Consumer Banking Service Market Synopsis

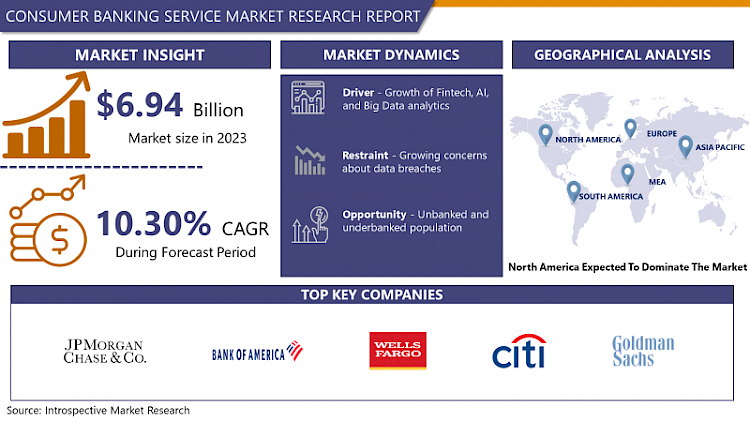

Consumer Banking Service Market Size Was Valued at USD 6.94 Billion in 2023, and is Projected to Reach USD 16.77 Million by 2032, Growing at a CAGR of 10.30% From 2024-2032.

Consumer banking is a segment of banking operation which offers banking services for the individuals and families, whereas other forms of banking offer services to businesses and large organizations. It usually includes various services onboard because customers usually have varying needs when it comes to financial services. Savings and checking accounts, overdraft and personal loan, housing finance, credit cards, investment facilities, and insurance and consulting services such as life insurance, health insurance, house insurance, etc.

- The main focus of consumer banking is to offer the people simple and easily available products that address the need of an average consumer in managing his/her expenses, saving, investing money and protecting oneself from monetary mishaps.

- Consumer banks need to provide good and cheap interest rates, fewer charges, customer convenience through online services, and good treating all customers with kindness to acquire more customers. Elaborate information concerning: As advanced and enhanced banking technologies in the digital platform has highly transformed the consumer banking where the customer is provided with the certain services of banking transactions and account management through the internet and mobile banking.

- In addition, a profound importance of consumer banking services cannot be disregarded when it comes to facilitating and enhancing opportunities for financial inclusiveness, enhancing the levels of usage of banking services among excluded population, and generally supporting economic self-empowerment among people and groups.

Consumer Banking Service Market Trend Analysis

Rising Demand for Financial Services

- In essence, the need for the financial services is one of the key trends currently obtaining an ever increasing customer attention in the context of the overall consumer banking service market due to several reasons. Firstly, with the emerging economies and rising incomes per capita, people require tools to better manage their money; in other worlds, there is the need to meet the need for various products and services that enables effective wealth management. This includes increased participation and embraces of purchases goods such as mutual funds, retirement accounts, and wealth management to enhance their future financial security.

- Also, more people alive today have become aware of the need for insurance to cater for medical bills particularly with regards to old people as well as the emergence of Millenials as the dominant customer age.

- Additionally, the implementation of technology and the continuing emergence of digital banking have altered the purchasing behavior of consumers and made banking increased comfort, accessibility, and openness. Fintech, with the emergence of startups and entrants using technology to delivering consumer banking services, has created pressure within traditional banking structures hence forcing them to improve customer experiences and product services.

- Hence the focus shifts towards developing quality omnichannel services, secure internet systems and solutions and offering customized financial advice to customers as consumers are more inclined towards intelligent and competitive environments. In summary, it is observed that demand for consumer banking is growing constantly and thus, for the consumer banking institutions to sustain and grow in today environment it continues to be focused on innovation and customer satisfaction.

Increasing Personalization and Innovation

- The fact that customer wants and needs are shifting from standardization to personalization and more innovation is the perfect opening for the consumer banking service to altogether increase its grounds for providing customer satisfaction. Due to the use of data analysis and artificial intelligence, customers’ perceptions can be utilized to come up with a favorable customer solution delivery channel, which can be personalized according to each customer’s needs and wants.

