BB Cream Market Synopsis

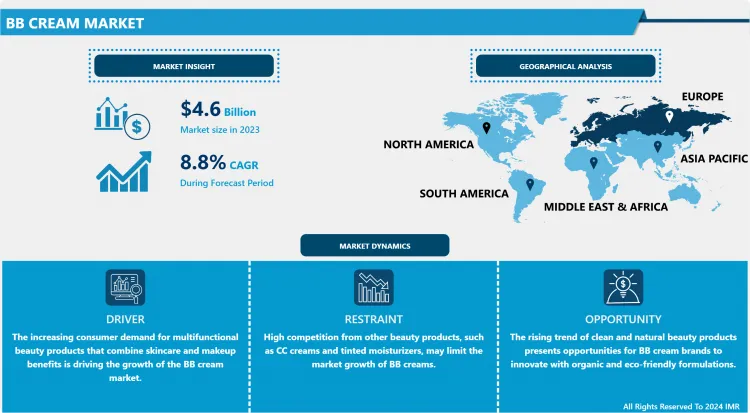

BB Cream Market Size is Valued at USD 4.6 Billion in 2024, and is Projected to Reach USD 9.0 Billion by 2032, Growing at a CAGR of 8.80% From 2024-2032.

Current market analysis of BB Cream has shown that it has received much popularity in the recent past season because consumers prefer products that offer many benefits to their skin. BB stands for beauty balm, and is a blemish balm that works to moisturize, protect from the sun, and provide coverage all in one product. This can be attributed to BB creams for these are lighter in texture but provide skin boosting appearance as opposed to most conventional makeups such as foundation creams.

Geographically, the BB Cream market is dominated by Asia-Pacific region, especially, South Korea and Japan due to a higher penetration of the product. This Asian beauty trend has been impactful on the global markets, as more and more Western brands try to introduce their clones of BB creams to match new customer demands. There is greater availability of BB cream through the online selling options due to the advance B2C selling policies that have also helped the growth of this market.

The products are differentiated depending on the quality and the price, from the most popular products, which can be found in the nearest drugstore, to the most prestigious and expensive brands for the young that desire to become rich. This consumer awareness about the ill-effects of chemicals in the cosmetics is also influencing the BB cream range, which is now moving towards organic beauty products. With the increasing knowledge of consumers on the active ingredients needed in skincare and beauty products, companies that are conscious of their ingredients source and the environment they originate from will also have high demands, therefore promoting growth in the BB Cream market.

BB Cream Market Trend Analysis

Rise of Clean and Organic Formulations

- Clean and organic BB cream is a growing trend as more consumers pay attention to what they’re putting on their face and body. They also reveal that there is a shift in the global consumer base longing for products that are not just chemical processed but get produced entirely from natural materials. Companies are adapting by introducing hybrid BB creams containing natural extracts of botanicals, free from toxic chemicals and carrying environmentally friendly packaging. This preference of clean beauty does not only appeal to the health-conscious consumers, but also appeals to the sustainability movement making it a plus for consumers who want to build brand loyalty with brands that are friendly to the environment.

- Therefore, firms that align to transparency in factors used in production and sourcing of their ingredients stand to benefit by capturing the market. ABL is increasing the demand for blemish-bearing BB creams and the advancement of cruelty-free and vegan products is also driving the formulation of BB creams. This consideration is likely to persist in the future as the number of customers who are interested in the aesthetic qualities of the products they use, as well as their beliefs about the effects on their bodies and on the planet’s state, increases.

Customization and Personalization

- Another major development that worth to note on the BB cream market is linked with the fact that the main producers start to pay more attention to customization. People feel the need to get products according to their skin and complexion types and needs, this view has made brands create several types of BB creams. Such a shift is best illustrated by the following aspects, namely, the custom flexibility of the shades, the extent of the coverage, and the special concern areas, including anti-aging, moisturizing, and shine control. By the use of some state of art technology such as virtual try-ons and personal online consultations, the search for the perfect BB cream in the market becomes easier and convenient.

- Moreover, companies are using social media and influencers to interact with the buyer and advertise their custom-products. Consumers’ generated content and feedback help the firms develop and improve their products leading to the creation of a community-oriented product development. Given the increased demands for the customized beauty products the BB cream market is expected to develop further innovations that will enable providing a specialized skincare and make-up regimen.

BB Cream Market Segment Analysis:

BB Cream Market Segmented on the basis of By Skin Type, By SPF Type, By End User , By Distribution Channel

By Skin Type, Combination segment is expected to dominate the market during the forecast period

- Currently, the demand for BB Creams is being met with regard to skins type such as dry, normal, oily, combination and sensitive skin types. Every one of them created to meet the needs of the consumers with different skin types allowing for the use of the product for improving the natural beauty of the consumers as well as providing the benefits of skincare. For example, those BB creams targeted at dry skin contain similar components such as hyaluronic acid for moisture and glycerin; on the other hand those for oily skin having ingredients aimed at controlling oil and reducing the look of pores.

