Bulk Food Ingredients Market Synopsis

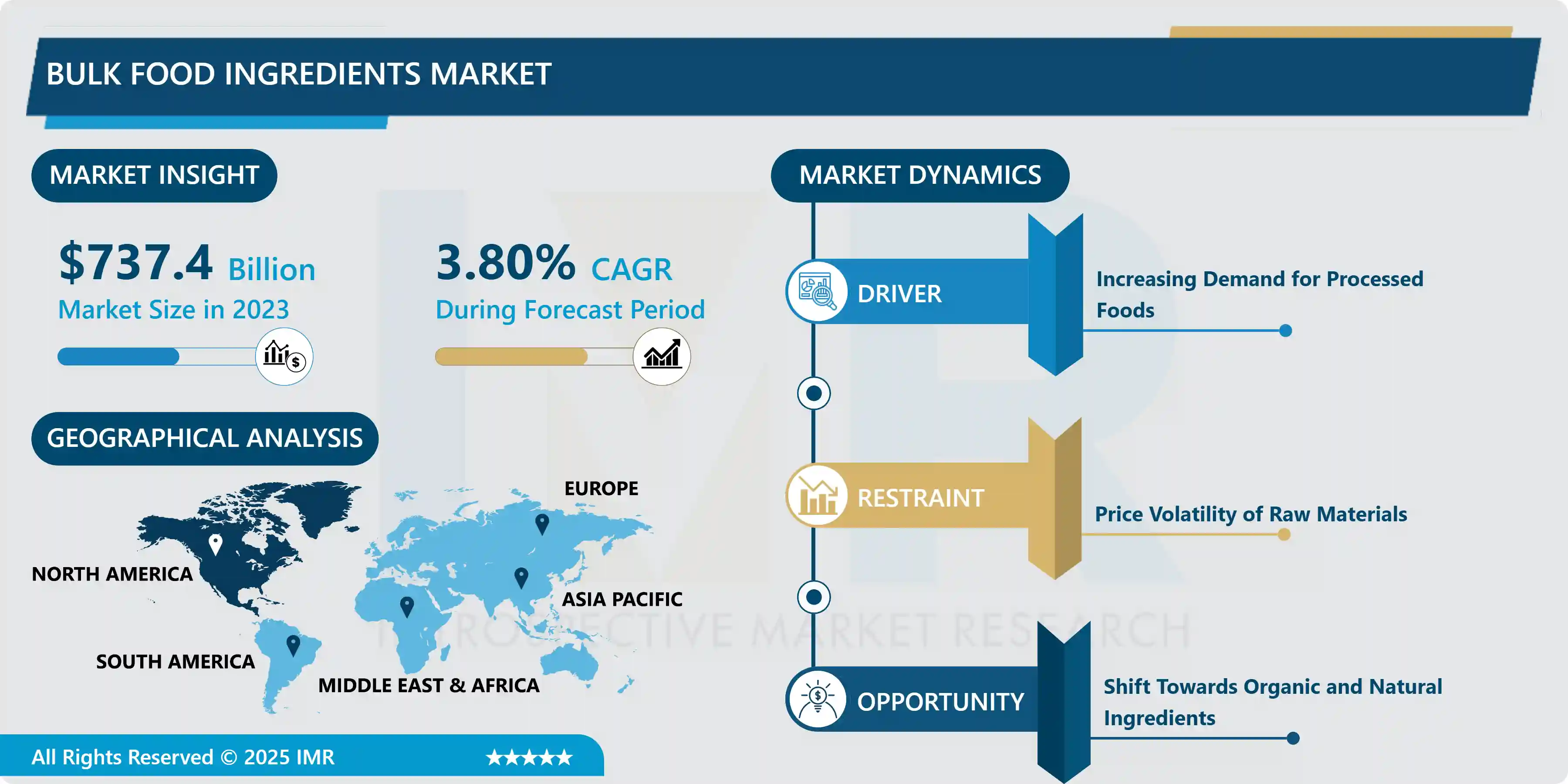

Bulk Food Ingredients Market Size Was Valued at USD 737.4 Billion in 2023, and is Projected to Reach USD 1031.5 Billion by 2032, Growing at a CAGR of 3.8% From 2024-2032.

The Bulk Food Ingredients Market involves a vast number of food ingredients available in large bulk to food processors, food services, and retail sellers. Some of these include commodity grains, sugars and syrups, starches, oils and fats, proteins and a host of functional ingredients that are indispensable for the preparation, processing as well as formulation of foods. It plays a significant role in developing processed foods, bakery and confectionery products, snack foods, and beverages and other functional uses in food industries. Since it is a major component of the global food market, this market has a critical task of maintaining and guaranteeing food quality and stability.

