Global Cloud Kitchen Market Overview

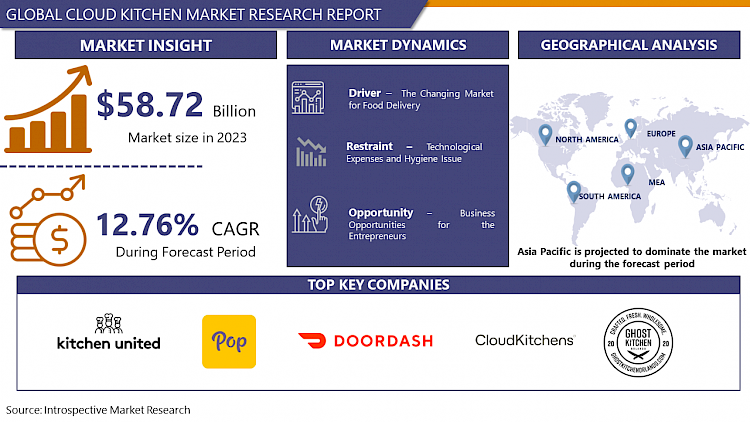

Global Cloud Kitchen Market Size Was Valued at USD 58.72 Billion In 2023 And Is Projected to Reach USD 173.05 Billion By 2032, Growing at A CAGR of 12.76% From 2024 To 2032.

A cloud kitchen is a commercial cooking space that gives restaurants the equipment and assistance they need to make food for takeout and delivery. Unlike traditional brick-and-mortar establishments, cloud kitchens enable the production and delivery of food products with low overhead. Whatever term you give it cloud kitchen, virtual kitchen, shadow kitchen, commissary kitchen, dark kitchen, or ghost kitchen it is fundamentally a place where customers order food mostly online. They can work independently or in the kitchen of a well-known company, although they are usually available online. They go by many names, but they all serve the same purpose: to provide clients with delivery-only meals.

Several terms in the "ghost kitchen" section need to be clarified. For instance, kitchen-as-a-service, often known as dark kitchens, are completely constructed rooms that are hired to concepts for their ghost kitchen responsibilities. Because they offer a full-service kitchen and a delivery concept, it is simple to start a delivery restaurant with little risk and little money. Although there may be a drive-through or takeout area in some ghost kitchens, there isn't a typical storefront or inside seating. No matter what we want to label these digital-only brands, they are significantly addressing a market demand. Additionally, according to recent data, meal delivery orders climbed by more than 150% between 2019 and 2020, and according to UBS, the food delivery market will grow more than 10 times over the next ten years, from $35 billion annually to $365 billion. As the need for food delivery rises, more and more restaurant owners and food entrepreneurs are turning to cloud kitchens as an excellent business solution. The market for cloud kitchens will expand over the forecast period as a result of the rising demand for ordering and meal delivery services.

Market Dynamics And Factors For Cloud Kitchen Market

Drivers:

The Changing Market for Food Delivery

Platforms for online meal delivery are increasing convenience and choice by enabling users to place orders from a variety of eateries with just one swipe on their smartphone. The restaurant meal delivery industry is changing quickly as new internet platforms compete for customers and markets in the Americas, Asia, Europe, and the Middle East. According to McKinsey & Company, although these new Internet platforms are now drawing large investments and having high valuations—five of them are worth more than $1 billion—few actual insights into market dynamics, growth potential, or consumer behavior exist. The market for food delivery is currently valued at USD 83.63 Billion globally, or 1% of the entire food market and 4% of food sold by restaurants and fast-food chains. With an expected five-year growth rate of just 3.5 percent, it has already reached maturity in the majority of countries.

Additionally, the demand for internet meal delivery has increased due to the increase in young people around the world and changing customer tastes. Additionally, a busy lifestyle and an increase in consumer disposable income are key drivers of the cloud kitchen market's expansion. Additionally, it is now simpler to order takeout because of the rise in smartphone usage, increased literacy rates, and easy access to the internet. To enhance their sales and provide meal delivery, businesses are now partnering with online food delivery services like Zomato. Online meal delivery services often provide a variety of promotions, which draw customers and broaden their customer base. As a result, the market for cloud kitchens is growing thanks to effective deals and top-notch customer support.

