Global Coal Power Generation Market Overview

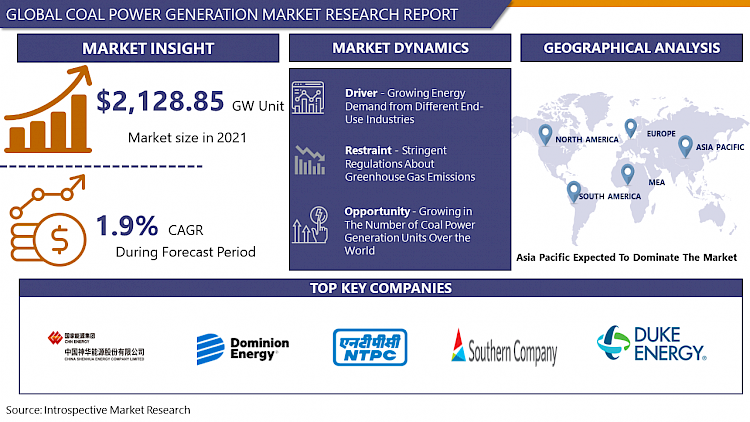

Coal Power Generation Market size is projected to reach 2,428.65 GW unit by 2028 from an estimated 2,128.85 GW unit in 2021, growing at a CAGR of 1.9% globally.

Coal is an important source of energy for the world, particularly for power generation. Demand for coal has grown rapidly over the last decade, outstripping that for gas, oil, nuclear, and renewable energy sources. This comes at a cost. Coal contributes to over 40% of global anthropomorphic CO2 emissions and more than 70% of CO2 emissions that arise from power generation are attributed to coal. To play its role in a sustainable energy future, its environmental footprint needs to be reduced; using coal more efficiently is an important first step. Beyond efficiency improvement, carbon capture and storage (CCS) must be deployed to make deep cuts in CO2 emissions. Coal-fired power generation is a thermal power station plant that burns coal to generate electricity. Gasification, pulverized coal firing, coal cyclone furnace, and fluidized bed combustion are some of the technologies used in the generation of power. Coal is a major source of power generation plants. The global coal power generation market was estimated to account for 2,057.6 Giga Watts in terms of volume by the end of 2019. The escalating demand for energy on account of rapid industrialization and the increasing dependence on electrification across the globe represents one of the key factors bolstering market growth.

COVID-19 Impact on the Coal Power Generation Market

The COVID-19 pandemic has become a major threat across the globe. The hospitality aviation industry is some of the worst-hit industries, the power generation is also critically influenced owing to the pandemic situation. Travel restrictions have meant that there has been a significant depletion in the application of public and private transport. Consequently, fuel demand for transport has declined significantly. These major factors are key reasons anticipated to hinder the growth of the coal power generation market during the forecast period. The EU imports of coal for thermal power plants thrust by almost two-thirds in recent months to reach lows not seen in 30 years. Furthermore, in April 2020 coal exports from Indonesia impact their lowest level since October 2010 amid the COVID-19 crisis. Comparing exports levels from 2015 to 2020, exports already declined below average in February and March 2020, to reduce further in April 2020.

Market Dynamics And Factors For Coal Power Generation Market

Drivers:

Coal power is still the major source of energy generation on a global level. In the US coal records about 19% of the energy generation in 2020. Growing energy demand from different end-use industries is increasing the global market growth. Furthermore, the easy availability of raw materials over the Asia Pacific region is primarily accelerating the market growth of coal power generation. Indonesia, China, India, and Australia are the major manufacturers of coal. Therefore, the ready availability of the coal in Asia Pacific region is stimulating the market growth of coal power generation. Growing demand for electricity is anticipated to increase the market growth of coal power generation. This is attributed to the rising population which is generating demand for the residential sector. Significant industrialization and urbanization along with the requirements for energy in heavy industries are again anticipated to hasten the market growth of coal power generation. Hence, the augmenting demand for electricity is estimated to drive market growth.

Restraints:

Stringent regulations about greenhouse gas emissions are motivating manufacturers to introduce green technologies. This is anticipated to hamper the market growth of coal power generation. Moreover, the availability of natural gas in large quantities, coupled with its relatively cheap prices, primarily in regions, such as North America, China, and Thailand, has led to a rise in power generation using natural gas. Growing focus on creating electricity through cleaner technologies and the degradation of coal reserves are the factors expected to raise the share of gas turbines in the global energy mix, thereby offering a positive environment for the growth of the gas turbine service sector. Therefore, these factors are anticipated to have a poor impact on the growth of the coal power generation market over the forecast period. In addition, the health problems related with the coal-fired power generation as they release harmful gases which lead to different respiratory problems such as asthma. This is anticipated to hinder the market growth of coal power generation.

