Global Biochar Market Overview

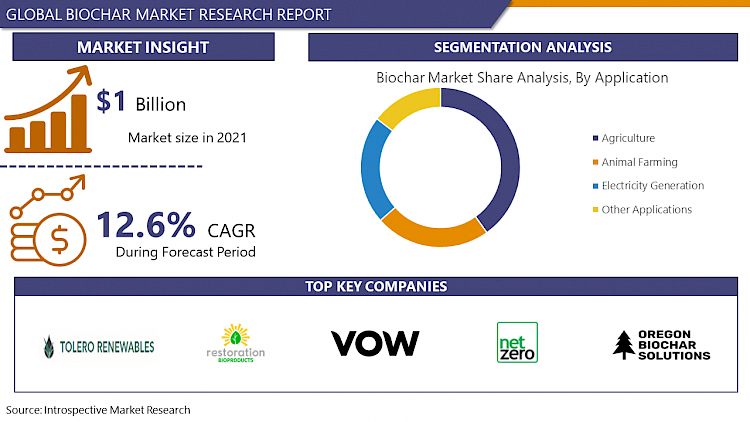

The Global Biochar Market size is expected to grow from USD 1.13 billion in 2022 to USD 2.92 billion by 2030, at a CAGR of 12.6% during the forecast period (2023-2030).

Soil is the main source and an abode for many nutrients and microflora that are required for the growth of crops. Ever-increasing population and excessive addition of chemical fertilizers have resulted in rapid depletion of agricultural areas and soil quality thus, promoting the need for sustainable approaches in agricultural crop production. Several studies have reported that crop growth and yield are significantly increased by using biochar. Biochar is carbonized biomass that is obtained from sustainable raw materials and sequestered in soils to enhance their beneficial agricultural and environmental value under present and future management. This differentiates it from charcoal which is widely utilized as fuel for heat, as a filter, as a reductant in iron-making, or as a coloring agent in industry or art. Due to its porous nature, it helps in retaining water and nutrients in the soil thereby, supporting plants as they grow. The process by which feedstock is converted into biochar is called a thermochemical reaction. Pyrolysis, combustion, and gasification are the major thermochemical processes employed. The growing popularity of biochar attributed to its benefits and the rise in climate change are the prominent factors anticipated to promote the development of the biochar market over the analysis period.

Market Dynamics And Factors For Biochar Market

Drivers:

Alternative to Chemicals Used in Waste Water Treatment

Biochar has high carbon content, large surface area, multiple functional groups, and enhanced pore volume. These properties enable the compound to exhibit excellent adsorption ability for a broad range of organic and inorganic pollutants found in water streams and wastewater. These contaminants can be disposed of by employing conventional approaches like membrane separation, ion exchange, or chemical precipitation, however, there are concerns regarding the cost-effectiveness of these processes and chemical residues left. Biochar’s beneficial physicochemical properties such as acid-base behavior, surface area, element composition, porosity, and surface functional groups, make it an economical and compelling alternative to remove a wide spectrum of pollutants such as phenols, antibiotics, pesticides, heavy metals, ammonium ion, nitrate, dyes, polycyclic aromatic hydrocarbons, phosphate and fluoride from wastewater and sewage.

In recent years biochar has gained tremendous popularity as an efficient approach to removing inorganic ions including phosphorus and nitrogen from wastewater along with fluorine from drinkable water. According to a study by Utrecht University and the United Nations University, 359 billion cubic meters of wastewater are generated each year across the globe. With only 50% of the total wastewater recycled each year, the rest is dumped in the oceans thus polluting them. This deficit in water treatment needs to be addressed in order to prevent the contamination of ocean water and surrounding ecology. Biochar presents a significant approach as it is economical and effective as other treatment procedures.

In urban areas, stormwater runoff contains numerous pollutants that pose a risk to contaminate the surface water. In such scenarios, biochar is utilized to remove indicator pathogens and organisms during water treatment. The treated water ensures safe surface water for irrigation, avoiding changes in vegetable contamination. Increasing wastewater concern is anticipated to stimulate the demand for biochar thereby, strengthening the growth of the market over the analysis period.

