Bicycle Market Synopsis

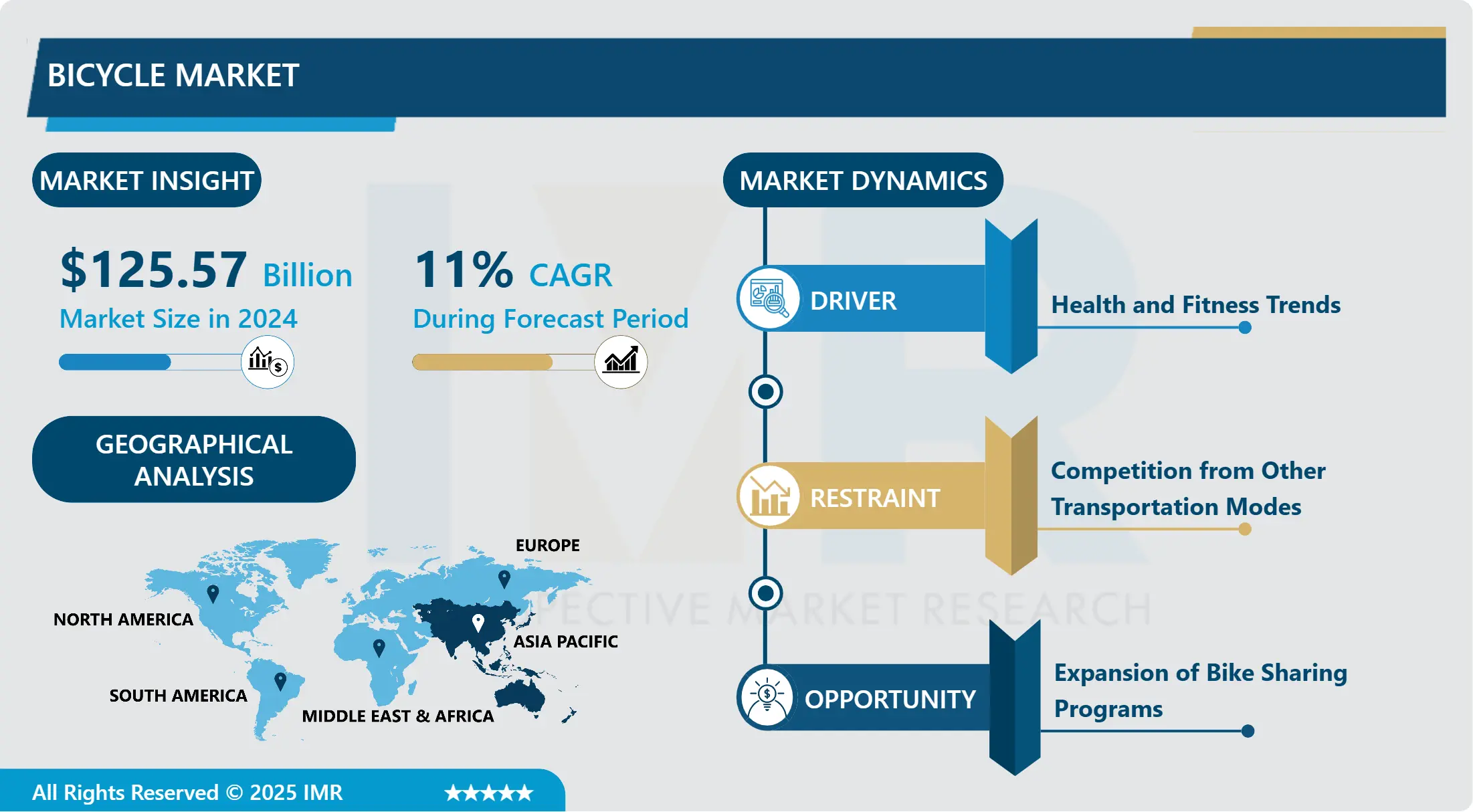

Bicycle Market Size Was Valued at USD 125.57 Billion in 2024, and is Projected to Reach USD 289.38 Billion by 2032, Growing at a CAGR of 11.00% From 2025-2032.

The bicycle market refers to the global industry involved in the manufacturing, distribution, and sale of bicycles and related accessories. This market encompasses a wide range of products including traditional bicycles, electric bicycles (e-bikes), components such as frames, wheels, and gears, as well as cycling apparel and safety gear. Key participants in the bicycle market include manufacturers, wholesalers, retailers, and online platforms that cater to both recreational and professional cyclists. Factors influencing the bicycle market dynamics include technological advancements in materials and design, environmental concerns promoting sustainable transportation solutions, evolving consumer preferences towards fitness and outdoor activities, as well as government policies encouraging cycling as a mode of urban mobility. The bicycle market is characterized by innovation in product development aimed at enhancing performance, comfort, and safety, while also catering to diverse consumer demographics and regional preferences worldwide.

