Citronellol Market Synopsis

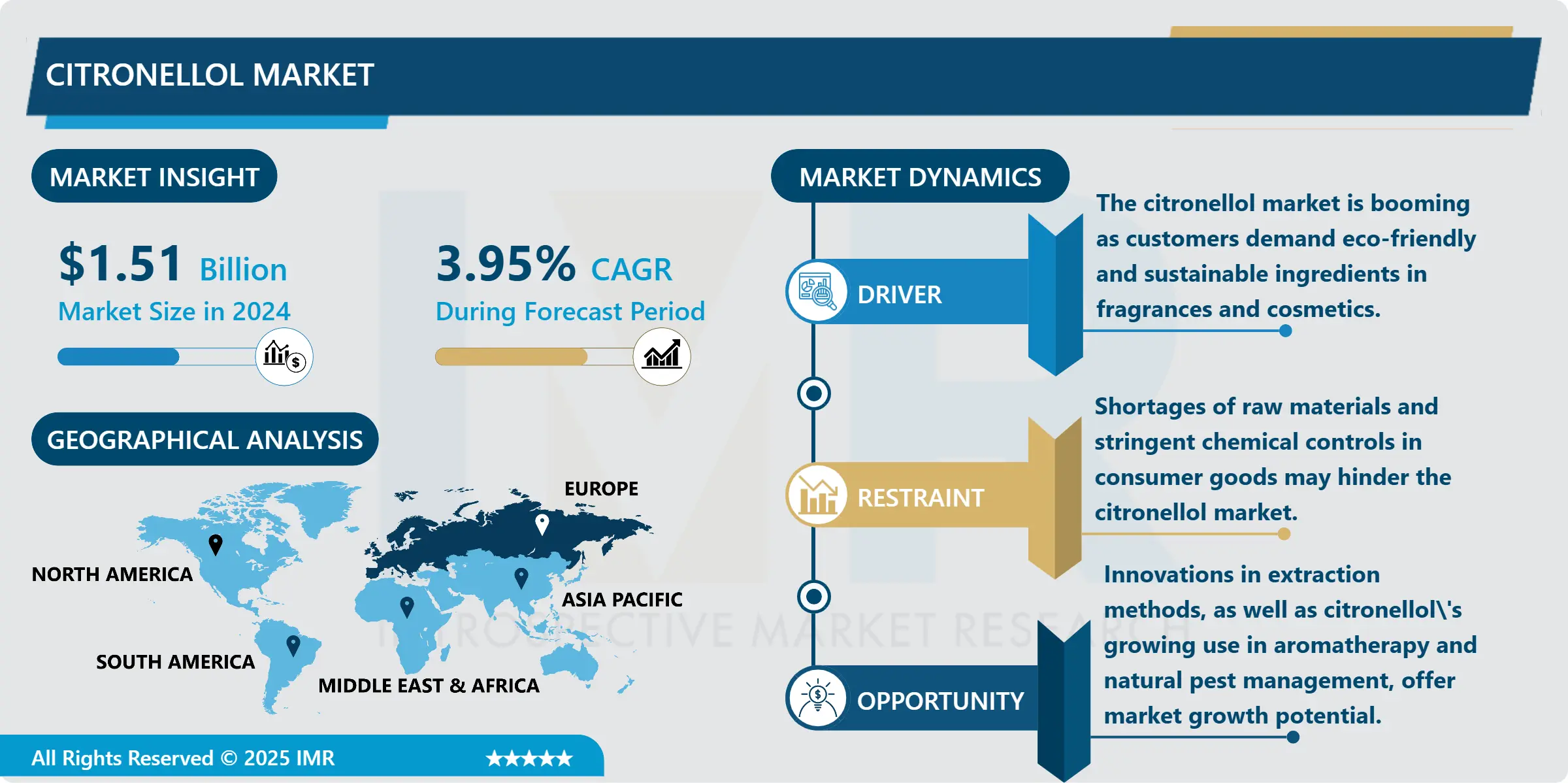

Citronellol Market Size is Valued at USD 1.51 Billion in 2024, and is Projected to Reach USD 2.06 Billion by 2035, Growing at a CAGR of 3.95% From 2025-2035.

The increasing necessity of natural and organic products in cosmetics and personal care products, food and beverages sectors or industries are some of the main reasons behind the high citronellol market growth rate. Citronellol, a monoterpenoid isolated from rose and citronella essential oils has been known to have multiple health benefits and great sweet floral scent. There is growing interest in citronellol, particularly in its application in perfumes and fragrances, and as a natural flavouring additive as consumers shift from synthetic to natural products.

Also, the realization of the negative effects of synthetic chemical products has led the manufacturers to look for green friendly and natural substitutes. Citronellol becomes safer because it has a possibility of having antimicrobial activity and is derived from a natural source. This trend is evident by the discovery of more products in cosmetics and personal care segment that are made from natural ingredients. It is expected that manufacturers are going to serve the changing demands of the consumers which will lead to the increase in the usage of citronellol.

