Business Intelligence Market Synopsis

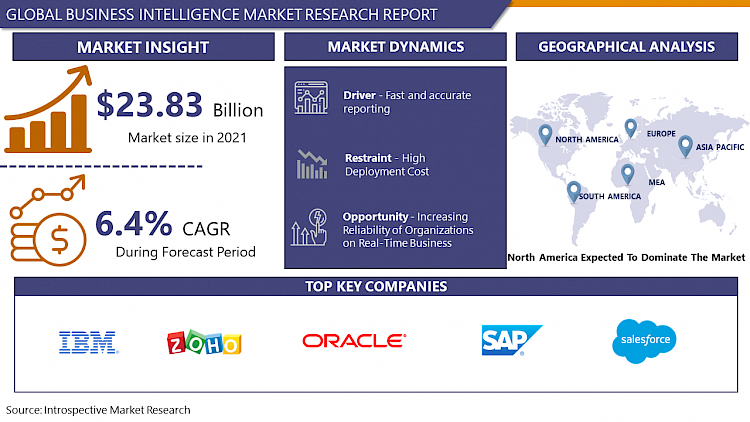

The Global Business Intelligence Market size is expected to grow from USD 39.25 billion in 2022 to USD 65.94 billion by 2030, at a CAGR of 6.7% during the forecast period (2023-2030).

Business intelligence (BI) is a set of tools and techniques that combines business analytics, data mining, data visualization, data tools and infrastructure, and best practices to help businesses make better data-driven decisions. Business intelligence may assist companies to make better decisions by providing current and historical data in the context of their business.

- The Business Intelligence (BI) market was experiencing rapid growth and transformation. BI refers to technologies, applications, and processes for the collection, analysis, and presentation of business information to support decision-making. BI market was characterized by an increasing demand for advanced analytics, data visualization tools, and self-service BI solutions.

- Key trends included the integration of artificial intelligence and machine learning into BI tools, enabling more predictive and prescriptive analytics. Cloud-based BI solutions were gaining popularity due to their scalability and accessibility, allowing organizations to analyze data from anywhere. Mobile BI applications were also on the rise, providing users with real-time insights on the go.

- Major players in the BI market, such as Microsoft, Tableau, and Qlik, were continually innovating to enhance their offerings. The market was driven by a growing awareness of the value of data-driven decision-making across various industries, including finance, healthcare, and retail.

Business Intelligence Market Trend Analysis

Fast and accurate reporting

- Businesses increasingly rely on real-time insights to make informed decisions and gain a competitive edge. Rapid access to precise data enables organizations to respond swiftly to market changes, identify emerging trends, and capitalize on opportunities.

- The demand for business intelligence solutions is propelled by the need for streamlined and automated reporting processes. As technology advances, BI tools offer sophisticated analytics, allowing companies to extract actionable intelligence from vast datasets promptly. This not only enhances operational efficiency but also facilitates strategic planning and performance evaluation.

- In a data-driven era, where information is a critical asset, businesses prioritize solutions that ensure not only speed but also accuracy in reporting. The convergence of data analytics, machine learning, and cloud computing further amplifies the role of fast and accurate reporting in shaping the landscape of the Business Intelligence Market, fostering a culture of data-driven decision-making.

Increasing Reliability of Organizations on Real-Time Business creates an Opportunity

- The increasing reliance of organizations on real-time business operations has created a significant opportunity for the growth of the Business Intelligence (BI) market. In today's fast-paced business environment, organizations seek timely and accurate insights to make informed decisions. Business Intelligence plays a crucial role in this scenario by providing advanced analytics, data visualization, and reporting tools that enable businesses to extract actionable intelligence from their data.

- Real-time BI allows organizations to monitor and analyze data as it is generated, providing immediate insights that can drive quick decision-making. This capability is essential for staying competitive, adapting to market changes, and identifying new opportunities. The BI market has witnessed substantial growth as businesses recognize the value of harnessing data for strategic decision-making.

