Global Commercial Refrigeration Equipment Market Synopsis

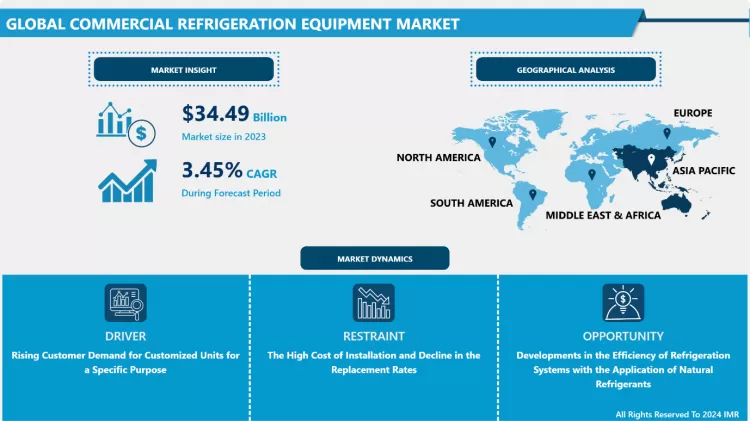

Global Commercial Refrigeration Equipment Market was valued at USD 34.49 billion in 2023 and is expected to reach USD 46.81 billion by the year 2032, at a CAGR of 3.45%.

Commercial refrigeration equipment includes devices used to store perishable products at regulated temperatures, essential for food service, retail, hospitality, and other industries. These systems are designed to keep food, beverages, and other temperature-sensitive items fresh and safe over extended periods, minimizing spoilage and preserving quality. Key types include refrigerators, freezers, display cases, walk-in coolers, ice machines, and beverage dispensers, each tailored to specific storage and display needs.

- The equipment ranges from small units, like under-counter refrigerators, to large walk-in coolers, each equipped with features such as digital temperature controls, energy-efficient compressors, and insulation. Some units have glass doors for easy product visibility, making them ideal for retail settings, while solid doors or chest designs are more common for back-of-house storage. Innovations like remote monitoring systems allow users to track temperature and performance remotely, minimizing downtime and energy usage, which is crucial for businesses managing high-volume operations.

- Energy efficiency is a top priority in commercial refrigeration, as these units often run continuously and can consume significant power. Modern equipment incorporates eco-friendly refrigerants and energy-saving technologies, responding to stricter environmental regulations and sustainability initiatives. The equipment’s durability is also critical, as commercial settings demand robust construction to withstand frequent usage and varied temperature conditions.

- Industries such as supermarkets, convenience stores, hotels, and restaurants rely heavily on commercial refrigeration equipment, making it a core component of their operations. The global market for this equipment is expanding due to growth in the food and beverage sector, urbanization, and rising demand for frozen and chilled products. Thus, commercial refrigeration equipment plays a vital role in ensuring food safety, reducing waste, and supporting a sustainable supply chain across industries.

COVID-19 Impact on Commercial Refrigeration Equipment Market

- The global commercial refrigeration market has observed a pattern shift in production due to frequent lockdown and restrictions. In response to the COVID-19 crisis, production businesses have brought down their production capacities and are revising their business models. Since consumers are forced to remain at home in the situation, it has resulted in low spending and a decrease in investments. COVID-19 had a significant economic effect on various financial as well as industrial sectors, such as travel & tourism, construction, manufacturing, and aviation. The end-use sectors of commercial refrigeration equipment, such as convenience stores, hotels & restaurants, supermarkets & hypermarkets, and bakeries have been impacted. Hotels & restaurants and bakeries were one of the adversely affected sectors owing to stringent lockdowns and curfews in most economies to prevent the spread of coronavirus. Apart from this, the food retailers are now anticipated to cope with the volume of online demand as social distancing practices and restrictions are probably to prevail for long. With the vaccination turn being in full throttle on a global scale, the pandemic situation is anticipated to alter slightly very shortly.

Market Dynamics And Factors For The Commercial Refrigeration Equipment Market

Drivers:

- Refrigerator and freezer are probably to be the most preferred product in commercial refrigeration equipment. The sales of refrigerator and freezer as compared to other products is probably to be high over the forecast period. Refrigerator and freezer have various types including walk-in, reach-in, and chest. Among these walks in and reach-in refrigerators and freezers are anticipated to observe increased demand. Due to the rising number of food producers, producing food products that need to be stored at a certain level of temperature, the reach-in, and walk-in freezers and refrigerators are being utilized. Furthermore, producers of walk-in refrigerators are targeting manufacturing customized walk-in refrigerators as per the need and convenience of the end-user. Furthermore, customers are also preferring for customized units for a specific purpose. Some of the companies are also emerging walk-in refrigerators with or without an insulated floor. Refrigerators and freezers equipped with touchscreen interfaces are also being emerged to provide better control. In-built safety sensors are also being included in the refrigeration system to eliminate any damage in case of disruption.

