Global Chlor-Alkali Market Overview

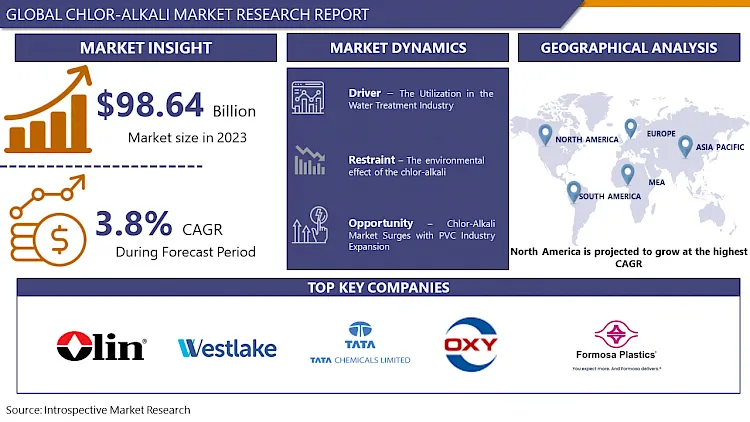

Global Chlor-Alkali Market was valued at USD 98.64 billion in 2023 and is expected to reach USD 137.98 billion by the year 2032, at a CAGR of 3.8%.

The global chlor-alkali market continues to exhibit robust growth, driven by increasing demand across various end-use industries such as chemicals, textiles, and water treatment. The market's expansion is fueled by the rising need for chlorine and caustic soda, the primary products of chlor-alkali manufacturing, in diverse applications including PVC production, pulp and paper manufacturing, and pharmaceuticals. Additionally, the adoption of membrane cell technology, which offers higher energy efficiency and lower environmental impact compared to mercury cell technology, is propelling market growth. Geographically, Asia Pacific remains a key contributor to market growth, attributed to rapid industrialization, urbanization, and infrastructure development in countries like China and India. Furthermore, stringent environmental regulations promoting sustainable production practices are reshaping the market landscape, encouraging manufacturers to invest in eco-friendly technologies and processes. However, fluctuations in raw material prices, particularly for salt and electricity, coupled with volatility in end-user industries, pose challenges to market players. Overall, the chlor-alkali market is poised for steady expansion, driven by evolving industrial dynamics and sustainability imperatives.

Furthermore, increased utilization in food, and paper & pulp industries, growth in requirements from the construction sector and automobile industry, rising demand for chlorine and its derivatives are some of the factors that are turning the chlor-alkali market. In addition, the caustic chlorine industry is turned by the demand-supply of chlorine; however, in India, the major demand driver is caustic soda. There is an urgent requirement to promote chlorine derivatives industry; vibrant bulk chlorine consuming Petro-chemical industry is needed to apply surplus chlorine, in products such as PVC, Propylene Oxide/Glycol, Chloro-Methanes/ HCFC/PTFE, Epichlorohydrin, Polycarbonates, TDI/ MDI, TiO2, DCP, CaCl2, etc.

Market Dynamics And Factors For The Chlor-Alkali Market

Drivers:

The Utilization in the Water Treatment Industry

The growing requirement for the integration or mixing of water treatment plants in the chemical industries owing to the environmental regulations by the government globally. The water treatment industry provides lucrative opportunities for vendors in the water treatment chemicals market. Chlor-alkali is majorly utilized for water neutralization, in case of low pH value. Chlor-alkali such as sodium hydroxide increases the pH value of water and neutralizes it without causing any hardness in the water. Growth in the number of water treatment plants is hastening the chlor-alkali market.

Growing Demand from the Soaps & Detergents Industry

The growth attributes for the chlor-alkali market in the soaps & detergents industry can be measured by the surfactants market. Moreover, the demand for surfactants is projected to witness a significant growth rate during the forecast period. Chlor-alkali is used in the manufacturing of soaps & detergents. So, the soaps & detergents industry growth is enhancing the requirements for chlor-alkali or caustic soda, which is reflected in the growth prospects in the chlor-alkali market.