- Key components of the BI market include data integration, data warehousing, dashboards, and self-service analytics. The demand for BI solutions continues to rise as organizations across various industries strive to enhance their operational efficiency and gain a competitive edge in the dynamic business landscape. The Business Intelligence market is poised for further expansion as businesses increasingly prioritize real-time data analytics to navigate the complexities of the modern market.

Business Intelligence Market Segment Analysis:

Business Intelligence Market Segmented on the basis of Component, Deployment, Enterprise Size, Application, Industry.

By Component, the solution segment is expected to dominate the market during the forecast period

- Business Intelligence (BI) market, the solution segment is poised to assert dominance. As organizations increasingly recognize the critical role of data-driven decision-making, the demand for comprehensive BI solutions has surged. These solutions encompass a spectrum of tools and technologies designed to gather, analyze, and visualize data, empowering businesses to derive actionable insights.

- The solution segment encompasses a wide array of BI offerings, including data visualization tools, reporting software, advanced analytics platforms, and dashboard applications. These components seamlessly integrate into organizational workflows, providing a holistic approach to data management and analysis. The versatility of BI solutions makes them indispensable for enterprises across various industries, fostering a data-centric culture.

- Factors contributing to the ascendancy of the solution segment include the growing complexity of data sources, the need for real-time analytics, and an emphasis on user-friendly interfaces. As organizations navigate the challenges of a data-rich environment, robust BI solutions become a linchpin for strategic decision-making.

By Deployment, the cloud segment held the largest share of 49.8% in 2022

- As organizations increasingly recognize the advantages of cloud-based BI solutions, a significant shift in deployment preferences is observed. The cloud offers unparalleled flexibility, scalability, and accessibility, allowing businesses to efficiently manage and analyze vast amounts of data.

- The ascendancy of the cloud segment in the BI market is underpinned by several factors. First and foremost is the agility it provides, enabling rapid deployment and updates without the need for extensive on-premises infrastructure. This fosters a dynamic and responsive BI environment, crucial for decision-making in today's fast-paced business landscape. Additionally, the cost-effectiveness of cloud-based BI solutions appeals to organizations seeking efficient ways to manage their data analytics needs without hefty upfront investments.

Business Intelligence Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to maintain its dominance in the Business Intelligence (BI) market. The region's supremacy can be attributed to several factors that contribute to its robust BI landscape. The presence of major industry players, technological advancements, and a well-established infrastructure are key drivers. The United States, in particular, hosts a significant number of leading BI vendors and is a hub for innovation in analytics and data-driven decision-making.

- The increasing adoption of cloud-based BI solutions, coupled with a growing emphasis on data-driven strategies across various industries, further propels North America's stronghold in the market. The region benefits from a mature ecosystem that fosters collaboration between businesses and technology providers, fostering a conducive environment for BI development and implementation.

- Moreover, a high awareness and understanding of the importance of BI among enterprises in North America contribute to the widespread adoption of these solutions. With a dynamic business landscape and a focus on leveraging data for competitive advantage, North America is likely to continue leading the way in the evolving realm of Business Intelligence.

Business Intelligence Market Top Key Players:

- Microsoft(USA)

- Tableau Software (USA)

- SAP (Germany)

- Oracle Corporation (USA)

- Qlik Technologies (USA)

- Sisense (Israel)

- Looker (USA)

- Domo (USA)

- Mode Analytics (USA)

- Zoho Analytics (India)

- Alteryx (USA)

- Qualtrics (USA)

- Yellowfin BI (Australia)

- Birst (USA)

- ThoughtSpot (USA)

- Domino Data Science (USA)

- Trifacta (Canada)

- Gtmhub (USA)

- Chartio (USA)

- Metabase (USA) and Other Major Players

Key Industry Developments in the Business Intelligence Market:

- In June 2023, Thoma Bravo acquires Coupa Software for $8 billion, This major acquisition expands Thoma Bravo's portfolio in the enterprise software space and strengthens Coupa's position in the Business Spend Management market.

