Global Canned Food Market Overview

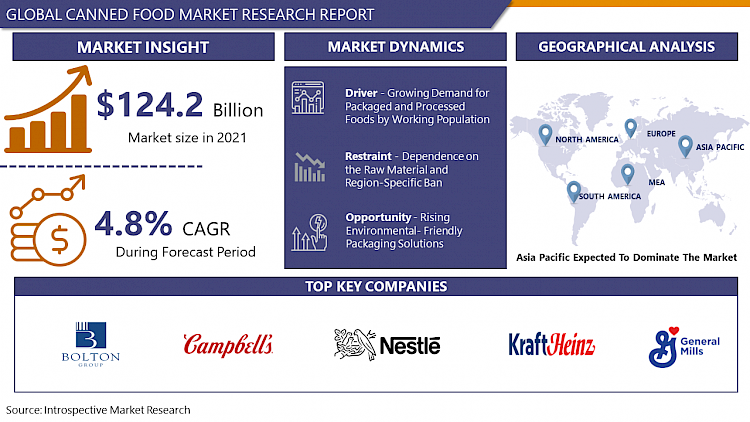

The Global Canned Food Market size is expected to grow from USD 130.53 billion in 2022 to USD 194.33 billion by 2030, at a CAGR of 5.1% during the forecast period (2023-2030).

Canning is a method of preserving foods for longer period of time by packing them in different airtight containers. The canned food serves enriched nutrients to the health-conscious consumers. The market is mainly driven by the rising urban population that prefers healthy food rich in protein, fibers, vitamins, and omega-3 fatty acids. Consumers who are ready to spend a little more for the small, easy, ready-to-cook meat and seafood as well as organic canned fruits and vegetables are thus boosting the market sales. The rise in the trend of busy life and working population especially among millennials, consumer inclination toward the consumption of convenience food products has increased rapidly during the recent years. Due to retention of high amount of nutrients, color and flavor, canned foods have become one of the most preferred choices of preserved foods among consumers. The growing number of food retail outlets with increasing urbanization, R&D and marketing strategies used by the players in the canned food market is expected to have a positive effect for the Canned Food Market growth in the projected years.

Market Dynamics And Factors For Canned Food Market

Drivers:

Growing Demand for Packaged and Processed Foods by Working Population

Growing number of working women has thereby increased the dependency of consumers on the easily available ready meals and convenience foods. This has led to the drastic growth in demand for nutritious and shelf stable packaged and processed food, which ultimately fuels growth of the canned food market. Furthermore, rapid surge in number of large retail platforms worldwide, including supermarkets or hypermarkets and e-commerce channels, cushions the demand for canned food products. Also, some of the canned food products contain more vitamins and minerals, as compared to the fresh products which thereby leads to rise in demand for processed foods. Such processed and packaged products have longer shelf lives and are also ready to eat as well as easy to use while meal preparation. The rise in the number of working populations especially in the developed urban area is increasing the dependency of the consumers on convenient and easy to use ready meals which leading to an increase in the demand for canned food market in the projected years.

Restraints:

Dependence on The Raw Material and Region-Specific Ban

Canned food market is continuously attaining a height in the global market due to its characteristic features. Nevertheless, the dependence on the raw material for the packaging purpose, region-specific ban and various limitations on the consumption of canned food in various regions is restraining the expansion of the canned food market. For instance, the growing awareness about fitness and health among consumers is shifting the consumers' demand towards fresh food which is negatively impacting the market of the canned food. Unavailability of the raw materials required for the preparation of canned food at proper time may also restrict the market and worsen the growth in the forecasted years.

Opportunity:

Rising Environmental- Friendly Packaging Solutions

Consumers are understanding the impact of plastic packaging on the environment and are demanding sustainable and recyclable solutions. The canned food meets all the concerns of the consumers which have been further driving the market of the canned food. Manufacturers are focusing on offering the varieties of the canned food products along with high quality, taste, and nutritional value to maintain their position in the competitive market. Thus, such rising awareness of the plastic packaging and the rising demand for a sustainable solution and increasing recycling rates globally have been further creating an opportunity and driving the market.