- The global market for commercial refrigeration equipment is observing growth in mergers and acquisitions. As companies are competing to reach the highest market share. Major players in the market have started to enter into a strategic alliance with the regional and small companies, to set themselves in the market. Furthermore, new entrants are also coming up with advanced technologies in the commercial refrigeration equipment market. This is also one of the reasons for the expansion in mergers and acquisitions.

Restraints:

- The high cost of installation and decline in the replacement rates for commercial refrigeration equipment, strict environmental regulations against fluorocarbon refrigerants is probably hindering the market. Fluorocarbon refrigerants severely affect the ozone layer owing to which, the governments of different economies worldwide such as, North America and Europe are imposing regulations to limit the application of fluorocarbon refrigerants. They have agreed to phase out the use of HCFCs and HFCs by imposing limits on their utilization.

Opportunities:

- Developments in the efficiency of refrigeration systems with the application of natural refrigerants are expected to create business opportunities in the upcoming years. Various government agencies and R&D companies are targeting boosting the coefficient of performance, efficiency, lifetime, and total ownership cost of commercial refrigeration systems. With the Kyoto Protocol and the recent EU F-Gas regulations, producers are trying to design natural refrigerant technologies that can improve the energy efficiency of commercial refrigeration systems. Key players such as Carnot Refrigeration, Danfoss, and Carrier Commercial Refrigeration are launching ammonia and CO2 refrigerant technologies. Prior, cascade refrigeration systems using CO2 and ammonia as refrigerants were confined to limited refrigeration utilization. Nevertheless, with the rising consciousness about eco-friendly refrigerants, cascade refrigeration systems are preferred for an extensive range of refrigeration applications.

Market Segmentation

Segmentation Analysis of Commercial Refrigeration Equipment Market:

- Based on the Product Type, Transport refrigeration systems are expected to record the maximum commercial refrigeration equipment market during the forecast period. Increasing international food trade and rising transport of perishable products across borders are growing the demand for these systems. Vegetables and fruits are being increasingly transported through roadways, accelerating the demand for this equipment. Fruits and vegetables, such as lettuce peas, and sweet corn, that have very high respiration rates need colder refrigerators to control the freshness and rise their shelf-life.

- Based on the Refrigerant Type, the fluorocarbons segment is projected to record the largest market share for the commercial refrigeration equipment over the forecast period. Fluorocarbons are chemical compounds containing carbon, hydrogen, chlorine, and fluorine as their major constituents. Nevertheless, not all fluorocarbons may consist of both chlorine and fluorine atoms. The applications of these refrigerants are in refrigerators (domestic, transport, and commercial) and large-scale refrigerators (supermarket/ hypermarket). Fluorocarbons are more subdivided into three types – HFCs, HCFCs, and HFOs.

- Based on the End-Users, Supermarket/Hypermarket is expected to register the maximum commercial refrigeration equipment market share over the forecast period. The developed commercial refrigerators provide for practical designs to hold the attention of customers at any such point of sale. Also, switching food consumption trends and growing international food trade are additional factors accelerating the growth of the market.

Regional Analysis of Commercial Refrigeration Equipment Market:

- The Asia Pacific is anticipated to be the largest commercial refrigeration equipment market of commercial refrigeration equipment during the forecast period. The rising population in the region, developing economic conditions, such as growing GDP & disposable incomes, and an enhancing consumer appliances sector have led to growth in the commercial refrigeration equipment in the region. Additionally, the growth of the commercial refrigeration equipment market in this region is accelerated by growth in the manufacturing sector; a rise in spending on private & public infrastructure development; and rapid urbanization.

- North America held a significant commercial refrigeration equipment market share over the forecast period. This is attributable to the presence of top key players. Furthermore, the growing application of commercial refrigeration equipment is anticipated to create massive demand for the commercial refrigeration equipment market in this region.

Players Covered in Commercial Refrigeration Equipment market are :

- Carrier

- Emerson Electric Company

- GEA Group

- Beverage-Air Corporation

- Daikin Industries Ltd.

- Danfoss A/S

- Dover Corporation

- Electrolux AB

- GE Appliances

- Hussmann Corporation

- Illinois Tool Works Inc.

- Ingersoll-Rand PLC

- Metalfrio Solutions SA

- United Technologies Corporation

- Whirlpool Corporation

- Standex International Corporation

- Lennox International Inc.

- Daikin IndustriesLtd.

- AHT Cooling Systems GmbH

- Manitowoc Company Inc.

- Panasonic Corporation

- Hoshizaki Corporation and other major players.

