Global Biofertilizers Market Overview

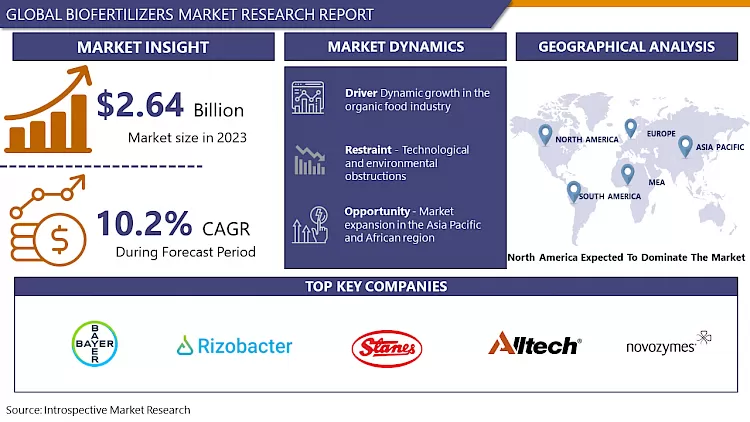

The Global Biofertilizers Market size is expected to grow from USD 2.64 billion in 2023 to USD 6.34 billion by 2032, at a CAGR of 10.2% during the forecast period (2024-2032).

Biofertilizers can be defined as biological products containing living microorganisms that, when applied to seed, plant surfaces, or soil, help in promoting growth. It promotes development of plants by increasing the uptake of nutrients, root biomass or root area. Biofertilizers are also crucial in mitigating the hazards that are arising from the increasing demand of the global population for food and also from the widely spread chemicalization in agroecosystems. The application of biofertilizers in amplifying productivity and quality of agricultural products has already been proven as a key factor that induces growth of the Biofertilizer market. The rise in usage of microbes in biofertilizers for sustainable farming methods and food safety is another major factor that is estimated to boost the global biofertilizer market growth. Furthermore, a rise in the concern related to food safety, an increase in soil and water pollution due to excessive usage of chemical fertilizers, and a rise in support from government bodies through the launch of new programs to spread awareness about their benefits will propel the biofertilizers market growth in the projected period.

Market Dynamics And Factors For Biofertilizers Market

Drivers:

Dynamic growth in the organic food industry.

Individuals nowadays are more concern about health, environmental issues, and the amount of chemical fertilizers utilized while growing crops. This sudden rise in awareness has induced consumers to prefer chemical-free food products. As a result, major supermarket chains such as Cosco and Walmart are thereby increasing their product offerings of organic foods instead of chemical-rich food. In addition, the restaurant and caterer industry in many economic countries are also switching to organic food menus with great taste and quality to serve health-conscious consumers. The growth in the organic food industry is stimulating the demand for organic manures and biofertilizers as they are the essential prerequisites of organic farming. Such a rise in demand for healthy organic food products is the major factor that drives the biofertilizer market growth. Also, these factors have brought a gradual increase in organic retail sales in many countries, such as the US, Switzerland, China, Germany, and Denmark.

Restraints:

Technological and environmental obstructions.

Biofertilizer products have a very limited shelf-life and they run a high risk of contamination. The microorganisms that are being used as biofertilizers become non-viable when exposed to sudden high temperatures. Henceforth, it is very important to store them in a dry and cool place. The major problem that arises in the agricultural inoculation technology is the survival of microorganisms during storage which may hamper the growth of the biofertilizers market. The culture medium, dehydration process, physiological state of the microorganisms when harvested, the rate of drying, the water activity of inoculants, and temperature maintenance during storage are the other major factors that hinder the market growth. These challenges impact the shelf-life of microbes. In addition, less availability of R&D and testing labs are also affecting the growth of the biofertilizers market.

Opportunity:

Market expansion in the Asia Pacific and African region.