- In this way, such data as customers’ financial needs and wants, their spending habits, their propensity for risk exposure, etc will help to deliver products and services that meet the market needs and can improve customer satisfaction and hence loyalty to the banks. Personalisation also applies to the online banking functionality, logic and design where better use of context and interaction can improve customer experiences and simplify banking routines.

- However, consumers’ banking innovation creates opportunities for new revenue sources and business ventilations in the marketplace. Online competitors applying innovative solutions to banking are actually changing the traditional approaches by offering new products like P2P marketplaces, robo-advisory, and ICO services. Conventional lenders can therefore consider partnering with such companies or implement similar models to run with the emerging trends and investors.

- Also, the development of new payment technologies like contactless payments and mobile money is transforming customer’s expectations and the accompanying engagement with brands. Thus, scientific and creativity approaches in the consumer banking services can help consumer banks to lead the change by tailoring with new expectations of customers and sustainable growth opportunities within the rapidly changing and competitive financial services industry.

Consumer Banking Service Market Segment Analysis:

Consumer Banking Service Market Segmented based on Type, Application.

By Type, digital-led is expected to dominate the market during the forecast period

- Although a majority of established consumer banking services are still led through technology-anchored channels, digital-led segment is currently the most prominent in the market. In the present globalised world and with the presence of smart phone, internet connection and highly defined banking systems, the consumers are shifting more and more to go for the online bank services.

- Branch banking often has certain time limitations attached to it, and the opportunity for customers to perform multiple tasks can be limited by banking hours, while digital banking provides customers with a range of services with convenience of time not being an issue. Such forces include the increase of mobile banking application where the clients prefer to work on their own, the increase of the overall efficiency where clients prefer to access banking services through digital platforms

- Furthermore, the new wave of technological advanced banks and the companies that have emerged as the financial tech companies has challenged the traditionalist banking methods and products and services offerings and delivery systems with better propositions in terms of value and efficiency and at times price too.

- These digital-born competitors deploy contemporary technologies including artificial intelligence, machine learning, or blockchain to offer customised solutions, ensure data security and increase company productivity. Consequently, they have managed to capture a good market of the consumer banking and especially the new generation consumers who are more proud of mobile banking solutions and orientated more towards value setters. Nonetheless, tangible banks still have relevant market share, but the visibility keeps on shifting towards digital banking due to customers’ demands for easy access, flexibility, and innovation.

By Applications, the transactional accounts segment held the largest share

- If we examined the detailed market segmentation in the consumer banking service market application, then transaction accounts could become a dominant one. Current accounts which are mostly in the form of demand deposit account, the largest type of account for the average consumers, are utilized for the routine banking activities including deposit, withdrawals, and bill payments.

- These accounts allow customers to make transactions such as pay bills and take advances easily through debit cards and other online services, and are crucial for meeting customers’ demands and being liquid. Since they are a crucial component in managing the financials of consumers, transacting accounts are used across the population demographics/age groups and continue to be the main income source for the banking institutions through fees and interchange fees.

- Further, credit cards is another emerging segment that is another key segment which has greatly impacting on the overall consumer banking service market. Credit card gives the convenience to purchase items on credit, avail easy cash through cash advances, and gains loyalty rewards and legal consumer rights. That is with credit cards, people have had the convenience to purchase what they want at any one, place, and the purchasing power, especially in cases where an individual is making bulk purchases online.

- However, credit cards are a popular product among people, and they are lucrative for banks as they make money through interests charges, annual fees, and merchant fees that are charged by the bank on the customers on the behalf of businesses. With consumers now increasingly widely using their cash or choosing to use more convenient ways of using electronic money for their purchases, credit cards are expected to retain their hegemonic positions in the consumer banking industry by fuelling the growth of this market and encouraging innovations.

Consumer Banking Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period.