Restraints:

Technological Expenses and Hygiene Issue

The biggest issue with the cloud kitchen model is that it has substituted technical expenditures and hygiene issues for real estate costs. Technically, cloud kitchens are quite expensive. This is because several different meal delivery applications must interface with these kitchens. The kitchen that is closest to the customer's location must receive the orders and relay them to it. Cloud-based solutions are readily available, enabling restaurants to upgrade their technology without incurring significant upfront costs. The monthly subscriber cost, however, also severely strains the finances of many fledgling cooks. As a result, the prices are relatively comparable to those of conventional restaurants. However, because these stores don't offer a dine-in option, the number of customers is significantly constrained. Scaling the cloud kitchen model is challenging. The issue is that businesses frequently construct their kitchens in unclean settings. To keep costs as low as possible, this is done. Customers don't desire their needs to be met in premium real estate. To ensure that the food is edible, the kitchen must be hygienic. Social media has been used extensively to highlight numerous instances of unclean food being given to diners.

In conclusion, there has been a significant development in the restaurant business. Kitchens in the clouds are a relatively recent invention. However, they assist in filling a very significant market gap that was previously ignored by conventional eateries. They are not eliminating present restaurant owners' market share as a result. Instead, they are growing current markets, which helps the entire sector.

Opportunity:

Business Opportunities for the Entrepreneurs

All industries, including those in education, infrastructure, hospitality, and travel, have been touched by technology. The restaurant industry is similar. Therefore, it's essential to approach every company with a fresh perspective as well as renewed interest. primarily to endure, persist, and compete. The Cloud Kitchen approach has gained popularity among novice restaurateurs since it lowers the expense of launching a culinary brand. Even if the idea was becoming more and more popular even before the pandemic, Cloud Kitchens are now more profitable for two main reasons. First of all, they enable restaurants to send food directly to consumers' homes. Additionally, they use resources more effectively thanks to streamlined kitchen processes because they function in a fraction of the space of a conventional restaurant. For a Cloud Kitchen business to be successful, it is essential to comprehend the unit economics of the collaboration with the delivery apps and the cost of acquiring menu items.

Many business owners now have the chance to operate virtual restaurants using shared commercial kitchen areas on a revenue-sharing basis thanks to the Cloud Kitchen arrangement. Cloud kitchen is experiencing nationwide growth, which has increased competition. In addition to attracting repeat customers by serving high-quality food, technology is the most crucial factor in the restaurant's success.

Segmentation Analysis Of Cloud Kitchen Market

By Type, the independent cloud kitchen segment held the largest revenue share in the forecast period of the overall market. Due to the increase in independent companies that serve customers from a single location, the trend is anticipated to last during the forecast period. Independent cloud kitchens mainly cater to customers who like a certain cuisine style and rely heavily on third-party delivery channels. The growing consumer appetite for fast food, international cuisine, and online ordering is anticipated to fuel the growth of the segment.

By Nature, Throughout the forecast period, the franchised segment produced the highest revenue share and led the worldwide cloud kitchen market. The rapid expansion of online meal delivery services has created enormous development potential for cloud kitchen brands, which has fueled the expansion of the franchised market. This sector has grown as a result of the popular franchises becoming more prevalent, particularly in emerging areas. Additionally, the franchisor extends to the franchisee it's assistance, training, and marketing initiatives, favoring the development of the franchise at several sites and thereby assisting the segment's global expansion. During the forecast period, the standalone is anticipated to grow the fastest. Global demand for standalone cloud kitchens has grown dramatically because of their low cost of entry, increased profitability, and simplicity of use. Additionally, the assistance from the companies that supply food has aided in this market growth.

By Deployment Mode, the Mobile segment is anticipated to capture the maximum market share during the forecast period. Mobile apps are excellent tools for interacting with customers. According to research, offering clients a positive cashless experience increases their likelihood of making a purchase. The transaction becomes more convenient the less cash you exchange. You can simply do that with mobile apps. The ability to take payments from a variety of gateways is a feature of a good restaurant ordering app. The buyer can select the most practical alternative in this way.

Regional Analysis Of Cloud Kitchen Market

The Asia Pacific region has emerged as the dominant force in the global cloud kitchen market, driven by a combination of factors including rapid urbanization, changing consumer lifestyles, and widespread adoption of food delivery apps. Countries like India, China, and Southeast Asian nations have seen a surge in demand for convenient, diverse, and affordable food options, creating a fertile ground for cloud kitchen businesses to thrive.