- In August 2023, J&J acquires Abiomed for $18 billion, This strategic move bolsters J&J's presence in the medical technology sector, particularly in the cardiovascular space, with Abiomed's leading heart support technologies

|

Global Business Intelligence Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 39.25 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.7 % |

Market Size in 2030: |

USD 65.94 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Application |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BUSINESS INTELLIGENCE MARKET BY COMPONENT (2016-2030)

- BUSINESS INTELLIGENCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- BUSINESS INTELLIGENCE MARKET BY DEPLOYMENT (2016-2030)

- BUSINESS INTELLIGENCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISE

- BUSINESS INTELLIGENCE MARKET BY ENTERPRISE SIZE (2016-2030)

- BUSINESS INTELLIGENCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMES

- BUSINESS INTELLIGENCE MARKET BY APPLICATION (2016-2030)

- BUSINESS INTELLIGENCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPPLY CHAIN ANALYTIC APPLICATIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CRM ANALYTIC APPLICATIONS

- FINANCIAL PERFORMANCE

- STRATEGY MANAGEMENT

- PRODUCTION PLANNING ANALYTIC OPERATIONS

- BUSINESS INTELLIGENCE MARKET BY INDUSTRY (2016-2030)

- BUSINESS INTELLIGENCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT AND TELECOMMUNICATIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BANKING

- FINANCE

- SECURITY AND INSURANCE (BFSI)

- HEALTHCARE

- MANUFACTURING

- RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BUSINESS INTELLIGENCE Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COMPANYA

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MICROSOFT (USA)

- TABLEAU SOFTWARE (USA)

- SAP (GERMANY)

- ORACLE CORPORATION (USA)

- QLIK TECHNOLOGIES (USA)

- SISENSE (ISRAEL)

- LOOKER (USA)

- DOMO (USA)

- MODE ANALYTICS (USA)

- ZOHO ANALYTICS (INDIA)

- ALTERYX (USA)

- QUALTRICS (USA)

- YELLOWFIN BI (AUSTRALIA)

- BIRST (USA)

- THOUGHTSPOT (USA)

- DOMINO DATA SCIENCE (USA)

- TRIFACTA (CANADA)

- GTMHUB (USA)

- CHARTIO (USA)

- METABASE (USA)

- COMPETITIVE LANDSCAPE

- GLOBAL BUSINESS INTELLIGENCE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Enterprise Size

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Industry

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Business Intelligence Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 39.25 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.7 % |

Market Size in 2030: |

USD 65.94 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Application |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BUSINESS INTELLIGENCE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BUSINESS INTELLIGENCE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BUSINESS INTELLIGENCE MARKET COMPETITIVE RIVALRY

TABLE 005. BUSINESS INTELLIGENCE MARKET THREAT OF NEW ENTRANTS

TABLE 006. BUSINESS INTELLIGENCE MARKET THREAT OF SUBSTITUTES

TABLE 007. BUSINESS INTELLIGENCE MARKET BY COMPONENT

TABLE 008. SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. BUSINESS INTELLIGENCE MARKET BY DEPLOYMENT

TABLE 011. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 012. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 013. BUSINESS INTELLIGENCE MARKET BY ENTERPRISE SIZE

TABLE 014. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 015. SMES MARKET OVERVIEW (2016-2028)

TABLE 016. BUSINESS INTELLIGENCE MARKET BY APPLICATION

TABLE 017. SUPPLY CHAIN ANALYTIC APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 018. CRM ANALYTIC APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 019. FINANCIAL PERFORMANCE MARKET OVERVIEW (2016-2028)

TABLE 020. STRATEGY MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 021. PRODUCTION PLANNING ANALYTIC OPERATIONS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. BUSINESS INTELLIGENCE MARKET BY INDUSTRY

