Beverage Cans Market Synopsis

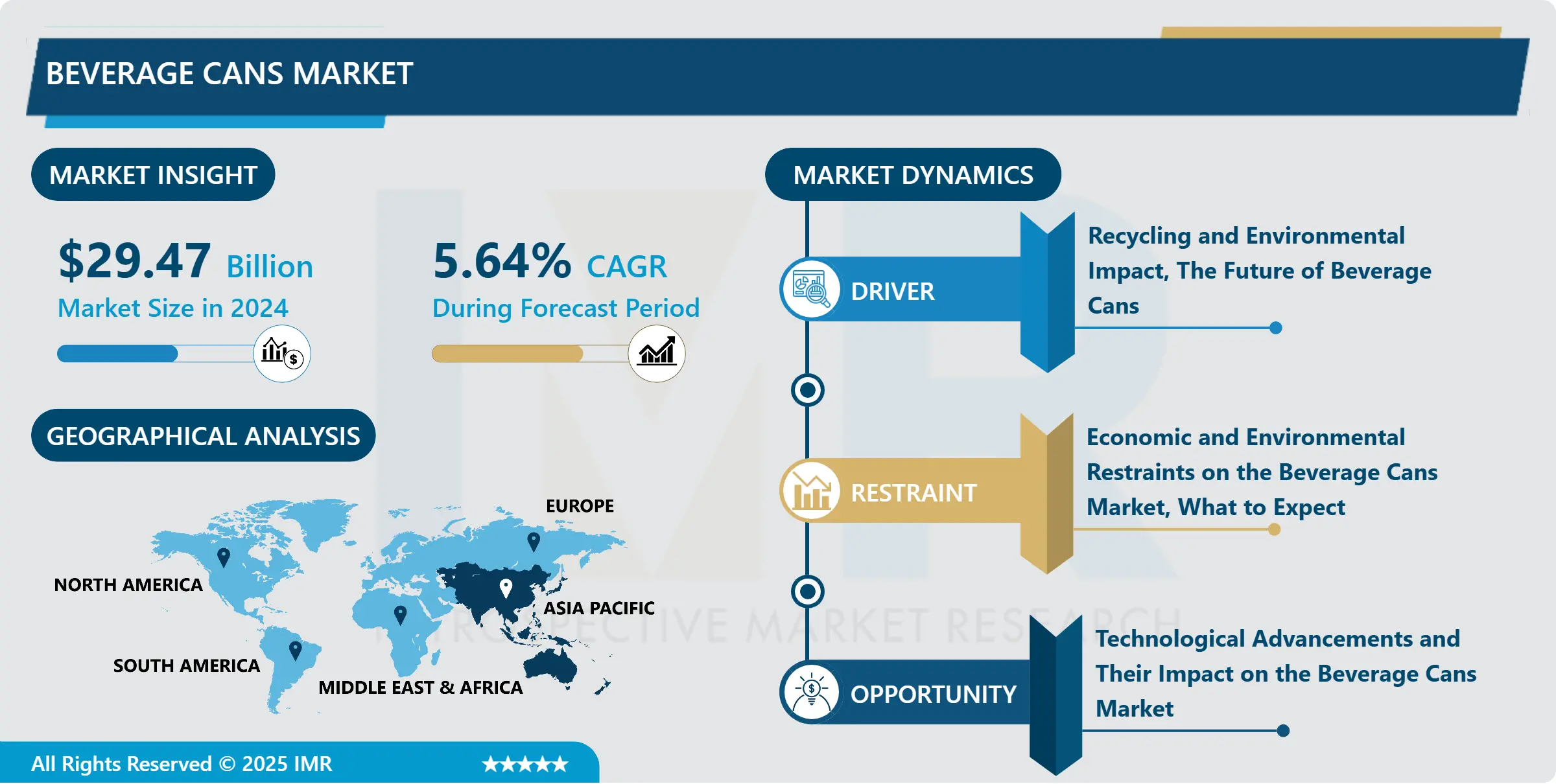

Beverage Cans Market Size is Valued at USD 29.47 Billion in 2024, and is Projected to Reach USD 53.89 Billion by 2035, Growing at a CAGR of 5.64% From 2025-2035.

The beverage cans industry involves the manufacturing and sale of aluminum cans and steel cans which are used in packaging different types of beverages such as soft drinks, alcoholic drinks, and energy drinks among others. This includes the process of making these cans, the process of putting labels on them, and taking them to the companies that deal with beverages. Its driving forces are factors that include convenience that cans are recyclable and relatively cheaper than other containers and that society favors on-the-go lifestyles. It depends on sustainability currents, changes in the can’s design, and the development and demand rate of the general beverage industry.

The factors that could be contributing to the global beverage cans market are as follows; Firstly, over the last ten years, there has been a growing trend of consumers choosing beverages that are portable and convenient, particularly for the freshly brewed ready-to-drink segment which has fostered the use of cans. Moreover, the fact that Aluminum cans can be recycled WOO adds to their appeal amid the existing trend of increased environmental sensitivity, ON which effectively positions them for increased usage.

