Candy Market Synopsis

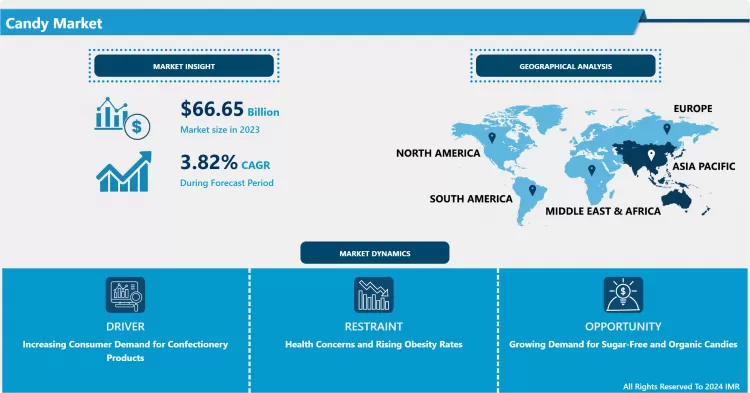

Candy Market Size Was Valued at USD 66.65 Billion in 2023, and is Projected to Reach USD 93.40 Billion by 2032, Growing at a CAGR of 3.82% From 2024-2032.

Candy industry covers worldwide manufacturing and trading of a broad spectrum of confectionery items such as chocolate, gummies, boiled sweets, liquorice, lollipops, tootsies and other related products. This is due to the rising consumer inclination towards indulgence, the new flavors and packaging, seasonal effect, and segmentation of the market across ages. This market is driven, for example, by attitudes to health, diet,and economy and encompasses large multinationals and small craft producers. Various niche markets in candies also evolve over time, precisely as the rising demand for sugar-free, organic and fairly-traded chocolates.

- The global candy market has remained stable in the past few years due to the rising demand for confectionery and better tastes.. The key drivers for the market are increasing disposable income per capita, increased urbanization, and increasing penchant for indulgent snacking. Furthermore, the industry has been rather flexible for the introduction of sugar-free and organic products hence catering for the health conscience market. Development in production and packaging sectors has also come in handy in its marketing strategies to help it post high returns in its operation.

- North America and Europe account for biggest share of candy consumption because of histories of indulging in sweet and relatively high incomes.. Nevertheless, currently, the Asia-Pacific region is seen to gain growth centrestage with its large population base and economic development together with westernization of the consumerist trends. Players in the presented market are currently employing strategies like acquisitions and mergers, new product & technology introduction, and market expansion for holding own competitiveness and share alive.

- Key competitors of the candy market include; High risk in the availability of raw materials prices because of the volatility in market prices, increasing health consciousness of the people and a constant reducing sugar consumption.. There are undesirable legal aspects and consumers are changing diets, so increased efforts are placed on developing more health-conscious products with clear labeling. Conclusively, the global candy market is a complex and a growing market that continues to evolve as it with stand the test of changes in the customers’ preferences and other perceived health concerns. Further strategic developments, organic growth along the existing profitable segments clustered in the formal sector, and concentration on health and fitness segmented products will remain essential for top players willing to take a lion share of the future strong market. Thus, the further development of the industry depends on how the various trends in consumer behavior will be addressed in the long run.

Candy Market Trend Analysis

Increasing Demand for Healthier Candy Options Reshaping the Confectionery Industry

- Consumers demanding healthier choices are shifting the way confectionery operates.. There is clearly a gradual shift in lifestyle and people’s culture when it comes to food and beverages, hence people prefer goods that are healthier apart from being sweet. The main driver on this shift is the growing consciousness of consumers to the adverse impact that artificial additives and high sugar content in foods has on human health. Therefore, there is the increasing demand in candies as products without artificial colors, flavors, and preservatives, made from natural components with transparent labels. Use of organic and non-GMO, and gluten-free chocolates has also becoming popular due to customer demands. These goods complement the broader clean eating trend apart from catering for nutritional requirements and palates. Furthermore, functional ingredients such as probiotics, minerals, and vitamins are being incorporated into candies in larger and larger measures as well. Since these improved sweets give better health benefits, customers who are in search of those salty bars that contribute to the improvement of their total health will be more encouraged.