Challenges:

Product Recalls May Hamper the Growth

Product recalls are very important to ensure safe supply to the consumers, so that any harm or risk can be avoided. However, the continuous rise in product recalls will further challenge the global canned food market growth during the projected period. These product recalls are a result of improper handling of raw materials or supplies during transportation and production. Over the last few years, many products have been recalled owing to the presence of allergens, use of contaminated raw materials and incorrect labelling. If such situation not resolved quickly, may cause a challenge in the global canned food market over the upcoming years.

Segmentation Analysis Of Canned Food Market

By Product Type, the canned meat & seafood segment is expected to dominate the global canned food market in the projected years. Canned meat & seafood has been the widely preferred segment of canned food among consumers owing to the growing demand for meat and seafood products worldwide, coupled with increase in demand for high protein foods in the market. Owing to this demand for convenience food products, the market for ready meals is likely to grow at pace during the canned food market forecasted period.

By Distribution Channel, the supermarket/hypermarket segment is estimated to dominate the canned food market, and is expected to retain its dominance throughout the forecast period. Supermarkets/hypermarkets are most preferred for purchasing canned foods in bulk volumes. Hence, owing to the remarkable presence of independent and chained supermarkets/hypermarkets in developed economic countries and growing penetration of supermarket/hypermarkets in developing countries, the growth of canned food market is substantial.

By Type, Organic canned food product segment is anticipated to dominate over the forecasted years. Due to the increase in health concerns among the consumers, the consumers are willing to switch their preference and are demanding more organic food products. Also, due to the changing lifestyle and trends, the organic canned food segment is attaining a rapid growth. This is further motivating the manufacturers of the canned food market and is creating opportunities for organic canned food products in the upcoming years.

Regional Analysis of Canned Food Market

The Asia Pacific region is expected to dominate the global canned food market in the projected years. Owing to growing disposable income and the busy lifestyle of consumers due to rising employment rate, the Asia Pacific region is retaining its dominance vastly. The growth in this region is derived from the rise in consumption practices of processed and packaged food products and beverages. The high consumer base as well as high population of working professionals in this region are most likely to boost the market growth over the projected time. Furthermore, the rapid urbanization as well as wide acceptance of westernized culture leads to a significant canned food market growth. In addition to this, the rise in millennial population, evolving dietary patterns and growing exposure to internet is expected to boost the rapid growth over the projected time.

Europe is the prominent market and is accounted for the maximum share in the global canned food market in the upcoming years. This is attributed to high consumption of canned food products in majority of the European countries including the UK, Germany, France, and Italy. Consumers in this region are majorly attracted by canned food products with new textures, flavors, and higher nutritional value, which leads to the canned food market growth in this region. Also, the wide utilization of meat and meat products as well as vegetables in various cuisines have further contributed to the gradual growth of canned food market in the European region.

North America is projected to have a substantial growth in canned food market sector over the projected time. The rapid improvement in supply chain and logistics and the improved infrastructure in this region is propelling the market growth of canned food. The rising popularity through online media and changing lifestyle trends in various regions of North America has contributed to the growth of the market. Also, the rise in ready to drink, and ready to eat food products and beverages is expected to dominate the canned food market in this region over the estimated period.

Covid-19 Impact Analysis On Canned Food Market

The COVID-19 pandemic has caused a positive trend within the consumption of canned foods as more people preferred home cooking and retail purchases. Retail is one in every of the most points of sale for foodstuff, for which the demand has gradually increased, during the period of lockdown. The sales of canned products increased during the lockdown because of their long period of time, which appealed to consumers who were subjected to home quarantines and other impacts of lockdowns. After an intensive analysis of the business implications of the pandemic and its induced financial condition, growth within the Canned Ready Meals segment is readjusted to a revised 5.3% CAGR for the subsequent 7-year period. The market is principally driven by the rising urban population that prefers convenient and easy food, and demand for healthy food rich in functional fibers, protein, vitamins, and omega-3 fatty acids. However, despite the momentary disruption, the canned foods market is predicted to grow at a gradual rate during the forecasted period.

