Online Brand Protection Software Market Synopsis

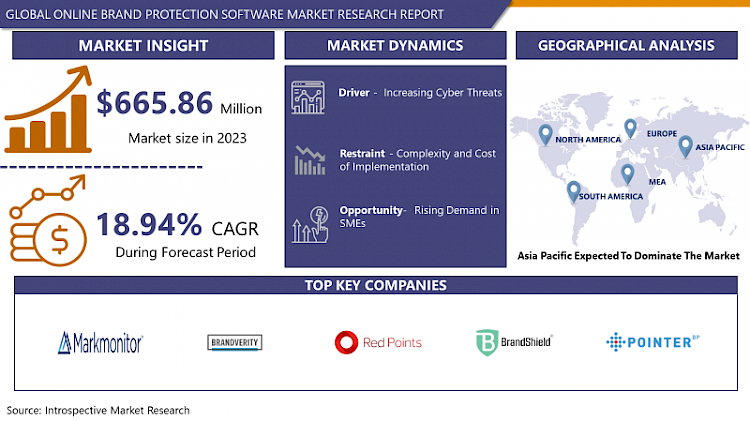

Online Brand Protection Software Market Size Was Valued at USD 665.86 Million in 2023, and is Projected to Reach USD 3172.01 Billion by 2032, Growing at a CAGR of 18.94% From 2024-2032.

The online brand protection software industry is a branch of the economy that covers the area that supplies tools and services to help safeguard brands and intellectual property assets from being misused or plagiarized on digital platforms. This program give businesses the means to detect and curb risks of brand misappropriation, counterfeiting, trademark infringement, and illegal digital activities.

Core features consist of brand watching across websites, social media, and online marketplaces, uncovering the illegal merchants, counterfeit product tracking, and the protection of intellectual property. Brand protection software online arise technologies like artificial intelligence, machine learning, big data analytics, and web crawling to identify and resolve the issues of brand integrity and reputation in the digital space proactively. The market covers a plethora of providers who provide customized services to ensure brand owners keep up with brand loyalty, trust-building with customers, and adherence to regulatory requirements in the digital environment.

- The online brand protection software market is experiencing fast track evolution, facilitated by the increased threats faced by businesses in protecting their digital assets. This market is ready for relevant growth because of the ever increasing online brand abuse such as trademark infringement, counterfeiting and use of various online platforms for distributing their content without consent. Now that digitalization is the trend all over the world, corporations are more likely to adopt robust online brand protection systems.

- Key market players are inclined towards the development and deployment of sophisticated technologies including artificial intelligence and machine learning in order to increase their offerings and cover more areas against emerging threats. The solutions provided are aimed at succesfully monitoring the online activities, detecting the risks and enforcing effectively brand policies. E-commerce transactions and the spread of social media have also made the position of online brand protection software stronger.

- Also, tightening rules as well as the introduction of more regulatory measures to combat the internet brand abuse are in turn driving organizations to invest in advanced brand protection solutions. Companies come to value brand preservation and consumer trust in the digital age more and more. Subsequently, the online brand protection software sector will celebrate a growing trend thanks to the crucial necessity of fighting online threats and preserving brand identity in the face of a fast developing digital world.

Online Brand Protection Software Market Trend Analysis

Advancements in AI-Powered Brand Protection Software

- Brand protection has been transformed by the introduction of AI and machine learning technologies into this software which allows businesses to safeguard their intellectual property and the integrity of their brand in the digital world. The use of these state-of-the-art technologies allows for an efficient monitoring and detection of infringement throughout the internet sphere, which comprises multiple platforms such as, for instance, e-commerce websites, social media, online marketplaces, and so on. AI algorithms which are capable of analyzing massive datasets can quickly detect violations related to trademarks, counterfeit production as well as misuse leading to damage to reputation and revenue of the company.