Restraints:

High Upfront Cost and Production of Toxic Compounds as By-Product

Chars and bio-oils produced during pyrolysis may also contain toxic substances such as polyaromatic hydrocarbons (PAHs) and dioxins. Evidence suggests that pyrolysis reactors operating between 350 °C and 600 °C can also produce small amounts of PAHs. Large amounts of PAHs are produced in chemical reactions at temperatures over 700 °C. Dioxins primarily form at temperatures above 1,000 °C and when chlorine and metals are absent, the number of dioxins produced is significantly reduced. The production of these toxins along with the desired biochar compound may hamper the biochar market growth over the analysis period. In addition, expensive, sophisticated pyrolysis equipment is needed for the production of biochar. These factors may refrain manufacturers with less investment to enter the market thus, hindering the development of the biochar market in the forecasted period.

Opportunity:

The Low-Middle Income Countries

Wastewater has been a matter of concern for several years. Various technologies have been adopted by high-income countries to treat wastewater and make it reusable for irrigation and other activities. However, as these treatment methods are expensive, developing and underdeveloped nations can't afford them. According to the 2017 UN World Water Development Report, Wastewater: The Untapped Resource, on average, high-income nations treat about 70% of the generated municipal and industrial wastewater. When compared with the upper-middle-income nations this ratio drops to 38%. In low-income countries, only 8% of the wastewater is treated and reused for irrigation and other purposes. With support from the World Bank and the UN, various programs have been launched in these regions to overcome water scarcity and produce potable waste from sewage water. These efforts are paving the way for market players to introduce their products in these regions thereby strengthening the expansion of the market in this region.

Challenges:

Regulations Regarding the Use of Biochar

In 2016, the European Commission (EC) announced a new regulation on a wide range of fertilizing products (revision of EC Regulation 2003/2003) as part of a package to stimulate the circular economy within the EU27. The European Parliament (EP) and the Council both amended the proposal. The EP agreed to a series of amendments in October of the same year, and the Council agreed to a proposal in December 2017. Biochar is expected to be included in the REACH regulation (EC Regulation 1907/2006) as a result of this new legislative framework. This regulation establishes a system for chemical registration, evaluation, authorization, and restriction. If fertilizer is sold in quantities of one tonne or more per year, a REACH registration is required.

Segmentation Analysis Of Biochar Market

By Feedstock, the woody biomass segment is estimated to lead the growth of the biochar market over the projected period. Biochar can be made from woody biomass such as wood chips, sawdust, shavings, or bark that is generated during timber harvesting or as a byproduct of the manufacturing of wood products. The Wood Recyclers Association (WRA) of the UK reported that the amount of waste wood processed in the country increased from 3.82 million tons in 2020 to 4.17 million tons last year, with total waste wood collected returning to pre-pandemic levels of 4.5 million tons. WRA also stated that biomass would continue to be the largest user of waste wood in 2021, accounting for 61% of total waste wood processed, a 5.5% increase over the previous year. Wood waste from all 28 EU countries accounted for approximately 50.2 MT. In the United States, approximately 55.75 MT of wood waste was generated in 2020. As the construction industry expands the demand for furniture also increases thereby, generating more wood waste. Due to the above-mentioned factors, the wood biomass segment is expected to dominate the market in the forecasted period.

By Technology, the pyrolysis segment is anticipated to have the highest share during the analysis period. Pyrolysis is the most common biochar production technology, and it also occurs in the early stages of the combustion and gasification processes. Aside from biochar, modern pyrolyzers can produce bio-oil and gas. If derived from sustainably produced biomass, these could be refined into a variety of chemicals and/or used as sources of renewable energy. During the pyrolysis process, pyrolysis gases known as syngas are produced. As the produced syngas is combusted and heat is released, the process becomes self-sustaining. Fast pyrolysis and slow pyrolysis are the two types of pyrolysis systems in use today. Slow pyrolysis produces more syngas while fast pyrolysis produces more oils and liquids. Furthermore, the addition of continuous feed pyrolyzers in the coming years is expected to bolster segment growth throughout the projected period.