Significant Growth of the Chemical industry

Chlor-alkali products such as caustic soda, chlorine, and soda ash act as a major role in the chemical industry. These products are necessary raw materials in major bulk chemical industries and are applied in various industrial and production value chains. The products are used in various applications such as paper & pulp, plastics, alumina, and others and find applications in diverse end-use industries includes construction, automotive, and others. Hence, growing chemical output and strong economic conditions in developing economies are anticipated to turn the growth of the chlor-alkali market. As per PlasticsEurope, global plastic production in 2019 was 368 million tons. APAC dominated the market registering for 51% of the worldwide production.

Restraints:

The environmental effect of the chlor-alkali market is one of the hampering factors for the market. As chlorine is highly toxic, its leakage and discharge in the environment are closely witnessed. The presence of dioxin in the pulp- and paper-based products and chlorinated organic compounds in pulp mill effluents are major concerns for environmental safety. Chlorine derivatives also have harmful impacts as these are responsible for ozone layer depletion and thus application is being restricted. The mercury cell process, if used for the production of chlorine and caustic soda, emits mercury through the discharge, which, if not treated before inclining to the environment, can poison freshwater resources. As per the Euro Chlor, European chlor-alkali industries phased out the mercury cell process by 2019, which is anticipated to lead to some capacity shutdowns. All these aforesaid concerns play as moderation for the growth of the chlor-alkali market.

Opportunities:

The (PVC) Poly Vinyl Chloride market is flourishing owing to its different usages in the production of PVC stabilizers, PVC resins, and PVC pipe. Chlor-alkali is utilized in the manufacturing of PVC, the trade value of polymers of vinyl chloride. Moreover, an estimated 35% of Europe's Chlorine production is utilized for the production of PVC. The bulk of global production of PVC is currently produced using the chemical compound ethylene in combination with chlorine to manufacture EDC (ethylene dichloride or 1,2-dichloroethane). EDC is utilized to make vinyl chloride monomer (VCM) and subsequently used to manufacture polyvinyl chloride (PVC). A substantial part of this trade value was attributed to PVC trade, which has produced opportunities in the chlor-alkali market.

Market Segmentation

Segmentation Analysis of Chlor-Alkali Market:

Based on the Product Type, the caustic soda segment is expected to hold the maximum Chlor-alkali market share over the forecast period. Due to growth in glass production and the rise in applications of glass applications in various verticals. Soda ash is a developing segment attributing to decent demand. Aluminum demand is rapidly increasing as its use is diversified and has different usages in various areas such as building and architectural sectors, food and chemical industries, transport, packaging, machinery and equipment, electrical sector, consumer durables, and also in the defense sector and wagon making by Indian Railways, automobile sector, electrification, and power infrastructure projects.

Based on the End-Users, the water treatment segment is expected to register the maximum market share during the forecast period. As urbanization escalates, so is the demand for wastewater treatment. Societal and environmental pressures have provoked industries, households, and agricultural stakeholders alike to overcome wastewater generation and thoroughly treat the same before discharge. Worldwide, 56% of household wastewater flows were safely treated in 2020, as per the UN-Water. Countries are attempting to grow the same to 100%, for which demand for efficient wastewater treatment systems is inclining. Therefore, preference for chlor-alkali based treatment is anticipated to surge in the upcoming years.

Based on the Production Process, the chlor-alkali market is classified into membrane cell process, diaphragm cell process, and mercury cell process. In 2021, the membrane cell process segment is expected to hold maximum chlor-alkali market share as it consumes less energy with low capital investment.

Regional Analysis of Chlor-Alkali Market:

In the ever-changing chlor-alkali industry, the Asia Pacific region stands out as a major player, ready to lead with its growing industrial sector and constant evolution. The demand for chlor-alkali products is soaring due to fast urbanization, industrialization, and infrastructure development in countries such as China, India, and Southeast Asian nations. The increase is driven by the crucial importance of chlorine and caustic soda in various industries such as chemicals, textiles, water treatment, and pharmaceuticals. Furthermore, the area has shown its dedication to sustainability by proactively incorporating cutting-edge membrane cell technology, leading to more efficient production methods and reducing its environmental impact.