Top Key Players Covered In Canned Food Market

- Bolton Group Srl (Italy)

- Campbell Soup Co (US)

- ConAgra Brands Inc (US)

- Del Monte Pacific Ltd (California)

- General Mills Inc. (Minnesota, US)

- Nestle SA (Switzerland)

- Princes Ltd (UK)

- The Hain Celestial Group Inc (New York)

- The J.M. Smucker Co (Ohio, US)

- The Kraft Heinz Co (Chicago, US)

- Danish Crown (Denmark)

- CHB Group (Cheltenham, UK)

- AYAM SARL. (Singapore)

- JBS S.A (Greeley, US), and other major players.

Key Industry Development In The Canned Food Market

In January, 2022, As Growers of Good, Del Monte Foods, Inc. is to reduce the footprint of packaging by investing in new materials and redesigning existing materials. They further continued that, since 2009, they have been reducing use of plastics and metal, and today, only 4% of their packaging by weight contains any plastics; the rest is fully recyclable steel, glass or paper based.

In December, 2021, General Mills is executing its Accelerate strategy to drive sustainable, profitable growth and top-tier shareholder returns over the long term. The company is prioritizing its global platforms, core markets, and local gem brands that have the best prospects for profitable growth and is committed to reshaping its portfolio with strategic acquisitions, including its recent pet treats acquisition and European Yoplait divestiture, to further enhance its growth profile.

|

Global Canned Food Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 130.53 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.1 % |

Market Size in 2030: |

USD 194.33 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Nature |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Distribution Channel

3.3 By Nature

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Canned Food Market by Product Type

5.1 Canned Food Market Overview Snapshot and Growth Engine

5.2 Canned Food Market Overview

5.3 Canned Meat Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Canned Meat Products: Grographic Segmentation

5.4 Canned Fish/Seafood

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Canned Fish/Seafood: Grographic Segmentation

5.5 Canned Vegetables

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Canned Vegetables: Grographic Segmentation

5.6 Canned Fruits

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Canned Fruits: Grographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Grographic Segmentation

Chapter 6: Canned Food Market by Distribution Channel

6.1 Canned Food Market Overview Snapshot and Growth Engine

6.2 Canned Food Market Overview

6.3 Supermarkets/Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Supermarkets/Hypermarkets: Grographic Segmentation

6.4 Convenience Stores

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Convenience Stores: Grographic Segmentation

6.5 Online Retail Channels

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Retail Channels: Grographic Segmentation

6.6 Other Distribution Channels

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other Distribution Channels: Grographic Segmentation

Chapter 7: Canned Food Market by Nature

7.1 Canned Food Market Overview Snapshot and Growth Engine

7.2 Canned Food Market Overview

7.3 Organic

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Organic: Grographic Segmentation

7.4 Conventional

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Conventional: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Canned Food Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Canned Food Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Canned Food Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 BOLTON GROUP SRL (ITALY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 CAMPBELL SOUP CO (US)

8.4 CONAGRA BRANDS INC (US)

8.5 DEL MONTE PACIFIC LTD (CALIFORNIA)

8.6 GENERAL MILLS INC. (MINNESOTA

8.7 US)

8.8 NESTLE SA (SWITZERLAND)

8.9 PRINCES LTD (UK)

8.10 THE HAIN CELESTIAL GROUP INC (NEW YORK)

8.11 THE J.M. SMUCKER CO (OHIO

8.12 US)

8.13 THE KRAFT HEINZ CO (CHICAGO

8.14 US)

8.15 DANISH CROWN (DENMARK)

8.16 CHB GROUP (CHELTENHAM

8.17 UK)

8.18 AYAM SARL. (SINGAPORE)

8.19 JBS S.A (GREELEY

8.20 US)

8.21 OTHER MAJOR PLAYERS

Chapter 9: Global Canned Food Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Product Type

9.2.1 Canned Meat Products

9.2.2 Canned Fish/Seafood

9.2.3 Canned Vegetables

9.2.4 Canned Fruits

9.2.5 Others

9.3 Historic and Forecasted Market Size By Distribution Channel

9.3.1 Supermarkets/Hypermarkets

9.3.2 Convenience Stores

9.3.3 Online Retail Channels

9.3.4 Other Distribution Channels

9.4 Historic and Forecasted Market Size By Nature

9.4.1 Organic

9.4.2 Conventional

Chapter 10: North America Canned Food Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product Type

