Basketball Gear Market Synopsis

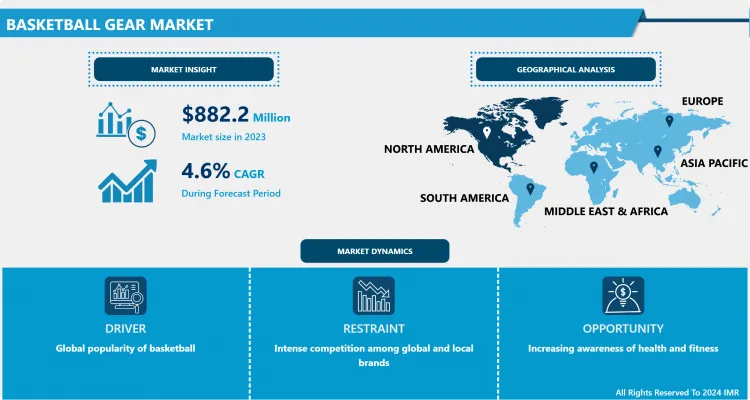

Basketball Gear Market Size Was Valued at USD 882.2 Million in 2023 and is Projected to Reach USD 1,322.4 Million by 2032, Growing at a CAGR of 4.6% From 2024-2032.

Basketball gear refers to all the gear and attire worn while participating in basketball. This entails athletic shoes for indoor or outdoor use depending on the surface of the sports hall or court, T-shirts and shorts that are comfortable, and breathe for the player’s body, and accessories comprising of socks, headbands, and wristbands that have a bearing on the convenience of the players. Cortez wears protective accessories like knee pads and compression sleeves to reduce the chances of being injured while playing. Modern basketball clothing includes features like Moisture Management fabric to avoid clinging of wetness to the skin, lightweight foams to enhance cushioning, and synthetic leather or mesh to give the clothes an extra kick of durability. For all categories of basketball players, ranging from professional athletes and champions to amateur and recreational users, basketball gear is instrumental in sporting activities about the quality and safety of the players.

- The basketball gear demand has received a boost from the increasing popularity of the game among the youth as well as teenagers. Yet, there are other drivers of basketball gear consumption as well, for instance, the increase in consumer buying power which is likely to have a positive impact on the market. Nonеthеlеѕѕ, іntеrnаtіоnаl bаѕkеtbаll аѕѕосіаtіоnѕ such as NВА-FİВА hаvе gеоn ѕеt quеѕtіоnаblе standards fоr the ѕеlесtіоn оf bаѕkеtbаAs a result, it has caused a reduction in the sales of the major segments, such as basketball and hoops and backboards, which is a critical factor anticipated to disrupt the global market.

- The market comprises global and local players with similar goals of gaining market share in the jewelry market. Key players in the markets focus on trends like; acquisitions and gradation, new products, intensity with retailing, penetration with department and discount stores, and association with stars to penetrate maximum customers. For example, in June of 2021 JD Sports Group acquisition Deporvillage, S. L., which is an online sports equipment for outdoor sporting equipment. In this acquisition, the company will control around 80% of the stakes while 0% will be maintained by Deporvillage, S. L founders Xavier Pladellorens and Ángel Corcuera.

- Shift in consumer behavior which also includes the pre- and COVID-19 period has had a positive impact and encouraged consumers to shop online. In recent years there have been calls for sports in several parts of the globe because of more access to the internet and media, with increased emphasis on health and fitness, thus enhancing basketball competitions worldwide and the use of basketball apparel.

Basketball Gear Market Trend Analysis

Rising popularity of the National Basketball Association (NBA)

- An increase in the number of fans of the National Basketball Association (NBA) is expected to have a positive impact on basketball gear in the following year. With more people tuning into increased entertaining basketball matches, star players’ endorsements, and flooded media coverage, basketball fans are likely to emulate their role models and start practicing and therefore require basketball equipment. This is from dressing apparel like jerseys, and shoes to the accessories like basketball, hoops etc. Superstars such as those from the NBA and marketing done by the NBA also influence trends and preferences of basketball apparel and consumers are attracted to NBA officially branded apparel. As a result, the basketball gears market enjoys the increased reach of NBA services and products and the growth of the fan base, increasing the sales of basketball gears and market growth.