The African and Asia Pacific regions are the highest consumers of fertilizers. The growing rate of population, especially in Asia, has resulted in the rising demand for food, which would, in turn, lead to the rapid growth and increased consumption of fertilizers. However, the major concerns that affected the market growth in this region are contamination of soils and pollution, and their adverse effects on a human being. To counter the harmful effects of such chemical fertilizers, governments in these regions are asserting the use of environmental-friendly fertilizers, such as organic manures and biofertilizers. Key players in the agricultural sector have already started to invest in software technologies and biotechnology in emerging markets of the Asia Pacific region. Thus, there is an emerging opportunity to expand the biofertilizer market in the Asia Pacific and African region in the forecasted years.

Challenges:

Lack of adoption and awareness of biofertilizers

The lack of awareness and low adoption rate in farmers about biofertilizers in many developing and underdeveloped countries is creating an immense challenge for the market. Farmers prefer using chemical fertilizers, as they are easy to understand and handle. This can be attributed to a lack of information and training for the farmers. Furthermore, the established nature of the chemical fertilizers market also leads to the slow adoption of biofertilizers, as many conventional fertilizer companies have a strong distribution network and they hold a wide range of product offerings. Moreover, there is a lack of awareness about various brands, as the market is highly fragmented. This lack of knowledge is creating confusion among farmers and leads to the slow adoption and slower growth of the biofertilizer market.

Segmentation Analysis Of Biofertilizers Market

By form, the market for the liquid segment is estimated to hold the largest share during the forecasted period. Liquid biofertilizer technology is taken into consideration as an alternative to carrier-based biofertilizers. Liquid biofertilizers are specially formulated and they contain desired microorganisms as well as substances that can support the storage conditions of resting cysts and spores for longer shelf-life. Owing to better tolerance limits for adverse conditions, this segment is estimated to hold the largest shares.

By product type, the nitrogen-fixing microbe segment is projected to dominate the biofertilizer market in the upcoming years. Nitrogen is utilized by plants to synthesize amino acids, nucleic acids, vitamins, and other nitrogenous compounds. They help in transforming nitrogen into organic compounds which thereby leads to the high market growth of the biofertilizer market.

By application, the seed treatment segment is projected to dominate the biofertilizer market during the forecast period. In seed treatment, biofertilizers such as Azotobacter, Rhizobium, and Azospirillum are applied as coatings on seeds as it is generally effective and easy under most conditions. This common and widely used method of applying biofertilizers drives the market growth for the seed treatment segment.

Regional Analysis Of Biofertilizers Market

North America is projected to dominate the market owing to the increasing acceptance of biofertilizers among rural farmers, rising demand for organic products, and high adoption of advanced irrigation systems such as sprinkler and drip irrigation for fertigation. A strict and significant regulatory environment in addition to an increasing preference for the usage of biofertilizer products has led to the rapid growth of the biofertilizer market in the North American region. Urbanization, mining, and industrialization have led to a decrease in arable land in the North American region. Along with the rapidly growing trend of practicing organic harvesting in the country, the U.S. population also adopted and increased the sale of organic food products.

Asia Pacific region is expected to grow significantly in the upcoming years. Agricultural growth in India, China, and Brazil due to the rising demand for food, backed by government initiatives and incentive structures, is estimated to reflect positive growth trends in the projected years. Rising demand for these products which is associated with increased awareness of the hazardous nature of chemicals is expected to propel market growth in the Asia Pacific region. Hostile response from consumers toward the use of chemical products to avoid environmental hazards is likely to fuel the market growth of biofertilizers over the predicted years.

Germany is one of the major European markets that is expected to grow at a pace in the upcoming years. Wheat is one of the largest cultivated crops in Germany, wherein organic farmers receive a 150% premium price for their crop harvest compared to conventional growers. This trend has led to a rapid increase in the adoption of organic farming practices for all major grains & cereals and fruits & vegetables grown in the country. The largest retail market for organic produces in Europe is Germany, followed by France, Italy, and the UK, with Germany recording an average growth rate of 10%, followed by France, Italy, and the UK at 22%, 14%, and 7%, respectively. The rapid shift towards organic farming practices will fuel the market growth in the estimated period.