TABLE 024. IT AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

TABLE 025. BANKING MARKET OVERVIEW (2016-2028)

TABLE 026. FINANCE MARKET OVERVIEW (2016-2028)

TABLE 027. SECURITY AND INSURANCE (BFSI) MARKET OVERVIEW (2016-2028)

TABLE 028. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 029. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 030. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 031. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 032. NORTH AMERICA BUSINESS INTELLIGENCE MARKET, BY COMPONENT (2016-2028)

TABLE 033. NORTH AMERICA BUSINESS INTELLIGENCE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 034. NORTH AMERICA BUSINESS INTELLIGENCE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 035. NORTH AMERICA BUSINESS INTELLIGENCE MARKET, BY APPLICATION (2016-2028)

TABLE 036. NORTH AMERICA BUSINESS INTELLIGENCE MARKET, BY INDUSTRY (2016-2028)

TABLE 037. N BUSINESS INTELLIGENCE MARKET, BY COUNTRY (2016-2028)

TABLE 038. EUROPE BUSINESS INTELLIGENCE MARKET, BY COMPONENT (2016-2028)

TABLE 039. EUROPE BUSINESS INTELLIGENCE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 040. EUROPE BUSINESS INTELLIGENCE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 041. EUROPE BUSINESS INTELLIGENCE MARKET, BY APPLICATION (2016-2028)

TABLE 042. EUROPE BUSINESS INTELLIGENCE MARKET, BY INDUSTRY (2016-2028)

TABLE 043. BUSINESS INTELLIGENCE MARKET, BY COUNTRY (2016-2028)

TABLE 044. ASIA PACIFIC BUSINESS INTELLIGENCE MARKET, BY COMPONENT (2016-2028)

TABLE 045. ASIA PACIFIC BUSINESS INTELLIGENCE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 046. ASIA PACIFIC BUSINESS INTELLIGENCE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 047. ASIA PACIFIC BUSINESS INTELLIGENCE MARKET, BY APPLICATION (2016-2028)

TABLE 048. ASIA PACIFIC BUSINESS INTELLIGENCE MARKET, BY INDUSTRY (2016-2028)

TABLE 049. BUSINESS INTELLIGENCE MARKET, BY COUNTRY (2016-2028)

TABLE 050. MIDDLE EAST & AFRICA BUSINESS INTELLIGENCE MARKET, BY COMPONENT (2016-2028)

TABLE 051. MIDDLE EAST & AFRICA BUSINESS INTELLIGENCE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 052. MIDDLE EAST & AFRICA BUSINESS INTELLIGENCE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 053. MIDDLE EAST & AFRICA BUSINESS INTELLIGENCE MARKET, BY APPLICATION (2016-2028)

TABLE 054. MIDDLE EAST & AFRICA BUSINESS INTELLIGENCE MARKET, BY INDUSTRY (2016-2028)

TABLE 055. BUSINESS INTELLIGENCE MARKET, BY COUNTRY (2016-2028)

TABLE 056. SOUTH AMERICA BUSINESS INTELLIGENCE MARKET, BY COMPONENT (2016-2028)

TABLE 057. SOUTH AMERICA BUSINESS INTELLIGENCE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 058. SOUTH AMERICA BUSINESS INTELLIGENCE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 059. SOUTH AMERICA BUSINESS INTELLIGENCE MARKET, BY APPLICATION (2016-2028)

TABLE 060. SOUTH AMERICA BUSINESS INTELLIGENCE MARKET, BY INDUSTRY (2016-2028)

TABLE 061. BUSINESS INTELLIGENCE MARKET, BY COUNTRY (2016-2028)

TABLE 062. IBM: SNAPSHOT

TABLE 063. IBM: BUSINESS PERFORMANCE

TABLE 064. IBM: PRODUCT PORTFOLIO

TABLE 065. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ZOHO: SNAPSHOT

TABLE 066. ZOHO: BUSINESS PERFORMANCE

TABLE 067. ZOHO: PRODUCT PORTFOLIO

TABLE 068. ZOHO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ORACLE: SNAPSHOT

