Cesium Market Synopsis

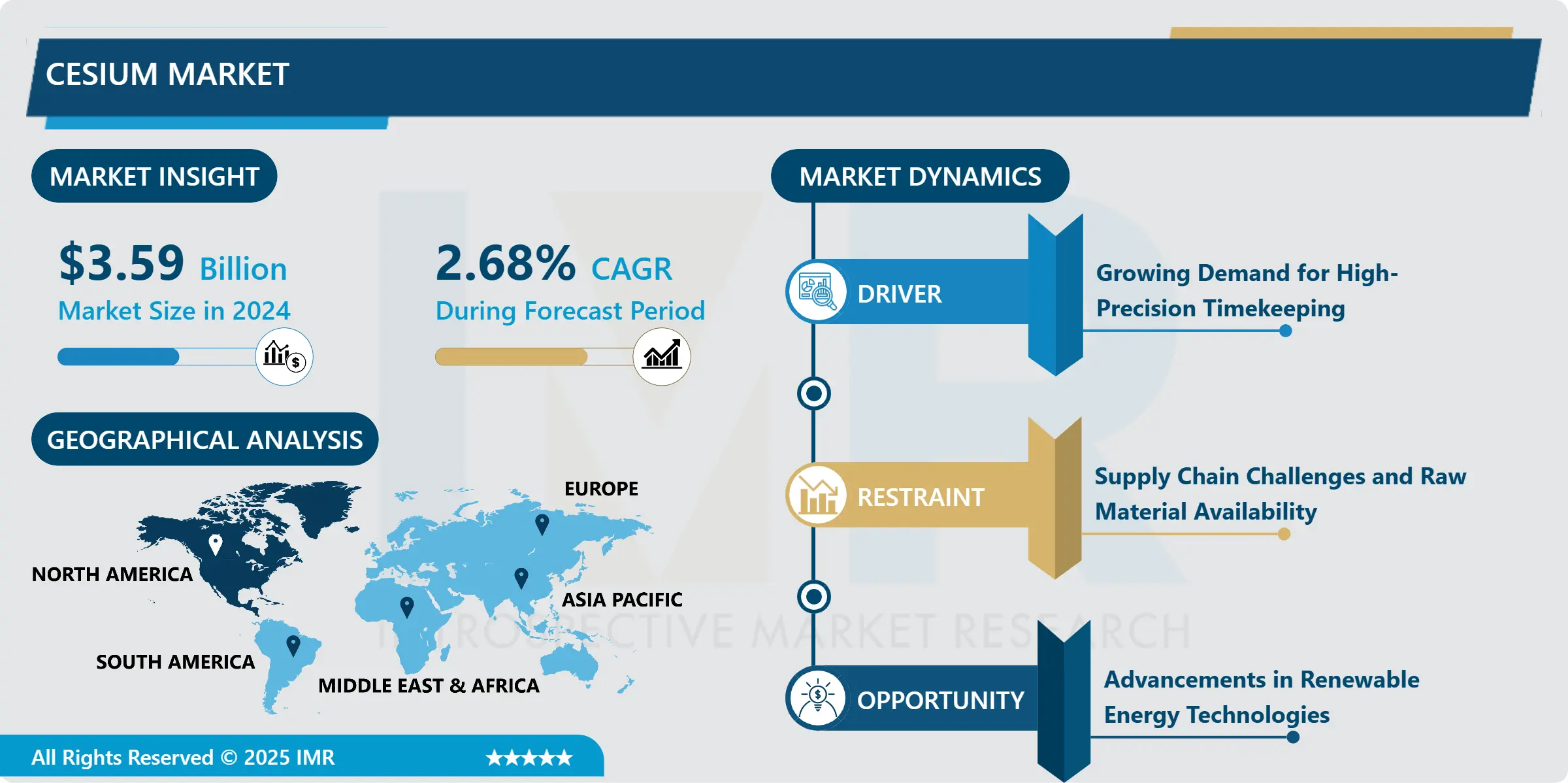

Cesium Market Size Was Valued at USD 3.59 Billion in 2024 and is Projected to Reach USD 4.8 Billion by 2035, Growing at a CAGR of 2.68% From 2025-2035.

