Bitcoin Technology Market Synopsis

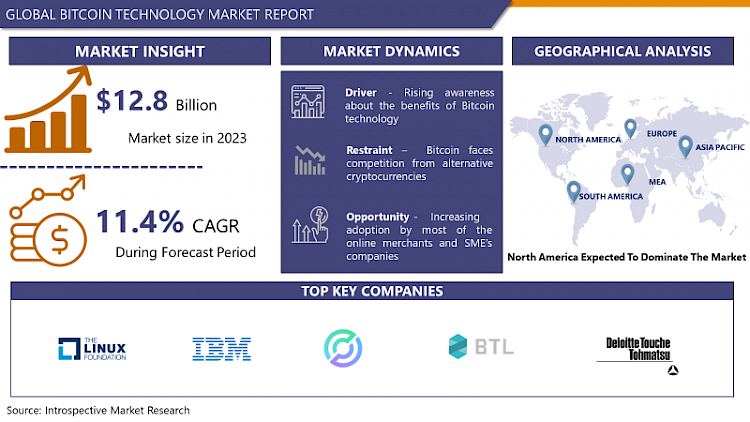

Bitcoin Technology Market Size Was Valued at USD 12.8 Billion in 2023 and is Projected to Reach USD 33.8 Billion by 2032, Growing at a CAGR of 11.4% From 2024-2032.

Bitcoin technology is the indispensable foundation of the Bitcoin network's blockchain structure and comprises the generation, distribution, and storage of the virtual cryptocurrency – Bitcoin The Bitcoin network is built on the basic principles of the distributed and P2P (peer-to-peer) network, cryptographic operations and consensus as a process.

- For cryptocurrencies, an investment is also meant for appreciation of their value soon. It's like a sort of future bet. As these sites develop there are even a handful of betting platforms that accept Bitcoins as payment. These platforms include the likes of SatoshiDice, RoyalBitcoin, Bitzino, and the Steem betting platform. Bitcoins are currently being adopted widely for online payments for the reason that there is a great surge in the number of merchants using this form of digital currency. Bitcoin wallet applications are nowadays apps on smartphones that help users make cryptocurrency transactions. The competitive advantage, however, is the fact that the cutting wire remittance does not require any personal data to be sent. Users are tiptoed from the troubles that come along with giving their identity information as a result of this attribute.

- Bitcoin is a digital 'cash' that works on distributed technology and does not require banks any personal identification to store transactions securely. It uses the technology called blockchain, which can be accessed by anyone. It stores only one ledger and it is continuously updated and open to all participants of the system. The bitcoins are saved in an encrypted fashion in the device or the cloud and can be accessed via the digital wallet. Compared to the traditional bank account, the wallet performs a similar role in the interplay, which means you can transfer or get bitcoins, store the funds, or make a purchase.

- As growing percentages of businesses are using bitcoins to buy stuff, there is an increase in the trend of using bitcoins to buy services and goods. Bitcoin transactions give a degree of privatization that can be adjusted at the user's preference; they are followed, however, among other cryptocurrencies. In this joint, bitcoins are used for effectingless transactions that are not face-to-face. Consequently, international payments are hassle-free owing to the non-governance which is not country-limited Bitcoins greatly reducing the transfer charges for individuals, governments, and businesses. A free person shall be allowed to do the business he/she considers, without any involvement of the government, unless with permission. Bitcoin uses robust cryptographic methods such as fairness and sheer complexity.

Bitcoin Technology Market Trend Analysis

The escalating prevalence of digital currency

- The soaring reputation of Bitcoin around the globe is fueled by the global market for Bitcoin technology that expands along with the scale of the digital currency. Furthermore, both the growth and sustainability of the market are also supported by the vibrant economies together with an increase in disposable income across the emerging countries' growing middle-income populace. However, restrictions and security questions that occur in several nations can be considered major problems that limit access to the global space market. However, as the majority of online vendors accept Bitcoin by default and the community awareness of its efficacy is growing, it creates opportunities for the market to expand further.

Advancements in Bitcoin's underlying technology

- While Bitcoin technology is all about the main ideals behind it, namely better scalability, security, and usability, factors crucial for its wider adoption and higher profits, the further development of these ideas may go a long way toward the growth of the market and demand.

- Thus, virtual currencies such as Bitcoin have had to implement scalability innovations to increase the capacity of transaction processing and improve the network's ability to handle this increased volume of transactions with more efficiency.