- Avoid matte formulations as these will prevent skin combinations together with normal skin types from achieving that natural lustre that is required. Moreover, specific BB creams for sensitive skin category do not contain strong acnes fighters but they are endowed with mild ingredients that help in preventing skin inflammation. Given the fact that consumers today are increasingly conscious of different skin types and issues, this implies that brands are placed at a position where more enhancement is certain to occur, with new and more distinct BB creams being developed to meet the needs of different customers and consequently help further BB creams market growth.

By Distribution Channel, Direct Selling segment held the largest share in 2024

- The market distribution channel for the BB cream is elaborate and rich because consumers in all categories purchase this product. Other dominant forms of distribution are represented exclusively by the, direct selling, which remains a comprehensive distribution method since it enables brands to get in touch with customers directly and offer them relevant advises on products they are interested in. Hence specialist shops and beauty shops are very relevant when it comes to the display of as many BB creams as possible as well as some exclusive or premium brands to beauty marts. That is why supermarkets and hypermarkets also placements for growing the market, as all the most popular BB cream brands are produced and sold there for average buyers.

- BB cream market has seen e- retailers playing a crucial role in its growth especially after the unprecedented outbreak of COVID 19 that has prompted the fashion world towards online shopping. Customers like the ease that comes with being able to look at a diverse range of brands, read other people’s experience, and compare prices without having to leave home. As a result, e-retailers are pulling up their socks, and brands are also concentrating more on their online market presence and proper online promotional plans to capture the enlarged online customer base.

BB Cream Market Regional Insights:

Europe is expected to dominate the market due to its climatic conditions and regional trends.

- The market for BB cream is expected to be controlled by Europe due to the climate and changing trends in this region. Consumer’s of the region are in some parts of the world exposed to fluctuating and rigorous climatic conditions such as in winters hence resulting to purchase products with efficiency of equal to weather conditions. BB creams that are fashioning light weight textures and skin boosting advantages are also well-appreciated among European consumers seeking for convenient solutions that are conformable with their dynamic life patterns.

- Also, the trend toward identity and naturalness is Indeed changing the nature of the European cosmetics market. The consumers are paying attention to what they use, making brands to advance with organic and sustainable products. For this reason, more European brands are striving to meet the demand by introducing their BB creams that are environmentally friendly and possess clear reporting on sourcing of raw materials. This is because even with slightly differing climatic conditions from most Asian countries, Europe has adopted the health-conscious beauty product trend which makes it likely to be one of the forerunners in the growing BB cream market.

Active Key Players in the BB Cream Market

- Coty, Inc. (U.S.)

- Dr. Jart (South Korea)

- Tarte Inc. (U.S.)

- L'Occitane International SA (Switzerland)

- L’Oréal (France)

- Shiseido Company, Limited (Japan)

- Bobbi Brown Professional Cosmetics Inc. (U.S.)

- Lancôme (France)

- PHYSICIANS FORMULA (U.S.)

- Estée Lauder Companies (U.S.)

- Christian Dior SE (France)

- Unilever (U.K.)

- Marcelle Inc. (Canada)

- Avon Products, Inc. (U.K.)

- Stila Cosmetics (U.S.)

- The Clorox Company (U.S.)

- Missha (South Korea)

- ABLE CNC US (South Korea)

- Amorepacific (South Korea)

- Revlon (U.S.) and Others Active Players

|

Global BB Cream Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.80% |

Market Size in 2032: |

USD 9 Bn. |

|

Segments Covered: |

By Skin Type |

|

|

|

By SPF Type |

|

||

|

By End-Use Industry |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: BB Cream Market by Skin Type (2018-2032)

4.1 BB Cream Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dry

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Normal

4.5 Oily

4.6 Combination

4.7 Sensitive

Chapter 5: BB Cream Market by SPF Type (2018-2032)

5.1 BB Cream Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Below 15 SPF

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Between 15-30 SPF

5.5 Above 30 SPF

Chapter 6: BB Cream Market by End-Use Industry (2018-2032)

6.1 BB Cream Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Men

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Women

Chapter 7: BB Cream Market by Distribution Channel (2018-2032)

7.1 BB Cream Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Direct Selling

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Outlets

7.5 Supermarkets/Hypermarkets

7.6 Convenience Stores

7.7 Beauty Stores

7.8 E-Retailers

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 BB Cream Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 COTY INC. (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DR. JART (SOUTH KOREA)