Opportunities:

Pulverized coal technology is gaining propulsion in the market as they use powdered coal to produce thermal energy. Furthermore, in pulverized coal, the rate of combustion can be managed easily. In addition, it provides faster results to load changes. The trend of using pulverized coal systems over both residential as well as commercial applications wing to rising consciousness about the environmental benefits is further anticipated to increase the market growth of the coal power generation.

Growing in the number of coal power generation units over the world is anticipated to provide lucrative market opportunities in the upcoming years. For instance, in February 2020, Japan declared that it is planning to build up to 22 new coal power plants at 17 different sites in the upcoming five years. Therefore, a growing number of coal power generation plants is anticipated to trigger the market growth of coal power generation.

According to Statista, global installed coal power capacity has increased to over 2.1 terawatts and is estimated to peak by 2030. Many governments have launched phase-out dates to be reached before mid-century to overcome their carbon footprint and diminish climate change. However, as of 2020, there was around 500 gigawatts worth of coal power plants in the pipeline. Russia, Malaysia, and India have recorded the greatest share of public support for coal expansion. More than half of the respective economies' residents were in favor of furthering coal application, despite concerns over its environmental impact. Furthermore, Chinese banks such as ICBC are the highest investment banks for coal organizations. Of the five banks having funded the largest amount in the past years, four were China-based companies.

Market Segmentation

Segmentation Analysis of Coal Power Generation Market:

Based on the technology, the pulverized segment is expected to hold the maximum market share during the forecast period. The pulverized coal system is extensively accepted in energy production owing to its huge efficiency and fewer pollution benefits as compared to other segments. By pulverizing the coal, the surface area for combustion rises much hence thermal efficiency increases. It results in a faster combustion rate and however declines the requirement of secondary air to complete combustion. The burden of the air intake fans also decreases. Moreover, another essential feature of the pulverized firing system is that it does not have any moving parts inside the combustion chamber which gives it a long trouble-free life. In addition, ash handling is simpler in this technology.

Based on the application, the commercial and industrial segment is expected to hold the maximum market share during the forecast period. Rapid industrialization over the emerging regions will help turn the application of coal power generation into commercial applications. An increase in the manufacturing industries, along with upcoming power plant projects over the developing areas, is anticipated to trigger the segment growth.

Regional Analysis of Coal Power Generation Market:

Asia Pacific region is expected to dominate the coal power generation market over the projected period. The power utilization has been augmenting at a significant rate in the region turn by industrialization, population growth, and rising urbanization, particularly in developing economies, such as India and China. China led the Asia Pacific regional market with a volume share of 71% in 2020. The market in the region is primarily driven by the upcoming power generation projects and rising industrialization in the region. Furthermore, the accessibility of low cost of the labor, as well as proximity to raw material suppliers, is further attracting investors to the region. Hence, rising power needs in the region are anticipated to grow the demand for the coal power generation market during the forecast period in the region.

North America region is expected to hold the significant market growth for the coal power generation during the forecast period. The market is majorly driven by the US country owing to for over a century coal has been among the major sources of electricity generation in the United States. Even though it lost its position as the highest contributor to the power mix to natural gas in 2016, coal energy is still extensively utilized over the nation. There is a large number of U.S. utilities utilizing coal not committed to retiring by 2030 despite greater efforts and incentives by the government to overcome reliance on this heavily polluting fossil fuel.

In Europe, the steady growth rate for the coal power generation market over the forecast period. The demand for electricity from coal during the COVID-19 pandemic lockdown has declined in the majority of countries in Europe. Between March 28 and April 30, the demand for coal in Germany's energy mix fell from 30 percent in this period in 2019 to 16 percent in 2020. In comparison, Portugal went completely coal-free for more than a month during this period.

Players Covered in Coal Power Generation Market are :

- Jindal India Thermal Power ltd.

- Southern Company

- Duke Energy Corporation

- Uniper SE

- CHINA SHENHUA

- China Huadian Corporation LTD. (CHD)

- China Huaneng Group Co. Ltd.

- American Electric Power Company Inc.