The citronellol market is also growing due to a vast food and beverage market, apart from cosmetics and personal care industries. Citronellol is used as a flavoring ingredient for a number of food items because of its pleasant, sweet citrusy note. As the market for consumer products become more selective and turn to clean label and natural food products, the demand for natural flavoring such as citronellol is expected to rise. Citronellol is expected to experience further growth in the years to come because of the increasing focus on sustainable sourcing and production and because its uses are expanding.

Citronellol Market Trend Analysis

Growing Demand for Natural Ingredients

- The citronellol market is being greatly affected by the growing use of natural compound as raw materials more so in the personal care and cosmetics. Products with natural and organic ingredients take precedence over synthetic chemicals primarily due to the negative impact on the body these chemicals are believed to have. Manufacturers who target these environmentally conscious consumers are turning to citronellol because it comes from plant sources like rose and citronella and is seen as safer with a better smell. This trend paves the way for enhanced use of citronellol in care products and fragrances, at the same time encouraging producers to seekcff. new formulations that accentuate the natural character of their products.

- Moreover, this demand for natural constituents is experienced in almost all sectors including the food and beverages sector, where citronellol is notably requested for its flavoring functions. Citronellol appears to have great potentiality as a natural flavoring agent, and its use is likely to increase as consumers place a premium on natural label and product health. The ability to expand the potential market for citronellol is additionally enhanced by the growing appreciation of the as of the benefits of natural constituents and ensures the Citronellyl acetate’s viability in a shifting market, which values the wellbeing, and preservation of the environment above all.

Expansion in the Food and Beverage Sector

- The growth of citronellol is largely dependent on the growth of the food and beverage industries especially because citronellol is used in the production of flavoring agents. Manufacturers are making use of citronellol because of its health benefits as well as the alluring flavor as consumers look for clean label products and natural additives. This monoterpenoid which is natural in it existence obtained from citrus fruits especially in the essential oils like citronella adds flavor to many foods also, increase with the level of transparency in labeling. Consumers’ increasing concern about the quality of food products they eat is increasing the use of citronellol as a flavoring ingredient making its market demand even stronger.

- With the growing wave of obesity and other related diseases, the trend of healthy living has prompted the formation of new standards in product formulation with reduced or no additive flavouring and preserving agents. Citronellol has been widely used today because of the transition to natural and organic products wherein it offers a great taste without having to give up taste and quality over safety concerns. Thus, the given trend continues to increase, and the citronellol market is also close to experiencing further growth due to shifts in consumers’ choice in the food & beverages industry.

Citronellol Market Segment Analysis:

Citronellol Market Segmented on the basis of By Purity, By Application and By Type

By Purity, More than 94% segment is expected to dominate the market during the forecast period

- In every market segment that has citronellol applications, the purity levels lower the market segmentation have large impacts. Citronellol is widely used in cosmetics as well as fragrances and those manufacturing deodorants use this product, being of extremely high quality and availability in a 94% pure form. Manufacturers seek this high-purity citronellol in a bid to provide their consumers with quality products that will entice those consumers who want natural ingredients in their products. The need for pure citronellol is expected to rise, especially in industries that require ‘clean’ labeling and all things natural and luxurious, owing to improved consumers’ knowledge regarding product ingredients.

- On the other hand, citronellol with purity of 85% and 87 % purity as well as those with the purity of less than or equal to 85%. These lower purity levels are commonly used in detergents, soaps, candles, etc., and in food that has relatively lower product value. The growth in the citronellol market is expected to be driven more broadly because not only the further production of high-purity citronellol, but also the need for the lower-purity product will be satisfied to ensure it does not become too expensive.

By Application, Flavour and Fragrance segment held the largest share in 2024

- Citronellol is applied in many industries, with attention to fragrant and flavor production. Citronellol is utilized in perfumes and scented goods primarily because it has an extremely pleasant smell of flowers; it is also often used to create an enjoyable and pleasing fragrance. In addition, the food and beverages industries use citronellol as a natural flavor, contributing to the trend toward more natural flavors, improving the flavor profile of a number of products. Citronellol is highly useful in culinary preparations and fragrant uses owing to the multipurpose nature of the chemical.

- Additionally, citronellol has lately found its way into the personal and home care industries to act as an natural insecticide and perhaps have antimicrobial effects too. It has a use value and affects basic classification senses in personal care products. Citronellol used in home care applications to structure cleaning agents and air freshener to make the environment more delightful. In general, the use of citronellol right from perfumery to pharmaceuticals shows that it plays a key role in these sectors of the market.

Citronellol Market Regional Insights:

Europe is expected to show growth in the citronellol Market

- There is expected to be increased development in the citronellol market in Europe because of the high measures that have been put in place against synthetic products used in different consumer products. The European Union has shifted its focus towards labeling that reflect the incorporation of natural and organic materials following higher trend in the health and environmentally friendly products. Specifically, target markets of cosmetics and personal care industries are redefining their product configurations to contain novelties from nature, for instance, citronellol which is believed to possess both curative properties as well as the ability to producing an aroma.