- A crucial benefit of AI-powered brand protection platforms is the provision of preemptive detection and reaction mechanisms. Conventional approaches for detecting the inconsistencies manually can consume the good deal of time but they remain reactive whereas AI backed tools can scan the various online platforms with out any delay. This ahead-of-the-curve approach empowers organizations to quickly act and mitigate the risks in an attempt to preserve the brand image so as to avoid potential losses in revenue. In addition to this, AI and machine learning technologies allow brand protection software to grow and change over time, learn different models of infringement as well as improve the precision of identifying new forms of brand abuse. Due to businesses increasingly understanding that proactive brand management in the digital realm is essential, the implementation of AI-enabled brand protection algorithms is foreseen to become a global trend in a class of their own in future.

The Digital Age Real-Time Brand Protection Evolvement.

- The online brand monitoring and response trend has recently emerged due to the fast development of digital seascapes and the high rate of online threats. In the online world that 24/7 operates on now, where social media platforms, e-commerce sites, and digital marketplaces are present, brands are at a higher risk level for issues such as trademark violations, counterfeit products, and brand impersonations. Real-time monitoring solutions built on modern brand protection techniques, powered by technologies, enable online activities to be tracked and monitored immediately. Continuously scanning through vast quantities of data, these solutions can instantly detect unauthorized usage and flag intellectual property violations as they unfold, so that businesses can quickly react.

- The focus on real-time monitoring and response bring to a light the brand management strategy shift to a reactive way in face of the ever-changing digital challenges. Nowadays, brand protection is not easy with traditional methods which mainly rely on auditing and manual checks to be done at periodic intervals. The real-time monitoring capabilities are an invaluable tool that brands use in order to anticipate and mitigate threats quickly, thus being able to protect their reputation and liquidity. This trend shows that the companies understand the necessity for such brand protection that can be adjusted to the continuous change while they operate on the Internet. The growth of brand protection will increasingly depend on real-time monitoring and responsiveness since brand protection software developers will aim at helping businesses overcome technological challenges with certainty and resilience.

Online Brand Protection Software Market Segment Analysis:

Online Brand Protection Software Market is Segmented based on Deployment Type, Software Type and End User.

By Deployment Type, Cloud based segment is expected to dominate the market during the forecast period

- Cloud-based deployment is the preferred software solution for brand protection thanks to its scalability and accessibility; therefore, it suits both large enterprises and small and medium-sized businesses. Due to the elasticity of the cloud-based solutions, organizations are able to offer brand protection services to their increasing business volume as their operations scale up without the hardware capacity constraints. It is especially beneficial for entities with multiple brand portfolios and SMEs who seek to operate their intellectual property more efficiently while saving upfront costs in infrastructure.

- Through cloud-based brand protection software, businesses both big and small have the flexibility and affordability to implement it. On-premise hardware and maintenance costs are all eliminated by cloud-based solutions, which not only lessen the IT overhead but also allow organizations to manage their resources more efficiently. The fact that cloud-based platforms are available to their users, enables these users to monitor brands, implement compliance, and detect infringements in real-time from anywhere, helping with the collaboration across distributed teams and ensuring a rapid response to brand threats without regard to geographical location. Hence, this democratization of the cutting-edge brand protection technology not only makes it possible for businesses to protect their brands successfully but also enables them to optimize the operational efficiency.

By End User, Enterprises segment held the largest share in 2023

- Enterprises, in particular, are at the forefront of the business adoption of brand protection software, which is due to several main reasons. Big companies usually have big portfolios of brands and strong presence on different markets, and therefore have an easy target for brand misuse and counterfeit activity, as well as intellectual property infringement.

- Brand protection software is deployed by companies with the aim of defending their valuable brands and even maintaining consumer trust by providing solutions that offer comprehensive surveillance and enforcement. With the help of these devices, enterprises can monitor the mentions of their brand in different digital channels, reveal copyright violations and trademarks misuse and respond quickly to different cases of brand infringement. Utilizing cutting-edge technologies such as machine learning and AI, enterprises acquire the ability to predict and promptly resolve brand integrity breaches and reduce the consequence of illicit acts on their name and profit.

