Bioenergy Market

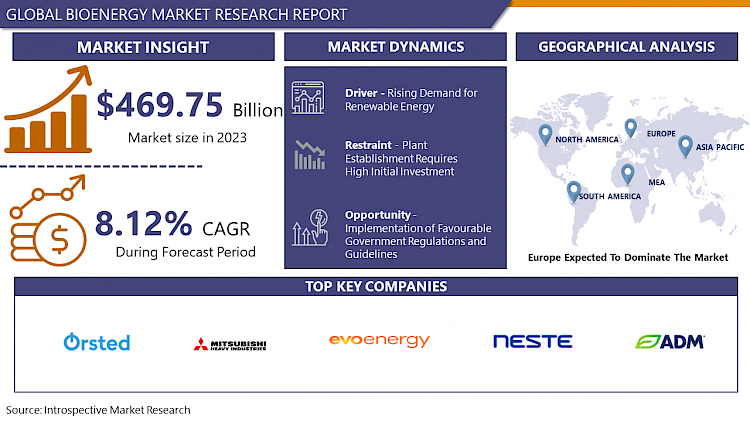

The Global Bioenergy Market Size Was Valued At USD 469.75 Billion In 2023 And Is Projected To Reach USD 948.46 Billion By 2032, Growing At a CAGR Of 8.12% From 2024 To 2032.

Bioenergy is one of many different resources available to help meet energy demand. It is a type of renewable energy derived from recently living organic materials known as biomass, and it can be used to generate transportation fuels, heat, electricity, and products. Agriculture and forest residues, energy crops, and algae are all examples of biomass.

- The bioenergy market has witnessed significant growth and evolution, driven by increasing global awareness of environmental issues and the need for sustainable energy sources. Bioenergy refers to renewable energy derived from biological sources, such as biomass, biofuels, and biogas. In recent years, the market has seen a surge in demand due to the growing emphasis on reducing greenhouse gas emissions and dependence on fossil fuels.

- Biomass, including organic materials like wood, crop residues, and waste, plays a crucial role in bioenergy production. Biofuels, such as ethanol and biodiesel, are gaining prominence as alternatives to traditional fuels, promoting a shift towards cleaner energy solutions. Additionally, biogas generated from organic waste through anaerobic digestion contributes to the diversification of the energy mix.

- Government initiatives and policies promoting renewable energy, along with advancements in technology, have spurred investments in the bioenergy sector.

Bioenergy Market Trend Analysis

Rising Demand for Renewable Energy

- The escalating global demand for renewable energy sources is a pivotal driving force behind the burgeoning bioenergy market. As societies seek sustainable alternatives to conventional fossil fuels, bioenergy emerges as a compelling solution due to its eco-friendly attributes. Bioenergy harnesses the power of organic materials such as biomass, biofuels, and biogas, offering a renewable and low-carbon option for power generation, heating, and transportation.

- Governments worldwide are increasingly recognizing the importance of mitigating climate change and reducing greenhouse gas emissions, leading to substantial investments and supportive policies for the bioenergy sector. Biomass, derived from organic matter like wood, agricultural residues, and waste, serves as a versatile feedstock for bioenergy production. Biofuels, including ethanol and biodiesel, present viable alternatives in the transportation sector, further driving market growth.

- The bioenergy market not only addresses the pressing need for cleaner energy sources but also promotes sustainable agricultural practices and waste management. With ongoing technological advancements and a growing emphasis on environmental conservation, the bioenergy market is poised for continued expansion, contributing significantly to the global transition towards a more sustainable and resilient energy landscape.

Implementation of Favourable Government Regulations and Guidelines Creates an Opportunity

- Favorable government regulations and guidelines play a pivotal role in shaping the landscape of the bioenergy market, creating a robust opportunity for growth and development. As governments worldwide increasingly prioritize sustainable and renewable energy sources, the bioenergy sector emerges as a key beneficiary.

- Governments often implement policies that promote the production and utilization of bioenergy, including incentives, subsidies, and mandates for renewable energy adoption. These measures not only drive investment but also encourage innovation in bioenergy technologies. Moreover, stringent environmental regulations and the global commitment to reduce carbon emissions further bolster the bioenergy market's prospects.