The Global Bulk Food Ingredients market is a growing market, which experienced a rapid growth in recent years due to rising consumption of processed and convenience foods. As seen from the following factors; today’s generation it is characterized by time constraint, more individuals residing in urban areas and the increasing number of working population, there is therefore high demand for convenience food. This has meant that food manufacturers must purchase large quantities of their ingredients in large quantities in an effort to maintain quality while lowering end costs. Furthermore, an increase in demand for quality and healthy food among the consumers is favoring the move towards natural and Organic bulk food ingredients that are also cascading the market.

In addition, technological change in food processing and preservation also funding the market.. Developments in processing methods like freeze-drying and spray-drying are increasing the stability and nutritional quality of bulk dehydrated food ingredients used in foods making processes hence appealing to food producers. The changes in the distribution channel of bulk ingredients have also been brought by the advancement of e-commerce and online food supply to a broad market. This environment is leading to intense supplier rivalry and demanding maintenance of compliance with food safety standards.

Bulk Food Ingredients Market Trend Analysis

Rise of Plant-Based Ingredients

- They forecast that the Bulk Food Ingredients Market will experience a shift in one trending type, which is the plant-based products.. Healthy and being conscious of the environment has been on the rise thus changes its consumers preference to vegetarian and vegan diets. This trend is not only affecting the consumers; however, it is affecting the food manufacturers that are adapting by introducing more plant-based products in their new products.

- Plant proteins, fibers and natural sweeteners are some of the other fashionable items being substituted for animal products.. Manufacturers are directing their efforts and money to research with the aim of improving the taste, texture and nutritional density of the plant-derived mass materials, due to increasing global demand for sustainable plant-based products. They anticipate that this trend will further contribute to market development as more people embrace a plant-based diet.

Growth in the Foodservice Sector

- •Market for bulk food ingredients is evidently a prospect within the huge food service market.. Due to increase in restaurants, cafes and catering services, there is increasing market for bulk food ingredients that could add more on the menu at cheaper prices. Purchasing departments of foodservice operators are more and more looking for high quality cost bulk ingredients to offer the quality, taste and nutritional profile expected by their customers, guaranteeing food safety and legal requirements. This shift enable the suppliers to develop new notions of ingredients that will be suitable for operators in the food service sector.on of restaurants, cafes, and catering services, there is a burgeoning demand for bulk food ingredients that can enhance menu offerings while optimizing costs. Foodservice operators are increasingly seeking high-quality bulk ingredients to meet consumer expectations for flavor and nutrition while ensuring food safety and compliance with regulations.

- This shift allows suppliers to create customized ingredient solutions tailored to the unique needs of foodservice operators. However, fused blending of bulk ingredients suppliers and foodservice providers can often spur new exciting concepts that bring a win-win situation into productive relationships. In the foodservice industry growth, market players are expected to benefit since there will always be an almost constant need for bulk ingredients.

Bulk Food Ingredients Market Segment Analysis:

- Bulk Food Ingredients Market Segmented on the basis of type and application.

By Type, Vegetable Oil segment is expected to dominate the market during the forecast period

- Out of all the segments included in the research report, the Vegetable Oil segment appears poised to dominate the market for Bulk Food Ingredients over the forecast period owing to impressive versatility of this product and demand in almost all sectors of food processing industries.. With the rising trends of healthy living, vegetable oils that can be associated with some of the most favorable fatty acid compositions and nutritional profile are replacing the other types of oils on the market. This segment is fueled by increased awareness of plant based diets and consumption of healthy cooking oils which has seen vegetable oils adopted in cooking, baking and food processing. Also, the multiple uses of vegetable oils in different applications, from dressing to baking to snacks and other food products further prop up the market.s various food processing sectors. As consumers increasingly prioritize health and wellness, vegetable oils, known for their favorable fatty acid profiles and nutritional benefits, are becoming the preferred choice for both manufacturers and consumers. This segment is bolstered by the rising trend of plant-based diets and the demand for healthier cooking oils, leading to an uptick in the use of vegetable oils in cooking, baking, and food production.

- Additionally, the versatility of vegetable oils in various culinary applications, from salad dressings to baked goods and snacks, further strengthens their market position. In the coming years, this Vegetable Oil segment is expected to expand its share more extensively due to new and improved manufacturing formulas that are currently available in the market, including cold-pressed and organic form, thus satisfying the generally healthier and safer food choices of the modern population.