Covid 19 Impact Analysis On Biofertilizers Market

Owing to the Coronavirus pandemic, the Biofertilizers market faced a bump in its growth. The market was negatively affected by COVID-19. Due to the sudden COVID-19 pandemic, there has been a tremendous supply chain disruption in the market. Since the COVID-19 virus outbreak in December 2019, the disease had spread to almost 100 countries around the globe with the World Health Organization declaring it a public health emergency. The global impacts of the coronavirus disease 2019 (COVID-19) are already starting to be felt and had roughly affect the Biofertilizer market in 2020. Covid-19 has impacted the market dynamics, competition, and global supply chain. The revenues have gone down in 2020 and may resume an uptrend gradually from 2021. Companies optimizing their operation and strategy will sustain and beat the competition. A decline in business for at least three months during 2020 coupled with lower demand from a few major markets has put pressure on the profitability of Biofertilizers manufacturers and vendors. However, the negative impact of COVID-19 is expected on Biofertilizers to be compensated over the medium to long term future.

Top Key Players Covered In Biofertilizers Market

- Novozymes A/S (Denmark)

- Bayers(Germany)

- UPL Limited (India)

- Gujarat State Fertilizers & Chemicals Ltd (India)

- Rizobacter Argentina S.A. (Argentina)

- Rashtriya Chemicals & Fertilizers Limited (India)

- T. Stanes & Company Limited India

- National Fertilizers Limited (India)

- Madras Fertilizers Limited (India)

- Alltech Inc (Kentucky)

- Blacksmith BioScience (US)

- EnviroKure Liquid Organic Fertilizer (Philadelphia) and other major players.

Key Industry Development In The Biofertilizers Market

In January 2024, the Indian Biogas Association (IBA), a non-profit organization based in Haryana, announced a demand for incentives for the Biogas-Fertilizer Fund”, as a part of the Wishlist for the Union Budget, 2024. The aim of the association is to promote the use of organically grown fertilizers and accelerate the bio-compressed natural gas industry’s growth.

In December 2023, IPL Biologicals, a subsidiary based in Gurugram, Haryana, signed a memorandum of understanding (MoU) with the Gujarat Government for opening a new production facility of bio-pesticide and bio- fertilizers in the state. The MoU was signed for 4000 million and would focus on minimizing the usage of chemicals in the Agri-industry.

|

Global Biofertilizers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 -2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.64 Bn. |

|

Forecast Period 2024 -32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 6.34 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biofertilizers Market by Form (2018-2032)

4.1 Biofertilizers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Liquid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Carrier-based

Chapter 5: Biofertilizers Market by Product Type (2018-2032)

5.1 Biofertilizers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Phosphate solubilizing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Nitrogen fixation

Chapter 6: Biofertilizers Market by Application (2018-2032)

6.1 Biofertilizers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Seed treatment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Soil treatment

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biofertilizers Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 KEMIN INDUSTRIES INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PACIFIC RAINBOW INTERNATIONAL INC. (US)