- The bioenergy market overview is characterized by a diverse range of sources, including biomass, biofuels, and biogas. With supportive government frameworks, businesses find a conducive environment for research, development, and commercialization of bioenergy solutions. This creates a positive cycle, fostering partnerships between public and private sectors, driving job creation, and contributing to energy security.

Bioenergy Market Segment Analysis:

Bioenergy Market Segmented on the basis of type, application.

By Type, Solid Biomass Segment Is Expected To Dominate The Market During The Forecast Period

- The solid biomass segment's ascendancy can be attributed to several factors. Firstly, solid biomass offers a reliable and established source of renewable energy, with a long history of traditional use. Its versatility enables the production of heat, electricity, and biofuels, addressing diverse energy needs.

- Additionally, solid biomass is considered a carbon-neutral or low-carbon option, as the carbon dioxide released during combustion is offset by the carbon dioxide absorbed by the plants during their growth. This aligns with global efforts to mitigate climate change and reduce carbon emissions.

- Furthermore, advancements in technology have enhanced the efficiency of solid biomass conversion processes, making them more economically viable and environmentally sustainable. Governments and businesses worldwide are increasingly recognizing the potential of solid biomass as a key player in achieving renewable energy targets, further driving its prominence in the bioenergy market.

By Application, heat generation segment held the largest share of 48.7% in 2022

- Heat generation segment is anticipated to assert its dominance, reflecting a pivotal role in the overall industry landscape. Bioenergy, derived from organic materials such as biomass, plays a crucial role in addressing the growing global demand for sustainable and renewable energy sources. The heat generation application involves the utilization of bioenergy for heating purposes, encompassing a diverse range of sectors such as residential, commercial, and industrial.

- One of the key drivers behind the ascendancy of the heat generation segment is the increasing recognition of bioenergy's eco-friendly attributes. As the world grapples with climate change concerns, the emphasis on reducing carbon emissions has intensified, prompting a shift towards cleaner energy alternatives. Bioenergy, in the form of heat generation, provides a viable solution by offering a renewable energy source that mitigates environmental impact.

Bioenergy Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is poised to lead the bioenergy market, reflecting a commitment to sustainable energy sources and environmental concerns. The region's proactive approach towards reducing carbon emissions and achieving renewable energy targets has positioned bioenergy as a key component of its energy mix. Government policies and incentives, such as the European Green Deal, promote the development and utilization of bioenergy technologies.

- The diverse feedstock availability in Europe, including agricultural residues, forestry residues, and organic waste, contributes to the robustness of the bioenergy sector. Advancements in technology have further enhanced the efficiency of bioenergy production processes, making them increasingly competitive in the energy market.

- Investments in research and development, coupled with collaborations between governments, industries, and research institutions, have propelled the innovation and deployment of cutting-edge bioenergy solutions. The emphasis on biofuels, biomethane, and biomass power generation solidifies Europe's position as a frontrunner in the global bioenergy landscape.

Bioenergy Market Top Key Players:

- Ørsted A/S (Denmark)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Fortum Oyj (Finland)

- Neste Corporation (Finland)

- Evoenergy (Australia)

- Green Biologics (Brazil)

- Archer Daniels Midland (ADM) (United States)

- POET Bioproducts (United States)

- Verbio Vereinigte BioEnergie AG (Germany)

- BBI International (Austria)

- Södra Cell AB (Sweden)

- Raizen Energia (Brazil)

- ABENGOA Bioenergy (Spain)

- Neste Oil Marketing Oy (Finland)

- Advanced Biofuels Canada (Canada)

- Drax Group plc (United Kingdom)

- RENOVA (Austria)

- Green Plains Renewable Energy Inc. (Canada)

- Choren Industries (Germany)

- Biotecha UAB (Lithuania)

Key Industry Developments in the Bioenergy Market:

- In 2023, Shell announced a $1 billion investment in a joint venture with LanzaTech, a company developing technology to produce jet fuel from sustainable feedstocks like waste biomass. This initiative aims to reduce the carbon footprint of aviation and support the transition to a low-carbon future.

