Beef Market Synopsis

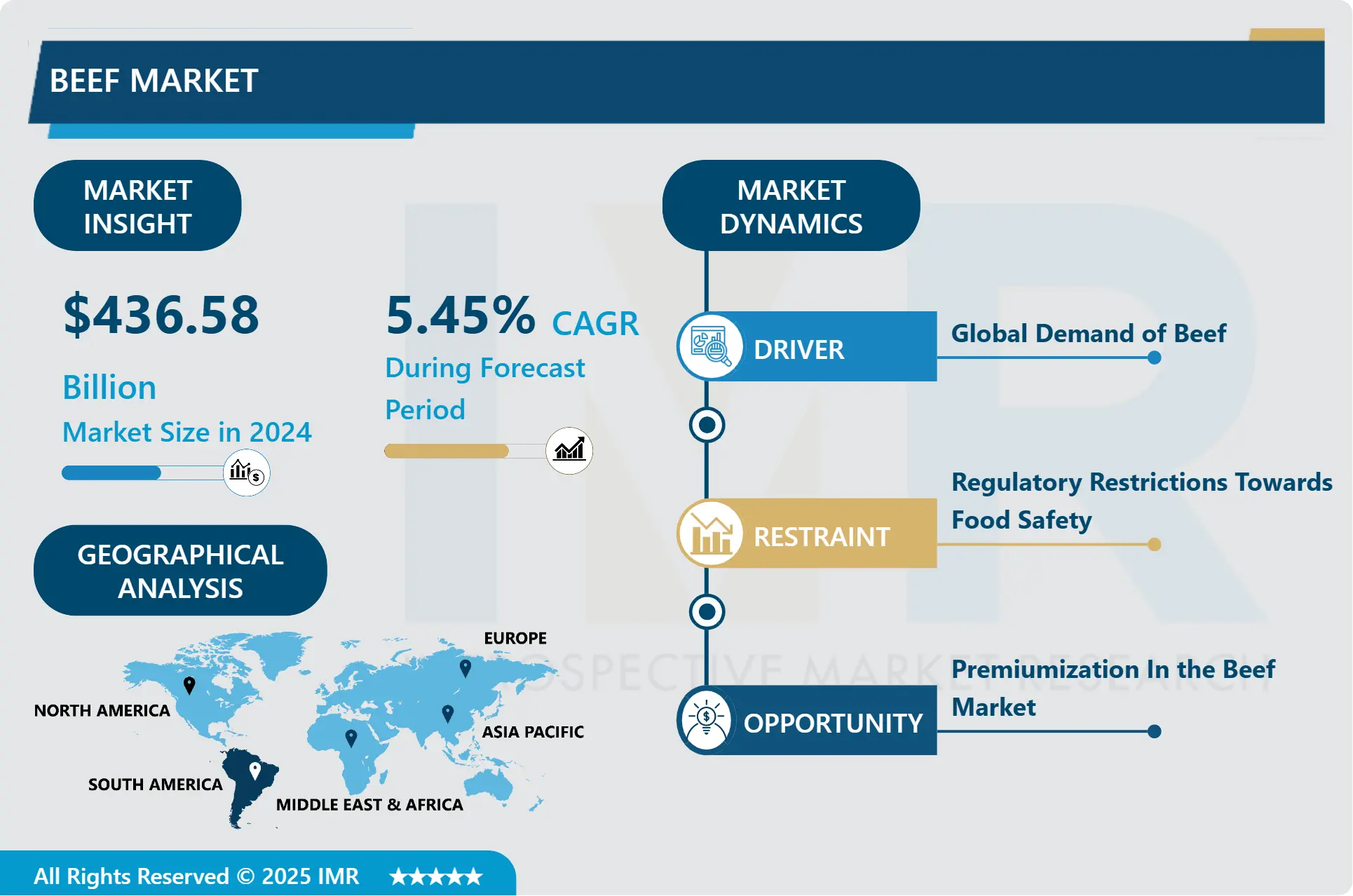

The global Beef Market was valued at USD 436.58 Billion in 2024 and is likely to reach USD 667.48 Billion by 2032, increasing at a CAGR of 5.45% from 2025 to 2032.