Cesium is an alkali metal that is in its solid, silvery-gold form at standard conditions closely resembling francium in its electropositive nature. It serves numerous applications such as atomic clocks, Aerospace, Healthcare, Electronics and Oil and Gas industries because of its characteristics such as having low ionization energy as well as high electro conductivity. The mobile industry and oil industry alone utilize cesium compounds particularly cesium formate for its role in drilling fluids, and cesium atomic clocks for measurement of time for GPS systems.

The key driver of the cesium market is the continually growing need for the substance in the oil and gas industry where cesium formate brine, a type of non-hazardous drilling fluid, finds application. Advantages includes low toxicity, high density, excellent lubricity, making the product to be a preferred choice where drilling is difficult such as deep-water drilling. As the world energy industry is always in a search for the right solution that would increase production and productivity, the importance of cesium-based compounds cannot be overestimated because they drive demand and promote market development.

Another huge push comes from the steady demand for cesium in the atomic clocks, and other complicated scientific applications. Cesium atomic clocks are one of the most precise time pieces that are used in GPS, space, telecommunication systems and Global Positioning System. Thus, more and more these technologies develop and with the rise in various applications for precise measurement of time this evolution will keep on increasing the demand for the cesium products and hence having a positive growth rate for the cesium market.

Cesium Market Trend Analysis

Renewable energy storage applications, specifically in solar panels and battery technologies.

- One interesting development is the increased demand of cesium for renewable energy storage in photovoltaic Tues and battery sectors. Current research activity has also depicted that cesium can be used to further the performance of perovskite solar cells, a versatile and efficient technology that has the potential to completely alter the manner in which the solar power industry functions. Regarding to the fact that the global targets the promotion of renewable energy sources, the trend is likely to stimulate the demand for cesium in the forthcoming years.

- On the same note, the application of cesium in healthcare technologies has continued to grow. In medical imaging systems, radiation treatment, and diagnostic instruments, its application is increasing, thanks to the development of medical treatment technologies. Cesium-based isotopes are widely used in cancer therapies; therefore, it contributes to the growing demand being driven by the health sector as requirements and advancement grow.

Advanced electronics and telecommunications

- The market for cesium is full of potential especially if it will be used in certain applications such as in electronics and telecommunications. They also suggested that the demand for cesium in atomic clocks is likely to grow as the usage of 5G technology as well as IoT (Internet of Things) networks expand. Cs atomic clocks accurately measure time with high stability for centralized time synchronizing within telecommunications networks. And this application may grow further as the utilization of smart city infrastructure, self-driving automobiles, and smart devices increases in the years to come – a major cuse modifier.

- However, the aerospace and defense industries can become the largest and still uncovered market for cesium. As space programs continue to expand and satellites become more important for communication and surveillance purposes, the demand for cesium as a component in radiation monitoring devices, satellites and timekeeping devices, is expected to rise. The advancing availability of aerospace confrontations as well as the defense systems also emphasizes the need for cesium in future precise data.

Cesium Market Segment Analysis:

Cesium Market Segmented on the basis of Grade, application, and end-users.

By Grade, Technical Grade segment is expected to dominate the market during the forecast period

- Cesium is available in two primary grades: WVG of alcohol is classified into technical grade and pharmaceutical grade. Technical grade cesium finds its application in industries cutting across production of specialty glass, drilling fluids besides other applications as a catalyst in chemical processes. This makes it preferable for use since it is characterized by high density and its reactivity in instances such as in the search for oil and gas. In another camp, cesium is used in pharmaceutical and medical industries with high level of purify as a therapeutic compound and for medical uses for instance cancer treatment involving radiation and medical imaging. This grade is produced to strictly maintained quality to so as to meet the safety and quality for medical usage.