- In 2023, ExxonMobil, a major oil and gas company, partnered with Sapphire Energy to develop and commercialize algae-based biofuels. This collaboration signifies a growing interest from traditional energy companies in exploring renewable energy sources.

|

Global Bioenergy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 469.75 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.0% |

Market Size in 2032: |

USD 948.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

Rising Demand for Renewable Energy |

||

|

Key Market Restraints: |

Plant Establishment Requires High Initial Investment |

||

|

Key Opportunities: |

Implementation of Favourable Government Regulations and Guidelines |

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BIOENERGY MARKET BY TYPE (2016-2030)

- BIOENERGY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BIOGAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOLID BIOMASS

- RENEWABLE WASTE

- BIOENERGY MARKET BY APPLICATION (2016-2030)

- BIOENERGY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POWER GENERATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEAT GENERATION

- TRANSPORTATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BIOENERGY Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ØRSTED A/S (DENMARK)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MITSUBISHI HEAVY INDUSTRIES LTD. (JAPAN)

- FORTUM OYJ (FINLAND)

- NESTE CORPORATION (FINLAND)

- EVOENERGY (AUSTRALIA)

- GREEN BIOLOGICS (BRAZIL)

- ARCHER DANIELS MIDLAND (ADM) (UNITED STATES)

- POET BIOPRODUCTS (UNITED STATES)

- VERBIO VEREINIGTE BIOENERGIE AG (GERMANY)

- BBI INTERNATIONAL (AUSTRIA)

- SÖDRA CELL AB (SWEDEN)

- RAIZEN ENERGIA (BRAZIL)

- ABENGOA BIOENERGY (SPAIN)

- NESTE OIL MARKETING OY (FINLAND)

- ADVANCED BIOFUELS CANADA (CANADA)

- DRAX GROUP PLC (UNITED KINGDOM)

- RENOVA (AUSTRIA)

- GREEN PLAINS RENEWABLE ENERGY INC. (CANADA)

- CHOREN INDUSTRIES (GERMANY)

- BIOTECHA UAB (LITHUANIA)

- COMPETITIVE LANDSCAPE

- GLOBAL BIOENERGY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

|

Global Bioenergy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 469.75 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.0% |

Market Size in 2032: |

USD 948.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

Rising Demand for Renewable Energy |

||

|

Key Market Restraints: |

Plant Establishment Requires High Initial Investment |

||

|

Key Opportunities: |

Implementation of Favourable Government Regulations and Guidelines |

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIOENERGY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIOENERGY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIOENERGY MARKET COMPETITIVE RIVALRY

TABLE 005. BIOENERGY MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIOENERGY MARKET THREAT OF SUBSTITUTES

TABLE 007. BIOENERGY MARKET BY TYPE

TABLE 008. BIOGAS MARKET OVERVIEW (2016-2028)

TABLE 009. SOLID BIOMASS MARKET OVERVIEW (2016-2028)

TABLE 010. RENEWABLE WASTE MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. BIOENERGY MARKET BY APPLICATION

TABLE 013. TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 014. HEAT GENERATION MARKET OVERVIEW (2016-2028)

TABLE 015. POWER GENERATION MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA BIOENERGY MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA BIOENERGY MARKET, BY APPLICATION (2016-2028)

TABLE 019. N BIOENERGY MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE BIOENERGY MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE BIOENERGY MARKET, BY APPLICATION (2016-2028)

TABLE 022. BIOENERGY MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC BIOENERGY MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC BIOENERGY MARKET, BY APPLICATION (2016-2028)

TABLE 025. BIOENERGY MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA BIOENERGY MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA BIOENERGY MARKET, BY APPLICATION (2016-2028)

TABLE 028. BIOENERGY MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA BIOENERGY MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA BIOENERGY MARKET, BY APPLICATION (2016-2028)

TABLE 031. BIOENERGY MARKET, BY COUNTRY (2016-2028)

TABLE 032. ENEXOR ENERGY: SNAPSHOT

TABLE 033. ENEXOR ENERGY: BUSINESS PERFORMANCE

TABLE 034. ENEXOR ENERGY: PRODUCT PORTFOLIO

TABLE 035. ENEXOR ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. DRAX GROUP: SNAPSHOT