The appeal of the Asia Pacific market is found not just in its size, but also in its capacity for significant growth. Due to strict environmental regulations changing how industries operate, businesses must adopt green technologies, which in turn spurs innovation and grows the market. The region's ability to remain strong and flexible is highlighted by its consistent progress, even in the face of uncertain raw material prices and market instability. Combining tradition and innovation, the Asia Pacific chlor-alkali market represents growth, opportunity, and sustainable progress, set to reshape industry norms worldwide.

Players Covered in Chlor-Alkali market are :

- Olin Corporation(US)

- Westlake Chemical Corporation (US)

- Tata Chemicals Limited (India)

- Occidental Petroleum Corporation (US)

- Formosa Plastics Corporation (Taiwan)

- Solvay SA (Belgium)

- Tosoh Corporation (Japan)

- Hanwha Solutions Corporation (South Korea)

- Nirma Limited (India)

- AGC Inc. (Japan)

- Dow Inc. (US)

- Xinjiang Zhongtai Chemical Co. Ltd. (China)

- INOVYN (UK)

- Ciner Resources Corporation (US)

- Wanhua-Borsodchem (Hungary) and other major players.

Key Industry Developments In The Chlor-Alkali Market

- In January 2021, INOVYN was selected by Koyuncu Group to provide chlor-alkali technology as part of a EUR 16million investment at the latest production unit in Konya province, Turkey. INOVYN will support state-of-the-art BICHLOR™ bipolar electrolyzers for a new facility that will manufacture sodium hypochlorite, chlorine, caustic soda, and hydrochloric acid. The new facility will have an annual production capacity of 50,000 tons, and it is projected to start production in 2022.

- In July 2021, Olin Corporation agreed with ASHTA Chemicals, Inc. (US) to purchase and sell chlorine which is manufactured at ASHTA's Ohio facility in the US.

-

In January 2024, Relevant Industrial, LLC expanded its portfolio through the acquisition of CHEMFLOW Products, a leading distributor specializing in precision-engineered Flow Control products for Chemical services. With over 75 years of combined expertise, CHEMFLOW provided tailored solutions meeting stringent industry standards. This strategic move bolstered Relevant Industrial's offerings, allowing it to provide a wider range of services and products while extending its industrial automation solutions to CHEMFLOW's customer base.

|

Global Chlor-Alkali Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 137.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 98.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End Users |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Chlor-Alkali Market by Type (2018-2032)

4.1 Chlor-Alkali Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Caustic Soda

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chlorine

4.5 Soda Ash

4.6 Others

Chapter 5: Chlor-Alkali Market by End Users (2018-2032)

5.1 Chlor-Alkali Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Soaps & Detergents

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Paper & Pulp

5.5 Organic Chemical

5.6 Water Treatment

5.7 Others

Chapter 6: Chlor-Alkali Market by Distribution Channels (2018-2032)

6.1 Chlor-Alkali Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct Sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Stores

6.5 Warehouses

6.6 Online

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Chlor-Alkali Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 COHERUS BIOSCIENCES (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VIATRIS (US)

7.4 BIOGEN INC. (US)

7.5 MERCK & COINC. (US)

7.6 PFIZER INC. (US)

7.7 AMGEN INC. (US)

7.8 APOBIOLOGIX (CANADA)

7.9 BIOCAD (RUSSIA)

7.10 FRESENIUS KABI (GERMANY)

7.11 SAMSUNG BIOEPIS (SOUTH KOREA)

7.12 CELLTRION INC. (SOUTH KOREA)

7.13 SAMSUNG BIOEPIS COLTD. (SOUTH KOREA)

7.14 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

7.15 SANDOZ (SWITZERLAND)

7.16 BIO-THERA SOLUTIONS (CHINA)

7.17 DR. REDDY'S LABORATORIES LTD. (INDIA)

7.18 BIOCON LTD (INDIA)

7.19 RELIANCE LIFE SCIENCES (INDIA)

7.20 INTAS PHARMA (INDIA)

7.21 ZYDUS CADILA (INDIA)

7.22 LUPIN PHARMA (INDIA)

7.23 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.24

Chapter 8: Global Chlor-Alkali Market By Region

8.1 Overview

8.2. North America Chlor-Alkali Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Caustic Soda

8.2.4.2 Chlorine

8.2.4.3 Soda Ash

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by End Users

8.2.5.1 Soaps & Detergents

8.2.5.2 Paper & Pulp

8.2.5.3 Organic Chemical

8.2.5.4 Water Treatment

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Distribution Channels

8.2.6.1 Direct Sales

8.2.6.2 Specialty Stores

8.2.6.3 Warehouses

8.2.6.4 Online

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Chlor-Alkali Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Caustic Soda