By Application, the agriculture segment is anticipated to dominate in the forecasted timeframe. The global agricultural land area is approximately five billion hectares or 38% of the total land surface. One-third of this is cropland, with the remaining two-thirds being meadows and pastures for grazing livestock. Food demand is increasing as the global population grows, with the world's population more than doubling between 1961 and 2021. The use of synthetic fertilizers diminishes both the feasibility of land and crop yield. Biochar can have a wide range of effects on different crops and soils. It has been observed to increase the yield on low fertile soils and in areas where a deep soil layer (organic) cannot be easily created. Biochar can help improve water management in drought-prone areas where water is expensive. Biochar can help trees produce nuts or fruit earlier in some types of perennial agriculture. Biochar can also increase the marketability of agricultural products by reducing metal absorption by plants, especially when the soil is toxic. These factors are anticipated to support the development of the segment over the forecasted period.

Regional Analysis Of Biochar Market

The Asia-Pacific region is anticipated to dominate the growth of the biochar market over the analysis period. India, China, Japan, South Korea, and Australia are the prominent countries supporting the growth of the market in this region. Developing countries in this region have acknowledged the role of biochar in electricity generation and have made plans to promote its usage. In India, fossil-based resources have been the core of electricity generation. It has the most installed capacity for electricity generation (59.9%) and supply (78.2%) in the country. Despite increased coal production, domestic coal supply is insufficient to meet thermal power plants (TPPs) coal demand. For electricity generation, India imports roughly one-third of its annual coal consumption. Furthermore, coal is regarded as the most polluting source of electricity generation. Under the Paris Agreement, India has committed to reducing its GHG emissions by 33-35% below 2005 levels by 2030, and the government is looking for alternative energy sources to meet this goal. The Indian government has ambitious plans to incorporate biochar into energy production. The results show that biochar produced from the identified agro resources is suitable for cofiring with coal at temperatures ranging from 400 °C to 500 °C. 121 MT of surplus residues from the selected crops could yield 40 MT of biochar with a potential electricity generation capacity of 90 TWh. The production of green energy from biochar can significantly reduce greenhouse gas emissions thereby, supporting the growth of the biochar market in this region over the forecasted period.