Beef is a type of meat from cattle. The word beef comes from the Old French word buef, which became the word for basically, cow meat. Beef is to cow as pork is to pig or mutton is to sheep.

Beef, meat of mature cattle, separated from veal. The best beef comes from special breeds that mature early. High-quality beef is firm, velvety, fine-grained, low in fat, bright red in color and well-marbled. The fat is smooth, creamy white and well distributed. Young cattle bones are soft, spongy and red; the less desirable mature beef has hard white bones.

The tenderness and flavor of beef improves with age; one common aging method involves hanging the carcass for about two weeks at about 2 °C, which promotes physical changes in the muscle tissue that improve meat quality. Assessment standards are somewhat similar across countries; there is a large international beef trade. In the United States, the grades are first, choice, fine, trade, utility, knife and canner in order of quality.

Commercial values come mainly from adult livestock, especially cows. In processed meat products, useful, knife and canned classes are used. Leather, which is used to make leather, is a valuable by-product of beef. The largest beef-consuming countries (per capita) in the world are Uruguay, Argentina, New Zealand, Australia and the United States. In a large part of Southeast Asia, Africa, and the Indian subcontinent, beef is relatively scarce and not particularly popular; The sanctity of the cow in the Hindu religion forbids Hindu followers from consuming its meat. However, beef is not uncommon in Korean and Japanese cuisines; In Kobe, Japan, near ?saka, prized beef (Kobe beef) is produced from cattle that are heavily rubbed and eaten with plenty of beer.

The kills vary from country to country, so different sections have several names. In the United States, where beef is the most popular meat, steaks - cross-sections of the juicy parts of the carcass - are the most sought-after cuts. Dubbed Britain's best prime rib, the prime rib is also a prized cut. Less desirable pieces can be roasted, used in stews or ground (see hamburger). Boiled beef is popular in a number of cuisines, such as the French dish known as pot-au-feu. Corned beef (or corned beef in the UK) is a brisket or loin that has been marinated in salt water.

In 2023, the world's production of beef and Veal is projected to amount to approximately 72.1 million metric tons, up from about 71.14 million metric tons in 2020.

Beef Market Trend Analysis

Beef Market Growth Driver- Global Demand of Beef

- Beef holds a significant place in the diets of numerous societies around the world, serving as a staple food source famous for its flavor, flexibility, and dietary esteem. Its part expands past insignificant food, regularly profoundly inserted in social conventions and culinary legacy. Over different landmasses, from the Americas to Europe, Asia, and past, meat dishes include noticeably in nearby cuisines, ranging from hearty steaks to savory stews and exotic delicacies. The surge in worldwide request for meat is especially articulated in emerging economies with burgeoning middle-class populaces, such as China and India. As these nations involvement fast financial development and urbanization, dietary inclinations are advancing, with an expanding inclination towards protein-rich diets. Beef, with its seen status as a premium protein source, becomes an appealing choice for shoppers looking for to promote their culinary encounters and embrace Western dietary habits.

- In China, for occasion, rising affluence has fuelled a surge in meat utilization, reflecting moving dietary patterns affected by globalization and urban ways of life. So also, in India, customarily a predominantly vegan nation, there's an eminent uptick in meat utilization, driven by components like urbanization, changing dietary preferences, and introduction to worldwide cuisines.

- Besides, the developing middle-class statistic in these districts not as it were extending the buyer base for beef but moreover cultivates a want for quality and assortment. This presents openings for producers and retailers to cater to different tastes and preferences, offering a run of beef items custom fitted to diverse culinary traditions and shopper preferences.

- By and large, the expanding request for meat in rising economies underscores its status as an all-inclusive prized protein source and highlights the energetic exchange between social impacts, financial improvement, and dietary choices. As the worldwide craving for meat proceeds to develop, partners over the supply chain are balanced to capitalize on this trend, driving development, speculation, and development within the beef market to meet advancing consumer requests.