- Some of the reasons that made North America to be leading in the market of consumer banking service are as follows;Firstly, there are many developed and complex financial structures in the region, which have high-level regulation and requirements of the banking industry, as well as technologies and sophisticated networks of financiers. This is because regions such as New York City and Toronto which are among the major global financial centers are located in the North American region which further establishes North America as a financial hub.

- Meanwhile, North American consumer remains as the largest and post-census rich class that target different and more banking products/ services.

- Besides, there is stiff competition from both the existing consumer banks and Fintechs, hence, the consumers benefit from technology-driven and competitive services in North America. The area has been one of the most progressive in terms of digital banking, where customers turn to online and mobile banking based on the keeping features.

- addition to this, the North American bank has also been fast to integrate new technology solutions including Artificial Intelligence, Big data and Analytics, and Block chain in order to boost on both customer relations and the overall performance of the operations with reduced risks. This has placed the North American continent at a strategic position in the provision of the consumer banking service market; more innovations are expected to follow in the region in the coming years

Active Key Players in the Consumer Banking Service Market

- JPMorgan Chase & Co. (New York, USA)

- Bank of America Corporation (Charlotte, USA)

- Wells Fargo & Company (San Francisco, USA)

- Citigroup Inc. (New York, USA)

- Goldman Sachs Group Inc. (New York, USA)

- Morgan Stanley (New York, USA)

- Royal Bank of Canada (Toronto, Canada)

- Toronto-Dominion Bank (Toronto, Canada)

- Scotiabank (Toronto, Canada)

- Bank of Montreal (BMO) (Montreal, Canada)

- HSBC Holdings plc (London, UK)

- Barclays plc (London, UK)

- Lloyds Banking Group (London, UK)

- UBS Group AG (Zurich, Switzerland)

- Credit Suisse Group AG (Zurich, Switzerland)

- BNP Paribas (Paris, France)

- Deutsche Bank AG (Frankfurt, Germany)

- Santander Group (Madrid, Spain)

- Mitsubishi UFJ Financial Group (Tokyo, Japan)

- Sumitomo Mitsui Financial Group (Tokyo, Japan)

- Other Key Players

|

Global Consumer Banking Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.94 Bn. |

|

Forecast Period 2023-34 CAGR: |

10.30% |

Market Size in 2032: |

USD 16.77 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CONSUMER BANKING SERVICE MARKET BY TYPE (2017-2032)

- CONSUMER BANKING SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRADITIONAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIGITAL LED

- CONSUMER BANKING SERVICE MARKET BY APPLICATION (2017-2032)

- CONSUMER BANKING SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRANSACTIONAL ACCOUNTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SAVINGS ACCOUNTS

- DEBIT CARDS

- CREDIT CARDS

- LOANS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Consumer Banking Service Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JPMORGAN CHASE & CO. (NEW YORK, USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BANK OF AMERICA CORPORATION (CHARLOTTE, USA)

- WELLS FARGO & COMPANY (SAN FRANCISCO, USA)

- CITIGROUP INC. (NEW YORK, USA)

- GOLDMAN SACHS GROUP INC. (NEW YORK, USA)

- MORGAN STANLEY (NEW YORK, USA)

- ROYAL BANK OF CANADA (TORONTO, CANADA)

- TORONTO-DOMINION BANK (TORONTO, CANADA)

- SCOTIABANK (TORONTO, CANADA)

- BANK OF MONTREAL (BMO) (MONTREAL, CANADA)

- HSBC HOLDINGS PLC (LONDON, UK)

- BARCLAYS PLC (LONDON, UK)

- LLOYDS BANKING GROUP (LONDON, UK)

- UBS GROUP AG (ZURICH, SWITZERLAND)

- CREDIT SUISSE GROUP AG (ZURICH, SWITZERLAND)

- BNP PARIBAS (PARIS, FRANCE)

- DEUTSCHE BANK AG (FRANKFURT, GERMANY)

- SANTANDER GROUP (MADRID, SPAIN)

- MITSUBISHI UFJ FINANCIAL GROUP (TOKYO, JAPAN)