- Dominion Energy

- YONDEN Shikoku Electric Power CO. Inc.

- RWE

- NTPC Ltd.

- TENAGA NASIONAL BERHAD

- STEAG GMBH

- KEPCO Engineering & Construction Company Inc

- and others major Players.

Key Industry Developments In Coal Power Generation Market

-

In July 2019, NTPC Ltd. declared that it has signed a Memorandum of Understanding with BHEL to install the world's 'most efficient' coal-fired power plant. The plant would result in a depletion of carbon dioxide emissions by around 20% as compared to conventional sub-critical technology.

- In 2021, the Chinese government planned to build 43 new coal-fired power plants and 18 new blast furnaces. The country is planning to design 247 gigawatts of power coal generation plants.

|

Global Coal Power Generation Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

2,128.85 GW Unit |

|

Forecast Period 2022-28 CAGR: |

1.9% |

Market Size in 2028: |

2,428.65 GW Unit |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Coal Power Generation Market by Type

4.1 Coal Power Generation Market Overview Snapshot and Growth Engine

4.2 Coal Power Generation Market Overview

4.3 Pulverized

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Pulverized: Grographic Segmentation

4.4 Cyclone Furnaces

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Cyclone Furnaces: Grographic Segmentation

Chapter 5: Coal Power Generation Market by Application

5.1 Coal Power Generation Market Overview Snapshot and Growth Engine

5.2 Coal Power Generation Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Residential: Grographic Segmentation

5.4 Commercial

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial: Grographic Segmentation

5.5 Industrial

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Industrial: Grographic Segmentation

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Positioning

6.1.2 Coal Power Generation Sales and Market Share By Players

6.1.3 Industry BCG Matrix

6.1.4 Ansoff Matrix

6.1.5 Coal Power Generation Industry Concentration Ratio (CR5 and HHI)

6.1.6 Top 5 Coal Power Generation Players Market Share

6.1.7 Mergers and Acquisitions

6.1.8 Business Strategies By Top Players

6.2 JINDAL INDIA THERMAL POWER LTD.

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Operating Business Segments

6.2.5 Product Portfolio

6.2.6 Business Performance

6.2.7 Key Strategic Moves and Recent Developments

6.2.8 SWOT Analysis

6.3 SOUTHERN COMPANY

6.4 DUKE ENERGY CORPORATION

6.5 UNIPER SE

6.6 CHINA SHENHUA

6.7 CHINA HUADIAN CORPORATION LTD. (CHD)

6.8 CHINA HUANENG GROUP CO. LTD.

6.9 AMERICAN ELECTRIC POWER COMPANY INC.

6.10 DOMINION ENERGY

6.11 YONDEN SHIKOKU ELECTRIC POWER CO. INC.

6.12 RWE

6.13 NTPC LTD.

6.14 TENAGA NASIONAL BERHAD

6.15 STEAG GMBH

6.16 KEPCO ENGINEERING & CONSTRUCTION COMPANY INC

Chapter 7: Global Coal Power Generation Market Analysis, Insights and Forecast, 2016-2028

7.1 Market Overview

7.2 Historic and Forecasted Market Size By Type

7.2.1 Pulverized

7.2.2 Cyclone Furnaces

7.3 Historic and Forecasted Market Size By Application

7.3.1 Residential

7.3.2 Commercial

7.3.3 Industrial

Chapter 8: North America Coal Power Generation Market Analysis, Insights and Forecast, 2016-2028

8.1 Key Market Trends, Growth Factors and Opportunities

8.2 Impact of Covid-19

8.3 Key Players

8.4 Key Market Trends, Growth Factors and Opportunities

8.4 Historic and Forecasted Market Size By Type

8.4.1 Pulverized

8.4.2 Cyclone Furnaces

8.5 Historic and Forecasted Market Size By Application

8.5.1 Residential

8.5.2 Commercial

8.5.3 Industrial

8.6 Historic and Forecast Market Size by Country

8.6.1 U.S.

8.6.2 Canada

8.6.3 Mexico

Chapter 9: Europe Coal Power Generation Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Pulverized

9.4.2 Cyclone Furnaces

9.5 Historic and Forecasted Market Size By Application

9.5.1 Residential

9.5.2 Commercial

9.5.3 Industrial

9.6 Historic and Forecast Market Size by Country

9.6.1 Germany

9.6.2 U.K.

9.6.3 France

9.6.4 Italy

9.6.5 Russia

9.6.6 Spain

Chapter 10: Asia-Pacific Coal Power Generation Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Pulverized