- Along with this aspect it unlocks the third-party use for Bitcoin, raises its popularity as currency for everyday transactions, and, what is especially important, provides cheaper, faster transactions for both enterprises and individuals. Moreover, robust security methods enhance the level of trust in the integrity of the network, thus minimizing the possibilities of unethical acts like fraud or cyber hacking, thus bringing more users and investors on board.

- On the other hand, the inclusion of modern usability such as easily adaptable payment systems and user-friendly instructions also goes a long way in making the process of networking attractive to the customers which in turn attracts other customers to join the internetwork. In general, these technological innovations inevitably not only reinvigorate Bitcoin technology but also play an instrumental role in spurring acceptance and application to the transaction network, hence increasing the demand and market growth.

Bitcoin Technology Market Segment Analysis:

Bitcoin Technology Market is Segmented based on services and vertical.

The services, Payment, and Wallet segment is expected to dominate the market during the forecast period

Bitcoin Payment & Wallets: Bitcoin wallets are places to keep your bitcoins. They are like banks, except they are unregulated. In the Bitcoin ecosystem, each holder of a token has a private key that points to the wallet's Bitcoin address. Bitcoin wallet is used as a confrontation means between Bitcoin being transferred and changing the position of the user's Bitcoin balance. A variety of four Bitcoin wallets are currently accessible: different design patterns like desktop, mobile, web, and hardware. No doubt usability has become a vital precondition of the gaining momentum of the segment Payment and Wallets, going at a CAGR of 6% through 2026.

By Vertical, the BFSI segment held the largest share in 2023

- The market is divided into the following verticals: We would have to deal with more financial services (BFSI), online retail too (E-Commerce), media and entertainment, as well as hospitality.

- For 2032 the BFSI segment has been forecast to have the expected market boom. One of the cashless transactions is bitcoin which is the most advantageous method of sending and receiving funds than some nation's domestic currencies, which services the public in fast, cheap, safe, and not-so-volatile.

- Such digital currencies serve stakeholders in both these nations as well as in and around the globe by storing values and facilitating transactions for a broad array of goods and services on the Internet and elsewhere. Bitcoin overcomes this problem with the ability to eliminate intermediaries by enabling the fund to transfer directly to the other party, therefore saving both parties time, effort, and money.

- This is a case where it can be seen that the technology of the cryptocurrency of Bitcoin will simply transform work in financial markets and provide an opportunity to use many other financial services. In this matter, banks are in favor of shortening the costs of transactions and replacing paperwork with new technologies. Through Bitcoin, the processing costs for financial institutions could be reduced on a vast scale, so that substantial totals in billions would no longer be needed.

Bitcoin Technology Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- As per the forecast, North Americans will retain their dominance in the Global Bitcoin technology market throughout the decade 2024-2032. By 2032, North America may own the top shelf due to having the greatest market share. In the case of bitcoin mining, North America is one of the regions that are expanding at a fast pace, and the increase is also a boom town for merchants and service providers that operate in that area. Leading between all its online bitcoin-using cashiers, justifying North America, Newegg concludes Canadian customers can use bitcoin as a currency. It has been predicted that this strategy will lead to a fiat currency swap among consumers hence increasing their demand for bitcoin.

- Plouton Mining, in June 2022, boasted of its plan to set up the most massive and the only solar-powered Bitcoin mining facility in North America and, as so, enhance people's participation in the lucrative Bitcoin economy at a low cost and in a greenway. Coin ATM Radar found out that in 2022, the US had the most bitcoin ATMs (3,229 locations) and the second was Canada: (687 locations, by May 2022). The volume of electronic currency buying and selling on the continent, however, is shown. Considered the main reason for the growth of this region provided that the cited factors will facilitate the expansion of the particular area on the global market in the period of forecast 2023-2029.

Active Key Players in the Bitcoin Technology Market

- The Linux Foundation

- IBM Corporation

- Circle Internet Financial Limited

- BTL Group Ltd.

- DeloitteTouche Tohmatsu Limited

- Global Arena Holding, Inc.

- Digital Asset Holdings, LLC

- Chain, Inc.