- Furthermore, the use of natural flavouring agents in the food and beverage industry is brought about by clean label especially in the European market. As the consumer gets more informed on the content of the foods and drinks they consume they are.Core to products without additives. It is forcing manufacturers to look at citronellol as a Flavor enhancer, besides contributing to its market growth in Europe.

Active Key Players in the Citronellol Market

- BASF SE (Germany)

- Privi Speciality Chemicals Limited (India)

- Crescent Fragrances Private Limited (India)

- Bo International (India)

- International Flavours & Fragrances Inc. (U.S.)

- Capot Chemical Co., Ltd (China)

- K. K. Enterprise (India)

- Shiv Shakti Trading Corporation (India)

- Takasago International Corporation (Japan)

- Jayshree Aromatics Pvt. Ltd (India)

- Emerald Performance Materials (U.S.), other Active Players.

|

Global Citronellol Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.51 Bn. |

|

Forecast Period 2025-35 CAGR: |

3.95% |

Market Size in 2035: |

USD 2.06 Bn. |

|

Segments Covered: |

By Purity |

|

|

|

By Application |

|

||

|

By Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Citronellol Market by Purity (2018-2035)

4.1 Citronellol Market Snapshot and Growth Engine

4.2 Market Overview

4.3 More than 94%

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Between 85% and 87%

4.5 Less than Equal to 85%

Chapter 5: Citronellol Market by Application (2018-2035)

5.1 Citronellol Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Flavour and Fragrance

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Personal Care

5.5 Fabric Care

5.6 Home Care

5.7 Others

Chapter 6: Citronellol Market by Type (2018-2035)

6.1 Citronellol Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Natural

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Synthesis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Citronellol Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BASF SE (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PRIVI SPECIALITY CHEMICALS LIMITED (INDIA)

7.4 CRESCENT FRAGRANCES PRIVATE LIMITED (INDIA)

7.5 BO INTERNATIONAL (INDIA)

7.6 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (U.S.)

7.7 CAPOT CHEMICAL COLTD (CHINA)

7.8 K. K. ENTERPRISE (INDIA)

7.9 SHIV SHAKTI TRADING CORPORATION (INDIA)

7.10 TAKASAGO INTERNATIONAL CORPORATION (JAPAN)

7.11 JAYSHREE AROMATICS PVT. LTD (INDIA)

7.12 EMERALD PERFORMANCE MATERIALS (U.S.)

7.13

Chapter 8: Global Citronellol Market By Region

8.1 Overview

8.2. North America Citronellol Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Purity

8.2.4.1 More than 94%

8.2.4.2 Between 85% and 87%

8.2.4.3 Less than Equal to 85%

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Flavour and Fragrance

8.2.5.2 Personal Care

8.2.5.3 Fabric Care

8.2.5.4 Home Care

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Type

8.2.6.1 Natural

8.2.6.2 Synthesis

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Citronellol Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Purity

8.3.4.1 More than 94%

8.3.4.2 Between 85% and 87%

8.3.4.3 Less than Equal to 85%

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Flavour and Fragrance

8.3.5.2 Personal Care

8.3.5.3 Fabric Care

8.3.5.4 Home Care

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Type

8.3.6.1 Natural

8.3.6.2 Synthesis

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Citronellol Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Purity

8.4.4.1 More than 94%

8.4.4.2 Between 85% and 87%

8.4.4.3 Less than Equal to 85%

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Flavour and Fragrance

8.4.5.2 Personal Care

8.4.5.3 Fabric Care

8.4.5.4 Home Care

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Type

8.4.6.1 Natural

8.4.6.2 Synthesis

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Citronellol Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Purity

8.5.4.1 More than 94%

8.5.4.2 Between 85% and 87%

8.5.4.3 Less than Equal to 85%

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Flavour and Fragrance

8.5.5.2 Personal Care

8.5.5.3 Fabric Care

8.5.5.4 Home Care

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Type

8.5.6.1 Natural

8.5.6.2 Synthesis

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Citronellol Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Purity

8.6.4.1 More than 94%

8.6.4.2 Between 85% and 87%

8.6.4.3 Less than Equal to 85%

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Flavour and Fragrance

8.6.5.2 Personal Care

8.6.5.3 Fabric Care

8.6.5.4 Home Care

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Type

8.6.6.1 Natural

8.6.6.2 Synthesis

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Citronellol Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Purity

8.7.4.1 More than 94%

8.7.4.2 Between 85% and 87%

8.7.4.3 Less than Equal to 85%

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Flavour and Fragrance

8.7.5.2 Personal Care

8.7.5.3 Fabric Care

8.7.5.4 Home Care

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Type

8.7.6.1 Natural

8.7.6.2 Synthesis

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Citronellol Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.51 Bn. |

|

Forecast Period 2025-35 CAGR: |

3.95% |

Market Size in 2035: |

USD 2.06 Bn. |

|

Segments Covered: |

By Purity |

|

|

|

By Application |

|

||

|

By Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||