- Furthermore, the legislation related to brand security is another factor for businesses to be employing cutting-edge software technologies. Adherence to intellectual property rights, trademark laws, and industry rules is a must for large international companies.

- Brand protection software not only empowers organizations to identify and tackle the risks related to fake products but also guarantees compliance with regulations on branding within their circle of distribution. It is not just a protective tool but also has positive impact on the brand’s image and helps it become more competitive. With brand integrity and risk management as key aspects, more enterprises will keep looking for software solutions with regard to brand protection that suit their specific needs and therefore the dominant position of this market segment is likely to be not affected any time soon.

Online Brand Protection Software Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- For the Asia-Pacific region, especially China, India, and Japan, the online brand protection software market holds a leading position thanks to several main factors. Counterfeit goods and intellectual property infringement, two major issues that China is confronting given its status as one of the biggest e-commerce markets worldwide. As an outcome, a big demand for the most innovative solutions of brand protection has emerged which are able to observe online platforms, detect the unauthorized dealers, and fight against the fraudulent activities efficiently. The fast increases of online payment systems and social media platforms in China increase the demand for brand monitoring tools which are comprehensive in order to maintain the brand reputation and the consumer trust.

- In India, online businesses are growing rapidly amidst a large population that is becoming increasingly internet-savvy. At the same time, this presents a fertile ground for abuse and new risks in the digital space. Through policymaking such as 'Digital India' and 'Make in India', the government is striving for protecting intellectual property rights and battling internet piracy. The result is the widespread use of online brand protection software by national and foreign brands in an Indian e-commerce startup environment which is constantly evolving. Also in Japan, the technologically most advanced market, the focus on protecting the brands and intellectual property rights is essential. Rising cross-border e-commerce activities are causing Japanese corporate brands to be vulnerable to global counterfeiters which require them to set up robust brand protection. Subsequently, this trend does not lose momentum in the Asia-Pacific region and continues to observe the sharp growth of investments in online brand protection software as well as innovations that take on the emerging issues of the digital economy.

Active Key Players in the Online Brand Protection Software Market

- BrandVerity

- MarkMonitor

- Red Points

- BrandShield

- BrandWatch

- Pointer Brand Protection

- Incopro

- Corsearch

- Appdetex

- Yellow Brand Protection

- Other Key Players

|

Global Online Brand Protection Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 665.86 Mn. |

|

Forecast Period 2024-32 CAGR: |

18.94% |

Market Size in 2032: |

USD 3172.01 Mn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Software Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

BrandVerity , MarkMonitor, Red Points, BrandShield, BrandWatch, Pointer Brand Protection, Incopro,Corsearch, Appdetex, Yellow Brand Protection and Other Major Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ONLINE BRAND PROTECTION SOFTWARE MARKET BY DEPLOYMENT TYPE (2017-2032)

- ONLINE BRAND PROTECTION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISES

- ONLINE BRAND PROTECTION SOFTWARE MARKET BY SOFTWARE TYPE 2017-2032)

- ONLINE BRAND PROTECTION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BRAND MONITORING AND ANALYTICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BRAND COMPLIANCE AND ENFORCEMENT

- COUNTERFEIT DETECTION

- TRADEMARK

- COPYRIGHT PROTECTION

- ONLINE BRAND PROTECTION SOFTWARE MARKET BY END-USER(2017-2032)

- ONLINE BRAND PROTECTION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

- GOVERNMENT

- NGOS.