8.3.4.2 Chlorine

8.3.4.3 Soda Ash

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by End Users

8.3.5.1 Soaps & Detergents

8.3.5.2 Paper & Pulp

8.3.5.3 Organic Chemical

8.3.5.4 Water Treatment

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Distribution Channels

8.3.6.1 Direct Sales

8.3.6.2 Specialty Stores

8.3.6.3 Warehouses

8.3.6.4 Online

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Chlor-Alkali Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Caustic Soda

8.4.4.2 Chlorine

8.4.4.3 Soda Ash

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by End Users

8.4.5.1 Soaps & Detergents

8.4.5.2 Paper & Pulp

8.4.5.3 Organic Chemical

8.4.5.4 Water Treatment

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Distribution Channels

8.4.6.1 Direct Sales

8.4.6.2 Specialty Stores

8.4.6.3 Warehouses

8.4.6.4 Online

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Chlor-Alkali Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Caustic Soda

8.5.4.2 Chlorine

8.5.4.3 Soda Ash

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by End Users

8.5.5.1 Soaps & Detergents

8.5.5.2 Paper & Pulp

8.5.5.3 Organic Chemical

8.5.5.4 Water Treatment

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Distribution Channels

8.5.6.1 Direct Sales

8.5.6.2 Specialty Stores

8.5.6.3 Warehouses

8.5.6.4 Online

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Chlor-Alkali Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Caustic Soda

8.6.4.2 Chlorine

8.6.4.3 Soda Ash

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by End Users

8.6.5.1 Soaps & Detergents

8.6.5.2 Paper & Pulp

8.6.5.3 Organic Chemical

8.6.5.4 Water Treatment

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Distribution Channels

8.6.6.1 Direct Sales

8.6.6.2 Specialty Stores

8.6.6.3 Warehouses

8.6.6.4 Online

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Chlor-Alkali Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Caustic Soda

8.7.4.2 Chlorine

8.7.4.3 Soda Ash

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by End Users

8.7.5.1 Soaps & Detergents

8.7.5.2 Paper & Pulp

8.7.5.3 Organic Chemical

8.7.5.4 Water Treatment

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Distribution Channels

8.7.6.1 Direct Sales

8.7.6.2 Specialty Stores

8.7.6.3 Warehouses

8.7.6.4 Online

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Chlor-Alkali Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 137.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 98.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End Users |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Chlor-Alkali Market research report is 2024-2032.

Olin Corporation (US), Westlake Chemical Corporation (US), Tata Chemicals Limited (India), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay SA (Belgium), Tosoh Corporation (Japan), Hanwha Solutions Corporation (South Korea), Nirma Limited (India), AGC Inc. (Japan), Dow Inc. (US), Xinjiang Zhongtai Chemical Co. Ltd. (China), INOVYN (UK), Ciner Resources Corporation (US), Wanhua-Borsodchem (Hungary), and other major players.

The Chlor-Alkali Market is segmented into type, end users, distribution channels, and region. By Type, the market is categorized into Caustic Soda, Chlorine, Soda Ash, and Others. By End Users, the market is categorized into Soaps & Detergents, Paper & Pulp, Organic Chemical, Water Treatment, and Others. By Distribution Channels, the market is categorized into Direct Sales, Specialty Stores, Warehouses, Online, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Chlor-alkali refers to the two chemicals such as chlorine and alkali which are concurrently manufactured as a result of the electrolysis of salt water.

Global Chlor-Alkali Market was valued at USD 98.64 billion in 2023 and is expected to reach USD 137.98 billion by the year 2032, at a CAGR of 3.8%.