- Monax

- Microsoft Corporation

- Other Key Players

Key Industry Developments in the Bitcoin Technology Market:

- Fidelity has come out with a provision to the US 401(k) retirement plan holders allowing the participants to invest up to 20% in Bitcoin (BTC) effective starting in September 2022. The financial service company thinks that Bitcoin is for the time to come’s blockchain technology more likely an investment for a long time. This $100 million commitment will become available by mid-2022 through which Fidelity now controls around 23,000 employer-sponsored retirement plans.

- In August 2022, Kenanga Investment Bank and the Ant Group tech giant formed a partnership to digitalize the financial sector by using applications within the crypto space. The app aims to consolidate several financial services including stock trading, digital investment management, cryptocurrency trading, digital wallet, foreign currency, etc., in a single platform. This will lead to the evolution of how wealth management is handled in Malaysia.

|

Global Bitcoin Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.4 % |

Market Size in 2032: |

USD 33.8 Bn. |

|

Segments Covered: |

By Services |

|

|

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BITCOIN TECHNOLOGY MARKET BY SERVICES (2017-2032)

- BITCOIN TECHNOLOGY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EXCHANGES REMITTANCE SERVICES PAYMENT

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WALLET

- BITCOIN TECHNOLOGY MARKET BY VERTICAL (2017-2032)

- BITCOIN TECHNOLOGY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- E-COMMERCE MEDIA AND ENTERTAINMENT

- HOSPITALITY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BITCOIN TECHNOLOGY Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- THE LINUX FOUNDATION

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- IBM CORPORATION

- CIRCLE INTERNET FINANCIAL LIMITED

- BTL GROUP LTD.

- DELOITTETOUCHE TOHMATSU LIMITED

- GLOBAL ARENA HOLDING, INC.

- DIGITAL ASSET HOLDINGS, LLC

- CHAIN, INC.

- MONAX

- MICROSOFT CORPORATION

- COMPETITIVE LANDSCAPE

- GLOBAL BITCOIN TECHNOLOGY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Services

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Bitcoin Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.4 % |

Market Size in 2032: |

USD 33.8 Bn. |

|

Segments Covered: |

By Services |

|

|

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BITCOIN TECHNOLOGY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BITCOIN TECHNOLOGY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BITCOIN TECHNOLOGY MARKET COMPETITIVE RIVALRY

TABLE 005. BITCOIN TECHNOLOGY MARKET THREAT OF NEW ENTRANTS

TABLE 006. BITCOIN TECHNOLOGY MARKET THREAT OF SUBSTITUTES

TABLE 007. BITCOIN TECHNOLOGY MARKET BY TYPE

TABLE 008. EXCHANGES MARKET OVERVIEW (2016-2028)

TABLE 009. REMITTANCE SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. PAYMENT MARKET OVERVIEW (2016-2028)

TABLE 011. WALLET MARKET OVERVIEW (2016-2028)

TABLE 012. BITCOIN TECHNOLOGY MARKET BY APPLICATION

TABLE 013. E-COMMERCE MARKET OVERVIEW (2016-2028)

TABLE 014. ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 015. HOSPITALITY MARKET OVERVIEW (2016-2028)

TABLE 016. BFSI MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA BITCOIN TECHNOLOGY MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA BITCOIN TECHNOLOGY MARKET, BY APPLICATION (2016-2028)

TABLE 020. N BITCOIN TECHNOLOGY MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE BITCOIN TECHNOLOGY MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE BITCOIN TECHNOLOGY MARKET, BY APPLICATION (2016-2028)

TABLE 023. BITCOIN TECHNOLOGY MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC BITCOIN TECHNOLOGY MARKET, BY TYPE (2016-2028)

TABLE 025. ASIA PACIFIC BITCOIN TECHNOLOGY MARKET, BY APPLICATION (2016-2028)

TABLE 026. BITCOIN TECHNOLOGY MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA BITCOIN TECHNOLOGY MARKET, BY TYPE (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA BITCOIN TECHNOLOGY MARKET, BY APPLICATION (2016-2028)

TABLE 029. BITCOIN TECHNOLOGY MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA BITCOIN TECHNOLOGY MARKET, BY TYPE (2016-2028)

TABLE 031. SOUTH AMERICA BITCOIN TECHNOLOGY MARKET, BY APPLICATION (2016-2028)

TABLE 032. BITCOIN TECHNOLOGY MARKET, BY COUNTRY (2016-2028)