The Rise of Premium and Artisanal Candies

- The increase in consumption of special and selective confectionery products changing the confectionery market globally as people no longer indulge in mass production candy products; they prefer products with superior quality creating the taste of exclusivity.. This is a willingness to pay a premium for standout products by the flavor, craftsmanship, and quality of products produced. One example is chocolates produced from single source cocoa, which come with their very own flavor characteristic of the origin of the cocoa beans. These chocolates are presented with extensive information on their sources and manufacturing procedures making them more attractive to sophisticated buyers. Likewise, the candy bars with quite unusual taste, for example, caramels with lavender or chocolates with chili, give the extraordinary taste sensation which seems to be very interesting to gourmets. Another element of this trend is unique homemade delicacies baked petits familles styled with careful attention to every detail and made from the highest quality ingredients.

Candy Market Segment Analysis:

Candy Market is segmented based on Type and Distribution Channel.

By Type, Chocolate Candy segment is expected to dominate the market during the forecast period

- Chocolate candy has the largest market share according to the consumer needs and preferences in the confectionery industry.. There is a great preference for this product because of the creamy consistency and the many different ways in which it is loved in bars, truffles, and coated nuts to mention but a few. Major consumers of chocolate spend most of the products during festive periods like Christmas, Easter, and in the Valentine Season when there is traditional imprints of sharing of chocolates. Moreover, people practice consumption of chocolate during cultural events, birthdays, and anniversaries among other occasions, thus confirming the labels of luxury product. Chocolate candy consumption is also many folds because the food item comes in different flavors and can be combined in any way depending on people’s taste and nutritional preferences such as dark chocolate, milk chocolate, white chocolate, sugary chocolate and organically produced chocolate.

By Distribution Channel, Supermarkets/Hypermarkets segment held the largest share in 2023

- Supermarket and hypermarket have the highest share in terms of distribution of candies because they are the largest stores selling this product.. These supermarkets and hypermarkets contain candy sections in stores that give consumers numerous kinds and brands of candy that include routine low-price candies, occasional fancy-priced candies and foreign candies. This convenience factor is important especially to the busy idiots and families; thus, the high traffic and, by implication, large candy sales. Also, supermarkets and hyper markets carry promotions, discounts and loyalty programs for candies which in turn gives them more sales and market share.

- Supermarkets and hypermarkets have a strong position in relation to candies and their proper location creates the impression of product aisles that increase the likelihood of purchases.. Candy is usually stocked at counter space, ends of aisles, and formats for customers to see at once, or even to pick as they shop. However, supermarkets and hypermarkets evolve the stock and launch seasonal and limited-version candies on the shelves interesting for recurrent buyers. These retail merchants are reliable and continually mobilise a vast and diverse clientele that remains responsive to known marketing and merchandising appeals – hence, they remain the primary conduits of the candy market.

Candy Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The two largest growth markets for candy are China and India and as such, the Asia Pacific region now leads the candy industry and is expected to do so for the forseeable future.. These include the existence of key competitive players in the market, the availability and current standard that the chocolate based confectionery products are gaining popularity and the fact that the large conglomerates are constantly streamlining there products line. The majority of customers purchase candy on the impulse, and given that the population of the region is rising, this is a popular product.

- The degree of sales of sugar based confectionery is being affected by the media management and advertisement encouraging new product consumables such as candy foods in some countries, comprising China, Japan and India. Because of this, businesses are gradually unveiling products bearing new tastes such as fresh mango, tamarind and strawberry etc. The area’s confectionery market is growing most quickly in India; The more efficient use of new tech and expansion of production facilities have influenced the increase in demand.