By Application, Bakery & Confectionery segment expected to held the largest share

- Bakery & Confectionery segment is anticipated to be the largest and is likely to dominate the market share of Bulk Food Ingredients Market during the forecast period as the consumption of baked products and confectionery products is still very high across the world.. Due to high demands of people’s busy life, more demand of pack bakery products which results in the demand of high quality bulk ingredients. Flour, sweeteners, fats and emulsifiers are essential components in the formation of specific textures, flavours and longevity that bakery products possess, hence useful to the manufacturers.

- In addition to this, the increasing trend of luxury and gourmet bakery products as well as increased chimney and specialty bakery products are making manufactures to look for unique recipes.. As with the previous segment this segment is also becoming result of development of confectionery industry where base ingredients such as chocolate, sugar and flavon are necessary for producing vast amount of sweet products. The global bakery and confectionery market are set to remain dominated by this segment as consumer appetite for better and wider health conscience baked products emerge, underlining the sustained industry upgrades and changes.

Bulk Food Ingredients Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America was the largest consumer of Bulk Food Ingredients Market in 2023, with approximately 40% market share.. This dominance is a result of several factors that revolve around such factors as key players, food processing technologies, and food manufacturing systems. In particular, the United States plays an important role in the development of the BFK industry due to the customer credulity and high consumption on processed and convenience products. The enhanced consumer consciousness towards health and wellness has also extended the popularity for organic and natural mass concoctions in the region. In addition, development in supply chain logistics in supply and e-commerce solutions have made it easier to source bulk food ingredients for the manufacturers as well as the foodservice providers in North America.

Active Key Players in the Bulk Food Ingredients Market

- ABF Ingredients (UK)

- Archer Daniels Midland Company (USA)

- Associated British Foods PLC (UK)

- Bühler Group (Switzerland)

- Bunge Limited (USA)

- Cargill, Incorporated (USA)

- DSM Nutritional Products (Switzerland)

- DuPont de Nemours, Inc. (USA)

- Emsland Group (Germany)

- Ingredion Incorporated (USA)

- Kerry Group PLC (Ireland)

- McCormick & Company, Inc. (USA)

- Olam International (Singapore)

- SunOpta Inc. (Canada)

- Tate & Lyle PLC (UK), Other key Players.

|

Bulk Food Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 737.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 1031.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bulk Food Ingredients Market by Type (2018-2032)

4.1 Bulk Food Ingredients Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vegetable Oil

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sea Salt

4.5 Sugar & Sweeteners

4.6 Tea

4.7 Coffee & Cocoa

4.8 Flours

4.9 Processed Grains

4.10 Pulses & Cereals

4.11 Dried Fruits & Processed Nuts

4.12 Processed Herbs & Spices

Chapter 5: Bulk Food Ingredients Market by Application (2018-2032)

5.1 Bulk Food Ingredients Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bakery & Confectionery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Beverages

5.5 Meat & Poultry

5.6 Sea Food

5.7 Ready Meals

5.8 Dairy Products

5.9 Snacks & Savory

5.10 Sauces & Dressings and Condiments

5.11 Frozen Foods

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Bulk Food Ingredients Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABF INGREDIENTS (UK)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ARCHER DANIELS MIDLAND COMPANY (USA)

6.4 ASSOCIATED BRITISH FOODS PLC (UK)

6.5 BÜHLER GROUP (SWITZERLAND)

6.6 BUNGE LIMITED (USA)

6.7 CARGILL INCORPORATED (USA)

6.8 DSM NUTRITIONAL PRODUCTS (SWITZERLAND)

6.9 DUPONT DE NEMOURS INC. (USA)

6.10 EMSLAND GROUP (GERMANY)

6.11 INGREDION INCORPORATED (USA)

6.12 KERRY GROUP PLC (IRELAND)

6.13 MCCORMICK & COMPANY INC. (USA)

6.14 OLAM INTERNATIONAL (SINGAPORE)

6.15 SUNOPTA INC. (CANADA)

6.16 TATE & LYLE PLC (UK)

6.17 OTHER KEY PLAYERS.

Chapter 7: Global Bulk Food Ingredients Market By Region

7.1 Overview

7.2. North America Bulk Food Ingredients Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Vegetable Oil

7.2.4.2 Sea Salt

7.2.4.3 Sugar & Sweeteners

7.2.4.4 Tea

7.2.4.5 Coffee & Cocoa

7.2.4.6 Flours

7.2.4.7 Processed Grains

7.2.4.8 Pulses & Cereals

7.2.4.9 Dried Fruits & Processed Nuts

7.2.4.10 Processed Herbs & Spices

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Bakery & Confectionery

7.2.5.2 Beverages

7.2.5.3 Meat & Poultry

7.2.5.4 Sea Food

7.2.5.5 Ready Meals

7.2.5.6 Dairy Products

7.2.5.7 Snacks & Savory

7.2.5.8 Sauces & Dressings and Condiments

7.2.5.9 Frozen Foods

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Bulk Food Ingredients Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Vegetable Oil