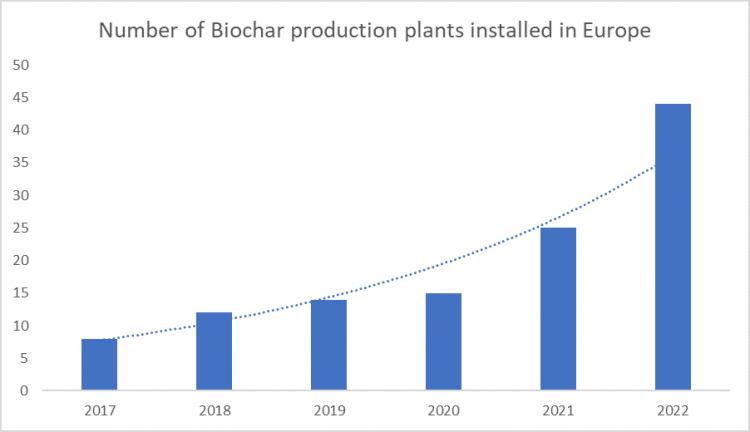

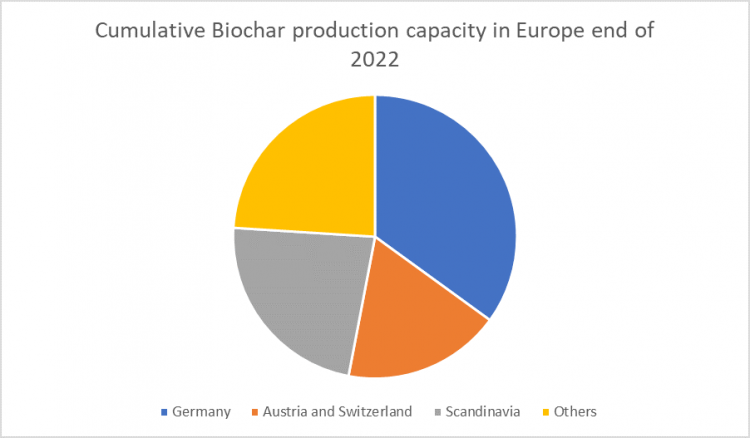

The European region is estimated to have the second highest share of the biochar market attributed to the increasing number of manufacturing plants. In the European region, more than 25 new systems were commissioned in 2021 thus, bringing the total number of operational plants to more than 100. This number suggests a rapid growth of the biochar industry in Europe. The production capacity reached 35,000 tonnes in 2021 (actual production of 20,000 tonnes) owing to the tremendous growth in the last decade. Growth rates for cumulative production capacity are expected to accelerate further in 2022, with a three-year compound annual growth rate (CAGR) of 67% projected between 2019 and 2022. Germany, Austria, Switzerland, and Scandinavian countries (most notably Sweden) dominated European biochar production during the same period, accounting for more than 75% of the market. The region harvests nearly 2,000,000 tonnes of biomass waste per year and has the potential to produce 491,000 tonnes of biochar per year, a significant amount with an estimated economic value of more than 850 million euros. This market potential alone presents attractive investment opportunities thereby, supporting the development of the biochar market over the forecasted timeframe.

The following graph depicts the number of biochar plants installed for the period 2017-2022.

The following pie chart depicts the biochar production by region

The biochar market in the North American region is estimated to develop at a significant growth rate over the analysis period. Dovetail Partners Inc. concluded that the future of the biochar industry was promising in a 2018 survey of the US biochar industry. Before this survey, the US Biochar Initiative (USBI) estimated annual industry production at 15,000-20,000 tons per year (TPY). The Dovetail survey suggested a production rate of 35,000 to 70,000 TPY between 2018-2022. Furthermore, according to a Wiley article, as of December 2018, the United States had 35 policies that directly or indirectly support and promote the use of biochar. Some of these policies are tailored toward energy and food production, environmental remediation and climate change management, and agricultural waste management. 15 of the 35 programs provide financial benefits, 8 provide R&D funding, and the rest help to increase financial awareness. Thus, the increase in production and supportive government policies are anticipated to strengthen the growth of the biochar market in this region.

Covid-19 Impact Analysis On Biochar Market

With the outbreak of the COVID-19 pandemic, the usage of Personal protective equipment (PPE) increased rapidly to curb the spread of the virus. The pandemic had an impact on the manufacture, usage, disposal, and recycling of plastic products. Plastics are used to make disposable PPE (such as face masks, gloves, gowns, eye protection, and filtering facepiece respirators). Countries across the globe made wearing a face mask or a face covering in public places mandatory. Since the outbreak of COVID-19, it is estimated that 1.6 million tons of plastic waste have been generated per day worldwide. This equates to 75 kg of plastic waste generated per person per year. During the peak infection period, it is estimated that 129 billion face masks and 65 billion gloves were used globally. Every day, approximately 3.4 billion single-use facemasks/face shields were also discarded globally. To address the issues caused by excessive plastic use, innovative solutions to upcycle plastic waste have been implemented around the world. According to research, co-pyrolysis of biomass and plastic waste produced a high amount of bio-oil but a low production of biochar. Thus, novel technologies for recovering biochar from plastic wastes can be used to not only remediate the plastic-contaminated environment but also to mitigate environmental issues. The pandemic has played a supportive role in the development of the biochar market and is anticipated to do the same in the forecasted timeframe.

Top Key Players Covered In Biochar Market

- Oregon Biochar Solutions

- American Biochar Company

- Aries Clean Energy LLC

- ArSta eco Pvt. Ltd.

- Avello Bioenergy Inc.