Active Key Players in the Candy Market

- The Hershey Company

- Nestle SA

- Perfetti Van Melle Group B.V.

- Mondelez International, Inc.

- Mars, Incorporated

- Other Key Players

Key Industry Developments in the Candy Market:

- In Jan 2025, The National Confectioners Association (NCA) and Candy & Snack announced the recipients of the 2025 Confectionery Leadership Awards. Mike Keller, Senior Category Manager for Confections at Circle K, and Robin Gutridge, Director of Non-Edible Grocery at Raley's, were honored for their outstanding contributions to the confectionery industry. The awards celebrate their leadership and dedication to innovation, growth, and excellence within the sector.

- In Nov 2024, Pulse launched the exciting #ScreamForPulse contest on its dedicated microsite, www.pulsecandyday.com. The interactive campaign invites candy enthusiasts from across the globe to participate in a fun and engaging challenge, offering a chance to win thrilling prizes. This creative initiative aims to connect with candy lovers, celebrating the joy of Pulse with unique activities and a vibrant online community experience.

|

Candy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.82% |

Market Size in 2032: |

USD 93.40 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Candy Market by Type (2018-2032)

4.1 Candy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Chocolate Candy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-chocolate Candy

4.5 Hard Boiled Candies

4.6 Pastilles

4.7 Gums

4.8 Jellies

4.9 and Chews

4.10 Toffees

4.11 Caramels

4.12 and Nougat

4.13 Mints

4.14 Other Non-chocolate Candies

Chapter 5: Candy Market by Distribution Channel (2018-2032)

5.1 Candy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supermarkets/Hypermarkets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Convenience Stores

5.5 Specalist Retailers

5.6 Online Retail

5.7 Other Distribution Channels

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Candy Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 THE HERSHEY COMPANY

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NESTLE SA

6.4 PERFETTI VAN MELLE GROUP B.VMONDELEZ INTERNATIONAL INCMARS INCORPORATED

6.5 OTHER KEY PLAYERS

Chapter 7: Global Candy Market By Region

7.1 Overview

7.2. North America Candy Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Chocolate Candy

7.2.4.2 Non-chocolate Candy

7.2.4.3 Hard Boiled Candies

7.2.4.4 Pastilles

7.2.4.5 Gums

7.2.4.6 Jellies

7.2.4.7 and Chews

7.2.4.8 Toffees

7.2.4.9 Caramels

7.2.4.10 and Nougat

7.2.4.11 Mints

7.2.4.12 Other Non-chocolate Candies

7.2.5 Historic and Forecasted Market Size by Distribution Channel

7.2.5.1 Supermarkets/Hypermarkets

7.2.5.2 Convenience Stores

7.2.5.3 Specalist Retailers

7.2.5.4 Online Retail

7.2.5.5 Other Distribution Channels

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Candy Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Chocolate Candy

7.3.4.2 Non-chocolate Candy

7.3.4.3 Hard Boiled Candies

7.3.4.4 Pastilles

7.3.4.5 Gums

7.3.4.6 Jellies

7.3.4.7 and Chews

7.3.4.8 Toffees

7.3.4.9 Caramels

7.3.4.10 and Nougat

7.3.4.11 Mints

7.3.4.12 Other Non-chocolate Candies

7.3.5 Historic and Forecasted Market Size by Distribution Channel

7.3.5.1 Supermarkets/Hypermarkets

7.3.5.2 Convenience Stores

7.3.5.3 Specalist Retailers

7.3.5.4 Online Retail

7.3.5.5 Other Distribution Channels

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Candy Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Chocolate Candy

7.4.4.2 Non-chocolate Candy

7.4.4.3 Hard Boiled Candies

7.4.4.4 Pastilles

7.4.4.5 Gums

7.4.4.6 Jellies

7.4.4.7 and Chews

7.4.4.8 Toffees

7.4.4.9 Caramels

7.4.4.10 and Nougat

7.4.4.11 Mints

7.4.4.12 Other Non-chocolate Candies

7.4.5 Historic and Forecasted Market Size by Distribution Channel

7.4.5.1 Supermarkets/Hypermarkets

7.4.5.2 Convenience Stores

7.4.5.3 Specalist Retailers

7.4.5.4 Online Retail

7.4.5.5 Other Distribution Channels

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Candy Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Chocolate Candy