By Application, Catalysts segment held the largest share in 2024

- Cesium is used in numerous applications mainly because of its characteristics as will be discussed in this paper. In catalysts, it improves the response of chemical procedures, especially in the sectors of refinery and petrochemical. Optical glass is greatly enhanced by cesium’s property to boost clarity besides reducing levels of mirror like reflection; thus, is suitable for precision lenses and high-definition optics. Cesium is also important in radiation measuring instruments, used in nuclear energy stations and various healthcare tools used to measure ionizing radiation. In the medical devices industry, cesium isotopes are used for the purposes of treatment and diagnosing cancer. Oak and Pine, some of the most accurate types of clocks are the atomic clocks, they use the element Cesium in order set the standard time, important in GPS and telecommunications. Cesium is applied in communication systems, satellite devices as well as in the defense technologies of the aerospace and defense industry. Other uses are in battery technologies, electricity and electronics, as well as in the speciality chemicals market.

Cesium Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The cesium market is led by North America especially the United States due to increased demand in oil and gas exploration, defense and health care industries. Huge defense investments by the US government for satellite communication systems which depend on atomic clocks, GPS systems which also require cesium, and atomic timekeeping processes have stimulated demand. Moreover, key factors shaping uniquelly strong market position of North America include a high level of healthcare and leading distribution of innovative technologies based on cesium.

- The great oil and gas exploration activity is also instrumental with the use of cesium formate in the drilling process in the region. As exploration in deep-water and unconventional reserves increases, demand for efficient and high-performance drilling fluids such as cesium formate has also increased making North America one of the largest consumers of cesium globally.

Active Key Players in the Cesium Market

- Cabot Corporation (United States)

- American Elements (United States)

- Albemarle Corporation (United States)

- Avalon Advanced Materials Inc. (Canada)

- Lithium Australia NL (Australia)

- Sinomine Resource Group Co., Ltd. (China)

- BASF SE (Germany)

- Pioneer Resources Limited (Australia)

- Metall Rare Earth Limited (China)

- GFS Chemicals, Inc. (United States) Others Active Players.

|

Global Cesium Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.59 Bn. |

|

Forecast Period 2025-35 CAGR: |

2.68% |

Market Size in 2035: |

USD 4.8 Bn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Cabot Corporation (United States), American Elements (United States), Albemarle Corporation (United States), Avalon Advanced Materials Inc. (Canada), Lithium Australia NL (Australia), Sinomine Resource Group Co., Ltd. (China), BASF SE (Germany), Pioneer, Resources Limited (Australia), Metall Rare Earth Limited (China), GFS Chemicals, Inc. (United States), and Other Major Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cesium Market by Grade (2018-2035)

4.1 Cesium Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Technical Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pharmaceutical Grade

Chapter 5: Cesium Market by Application (2018-2035)

5.1 Cesium Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Catalysts

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Optical Glass

5.5 Radiation Detection and Monitoring

5.6 Medical Devices

5.7 Atomic Clocks

5.8 Aerospace and Defense

5.9 Others

Chapter 6: Cesium Market by End User (2018-2035)

6.1 Cesium Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Healthcare

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Energy

6.5 Defense and Military

6.6 Oil and Gas

6.7 Electronics

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cesium Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CABOT CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMERICAN ELEMENTS (UNITED STATES)