The COVID-19 pandemic acted as a catalyst, accelerating the growth of cloud kitchens in the region. Lockdowns and social distancing measures led to a significant increase in food delivery orders, prompting both established restaurant chains and new entrepreneurs to invest in cloud kitchen operations. This shift allowed businesses to reduce overhead costs associated with traditional dine-in establishments while expanding their reach to a broader customer base.

The region's tech-savvy population and high smartphone penetration rates have played a crucial role in the success of cloud kitchens. Food delivery platforms like Swiggy, Zomato in India, Meituan in China, and Grab in Southeast Asia have become integral to urban life, providing a ready distribution channel for cloud kitchen brands. These platforms have also invested in their own cloud kitchen spaces, further driving market growth.

Government support and favorable regulations in many Asian countries have contributed to the rapid expansion of the cloud kitchen sector. For instance, Singapore's government has actively encouraged the development of cloud kitchens as part of its food industry transformation map. Similarly, in India, the government's focus on promoting entrepreneurship and digitalization has indirectly benefited the cloud kitchen ecosystem.

Top Key Players Covered In Cloud Kitchen Market

- Dahmakan

- Kitchen United

- DoorDash, Inc.

- Zuul Kitchens, Inc.

- Kitopi Catering Services LLC

- City Storage Systems LLC

- CloudKitchens

- Zomato

- Keatz GmbH

- KITCHEN MANTRA

- Franklin Junction

- Nextbite Brands LLC.

- REEF TECHNOLOGY INC.

- Virturant Brands

- Rebel Foods Private Limited

- Ghost Kitchen Orlando

- Pop Meals

- Swiggy

- Starbucks Corporation and other major players.

Key Industry Development In The Cloud Kitchen Market

- In January 2024, ITC announced plans to expand its cloud kitchen business beyond its pilot phase in Bengaluru. The company, which referred to this venture as "food-tech," identified it as a key growth area. ITC was operating three brands in this space: ITC Aashirvaad Soul Creations for North Indian comfort food, ITC Master Chef Creations for North Indian gourmet cuisines, and ITC Sunfeast Baked Creations for bakery products. The expansion aimed to bring these cloud kitchen services to more cities across India.

- In May 2023, Swiggy expanded its premium food delivery service, Swiggy Gourmet, to 31 cities across India, including Pune, Kolkata, and Jaipur. This move was aimed at strengthening the company's position in the premium food category.

- In March 2022, DoorDash entered into an agreement to acquire Bbot, a technology company specializing in hospitality solutions. This acquisition was intended to enhance DoorDash's offerings in the U.S. market, providing merchants with more comprehensive solutions for both in-store and online channels, including digital ordering and payment systems.

- In July 2021, DoorDash launched a new business initiative by opening a temporary kitchen facility in San Jose, California. This kitchen was set up to prepare meals for six different restaurants, allowing DoorDash to expand its service offerings and explore new operational models.

|

Global Cloud Kitchen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 58.72 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.76% |

Market Size in 2032: |

USD 173.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Deployment Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Nature

3.3 By Deployment Mode

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Cloud Kitchen Market by Type

5.1 Cloud Kitchen Market Overview Snapshot and Growth Engine

5.2 Cloud Kitchen Market Overview

5.3 Independent

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Independent: Grographic Segmentation

5.4 Shared Kitchen

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Shared Kitchen: Grographic Segmentation

5.5 Kitchen Pods

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Kitchen Pods: Grographic Segmentation

Chapter 6: Cloud Kitchen Market by Nature

6.1 Cloud Kitchen Market Overview Snapshot and Growth Engine

6.2 Cloud Kitchen Market Overview

6.3 Standalone

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Standalone: Grographic Segmentation

6.4 Franchised

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Franchised: Grographic Segmentation

Chapter 7: Cloud Kitchen Market by Deployment Mode

7.1 Cloud Kitchen Market Overview Snapshot and Growth Engine

7.2 Cloud Kitchen Market Overview

7.3 Web

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Web: Grographic Segmentation

7.4 Mobile

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Mobile: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Cloud Kitchen Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Cloud Kitchen Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Cloud Kitchen Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 DAHMAKAN

