (South Korea)

- NTT Communications (Japan), and other major players

Key Industry Developments in the Content Delivery Network (CDN) Market:

- In June 2023, Amazon Web Services (AWS) opened its first office in Budapest, Hungary, in June. The new office is part of AWS’s ongoing investment in Central Eastern Europe the company expand with the growing number of customers and partners in the region. The new office space will help the teams better support organisations of all sizes in Hungary, including start-ups, enterprises, and public sector organisations, as they make the transition to the AWS Cloud.

- In March 2023, Cloudways, the leading cloud hosting provider, is announced the launch of a new integration in partnership with Cloudflare, the security, performance, and reliability company helping to build a better Internet. The integration will equip Cloudways customers with enterprise-level performance and security features.

|

Global Content Delivery Network (CDN) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

21.9 Bn |

|

Forecast Period 2024-32 CAGR: |

10.8 % |

Market Size in 2032: |

55.12 Bn |

|

Segments Covered: |

By Component |

|

|

|

By Content Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CONTENT DELIVERY NETWORK (CDN) MARKET BY COMPONENT (2017-2032)

- CONTENT DELIVERY NETWORK (CDN) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICE

- CONTENT DELIVERY NETWORK (CDN) MARKET BY CONTENT TYPE (2017-2032)

- CONTENT DELIVERY NETWORK (CDN) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STATIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DYNAMIC

- CONTENT DELIVERY NETWORK (CDN) MARKET BY END USER (2017-2032)

- CONTENT DELIVERY NETWORK (CDN) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEDIA AND ENTERTAINMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ADVERTISING

- E-COMMERCE

- HEALTHCARE

- BUSINESS AND FINANCIAL SERVICES

- RESEARCH AND EDUCATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Content Delivery Network (CDN) Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AKAMAI TECHNOLOGIES (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CLOUDFLARE (US)

- FASTLY (US)

- LIMELIGHT NETWORKS (US)

- AMAZON WEB SERVICES (US)

- MICROSOFT AZURE (US)

- GOOGLE CLOUD PLATFORM (US)

- VERIZON DIGITAL MEDIA SERVICES (US)

- STACKPATH (US)

- CENTURYLINK (US)

- ARYAKA NETWORKS (US)

- COMCAST TECHNOLOGY SOLUTIONS (US)

- LUMEN TECHNOLOGIES (US)

- CLOUDFRONT (US)

- IMPERVA (US)

- LEVEL 3 COMMUNICATIONS (US)

- RACKSPACE TECHNOLOGY (US)

- EDGECAST (US)

- INTERNAP (US)

- IBM CLOUD (US)

- BITGRAVITY (US)

- ALIBABA CLOUD (CHINA)

- TENCENT CLOUD (CHINA)

- CDNETWORKS (SOUTH KOREA)

- NTT COMMUNICATIONS (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL CONTENT DELIVERY NETWORK (CDN) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Content Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Content Delivery Network (CDN) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

21.9 Bn |

|

Forecast Period 2024-32 CAGR: |

10.8 % |

Market Size in 2032: |

55.12 Bn |

|

Segments Covered: |

By Component |

|

|

|

By Content Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CONTENT DELIVERY NETWORK (CDN) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CONTENT DELIVERY NETWORK (CDN) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CONTENT DELIVERY NETWORK (CDN) MARKET COMPETITIVE RIVALRY

TABLE 005. CONTENT DELIVERY NETWORK (CDN) MARKET THREAT OF NEW ENTRANTS

TABLE 006. CONTENT DELIVERY NETWORK (CDN) MARKET THREAT OF SUBSTITUTES

TABLE 007. CONTENT DELIVERY NETWORK (CDN) MARKET BY CONTENT TYPE

TABLE 008. STATIC CONTENT MARKET OVERVIEW (2016-2028)

TABLE 009. DYNAMIC CONTENT MARKET OVERVIEW (2016-2028)

TABLE 010. CONTENT DELIVERY NETWORK (CDN) MARKET BY PROVIDER TYPE

TABLE 011. TRADITIONAL CDN MARKET OVERVIEW (2016-2028)

TABLE 012. CLOUD CDN MARKET OVERVIEW (2016-2028)