Key Industry Developments In The Commercial Refrigeration Equipment Market

- In March 2024, Hoshizaki America, a wholly owned subsidiary of Japan-based foodservice equipment manufacuturer Hoshizaki, has announced it has acquired 25% of Fogel, a commercial refrigeration-solutions provider based in Panama with manufacturing facilities in Guatemala, for $28 million (€25.6 million).

- In December 2023, Carrier Global Corporation, global leader in intelligent climate and energy solutions, entered into a definitive agreement to sell its global commercial refrigeration business to its decades-long joint venture partner Haier for an enterprise value of $775 million, including approximately $200 million of net pension liabilities. This represents about 16.5x 2023 expected EBITDA. The announcement follows last week's agreement to sell Carrier's Global Access Solutions business and marks another meaningful step forward in the company's portfolio transformation. Definitive agreements are now in place to exit businesses representing about half the EBITDA Carrier is divesting.

|

Global Commercial Refrigeration Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.49 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.45% |

Market Size in 2032: |

USD 46.81 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Refrigerant Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Commercial Refrigeration Equipment Market by Product Type (2018-2032)

4.1 Commercial Refrigeration Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Refrigerator & Freezer

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Transportation Refrigeration

4.5 Refrigerated Display Cases

4.6 Beverage Refrigeration

4.7 Ice Cream Merchandiser

4.8 Refrigerated Vending Machine

Chapter 5: Commercial Refrigeration Equipment Market by Refrigerant (2018-2032)

5.1 Commercial Refrigeration Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Type

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fluorocarbons

5.5 Hydrocarbons

5.6 Inorganics

Chapter 6: Commercial Refrigeration Equipment Market by End Users (2018-2032)

6.1 Commercial Refrigeration Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Full-Service Restaurant & Hotels

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Food Processing Industry

6.5 Hospitals

6.6 Retail Pharmacies

6.7 Supermarket/Hypermarket

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Commercial Refrigeration Equipment Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THE ARCHER DANIELS MIDLAND COMPANY (ADM) (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KERRY GROUP (IRELAND)

7.4 MANE SA (FRANCE)

7.5 GIVAUDAN (SWITZERLAND)

7.6 BELL FLAVORS & FRAGRANCES (US)

7.7 FIRMENICH SA (SWITZERLAND)

7.8 INTERNATIONAL FLAVORS & FRAGRANCES (IFF) (US)

7.9 SENSIENT TECHNOLOGIES (US)

7.10 SYMRISE AG (GERMANY)

7.11 TAKASAGO (JAPAN)

7.12 ROBERTET (FRANCE)

7.13 FRUTAROM (ISRAEL)

7.14 T. HASEGAWA (JAPAN)

7.15 HUABAO (CHINA)

7.16 OGAWA & CO.LTD. (JAPAN)

Chapter 8: Global Commercial Refrigeration Equipment Market By Region

8.1 Overview

8.2. North America Commercial Refrigeration Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Refrigerator & Freezer

8.2.4.2 Transportation Refrigeration

8.2.4.3 Refrigerated Display Cases

8.2.4.4 Beverage Refrigeration

8.2.4.5 Ice Cream Merchandiser

8.2.4.6 Refrigerated Vending Machine

8.2.5 Historic and Forecasted Market Size by Refrigerant

8.2.5.1 Type

8.2.5.2 Fluorocarbons

8.2.5.3 Hydrocarbons

8.2.5.4 Inorganics

8.2.6 Historic and Forecasted Market Size by End Users

8.2.6.1 Full-Service Restaurant & Hotels

8.2.6.2 Food Processing Industry

8.2.6.3 Hospitals

8.2.6.4 Retail Pharmacies

8.2.6.5 Supermarket/Hypermarket

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Commercial Refrigeration Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Refrigerator & Freezer

8.3.4.2 Transportation Refrigeration

8.3.4.3 Refrigerated Display Cases

8.3.4.4 Beverage Refrigeration

8.3.4.5 Ice Cream Merchandiser

8.3.4.6 Refrigerated Vending Machine

8.3.5 Historic and Forecasted Market Size by Refrigerant

8.3.5.1 Type

8.3.5.2 Fluorocarbons

8.3.5.3 Hydrocarbons

8.3.5.4 Inorganics

8.3.6 Historic and Forecasted Market Size by End Users

8.3.6.1 Full-Service Restaurant & Hotels

8.3.6.2 Food Processing Industry

8.3.6.3 Hospitals

8.3.6.4 Retail Pharmacies

8.3.6.5 Supermarket/Hypermarket

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Commercial Refrigeration Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Refrigerator & Freezer

