Global Business Health Insurance Market Overview

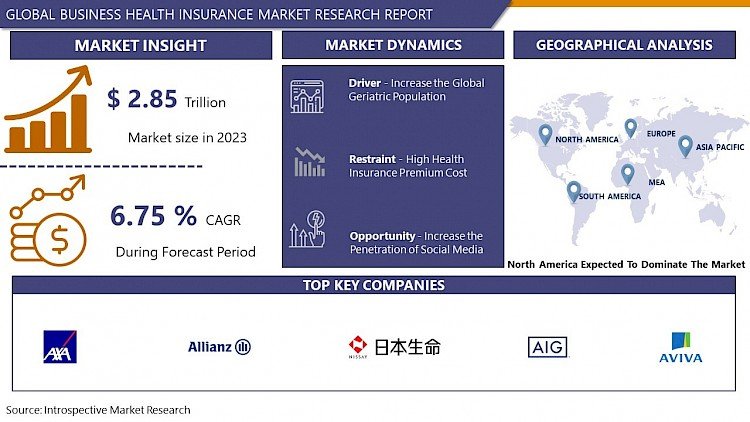

The global Business Health Insurance Market Size Was Valued at USD 2.85 Trillion in 2023 and is Projected to Reach USD 5.13 Trillion by 2032, Growing at a CAGR of 6.75% From 2024-2032.

Business Health Insurance, is provided by employers to their employees for medical coverage. It includes doctor visits, hospitalization, prescriptions, and preventive services. Employers and employees share the cost, with the employer often paying a portion of the premium.

- Business health insurance provides extensive benefits for staff, such as hospitalization, consultations with doctors, prescription medications, and preventive services. This aids in reducing financial stress and guarantees availability of essential medical care.

- Offering health insurance as a perk aid in attracting and maintaining skilled workers, revealing a dedication to staff health and giving a competitive advantage in the labour market.

- Sharing costs between employers and employees alleviates financial pressure on employees while guaranteeing access to high-quality healthcare. Employers can receive tax benefits for health insurance premiums they pay. Access to affordable medical care helps support employee health and productivity by decreasing absenteeism and increasing morale.

- A group of healthcare professionals guarantees easy reach to different medical treatments, while support for preventive healthcare services encourages early identification and overall employee health.

Market Dynamics And Factors For Business Health Insurance Market

Drivers:

Increase the Global Geriatric Population

The geriatric population in the world is increasing, which is key factor support to the growth of the business health insurance market. People aged 65 and up are more susceptible to chronic diseases. For instance, Statista stated that Japan is the country with which highest population of 65 aged people in 2021. 29% of Japanese are over 65 age and Germany has 22% of people over 65 age in 2021. Due to the increasing geriatric population, growing the prevalence rate of chronic diseases such as cancer among them. Thus, most health insurance providers made insurance policies for only geriatric people, which increases the government’s concern about the health of geriatric people. They give financial support to geriatric people suffering from chronic diseases. These all factors support the growth of the business health insurance market over the forecast year.

Restraints:

High Health Insurance Premium Cost

The private health insurance providers raise the insurance premium cost because of increasing healthcare expenses rates such as hospital admission charges, medicine costs, and other treatment costs. In addition to this, most people suffer from chronic diseases such as heart disease, diabetes, and Alzheimer’s disease. Thus, healthcare professionals increase the cost of treatment of such chronic diseases, and this cost may not affordable for those employers has financial conditions not good. This factor is responsible for hampering the growth of the market of business health insurance.

Opportunity:

Increase the Penetration of Social Media

Nowadays, most people are addicted to social media. A number of people have insufficient knowledge about health insurance plans but due to social media, people are more aware of health insurance plans for the treatment of any disease, is provide a profitable opportunity for the business health insurance market. Most health insurance providers launch new mobile applications to provide policy details. So, people can easily purchase a health insurance policy for the treatment of any illness or accident. In addition to this, several companies create their own significant online sales channels through which people can buy any insurance policy. These all factors are anticipated to provide lucrative opportunities for the growth of the business health insurance market in the forecast period.

Segmentation Analysis Of Business Health Insurance Market

By Service Providers, the private provider’s sector is anticipated to dominate the market in terms of business health insurance market share. In developing countries, increase the number of private health insurance providers. Private health insurance policies are more flexible and offer more options to policyholders. The policyholder has more plans; thus, they choose a policy on the basis of their need. According to Statista, in 2020, in the United State, about 177 million people had private health insurance, and in 2021 above 60% of people had private health insurance. In addition to this, commercial providers are providing new policies with a number of benefits that helps to increase the demand of the public. These all factors propel the growth of the business health insurance market.