- Biochar Supreme LLC

- Carbon Gold Ltd.

- Karr Group

- Restoration Bioproducts

- NetZero

- Pacific Biochar Benefit Corporation

- Phoenix energy systems Inc.

- Vow ASA

- Swiss Biochar GmbH, And Other Major Players

Key Industry Development In The Biochar Market

In July 2022, NetZero announced the start of the first industrial biochar production plant in Latin America. Brazil has been chosen by the company for this project. The plant is expected to begin operations by the end of 2022. Its annual capacity will be 4,000 tons of biochar, which equates to more than 6,500 tons of CO2 removed each year.

In May 2022, Carbon Streaming Corporation announced the signing of a carbon credit streaming agreement (the "Stream Agreement") with Restoration Bioproducts LLC ("Restoration Bioproducts") to fund the construction of a biochar production facility in Virginia.

In June 2021, A wholly owned subsidiary of Vow ASA signed an agreement with Wakefield Biochar to install an industry-scale Biogreen system at Wakefield's facility in Valdosta, Georgia, USA. The Biogreen system will convert biomass and bio-residues into high-quality biochar.

|

Global Biochar Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 1.13 Bn. |

|

Forecast Period 2023-30 CAGR: |

12.6% |

Market Size in 2030: |

USD 2.92 Bn. |

|

Segments Covered: |

By Feedstock |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Feedstock

3.2 By Technology

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Biochar Market by Feedstock

5.1 Biochar Market Overview Snapshot and Growth Engine

5.2 Biochar Market Overview

5.3 Woody Biomass

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Woody Biomass: Grographic Segmentation

5.4 Agricultural Waste

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Agricultural Waste: Grographic Segmentation

5.5 Animal Manure

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Animal Manure: Grographic Segmentation

5.6 Other Feedstocks

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other Feedstocks: Grographic Segmentation

Chapter 6: Biochar Market by Technology

6.1 Biochar Market Overview Snapshot and Growth Engine

6.2 Biochar Market Overview

6.3 Pyrolysis

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pyrolysis: Grographic Segmentation

6.4 Gasification

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Gasification: Grographic Segmentation

6.5 Combustion

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Combustion: Grographic Segmentation

Chapter 7: Biochar Market by Application

7.1 Biochar Market Overview Snapshot and Growth Engine

7.2 Biochar Market Overview

7.3 Agriculture

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Agriculture: Grographic Segmentation

7.4 Animal Farming

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Animal Farming: Grographic Segmentation

7.5 Electricity Generation

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Electricity Generation: Grographic Segmentation

7.6 Other Applications

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Other Applications: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Biochar Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Biochar Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Biochar Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 OREGON BIOCHAR SOLUTIONS

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 AMERICAN BIOCHAR COMPANY

8.4 ARIES CLEAN ENERGY LLC

8.5 ARSTA ECO PVT. LTD.

8.6 AVELLO BIOENERGY INC.

8.7 BIOCHAR SUPREME LLC

8.8 CARBON GOLD LTD.

8.9 KARR GROUP

8.10 RESTORATION BIOPRODUCTS

8.11 NETZERO

8.12 PACIFIC BIOCHAR BENEFIT CORPORATION

8.13 PHOENIX ENERGY SYSTEMS INC.

8.14 VOW ASA

8.15 SWISS BIOCHAR GMBH

8.16 OTHER MAJOR PLAYERS

Chapter 9: Global Biochar Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Feedstock

9.2.1 Woody Biomass

9.2.2 Agricultural Waste

9.2.3 Animal Manure

9.2.4 Other Feedstocks

9.3 Historic and Forecasted Market Size By Technology

9.3.1 Pyrolysis

9.3.2 Gasification

9.3.3 Combustion

9.4 Historic and Forecasted Market Size By Application

9.4.1 Agriculture

9.4.2 Animal Farming

9.4.3 Electricity Generation

9.4.4 Other Applications

Chapter 10: North America Biochar Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Feedstock

