China Orthosis and Prosthetics Market Synopsis:

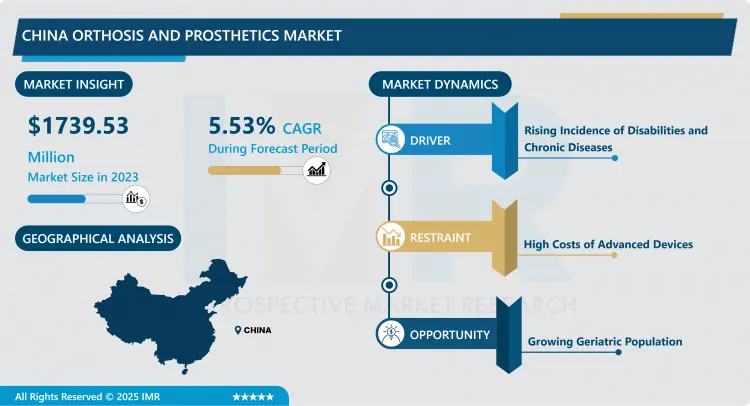

China Orthosis and Prosthetics Market Size Was Valued at USD 1739.53 Million in 2023 and is Projected to Reach USD 2823.68 Million by 2032, Growing at a CAGR of 5.53% From 2024-2032.

The China Orthosis and Prosthetics Market refers to the devices used to correct the movements and support persons with disabilities, amputation or any form of dysfunction. This market encompasses orthotic devices which enable proper musculoskeletal support or correction using braces, support, and splint, prosthetic devices that allow the lost or amputated limbs to move and improve the living conditions. Mainly spurred by the growth in the proportion of the elderly population, the increase in chronic diseases, and enhanced public recognition of rehabilitation equipment and technologies, improvements in product lightweight, durability, and a more targeted product design to suit the Chinese population are highlighted.

China has adopted an orthosis and prosthetics market in the past few years due to increased population aging, diabetes, and cardiovascular diseases, and a raising awareness of rehabilitative health care. Being one of the largest healthcare markets worldwide, China’s demand for O&P devices also grows constantly buoyed by the growing government concern toward the enhancement of healthcare availability and rehabilitative services. Other technologies like the new generation 3D printing and material science also contributed to the enhanced and customized, lightweight and durable orthotic and Prosthetic products to the various category patient requiring rehabilitation. Also, an improvement in the standards of living across the country through higher disposable incomes and increased number of private players in the healthcare sector has further strengthened the penetration of advanced orthotic and prosthetic solutions for mobility impaired consumers.

That is why government support is a highly significant factor in the development of the orthosis and prosthetics market in China. It is better accessibility and utilization of effective policy, investment on health care facilities and other options, which is improving the availability and affordable levels of prosthetic and orthotic devices. However, the addition of these devices in the packages of public health insurance programs has made it easier for people to access them since there is a poorly developed medical sector in rural areas. Other benefits worth mentioning include increased use of artificial intelligence and digital solutions in rehabilitative healthcare, real time data collection, and increased fitting precision, that have all contributed to enhancing the quality of patient care, and perhaps a new focus of patient-centric solutions. In summary, the market of orthosis and prosthetics in China is expected to keep a satisfying growth rate in the future due to the development of high technology, reform of medicalisation, and the society population aging which need more remedy aids to have a better life quality.

China Orthosis and Prosthetics Market Trend Analysis:

Growing Demand and Accessibility in China’s Orthosis and Prosthetics Market Amid Aging Population and Healthcare Reforms

- The China Orthosis and Prosthetics market category includes products used by the physically challenged and people with loss of limbs part, to offer support and facilitate their movements. This market consists of orthotic devices which are appliances used to correct or support musculoskeletal abnormalities through braces, supports and splints; and prosthetics, which are manufactured body parts used to replace lost or amputated limbs to enable the patient to move around in a more natural way. The main motivations of the market in which sits are an aging population, increasing prevalence of chronic diseases, and enhanced awareness of rehabilitation technologies, the major trends being lightweight and durable materials and development of the individual requirements of patients in China.

- Complementing this, the Orthosis and prosthetics market in China has grown over the years due to increased ageing population, increasing prevalence of diabetes and cardiovascular diseases, increasing awareness of rehabilitative healthcare. China is among the biggest and fastest-growing markets for healthcare products and services, and more efforts and policies will be launched in future to promote the development of healthcare services for orthotic and prosthetic devices. State-of-the-art techniques, such as 3D innovations and material science, have also boosted improvements in new high customized, light, and strong o&p products that meet a broad and diversifying base of patients with different rehabilitation requirements. Further, the improved standard living across the length and breadth of the country; coupled with a higher number of private healthcare organisations, has contributed to the increased penetration of high-end orthotic and prosthetic solutions to the physically challenged individuals.