TABLE 069. ORACLE: BUSINESS PERFORMANCE

TABLE 070. ORACLE: PRODUCT PORTFOLIO

TABLE 071. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. SAP: SNAPSHOT

TABLE 072. SAP: BUSINESS PERFORMANCE

TABLE 073. SAP: PRODUCT PORTFOLIO

TABLE 074. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SALESFORCE: SNAPSHOT

TABLE 075. SALESFORCE: BUSINESS PERFORMANCE

TABLE 076. SALESFORCE: PRODUCT PORTFOLIO

TABLE 077. SALESFORCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. YELLOFIN: SNAPSHOT

TABLE 078. YELLOFIN: BUSINESS PERFORMANCE

TABLE 079. YELLOFIN: PRODUCT PORTFOLIO

TABLE 080. YELLOFIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. SAS: SNAPSHOT

TABLE 081. SAS: BUSINESS PERFORMANCE

TABLE 082. SAS: PRODUCT PORTFOLIO

TABLE 083. SAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. GOOGLE: SNAPSHOT

TABLE 084. GOOGLE: BUSINESS PERFORMANCE

TABLE 085. GOOGLE: PRODUCT PORTFOLIO

TABLE 086. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. AWS: SNAPSHOT

TABLE 087. AWS: BUSINESS PERFORMANCE

TABLE 088. AWS: PRODUCT PORTFOLIO

TABLE 089. AWS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. MICROSTRATEGY: SNAPSHOT

TABLE 090. MICROSTRATEGY: BUSINESS PERFORMANCE

TABLE 091. MICROSTRATEGY: PRODUCT PORTFOLIO

TABLE 092. MICROSTRATEGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. DOMO: SNAPSHOT

TABLE 093. DOMO: BUSINESS PERFORMANCE

TABLE 094. DOMO: PRODUCT PORTFOLIO

TABLE 095. DOMO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. TIBCO: SNAPSHOT

TABLE 096. TIBCO: BUSINESS PERFORMANCE

TABLE 097. TIBCO: PRODUCT PORTFOLIO

TABLE 098. TIBCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. INFORMATION BUILDERS: SNAPSHOT

TABLE 099. INFORMATION BUILDERS: BUSINESS PERFORMANCE

TABLE 100. INFORMATION BUILDERS: PRODUCT PORTFOLIO

TABLE 101. INFORMATION BUILDERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. TERADATA: SNAPSHOT

TABLE 102. TERADATA: BUSINESS PERFORMANCE

TABLE 103. TERADATA: PRODUCT PORTFOLIO

TABLE 104. TERADATA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. SISENSE: SNAPSHOT

TABLE 105. SISENSE: BUSINESS PERFORMANCE

TABLE 106. SISENSE: PRODUCT PORTFOLIO

TABLE 107. SISENSE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. BOARD INTERNATIONAL: SNAPSHOT

TABLE 108. BOARD INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 109. BOARD INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 110. BOARD INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. MICROSOFT: SNAPSHOT

TABLE 111. MICROSOFT: BUSINESS PERFORMANCE

TABLE 112. MICROSOFT: PRODUCT PORTFOLIO

TABLE 113. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. AMLGO LABS: SNAPSHOT

TABLE 114. AMLGO LABS: BUSINESS PERFORMANCE

TABLE 115. AMLGO LABS: PRODUCT PORTFOLIO

TABLE 116. AMLGO LABS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. INFOR: SNAPSHOT

TABLE 117. INFOR: BUSINESS PERFORMANCE

TABLE 118. INFOR: PRODUCT PORTFOLIO

TABLE 119. INFOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. TARGIT: SNAPSHOT

TABLE 120. TARGIT: BUSINESS PERFORMANCE

TABLE 121. TARGIT: PRODUCT PORTFOLIO

TABLE 122. TARGIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. DUNDAS: SNAPSHOT