10.4.1 Woody Biomass

10.4.2 Agricultural Waste

10.4.3 Animal Manure

10.4.4 Other Feedstocks

10.5 Historic and Forecasted Market Size By Technology

10.5.1 Pyrolysis

10.5.2 Gasification

10.5.3 Combustion

10.6 Historic and Forecasted Market Size By Application

10.6.1 Agriculture

10.6.2 Animal Farming

10.6.3 Electricity Generation

10.6.4 Other Applications

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Biochar Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Feedstock

11.4.1 Woody Biomass

11.4.2 Agricultural Waste

11.4.3 Animal Manure

11.4.4 Other Feedstocks

11.5 Historic and Forecasted Market Size By Technology

11.5.1 Pyrolysis

11.5.2 Gasification

11.5.3 Combustion

11.6 Historic and Forecasted Market Size By Application

11.6.1 Agriculture

11.6.2 Animal Farming

11.6.3 Electricity Generation

11.6.4 Other Applications

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Biochar Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Feedstock

12.4.1 Woody Biomass

12.4.2 Agricultural Waste

12.4.3 Animal Manure

12.4.4 Other Feedstocks

12.5 Historic and Forecasted Market Size By Technology

12.5.1 Pyrolysis

12.5.2 Gasification

12.5.3 Combustion

12.6 Historic and Forecasted Market Size By Application

12.6.1 Agriculture

12.6.2 Animal Farming

12.6.3 Electricity Generation

12.6.4 Other Applications

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Biochar Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Feedstock

13.4.1 Woody Biomass

13.4.2 Agricultural Waste

13.4.3 Animal Manure

13.4.4 Other Feedstocks

13.5 Historic and Forecasted Market Size By Technology

13.5.1 Pyrolysis

13.5.2 Gasification

13.5.3 Combustion

13.6 Historic and Forecasted Market Size By Application

13.6.1 Agriculture

13.6.2 Animal Farming

13.6.3 Electricity Generation

13.6.4 Other Applications

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Biochar Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Feedstock

14.4.1 Woody Biomass

14.4.2 Agricultural Waste

14.4.3 Animal Manure

14.4.4 Other Feedstocks

14.5 Historic and Forecasted Market Size By Technology

14.5.1 Pyrolysis

14.5.2 Gasification

14.5.3 Combustion

14.6 Historic and Forecasted Market Size By Application

14.6.1 Agriculture

14.6.2 Animal Farming

14.6.3 Electricity Generation

14.6.4 Other Applications

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Biochar Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 1.13 Bn. |

|

Forecast Period 2023-30 CAGR: |

12.6% |

Market Size in 2030: |

USD 2.92 Bn. |

|

Segments Covered: |

By Feedstock |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIOCHAR MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIOCHAR MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIOCHAR MARKET COMPETITIVE RIVALRY

TABLE 005. BIOCHAR MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIOCHAR MARKET THREAT OF SUBSTITUTES

TABLE 007. BIOCHAR MARKET BY FEEDSTOCK

TABLE 008. WOODY BIOMASS MARKET OVERVIEW (2016-2028)

TABLE 009. AGRICULTURAL WASTE MARKET OVERVIEW (2016-2028)

TABLE 010. ANIMAL MANURE MARKET OVERVIEW (2016-2028)

TABLE 011. OTHER FEEDSTOCKS MARKET OVERVIEW (2016-2028)

TABLE 012. BIOCHAR MARKET BY TECHNOLOGY

TABLE 013. PYROLYSIS MARKET OVERVIEW (2016-2028)

TABLE 014. GASIFICATION MARKET OVERVIEW (2016-2028)

TABLE 015. COMBUSTION MARKET OVERVIEW (2016-2028)

TABLE 016. BIOCHAR MARKET BY APPLICATION

TABLE 017. AGRICULTURE MARKET OVERVIEW (2016-2028)

TABLE 018. ANIMAL FARMING MARKET OVERVIEW (2016-2028)

TABLE 019. ELECTRICITY GENERATION MARKET OVERVIEW (2016-2028)

TABLE 020. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA BIOCHAR MARKET, BY FEEDSTOCK (2016-2028)