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- ONLINE BRAND PROTECTION SOFTWARE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BRANDVERITY

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MARKMONITOR

- RED POINTS

- BRANDSHIELD

- BRANDWATCH

- POINTER BRAND PROTECTION

- INCOPRO

- CORSEARCH

- APPDETEX

- YELLOW BRAND PROTECTION

- COMPETITIVE LANDSCAPE

- GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Deployment Type

- Historic And Forecasted Market Size By Software Type

- Historic And Forecasted Market Size By End-USer

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Online Brand Protection Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 665.86 Mn. |

|

Forecast Period 2024-32 CAGR: |

18.94% |

Market Size in 2032: |

USD 3172.01 Mn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Software Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

BrandVerity , MarkMonitor, Red Points, BrandShield, BrandWatch, Pointer Brand Protection, Incopro,Corsearch, Appdetex, Yellow Brand Protection and Other Major Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ONLINE BRAND PROTECTION SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ONLINE BRAND PROTECTION SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ONLINE BRAND PROTECTION SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. ONLINE BRAND PROTECTION SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ONLINE BRAND PROTECTION SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. ONLINE BRAND PROTECTION SOFTWARE MARKET BY TYPE

TABLE 008. CLOUD-BASED MARKET OVERVIEW (2016-2028)

TABLE 009. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 010. ONLINE BRAND PROTECTION SOFTWARE MARKET BY APPLICATION

TABLE 011. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 012. SMALL & MEDIUM-SIZED ENTERPRISES (SMES) MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA ONLINE BRAND PROTECTION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA ONLINE BRAND PROTECTION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 015. N ONLINE BRAND PROTECTION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE ONLINE BRAND PROTECTION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE ONLINE BRAND PROTECTION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 018. ONLINE BRAND PROTECTION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC ONLINE BRAND PROTECTION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC ONLINE BRAND PROTECTION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 021. ONLINE BRAND PROTECTION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA ONLINE BRAND PROTECTION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA ONLINE BRAND PROTECTION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 024. ONLINE BRAND PROTECTION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA ONLINE BRAND PROTECTION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA ONLINE BRAND PROTECTION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 027. ONLINE BRAND PROTECTION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 028. MARKMONITOR: SNAPSHOT

TABLE 029. MARKMONITOR: BUSINESS PERFORMANCE

TABLE 030. MARKMONITOR: PRODUCT PORTFOLIO

TABLE 031. MARKMONITOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. RESOLVER: SNAPSHOT

TABLE 032. RESOLVER: BUSINESS PERFORMANCE

TABLE 033. RESOLVER: PRODUCT PORTFOLIO

TABLE 034. RESOLVER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. BRANDSHIELD: SNAPSHOT

TABLE 035. BRANDSHIELD: BUSINESS PERFORMANCE

TABLE 036. BRANDSHIELD: PRODUCT PORTFOLIO

TABLE 037. BRANDSHIELD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. PHISHLABS: SNAPSHOT

TABLE 038. PHISHLABS: BUSINESS PERFORMANCE

TABLE 039. PHISHLABS: PRODUCT PORTFOLIO

TABLE 040. PHISHLABS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BRANDVERITY: SNAPSHOT

TABLE 041. BRANDVERITY: BUSINESS PERFORMANCE

TABLE 042. BRANDVERITY: PRODUCT PORTFOLIO

TABLE 043. BRANDVERITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. APPDETEX: SNAPSHOT

TABLE 044. APPDETEX: BUSINESS PERFORMANCE

TABLE 045. APPDETEX: PRODUCT PORTFOLIO

TABLE 046. APPDETEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. HUBSTREAM: SNAPSHOT

TABLE 047. HUBSTREAM: BUSINESS PERFORMANCE

TABLE 048. HUBSTREAM: PRODUCT PORTFOLIO

TABLE 049. HUBSTREAM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. NUMERATOR: SNAPSHOT

TABLE 050. NUMERATOR: BUSINESS PERFORMANCE

TABLE 051. NUMERATOR: PRODUCT PORTFOLIO

TABLE 052. NUMERATOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. POINTER BRAND PROTECTION: SNAPSHOT

TABLE 053. POINTER BRAND PROTECTION: BUSINESS PERFORMANCE

TABLE 054. POINTER BRAND PROTECTION: PRODUCT PORTFOLIO

TABLE 055. POINTER BRAND PROTECTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. RED POINTS SOLUTIONS: SNAPSHOT

TABLE 056. RED POINTS SOLUTIONS: BUSINESS PERFORMANCE

TABLE 057. RED POINTS SOLUTIONS: PRODUCT PORTFOLIO

TABLE 058. RED POINTS SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. RUVIXX: SNAPSHOT