10.4.1 Canned Meat Products

10.4.2 Canned Fish/Seafood

10.4.3 Canned Vegetables

10.4.4 Canned Fruits

10.4.5 Others

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Supermarkets/Hypermarkets

10.5.2 Convenience Stores

10.5.3 Online Retail Channels

10.5.4 Other Distribution Channels

10.6 Historic and Forecasted Market Size By Nature

10.6.1 Organic

10.6.2 Conventional

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Canned Food Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Canned Meat Products

11.4.2 Canned Fish/Seafood

11.4.3 Canned Vegetables

11.4.4 Canned Fruits

11.4.5 Others

11.5 Historic and Forecasted Market Size By Distribution Channel

11.5.1 Supermarkets/Hypermarkets

11.5.2 Convenience Stores

11.5.3 Online Retail Channels

11.5.4 Other Distribution Channels

11.6 Historic and Forecasted Market Size By Nature

11.6.1 Organic

11.6.2 Conventional

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Canned Food Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Canned Meat Products

12.4.2 Canned Fish/Seafood

12.4.3 Canned Vegetables

12.4.4 Canned Fruits

12.4.5 Others

12.5 Historic and Forecasted Market Size By Distribution Channel

12.5.1 Supermarkets/Hypermarkets

12.5.2 Convenience Stores

12.5.3 Online Retail Channels

12.5.4 Other Distribution Channels

12.6 Historic and Forecasted Market Size By Nature

12.6.1 Organic

12.6.2 Conventional

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Canned Food Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Canned Meat Products

13.4.2 Canned Fish/Seafood

13.4.3 Canned Vegetables

13.4.4 Canned Fruits

13.4.5 Others

13.5 Historic and Forecasted Market Size By Distribution Channel

13.5.1 Supermarkets/Hypermarkets

13.5.2 Convenience Stores

13.5.3 Online Retail Channels

13.5.4 Other Distribution Channels

13.6 Historic and Forecasted Market Size By Nature

13.6.1 Organic

13.6.2 Conventional

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Canned Food Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 Canned Meat Products

14.4.2 Canned Fish/Seafood

14.4.3 Canned Vegetables

14.4.4 Canned Fruits

14.4.5 Others

14.5 Historic and Forecasted Market Size By Distribution Channel

14.5.1 Supermarkets/Hypermarkets

14.5.2 Convenience Stores

14.5.3 Online Retail Channels

14.5.4 Other Distribution Channels

14.6 Historic and Forecasted Market Size By Nature

14.6.1 Organic

14.6.2 Conventional

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Canned Food Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 130.53 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.1 % |

Market Size in 2030: |

USD 194.33 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Nature |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CANNED FOOD MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CANNED FOOD MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CANNED FOOD MARKET COMPETITIVE RIVALRY

TABLE 005. CANNED FOOD MARKET THREAT OF NEW ENTRANTS

TABLE 006. CANNED FOOD MARKET THREAT OF SUBSTITUTES

TABLE 007. CANNED FOOD MARKET BY PRODUCT TYPE

TABLE 008. CANNED MEAT PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 009. CANNED FISH/SEAFOOD MARKET OVERVIEW (2016-2028)

TABLE 010. CANNED VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 011. CANNED FRUITS MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. CANNED FOOD MARKET BY DISTRIBUTION CHANNEL

TABLE 014. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 015. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 016. ONLINE RETAIL CHANNELS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHER DISTRIBUTION CHANNELS MARKET OVERVIEW (2016-2028)

TABLE 018. CANNED FOOD MARKET BY NATURE

TABLE 019. ORGANIC MARKET OVERVIEW (2016-2028)

TABLE 020. CONVENTIONAL MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA CANNED FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 022. NORTH AMERICA CANNED FOOD MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 023. NORTH AMERICA CANNED FOOD MARKET, BY NATURE (2016-2028)