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 STARBUCKS COFFEE COMPANY

8.4 KITCHEN UNITED

8.5 DOORDASH INC

8.6 ZUUL KITCHENS INC.

8.7 KITOPI CATERING SERVICES LLC

8.8 CITY STORAGE SYSTEMS LLC

8.9 CLOUDKITCHENS

8.10 ZOMATO

8.11 KEATZ GMBH

8.12 KITCHEN MANTRA

8.13 FRANKLIN JUNCTION

8.14 NEXTBITE BRANDS LLC.

8.15 REEF TECHNOLOGY INC.

8.16 VIRTURANT BRANDS

8.17 REBEL FOODS PRIVATE LIMITED

8.18 GHOST KITCHEN ORLANDO

8.19 POP MEALS

8.20 SWIGGY

8.21 STARBUCKS CORPORATION

8.22 OTHER MAJOR PLAYERS

Chapter 9: Global Cloud Kitchen Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Independent

9.2.2 Shared Kitchen

9.2.3 Kitchen Pods

9.3 Historic and Forecasted Market Size By Nature

9.3.1 Standalone

9.3.2 Franchised

9.4 Historic and Forecasted Market Size By Deployment Mode

9.4.1 Web

9.4.2 Mobile

Chapter 10: North America Cloud Kitchen Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Independent

10.4.2 Shared Kitchen

10.4.3 Kitchen Pods

10.5 Historic and Forecasted Market Size By Nature

10.5.1 Standalone

10.5.2 Franchised

10.6 Historic and Forecasted Market Size By Deployment Mode

10.6.1 Web

10.6.2 Mobile

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Cloud Kitchen Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Independent

11.4.2 Shared Kitchen

11.4.3 Kitchen Pods

11.5 Historic and Forecasted Market Size By Nature

11.5.1 Standalone

11.5.2 Franchised

11.6 Historic and Forecasted Market Size By Deployment Mode

11.6.1 Web

11.6.2 Mobile

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

Chapter 12: Asia-Pacific Cloud Kitchen Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Independent

12.4.2 Shared Kitchen

12.4.3 Kitchen Pods

12.5 Historic and Forecasted Market Size By Nature

12.5.1 Standalone

12.5.2 Franchised

12.6 Historic and Forecasted Market Size By Deployment Mode

12.6.1 Web

12.6.2 Mobile

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Southeast Asia

Chapter 13: South America Cloud Kitchen Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Independent

13.4.2 Shared Kitchen

13.4.3 Kitchen Pods

13.5 Historic and Forecasted Market Size By Nature

13.5.1 Standalone

13.5.2 Franchised

13.6 Historic and Forecasted Market Size By Deployment Mode

13.6.1 Web

13.6.2 Mobile

13.7 Historic and Forecast Market Size by Country

13.7.1 Brazil

13.7.2 Argentina

Chapter 14: Middle East & Africa Cloud Kitchen Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Independent

14.4.2 Shared Kitchen

14.4.3 Kitchen Pods

14.5 Historic and Forecasted Market Size By Nature

14.5.1 Standalone

14.5.2 Franchised

14.6 Historic and Forecasted Market Size By Deployment Mode

14.6.1 Web

14.6.2 Mobile

14.7 Historic and Forecast Market Size by Country

14.7.1 Saudi Arabia

14.7.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Cloud Kitchen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 58.72 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.76% |

Market Size in 2032: |

USD 173.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Deployment Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CLOUD KITCHEN MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CLOUD KITCHEN MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CLOUD KITCHEN MARKET COMPETITIVE RIVALRY

TABLE 005. CLOUD KITCHEN MARKET THREAT OF NEW ENTRANTS

TABLE 006. CLOUD KITCHEN MARKET THREAT OF SUBSTITUTES

TABLE 007. CLOUD KITCHEN MARKET BY TYPE

TABLE 008. INDEPENDENT MARKET OVERVIEW (2016-2028)

TABLE 009. SHARED KITCHEN MARKET OVERVIEW (2016-2028)

TABLE 010. KITCHEN PODS MARKET OVERVIEW (2016-2028)

TABLE 011. CLOUD KITCHEN MARKET BY NATURE

TABLE 012. STANDALONE MARKET OVERVIEW (2016-2028)

TABLE 013. FRANCHISED MARKET OVERVIEW (2016-2028)

TABLE 014. CLOUD KITCHEN MARKET BY DEPLOYMENT MODE

TABLE 015. WEB MARKET OVERVIEW (2016-2028)

TABLE 016. MOBILE MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA CLOUD KITCHEN MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA CLOUD KITCHEN MARKET, BY NATURE (2016-2028)