The bicycle market is experiencing significant growth driven by several key factors. Increasing awareness of health and environmental benefits associated with cycling has spurred demand among consumers seeking sustainable and active transportation options.

Technological advancements in bicycle design, such as lightweight materials and electric assistance systems, are enhancing performance and expanding market appeal. Moreover, urbanization trends are promoting cycling as a convenient solution for commuting and reducing traffic congestion in cities.

Despite these opportunities, the market faces challenges such as fluctuating raw material costs and regulatory complexities in different regions. To capitalize on growth prospects, stakeholders should focus on innovation, sustainability, and strategic partnerships to cater to evolving consumer preferences and regulatory landscapes effectively.

This executive summary provides a concise overview of the current dynamics and future outlook of the global bicycle market, highlighting opportunities and challenges that businesses need to navigate to thrive in this evolving industry.

Bicycle Market Trend Analysis

Bicycle Market Growth Driver- The Rise of Electric Bicycles

- The bicycle business is undergoing a radical change as a result of the spike in demand for electric bicycles, or "e-bikes." E-bikes' adaptability and capacity to serve a diverse user base have led to their rising popularity. For example, commuters are drawn to e-bikes because they provide a quicker and more effective means of getting around crowded urban areas, frequently avoiding traffic bottlenecks and cutting commuting times. Together with their efficiency, e-bikes are environmentally benign since they emit no emissions when in use, lowering their carbon footprint and improving air quality in cities where it is a problem.

- Furthermore, e-bikes have made cycling more accessible to groups of people who would have been discouraged by physical restrictions or worries about exertion in the past. E-bikes are especially popular with older individuals since they allow them to enjoy riding without the strain associated with traditional pedal-powered bikes. E-bikes' assisted pedaling feature lets users adjust their pedaling force, which makes riding hills and longer distances more doable. Because of its accessibility, cycling has become more popular as a recreational and fitness activity, encouraging better lifestyles among a wide range of age groups.

- Additionally, new developments including lighter frames, more efficient motors, and longer-lasting batteries have resulted from technological improvements in e-bike design. These innovations keep improving the functionality and performance of e-bikes, which promotes their widespread acceptance in international markets. The future of e-bikes looks bright, with continuing growth anticipated as more customers realize the advantages of this handy and environmentally friendly form of transportation. This development will likely come from communities investing more in cycling infrastructure and promoting sustainable transportation alternatives.

Bicycle Market Expansion Opportunity- Bike-Sharing and Infrastructure Investments

- Growing investments in bicycle infrastructure and the expansion of bike-sharing schemes are indicators of a global trend toward the prioritization of sustainable urban mobility options. Bicycles are becoming more and more integrated into city planning frameworks by governments and urban planners in an effort to address problems including air pollution, traffic congestion, and public health hazards. For example, bike-sharing systems have been popular because they make it easy to obtain bicycles for quick excursions, which lessens dependency on cars and encourages active commuting. Large-scale bike-sharing programs have been implemented by cities all over the world, frequently with the help of public-private partnerships, to increase the accessibility and viability of riding for both locals and tourists.

- Investments in cycling infrastructure, when combined with bike-sharing schemes, have proven essential in promoting riding among the public. In order to provide cyclists with safer and more linked routes, cities are growing their networks of bike lanes and bicycle trails. By lessening confrontations between bicycles and motor vehicles, these designated bike lanes not only improve traffic flow but also increase the safety of bikers. Additionally, laws that support bicycling, including those that provide bike parking spaces and rewards for commuters who ride their bikes, encourage people to use bicycles as their primary form of transportation. The construction of bicycle infrastructure remains a top goal for cities hoping to promote sustainable mobility options and lessen their carbon footprint as urban populations increase and environmental concerns grow.

Bicycle Market Segment Analysis:

Bicycle Market Segmented based on By Product, By Design, By Technology and By End-user.

By Product, Mountain Bikes segment is expected to dominate the market during the forecast period

- Mountain bikes have carved out a significant niche in the cycling industry, particularly in regions characterized by rugged terrain and extensive natural landscapes. These bikes are purpose-built to handle challenging off-road conditions, including steep inclines, rocky paths, and uneven surfaces that are common in mountainous areas. Their design typically features robust frames, wide and knobby tires for better traction, and suspension systems that absorb shocks from rough terrains. This makes them ideal companions for enthusiasts and athletes seeking adrenaline-pumping adventures in remote wilderness areas or established trail networks.