TABLE 024. N CANNED FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE CANNED FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 026. EUROPE CANNED FOOD MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. EUROPE CANNED FOOD MARKET, BY NATURE (2016-2028)

TABLE 028. CANNED FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC CANNED FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 030. ASIA PACIFIC CANNED FOOD MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 031. ASIA PACIFIC CANNED FOOD MARKET, BY NATURE (2016-2028)

TABLE 032. CANNED FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA CANNED FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA CANNED FOOD MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA CANNED FOOD MARKET, BY NATURE (2016-2028)

TABLE 036. CANNED FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA CANNED FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 038. SOUTH AMERICA CANNED FOOD MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 039. SOUTH AMERICA CANNED FOOD MARKET, BY NATURE (2016-2028)

TABLE 040. CANNED FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 041. BOLTON GROUP SRL (ITALY): SNAPSHOT

TABLE 042. BOLTON GROUP SRL (ITALY): BUSINESS PERFORMANCE

TABLE 043. BOLTON GROUP SRL (ITALY): PRODUCT PORTFOLIO

TABLE 044. BOLTON GROUP SRL (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. CAMPBELL SOUP CO (US): SNAPSHOT

TABLE 045. CAMPBELL SOUP CO (US): BUSINESS PERFORMANCE

TABLE 046. CAMPBELL SOUP CO (US): PRODUCT PORTFOLIO

TABLE 047. CAMPBELL SOUP CO (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. CONAGRA BRANDS INC (US): SNAPSHOT

TABLE 048. CONAGRA BRANDS INC (US): BUSINESS PERFORMANCE

TABLE 049. CONAGRA BRANDS INC (US): PRODUCT PORTFOLIO

TABLE 050. CONAGRA BRANDS INC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DEL MONTE PACIFIC LTD (CALIFORNIA): SNAPSHOT

TABLE 051. DEL MONTE PACIFIC LTD (CALIFORNIA): BUSINESS PERFORMANCE

TABLE 052. DEL MONTE PACIFIC LTD (CALIFORNIA): PRODUCT PORTFOLIO

TABLE 053. DEL MONTE PACIFIC LTD (CALIFORNIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. GENERAL MILLS INC. (MINNESOTA: SNAPSHOT

TABLE 054. GENERAL MILLS INC. (MINNESOTA: BUSINESS PERFORMANCE

TABLE 055. GENERAL MILLS INC. (MINNESOTA: PRODUCT PORTFOLIO

TABLE 056. GENERAL MILLS INC. (MINNESOTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. US): SNAPSHOT

TABLE 057. US): BUSINESS PERFORMANCE

TABLE 058. US): PRODUCT PORTFOLIO

TABLE 059. US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. NESTLE SA (SWITZERLAND): SNAPSHOT

TABLE 060. NESTLE SA (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 061. NESTLE SA (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 062. NESTLE SA (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. PRINCES LTD (UK): SNAPSHOT

TABLE 063. PRINCES LTD (UK): BUSINESS PERFORMANCE

TABLE 064. PRINCES LTD (UK): PRODUCT PORTFOLIO

TABLE 065. PRINCES LTD (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. THE HAIN CELESTIAL GROUP INC (NEW YORK): SNAPSHOT

TABLE 066. THE HAIN CELESTIAL GROUP INC (NEW YORK): BUSINESS PERFORMANCE

TABLE 067. THE HAIN CELESTIAL GROUP INC (NEW YORK): PRODUCT PORTFOLIO

TABLE 068. THE HAIN CELESTIAL GROUP INC (NEW YORK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. THE J.M. SMUCKER CO (OHIO: SNAPSHOT

TABLE 069. THE J.M. SMUCKER CO (OHIO: BUSINESS PERFORMANCE

TABLE 070. THE J.M. SMUCKER CO (OHIO: PRODUCT PORTFOLIO

TABLE 071. THE J.M. SMUCKER CO (OHIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. US): SNAPSHOT