Besides, new technologies that are being incorporated into the making of cans and innovative designs are improving the market further. The technological growth of artwork is enabling colorful and attractive artworks on the can thus enhancing its display. Also, reductions in cost and environmental impact have been achieved through technological advancements such as the availability of new materials that are both lightweight and robust and can be used to manufacture can. Overall, these factors are seen to be the main factors that propel the beverage cans market growth around the globe.

Beverage Cans Market Trend Analysis

Canned Convenience, A Market Trend Analysis of Beverage Cans

- The overall market for beverage cans is growing at a fast pace based on several important factors. One of the major trends is the growing concern about the environment and specifically, the need for the usage of eco-friendly packaging. Aluminum beverage cans also bear the lowest recycling rate and are therefore well suited for the green and eco-friendly consumer as well as the beverage makers who wish to use packaging material of low impact on the environment. Furthermore, there has also been progress in the related technology industry such as changes in manufacturing that have made cans more recyclable and sustainable, thus promoting their use.

- Another trend is the projected increase in demand for canned beverages especially in developing countries thus boosting the beverage cans market. It is displayed that can boast the advantages of convenience, portability, and, in most cases, a longer shelf life compared with other formats. In addition, developments in technology have increased the opportunities for selling canned beverages through electronic channels, which expanded the consumer audience for the production.

- In general, the beverage cans market is also projected to demonstrate steady growth in the years to come, driven by the demand for eco-friendly packaging materials and the consumer benefits associated with the consumption of canned products. The developments in the design, material, and manufacturing techniques will continue to drive the growth of the can market in light of customer preferences and environmental conservation.

Pop the Top, Innovations Driving Beverage Can Market Growth

- The beverage cans market is rapidly moving across the global market due to factors like rising demand for ease in packaging, flavors, portable and safe products including canned beverages, and enough sustainable material like Aluminum cans. The market is continually evolving with new and unique designs of packaging cans, lightweight materials used, and manufacturing technologies that are giving a boost to beverage cans with consumers.

- The market is expected to witness high growth as key players are trying to consolidate their markets by bringing product differentiation and appropriate strategic partnerships. For instance, they are now coming up with ‘twist open and reseal’ cans, new easy-to-open can neck designs, and engaging with soft drink companies to devise innovative can sleeve designs. Also, the global market of beverage packaging is changing to the use of more eco-friendly materials and this can create more opportunities for the growth of the beverage can market in the future years. This is proven by the fact that Asia-Pacific is projected to record remarkable growth in the beverage can market, due to the increasing popularity of carbonated and on-the-go drinks.

Beverage Cans Market Segment Analysis:

The beverage Cans Market is Segmented based on Material type, Structure, application, and end-users.

By Material Type, Steel segment is expected to dominate the market during the forecast period

- The structure is quite simple and depends mostly on the material – and here the choice is between Aluminum and steel. Aluminum cans are preferred due to their light nature because it is easier to transport as well as handling. They are also very much reusable and this makes them very suitable for present-day calls for green packaging. Lastly, steel cans are strong and last long hence acceptable for commodities that require long-term use or extra protection. They both are relevant to the market of beverage cans but meet different consumer demands and requirements for materials of the canned beverage.

By Application, the Alcoholic Beverages segment held the largest share in 2023

- Categorization of the beverage cans market based on the product is done in terms of alcoholic beverages cans and non-alcoholic beverages cans. Cans as Aluminum containers are utilized in packaging Beer, cider, and ready-to-drink cocktails making them easier for consumers to carry around. Popular beverages packed in non-alcoholic cans are carbonated drinks, fruit and vegetable juices, energy boosters, and plain water. Each segment plays a considerable role in total beverage cans demand, attributable to factors like the convenience of using cans, brand identification, and trends in single-serve consumption.

Beverage Cans Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific beverage cans market has great possibilities to develop due to such factors: Urbanization, which is a growth in the population of the urban cities, rising per capita income, and amendments in the lifestyles are factors driving the market for bottled beverages and wine that needs portable packaging solutions which are offered by the beverage cans. Also, the increasing customer consciousness and demand for eco-friendly packaging solutions have strained the need for beverage cans since these types of packing materials are recyclable and can help cut back on carbon emissions.

- In addition, the market of beverage cans in this region is dynamized by the growth of the beverage sector, including carbonated soft drink concentrates, energy drinks, and alcoholic beverages. Manufacturers are also concentrating on the advanced techniques in the construction of the cans and the type of material to be used in developing the products to suit the trends in the market and creating an excellent appearance of the containers on the shelves. The rising concern towards the environment and prefer Metal packaging is also significantly fueling the growth of the beverage can market in the Asia-Pacific.