- In regions with a strong outdoor adventure culture, such as mountainous areas in the western United States, Canada, parts of Europe like the Alps, and various locations in Asia and South America, mountain bikes dominate due to their versatility and durability. They cater not only to extreme sports enthusiasts but also to recreational riders looking to explore nature on challenging trails. The popularity of mountain biking events and competitions further enhances their prominence in these regions, attracting both participants and spectators alike. Additionally, the development of dedicated mountain biking parks and trail systems in these areas has bolstered the demand for mountain bikes, fostering a community of avid riders who appreciate the thrill and physical challenge that these bikes offer in rugged outdoor settings. Thus, mountain bikes not only dominate the market in these regions but also contribute significantly to the cultural and recreational fabric of outdoor adventure sports.

By Design, Folding segment held the largest share in 2024

- In urban settings where commuters prioritize practicality and convenience, folding bikes have grown in popularity. Because of their collapsible frames, these bikes are simple to stow in small spaces like offices and flats or to take on public transportation like buses and trains. The difficulties of urban commuting, where room is scarce and storing a full-size bicycle can be laborious, are addressed by this portability. Folding bikes provide a flexible choice that easily fits into multimodal transportation systems as communities all around the world encourage environmentally friendly transportation options and lessen dependency on automobiles.

- Folding bikes have built itself a niche market in places like New York, Tokyo, London, and Paris, which are known for their dense populations and vast public transportation systems. They serve commuters who have to move fast and effectively over short to medium distances, whether they are hopping between transit stops or maneuvering through traffic. Users of all ages and physical capacities, from office professionals to students and elders, can benefit from folding bikes due to its lightweight design. Furthermore, improvements in ride quality and durability brought about by folding bike technology ensure that these bikes not only suit the needs of daily commuting but also offer a dependable and comfortable riding experience. As more people choose efficient and environmentally friendly modes of transportation, foldable bikes are predicted to gain popularity and market share as they meet the changing needs of urban residents everywhere.

Bicycle Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Recent years have seen major changes in the bicycle market in China, mostly due to the country's fast urbanization and rising disposable incomes. China, which has historically been recognized as the largest bicycle market in the world, has witnessed a shift in popularity toward high-end and electric bikes, or e-bikes. E-bikes are becoming more and more popular as short-distance transportation alternatives to cars because of how convenient they are in crowded urban settings. Furthermore, improvements in battery technology have increased e-bikes' allure by making them more dependable and useful for regular usage. In addition to e-bikes, premium bicycles are becoming more and more popular among enthusiasts and fitness-conscious people, which is indicative of a larger trend towards healthy lives and recreational pursuits.

- The bicycle industry in Japan is distinguished by a significant focus on innovation and quality. Functionality, design, and technology improvements are valued by Japanese consumers, which fuels demand for niche products like foldable bikes and high-performance cycling gear. Particularly foldable bikes are well-liked because of their small size and practicality in cities with little room for storage. Moreover, Japanese cyclists have a culture that goes beyond utilitarianism, with aficionados spending money on accessories and specialty gear to improve their riding. Because of this market dynamic, producers are encouraged to continuously innovate in order to satisfy the wide range of wants of consumers who want their bicycles to be both functional and performant.

- Bicycles are used for a variety of purposes throughout the Asia-Pacific area, ranging from regular transportation to recreational and fitness pursuits. While bicycles continue to be an essential and reasonably priced mode of transportation in rural India, urban regions around the region are seeing an increase in interest in riding for fitness and enjoyment. Growing health consciousness, innovative bike-sharing programs in large cities, and urban planning initiatives supporting bicycle infrastructure all contribute to this change. The bicycle market in Asia-Pacific is expected to grow further as consumer preferences and technology continue to progress. Manufacturers have the opportunity to innovate and meet the different needs and preferences of these markets.

Active Key Players in the Bicycle Market

- Accell Group

- Atlas Cycles (Haryana) Ltd.

- Avon Cycles Ltd.

- Cervelo

- Dorel Industries Inc.

- Giant Bicycles

- Merida Industry Co., Ltd

- Specialized Bicycle Components, Inc.