TABLE 072. US): BUSINESS PERFORMANCE

TABLE 073. US): PRODUCT PORTFOLIO

TABLE 074. US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. THE KRAFT HEINZ CO (CHICAGO: SNAPSHOT

TABLE 075. THE KRAFT HEINZ CO (CHICAGO: BUSINESS PERFORMANCE

TABLE 076. THE KRAFT HEINZ CO (CHICAGO: PRODUCT PORTFOLIO

TABLE 077. THE KRAFT HEINZ CO (CHICAGO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. US): SNAPSHOT

TABLE 078. US): BUSINESS PERFORMANCE

TABLE 079. US): PRODUCT PORTFOLIO

TABLE 080. US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. DANISH CROWN (DENMARK): SNAPSHOT

TABLE 081. DANISH CROWN (DENMARK): BUSINESS PERFORMANCE

TABLE 082. DANISH CROWN (DENMARK): PRODUCT PORTFOLIO

TABLE 083. DANISH CROWN (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. CHB GROUP (CHELTENHAM: SNAPSHOT

TABLE 084. CHB GROUP (CHELTENHAM: BUSINESS PERFORMANCE

TABLE 085. CHB GROUP (CHELTENHAM: PRODUCT PORTFOLIO

TABLE 086. CHB GROUP (CHELTENHAM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. UK): SNAPSHOT

TABLE 087. UK): BUSINESS PERFORMANCE

TABLE 088. UK): PRODUCT PORTFOLIO

TABLE 089. UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. AYAM SARL. (SINGAPORE): SNAPSHOT

TABLE 090. AYAM SARL. (SINGAPORE): BUSINESS PERFORMANCE

TABLE 091. AYAM SARL. (SINGAPORE): PRODUCT PORTFOLIO

TABLE 092. AYAM SARL. (SINGAPORE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. JBS S.A (GREELEY: SNAPSHOT

TABLE 093. JBS S.A (GREELEY: BUSINESS PERFORMANCE

TABLE 094. JBS S.A (GREELEY: PRODUCT PORTFOLIO

TABLE 095. JBS S.A (GREELEY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. US): SNAPSHOT

TABLE 096. US): BUSINESS PERFORMANCE

TABLE 097. US): PRODUCT PORTFOLIO

TABLE 098. US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 099. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 100. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 101. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CANNED FOOD MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CANNED FOOD MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. CANNED MEAT PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 013. CANNED FISH/SEAFOOD MARKET OVERVIEW (2016-2028)

FIGURE 014. CANNED VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 015. CANNED FRUITS MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. CANNED FOOD MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 018. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 019. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 020. ONLINE RETAIL CHANNELS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHER DISTRIBUTION CHANNELS MARKET OVERVIEW (2016-2028)

FIGURE 022. CANNED FOOD MARKET OVERVIEW BY NATURE

FIGURE 023. ORGANIC MARKET OVERVIEW (2016-2028)

FIGURE 024. CONVENTIONAL MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA CANNED FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE CANNED FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC CANNED FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA CANNED FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA CANNED FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Canned Food Market research report is 2022-2028.

Bolton Group Srl (Italy), Campbell Soup Co (US), ConAgra Brands Inc (US), Del Monte Pacific Ltd (California), General Mills Inc. (Minnesota, US), Nestle SA (Switzerland), Princes Ltd (UK), The Hain Celestial Group Inc (New York), The J.M. Smucker Co (Ohio, US), The Kraft Heinz Co (Chicago, US), Danish Crown (Denmark), CHB Group (Cheltenham, UK), AYAM SARL. (Singapore), JBS S.A (Greeley, US), and other major players.

The Canned Food Market is segmented into Product type, Distribution Channel, Type and region. By Product Type, the market is categorized into Meat Products, Fish/Sea Food, Vegetables, Fruits. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Convenience stores and Online Retail Channels. By Type, the market is categorized into Organic and Conventional. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Canning is a method of preserving foods for longer period of time by packing them in different airtight containers. The market is mainly driven by the rising urban population that prefers healthy food rich in protein, fibers, vitamins, and omega-3 fatty acids.

The Global Canned Food Market size is expected to grow from USD 130.53 billion in 2022 to USD 194.33 billion by 2030, at a CAGR of 5.1% during the forecast period (2023-2030).