Beef Market Opportunities- Premiumization In the Beef Market

- Premiumization within the beef market represents a move towards higher-quality, specialty items that cater to perceiving customers looking for interesting flavors, ethical sourcing, and health-conscious alternatives. This trend is driven by a variety of components counting expanding expendable livelihoods, increased mindfulness of wellbeing and supportability, and a want for raised culinary encounters. Natural beef, for case, is produced without synthetic pesticides, herbicides, or GMOs, engaging to customers concerned almost chemical presentation in their nourishment. Grass-fed beef, on the other hand, is prized for its leaner profile and potential health benefits, as well as its seen predominant taste and natural supportability compared to ordinarily raised grain-fed meat.

- Locally sourced meat reverberates with consumers looking to support neighbourhood economies, diminish their carbon impression, and ensure transparency and traceability within the food supply chain. These premium and claim to fame beef items regularly command higher costs due to their seen esteem and the extra costs related with their generation, such as natural certification, pasture-raising practices, or adherence to strict sourcing standards. In spite of the higher cost point, these items request to a growing section of shoppers willing to pay more for properties like quality, sustainability, and moral production practices.

- For producers, premiumization presents an opportunity to distinguish their items in a competitive market, capture higher edges, and build brand loyalty among consumers looking for premium offerings. By contributing in sustainable and moral generation practices, as well as straightforward promoting techniques highlighting the special qualities of their items, makers can tap into specialty markets and capitalize on the developing request for premium and specialty beef items.

Market Segment Analysis:

Market Segmented based on by Cut Type, by Slaughter Method, by Distribution Channel and region.

By Cut Type, Ground Cut Is Expected to Dominate the Market During the Forecast Period 2025-2032

By Cut Type, Ground, Roasts, Steaks and Others

- Ground beef holds a predominant position within the beef market due to a few compelling components. Its versatility stands out as a essential reason; it can be easily changed into a wide cluster of well-known dishes such as burgers, meatballs, tacos, casseroles, and spaghetti Bolognese. This versatility makes it a staple in differing cuisines and formulas, catering to changed tastes and dietary preferences. Affordability assists cements ground beef’s dominance, because it is ordinarily less costly than entire cuts of beef, making it an open protein choice for a broader portion of the populace.

- This cost-effectiveness is especially engaging to budget-conscious customers and expansive families. Convenience is another basic figure contributing to the popularity of ground meat. It is simple to plan and cook, requiring negligible time and effort, which is profoundly invaluable for active families and the food benefit industry. Whether it’s a speedy weeknight supper or a fast-food restaurant’s staple thing, ground beef’s ease of utilize meets the request for fast and hassle-free dinners.

- The rising request for prepared nourishments too essentially boosts the showcase for ground beef. The quick food industry, with its omnipresent burgers and other beef-based items, depends intensely on ground meat, driving reliable request. Additionally, its consolidation into ready-to-eat and frozen dinners adjusts well with the advanced consumer’s inclination for comfort nourishments, strengthening its solid market presence.

By Distribution Channel, Retail Sales held the largest share

By Distribution Channel, Retail Sales, HoReCa, Butcher Shops

- Retail sales have developed as the driving constrain within the beef market, applying significant impact over shopper inclinations and advertise dynamics. A few factors contribute to the dominance of retail sales in this sector. Firstly, customer request plays a significant part, with comfort and get to to a diverse extend of beef cuts and items being essential inspirations for obtaining from supermarkets and basic supply stores. Also, retailers capitalize on showcasing and branding strategies, cultivating brand devotion through focused on campaigns and alluring promotions, thereby bolstering customer engagement and deals. The broad conveyance systems of retailers guarantee a unfaltering supply of beef items to various areas, encouraged by efficient logistics and supply chain management practices, which further solidify their dominance within the market.

- Financial factors such as competitive pricing and economies of scale empower huge retail chains to offer alluring deals and keep up a competitive edge, driving proceeded customer engagement and deals development. Finally, customer behavior, characterized by a inclination for freshness and a believe within the reliability of retail outlets, encourage strengthens the dominance of retail deals within the beef market, highlighting the integral part played by retailers in forming industry patterns and assembly consumer requests.