- SUMITOMO MITSUI FINANCIAL GROUP (TOKYO, JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL CONSUMER BANKING SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Consumer Banking Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.94 Bn. |

|

Forecast Period 2023-34 CAGR: |

10.30% |

Market Size in 2032: |

USD 16.77 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CONSUMER BANKING SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CONSUMER BANKING SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CONSUMER BANKING SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. CONSUMER BANKING SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. CONSUMER BANKING SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. CONSUMER BANKING SERVICE MARKET BY TYPE

TABLE 008. TRADITIONAL MARKET OVERVIEW (2016-2028)

TABLE 009. DIGITAL LED MARKET OVERVIEW (2016-2028)

TABLE 010. CONSUMER BANKING SERVICE MARKET BY APPLICATION

TABLE 011. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 012. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA CONSUMER BANKING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA CONSUMER BANKING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 016. N CONSUMER BANKING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE CONSUMER BANKING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE CONSUMER BANKING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 019. CONSUMER BANKING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC CONSUMER BANKING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC CONSUMER BANKING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 022. CONSUMER BANKING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA CONSUMER BANKING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA CONSUMER BANKING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 025. CONSUMER BANKING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA CONSUMER BANKING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA CONSUMER BANKING SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 028. CONSUMER BANKING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 029. ALLIED IRISH BANK (UK): SNAPSHOT

TABLE 030. ALLIED IRISH BANK (UK): BUSINESS PERFORMANCE

TABLE 031. ALLIED IRISH BANK (UK): PRODUCT PORTFOLIO

TABLE 032. ALLIED IRISH BANK (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. ALDERMORE BANK: SNAPSHOT

TABLE 033. ALDERMORE BANK: BUSINESS PERFORMANCE

TABLE 034. ALDERMORE BANK: PRODUCT PORTFOLIO

TABLE 035. ALDERMORE BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BANK OF IRELAND UK: SNAPSHOT

TABLE 036. BANK OF IRELAND UK: BUSINESS PERFORMANCE

TABLE 037. BANK OF IRELAND UK: PRODUCT PORTFOLIO

TABLE 038. BANK OF IRELAND UK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CLOSE BROTHERS: SNAPSHOT

TABLE 039. CLOSE BROTHERS: BUSINESS PERFORMANCE

TABLE 040. CLOSE BROTHERS: PRODUCT PORTFOLIO

TABLE 041. CLOSE BROTHERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. THE CO-OPERATIVE BANK: SNAPSHOT

TABLE 042. THE CO-OPERATIVE BANK: BUSINESS PERFORMANCE

TABLE 043. THE CO-OPERATIVE BANK: PRODUCT PORTFOLIO

TABLE 044. THE CO-OPERATIVE BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. CYBG (CLYDESDALE AND YORKSHIRE BANKS): SNAPSHOT

TABLE 045. CYBG (CLYDESDALE AND YORKSHIRE BANKS): BUSINESS PERFORMANCE

TABLE 046. CYBG (CLYDESDALE AND YORKSHIRE BANKS): PRODUCT PORTFOLIO

TABLE 047. CYBG (CLYDESDALE AND YORKSHIRE BANKS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. FIRST DIRECT: SNAPSHOT

TABLE 048. FIRST DIRECT: BUSINESS PERFORMANCE

TABLE 049. FIRST DIRECT: PRODUCT PORTFOLIO

TABLE 050. FIRST DIRECT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. HANDELSBANKEN: SNAPSHOT

TABLE 051. HANDELSBANKEN: BUSINESS PERFORMANCE

TABLE 052. HANDELSBANKEN: PRODUCT PORTFOLIO

TABLE 053. HANDELSBANKEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. MASTHAVEN BANK: SNAPSHOT

TABLE 054. MASTHAVEN BANK: BUSINESS PERFORMANCE

TABLE 055. MASTHAVEN BANK: PRODUCT PORTFOLIO

TABLE 056. MASTHAVEN BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. METRO BANK: SNAPSHOT