7.5.4.2 Non-chocolate Candy

7.5.4.3 Hard Boiled Candies

7.5.4.4 Pastilles

7.5.4.5 Gums

7.5.4.6 Jellies

7.5.4.7 and Chews

7.5.4.8 Toffees

7.5.4.9 Caramels

7.5.4.10 and Nougat

7.5.4.11 Mints

7.5.4.12 Other Non-chocolate Candies

7.5.5 Historic and Forecasted Market Size by Distribution Channel

7.5.5.1 Supermarkets/Hypermarkets

7.5.5.2 Convenience Stores

7.5.5.3 Specalist Retailers

7.5.5.4 Online Retail

7.5.5.5 Other Distribution Channels

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Candy Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Chocolate Candy

7.6.4.2 Non-chocolate Candy

7.6.4.3 Hard Boiled Candies

7.6.4.4 Pastilles

7.6.4.5 Gums

7.6.4.6 Jellies

7.6.4.7 and Chews

7.6.4.8 Toffees

7.6.4.9 Caramels

7.6.4.10 and Nougat

7.6.4.11 Mints

7.6.4.12 Other Non-chocolate Candies

7.6.5 Historic and Forecasted Market Size by Distribution Channel

7.6.5.1 Supermarkets/Hypermarkets

7.6.5.2 Convenience Stores

7.6.5.3 Specalist Retailers

7.6.5.4 Online Retail

7.6.5.5 Other Distribution Channels

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Candy Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Chocolate Candy

7.7.4.2 Non-chocolate Candy

7.7.4.3 Hard Boiled Candies

7.7.4.4 Pastilles

7.7.4.5 Gums

7.7.4.6 Jellies

7.7.4.7 and Chews

7.7.4.8 Toffees

7.7.4.9 Caramels

7.7.4.10 and Nougat

7.7.4.11 Mints

7.7.4.12 Other Non-chocolate Candies

7.7.5 Historic and Forecasted Market Size by Distribution Channel

7.7.5.1 Supermarkets/Hypermarkets

7.7.5.2 Convenience Stores

7.7.5.3 Specalist Retailers

7.7.5.4 Online Retail

7.7.5.5 Other Distribution Channels

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Candy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.82% |

Market Size in 2032: |

USD 93.40 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Candy Market research report is 2024-2032.

The Hershey Company, Nestle SA, Perfetti Van Melle Group B.V., Mondelez International, Inc., Mars, Incorporated and Other Major Players

The Candy Market is segmented into By Type, By Distribution Channel and region. By Type, the market is categorized into Chocolate Candy, Non-chocolate Candy, Hard Boiled Candies, Pastilles, Gums, Jellies, and Chews, Toffees, Caramels, and Nougat, Mints and Other Non-chocolate Candies. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Convenience Stores, Specalist Retailers, Online Retail and Other Distribution Channels.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The candy market encompasses the global production, distribution, and sales of a wide variety of confectionery products, including chocolates, gummies, hard candies, licorice, lollipops, and other sweet treats. It is driven by consumer demand for indulgence, innovation in flavors and packaging, seasonal sales spikes, and marketing strategies targeting various age groups. This market is influenced by factors such as health trends, economic conditions, and cultural preferences, and it includes major multinational corporations as well as smaller, niche producers. The candy market also adapts to changes in consumer preferences, such as the growing interest in sugar-free, organic, and ethically sourced products.

Candy Market Size Was Valued at USD 66.65 Billion in 2023, and is Projected to Reach USD 93.40 Billion by 2032, Growing at a CAGR of 3.82% From 2024-2032.