TABLE 033. BLOCKSTREAM: SNAPSHOT

TABLE 034. BLOCKSTREAM: BUSINESS PERFORMANCE

TABLE 035. BLOCKSTREAM: PRODUCT PORTFOLIO

TABLE 036. BLOCKSTREAM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. COINBASE: SNAPSHOT

TABLE 037. COINBASE: BUSINESS PERFORMANCE

TABLE 038. COINBASE: PRODUCT PORTFOLIO

TABLE 039. COINBASE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. COINIFY: SNAPSHOT

TABLE 040. COINIFY: BUSINESS PERFORMANCE

TABLE 041. COINIFY: PRODUCT PORTFOLIO

TABLE 042. COINIFY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. GOCOIN: SNAPSHOT

TABLE 043. GOCOIN: BUSINESS PERFORMANCE

TABLE 044. GOCOIN: PRODUCT PORTFOLIO

TABLE 045. GOCOIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. FACTOM: SNAPSHOT

TABLE 046. FACTOM: BUSINESS PERFORMANCE

TABLE 047. FACTOM: PRODUCT PORTFOLIO

TABLE 048. FACTOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. UNOCOIN: SNAPSHOT

TABLE 049. UNOCOIN: BUSINESS PERFORMANCE

TABLE 050. UNOCOIN: PRODUCT PORTFOLIO

TABLE 051. UNOCOIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BITSTAMP: SNAPSHOT

TABLE 052. BITSTAMP: BUSINESS PERFORMANCE

TABLE 053. BITSTAMP: PRODUCT PORTFOLIO

TABLE 054. BITSTAMP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. BITFINEX: SNAPSHOT

TABLE 055. BITFINEX: BUSINESS PERFORMANCE

TABLE 056. BITFINEX: PRODUCT PORTFOLIO

TABLE 057. BITFINEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ITBIT: SNAPSHOT

TABLE 058. ITBIT: BUSINESS PERFORMANCE

TABLE 059. ITBIT: PRODUCT PORTFOLIO

TABLE 060. ITBIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. BLOCKCYPHER: SNAPSHOT

TABLE 061. BLOCKCYPHER: BUSINESS PERFORMANCE

TABLE 062. BLOCKCYPHER: PRODUCT PORTFOLIO

TABLE 063. BLOCKCYPHER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 064. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 065. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 066. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BITCOIN TECHNOLOGY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BITCOIN TECHNOLOGY MARKET OVERVIEW BY TYPE

FIGURE 012. EXCHANGES MARKET OVERVIEW (2016-2028)

FIGURE 013. REMITTANCE SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. PAYMENT MARKET OVERVIEW (2016-2028)

FIGURE 015. WALLET MARKET OVERVIEW (2016-2028)

FIGURE 016. BITCOIN TECHNOLOGY MARKET OVERVIEW BY APPLICATION

FIGURE 017. E-COMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 018. ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 019. HOSPITALITY MARKET OVERVIEW (2016-2028)

FIGURE 020. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA BITCOIN TECHNOLOGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE BITCOIN TECHNOLOGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC BITCOIN TECHNOLOGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA BITCOIN TECHNOLOGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA BITCOIN TECHNOLOGY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Bitcoin Technology Market research report is 2024-2032.

The Linux Foundation, IBM Corporation, Circle Internet Financial Limited, BTL Group Ltd., DeloitteTouche Tohmatsu Limited, Global Arena Holding, Inc., Digital Asset Holdings, LLC, Chain, Inc., Monax, Microsoft Corporation, and Other Major Players..

The Bitcoin Technology Market is segmented into services, verticals, and regions. By services, the market is categorized into Exchanges Remittance Services Payment, and Wallet. By vertical, the market is categorized into BFSI E-Commerce Media & Entertainment Hospitality. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Bitcoin is an anonymous digital currency that stores and conducts secure transactions using decentralized technology; no bank or individual identification is required. It operates on a publicly accessible ledger known as a blockchain. It maintains a decentralized ledger of all transactions, which is continually updated and accessible to all network users. Bitcoins are stored in an encrypted format in a "digital wallet" on a user's device or in the cloud. A wallet functions in a manner akin to a digital bank account, enabling users to conduct transactions, transfer bitcoins, or store their funds.

Bitcoin Technology Market Size Was Valued at USD 12.8 Billion in 2023 and is Projected to Reach USD 33.8 Billion by 2032, Growing at a CAGR of 11.4% From 2024-2032.