10.4.2 Cyclone Furnaces

10.5 Historic and Forecasted Market Size By Application

10.5.1 Residential

10.5.2 Commercial

10.5.3 Industrial

10.6 Historic and Forecast Market Size by Country

10.6.1 China

10.6.2 India

10.6.3 Japan

10.6.4 Southeast Asia

Chapter 11: South America Coal Power Generation Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Pulverized

11.4.2 Cyclone Furnaces

11.5 Historic and Forecasted Market Size By Application

11.5.1 Residential

11.5.2 Commercial

11.5.3 Industrial

11.6 Historic and Forecast Market Size by Country

11.6.1 Brazil

11.6.2 Argentina

Chapter 12: Middle East & Africa Coal Power Generation Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Pulverized

12.4.2 Cyclone Furnaces

12.5 Historic and Forecasted Market Size By Application

12.5.1 Residential

12.5.2 Commercial

12.5.3 Industrial

12.6 Historic and Forecast Market Size by Country

12.6.1 Saudi Arabia

12.6.2 South Africa

Chapter 13 Investment Analysis

Chapter 14 Analyst Viewpoint and Conclusion

|

Global Coal Power Generation Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

2,128.85 GW Unit |

|

Forecast Period 2022-28 CAGR: |

1.9% |

Market Size in 2028: |

2,428.65 GW Unit |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COAL POWER GENERATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COAL POWER GENERATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COAL POWER GENERATION MARKET COMPETITIVE RIVALRY

TABLE 005. COAL POWER GENERATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. COAL POWER GENERATION MARKET THREAT OF SUBSTITUTES

TABLE 007. COAL POWER GENERATION MARKET BY TYPE

TABLE 008. PULVERIZED MARKET OVERVIEW (2016-2028)

TABLE 009. CYCLONE FURNACES MARKET OVERVIEW (2016-2028)

TABLE 010. COAL POWER GENERATION MARKET BY APPLICATION

TABLE 011. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 012. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 013. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA COAL POWER GENERATION MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA COAL POWER GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 016. N COAL POWER GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE COAL POWER GENERATION MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE COAL POWER GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 019. COAL POWER GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC COAL POWER GENERATION MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC COAL POWER GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 022. COAL POWER GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA COAL POWER GENERATION MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA COAL POWER GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 025. COAL POWER GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA COAL POWER GENERATION MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA COAL POWER GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 028. COAL POWER GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 029. JINDAL INDIA THERMAL POWER LTD.: SNAPSHOT

TABLE 030. JINDAL INDIA THERMAL POWER LTD.: BUSINESS PERFORMANCE

TABLE 031. JINDAL INDIA THERMAL POWER LTD.: PRODUCT PORTFOLIO

TABLE 032. JINDAL INDIA THERMAL POWER LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. SOUTHERN COMPANY: SNAPSHOT

TABLE 033. SOUTHERN COMPANY: BUSINESS PERFORMANCE

TABLE 034. SOUTHERN COMPANY: PRODUCT PORTFOLIO

TABLE 035. SOUTHERN COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. DUKE ENERGY CORPORATION: SNAPSHOT

TABLE 036. DUKE ENERGY CORPORATION: BUSINESS PERFORMANCE

TABLE 037. DUKE ENERGY CORPORATION: PRODUCT PORTFOLIO

TABLE 038. DUKE ENERGY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. UNIPER SE: SNAPSHOT

TABLE 039. UNIPER SE: BUSINESS PERFORMANCE

TABLE 040. UNIPER SE: PRODUCT PORTFOLIO

TABLE 041. UNIPER SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. CHINA SHENHUA: SNAPSHOT

TABLE 042. CHINA SHENHUA: BUSINESS PERFORMANCE

TABLE 043. CHINA SHENHUA: PRODUCT PORTFOLIO

TABLE 044. CHINA SHENHUA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. CHINA HUADIAN CORPORATION LTD. (CHD): SNAPSHOT

TABLE 045. CHINA HUADIAN CORPORATION LTD. (CHD): BUSINESS PERFORMANCE

TABLE 046. CHINA HUADIAN CORPORATION LTD. (CHD): PRODUCT PORTFOLIO

TABLE 047. CHINA HUADIAN CORPORATION LTD. (CHD): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. CHINA HUANENG GROUP CO. LTD.: SNAPSHOT