8.4 TARTE INC. (U.S.)

8.5 L'OCCITANE INTERNATIONAL SA (SWITZERLAND)

8.6 L’ORÉAL (FRANCE)

8.7 SHISEIDO COMPANY

8.8 LIMITED (JAPAN)

8.9 BOBBI BROWN PROFESSIONAL COSMETICS INC. (U.S.)

8.10 LANCÔME (FRANCE)

8.11 PHYSICIANS FORMULA (U.S.)

8.12 ESTÉE LAUDER COMPANIES (U.S.)

8.13 CHRISTIAN DIOR SE (FRANCE)

8.14 UNILEVER (U.K.)

8.15 MARCELLE INC. (CANADA)

8.16 AVON PRODUCTS INC. (U.K.)

8.17 STILA COSMETICS (U.S.)

8.18 THE CLOROX COMPANY (U.S.)

8.19 MISSHA (SOUTH KOREA)

8.20 ABLE CNC US (SOUTH KOREA)

8.21 AMOREPACIFIC (SOUTH KOREA)

8.22 REVLON (U.S.) OTHERS ACTIVE PLAYERS

8.23

Chapter 9: Global BB Cream Market By Region

9.1 Overview

9.2. North America BB Cream Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Skin Type

9.2.4.1 Dry

9.2.4.2 Normal

9.2.4.3 Oily

9.2.4.4 Combination

9.2.4.5 Sensitive

9.2.5 Historic and Forecasted Market Size by SPF Type

9.2.5.1 Below 15 SPF

9.2.5.2 Between 15-30 SPF

9.2.5.3 Above 30 SPF

9.2.6 Historic and Forecasted Market Size by End-Use Industry

9.2.6.1 Men

9.2.6.2 Women

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Direct Selling

9.2.7.2 Specialty Outlets

9.2.7.3 Supermarkets/Hypermarkets

9.2.7.4 Convenience Stores

9.2.7.5 Beauty Stores

9.2.7.6 E-Retailers

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe BB Cream Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Skin Type

9.3.4.1 Dry

9.3.4.2 Normal

9.3.4.3 Oily

9.3.4.4 Combination

9.3.4.5 Sensitive

9.3.5 Historic and Forecasted Market Size by SPF Type

9.3.5.1 Below 15 SPF

9.3.5.2 Between 15-30 SPF

9.3.5.3 Above 30 SPF

9.3.6 Historic and Forecasted Market Size by End-Use Industry

9.3.6.1 Men

9.3.6.2 Women

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Direct Selling

9.3.7.2 Specialty Outlets

9.3.7.3 Supermarkets/Hypermarkets

9.3.7.4 Convenience Stores

9.3.7.5 Beauty Stores

9.3.7.6 E-Retailers

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe BB Cream Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Skin Type

9.4.4.1 Dry

9.4.4.2 Normal

9.4.4.3 Oily

9.4.4.4 Combination

9.4.4.5 Sensitive

9.4.5 Historic and Forecasted Market Size by SPF Type

9.4.5.1 Below 15 SPF

9.4.5.2 Between 15-30 SPF

9.4.5.3 Above 30 SPF

9.4.6 Historic and Forecasted Market Size by End-Use Industry

9.4.6.1 Men

9.4.6.2 Women

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Direct Selling

9.4.7.2 Specialty Outlets

9.4.7.3 Supermarkets/Hypermarkets

9.4.7.4 Convenience Stores

9.4.7.5 Beauty Stores

9.4.7.6 E-Retailers

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific BB Cream Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Skin Type

9.5.4.1 Dry

9.5.4.2 Normal

9.5.4.3 Oily

9.5.4.4 Combination

9.5.4.5 Sensitive

9.5.5 Historic and Forecasted Market Size by SPF Type

9.5.5.1 Below 15 SPF

9.5.5.2 Between 15-30 SPF

9.5.5.3 Above 30 SPF

9.5.6 Historic and Forecasted Market Size by End-Use Industry

9.5.6.1 Men

9.5.6.2 Women

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Direct Selling

9.5.7.2 Specialty Outlets

9.5.7.3 Supermarkets/Hypermarkets

9.5.7.4 Convenience Stores

9.5.7.5 Beauty Stores

9.5.7.6 E-Retailers

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa BB Cream Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Skin Type

9.6.4.1 Dry

9.6.4.2 Normal

9.6.4.3 Oily

9.6.4.4 Combination

9.6.4.5 Sensitive

9.6.5 Historic and Forecasted Market Size by SPF Type

9.6.5.1 Below 15 SPF

9.6.5.2 Between 15-30 SPF

9.6.5.3 Above 30 SPF

9.6.6 Historic and Forecasted Market Size by End-Use Industry

9.6.6.1 Men

9.6.6.2 Women

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Direct Selling

9.6.7.2 Specialty Outlets

9.6.7.3 Supermarkets/Hypermarkets

9.6.7.4 Convenience Stores

9.6.7.5 Beauty Stores

9.6.7.6 E-Retailers

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America BB Cream Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Skin Type

9.7.4.1 Dry

9.7.4.2 Normal

9.7.4.3 Oily

9.7.4.4 Combination

9.7.4.5 Sensitive

9.7.5 Historic and Forecasted Market Size by SPF Type

9.7.5.1 Below 15 SPF

9.7.5.2 Between 15-30 SPF

9.7.5.3 Above 30 SPF

9.7.6 Historic and Forecasted Market Size by End-Use Industry

9.7.6.1 Men

9.7.6.2 Women

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Direct Selling

9.7.7.2 Specialty Outlets

9.7.7.3 Supermarkets/Hypermarkets

9.7.7.4 Convenience Stores

9.7.7.5 Beauty Stores

9.7.7.6 E-Retailers

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global BB Cream Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.80% |

Market Size in 2032: |

USD 9 Bn. |

|

Segments Covered: |

By Skin Type |

|

|

|

By SPF Type |

|

||

|

By End-Use Industry |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||