TABLE 123. DUNDAS: BUSINESS PERFORMANCE

TABLE 124. DUNDAS: PRODUCT PORTFOLIO

TABLE 125. DUNDAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. QLIK: SNAPSHOT

TABLE 126. QLIK: BUSINESS PERFORMANCE

TABLE 127. QLIK: PRODUCT PORTFOLIO

TABLE 128. QLIK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128. VPHRASE: SNAPSHOT

TABLE 129. VPHRASE: BUSINESS PERFORMANCE

TABLE 130. VPHRASE: PRODUCT PORTFOLIO

TABLE 131. VPHRASE: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BUSINESS INTELLIGENCE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BUSINESS INTELLIGENCE MARKET OVERVIEW BY COMPONENT

FIGURE 012. SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. BUSINESS INTELLIGENCE MARKET OVERVIEW BY DEPLOYMENT

FIGURE 015. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 016. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 017. BUSINESS INTELLIGENCE MARKET OVERVIEW BY ENTERPRISE SIZE

FIGURE 018. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 019. SMES MARKET OVERVIEW (2016-2028)

FIGURE 020. BUSINESS INTELLIGENCE MARKET OVERVIEW BY APPLICATION

FIGURE 021. SUPPLY CHAIN ANALYTIC APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 022. CRM ANALYTIC APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 023. FINANCIAL PERFORMANCE MARKET OVERVIEW (2016-2028)

FIGURE 024. STRATEGY MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 025. PRODUCTION PLANNING ANALYTIC OPERATIONS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. BUSINESS INTELLIGENCE MARKET OVERVIEW BY INDUSTRY

FIGURE 028. IT AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 029. BANKING MARKET OVERVIEW (2016-2028)

FIGURE 030. FINANCE MARKET OVERVIEW (2016-2028)

FIGURE 031. SECURITY AND INSURANCE (BFSI) MARKET OVERVIEW (2016-2028)

FIGURE 032. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 033. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 034. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 035. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 036. NORTH AMERICA BUSINESS INTELLIGENCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. EUROPE BUSINESS INTELLIGENCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 038. ASIA PACIFIC BUSINESS INTELLIGENCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 039. MIDDLE EAST & AFRICA BUSINESS INTELLIGENCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 040. SOUTH AMERICA BUSINESS INTELLIGENCE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Business Intelligence Market research report is 2023-2030.

Microsoft (USA), Tableau Software (USA), SAP (Germany), Oracle Corporation (USA), Qlik Technologies (USA), Sisense (Israel), Looker (USA), Domo (USA), Mode Analytics (USA), Zoho Analytics (India), Alteryx (USA), Qualtrics (USA), Yellowfin BI (Australia), Birst (USA), ThoughtSpot (USA), Domino Data Science (USA), Trifacta (Canada), Gtmhub (USA), Chartio (USA), Metabase (USA) and Other Major Players.

The Business Intelligence Market is segmented into Component, Deployment, Enterprise Size, Application, Industry, and region. By Component, the market is categorized into Solutions, Services. By Deployment, the market is categorized into Cloud, On-Premise. By Enterprise Size, the market is categorized into Large Enterprises, Small and Medium-Sized Enterprises. By Application, the market is categorized into Supply Chain Analytic Applications, CRM Analytic Applications, Financial Performance & Strategy Management, Production Planning Analytic Operations, and Others. By End-User Industry, the market is categorized into IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Business intelligence (BI) is a set of tools and techniques that combines business analytics, data mining, data visualization, data tools and infrastructure, and best practices to help businesses make better data-driven decisions. Business intelligence may assist companies to make better decisions by providing current and historical data in the context of their business.

The Global Business Intelligence Market size is expected to grow from USD 39.25 billion in 2022 to USD 65.94 billion by 2030, at a CAGR of 6.7% during the forecast period (2023-2030).