TABLE 059. RUVIXX: BUSINESS PERFORMANCE

TABLE 060. RUVIXX: PRODUCT PORTFOLIO

TABLE 061. RUVIXX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. CUSTODIAN SOLUTIONS: SNAPSHOT

TABLE 062. CUSTODIAN SOLUTIONS: BUSINESS PERFORMANCE

TABLE 063. CUSTODIAN SOLUTIONS: PRODUCT PORTFOLIO

TABLE 064. CUSTODIAN SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ENABLON: SNAPSHOT

TABLE 065. ENABLON: BUSINESS PERFORMANCE

TABLE 066. ENABLON: PRODUCT PORTFOLIO

TABLE 067. ENABLON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. INCOPRO: SNAPSHOT

TABLE 068. INCOPRO: BUSINESS PERFORMANCE

TABLE 069. INCOPRO: PRODUCT PORTFOLIO

TABLE 070. INCOPRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SCOUT: SNAPSHOT

TABLE 071. SCOUT: BUSINESS PERFORMANCE

TABLE 072. SCOUT: PRODUCT PORTFOLIO

TABLE 073. SCOUT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. OPTEL (VERIFY BRAND): SNAPSHOT

TABLE 074. OPTEL (VERIFY BRAND): BUSINESS PERFORMANCE

TABLE 075. OPTEL (VERIFY BRAND): PRODUCT PORTFOLIO

TABLE 076. OPTEL (VERIFY BRAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. INTELLICRED: SNAPSHOT

TABLE 077. INTELLICRED: BUSINESS PERFORMANCE

TABLE 078. INTELLICRED: PRODUCT PORTFOLIO

TABLE 079. INTELLICRED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. CSC: SNAPSHOT

TABLE 080. CSC: BUSINESS PERFORMANCE

TABLE 081. CSC: PRODUCT PORTFOLIO

TABLE 082. CSC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. CLOUD-BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 014. ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 015. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 016. SMALL & MEDIUM-SIZED ENTERPRISES (SMES) MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA ONLINE BRAND PROTECTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Online Brand Protection Software Market research report is 2024-2032.

BrandVerity, MarkMonitor, Red Points, BrandShield, BrandWatch, Pointer Brand Protection, Incopro, Corsearch, Appdetex, Yellow Brand Protection and Other Major Players.

The Online Brand Protection Software Market is segmented into By Deployment Type, By Software Type, By End User, and region. By Deployment Type, the market is categorized into Cloud-based and On-premises. By Software Type, the market is categorized into Brand Monitoring and Analytics, Brand Compliance and Enforcement, Counterfeit Detection, Trademark and Copyright Protection, and others. By End User, the market is categorized into Enterprises, SMEs (Small and Medium-sized Enterprises ), Government and NGOs, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The online brand protection software market refers to the industry segment focused on providing solutions and services designed to safeguard brands and intellectual property (IP) assets across digital platforms. This software helps organizations monitor and mitigate risks associated with brand misuse, counterfeiting, trademark infringement, and unauthorized digital activities. Key functionalities include brand monitoring across websites, social media, and online marketplaces, detecting unauthorized sellers, tracking counterfeit products, and enforcing intellectual property rights. Online brand protection software leverages technologies such as AI, machine learning, big data analytics, and web crawling to proactively identify and address potential threats to brand integrity and reputation in the digital space. The market encompasses a range of vendors offering tailored solutions to support brand owners in maintaining brand trust, customer loyalty, and regulatory compliance in the online environment.

Online Brand Protection Software Market Size Was Valued at USD 665.86 Million in 2023, and is Projected to Reach USD 3172.01 Billion by 2032, Growing at a CAGR of 18.94% From 2024-2032.