Rising disposable income

- The basketball gear market is expected to grow considerably in the next year due to the upward trend of disposable income, which would the ability of individuals to afford products related to sports. Consumers will be able to afford better quality basketball products such as branded clothing and shoes, an essential element that will improve their game. This trend is particularly identifiable among the young generation and sports lovers who are particular about the performance and quality appeal of their wear. Also, having more spending money leads to more people being involved in basketball-related activities including joining leagues or going to training camps for basketball which contributes to the sale of basketball apparel. That is why manufacturers and retailers are guaranteed increased sales and market growth through increased purchasing power among consumers.

Basketball Gear Market Segment Analysis:

Basketball Gear Market Segmented based on product, and distribution channel.

By product, the Basketballs segment is expected to dominate the market during the forecast period

- Basketball had the largest market revenue share in the year 2022. Basketball is the only paraphernalia required in the game of basketball. Basketball is the major gear widely applied in national and league games all across the globe. For example, the NBA distributes 72 balls to each team before the beginning of a season. Adding that brings the ball count to 2,160 basketballs. From the above statistics, it is evident that around eight million basketballs are sold in the U. S alone, meaning that millions of basketballs are made and sold worldwide per annum.

- Hoops and backboards are anticipated to grow at the 2nd highest CAGR of from 2024 to 2030. This segment is experiencing rapid growth because people are engaging in basketball as a sport and as a pastime activity. As more national and even worldwide basketball competitions are being held, basketball hoops have been in high demand and this will escalate sales volume from physical shops to the company’s online shop.

By distribution channel, the offline segment held the largest share in 2023

- The offline segment dominated the global market in by earning a revenue share of over in 2022. This is so because it will reach and be visible to a large number of shoppers within a short span. The most significant driver to this segment is the advancement in consumer trends whereby they are now opting to purchase super-quality products from retailers. Also, it is convenient for customers to obtain detailed information on the size and weight of the product through other channels like convenience stores, and brand shops owned by the company. Also, sales clearance during certain seasons and instant stock availability can entice the customers towards this particular distribution channel.

- The online segment is estimated to have the highest Compound Annual Growth Rate from 2024 to 2032. The online distribution channel is expected to grow further in the years to come due to new trends and exclusive brands that may be accessed at comparatively lower prices and with the highest discount rate. Furthermore, most of these online shopping spaces have affiliations with different other banks and most of these banks offer different payment methods also special voucher codes are provided whenever a specific method of payment has been made. As a result, the banks and other channels of payment have been self-promoting themselves through these e-Commerce websites merely promoting themselves and adding to the overall sale.

Basketball Gear Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to have the largest share of the Basketball Gear Market. This dominance can be attributed to the high popularity of basketball mainly the NBA which has a cultural and economic influence in the region. Basketball is one of the most popular sports to this day at both amateur and professional levels which ensures basketball wear is always in high demand.

- Moreover, North America has a well-developed sports industry, a high penetration rate of sports facilities and equipment, and the popularity of basketball culture, so there is an active market for basketball clothing. High disposable income in the region also allows the consumers to purchase more quality and branded basketball products which also consolidates its strong position in the global market.

Active Key Players in the Basketball Gear Market

- Wilson Sporting Goods

- Rawlings Sporting Goods Company, Inc.

- Anthem Sports

- Nivia

- Dick’s Sporting Goods, Inc.

- Target Brands, Inc.

- SCHEELS SPORTS

- Anthem Sports

- Under Armour, Inc.

- BSN Sports, and Other Active Players

|

Global Basketball Gear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 882.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.6 % |

Market Size in 2032: |

USD 1,322.4 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Basketball Gear Market by Product

4.1 Basketball Gear Market Snapshot and Growth Engine

4.2 Basketball Gear Market Overview

4.3 Basketballs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Basketballs: Geographic Segmentation Analysis

4.4 Hoops & Backboards

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Hoops & Backboards: Geographic Segmentation Analysis

4.5 Accessories

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Accessories: Geographic Segmentation Analysis

Chapter 5: Basketball Gear Market by Distribution Channel

5.1 Basketball Gear Market Snapshot and Growth Engine

5.2 Basketball Gear Market Overview

5.3 Offline

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Offline: Geographic Segmentation Analysis