TABLE 013. P2P CDN MARKET OVERVIEW (2016-2028)

TABLE 014. TELECOM CDN MARKET OVERVIEW (2016-2028)

TABLE 015. CONTENT DELIVERY NETWORK (CDN) MARKET BY END USER

TABLE 016. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 017. ADVERTISING MARKET OVERVIEW (2016-2028)

TABLE 018. E-COMMERCE MARKET OVERVIEW (2016-2028)

TABLE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 020. BUSINESS & FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

TABLE 021. RESEARCH & EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 022. OTHER MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY CONTENT TYPE (2016-2028)

TABLE 024. NORTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY PROVIDER TYPE (2016-2028)

TABLE 025. NORTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY END USER (2016-2028)

TABLE 026. N CONTENT DELIVERY NETWORK (CDN) MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE CONTENT DELIVERY NETWORK (CDN) MARKET, BY CONTENT TYPE (2016-2028)

TABLE 028. EUROPE CONTENT DELIVERY NETWORK (CDN) MARKET, BY PROVIDER TYPE (2016-2028)

TABLE 029. EUROPE CONTENT DELIVERY NETWORK (CDN) MARKET, BY END USER (2016-2028)

TABLE 030. CONTENT DELIVERY NETWORK (CDN) MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC CONTENT DELIVERY NETWORK (CDN) MARKET, BY CONTENT TYPE (2016-2028)

TABLE 032. ASIA PACIFIC CONTENT DELIVERY NETWORK (CDN) MARKET, BY PROVIDER TYPE (2016-2028)

TABLE 033. ASIA PACIFIC CONTENT DELIVERY NETWORK (CDN) MARKET, BY END USER (2016-2028)

TABLE 034. CONTENT DELIVERY NETWORK (CDN) MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY CONTENT TYPE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY PROVIDER TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY END USER (2016-2028)

TABLE 038. CONTENT DELIVERY NETWORK (CDN) MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY CONTENT TYPE (2016-2028)

TABLE 040. SOUTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY PROVIDER TYPE (2016-2028)

TABLE 041. SOUTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET, BY END USER (2016-2028)

TABLE 042. CONTENT DELIVERY NETWORK (CDN) MARKET, BY COUNTRY (2016-2028)

TABLE 043. AKAMAI TECHNOLOGIES: SNAPSHOT

TABLE 044. AKAMAI TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 045. AKAMAI TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 046. AKAMAI TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MICROSOFT CORPORATION: SNAPSHOT

TABLE 047. MICROSOFT CORPORATION: BUSINESS PERFORMANCE

TABLE 048. MICROSOFT CORPORATION: PRODUCT PORTFOLIO

TABLE 049. MICROSOFT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. IBM CORPORATION: SNAPSHOT

TABLE 050. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 051. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 052. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. LIMELIGHT NETWORKS: SNAPSHOT

TABLE 053. LIMELIGHT NETWORKS: BUSINESS PERFORMANCE

TABLE 054. LIMELIGHT NETWORKS: PRODUCT PORTFOLIO

TABLE 055. LIMELIGHT NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. AMAZON WEB SERVICES INC.: SNAPSHOT

TABLE 056. AMAZON WEB SERVICES INC.: BUSINESS PERFORMANCE

TABLE 057. AMAZON WEB SERVICES INC.: PRODUCT PORTFOLIO

TABLE 058. AMAZON WEB SERVICES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CLOUDFLARE INC.: SNAPSHOT

TABLE 059. CLOUDFLARE INC.: BUSINESS PERFORMANCE

TABLE 060. CLOUDFLARE INC.: PRODUCT PORTFOLIO

TABLE 061. CLOUDFLARE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ONAPP LIMITED.: SNAPSHOT

TABLE 062. ONAPP LIMITED.: BUSINESS PERFORMANCE

TABLE 063. ONAPP LIMITED.: PRODUCT PORTFOLIO

TABLE 064. ONAPP LIMITED.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. GOOGLE: SNAPSHOT

TABLE 065. GOOGLE: BUSINESS PERFORMANCE

TABLE 066. GOOGLE: PRODUCT PORTFOLIO

TABLE 067. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. AT&T: SNAPSHOT

TABLE 068. AT&T: BUSINESS PERFORMANCE

TABLE 069. AT&T: PRODUCT PORTFOLIO

TABLE 070. AT&T: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. DEUTSCHE TELEKOM AG: SNAPSHOT