TABLE 019. NORTH AMERICA CLOUD KITCHEN MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 020. N CLOUD KITCHEN MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE CLOUD KITCHEN MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE CLOUD KITCHEN MARKET, BY NATURE (2016-2028)

TABLE 023. EUROPE CLOUD KITCHEN MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 024. CLOUD KITCHEN MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC CLOUD KITCHEN MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC CLOUD KITCHEN MARKET, BY NATURE (2016-2028)

TABLE 027. ASIA PACIFIC CLOUD KITCHEN MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 028. CLOUD KITCHEN MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA CLOUD KITCHEN MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA CLOUD KITCHEN MARKET, BY NATURE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA CLOUD KITCHEN MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 032. CLOUD KITCHEN MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA CLOUD KITCHEN MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA CLOUD KITCHEN MARKET, BY NATURE (2016-2028)

TABLE 035. SOUTH AMERICA CLOUD KITCHEN MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 036. CLOUD KITCHEN MARKET, BY COUNTRY (2016-2028)

TABLE 037. DAHMAKAN: SNAPSHOT

TABLE 038. DAHMAKAN: BUSINESS PERFORMANCE

TABLE 039. DAHMAKAN: PRODUCT PORTFOLIO

TABLE 040. DAHMAKAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. STARBUCKS COFFEE COMPANY: SNAPSHOT

TABLE 041. STARBUCKS COFFEE COMPANY: BUSINESS PERFORMANCE

TABLE 042. STARBUCKS COFFEE COMPANY: PRODUCT PORTFOLIO

TABLE 043. STARBUCKS COFFEE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. KITCHEN UNITED: SNAPSHOT

TABLE 044. KITCHEN UNITED: BUSINESS PERFORMANCE

TABLE 045. KITCHEN UNITED: PRODUCT PORTFOLIO

TABLE 046. KITCHEN UNITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. DOORDASH INC: SNAPSHOT

TABLE 047. DOORDASH INC: BUSINESS PERFORMANCE

TABLE 048. DOORDASH INC: PRODUCT PORTFOLIO

TABLE 049. DOORDASH INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. ZUUL KITCHENS INC.: SNAPSHOT

TABLE 050. ZUUL KITCHENS INC.: BUSINESS PERFORMANCE

TABLE 051. ZUUL KITCHENS INC.: PRODUCT PORTFOLIO

TABLE 052. ZUUL KITCHENS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. KITOPI CATERING SERVICES LLC: SNAPSHOT

TABLE 053. KITOPI CATERING SERVICES LLC: BUSINESS PERFORMANCE

TABLE 054. KITOPI CATERING SERVICES LLC: PRODUCT PORTFOLIO

TABLE 055. KITOPI CATERING SERVICES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. CITY STORAGE SYSTEMS LLC: SNAPSHOT

TABLE 056. CITY STORAGE SYSTEMS LLC: BUSINESS PERFORMANCE

TABLE 057. CITY STORAGE SYSTEMS LLC: PRODUCT PORTFOLIO

TABLE 058. CITY STORAGE SYSTEMS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CLOUDKITCHENS: SNAPSHOT

TABLE 059. CLOUDKITCHENS: BUSINESS PERFORMANCE

TABLE 060. CLOUDKITCHENS: PRODUCT PORTFOLIO

TABLE 061. CLOUDKITCHENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ZOMATO: SNAPSHOT

TABLE 062. ZOMATO: BUSINESS PERFORMANCE

TABLE 063. ZOMATO: PRODUCT PORTFOLIO

TABLE 064. ZOMATO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. KEATZ GMBH: SNAPSHOT

TABLE 065. KEATZ GMBH: BUSINESS PERFORMANCE

TABLE 066. KEATZ GMBH: PRODUCT PORTFOLIO

TABLE 067. KEATZ GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. KITCHEN MANTRA: SNAPSHOT