Market Regional Insights:

South America Region is Expected to Dominate the Market Over the Forecast Period

- South America, especially Brazil, is the leading force within the worldwide meat market, a dominance driven by a few key variables. The locale brags copious characteristic assets, counting endless tracts of arrive perfect for cattle farming and a favorable climate that upgrades efficiency and effectiveness in beef production. This, coupled with the large-scale operations predominant in South American nations, positions them as a few of the world’s biggest beef producers. Innovative headways in breeding, feedlot operations, and infection control further support generation capacity, ensuring a steady and high-quality beef supply. Cost-effectiveness is another basic factor, as South America benefits from lower generation costs due to cheaper arrive and labor, as well as climatic conditions that decrease nourish costs.

- Economies of scale from large operations moreover contribute to lower in general costs. The solid trade advertise underscores the worldwide demand for South American meat, especially from Brazil, which is prized for its competitive estimating and quality. Trade agreements encourage these exports, extending market reach to major goals like China, the European Union, and the Middle East. Government back within the shape of arrangements, subsidies, and trade motivations improves the worldwide competitiveness of South American meat producers. The region's beef appreciates a solid market notoriety, with nations like Argentina renowned for premium items, supported by viable branding and marketing strategies. Supportability endeavours, counting the appropriation of eco-friendly hones and cooperation in universal certification programs, pull in environmentally cognizant buyers and include to the offer of South American beef. At long last, market diversification, with a wide extend of hamburger items from new cuts to handled and bundled products, caters to different buyer inclinations, setting the region's overwhelming position within the worldwide beef market.

Market Top Key Players:

The top key companies in the Beef Market are:

- JBS S.A. (Brazil)

- Tyson Foods, Inc. (United States)

- Cargill, Incorporated (United States)

- Marfrig Global Foods S.A. (Brazil)

- National Beef Packing Company, LLC (United States)

- Minerva S.A. (Brazil)

- Nipponham Group (Japan)

- Australian Agricultural Company Limited (Australia)

- Vion Food Group (Netherlands)

- Danish Crown (Denmark)

- NH Foods Ltd. (Japan)

- BRF S.A. (Brazil)

- Hormel Foods Corporation (United States)

- Smithfield Foods, Inc. (United States)

- Dawn Meats Group (Ireland)

- ABP Food Group (Ireland)

- Jollibee Foods Corporation (Philippines)

- OSI Group (United States)

- Grupo Los Grobo (Argentina)

- Astral Foods Ltd. (South Africa)

- Beijing DQY Agricultural Technology Co., Ltd. (China)

- Danish Crown Beef (Germany)

- Goodman Fielder (Australia)

- Zandbergen World’s Finest Meat (Netherlands)

- Greater Omaha Packing Co., Inc. (United States)

- Farmland Foods, Inc. (United States) and Other Active Players.

Key Industry Developments in the Market:

- In March 2024, Brazilian meat processor JBS SA reported much weaker-than-expected fourth-quarter results on Tuesday, saying U.S. cattle supply restrictions had affected business, Reuters reported. In addition, the company said global poultry markets and high grain prices in the early months of 2023 weighed on its annual profit. JBS posted a fourth-quarter net profit of 82.6 million reais ($16.58 million), compared with analyst estimates of 800.2 million reais. The company reported a full-year 2023 loss of 1.06 billion reais ($212.99 million).

|

Global Beef Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 436.58 Bn |

|

Forecast Period 2025-32 CAGR: |

5.45% |

Market Size In 2032: |

USD 667.48 Bn |

|

Segments Covered: |

By Cut Type |

|

|

|

By Slaughter Method |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

JBS S.A. (Brazil), Tyson Foods, Inc. (United States), Cargill, Incorporated (United States), Marfrig Global Foods S.A. (Brazil), National Beef Packing Company, LLC (United States) |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Beef Market by Cut Type (2018-2032)

4.1 Beef Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ground

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Roasts

4.5 Steaks

Chapter 5: Beef Market by Slaughter Method (2018-2032)

5.1 Beef Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Kosher

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Halal

Chapter 6: Beef Market by Distribution Channel (2018-2032)

6.1 Beef Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail Sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 HoReCa

6.5 Butcher Shops

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Beef Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 JBS S.A. (BRAZIL)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TYSON FOODS INC. (UNITED STATES)