By Age group, the adult segment is expected to have maximum market growth in business health insurance. Most adults adopt the health insurance plan for treatment and hospitalization. The adult group is more aware of the health insurance plan. Some health insurance providers decide the insurance plan for only adult people. This factor supported the growth of the market in the analysis year.

By Network Providers, the PPOs segment is projected to have the highest market share in the business health insurance market. They give you more options when it comes to hospitals, doctors, and other advantages, which makes this network more appealing. The preferred provider organization (PPO) is designed for families and individuals. PPO contains a network of contracted medical professionals and health insurance companies. PPO offers benefits such as plan options, and flexibility, and people can choose any doctor and offers a discount to people in their preferred network. These beneficial factors propel the growth of the business health insurance market.

By Insurance Type, Medical Insurance is anticipated to have maximum market growth in business health insurance. Medical insurance contains a basic type of health insurance plan. It offers financial security to the people. Medical insurance covers the cost of treatment, hospitalization, free health check-up, and expenses of pre and post-hospitalization. Under section 80D, there is no need of paying the tax for medical insurance. These all services support the increase in the demand for medical insurance that boosts the growth of the business health insurance market in the analysis year.

Regional Analysis Of Business Health Insurance Market

North America dominated the Business Health Insurance market. The presence of a large number of health and life insurance providers in the North American region. The growing prevalence of diseases and the rising number of elderly populations in this region support the growth of the market. The US is the dominant region in the business health insurance market. This is owing to the rising cost of medical services, and an increasing number of day-care procedures boosting the growth of the market. In addition, these people in this region are more aware of the health insurance plan, increasing the number of health sectors in this region also helps to rising the adoption of health insurance plans that propels the growth of the business health insurance market in the forecast year.

After North America, Asia Pacific is the second dominating region in the market for business health insurance. The presence of a large number of healthcare sectors, a growing number of day-care procedures, and increased medical costs are the key factors responsible for the growth of the market. The government of the Asia Pacific region increases its investment in business health insurance. For instance, in India in the financial year 2021, 43 billion Indian rupees were invested by the government of India in the health insurance program, and excepting state-owned enterprises Group firms had installed 281 billion. The 514 million Indian people were covered under the health insurance scheme. In addition to this, the national policy suppliers in the Asia Pacific developing countries offer cost-effective term of insurance policies. These all factors supported the growth of the business health insurance market in the analysis period.

Top Key Players Covered In The Business Health Insurance Market

- Allianz(Germany)

- AXA (France)

- Nippon Life Insurance (Japan)

- American Intl. Group (US)

- Aviva(UK)

- Assicurazioni Generali (Italy)

- Cardinal Health (US)

- State Farm Insurance (US)

- Dai-ichi Mutual Life Insurance (Japan

- Munich Re Group (Germany)

- Zurich Financial Services (Switzerland)

- Prudential (US)

- Asahi Mutual Life Insurance (Japan)

- Sumitomo Life Insurance (Japan)

- MetLife (US)

- Allstate (US)

- Aegon (Netherlands)

- Prudential Financial (US) and other major players.

Key Industry Development in The Business Health Insurance Market

- In March 2024, Narayana Health Insurance Limited received approval from IRDAI to launch its health insurance business in India, making it the sixth Standalone Health Insurance Company in the country. IRDAI's goal of 'Insurance for All' by 2047, non-life insurance penetration in India remains at 1%.

- In March 2024, The Indian consulate in Dubai launched a new insurance package for blue-collar Indian workers to offer financial aid to their families in case of natural or accidental deaths. This decision came after meetings between the Consulate General of India, major companies, and insurance providers. The Life Protection Plan (LPP) covers death due to any cause.

|

Global Business Health Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2024: |

USD 2.85 Tn. |

|

Forecast Period 2024-23 CAGR: |

6.75 % |

Market Size in 2032: |

USD 5.13 Tn. |

|

Segments Covered: |

By Service Providers |

|

|

|

By Age Group |

|

||

|

By Network Providers |

|

||

|

By Insurance Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BUSINESS HEALTH INSURANCE MARKET BY SERVICE PROVIDERS (2017-2032)

- BUSINESS HEALTH INSURANCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PUBLIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- PRIVATE

- BUSINESS HEALTH INSURANCE MARKET BY AGE GROUP (2017-2032)

- BUSINESS HEALTH INSURANCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ADULTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MINORS

- SENIOR CITIZENS

- BUSINESS HEALTH INSURANCE MARKET BY NETWORK PROVIDERS (2017-2032)