TABLE 068. KITCHEN MANTRA: BUSINESS PERFORMANCE

TABLE 069. KITCHEN MANTRA: PRODUCT PORTFOLIO

TABLE 070. KITCHEN MANTRA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. FRANKLIN JUNCTION: SNAPSHOT

TABLE 071. FRANKLIN JUNCTION: BUSINESS PERFORMANCE

TABLE 072. FRANKLIN JUNCTION: PRODUCT PORTFOLIO

TABLE 073. FRANKLIN JUNCTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. NEXTBITE BRANDS LLC.: SNAPSHOT

TABLE 074. NEXTBITE BRANDS LLC.: BUSINESS PERFORMANCE

TABLE 075. NEXTBITE BRANDS LLC.: PRODUCT PORTFOLIO

TABLE 076. NEXTBITE BRANDS LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. REEF TECHNOLOGY INC.: SNAPSHOT

TABLE 077. REEF TECHNOLOGY INC.: BUSINESS PERFORMANCE

TABLE 078. REEF TECHNOLOGY INC.: PRODUCT PORTFOLIO

TABLE 079. REEF TECHNOLOGY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. VIRTURANT BRANDS: SNAPSHOT

TABLE 080. VIRTURANT BRANDS: BUSINESS PERFORMANCE

TABLE 081. VIRTURANT BRANDS: PRODUCT PORTFOLIO

TABLE 082. VIRTURANT BRANDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. REBEL FOODS PRIVATE LIMITED: SNAPSHOT

TABLE 083. REBEL FOODS PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 084. REBEL FOODS PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 085. REBEL FOODS PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. GHOST KITCHEN ORLANDO: SNAPSHOT

TABLE 086. GHOST KITCHEN ORLANDO: BUSINESS PERFORMANCE

TABLE 087. GHOST KITCHEN ORLANDO: PRODUCT PORTFOLIO

TABLE 088. GHOST KITCHEN ORLANDO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. POP MEALS: SNAPSHOT

TABLE 089. POP MEALS: BUSINESS PERFORMANCE

TABLE 090. POP MEALS: PRODUCT PORTFOLIO

TABLE 091. POP MEALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. SWIGGY: SNAPSHOT

TABLE 092. SWIGGY: BUSINESS PERFORMANCE

TABLE 093. SWIGGY: PRODUCT PORTFOLIO

TABLE 094. SWIGGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. STARBUCKS CORPORATION: SNAPSHOT

TABLE 095. STARBUCKS CORPORATION: BUSINESS PERFORMANCE

TABLE 096. STARBUCKS CORPORATION: PRODUCT PORTFOLIO

TABLE 097. STARBUCKS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 098. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 099. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 100. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CLOUD KITCHEN MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CLOUD KITCHEN MARKET OVERVIEW BY TYPE

FIGURE 012. INDEPENDENT MARKET OVERVIEW (2016-2028)

FIGURE 013. SHARED KITCHEN MARKET OVERVIEW (2016-2028)

FIGURE 014. KITCHEN PODS MARKET OVERVIEW (2016-2028)

FIGURE 015. CLOUD KITCHEN MARKET OVERVIEW BY NATURE

FIGURE 016. STANDALONE MARKET OVERVIEW (2016-2028)

FIGURE 017. FRANCHISED MARKET OVERVIEW (2016-2028)

FIGURE 018. CLOUD KITCHEN MARKET OVERVIEW BY DEPLOYMENT MODE

FIGURE 019. WEB MARKET OVERVIEW (2016-2028)

FIGURE 020. MOBILE MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA CLOUD KITCHEN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE CLOUD KITCHEN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC CLOUD KITCHEN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA CLOUD KITCHEN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA CLOUD KITCHEN MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Cloud Kitchen Market research report is 2024-2032.

Dahmakan, Starbucks Coffee Company, Kitchen United, DoorDash, Inc., Zuul Kitchens, Inc., Kitopi Catering Services LLC, City Storage Systems LLC, CloudKitchens, Zomato, Keatz GmbH, KITCHEN MANTRA., Franklin Junction, Nextbite Brands LLC., REEF TECHNOLOGY INC., Virturant Brands, Rebel Foods Private Limited, Ghost Kitchen Orlando, Pop Meals, Swiggy, Starbucks Corporation, and other major players.

The Cloud Kitchen Market is segmented into Type, Nature, Deployment Mode, and region. By Type, the market is categorized into Independent, Shared Kitchen, and Kitchen Pods. By Nature, the market is categorized into Standalone, Franchised. By Deployment Mode, the market is categorized into Web and Mobile. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A cloud kitchen is a commercial cooking space that gives restaurants the equipment and assistance they need to make food for takeout and delivery. Unlike traditional brick-and-mortar establishments, cloud kitchens enable the production and delivery of food products with low overhead.

Global Cloud Kitchen Market Size Was Valued at USD 58.72 Billion In 2023 And Is Projected to Reach USD 173.05 Billion By 2032, Growing at A CAGR of 12.76% From 2024 To 2032.