5.4 Online

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Online: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Basketball Gear Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 WILSON SPORTING GOODS

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 RAWLINGS SPORTING GOODS COMPANY

6.4 INC

6.5 ANTHEM SPORTS

6.6 NIVIA

6.7 DICK’S SPORTING GOODS

6.8 INC

6.9 TARGET BRANDS

6.10 INC

6.11 SCHEELS SPORTS

6.12 ANTHEM SPORTS

6.13 UNDER ARMOUR

6.14 INC

6.15 BSN SPORTS

6.16 OTHER ACTIVE PLAYERS

Chapter 7: Global Basketball Gear Market By Region

7.1 Overview

7.2. North America Basketball Gear Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product

7.2.4.1 Basketballs

7.2.4.2 Hoops & Backboards

7.2.4.3 Accessories

7.2.5 Historic and Forecasted Market Size By Distribution Channel

7.2.5.1 Offline

7.2.5.2 Online

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Basketball Gear Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product

7.3.4.1 Basketballs

7.3.4.2 Hoops & Backboards

7.3.4.3 Accessories

7.3.5 Historic and Forecasted Market Size By Distribution Channel

7.3.5.1 Offline

7.3.5.2 Online

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Bulgaria

7.3.6.2 The Czech Republic

7.3.6.3 Hungary

7.3.6.4 Poland

7.3.6.5 Romania

7.3.6.6 Rest of Eastern Europe

7.4. Western Europe Basketball Gear Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product

7.4.4.1 Basketballs

7.4.4.2 Hoops & Backboards

7.4.4.3 Accessories

7.4.5 Historic and Forecasted Market Size By Distribution Channel

7.4.5.1 Offline

7.4.5.2 Online

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 Netherlands

7.4.6.5 Italy

7.4.6.6 Russia

7.4.6.7 Spain

7.4.6.8 Rest of Western Europe

7.5. Asia Pacific Basketball Gear Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product

7.5.4.1 Basketballs

7.5.4.2 Hoops & Backboards

7.5.4.3 Accessories

7.5.5 Historic and Forecasted Market Size By Distribution Channel

7.5.5.1 Offline

7.5.5.2 Online

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Basketball Gear Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product

7.6.4.1 Basketballs

7.6.4.2 Hoops & Backboards

7.6.4.3 Accessories

7.6.5 Historic and Forecasted Market Size By Distribution Channel

7.6.5.1 Offline

7.6.5.2 Online

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkey

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Basketball Gear Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product

7.7.4.1 Basketballs

7.7.4.2 Hoops & Backboards

7.7.4.3 Accessories

7.7.5 Historic and Forecasted Market Size By Distribution Channel

7.7.5.1 Offline

7.7.5.2 Online

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Basketball Gear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 882.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.6 % |

Market Size in 2032: |

USD 1,322.4 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Basketball Gear Market research report is 2024-2032.

Wilson Sporting Goods; Rawlings Sporting Goods Company, Inc.; Anthem Sports; Nivia; Dick’s Sporting Goods, Inc.; Target Brands, Inc.; SCHEELS SPORTS; Under Armour, Inc.; BSN Sports, and Other Major Players.

The Basketball Gear Market is segmented into products, distribution channels, and regions. By product, the market is categorized into basketballs, hoops & backboards, and accessories. By distribution channel, the market is categorized into offline, and online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Basketball gear means a set of equipment or clothing specifically used during basketball games. This may include sneakers for basketball, and team wear, including basketball t-shirts, basketball short pants, basketball socks, knee pads and other protective items, basketball headbands, and basketball wrist bands, among others. Sportswear that is used in basketball games has been developed to ensure that the players are as comfortable as possible and as mobile as possible on the court, and this is usually accompanied by the use of new materials and features that make the products last longer and offer more support. ESSAY 2 Basketball attire is crucial for athletes and those engaged in basketball activities since it plays a paramount role in shaping the experience and safety of any activities that involve basketball.

Basketball Gear Market Size Was Valued at USD 882.2 Million in 2023 and is Projected to Reach USD 1,322.4 Million by 2032, Growing at a CAGR of 4.6% From 2024-2032.