- SCOTT Sports SA

- Trek Bicycle Corporation

- Orbea

- BH Bikes

- Axalko Bikes

- Hagen Bikes

- Mammoth bikes

- Egurra Bikes

- Garri Bike

- Other Active Players

Key Industry Developments in the Bicycle Market:

- In October 2023, Merida Industry Co., Ltd. launched the all-new Silex gravel bike, which aims to improve comfort, speed, and handling across all types of terrain. This second-generation Silex gravel bike features revised geometry, increased tire clearance, and a focus on backpacking and multi-surface adventure riding. The updated Silex range includes six models, including carbon fiber and aluminum options.

|

Global Bicycle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 125.57 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.00% |

Market Size in 2032: |

USD 289.38 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Design |

|

||

|

By Technology |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bicycle Market by Product (2018-2032)

4.1 Bicycle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mountain Bikes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid Bikes

4.5 Road Bikes

4.6 Cargo Bikes

4.7 Others

Chapter 5: Bicycle Market by Design (2018-2032)

5.1 Bicycle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Folding

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Regular

Chapter 6: Bicycle Market by Technology (2018-2032)

6.1 Bicycle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Electric

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Conventional

Chapter 7: Bicycle Market by End-user (2018-2032)

7.1 Bicycle Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Men

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Women

7.5 Kids

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bicycle Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ACCELL GROUP

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ATLAS CYCLES (HARYANA) LTDAVON CYCLES LTDCERVELO

8.4 DOREL INDUSTRIES INCGIANT BICYCLES

8.5 MERIDA INDUSTRY COLTD

8.6 SPECIALIZED BICYCLE COMPONENTS INCSCOTT SPORTS SA

8.7 TREK BICYCLE CORPORATION

8.8 ORBEA

8.9 BH BIKES

8.10 AXALKO BIKES

8.11 HAGEN BIKES

8.12 MAMMOTH BIKES

8.13 EGURRA BIKES

8.14 GARRI BIKE

8.15 OTHER KEY PLAYERS

Chapter 9: Global Bicycle Market By Region

9.1 Overview

9.2. North America Bicycle Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Mountain Bikes

9.2.4.2 Hybrid Bikes

9.2.4.3 Road Bikes

9.2.4.4 Cargo Bikes

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Design

9.2.5.1 Folding

9.2.5.2 Regular

9.2.6 Historic and Forecasted Market Size by Technology

9.2.6.1 Electric

9.2.6.2 Conventional

9.2.7 Historic and Forecasted Market Size by End-user

9.2.7.1 Men

9.2.7.2 Women

9.2.7.3 Kids

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bicycle Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Mountain Bikes

9.3.4.2 Hybrid Bikes

9.3.4.3 Road Bikes

9.3.4.4 Cargo Bikes

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Design

9.3.5.1 Folding

9.3.5.2 Regular

9.3.6 Historic and Forecasted Market Size by Technology

9.3.6.1 Electric

9.3.6.2 Conventional

9.3.7 Historic and Forecasted Market Size by End-user

9.3.7.1 Men

9.3.7.2 Women

9.3.7.3 Kids

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bicycle Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Mountain Bikes

9.4.4.2 Hybrid Bikes

9.4.4.3 Road Bikes

9.4.4.4 Cargo Bikes

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Design

9.4.5.1 Folding

9.4.5.2 Regular

9.4.6 Historic and Forecasted Market Size by Technology

9.4.6.1 Electric

9.4.6.2 Conventional

9.4.7 Historic and Forecasted Market Size by End-user

9.4.7.1 Men

9.4.7.2 Women

9.4.7.3 Kids

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bicycle Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Mountain Bikes

9.5.4.2 Hybrid Bikes

9.5.4.3 Road Bikes

9.5.4.4 Cargo Bikes

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Design

9.5.5.1 Folding

9.5.5.2 Regular

9.5.6 Historic and Forecasted Market Size by Technology

9.5.6.1 Electric

9.5.6.2 Conventional

9.5.7 Historic and Forecasted Market Size by End-user

9.5.7.1 Men

9.5.7.2 Women

9.5.7.3 Kids

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bicycle Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Mountain Bikes

9.6.4.2 Hybrid Bikes

9.6.4.3 Road Bikes

9.6.4.4 Cargo Bikes

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Design

9.6.5.1 Folding

9.6.5.2 Regular

9.6.6 Historic and Forecasted Market Size by Technology

9.6.6.1 Electric

9.6.6.2 Conventional

9.6.7 Historic and Forecasted Market Size by End-user

9.6.7.1 Men

9.6.7.2 Women

9.6.7.3 Kids

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bicycle Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Mountain Bikes

9.7.4.2 Hybrid Bikes

9.7.4.3 Road Bikes

9.7.4.4 Cargo Bikes

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Design

9.7.5.1 Folding

9.7.5.2 Regular

9.7.6 Historic and Forecasted Market Size by Technology

9.7.6.1 Electric

9.7.6.2 Conventional

9.7.7 Historic and Forecasted Market Size by End-user

9.7.7.1 Men

9.7.7.2 Women

9.7.7.3 Kids

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Bicycle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 125.57 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.00% |

Market Size in 2032: |

USD 289.38 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Design |

|

||

|

By Technology |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||