- BUSINESS HEALTH INSURANCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PREFERRED PROVIDER ORGANIZATIONS (PPOS)

- HEALTH MAINTENANCE ORGANIZATION (HMOS)

- POINT OF SERVICES (POS)

- BUSINESS HEALTH INSURANCE MARKET BY INSURANCE TYPE (2017-2032)

- BUSINESS HEALTH INSURANCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALIZATION INSURANCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDICAL INSURANCE

- DISEASE INSURANCE

- INCOME PROTECTION INSURANCE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- BUSINESS HEALTH INSURANCE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ALLIANZ (GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AXA (FRANCE)

- NIPPON LIFE INSURANCE (JAPAN)

- AMERICAN INTL. GROUP (US)

- AVIVA (UK)

- ASSICURAZIONI GENERALI (ITALY)

- CARDINAL HEALTH (US)

- STATE FARM INSURANCE (US)

- DAI-ICHI MUTUAL LIFE INSURANCE (JAPAN

- MUNICH RE GROUP (GERMANY)

- ZURICH FINANCIAL SERVICES (SWITZERLAND)

- PRUDENTIAL (US)

- ASAHI MUTUAL LIFE INSURANCE (JAPAN)

- SUMITOMO LIFE INSURANCE (JAPAN)

- METLIFE (US)

- ALLSTATE (US)

- AEGON (NETHERLANDS)

- PRUDENTIAL FINANCIAL (US)

- COMPETITIVE LANDSCAPE

- GLOBAL BUSINESS HEALTH INSURANCE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service Providers

- Historic And Forecasted Market Size By Age Group

- Historic And Forecasted Market Size By Network Providers

- Historic And Forecasted Market Size By Insurance Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Business Health Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2024: |

USD 2.85 Tn. |

|

Forecast Period 2024-23 CAGR: |

6.75 % |

Market Size in 2032: |

USD 5.13 Tn. |

|

Segments Covered: |

By Service Providers |

|

|

|

By Age Group |

|

||

|

By Network Providers |

|

||

|

By Insurance Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BUSINESS HEALTH INSURANCE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BUSINESS HEALTH INSURANCE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BUSINESS HEALTH INSURANCE MARKET COMPETITIVE RIVALRY

TABLE 005. BUSINESS HEALTH INSURANCE MARKET THREAT OF NEW ENTRANTS

TABLE 006. BUSINESS HEALTH INSURANCE MARKET THREAT OF SUBSTITUTES

TABLE 007. BUSINESS HEALTH INSURANCE MARKET BY SERVICE PROVIDERS

TABLE 008. PUBLIC MARKET OVERVIEW (2016-2028)

TABLE 009. PRIVATE MARKET OVERVIEW (2016-2028)

TABLE 010. BUSINESS HEALTH INSURANCE MARKET BY AGE GROUP

TABLE 011. ADULTS MARKET OVERVIEW (2016-2028)

TABLE 012. MINORS MARKET OVERVIEW (2016-2028)

TABLE 013. SENIOR CITIZENS MARKET OVERVIEW (2016-2028)

TABLE 014. BUSINESS HEALTH INSURANCE MARKET BY NETWORK PROVIDERS

TABLE 015. EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS) MARKET OVERVIEW (2016-2028)

TABLE 016. PREFERRED PROVIDER ORGANIZATIONS (PPOS) MARKET OVERVIEW (2016-2028)

TABLE 017. HEALTH MAINTENANCE ORGANIZATION (HMOS) MARKET OVERVIEW (2016-2028)

TABLE 018. POINT OF SERVICES (POS) MARKET OVERVIEW (2016-2028)

TABLE 019. BUSINESS HEALTH INSURANCE MARKET BY INSURANCE TYPE

TABLE 020. HOSPITALIZATION INSURANCE MARKET OVERVIEW (2016-2028)

TABLE 021. MEDICAL INSURANCE MARKET OVERVIEW (2016-2028)

TABLE 022. DISEASE INSURANCE MARKET OVERVIEW (2016-2028)

TABLE 023. INCOME PROTECTION INSURANCE MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 025. NORTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY AGE GROUP (2016-2028)

TABLE 026. NORTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY NETWORK PROVIDERS (2016-2028)

TABLE 027. NORTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY INSURANCE TYPE (2016-2028)

TABLE 028. N BUSINESS HEALTH INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE BUSINESS HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 030. EUROPE BUSINESS HEALTH INSURANCE MARKET, BY AGE GROUP (2016-2028)