TABLE 022. NORTH AMERICA BIOCHAR MARKET, BY TECHNOLOGY (2016-2028)

TABLE 023. NORTH AMERICA BIOCHAR MARKET, BY APPLICATION (2016-2028)

TABLE 024. N BIOCHAR MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE BIOCHAR MARKET, BY FEEDSTOCK (2016-2028)

TABLE 026. EUROPE BIOCHAR MARKET, BY TECHNOLOGY (2016-2028)

TABLE 027. EUROPE BIOCHAR MARKET, BY APPLICATION (2016-2028)

TABLE 028. BIOCHAR MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC BIOCHAR MARKET, BY FEEDSTOCK (2016-2028)

TABLE 030. ASIA PACIFIC BIOCHAR MARKET, BY TECHNOLOGY (2016-2028)

TABLE 031. ASIA PACIFIC BIOCHAR MARKET, BY APPLICATION (2016-2028)

TABLE 032. BIOCHAR MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA BIOCHAR MARKET, BY FEEDSTOCK (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA BIOCHAR MARKET, BY TECHNOLOGY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BIOCHAR MARKET, BY APPLICATION (2016-2028)

TABLE 036. BIOCHAR MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA BIOCHAR MARKET, BY FEEDSTOCK (2016-2028)

TABLE 038. SOUTH AMERICA BIOCHAR MARKET, BY TECHNOLOGY (2016-2028)

TABLE 039. SOUTH AMERICA BIOCHAR MARKET, BY APPLICATION (2016-2028)

TABLE 040. BIOCHAR MARKET, BY COUNTRY (2016-2028)

TABLE 041. OREGON BIOCHAR SOLUTIONS: SNAPSHOT

TABLE 042. OREGON BIOCHAR SOLUTIONS: BUSINESS PERFORMANCE

TABLE 043. OREGON BIOCHAR SOLUTIONS: PRODUCT PORTFOLIO

TABLE 044. OREGON BIOCHAR SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. AMERICAN BIOCHAR COMPANY: SNAPSHOT

TABLE 045. AMERICAN BIOCHAR COMPANY: BUSINESS PERFORMANCE

TABLE 046. AMERICAN BIOCHAR COMPANY: PRODUCT PORTFOLIO

TABLE 047. AMERICAN BIOCHAR COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ARIES CLEAN ENERGY LLC: SNAPSHOT

TABLE 048. ARIES CLEAN ENERGY LLC: BUSINESS PERFORMANCE

TABLE 049. ARIES CLEAN ENERGY LLC: PRODUCT PORTFOLIO

TABLE 050. ARIES CLEAN ENERGY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ARSTA ECO PVT. LTD.: SNAPSHOT

TABLE 051. ARSTA ECO PVT. LTD.: BUSINESS PERFORMANCE

TABLE 052. ARSTA ECO PVT. LTD.: PRODUCT PORTFOLIO

TABLE 053. ARSTA ECO PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. AVELLO BIOENERGY INC.: SNAPSHOT

TABLE 054. AVELLO BIOENERGY INC.: BUSINESS PERFORMANCE

TABLE 055. AVELLO BIOENERGY INC.: PRODUCT PORTFOLIO

TABLE 056. AVELLO BIOENERGY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. BIOCHAR SUPREME LLC: SNAPSHOT

TABLE 057. BIOCHAR SUPREME LLC: BUSINESS PERFORMANCE

TABLE 058. BIOCHAR SUPREME LLC: PRODUCT PORTFOLIO

TABLE 059. BIOCHAR SUPREME LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. CARBON GOLD LTD.: SNAPSHOT

TABLE 060. CARBON GOLD LTD.: BUSINESS PERFORMANCE

TABLE 061. CARBON GOLD LTD.: PRODUCT PORTFOLIO

TABLE 062. CARBON GOLD LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. KARR GROUP: SNAPSHOT