7.3.4.2 Sea Salt

7.3.4.3 Sugar & Sweeteners

7.3.4.4 Tea

7.3.4.5 Coffee & Cocoa

7.3.4.6 Flours

7.3.4.7 Processed Grains

7.3.4.8 Pulses & Cereals

7.3.4.9 Dried Fruits & Processed Nuts

7.3.4.10 Processed Herbs & Spices

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Bakery & Confectionery

7.3.5.2 Beverages

7.3.5.3 Meat & Poultry

7.3.5.4 Sea Food

7.3.5.5 Ready Meals

7.3.5.6 Dairy Products

7.3.5.7 Snacks & Savory

7.3.5.8 Sauces & Dressings and Condiments

7.3.5.9 Frozen Foods

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Bulk Food Ingredients Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Vegetable Oil

7.4.4.2 Sea Salt

7.4.4.3 Sugar & Sweeteners

7.4.4.4 Tea

7.4.4.5 Coffee & Cocoa

7.4.4.6 Flours

7.4.4.7 Processed Grains

7.4.4.8 Pulses & Cereals

7.4.4.9 Dried Fruits & Processed Nuts

7.4.4.10 Processed Herbs & Spices

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Bakery & Confectionery

7.4.5.2 Beverages

7.4.5.3 Meat & Poultry

7.4.5.4 Sea Food

7.4.5.5 Ready Meals

7.4.5.6 Dairy Products

7.4.5.7 Snacks & Savory

7.4.5.8 Sauces & Dressings and Condiments

7.4.5.9 Frozen Foods

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Bulk Food Ingredients Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Vegetable Oil

7.5.4.2 Sea Salt

7.5.4.3 Sugar & Sweeteners

7.5.4.4 Tea

7.5.4.5 Coffee & Cocoa

7.5.4.6 Flours

7.5.4.7 Processed Grains

7.5.4.8 Pulses & Cereals

7.5.4.9 Dried Fruits & Processed Nuts

7.5.4.10 Processed Herbs & Spices

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Bakery & Confectionery

7.5.5.2 Beverages

7.5.5.3 Meat & Poultry

7.5.5.4 Sea Food

7.5.5.5 Ready Meals

7.5.5.6 Dairy Products

7.5.5.7 Snacks & Savory

7.5.5.8 Sauces & Dressings and Condiments

7.5.5.9 Frozen Foods

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Bulk Food Ingredients Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Vegetable Oil

7.6.4.2 Sea Salt

7.6.4.3 Sugar & Sweeteners

7.6.4.4 Tea

7.6.4.5 Coffee & Cocoa

7.6.4.6 Flours

7.6.4.7 Processed Grains

7.6.4.8 Pulses & Cereals

7.6.4.9 Dried Fruits & Processed Nuts

7.6.4.10 Processed Herbs & Spices

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Bakery & Confectionery

7.6.5.2 Beverages

7.6.5.3 Meat & Poultry

7.6.5.4 Sea Food

7.6.5.5 Ready Meals

7.6.5.6 Dairy Products

7.6.5.7 Snacks & Savory

7.6.5.8 Sauces & Dressings and Condiments

7.6.5.9 Frozen Foods

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Bulk Food Ingredients Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Vegetable Oil

7.7.4.2 Sea Salt

7.7.4.3 Sugar & Sweeteners

7.7.4.4 Tea

7.7.4.5 Coffee & Cocoa

7.7.4.6 Flours

7.7.4.7 Processed Grains

7.7.4.8 Pulses & Cereals

7.7.4.9 Dried Fruits & Processed Nuts

7.7.4.10 Processed Herbs & Spices

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Bakery & Confectionery

7.7.5.2 Beverages

7.7.5.3 Meat & Poultry

7.7.5.4 Sea Food

7.7.5.5 Ready Meals

7.7.5.6 Dairy Products

7.7.5.7 Snacks & Savory

7.7.5.8 Sauces & Dressings and Condiments

7.7.5.9 Frozen Foods

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Bulk Food Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 737.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 1031.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||