TABLE 036. DRAX GROUP: BUSINESS PERFORMANCE

TABLE 037. DRAX GROUP: PRODUCT PORTFOLIO

TABLE 038. DRAX GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LIGNETICS: SNAPSHOT

TABLE 039. LIGNETICS: BUSINESS PERFORMANCE

TABLE 040. LIGNETICS: PRODUCT PORTFOLIO

TABLE 041. LIGNETICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. PACIFIC BIOENERGY CORP: SNAPSHOT

TABLE 042. PACIFIC BIOENERGY CORP: BUSINESS PERFORMANCE

TABLE 043. PACIFIC BIOENERGY CORP: PRODUCT PORTFOLIO

TABLE 044. PACIFIC BIOENERGY CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. GREEN PLAINS INC.: SNAPSHOT

TABLE 045. GREEN PLAINS INC.: BUSINESS PERFORMANCE

TABLE 046. GREEN PLAINS INC.: PRODUCT PORTFOLIO

TABLE 047. GREEN PLAINS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ENVIVA: SNAPSHOT

TABLE 048. ENVIVA: BUSINESS PERFORMANCE

TABLE 049. ENVIVA: PRODUCT PORTFOLIO

TABLE 050. ENVIVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ENERKEM: SNAPSHOT

TABLE 051. ENERKEM: BUSINESS PERFORMANCE

TABLE 052. ENERKEM: PRODUCT PORTFOLIO

TABLE 053. ENERKEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ADM: SNAPSHOT

TABLE 054. ADM: BUSINESS PERFORMANCE

TABLE 055. ADM: PRODUCT PORTFOLIO

TABLE 056. ADM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. POET: SNAPSHOT

TABLE 057. POET: BUSINESS PERFORMANCE

TABLE 058. POET: PRODUCT PORTFOLIO

TABLE 059. POET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. AMERESCO INC.: SNAPSHOT

TABLE 060. AMERESCO INC.: BUSINESS PERFORMANCE

TABLE 061. AMERESCO INC.: PRODUCT PORTFOLIO

TABLE 062. AMERESCO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 063. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 064. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 065. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIOENERGY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIOENERGY MARKET OVERVIEW BY TYPE

FIGURE 012. BIOGAS MARKET OVERVIEW (2016-2028)

FIGURE 013. SOLID BIOMASS MARKET OVERVIEW (2016-2028)

FIGURE 014. RENEWABLE WASTE MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. BIOENERGY MARKET OVERVIEW BY APPLICATION

FIGURE 017. TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 018. HEAT GENERATION MARKET OVERVIEW (2016-2028)

FIGURE 019. POWER GENERATION MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA BIOENERGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE BIOENERGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC BIOENERGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA BIOENERGY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA BIOENERGY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Bioenergy Market research report is 2024-2032.

Ørsted A/S (Denmark), Mitsubishi Heavy Industries Ltd. (Japan), Fortum Oyj (Finland), Neste Corporation (Finland), Evoenergy (Australia), Green Biologics (Brazil), Archer Daniels Midland (ADM) (United States), POET Bioproducts (United States), Verbio Vereinigte BioEnergie AG (Germany), BBI International (Austria), Södra Cell AB (Sweden), Raizen Energia (Brazil), ABENGOA Bioenergy (Spain), Neste Oil Marketing Oy (Finland), Advanced Biofuels Canada (Canada), Drax Group plc (United Kingdom), RENOVA (Austria), Green Plains Renewable Energy Inc. (Canada), Choren Industries (Germany), Biotecha UAB (Lithuania) and Other Major Players.

The Bioenergy Market is segmented into Type, Application, and region. By Type, the market is categorized into Biogas, Solid Biomass, Renewable Waste, and Others. By Application, the market is categorized into Transportation, Heat generation, Power generation, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Bioenergy is one of many different resources available to help meet energy demand. It is a type of renewable energy derived from recently living organic materials known as biomass, and it can be used to generate transportation fuels, heat, electricity, and products. Agriculture and forest residues, energy crops, and algae are all examples of biomass.

The Global Bioenergy Market Size Was Valued At USD 469.75 Billion In 2023 And Is Projected To Reach USD 948.46 Billion By 2032, Growing At a CAGR Of 8.12% From 2024 To 2032.