TABLE 071. DEUTSCHE TELEKOM AG: BUSINESS PERFORMANCE

TABLE 072. DEUTSCHE TELEKOM AG: PRODUCT PORTFOLIO

TABLE 073. DEUTSCHE TELEKOM AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. STACK PATH LLC.: SNAPSHOT

TABLE 074. STACK PATH LLC.: BUSINESS PERFORMANCE

TABLE 075. STACK PATH LLC.: PRODUCT PORTFOLIO

TABLE 076. STACK PATH LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. FASTLY: SNAPSHOT

TABLE 077. FASTLY: BUSINESS PERFORMANCE

TABLE 078. FASTLY: PRODUCT PORTFOLIO

TABLE 079. FASTLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. G-CORE LABS: SNAPSHOT

TABLE 080. G-CORE LABS: BUSINESS PERFORMANCE

TABLE 081. G-CORE LABS: PRODUCT PORTFOLIO

TABLE 082. G-CORE LABS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. NTT COMMUNICATIONS CORPORATIONS: SNAPSHOT

TABLE 083. NTT COMMUNICATIONS CORPORATIONS: BUSINESS PERFORMANCE

TABLE 084. NTT COMMUNICATIONS CORPORATIONS: PRODUCT PORTFOLIO

TABLE 085. NTT COMMUNICATIONS CORPORATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 086. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 087. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 088. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY CONTENT TYPE

FIGURE 012. STATIC CONTENT MARKET OVERVIEW (2016-2028)

FIGURE 013. DYNAMIC CONTENT MARKET OVERVIEW (2016-2028)

FIGURE 014. CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY PROVIDER TYPE

FIGURE 015. TRADITIONAL CDN MARKET OVERVIEW (2016-2028)

FIGURE 016. CLOUD CDN MARKET OVERVIEW (2016-2028)

FIGURE 017. P2P CDN MARKET OVERVIEW (2016-2028)

FIGURE 018. TELECOM CDN MARKET OVERVIEW (2016-2028)

FIGURE 019. CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY END USER

FIGURE 020. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 021. ADVERTISING MARKET OVERVIEW (2016-2028)

FIGURE 022. E-COMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 023. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 024. BUSINESS & FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 025. RESEARCH & EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA CONTENT DELIVERY NETWORK (CDN) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Content Delivery Network (CDN) Market research report is 2024-2032.

Akamai Technologies (US), Cloudflare (US),Fastly (US), Limelight Networks (US), Amazon Web Services (US), Microsoft Azure (US), Google Cloud Platform (US), Verizon Digital Media Services (US), StackPath (US), CenturyLink (US), Aryaka Networks (US), Comcast Technology Solutions (US), Lumen Technologies (US), CloudFront (US), Imperva (US), Level 3 Communications (US), Rackspace Technology (US), EdgeCast (US), Internap (US), IBM Cloud (US), BitGravity (US), Alibaba Cloud (China), Tencent Cloud (China), CDNetworks (South Korea), NTT Communications (Japan), and Other Major Players.

The Content Delivery Network (CDN) Market is segmented into Component, Content Type, End User, and region. By Component, the market is categorized into Solution, Service. By Content Type, the market is categorized into Static, Dynamic. By End User, the market is categorized into Media and Entertainment, Advertising, E-Commerce, Healthcare, Business and Financial Services, Research and Education. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Content Delivery Network (CDN) market involves services provided by companies to deliver internet content, such as web pages, videos, images, and other digital assets, quickly and efficiently to end-users. CDNs use a network of servers strategically distributed across various locations to cache and deliver content to users based on their geographic location, reducing latency and improving website performance. This market has grown significantly due to the increasing demand for fast and reliable content delivery, driven by the proliferation of online media consumption, e-commerce, and cloud-based services.

Content Delivery Network (CDN) Market Size Was Valued at USD 21.9 Billion in 2023, and is Projected to Reach USD 55.12 Billion by 2032, Growing at a CAGR of 10.8 % From 2024-2032.