7.4 CARGILL INCORPORATED (UNITED STATES)

7.5 MARFRIG GLOBAL FOODS S.A. (BRAZIL)

7.6 NATIONAL BEEF PACKING COMPANY

7.7 LLC (UNITED STATES)

7.8 MINERVA S.A. (BRAZIL)

7.9 NIPPONHAM GROUP (JAPAN)

7.10 AUSTRALIAN AGRICULTURAL COMPANY LIMITED (AUSTRALIA)

7.11 VION FOOD GROUP (NETHERLANDS)

7.12 DANISH CROWN (DENMARK)

7.13 NH FOODS LTD. (JAPAN)

7.14 BRF S.A. (BRAZIL)

7.15 HORMEL FOODS CORPORATION (UNITED STATES)

7.16 SMITHFIELD FOODS INC. (UNITED STATES)

7.17 DAWN MEATS GROUP (IRELAND)

7.18 ABP FOOD GROUP (IRELAND)

7.19 JOLLIBEE FOODS CORPORATION (PHILIPPINES)

7.20 OSI GROUP (UNITED STATES)

7.21 GRUPO LOS GROBO (ARGENTINA)

7.22 ASTRAL FOODS LTD. (SOUTH AFRICA)

7.23 BEIJING DQY AGRICULTURAL TECHNOLOGY COLTD. (CHINA)

7.24 DANISH CROWN BEEF (GERMANY)

7.25 GOODMAN FIELDER (AUSTRALIA)

7.26 ZANDBERGEN WORLD’S FINEST MEAT (NETHERLANDS)

7.27 GREATER OMAHA PACKING COINC. (UNITED STATES)

7.28 FARMLAND FOODS INC. (UNITED STATES)

Chapter 8: Global Beef Market By Region

8.1 Overview

8.2. North America Beef Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Cut Type

8.2.4.1 Ground

8.2.4.2 Roasts

8.2.4.3 Steaks

8.2.5 Historic and Forecasted Market Size by Slaughter Method

8.2.5.1 Kosher

8.2.5.2 Halal

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Retail Sales

8.2.6.2 HoReCa

8.2.6.3 Butcher Shops

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Beef Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Cut Type

8.3.4.1 Ground

8.3.4.2 Roasts

8.3.4.3 Steaks

8.3.5 Historic and Forecasted Market Size by Slaughter Method

8.3.5.1 Kosher

8.3.5.2 Halal

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Retail Sales

8.3.6.2 HoReCa

8.3.6.3 Butcher Shops

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Beef Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Cut Type

8.4.4.1 Ground

8.4.4.2 Roasts

8.4.4.3 Steaks

8.4.5 Historic and Forecasted Market Size by Slaughter Method

8.4.5.1 Kosher

8.4.5.2 Halal

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Retail Sales

8.4.6.2 HoReCa

8.4.6.3 Butcher Shops

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Beef Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Cut Type

8.5.4.1 Ground

8.5.4.2 Roasts

8.5.4.3 Steaks

8.5.5 Historic and Forecasted Market Size by Slaughter Method

8.5.5.1 Kosher

8.5.5.2 Halal

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Retail Sales

8.5.6.2 HoReCa

8.5.6.3 Butcher Shops

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Beef Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Cut Type

8.6.4.1 Ground

8.6.4.2 Roasts

8.6.4.3 Steaks

8.6.5 Historic and Forecasted Market Size by Slaughter Method

8.6.5.1 Kosher

8.6.5.2 Halal

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Retail Sales

8.6.6.2 HoReCa

8.6.6.3 Butcher Shops

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Beef Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Cut Type

8.7.4.1 Ground

8.7.4.2 Roasts

8.7.4.3 Steaks

8.7.5 Historic and Forecasted Market Size by Slaughter Method

8.7.5.1 Kosher

8.7.5.2 Halal

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Retail Sales

8.7.6.2 HoReCa

8.7.6.3 Butcher Shops

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Beef Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 436.58 Bn |

|

Forecast Period 2025-32 CAGR: |

5.45% |

Market Size In 2032: |

USD 667.48 Bn |

|

Segments Covered: |

By Cut Type |

|

|

|

By Slaughter Method |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

JBS S.A. (Brazil), Tyson Foods, Inc. (United States), Cargill, Incorporated (United States), Marfrig Global Foods S.A. (Brazil), National Beef Packing Company, LLC (United States) |

||