7.4 ALBEMARLE CORPORATION (UNITED STATES)

7.5 AVALON ADVANCED MATERIALS INC. (CANADA)

7.6 LITHIUM AUSTRALIA NL (AUSTRALIA)

7.7 SINOMINE RESOURCE GROUP COLTD. (CHINA)

7.8 BASF SE (GERMANY)

7.9 PIONEER RESOURCES LIMITED (AUSTRALIA)

7.10 METALL RARE EARTH LIMITED (CHINA)

7.11 GFS CHEMICALS INC. (UNITED STATES) OTHERS ACTIVE PLAYERS

Chapter 8: Global Cesium Market By Region

8.1 Overview

8.2. North America Cesium Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Grade

8.2.4.1 Technical Grade

8.2.4.2 Pharmaceutical Grade

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Catalysts

8.2.5.2 Optical Glass

8.2.5.3 Radiation Detection and Monitoring

8.2.5.4 Medical Devices

8.2.5.5 Atomic Clocks

8.2.5.6 Aerospace and Defense

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Healthcare

8.2.6.2 Energy

8.2.6.3 Defense and Military

8.2.6.4 Oil and Gas

8.2.6.5 Electronics

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cesium Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Grade

8.3.4.1 Technical Grade

8.3.4.2 Pharmaceutical Grade

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Catalysts

8.3.5.2 Optical Glass

8.3.5.3 Radiation Detection and Monitoring

8.3.5.4 Medical Devices

8.3.5.5 Atomic Clocks

8.3.5.6 Aerospace and Defense

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Healthcare

8.3.6.2 Energy

8.3.6.3 Defense and Military

8.3.6.4 Oil and Gas

8.3.6.5 Electronics

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cesium Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Grade

8.4.4.1 Technical Grade

8.4.4.2 Pharmaceutical Grade

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Catalysts

8.4.5.2 Optical Glass

8.4.5.3 Radiation Detection and Monitoring

8.4.5.4 Medical Devices

8.4.5.5 Atomic Clocks

8.4.5.6 Aerospace and Defense

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Healthcare

8.4.6.2 Energy

8.4.6.3 Defense and Military

8.4.6.4 Oil and Gas

8.4.6.5 Electronics

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cesium Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Grade

8.5.4.1 Technical Grade

8.5.4.2 Pharmaceutical Grade

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Catalysts

8.5.5.2 Optical Glass

8.5.5.3 Radiation Detection and Monitoring

8.5.5.4 Medical Devices

8.5.5.5 Atomic Clocks

8.5.5.6 Aerospace and Defense

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Healthcare

8.5.6.2 Energy

8.5.6.3 Defense and Military

8.5.6.4 Oil and Gas

8.5.6.5 Electronics

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cesium Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Grade

8.6.4.1 Technical Grade

8.6.4.2 Pharmaceutical Grade

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Catalysts

8.6.5.2 Optical Glass

8.6.5.3 Radiation Detection and Monitoring

8.6.5.4 Medical Devices

8.6.5.5 Atomic Clocks

8.6.5.6 Aerospace and Defense

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Healthcare

8.6.6.2 Energy

8.6.6.3 Defense and Military

8.6.6.4 Oil and Gas

8.6.6.5 Electronics

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cesium Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Grade

8.7.4.1 Technical Grade

8.7.4.2 Pharmaceutical Grade

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Catalysts

8.7.5.2 Optical Glass

8.7.5.3 Radiation Detection and Monitoring

8.7.5.4 Medical Devices

8.7.5.5 Atomic Clocks

8.7.5.6 Aerospace and Defense

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Healthcare

8.7.6.2 Energy

8.7.6.3 Defense and Military

8.7.6.4 Oil and Gas

8.7.6.5 Electronics

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cesium Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.59 Bn. |

|

Forecast Period 2025-35 CAGR: |

2.68% |

Market Size in 2035: |

USD 4.8 Bn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Cabot Corporation (United States), American Elements (United States), Albemarle Corporation (United States), Avalon Advanced Materials Inc. (Canada), Lithium Australia NL (Australia), Sinomine Resource Group Co., Ltd. (China), BASF SE (Germany), Pioneer, Resources Limited (Australia), Metall Rare Earth Limited (China), GFS Chemicals, Inc. (United States), and Other Major Players. |

||