7.4 KINGCHEM LLC (US)

7.5 SIGMA-ALDRICH

7.6 CO. LLC. (US)

7.7 PRINOVA GROUP LLC. (US)

7.8 PHIBRO ANIMAL HEALTH CORPORATION (USA)

7.9 ANGUS CHEMICAL COMPANY (USA)

7.10 ROCHEM INTERNATIONAL INC. (NEW YORK)

7.11 EVONIK INDUSTRIES AG (GERMANY)

7.12 TAIYO INTERNATIONAL (GERMANY)

7.13 BRENNTAG AG (GERMANY)

7.14 AZELIS S.A (EUROPE)

7.15 MYCSA AG (SWITZERLAND)

7.16 ROYAL DSM N.V. (NETHERLANDS)

7.17 SUNTHENINE BY TAIYO INTERNATIONAL INC. (JAPAN)

7.18 DONBOO AMINO ACID COLTD. (JAPAN)

7.19 AJINOMOTO COINC. (JAPAN)

7.20 KYOWA HAKKO KIRIN COLTD. (JAPAN)

7.21 DAESANG CORPORATION (KOREA)

7.22 QINGDAO SAMIN CHEMICAL COLTD. (CHINA)

7.23 HUGESTONE ENTERPRISE COLTD. (CHINA)

7.24 QINGDAO SAMIN CHEMICAL COLTD (CHINA)

7.25 TAIWAN AMINO ACIDS CO. LTD. (CHINA)

Chapter 8: Global Biofertilizers Market By Region

8.1 Overview

8.2. North America Biofertilizers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Form

8.2.4.1 Liquid

8.2.4.2 Carrier-based

8.2.5 Historic and Forecasted Market Size by Product Type

8.2.5.1 Phosphate solubilizing

8.2.5.2 Nitrogen fixation

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Seed treatment

8.2.6.2 Soil treatment

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biofertilizers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Form

8.3.4.1 Liquid

8.3.4.2 Carrier-based

8.3.5 Historic and Forecasted Market Size by Product Type

8.3.5.1 Phosphate solubilizing

8.3.5.2 Nitrogen fixation

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Seed treatment

8.3.6.2 Soil treatment

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biofertilizers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Form

8.4.4.1 Liquid

8.4.4.2 Carrier-based

8.4.5 Historic and Forecasted Market Size by Product Type

8.4.5.1 Phosphate solubilizing

8.4.5.2 Nitrogen fixation

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Seed treatment

8.4.6.2 Soil treatment

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biofertilizers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Form

8.5.4.1 Liquid

8.5.4.2 Carrier-based

8.5.5 Historic and Forecasted Market Size by Product Type

8.5.5.1 Phosphate solubilizing

8.5.5.2 Nitrogen fixation

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Seed treatment

8.5.6.2 Soil treatment

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biofertilizers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Form

8.6.4.1 Liquid

8.6.4.2 Carrier-based

8.6.5 Historic and Forecasted Market Size by Product Type

8.6.5.1 Phosphate solubilizing

8.6.5.2 Nitrogen fixation

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Seed treatment

8.6.6.2 Soil treatment

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biofertilizers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Form

8.7.4.1 Liquid

8.7.4.2 Carrier-based

8.7.5 Historic and Forecasted Market Size by Product Type

8.7.5.1 Phosphate solubilizing

8.7.5.2 Nitrogen fixation

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Seed treatment

8.7.6.2 Soil treatment

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Biofertilizers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 -2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.64 Bn. |

|

Forecast Period 2024 -32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 6.34 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Biofertilizers Market research report is 2024-2032.

BASF SE (Germany), Syngenta (Switzerland), UPL (India), Bayer CropScience (Germany), Valagro (Italy), Italpollina SAP, Lallemand (Canada), AlgaEnergy (Spain), and other major players.

The Biofertilizers Market is segmented into form, product type, application, and region. By Form, the market is categorized into liquid and carrier-based. By Product type, the market is categorized into Phosphate solubilizing and nitrogen fixation. By Application, the market is categorized into Seed treatment and Soil treatment. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Biofertilizers can be defined as biological products containing living microorganisms that, when sown to seed, plant surfaces, or soil, help in promoting growth by several mechanisms such as increasing the supply of various nutrients, and also increasing root biomass or root area, and increasing the nutrient uptake ability of particular plant and the application of biofertilizers in various agricultural practices drives the market growth.

The Global Biofertilizers Market size is expected to grow from USD 2.64 billion in 2023 to USD 6.34 billion by 2032, at a CAGR of 10.2% during the forecast period (2024-2032).