TABLE 031. EUROPE BUSINESS HEALTH INSURANCE MARKET, BY NETWORK PROVIDERS (2016-2028)

TABLE 032. EUROPE BUSINESS HEALTH INSURANCE MARKET, BY INSURANCE TYPE (2016-2028)

TABLE 033. BUSINESS HEALTH INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC BUSINESS HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 035. ASIA PACIFIC BUSINESS HEALTH INSURANCE MARKET, BY AGE GROUP (2016-2028)

TABLE 036. ASIA PACIFIC BUSINESS HEALTH INSURANCE MARKET, BY NETWORK PROVIDERS (2016-2028)

TABLE 037. ASIA PACIFIC BUSINESS HEALTH INSURANCE MARKET, BY INSURANCE TYPE (2016-2028)

TABLE 038. BUSINESS HEALTH INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA BUSINESS HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA BUSINESS HEALTH INSURANCE MARKET, BY AGE GROUP (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA BUSINESS HEALTH INSURANCE MARKET, BY NETWORK PROVIDERS (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA BUSINESS HEALTH INSURANCE MARKET, BY INSURANCE TYPE (2016-2028)

TABLE 043. BUSINESS HEALTH INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 045. SOUTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY AGE GROUP (2016-2028)

TABLE 046. SOUTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY NETWORK PROVIDERS (2016-2028)

TABLE 047. SOUTH AMERICA BUSINESS HEALTH INSURANCE MARKET, BY INSURANCE TYPE (2016-2028)

TABLE 048. BUSINESS HEALTH INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 049. ALLIANZ: SNAPSHOT

TABLE 050. ALLIANZ: BUSINESS PERFORMANCE

TABLE 051. ALLIANZ: PRODUCT PORTFOLIO

TABLE 052. ALLIANZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AXA: SNAPSHOT

TABLE 053. AXA: BUSINESS PERFORMANCE

TABLE 054. AXA: PRODUCT PORTFOLIO

TABLE 055. AXA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. NIPPON LIFE INSURANCE: SNAPSHOT

TABLE 056. NIPPON LIFE INSURANCE: BUSINESS PERFORMANCE

TABLE 057. NIPPON LIFE INSURANCE: PRODUCT PORTFOLIO

TABLE 058. NIPPON LIFE INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. AMERICAN INTL. GROUP: SNAPSHOT

TABLE 059. AMERICAN INTL. GROUP: BUSINESS PERFORMANCE

TABLE 060. AMERICAN INTL. GROUP: PRODUCT PORTFOLIO

TABLE 061. AMERICAN INTL. GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. AVIVA: SNAPSHOT