8.4.4.2 Transportation Refrigeration

8.4.4.3 Refrigerated Display Cases

8.4.4.4 Beverage Refrigeration

8.4.4.5 Ice Cream Merchandiser

8.4.4.6 Refrigerated Vending Machine

8.4.5 Historic and Forecasted Market Size by Refrigerant

8.4.5.1 Type

8.4.5.2 Fluorocarbons

8.4.5.3 Hydrocarbons

8.4.5.4 Inorganics

8.4.6 Historic and Forecasted Market Size by End Users

8.4.6.1 Full-Service Restaurant & Hotels

8.4.6.2 Food Processing Industry

8.4.6.3 Hospitals

8.4.6.4 Retail Pharmacies

8.4.6.5 Supermarket/Hypermarket

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Commercial Refrigeration Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Refrigerator & Freezer

8.5.4.2 Transportation Refrigeration

8.5.4.3 Refrigerated Display Cases

8.5.4.4 Beverage Refrigeration

8.5.4.5 Ice Cream Merchandiser

8.5.4.6 Refrigerated Vending Machine

8.5.5 Historic and Forecasted Market Size by Refrigerant

8.5.5.1 Type

8.5.5.2 Fluorocarbons

8.5.5.3 Hydrocarbons

8.5.5.4 Inorganics

8.5.6 Historic and Forecasted Market Size by End Users

8.5.6.1 Full-Service Restaurant & Hotels

8.5.6.2 Food Processing Industry

8.5.6.3 Hospitals

8.5.6.4 Retail Pharmacies

8.5.6.5 Supermarket/Hypermarket

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Commercial Refrigeration Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Refrigerator & Freezer

8.6.4.2 Transportation Refrigeration

8.6.4.3 Refrigerated Display Cases

8.6.4.4 Beverage Refrigeration

8.6.4.5 Ice Cream Merchandiser

8.6.4.6 Refrigerated Vending Machine

8.6.5 Historic and Forecasted Market Size by Refrigerant

8.6.5.1 Type

8.6.5.2 Fluorocarbons

8.6.5.3 Hydrocarbons

8.6.5.4 Inorganics

8.6.6 Historic and Forecasted Market Size by End Users

8.6.6.1 Full-Service Restaurant & Hotels

8.6.6.2 Food Processing Industry

8.6.6.3 Hospitals

8.6.6.4 Retail Pharmacies

8.6.6.5 Supermarket/Hypermarket

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Commercial Refrigeration Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Refrigerator & Freezer

8.7.4.2 Transportation Refrigeration

8.7.4.3 Refrigerated Display Cases

8.7.4.4 Beverage Refrigeration

8.7.4.5 Ice Cream Merchandiser

8.7.4.6 Refrigerated Vending Machine

8.7.5 Historic and Forecasted Market Size by Refrigerant

8.7.5.1 Type

8.7.5.2 Fluorocarbons

8.7.5.3 Hydrocarbons

8.7.5.4 Inorganics

8.7.6 Historic and Forecasted Market Size by End Users

8.7.6.1 Full-Service Restaurant & Hotels

8.7.6.2 Food Processing Industry

8.7.6.3 Hospitals

8.7.6.4 Retail Pharmacies

8.7.6.5 Supermarket/Hypermarket

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Commercial Refrigeration Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.49 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.45% |

Market Size in 2032: |

USD 46.81 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Refrigerant Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Commercial Refrigeration Equipment Market research report is 2022-2028.

Carrier, Emerson Electric Company, GEA Group, Beverage-Air Corporation, Daikin Industries Ltd., Danfoss A/S, Dover Corporation, Electrolux AB, GE Appliances, Hussmann Corporation, Illinois Tool Works Inc., Ingersoll-Rand PLC, Metalfrio Solutions SA, United Technologies Corporation, Whirlpool Corporation, Standex International Corporation, Lennox International Inc., Daikin Industries Ltd., AHT Cooling Systems GmbH, Manitowoc Company Inc., Panasonic Corporation, Hoshizaki Corporation, and other major players.

The Commercial Refrigeration Equipment Market is segmented into product type, refrigerant type, end users, and region. By Product Type, the market is categorized into Refrigerator & Freezer, Transportation Refrigeration, Refrigerated Display Cases, Beverage Refrigeration, Ice Cream Merchandiser, and Refrigerated Vending Machine. By Refrigerant Type, the market is categorized into Fluorocarbons, Hydrocarbons, and Inorganics. By End Users, the market is categorized into Full-Service Restaurant & Hotels, Food Processing Industry, Hospitals, Retail Pharmacies, Supermarket/Hypermarket, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Commercial Refrigeration is the process of eliminating excessive heat from a source of a material to control the temperature lower than its surrounding. Commercial refrigeration equipment is utilized for preserving food such as fruits, vegetables, meat, and other similar products by controlling a specific temperature to grow the shelf life of a product.

Global Commercial Refrigeration Equipment Market was valued at USD 34.49 billion in 2023 and is expected to reach USD 46.81 billion by the year 2032, at a CAGR of 3.45%.