TABLE 063. KARR GROUP: BUSINESS PERFORMANCE

TABLE 064. KARR GROUP: PRODUCT PORTFOLIO

TABLE 065. KARR GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. RESTORATION BIOPRODUCTS: SNAPSHOT

TABLE 066. RESTORATION BIOPRODUCTS: BUSINESS PERFORMANCE

TABLE 067. RESTORATION BIOPRODUCTS: PRODUCT PORTFOLIO

TABLE 068. RESTORATION BIOPRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. NETZERO: SNAPSHOT

TABLE 069. NETZERO: BUSINESS PERFORMANCE

TABLE 070. NETZERO: PRODUCT PORTFOLIO

TABLE 071. NETZERO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. PACIFIC BIOCHAR BENEFIT CORPORATION: SNAPSHOT

TABLE 072. PACIFIC BIOCHAR BENEFIT CORPORATION: BUSINESS PERFORMANCE

TABLE 073. PACIFIC BIOCHAR BENEFIT CORPORATION: PRODUCT PORTFOLIO

TABLE 074. PACIFIC BIOCHAR BENEFIT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. PHOENIX ENERGY SYSTEMS INC.: SNAPSHOT

TABLE 075. PHOENIX ENERGY SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 076. PHOENIX ENERGY SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 077. PHOENIX ENERGY SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. VOW ASA: SNAPSHOT

TABLE 078. VOW ASA: BUSINESS PERFORMANCE

TABLE 079. VOW ASA: PRODUCT PORTFOLIO

TABLE 080. VOW ASA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. SWISS BIOCHAR GMBH: SNAPSHOT

TABLE 081. SWISS BIOCHAR GMBH: BUSINESS PERFORMANCE

TABLE 082. SWISS BIOCHAR GMBH: PRODUCT PORTFOLIO

TABLE 083. SWISS BIOCHAR GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 084. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 085. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 086. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIOCHAR MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIOCHAR MARKET OVERVIEW BY FEEDSTOCK

FIGURE 012. WOODY BIOMASS MARKET OVERVIEW (2016-2028)

FIGURE 013. AGRICULTURAL WASTE MARKET OVERVIEW (2016-2028)

FIGURE 014. ANIMAL MANURE MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHER FEEDSTOCKS MARKET OVERVIEW (2016-2028)

FIGURE 016. BIOCHAR MARKET OVERVIEW BY TECHNOLOGY

FIGURE 017. PYROLYSIS MARKET OVERVIEW (2016-2028)

FIGURE 018. GASIFICATION MARKET OVERVIEW (2016-2028)

FIGURE 019. COMBUSTION MARKET OVERVIEW (2016-2028)

FIGURE 020. BIOCHAR MARKET OVERVIEW BY APPLICATION

FIGURE 021. AGRICULTURE MARKET OVERVIEW (2016-2028)

FIGURE 022. ANIMAL FARMING MARKET OVERVIEW (2016-2028)

FIGURE 023. ELECTRICITY GENERATION MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA BIOCHAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE BIOCHAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC BIOCHAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA BIOCHAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA BIOCHAR MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Biochar Market research report is 2023-2030.

NetZero, Restoration Bioproducts LLC, Vow ASA, Avello Bioenergy Inc, Phoenix energy systems Inc, Carbon Gold Ltd., and Other Major Players

The Biochar Market is segmented into Feedstock, Technology, Application, and region. By Feedstock, the market is categorized into Woody Biomass, Agricultural Waste, Animal Manure, and Other Feedstocks. By Technology, the market is categorized into Pyrolysis, Gasification, and Combustion. By Application, the market is categorized into Agriculture, Animal Farming, Electricity Generation, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Biochar is carbonized biomass that is obtained from sustainable raw materials and sequestered in soils to enhance their beneficial agricultural and environmental value under present and future management. This differentiates it from charcoal which is widely utilized as fuel for heat, as a filter, as a reductant in iron-making, or as a coloring agent in industry or art.

The Global Biochar Market size is expected to grow from USD 1.13 billion in 2022 to USD 2.92 billion by 2030, at a CAGR of 12.6% during the forecast period (2023-2030).