- Government support and intervention exist as the key factors behind the formulation of the orthosis and prosthetics market in China. Better availability and affordability of prosthetic and orthotic are being promoted with the help of policy initiatives and improvement in the healthcare facility. Further, the availability of these devices has also became general after including them in public health insurance systems, more notably in rural communities which are still underprivileged in regards to access to health care services. Real-time data collection and enhanced accuracy of fitting also progresses rehabilitative health care involving artificial intelligence and digital methods Part and parcel of these developments, patient-centric approaches have also received a boost. In summary, the Chinese orthosis and prosthetics market should sustain high-growth rates influenced by technological development, the reform of the healthcare system and an increasing number of geriatric population in need of improved mobility and quality of life.

Innovations in Digital Health and 3D Printing in Orthotics and Prosthetics Manufacturing

- Advanced features in digital health technology and 3D printers are changing the Market Of Custom Orthotics and prosthetics for developing comfort along with functionality. As the way to the highly specialised medical devices becomes more and more popular, 3D printing allows creating the orthotic and prosthetic products, which individual design and shape answer to definite human organism peculiarities. It not only adds value to the experience encountered by the users, but it also increases the level of health-related comfort as a result of perfectly match supporting structures. In addition, the incorporation of smart materials into these devices provides an extra level of programmability and control to the devices so that they can change, for instance, the force exerted on the user due to the forces being sensed by the device. With increasing demands in these technologies, manufacturers are able to cost effectively bring a variety of devices to market differentiated by demographic needs.

- The development of biomechanics also helps to strengthen the increase of the Orthotics and Prosthetics market in China and improve the mobility and usage of prosthetic limbs. These advances enable the development of further adaptive and effective prosthetics to increase mimicry of real movement patterns, which would enhance the living experience of individuals with amputations. There is a strong positive correlation between the sector’s growth and partnerships between local industries and foreign firms in terms of expertise imports. Such collaborations might result in improved production of quality and cheap orthotic and prosthetic devises to enhance patient’s access all over China. If the market is properly equipped as well as adopting the modern technological solutions and common practices from all over the world, it can successfully serve the needs of a heated patient population and promote competition for further advancement.

China Orthosis and Prosthetics Market Segment Analysis:

China Orthosis and Prosthetics Market is Segmented on the basis of Product Type, Age Group, Indication, and Region

By Product Type, Orthosis (Knee Ankle Foot Orthoses (KAFO) segment is expected to dominate the market during the forecast period

- Knee Ankle Foot Orthoses (KAFO) are medical support systems specifically developed to support the knee, ankle and foot. These orthotic devices are invaluable in the rehabilitation of people with lower limb dysfunction, such as weaknesses, deformities or other motor control problems. A KAFO is made of light materials such as thermoplastics or light alloys like aluminum or carbon fiber as well as for comfort’s sake. Ideally they are constructed for the individual’s body features so that they fit well and function properly. KAFOs work on the knee and ankle joint to allow the user to achieve more stability and thus improve upon mobility to perform activities such as walking, standing as well as changes in posture.

- Such equipment is most helpful for people who have diseases like cerebral palsy, post-polio syndrome or muscular dystrophy, spinal cord injury, or other conditions that impact muscle control of movement. KAFOs are advised for patients with cerebral palsy so as to help them control for the irregular movement pattern and the requisite support for ambulation. For post-polio syndrome patients, they alleviate the effects or the development of muscle atrophy through effective therapy or prevention devices that ensure that patients can lead normal and very active lives. Also, the use of KAFOs can be combined with other walking aids, as crutches or walkers in order to provide the best functional result with patients. Presetting: The results reveal that the reviewed types of KAFOs improve the quality of life and motor function in patients with SD, and their effectiveness is maintained through reevaluation and possible modification over time and in response to other conditions affecting the patient.

By Indication, Upper limb segment expected to held the largest share

- Consequently, upper limb deformities consist of comprehensible disorders that affect both the movement and mechanical structure of the arms, hands, and shoulders. Fractures can be developmental abnormalities due to genetic factors, major trauma, or neuromuscular disorders including cerebal palsy. Patients suffering from upper limb deformities have limitations in lifting and manipulating objects as well as holding and grasping. Therefore, there is a growing need for interventions to boost performance and, hence, self-sufficiency. Therapies also include medical therapies including surgeries, physiotherapy and physiotherapy gadgets inclusive of orthosis and prostheses that are unique to each of the patients.

- Upper limb orthotics are developed to bring changes to the life of children with deformities by enhancing use of the affected limbs and enable them to be active in most activities. These solutions begin with what is termed Orthotics, which include complete custom made orthotic supports that offer support and immobilization of the affected part; the other one includes the use of prosthetics with myoelectrics, systems of prosthesis that is controlled by muscular signals. Advances in the material and structure of the devices have made the devices compact, thus easily adaptable to meet different needs of different ages and levels of activities. Furthermore, practical skills for proper usage of these technologies are launched during rehabilitation courses; the employment of these technologies brings people back to normal life and prove that they are capable to perform tasks by themselves. These concepts can be expected to improve as the research and development in orthotics and prosthetics expands, so that users with upper limb deformities may enjoy better technologies for solutions for their orthoses and prostheses.