Active Key Players in the Beverage Cans Market

- Crown Holdings Inc. (US)

- ArdaghGroup S.A, (Luxemburg)

- CPMC Holdings Limited (China)

- Toyo Seikan Group Holdings Ltd. (Japan)

- Can-One Berhad (Malaysia)

- Can-Pack S.A (Poland)

- Ball Corporation (Colorado, US)

- Envases Universales (Spain)

- Universal Can Corporation (Japan)

- Interpack Group Inc. (China)

- GZ Industries (Nigeria)

- Showa Denko K.K (Tokyo, Japan)

- Nampak Bevcan Limited (South Africa)

- The Olayan Group (Saudi Arabia)

- Techpack Solutions Pvt Limited (South Korea), and Other Active Players

|

Beverage Cans Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 29.47 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.64 % |

Market Size in 2035: |

USD 53.89 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Structure |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Beverage Cans Market by Material Type (2018-2035)

4.1 Beverage Cans Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aluminum

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Steel

Chapter 5: Beverage Cans Market by Structure (2018-2035)

5.1 Beverage Cans Market Snapshot and Growth Engine

5.2 Market Overview

5.3 2-Piece Cans

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 3-Piece Cans

Chapter 6: Beverage Cans Market by Application (2018-2035)

6.1 Beverage Cans Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Alcoholic Beverages

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Non-Alcoholic Beverages

Chapter 7: Beverage Cans Market by End User (2018-2035)

7.1 Beverage Cans Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Beverage

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Beverage Cans Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CROWN HOLDINGS INC. (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ARDAGHGROUP S.A

8.4 (LUXEMBURG)

8.5 CPMC HOLDINGS LIMITED (CHINA)

8.6 TOYO SEIKAN GROUP HOLDINGS LTD. (JAPAN)

8.7 CAN-ONE BERHAD (MALAYSIA)

8.8 CAN-PACK S.A (POLAND)

8.9 BALL CORPORATION (COLORADO

8.10 US)

8.11 ENVASES UNIVERSALES (SPAIN)

8.12 UNIVERSAL CAN CORPORATION (JAPAN)

8.13 INTERPACK GROUP INC. (CHINA)

8.14 GZ INDUSTRIES (NIGERIA)

8.15 SHOWA DENKO K.K (TOKYO

8.16 JAPAN)

8.17 NAMPAK BEVCAN LIMITED (SOUTH AFRICA)

8.18 THE OLAYAN GROUP (SAUDI ARABIA)

8.19 TECHPACK SOLUTIONS PVT LIMITED (SOUTH KOREA)

8.20 AND

Chapter 9: Global Beverage Cans Market By Region

9.1 Overview

9.2. North America Beverage Cans Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Material Type

9.2.4.1 Aluminum

9.2.4.2 Steel

9.2.5 Historic and Forecasted Market Size by Structure

9.2.5.1 2-Piece Cans

9.2.5.2 3-Piece Cans

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Alcoholic Beverages

9.2.6.2 Non-Alcoholic Beverages

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Food

9.2.7.2 Beverage

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Beverage Cans Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Material Type

9.3.4.1 Aluminum

9.3.4.2 Steel

9.3.5 Historic and Forecasted Market Size by Structure

9.3.5.1 2-Piece Cans

9.3.5.2 3-Piece Cans

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Alcoholic Beverages

9.3.6.2 Non-Alcoholic Beverages

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Food

9.3.7.2 Beverage

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Beverage Cans Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Material Type

9.4.4.1 Aluminum

9.4.4.2 Steel

9.4.5 Historic and Forecasted Market Size by Structure

9.4.5.1 2-Piece Cans

9.4.5.2 3-Piece Cans

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Alcoholic Beverages

9.4.6.2 Non-Alcoholic Beverages

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Food

9.4.7.2 Beverage

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Beverage Cans Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Material Type

9.5.4.1 Aluminum

9.5.4.2 Steel

9.5.5 Historic and Forecasted Market Size by Structure

9.5.5.1 2-Piece Cans

9.5.5.2 3-Piece Cans

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Alcoholic Beverages

9.5.6.2 Non-Alcoholic Beverages

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Food

9.5.7.2 Beverage

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Beverage Cans Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Material Type

9.6.4.1 Aluminum

9.6.4.2 Steel

9.6.5 Historic and Forecasted Market Size by Structure

9.6.5.1 2-Piece Cans

9.6.5.2 3-Piece Cans

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Alcoholic Beverages

9.6.6.2 Non-Alcoholic Beverages

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Food

9.6.7.2 Beverage

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Beverage Cans Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Material Type

9.7.4.1 Aluminum

9.7.4.2 Steel

9.7.5 Historic and Forecasted Market Size by Structure

9.7.5.1 2-Piece Cans

9.7.5.2 3-Piece Cans

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Alcoholic Beverages

9.7.6.2 Non-Alcoholic Beverages

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Food

9.7.7.2 Beverage

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Beverage Cans Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 29.47 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.64 % |

Market Size in 2035: |

USD 53.89 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Structure |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||