TABLE 048. CHINA HUANENG GROUP CO. LTD.: BUSINESS PERFORMANCE

TABLE 049. CHINA HUANENG GROUP CO. LTD.: PRODUCT PORTFOLIO

TABLE 050. CHINA HUANENG GROUP CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. AMERICAN ELECTRIC POWER COMPANY INC.: SNAPSHOT

TABLE 051. AMERICAN ELECTRIC POWER COMPANY INC.: BUSINESS PERFORMANCE

TABLE 052. AMERICAN ELECTRIC POWER COMPANY INC.: PRODUCT PORTFOLIO

TABLE 053. AMERICAN ELECTRIC POWER COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. DOMINION ENERGY: SNAPSHOT

TABLE 054. DOMINION ENERGY: BUSINESS PERFORMANCE

TABLE 055. DOMINION ENERGY: PRODUCT PORTFOLIO

TABLE 056. DOMINION ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. YONDEN SHIKOKU ELECTRIC POWER CO. INC.: SNAPSHOT

TABLE 057. YONDEN SHIKOKU ELECTRIC POWER CO. INC.: BUSINESS PERFORMANCE

TABLE 058. YONDEN SHIKOKU ELECTRIC POWER CO. INC.: PRODUCT PORTFOLIO

TABLE 059. YONDEN SHIKOKU ELECTRIC POWER CO. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. RWE: SNAPSHOT

TABLE 060. RWE: BUSINESS PERFORMANCE

TABLE 061. RWE: PRODUCT PORTFOLIO

TABLE 062. RWE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. NTPC LTD.: SNAPSHOT

TABLE 063. NTPC LTD.: BUSINESS PERFORMANCE

TABLE 064. NTPC LTD.: PRODUCT PORTFOLIO

TABLE 065. NTPC LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. TENAGA NASIONAL BERHAD: SNAPSHOT

TABLE 066. TENAGA NASIONAL BERHAD: BUSINESS PERFORMANCE

TABLE 067. TENAGA NASIONAL BERHAD: PRODUCT PORTFOLIO

TABLE 068. TENAGA NASIONAL BERHAD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. STEAG GMBH: SNAPSHOT

TABLE 069. STEAG GMBH: BUSINESS PERFORMANCE

TABLE 070. STEAG GMBH: PRODUCT PORTFOLIO

TABLE 071. STEAG GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. KEPCO ENGINEERING & CONSTRUCTION COMPANY INC: SNAPSHOT

TABLE 072. KEPCO ENGINEERING & CONSTRUCTION COMPANY INC: BUSINESS PERFORMANCE

TABLE 073. KEPCO ENGINEERING & CONSTRUCTION COMPANY INC: PRODUCT PORTFOLIO

TABLE 074. KEPCO ENGINEERING & CONSTRUCTION COMPANY INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COAL POWER GENERATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COAL POWER GENERATION MARKET OVERVIEW BY TYPE

FIGURE 012. PULVERIZED MARKET OVERVIEW (2016-2028)

FIGURE 013. CYCLONE FURNACES MARKET OVERVIEW (2016-2028)

FIGURE 014. COAL POWER GENERATION MARKET OVERVIEW BY APPLICATION

FIGURE 015. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 017. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA COAL POWER GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE COAL POWER GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC COAL POWER GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA COAL POWER GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA COAL POWER GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Coal Power Generation Market research report is 2022-2028.

Jindal India Thermal Power ltd., Southern Company, Duke Energy Corporation, Uniper SE, CHINA SHENHUA, China Huadian Corporation LTD. (CHD), China Huaneng Group Co. Ltd., American Electric Power Company Inc., Dominion Energy, YONDEN Shikoku Electric Power CO. Inc., RWE, NTPC Ltd., TENAGA NASIONAL BERHAD, STEAG GMBH, KEPCO Engineering & Construction Company Inc and other major players.

The Coal Power Generation Market is segmented into Technology, Application, and region. By Technology, the market is categorized into Pulverized, Cyclone Furnaces, Others. By Application, the market is categorized into Residential, Commercial, Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Coal is an important source of energy for the world, particularly for power generation. Demand for coal has grown rapidly over the last decade, outstripping that for gas, oil, nuclear, and renewable energy sources.

Coal Power Generation Market size is projected to reach 2,428.65 GW unit by 2028 from an estimated 2,128.85 GW unit in 2021, growing at a CAGR of 1.9% globally.