TABLE 062. AVIVA: BUSINESS PERFORMANCE

TABLE 063. AVIVA: PRODUCT PORTFOLIO

TABLE 064. AVIVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ASSICURAZIONI GENERALI: SNAPSHOT

TABLE 065. ASSICURAZIONI GENERALI: BUSINESS PERFORMANCE

TABLE 066. ASSICURAZIONI GENERALI: PRODUCT PORTFOLIO

TABLE 067. ASSICURAZIONI GENERALI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CARDINAL HEALTH: SNAPSHOT

TABLE 068. CARDINAL HEALTH: BUSINESS PERFORMANCE

TABLE 069. CARDINAL HEALTH: PRODUCT PORTFOLIO

TABLE 070. CARDINAL HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. STATE FARM INSURANCE: SNAPSHOT

TABLE 071. STATE FARM INSURANCE: BUSINESS PERFORMANCE

TABLE 072. STATE FARM INSURANCE: PRODUCT PORTFOLIO

TABLE 073. STATE FARM INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. DAI-ICHI MUTUAL LIFE INSURANCE: SNAPSHOT

TABLE 074. DAI-ICHI MUTUAL LIFE INSURANCE: BUSINESS PERFORMANCE

TABLE 075. DAI-ICHI MUTUAL LIFE INSURANCE: PRODUCT PORTFOLIO

TABLE 076. DAI-ICHI MUTUAL LIFE INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. MUNICH RE GROUP: SNAPSHOT

TABLE 077. MUNICH RE GROUP: BUSINESS PERFORMANCE

TABLE 078. MUNICH RE GROUP: PRODUCT PORTFOLIO

TABLE 079. MUNICH RE GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. ZURICH FINANCIAL SERVICES: SNAPSHOT

TABLE 080. ZURICH FINANCIAL SERVICES: BUSINESS PERFORMANCE

TABLE 081. ZURICH FINANCIAL SERVICES: PRODUCT PORTFOLIO

TABLE 082. ZURICH FINANCIAL SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. PRUDENTIAL: SNAPSHOT

TABLE 083. PRUDENTIAL: BUSINESS PERFORMANCE

TABLE 084. PRUDENTIAL: PRODUCT PORTFOLIO

TABLE 085. PRUDENTIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. ASAHI MUTUAL LIFE INSURANCE: SNAPSHOT

TABLE 086. ASAHI MUTUAL LIFE INSURANCE: BUSINESS PERFORMANCE

TABLE 087. ASAHI MUTUAL LIFE INSURANCE: PRODUCT PORTFOLIO

TABLE 088. ASAHI MUTUAL LIFE INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. SUMITOMO LIFE INSURANCE: SNAPSHOT

TABLE 089. SUMITOMO LIFE INSURANCE: BUSINESS PERFORMANCE

TABLE 090. SUMITOMO LIFE INSURANCE: PRODUCT PORTFOLIO

TABLE 091. SUMITOMO LIFE INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. METLIFE: SNAPSHOT

TABLE 092. METLIFE: BUSINESS PERFORMANCE

TABLE 093. METLIFE: PRODUCT PORTFOLIO

TABLE 094. METLIFE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. ALLSTATE: SNAPSHOT

TABLE 095. ALLSTATE: BUSINESS PERFORMANCE

TABLE 096. ALLSTATE: PRODUCT PORTFOLIO

TABLE 097. ALLSTATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. AEGON: SNAPSHOT

TABLE 098. AEGON: BUSINESS PERFORMANCE

TABLE 099. AEGON: PRODUCT PORTFOLIO

TABLE 100. AEGON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. PRUDENTIAL FINANCIAL: SNAPSHOT

TABLE 101. PRUDENTIAL FINANCIAL: BUSINESS PERFORMANCE

TABLE 102. PRUDENTIAL FINANCIAL: PRODUCT PORTFOLIO

TABLE 103. PRUDENTIAL FINANCIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 104. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 105. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 106. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY SERVICE PROVIDERS

FIGURE 012. PUBLIC MARKET OVERVIEW (2016-2028)

FIGURE 013. PRIVATE MARKET OVERVIEW (2016-2028)

FIGURE 014. BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY AGE GROUP

FIGURE 015. ADULTS MARKET OVERVIEW (2016-2028)

FIGURE 016. MINORS MARKET OVERVIEW (2016-2028)

FIGURE 017. SENIOR CITIZENS MARKET OVERVIEW (2016-2028)

FIGURE 018. BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY NETWORK PROVIDERS

FIGURE 019. EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS) MARKET OVERVIEW (2016-2028)

FIGURE 020. PREFERRED PROVIDER ORGANIZATIONS (PPOS) MARKET OVERVIEW (2016-2028)

FIGURE 021. HEALTH MAINTENANCE ORGANIZATION (HMOS) MARKET OVERVIEW (2016-2028)

FIGURE 022. POINT OF SERVICES (POS) MARKET OVERVIEW (2016-2028)

FIGURE 023. BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY INSURANCE TYPE

FIGURE 024. HOSPITALIZATION INSURANCE MARKET OVERVIEW (2016-2028)

FIGURE 025. MEDICAL INSURANCE MARKET OVERVIEW (2016-2028)

FIGURE 026. DISEASE INSURANCE MARKET OVERVIEW (2016-2028)

FIGURE 027. INCOME PROTECTION INSURANCE MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA BUSINESS HEALTH INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Business Health Insurance Market research report is 2024-2032.

Allianz (Germany), AXA (France), Nippon Life Insurance (Japan), American Intl. Group (US), Aviva (UK) and other major players.

The Business Health Insurance Market is segmented into type, distribution channels, and region. By Service Provider, the market is categorized into Public and Private. By Age group, the market is categorized into Adults, Minors, and Senior Citizens. By Network Provider, the market is categorized into Exclusive Provider Organizations (EPOs), Preferred Provider Organizations (PPOs), Health Maintenance Organization (H MOs), Point of Services (POS.) By Insurance Type, the market is categorized into Hospitalization Insurance, Medical Insurance, Disease Insurance, and Income Protection Insurance. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Business health insurance is referred to as group health insurance. It is a health insurance policy received by employers for eligible employees and their dependents. Most larger companies offer business health insurance to qualified employees it covers all expenses of medical.

The global Business Health Insurance Market Size Was Valued at USD 2.85 Trillion in 2023 and is Projected to Reach USD 5.13 Trillion by 2032, Growing at a CAGR of 6.75% From 2024-2032.