Active Key Players in the China Orthosis and Prosthetics Market:

- Ottobock, Össur hf,

- Teh Lin Pros. & Ortho. Inc.,

- Shijiazhuang Wonderfu Rehabilitation Device Technology Co., Ltd.,

- Hebei Baisite Prosthetic Orthotic Technology Co., Ltd.,

- Beijing Jingbo Prosthetics & Orthotics Technical Co., Ltd.,

- Nobel China Limited,

- Shijiazhuang Aofeite Import & Export Co., Ltd.,

- e-Life International Co., Ltd.,

- Rehan International Co., Ltd.,

- Xiamen Huakang Orthopedic Co., Ltd.

- Other Active Players

|

China Orthosis and Prosthetics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1739.53 Billion |

|

Forecast Period 2024-32 CAGR: |

5.53% |

Market Size in 2032: |

USD 2823.68 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Age Group |

|

||

|

By Indication |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: China Orthosis and Prosthetics Market by Product Type (2018-2032)

4.1 China Orthosis and Prosthetics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Orthosis (Knee Ankle Foot Orthoses (KAFO)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wrist Hand Orthoses (WHO)

4.5 Foot Orthoses (FO)

4.6 Ankle Foot Orthoses (AFO)

4.7 Elbow Orthosis (EO)

4.8 Hip Knee Ankle Foot Orthoses (HKAFO)

4.9 Shoulder Orthoses

4.10 Upper Limb Orthoses

4.11 Others)

4.12 Prosthetic

4.13 Below Knee (BK) – Transtibial

4.14 Above Knee (AK) – Transfemoral

4.15 Upper Extremity (UE) –

4.16 Transradial

4.17 Transhumeral

Chapter 5: China Orthosis and Prosthetics Market by Age Group (2018-2032)

5.1 China Orthosis and Prosthetics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pediatric

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Adult

Chapter 6: China Orthosis and Prosthetics Market by Indication (2018-2032)

6.1 China Orthosis and Prosthetics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Lower Limb Deformities

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Upper Limb

6.5 Deformities

6.6 Others (Spinal)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 China Orthosis and Prosthetics Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 OTTOBOCK

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ÖSSUR HF

7.4 TEH LIN PROS. & ORTHO. INC.

7.5 SHIJIAZHUANG WONDERFU REHABILITATION DEVICE TECHNOLOGY CO. LTD.

7.6 HEBEI BAISITE PROSTHETIC ORTHOTIC TECHNOLOGY CO. LTD.

7.7 BEIJING JINGBO PROSTHETICS & ORTHOTICS TECHNICAL CO. LTD.

7.8 NOBEL CHINA LIMITED

7.9 SHIJIAZHUANG AOFEITE IMPORT & EXPORT CO. LTD.

7.10 E-LIFE INTERNATIONAL CO. LTD.

7.11 REHAN INTERNATIONAL CO. LTD.

7.12 XIAMEN HUAKANG ORTHOPEDIC CO. LTD

7.13 OTHER ACTIVE PLAYERS

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

China Orthosis and Prosthetics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1739.53 Billion |

|

Forecast Period 2024-32 CAGR: |

5.53% |

Market Size in 2032: |

USD 2823.68 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Age Group |

|

||

|

By Indication |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the China Orthosis and Prosthetics Market research report is 2024-2032.

Ottobock, Össur hf, Teh Lin Pros. & Ortho. Inc., Shijiazhuang Wonderfu Rehabilitation Device Technology Co., Ltd., Hebei Baisite Prosthetic Orthotic Technology Co., Ltd., Beijing Jingbo Prosthetics & Orthotics Technical Co., Ltd., Nobel China Limited, Shijiazhuang Aofeite Import & Export Co., Ltd., e-Life International Co., Ltd., Rehan International Co., Ltd., and Xiamen Huakang Orthopedic Co., Ltd. and Other Active Players.

The China Orthosis and Prosthetics Market is segmented into By Product Type, By Age Group, By Indication and region. By Product Type, the market is categorized into Orthosis (Knee Ankle Foot Orthoses (KAFO), Wrist Hand Orthoses (WHO), Foot Orthoses (FO), Ankle Foot Orthoses (AFO), Elbow Orthosis (EO), Hip Knee Ankle Foot Orthoses (HKAFO), Shoulder Orthoses, Upper Limb Orthoses, Others), Prosthetic, Upper Extremity (UE). By Age Group, the market is categorized into Pediatric and Adult. By Indication, the market is categorized into Lower Limb Deformities, Upper Limb, Deformities and Others (Spinal).

The China Orthosis and Prosthetics Market encompasses medical devices designed to aid individuals with physical impairments or limb deficiencies, providing support, improved mobility, and functionality. This market includes orthotic devices, which support or correct musculoskeletal issues through braces, supports, and splints, as well as prosthetic devices, which replace lost or amputated limbs to restore movement and enhance the quality of life. Driven by an aging population, rising chronic diseases, and increased awareness of rehabilitation technologies, the market focuses on innovations in lightweight, durable materials and customized solutions to meet the specific needs of Chinese patients.

China Orthosis and Prosthetics Market Size Was Valued at USD 1739.53 Million in 2023, and is Projected to Reach USD 2823.68 Million by 2032, Growing at a CAGR of 5.53% From 2024-2032.