TABLE 057. METRO BANK: BUSINESS PERFORMANCE

TABLE 058. METRO BANK: PRODUCT PORTFOLIO

TABLE 059. METRO BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ONESAVINGS BANK: SNAPSHOT

TABLE 060. ONESAVINGS BANK: BUSINESS PERFORMANCE

TABLE 061. ONESAVINGS BANK: PRODUCT PORTFOLIO

TABLE 062. ONESAVINGS BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. PARAGON BANK: SNAPSHOT

TABLE 063. PARAGON BANK: BUSINESS PERFORMANCE

TABLE 064. PARAGON BANK: PRODUCT PORTFOLIO

TABLE 065. PARAGON BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SECURE TRUST BANK: SNAPSHOT

TABLE 066. SECURE TRUST BANK: BUSINESS PERFORMANCE

TABLE 067. SECURE TRUST BANK: PRODUCT PORTFOLIO

TABLE 068. SECURE TRUST BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. SHAWBROOK BANK: SNAPSHOT

TABLE 069. SHAWBROOK BANK: BUSINESS PERFORMANCE

TABLE 070. SHAWBROOK BANK: PRODUCT PORTFOLIO

TABLE 071. SHAWBROOK BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. TSB: SNAPSHOT

TABLE 072. TSB: BUSINESS PERFORMANCE

TABLE 073. TSB: PRODUCT PORTFOLIO

TABLE 074. TSB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. VIRGIN MONEY: SNAPSHOT

TABLE 075. VIRGIN MONEY: BUSINESS PERFORMANCE

TABLE 076. VIRGIN MONEY: PRODUCT PORTFOLIO

TABLE 077. VIRGIN MONEY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CONSUMER BANKING SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CONSUMER BANKING SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. TRADITIONAL MARKET OVERVIEW (2016-2028)

FIGURE 013. DIGITAL LED MARKET OVERVIEW (2016-2028)

FIGURE 014. CONSUMER BANKING SERVICE MARKET OVERVIEW BY APPLICATION

FIGURE 015. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA CONSUMER BANKING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE CONSUMER BANKING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC CONSUMER BANKING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA CONSUMER BANKING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA CONSUMER BANKING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Consumer Banking Service Market research report is 2024-2032.

JPMorgan Chase & Co. (New York, USA), Bank of America Corporation (Charlotte, USA), Wells Fargo & Company (San Francisco, USA), Citigroup Inc. (New York, USA), Goldman Sachs Group Inc. (New York, USA), Morgan Stanley (New York, USA), Royal Bank of Canada (Toronto, Canada), Toronto-Dominion Bank (Toronto, Canada), Scotiabank (Toronto, Canada), Bank of Montreal (BMO) (Montreal, Canada), HSBC Holdings plc (London, UK), Barclays plc (London, UK), Lloyds Banking Group (London, UK), UBS Group AG (Zurich, Switzerland), Credit Suisse Group AG (Zurich, Switzerland), BNP Paribas (Paris, France), Deutsche Bank AG (Frankfurt, Germany), Santander Group (Madrid, Spain), Mitsubishi UFJ Financial Group (Tokyo, Japan, Sumitomo Mitsui Financial Group (Tokyo, Japan) and Other Major Players.

The Consumer Banking Service Market is segmented into Type, Application, and region. By Type, the market is categorized into Traditional, Digital Led. By Applications, the market is categorized into Transactional Accounts Savings Accounts Debit Cards Credit Cards Loans Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Consumer banking can also be defined as those banking services and products that are designed for individual customers and their everyday needs. Such services include deposit taking and management, transactions and other services namely, accounts, loans, credit cards, and housing and other financial instruments. These are to assist the people in staying on track within their means, saving, investing, and planning for the future. They must be convenient, easily accessible, and develop appropriate LCCs to satisfy the demands of a wide base of consumers.

Consumer Banking Service Market Size Was Valued at USD6.94 Billion in 2023, and is Projected to Reach USD 16.77 Million by 2032, Growing at a CAGR of 10.30% From 2024-2032.